Carpenter Technology Announces Completion of $200 Million Syndicated Credit Facility

November 24 2009 - 4:05PM

Business Wire

Carpenter Technology Corporation (NYSE: CRS), announced today

the successful completion of a $200 million syndicated credit

facility. This three year revolving line of credit replaces the

five year $150 million revolver due to expire in August, 2010 and

the $50 million accounts receivable securitization facility due to

expire in March, 2010. The new facility, comprised of nine lenders,

was substantially oversubscribed prior to allocations.

“We are very pleased with the lender group’s show of confidence

in our business and financial position,” said K. Douglas Ralph,

Senior Vice President and Chief Financial Officer. “The completion

of this $200 million facility further solidifies our strong

liquidity position which includes over $375 million of cash on our

balance sheet.”

Bank of America and JPMorgan Chase served as the Co-Lead

Arrangers. Terms of the facility remain largely unchanged from the

prior agreement and include the same two financial covenants, debt

to total capital and interest coverage ratio.

Carpenter Technology produces and distributes specialty alloys,

including stainless steels, titanium alloys and superalloys, and

various engineered products. Detailed information about Carpenter

Technology can be accessed at our website: www.cartech.com.

Except for historical information, all other information in this

news release consists of forward-looking statements within the

meaning of the Private Securities Litigation Act of 1995. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ from those projected,

anticipated or implied. The most significant of these uncertainties

are described in Carpenter's filings with the Securities and

Exchange Commission including its annual report on Form 10-K for

the year ended June 30, 2009, its quarterly report on Form 10-Q for

the period ended September 30, 2009 and the exhibits attached to

those filings. They include but are not limited to: (1) the

cyclical nature of the specialty materials business and certain

end-use markets, including aerospace, industrial, automotive,

consumer, medical, and energy, or other influences on Carpenter’s

business such as new competitors, the consolidation of competitors,

customers, and suppliers or the transfer of manufacturing capacity

from the United States to foreign countries; (2) the ability

of Carpenter to achieve cost savings, productivity improvements or

process changes; (3) the ability to recoup increases in the

cost of energy, raw materials, freight or other factors;

(4) domestic and foreign excess manufacturing capacity for

certain metals; (5) fluctuations in currency exchange rates;

(6) the degree of success of government trade actions;

(7) the valuation of the assets and liabilities in Carpenter’s

pension trusts and the accounting for pension plans;

(8) possible labor disputes or work stoppages; (9) the

potential that our customers may substitute alternate materials or

adopt different manufacturing practices that replace or limit the

suitability of our products; (10) the ability to successfully

acquire and integrate acquisitions; (11) the availability of

credit facilities to Carpenter, its customers or other members of

the supply chain; (12) the ability to obtain energy or raw

materials, especially from suppliers located in countries that may

be subject to unstable political or economic conditions;

(13) our manufacturing processes are dependent upon highly

specialized equipment located primarily in one facility in Reading,

Pennsylvania and for which there may be limited alternatives if

there are significant equipment failures or catastrophic events;

and (14) our future success depends on the continued service

and availability of key personnel, including members of our

executive management team, management, metallurgists and other

skilled personnel and the loss of these key personnel could affect

our ability to perform until suitable replacements are found. Any

of these factors could have an adverse and/or fluctuating effect on

Carpenter's results of operations. The forward-looking statements

in this document are intended to be subject to the safe harbor

protection provided by Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Carpenter undertakes no obligation to update or revise

any forward-looking statements.

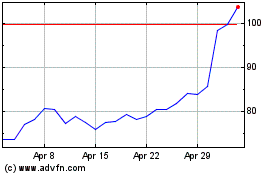

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

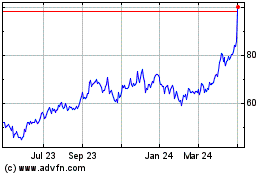

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024