Carpenter Technology Corporation (NYSE:CRS) today reported record

second quarter sales and net income. Gross margins, excluding the

negative impact of nickel, increased by 320 basis points from a

year ago. Results benefited from increased shipments, a continued

focus on cost improvements through lean manufacturing, and higher

prices. Net sales for the second fiscal quarter ended December 31,

2006 were $441.3 million, compared with $345.7 million for the same

quarter a year ago. Net income in the second quarter was $48.1

million, or $1.82 per diluted share, compared with net income of

$42.9 million, or $1.65 per diluted share, a year ago. Free cash

flow in the second quarter was $30.4 million, compared with $41.4

million in the quarter a year ago. Six-Months Results For the six

months ended December 31, 2006, net sales were $845.8 million,

compared with $691.7 million for the first half of fiscal 2006. Net

income for the first six months of the current fiscal year was

$99.3 million, or $3.76 per diluted share, compared to net income

of $83.0 million, or $3.19 per diluted share, a year ago. Free cash

flow in the first half of fiscal 2007 was $81.2 million, compared

with $42.1 million in the same period a year ago. Second Quarter �

Operating Summary �We achieved record second quarter results due,

in part, to solid demand from the industrial and aerospace markets

and our greater emphasis on the energy market,� said Anne Stevens,

chairman, president and chief executive officer. �Our ability to

achieve record earnings despite nickel prices that more than

doubled from a year ago reflected our strong operational focus,�

Stevens said. �The rapid rise in the cost of nickel had a profound

impact on our margins. If raw materials prices stabilize, we fully

expect that our margins will improve.� For the second quarter,

Carpenter�s sales were 28 percent higher than a year ago.

Surcharges, an increase in pounds shipped, and higher base prices

contributed to the sales gain. Adjusted for surcharges, sales

increased 14 percent from the second quarter a year ago. Sales to

the industrial market improved by 46 percent to a record $94

million, as a result of increased shipments of materials used in

the capital equipment and semiconductor markets, higher base prices

and surcharges. Automotive and truck market sales grew 34 percent

from the second quarter a year ago to $56 million. Higher

surcharges and base prices more than offset reduced shipments,

which were negatively affected by lower U.S. automotive production

rates. Sales to the energy market, which includes oil and gas and

power generation, increased 34 percent from a year ago to $36

million. Sales to the oil and gas sector grew 58 percent from the

same quarter a year ago. The sales growth reflected the Company�s

increased dedication of resources to service the oil and gas

sector. Also, sales to the power generation sector increased 4

percent from a year ago. Sales to the aerospace market increased 26

percent from the second quarter a year ago to $167 million, a

second quarter record. Sales benefited from strong demand for

titanium materials used in the manufacture of fasteners for

commercial and military aircraft. Carpenter also experienced solid

demand for its specialty alloys used in the manufacture of aircraft

engines and airframe structural components. Increased shipments,

higher base prices and surcharges contributed to the sales growth.

Consumer market sales rose 20 percent to $56 million. Higher sales

of materials used in consumer electronics were partially offset by

reduced sales of materials used in the housing and sporting goods

sectors. Medical market sales decreased 5 percent to $32 million

from last year�s second quarter record. The decline in sales

reflected the continued inventory adjustments taking place within

that supply chain. Geographically, sales outside the United States

increased 13 percent from the same quarter a year ago to $121

million, a second quarter record. International sales, which

represented 27 percent of total sales, benefited from higher base

prices and surcharges, and increased shipments of aerospace

materials. Second quarter gross profit improved to $97.1 million,

or 22.0 percent of sales, from $93.8 million, or 27.1 percent of

sales, in the same quarter a year ago. Gross profit as a percent of

sales was negatively impacted from the dramatic rise in the cost of

nickel, a primary raw material for the Company. Nickel prices on

the London Metal Exchange increased from an average of

approximately $5.75 for the second fiscal quarter a year ago to

$15.00 for this year�s second quarter. In the environment of

escalating raw material prices, the Company�s last-in, first-out

(LIFO) method of accounting to value inventories resulted in a $53

million LIFO expense in the second quarter of fiscal 2007. In the

second quarter a year ago, cost of sales included a $10.6 million

credit to value inventories using LIFO. Also, gross profit as a

percent of sales was negatively impacted by a 128 percent increase

in the amount of surcharge collected during the recent second

quarter versus a year ago. While the surcharge protects the

absolute gross profit dollars, it does have a dilutive effect on

gross margin as a percent of sales. In the recent second quarter,

the dilutive effect of the increased surcharge on gross margin was

approximately 340 basis points. Additionally, Carpenter�s gross

profit was negatively impacted by the lag effect in its surcharge

mechanism, which is structured to recover high raw material costs.

This lag effect can result in margin decline during periods of

rapidly escalating raw material prices, especially for companies

using the LIFO method of accounting for inventory. The Company

estimated that the lag effect negatively impacted gross margins by

approximately 500 basis points during the recent second quarter.

Adjusting for the dilutive effect of the surcharge and the negative

impact from the lag in the surcharge mechanism, gross margins would

have improved by 320 basis points in the recent second quarter from

a year ago. The underlying improvement was driven by higher base

prices, increased shipments and ongoing cost controls. Operating

income in the recent second quarter was $62.7 million or 14.2

percent of sales, compared to $63.9 million or 18.5 percent of

sales in the second quarter a year ago. In addition to the impact

of significantly higher raw material costs, operating income was

reduced by $3.6 million from increased expenses associated with

executive separation obligations. Outlook �The overall 2007 outlook

for our end-use markets remains strong and we are particularly

excited by the opportunities we are developing in the energy

market,� Stevens said. �Since joining the Company last November, I

have been very impressed by the product depth, by the technical and

managerial talent, and by the efforts of our employees to satisfy

customers.� Stevens concluded, �I am confident in our strategic

direction and the long-term strength in the key end-use markets

that we serve. Our announcement this morning to invest

approximately $115 million in additional premium melt capacity will

allow us to capitalize on the growth opportunities within these

markets and create significant value for shareholders. �Based upon

current market conditions, and our confidence in the performance of

Carpenter, we continue to expect record results for fiscal 2007.

Additionally, as we previously stated, free cash flow should be in

excess of $200 million in the current fiscal year.� Segment Results

� Second Quarter Specialty Metals Net sales for the quarter ended

December 31, 2006 for the Specialty Metals segment, which includes

Specialty Alloys Operations, Dynamet, and Carpenter Powder Products

business units, were $417.5 million, compared to $321.0 million in

the same quarter a year ago. Sales of specialty alloys were $199.7

million or 38 percent higher than the second quarter a year ago.

Increased shipments to the aerospace and energy markets, higher

base prices, and surcharges were the primary contributors to the

increase. Stainless steel sales were $155.3 million or 29 percent

higher than a year ago. Increased shipments to the industrial

market and pricing actions contributed to the sales growth. Sales

of titanium increased 18 percent to $48.4 million. Higher prices

and strong demand from the aerospace market for coil products used

in the manufacture of aerospace structural fasteners were the

primary contributors to growth. Operating income for the Specialty

Metals segment was $64.2 million or 15.4 percent of sales in the

recent second quarter, compared to $63.2 million or 19.7 percent in

the same quarter a year ago. The Specialty Metals segment was able

to increase operating income despite escalating raw material prices

and the lag in recovery of the Company�s surcharge mechanism. This

was achieved as a result of increased shipments, continued efforts

in lean manufacturing, and higher base prices. Engineered Products

Segment Net sales for this segment, which includes sales of ceramic

components and fabricated metal, decreased 4 percent to $24.3

million from $25.3 million a year ago. In the second quarter,

operating income for the Engineered Products segment was $4.8

million or 19.8 percent of sales compared to $4.2 million or 16.6

percent of sales in the same quarter a year ago. The increase was

attributable to better operating efficiencies at Certech, which

primarily produces ceramic cores used in the casting of turbine

blades. Segment Results � Year-to-Date Specialty Metals Net sales

for the first six months of fiscal 2007 for the Specialty Metals

segment were $794.7 million, compared to $642.3 million for the

same period a year ago. Sales of specialty alloys increased 29

percent to $371.7 million from $288.6 million for the same period a

year ago. Pricing actions and solid demand from the aerospace and

energy markets were the primary drivers of the increase. Titanium

sales rose 25 percent to $96.3 million from $77.0 million for the

same period a year ago. Sales benefited from increased shipments to

the aerospace market and higher selling prices. Sales of stainless

steel products grew 21 percent to $299.2 million from $247.5

million for the same period a year ago. Stainless sales benefited

from increased shipments to the industrial and automotive markets,

higher base prices and surcharges. Operating income for the

Specialty Metals segment was $136.1 million or 17.1 percent of

sales compared to $124.2 million or 19.3 percent of sales generated

for the same period a year ago. The change in operating income

reflected higher pricing, a continued focus on operational

improvements, and increased shipments. Operating income as a

percent of sales decreased due to the dilutive effect on margins

from the increase in surcharge revenue and the negative impact from

the lag effect of the Company�s surcharge mechanism. Engineered

Products Segment Net sales for the first six months of fiscal 2007

for the Engineered Products segment increased 4 percent to $52.3

million from $50.3 million for the same period a year ago.

Increased sales of ceramic cores used in the casting of jet engine

turbine blades primarily drove the improvement. Operating income

was $10.1 million or 19.3 percent of sales in the first half of

fiscal 2007 compared to $9.4 million or 18.7 percent of sales for

the same period a year ago. Higher prices, better operating

efficiencies, and increased shipments aided the improvement. Other

Items In the second quarter of fiscal 2007, selling and

administrative expenses were $34.4 million, or 7.8 percent of

sales, compared to $29.9 million, or 8.6 percent of sales, in the

same quarter a year ago. The difference primarily reflected $3.6

million of separation costs. For the first six months of fiscal

2007, selling and administrative expenses were $65.2 million, or

7.7 percent of sales compared to $58.0 million, or 8.4 percent of

sales for the same period a year ago. The increase primarily

reflected the separation costs incurred in the second quarter of

the current fiscal year, and first quarter expenses of $1.6 million

associated with the review of an acquisition, and $0.8 million from

executive recruitment fees. Interest expense for the quarter was

$5.7 million, compared with $5.9 million in the second quarter a

year ago. For the first six months of fiscal 2007, interest expense

was $11.5 million, compared with $11.9 million in the same period a

year ago. Other income in the quarter was $11.6 million, compared

with $8.7 million in last year�s second quarter. The increase in

other income is primarily due to increases in interest income from

higher balances of invested cash and increased receipts from the

�Continued Dumping and Subsidy Offset Act of 2000� (the �Act�).

Receipts under this Act in the recent second quarter were $6.4

million compared to $4.8 million in the second quarter a year ago.

For fiscal 2007 year-to-date, other income rose to $17.5 million

from $11.7 million for the comparable period a year ago. The

increase in other income was primarily attributed to higher

balances of invested cash and increased receipts under the Act.

Carpenter�s income tax provision in the recent second quarter was

$20.5 million, or 29.9 percent of pre-tax income, versus $23.8

million, or 35.7 percent, in the same quarter a year ago. The tax

provision in the recent second quarter was favorably impacted by

adjustments due to Congress� retroactive extension of the Federal

research and development tax credit and the favorable settlement of

a state tax audit. For the first six months of fiscal 2007,

Carpenter�s income tax provision was $42.5 million, or 30.0 percent

of pre-tax income, compared to $44.3 million, or 34.8 percent of

pre-tax income for the same period a year ago. The Company�s income

tax rate also benefited in the first quarter from the reversal of

certain deferred tax valuation allowances due to changes in

specific state tax laws and an improved outlook regarding the

ability to use those benefits. The Company expects that its

full-year tax rate will be in the range of 33 to 35 percent. Cash

Flow and Liquidity Carpenter has maintained the ability to provide

cash to meet its needs through cash flow from operations,

management of working capital, and the flexibility to use outside

sources of financing to supplement internally generated funds. Free

cash flow in the recent second quarter was $30.4 million, compared

with free cash flow of $41.4 million in the quarter a year ago. For

the first six months of fiscal 2007, free cash flow was $81.2

million compared to $42.1 million for the same period a year ago.

Conference Call Carpenter will host a conference call and webcast

today, January 26, at 10:00 a.m., ET, to discuss financial results

and operations for the second quarter. Please call 610-208-2800 for

details of the conference call. Access to the call will also be

made available at Carpenter�s web site (www.cartech.com) and

through CCBN (www.ccbn.com). A replay of the call will be made

available at www.cartech.com or at www.ccbn.com. Carpenter produces

and distributes specialty alloys, including stainless steels,

titanium alloys, and superalloys, and various engineered products.

Information about Carpenter can be found on the Internet at

www.cartech.com. Except for historical information, all other

information in this news release consists of forward-looking

statements within the meaning of the Private Securities Litigation

Act of 1995. These forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ from

those projected, anticipated or implied. The most significant of

these uncertainties are described in Carpenter's filings with the

Securities and Exchange Commission including its annual report on

Form 10-K for the year ended June 30, 2006, its subsequent Form

10-Q, and the exhibits attached to those filings. They include but

are not limited to: 1) the cyclical nature of the specialty

materials business and certain end-use markets, including

aerospace, industrial, automotive, consumer, medical, and energy

including power generation, or other influences on Carpenter�s

business such as new competitors, the consolidation of customers,

and suppliers or the transfer of manufacturing capacity from the

United States to foreign countries; 2) the ability of Carpenter to

achieve cost savings, productivity improvements or process changes;

3)�the ability to recoup increases in the cost of energy and raw

materials or other factors; 4)�domestic and foreign excess

manufacturing capacity for certain metals; 5)�fluctuations in

currency exchange rates; 6) the degree of success of government

trade actions; 7)�the valuation of the assets and liabilities in

Carpenter�s pension trusts and the accounting for pension plans;

8)�possible labor disputes or work stoppages; 9) the potential that

our customers may substitute alternate materials or adopt different

manufacturing practices that replace or limit the suitability of

our products; 10) the ability to successfully acquire and integrate

acquisitions; and 11) the ability of Carpenter to implement and

manage material capital expansion projects in a timely and

efficient manner. Any of these factors could have an adverse and/or

fluctuating effect on Carpenter's results of operations. The

forward-looking statements in this document are intended to be

subject to the safe harbor protection provided by Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Carpenter undertakes

no obligation to update or revise any forward-looking statements.

PRELIMINARY CONSOLIDATED STATEMENT OF INCOME (in millions, except

per share data) � � Three Months Ended Six Months Ended December 31

December 31 � 2006� 2005� 2006� 2005� � NET SALES $441.3� $345.7�

$845.8� $691.7� � Cost of sales 344.2� 251.9� 644.8� 506.2� Gross

profit 97.1� 93.8� 201.0� 185.5� � Selling and administrative

expenses 34.4� 29.9� 65.2� 58.0� Operating income 62.7� 63.9�

135.8� 127.5� � Interest expense 5.7� 5.9� 11.5� 11.9� Other

income, net (11.6) (8.7) (17.5) (11.7) � Income before income taxes

68.6� 66.7� 141.8� 127.3� Income taxes 20.5� 23.8� 42.5� 44.3� NET

INCOME $48.1� $42.9� $99.3� $83.0� � EARNINGS PER COMMON SHARE:

Basic $1.87� $1.69� $3.86� $3.28� Diluted $1.82� $1.65� $3.76�

$3.19� � � WEIGHTED AVERAGE COMMON SHARES OUTSTANDING: Basic 25.6�

25.2� 25.6� 25.1� Diluted 26.4� 26.0� 26.3� 25.9� � Cash dividends

per common share $0.225� $0.15� $0.45� $0.30� PRELIMINARY

CONSOLIDATED STATEMENT OF CASH FLOWS (in millions) � Six Months

Ended December 31 � 2006� 2005� � OPERATING ACTIVITIES: Net income

$99.3� $83.0� Adjustments to reconcile net income to net cash

provided from operations: Depreciation 23.0� 22.5� Amortization

0.8� 1.0� Deferred income taxes (7.2) 1.8� Net pension expense 2.4�

5.4� Net loss on asset disposals 0.2� 0.3� Changes in working

capital and other: Receivables 17.9� 15.6� Inventories (32.4)

(36.5) Other current assets (6.4) 4.7� Accounts payable 40.4�

(27.0) Accrued current liabilities (34.5) (6.0) Other, net 4.3�

(4.5) Net cash provided from operating activities 107.8� 60.3� �

INVESTING ACTIVITIES: Purchases of plant, equipment and software

(14.6) (10.2) Proceeds from disposals of plant and equipment 0.2�

0.2� Purchases of marketable securities (412.1) (125.7) Sales of

marketable securities 231.3� 155.1� Net cash (used for) provided

from investing activities (195.2) 19.4� � FINANCING ACTIVITIES:

Payments on long-term debt (0.1) --� Dividends paid (12.2) (8.2)

Tax benefits on share-based compensation 2.2� --� Proceeds from

common stock options exercised 1.3� 7.7� Net cash used for

financing activities (8.8) (0.5) � Effect of exchange rate changes

on cash and cash equivalents (3.6) 0.9� � (DECREASE) INCREASE IN

CASH AND CASH EQUIVALENTS (99.8) 80.1� Cash and cash equivalents at

beginning of period 352.8� 159.5� Cash and cash equivalents at end

of period $253.0� $239.6� PRELIMINARY CONSOLIDATED BALANCE SHEET

(in millions) � December 31 June 30 2006� 2006� � ASSETS Current

assets: Cash and cash equivalents $253.0� $352.8� Marketable

securities 322.6� 141.8� Accounts receivable, net 219.0� 234.7�

Inventories 258.5� 224.3� Deferred income taxes 12.8� 13.7� Other

current assets 40.8� 32.0� Total current assets 1,106.7� 999.3� �

Property, plant and equipment, net 532.5� 541.1� Prepaid pension

cost 246.9� 247.1� Goodwill 46.4� 46.4� Trademarks and trade names,

net 19.6� 20.1� Other assets 31.5� 33.9� Total assets $1,983.6�

$1,887.9� � LIABILITIES Current liabilities: Accounts payable

$178.2� $137.4� Accrued liabilities 99.5� 133.8� Current portion of

long-term debt 0.2� 0.2� Total current liabilities 277.9� 271.4� �

Long-term debt, net of current portion 332.8� 333.1� Accrued

postretirement benefits 97.0� 102.2� Deferred income taxes 182.0�

189.0� Other liabilities 47.6� 45.9� Total liabilities 937.3�

941.6� � STOCKHOLDERS' EQUITY Convertible preferred stock 17.7�

18.0� Common stock 132.8� 132.5� Capital in excess of par value -

common stock 300.4� 294.2� Reinvested earnings 636.9� 549.8� Common

stock in treasury, at cost (37.2) (37.3) Deferred compensation

(1.2) (1.5) Accumulated other comprehensive loss (3.1) (9.4) Total

stockholders' equity 1,046.3� 946.3� � Total liabilities and

stockholders' equity $1,983.6� $1,887.9� PRELIMINARY SEGMENT

FINANCIAL DATA (in millions) � � Three Months Ended Six Months

Ended December 31 December 31 � 2006� 2005� 2006� 2005� � Net

sales: Specialty Metals $417.5� $321.0� $794.7� $642.3� Engineered

Products 24.3� 25.3� 52.3� 50.3� Intersegment (0.5) (0.6) (1.2)

(0.9) � Consolidated net sales $441.3� $345.7� $845.8� $691.7� �

Operating income: Specialty Metals $64.2� $63.2� $136.1� $124.2�

Engineered Products 4.8� 4.2� 10.1� 9.4� Corporate costs (10.1)

(6.1) (18.0) (11.4) Pension earnings, interest & deferrals 3.6�

2.6� 7.3� 5.2� Intersegment 0.2� ---� 0.3� 0.1� � Consolidated

operating income $62.7� $63.9� $135.8� $127.5� � � � Carpenter

operates in two business segments, Specialty Metals and Engineered

Products. Specialty Metals includes our Specialty Alloys, Dynamet

and Carpenter Powder Products business operations. These operations

have been aggregated into one reportable segment because of the

similarities in products, processes, customers, distribution

methods and economic characteristics. � The service cost component

of net pension expense, which represents the estimated cost of

future pension liabilities earned associated with active employees,

is included in the operating income of the business segments. The

residual net pension expense, which is comprised of the expected

return on plan assets, interest costs on the projected benefit

obligations of the plans, and amortization of actuarial gains and

losses and prior service costs, is included under the heading

"Pension earnings, interest & deferrals." PRELIMINARY SELECTED

FINANCIAL MEASURES (in millions, except per share data) � � Three

Months Ended Six Months Ended December 31 December 31 FREE CASH

FLOW 2006� 2005� 2006� 2005� � Net cash provided from operations

$43.8� $50.0� $107.8� $60.3� Purchases of plant, equipment and

software (7.3) (4.5) (14.6) (10.2) Proceeds from disposals of plant

and equipment ---� ---� 0.2� 0.2� Dividends paid (6.1) (4.1) (12.2)

(8.2) Free cash flow $30.4� $41.4� $81.2� $42.1� � � Free cash flow

is a measure of cash generated which management evaluates for

alternative uses.

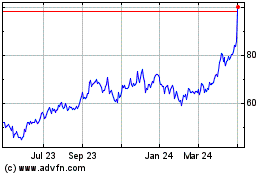

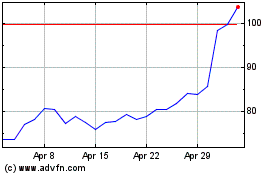

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024