Carpenter Technology Breaks Ground for $115 Million Facility in Reading

June 06 2007 - 1:38PM

Business Wire

Carpenter Technology Corporation (NYSE:CRS) today broke ground for

a $115 million facility in Reading, Pa., to expand its premium melt

capacity by 40 percent. The Company�s Chairman, President and CEO

Anne Stevens made the announcement. The facility will be located at

101 West Bern Street in Reading. �This investment further

strengthens Carpenter�s position in specialty materials

manufacturing, and demonstrates its confidence in domestic

production and commitment to the community,� said Stevens. The

expansion of the Company�s melt capacity and related

infrastructure, which is expected to be completed by mid-fiscal

year 2009, is part of approximately $200 million in capital

expenditures that the Company will make over the next four years

under the strategic plan it announced in September 2006. Premium

melting is the first step in producing Carpenter�s specialty alloys

for critical applications used in the aerospace, energy, medical

and automotive markets. The premium melt expansion will allow the

Company to meet the demand expected over the next several years

from those key end-use markets. Carpenter believes that more than

$500 million of organic growth opportunities in its highest margin

business exist over the next several years in those markets, which

require high performance products made to exacting specifications

for critical applications that cannot be easily substituted. The

premium melt expansion will complement Carpenter's existing

state-of-the-art melting, forging and finishing operations. These

operations are being enhanced with laser technology welding for

strip finishing and centerless turning equipment for bar finishing.

"This expansion of our premium melt capacity reflects the

increasing demand for premium alloy materials that is at the heart

of Carpenter's growth plan," said Stevens. "The investment is a

continuation of our strategy to focus on higher value materials

that have applications in niche markets." Stevens added, "The

growth over the next several years for Carpenter's high-margin

products is the result of increased needs for the more specialized

products manufactured by the Company's aerospace, energy, medical,

automotive and truck customers. However, these growing

opportunities can only be captured by the timely strategic

deployment of adequate capacity and technical resources that meet

both the current and future demands of these key end-market

customers." Dennis M. Oates, senior vice president of Carpenter�s

Specialty Alloys Operations added, "Our decision to make this

significant investment reflects not only our confidence in the

markets but also our confidence in our workforce in Reading and at

our other supporting operations. Our highly skilled and dedicated

employees will ensure the success of this project." The Company

expects that the investment will generate approximately $150

million of additional revenue from the sale of higher value

products by fiscal year 2010 (ending June 30) and provide

significant returns on the capital invested. At the core of the

Company's premium melt capacity expansion program will be an

approximate 40 percent increase in its vacuum induction melting

(VIM) capacity. VIM furnaces are typically used in the first

melting step to produce materials for demanding applications, such

as high-temperature and highly corrosive environments, high purity

alloys for medical procedures, and specialty applications in

automotive and truck. The expansion program also includes four

vacuum arc remelting (VAR) furnaces and two electro-slag remelting

(ESR) furnaces. These furnaces are used in the production of higher

margin products for critical end applications, such as rotating

aircraft engine parts, high performance automotive and truck engine

parts and medical devices. These furnaces will augment the

Company's existing 27 VAR and ESR furnaces, two of which were added

in December 2006. The expansion program will also include related

annealing, homogenization and other process machinery; associated

testing equipment, raw materials management systems, and

information technology infrastructure. Carpenter produces and

distributes specialty alloys, including stainless steels, titanium

alloys, and superalloys, and various engineered products.

Information about Carpenter can be found at www.cartech.com. Except

for historical information, all other information in this news

release consists of forward-looking statements within the meaning

of the Private Securities Litigation Act of 1995. These

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ from those projected,

anticipated or implied. The most significant of these uncertainties

are described in Carpenter's filings with the Securities and

Exchange Commission including its annual report on Form 10-K for

the year ended June 30, 2006, its subsequent Form 10-Q, and the

exhibits attached to those filings. They include but are not

limited to: 1) the cyclical nature of the specialty materials

business and certain end-use markets, including aerospace,

industrial, automotive, consumer, medical, and energy including

power generation, or other influences on Carpenter's business such

as new competitors, the consolidation of customers, and suppliers

or the transfer of manufacturing capacity from the United States to

foreign countries; 2) the ability of Carpenter to achieve cost

savings, productivity improvements or process changes; 3) the

ability to recoup increases in the cost of energy and raw materials

or other factors; 4) domestic and foreign excess manufacturing

capacity for certain metals; 5) fluctuations in currency exchange

rates; 6) the degree of success of government trade actions; 7) the

valuation of the assets and liabilities in Carpenter's pension

trusts and the accounting for pension plans; 8) possible labor

disputes or work stoppages; 9) the potential that our customers may

substitute alternate materials or adopt different manufacturing

practices that replace or limit the suitability of our products;

10) the ability to successfully acquire and integrate acquisitions;

and 11) the ability of Carpenter to implement and manage material

capital expansion projects in a timely and efficient manner. Any of

these factors could have an adverse and/or fluctuating effect on

Carpenter's results of operations. The forward-looking statements

in this document are intended to be subject to the safe harbor

protection provided by Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Carpenter undertakes no obligation to update or revise

any forward-looking statements.

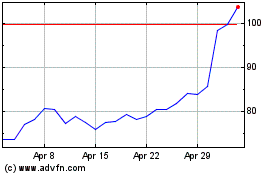

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

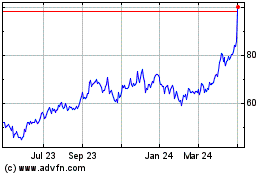

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024