Carpenter Technology Corporation (NYSE:CRS) today reported record

first quarter sales and net income. Results were led by solid

demand across several key end-use markets, increased sales of

higher value products, and the company�s continued focus on cost

through lean and variation reduction. Net sales for the first

quarter ended September 30, 2006 were $404.5 million, compared with

$346.0 million for the same quarter a year ago. Net income in the

first quarter was $51.2 million, or $1.94 per diluted share,

compared to net income of $40.1 million, or $1.54 per diluted

share, a year ago. Free cash flow in the first quarter was $50.8

million, compared with $0.7 million in the quarter a year ago.

First Quarter � Operating Summary �Our focus on the sale of higher

value materials, continued efforts in lean and variation reduction,

and favorable market conditions helped us to achieve record first

quarter results,� said Robert J. Torcolini, chairman, president and

chief executive officer. �We are especially pleased to report

record performance despite the significant rise in the cost of raw

materials during the quarter. �Demand from the aerospace market

remained robust during the quarter, resulting in record first

quarter shipments of titanium materials and solid growth in our

specialty alloys and ceramic materials.� For the first quarter,

Carpenter�s sales increased 17 percent compared to a year ago.

Sales benefited from higher surcharges, base price increases, and

increased sales of higher value materials. Adjusted for surcharges,

sales increased 10 percent from the first quarter a year ago. Sales

to the aerospace market increased 34 percent from the first quarter

a year ago to $158 million, a first quarter record. Demand for

titanium materials used in the manufacture of fasteners for

commercial and military aircraft was particularly strong during the

quarter and resulted in record shipments. Additionally, Carpenter

experienced solid demand for its specialty alloys and ceramic

materials used in the manufacture of aircraft engines, turbine

blades, and airframe structural components. Automotive and truck

market sales grew 23 percent from the first quarter a year ago to

$52 million. Increased sales of high temperature materials used in

engine components were the primary reason for the growth. Also,

higher sales of materials used in automotive safety devices

contributed to the increase. Sales to the industrial market

increased 13 percent to $88 million. The industrial market excludes

sales of materials used in oil and gas exploration applications,

which are now included in a new category titled �energy.� Sales to

the industrial market primarily benefited from increased sales of

materials used in the manufacture of capital equipment and higher

value products sold to independent distributors. Consumer market

sales increased 2 percent to $48 million. Increased sales of higher

value strip products used in thermostats and consumer electronic

applications were partially offset by reduced sales to the sporting

goods market. Sales to the energy market, which includes oil and

gas and power generation, were $29 million or flat with a year ago.

Sales to the oil and gas sector increased 67 percent from the same

quarter a year ago. Sales benefited from profitable market share

gains as well as growth with key customers. Offsetting the growth

was lower sales to the power generation sector due to the timing of

shipments to customers. Medical market sales decreased 7 percent to

$30 million. The decline in sales reflected inventory adjustments

taking place within that supply chain. Geographically, sales

outside the United States increased 20 percent from the same

quarter a year ago to $123 million, a first quarter record.

International sales, which represented 30 percent of total sales,

reflected strong demand for higher value materials, particularly

from the aerospace market. Carpenter�s first quarter gross profit

increased 13 percent to $103.9 million, or 25.7 percent of sales,

from $91.7 million, or 26.5 percent of sales, in the same quarter a

year ago. The decline in gross margin as a percent of sales

resulted from the steep rise in the cost of nickel, a primary raw

material for the company. During the quarter, average nickel prices

on the London Metal Exchange were 100 percent higher than the

quarter a year ago. Cost of sales in the first quarter of fiscal

2006 included a charge of $26.2 million to value inventories using

the last-in, first-out (LIFO) method of accounting, due primarily

to rising nickel costs. In the first quarter a year ago, cost of

sales included a $3.7 million credit to value inventories using

LIFO. Carpenter�s surcharge mechanism is structured to recover high

raw material costs, although with a lag effect. Additionally, gross

margin as a percent of sales was negatively impacted by a 68

percent increase in the amount of surcharge collected during the

recent first quarter versus a year ago. While the surcharge

protects the absolute gross profit dollars, it does have a dilutive

effect on gross margin as a percent of sales. In the recent first

quarter, the dilutive effect on gross margin was approximately 120

basis points. Partially offsetting the impact of higher raw

material costs on margins were increased base prices, higher

volumes and ongoing cost reductions generated by lean and variation

reduction initiatives. Carpenter generated a 15 percent increase in

operating income to a first quarter record of $73.1 million, or

18.1 percent of sales from $63.7 million, or 18.4 percent of sales,

generated a year ago. Operating income in the recent first quarter

reflected $1.6 million of due diligence expenses associated with

the review of an acquisition target. Outlook �The strength in

aerospace and other key markets should continue to drive our

performance through the balance of this fiscal year,� said

Torcolini. �We are continuing with our relentless focus on lean and

variation reduction to create additional operating leverage as we

capitalize on these strong market conditions. �We remain committed

to refining our business operating model so that we will continue

to generate returns in excess of our cost of capital through all

phases of a business cycle.� Torcolini concluded, �Based on current

market conditions and expectations for steady growth, we anticipate

another record year of sales and net income in fiscal 2007.

Additionally, we expect free cash flow to exceed $200 million.�

Segment Results � First Quarter Specialty Metals Net sales for the

quarter ended September 30, 2006 for the Specialty Metals segment,

which includes Specialty Alloys Operations, Dynamet, and Carpenter

Powder Products business units, were $377.2 million, compared to

$321.3 million in the same quarter a year ago. Sales of specialty

alloys, stainless steels and titanium experienced strong growth in

the quarter. Sales of specialty alloys increased 20 percent to $172

million in the first quarter from a year ago. Solid demand from the

aerospace and oil and gas markets were the primary contributors to

the increase. Stainless steel sales were $144 million or 13 percent

higher than a year ago. Higher sales to the automotive and

industrial markets contributed to the increase. Sales of titanium

increased 33 percent to $48 million. Robust demand from the

aerospace market for wire products used in the manufacture of

aerospace structural fasteners was the primary contributor to the

growth. Partially offsetting the increase was reduced sales to the

medical market. Operating income for the Specialty Metals segment

was $71.9 million in the recent first quarter, compared to $61.0

million in the same quarter a year ago. The change in operating

income reflected increased sales of higher value materials, higher

base prices, and a continued focus on operational improvements.

Engineered Products Segment Net sales for this segment, which

includes sales of ceramic components and fabricated metal,

increased 12 percent to $28.0 million from $25.1 million a year

ago. Increased sales of ceramic cores used in the casting of jet

engine turbine blades primarily drove the improvement. In the first

quarter, operating income for the Engineered Products segment was

$5.4 million compared to $5.2 million in the same quarter a year

ago. The increase was attributable to higher sales and better

operating efficiencies. Other Items In the first quarter of fiscal

2007, selling and administrative expenses were $30.8 million, or

7.6 percent of sales, compared to $28.0 million, or 8.1 percent of

sales, in the same quarter a year ago. The increase was primarily

related to $1.6 million of due diligence expenses associated with

the review of an acquisition target and $0.8 million from executive

recruitment fees. Interest expense for the quarter was $5.8

million, compared with $6.0 million in the first quarter a year

ago. Other income in the quarter was $5.9 million, compared with

$3.0 million in last year�s first quarter. The change in other

income is primarily due to increased interest income from higher

balances of invested cash. Carpenter�s income tax provision in the

recent first quarter was $22.0 million, or 30.1 percent of pre-tax

income, versus $20.6 million, or 33.9 percent, in the same quarter

a year ago. The tax provision in the recent first quarter was

favorably impacted by the reversal of certain deferred tax

valuation allowances due to changes in specific state tax laws and

an improved outlook regarding the ability to use those benefits.

The company expects that its full year tax rate will be in the

range of 33 to 35 percent. Cash Flow and Liquidity Carpenter has

maintained the ability to provide cash to meet its needs through

cash flow from operations, management of working capital, and the

flexibility to use outside sources of financing to supplement

internally generated funds. Free cash flow in the recent first

quarter was $50.8 million, compared with free cash flow of $0.7

million in the quarter a year ago. Conference Call Carpenter will

host a conference call and webcast today, October 26, at 10:00 AM,

Eastern Time, to discuss the results of operations for the first

quarter of fiscal 2007. Please call 610-208-2800 for details of the

conference call. Access to the call will also be made available at

Carpenter�s web site (www.cartech.com) and through CCBN

(www.ccbn.com). A replay of the call will be made available at

www.cartech.com or at www.ccbn.com. Carpenter produces and

distributes specialty alloys, including stainless steels, titanium

alloys, and superalloys, and various engineered products.

Information about Carpenter can be found on the Internet at

www.cartech.com. Except for historical information, all other

information in this news release consists of forward-looking

statements within the meaning of the Private Securities Litigation

Act of 1995. These forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ from

those projected, anticipated or implied. The most significant of

these uncertainties are described in Carpenter's filings with the

Securities and Exchange Commission including its annual report on

Form 10-K for the year ended June 30, 2006, and the exhibits

attached to those filings. They include but are not limited to: 1)

the cyclical nature of the specialty materials business and certain

end-use markets, including aerospace, industrial, automotive,

consumer, medical, and energy including power generation, or other

influences on Carpenter�s business such as new competitors, the

consolidation of customers, and suppliers or the transfer of

manufacturing capacity from the United States to foreign countries;

2) the ability of Carpenter to achieve cost savings, productivity

improvements or process changes; 3)�the ability to recoup increases

in the cost of energy and raw materials or other factors;

4)�domestic and foreign excess manufacturing capacity for certain

metals; 5)�fluctuations in currency exchange rates; 6) the degree

of success of government trade actions; 7)�the valuation of the

assets and liabilities in Carpenter�s pension trusts and the

accounting for pension plans; 8)�possible labor disputes or work

stoppages; 9) the potential that our customers may substitute

alternate materials or adopt different manufacturing practices that

replace or limit the suitability of our products; and 10) the

ability to successfully acquire and integrate acquisitions. Any of

these factors could have an adverse and/or fluctuating effect on

Carpenter's results of operations. The forward-looking statements

in this document are intended to be subject to the safe harbor

protection provided by Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Carpenter undertakes no obligation to update or revise

any forward-looking statements. PRELIMINARY CONSOLIDATED STATEMENT

OF INCOME (in millions, except per share data) � � Three Months

Ended September 30 � 2006� 2005� � NET SALES $404.5� $346.0� � Cost

of sales 300.6� 254.3� Gross profit 103.9� 91.7� � Selling and

administrative expenses 30.8� 28.0� Operating income 73.1� 63.7� �

Interest expense 5.8� 6.0� Other income, net (5.9) (3.0) � Income

before income taxes 73.2� 60.7� Income taxes 22.0� 20.6� NET INCOME

$51.2� $40.1� � EARNINGS PER COMMON SHARE: Basic $1.99� $1.59�

Diluted $1.94� $1.54� � � WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING: Basic 25.5� 25.0� Diluted 26.3� 25.9� � Cash dividends

per common share 0.225� $0.15� PRELIMINARY CONSOLIDATED STATEMENT

OF CASH FLOWS (in millions) � Three Months Ended September 30 �

2006� 2005� � OPERATING ACTIVITIES: Net income $51.2� $40.1�

Adjustments to reconcile net income to net cash provided from

operations: Depreciation 11.5� 11.0� Amortization 0.4� 0.6�

Deferred income taxes (6.1) 0.3� Net pension expense 1.2� 2.7� Net

loss on asset disposals 0.1� 0.2� Changes in working capital and

other: Receivables 5.1� 4.3� Inventories (8.6) (25.6) Other current

assets (8.0) 0.5� Accounts payable 25.4� (12.4) Accrued current

liabilities (3.5) (10.1) Other, net (4.7) (1.3) Net cash provided

from operating activities 64.0� 10.3� � INVESTING ACTIVITIES:

Purchases of plant, equipment and software (7.3) (5.7) Proceeds

from disposals of plant and equipment 0.2� 0.2� Purchases of

marketable securities (309.2) (73.9) Sales of marketable securities

100.4� 72.3� Net cash used for investing activities (215.9) (7.1) �

FINANCING ACTIVITIES: Payments on long-term debt (0.1) --�

Dividends paid (6.1) (4.1) Tax benefits on share-based compensation

0.1� --� Proceeds from common stock options exercised 0.1� 3.1� Net

cash used for financing activities (6.0) (1.0) � Effect of exchange

rate changes on cash and cash equivalents (1.0) 0.2� � (DECREASE)

INCREASE IN CASH AND CASH EQUIVALENTS (158.9) 2.4� Cash and cash

equivalents at beginning of period 413.4� 163.8� Cash and cash

equivalents at end of period $254.5� $166.2� PRELIMINARY

CONSOLIDATED BALANCE SHEET (in millions) � September 30 June 30

2006� 2006� � ASSETS Current assets: Cash and cash equivalents

$254.5� $413.4� Marketable securities 290.0� 81.2� Accounts

receivable, net 229.8� 234.7� Inventories 233.7� 224.3� Deferred

income taxes 15.5� 13.7� Other current assets 40.6� 32.0� Total

current assets 1,064.1� 999.3� � Property, plant and equipment, net

536.4� 541.1� Prepaid pension cost 247.0� 247.1� Goodwill 46.4�

46.4� Trademarks and trade names, net 19.9� 20.1� Other assets

33.9� 33.9� Total assets $1,947.7� $1,887.9� � LIABILITIES Current

liabilities: Accounts payable $162.9� $137.4� Accrued liabilities

130.7� 133.8� Current portion of long-term debt 0.2� 0.2� Total

current liabilities 293.8� 271.4� � Long-term debt, net of current

portion 332.9� 333.1� Accrued postretirement benefits 99.4� 102.2�

Deferred income taxes 183.2� 189.0� Other liabilities 47.3� 45.9�

Total liabilities 956.6� 941.6� � STOCKHOLDERS' EQUITY Convertible

preferred stock 17.8� 18.0� Common stock 132.6� 132.5� Capital in

excess of par value - common stock 294.8� 294.2� Reinvested

earnings 594.9� 549.8� Common stock in treasury, at cost (36.7)

(37.3) Deferred compensation (1.5) (1.5) Accumulated other

comprehensive loss (10.8) (9.4) Total stockholders' equity 991.1�

946.3� � Total liabilities and stockholders' equity $1,947.7�

$1,887.9� PRELIMINARY SEGMENT FINANCIAL DATA (in millions) � �

Three Months Ended September 30 � 2006� 2005� � Net sales:

Specialty Metals $377.2� $321.3� Engineered Products 28.0� 25.1�

Intersegment (0.7) (0.4) � Consolidated net sales $404.5� $346.0� �

Operating income: Specialty Metals $71.9� $61.0� Engineered

Products 5.4� 5.2� Corporate costs (7.9) (5.1) Pension earnings,

interest & deferrals 3.6� 2.6� Intersegment 0.1� --� �

Consolidated operating income $73.1� $63.7� � � � Carpenter

operates in two business segments, Specialty Metals and Engineered

Products. Specialty Metals includes our Specialty Alloys, Dynamet

and Carpenter Powder Products business operations. These operations

have been aggregated into one reportable segment because of the

similarities in products, processes, customers, distribution

methods and economic characteristics. � The service cost component

of net pension expense, which represents the estimated cost of

future pension liabilities earned associated with active employees,

is included in the operating results of the business segments. The

residual net pension expense, which is comprised of the expected

return on plan assets, interest costs on the projected benefit

obligations of the plans, and amortization of actuarial gains and

losses and prior service costs, is included under the heading

"Pension earnings, interest & deferrals." PRELIMINARY SELECTED

FINANCIAL MEASURES (in millions, except per share data) � � Three

Months Ended September 30 FREE CASH FLOW 2006� 2005� � Net cash

provided from operations $64.0� $10.3� Purchases of plant,

equipment and software (7.3) (5.7) Proceeds from disposals of plant

and equipment 0.2� 0.2� Dividends paid (6.1) (4.1) Free cash flow

$50.8� $0.7� � Free cash flow is a measure of cash generated which

management evaluates for alternative uses. Carpenter Technology

Corporation (NYSE:CRS) today reported record first quarter sales

and net income. Results were led by solid demand across several key

end-use markets, increased sales of higher value products, and the

company's continued focus on cost through lean and variation

reduction. Net sales for the first quarter ended September 30, 2006

were $404.5 million, compared with $346.0 million for the same

quarter a year ago. Net income in the first quarter was $51.2

million, or $1.94 per diluted share, compared to net income of

$40.1 million, or $1.54 per diluted share, a year ago. Free cash

flow in the first quarter was $50.8 million, compared with $0.7

million in the quarter a year ago. First Quarter - Operating

Summary "Our focus on the sale of higher value materials, continued

efforts in lean and variation reduction, and favorable market

conditions helped us to achieve record first quarter results," said

Robert J. Torcolini, chairman, president and chief executive

officer. "We are especially pleased to report record performance

despite the significant rise in the cost of raw materials during

the quarter. "Demand from the aerospace market remained robust

during the quarter, resulting in record first quarter shipments of

titanium materials and solid growth in our specialty alloys and

ceramic materials." For the first quarter, Carpenter's sales

increased 17 percent compared to a year ago. Sales benefited from

higher surcharges, base price increases, and increased sales of

higher value materials. Adjusted for surcharges, sales increased 10

percent from the first quarter a year ago. Sales to the aerospace

market increased 34 percent from the first quarter a year ago to

$158 million, a first quarter record. Demand for titanium materials

used in the manufacture of fasteners for commercial and military

aircraft was particularly strong during the quarter and resulted in

record shipments. Additionally, Carpenter experienced solid demand

for its specialty alloys and ceramic materials used in the

manufacture of aircraft engines, turbine blades, and airframe

structural components. Automotive and truck market sales grew 23

percent from the first quarter a year ago to $52 million. Increased

sales of high temperature materials used in engine components were

the primary reason for the growth. Also, higher sales of materials

used in automotive safety devices contributed to the increase.

Sales to the industrial market increased 13 percent to $88 million.

The industrial market excludes sales of materials used in oil and

gas exploration applications, which are now included in a new

category titled "energy." Sales to the industrial market primarily

benefited from increased sales of materials used in the manufacture

of capital equipment and higher value products sold to independent

distributors. Consumer market sales increased 2 percent to $48

million. Increased sales of higher value strip products used in

thermostats and consumer electronic applications were partially

offset by reduced sales to the sporting goods market. Sales to the

energy market, which includes oil and gas and power generation,

were $29 million or flat with a year ago. Sales to the oil and gas

sector increased 67 percent from the same quarter a year ago. Sales

benefited from profitable market share gains as well as growth with

key customers. Offsetting the growth was lower sales to the power

generation sector due to the timing of shipments to customers.

Medical market sales decreased 7 percent to $30 million. The

decline in sales reflected inventory adjustments taking place

within that supply chain. Geographically, sales outside the United

States increased 20 percent from the same quarter a year ago to

$123 million, a first quarter record. International sales, which

represented 30 percent of total sales, reflected strong demand for

higher value materials, particularly from the aerospace market.

Carpenter's first quarter gross profit increased 13 percent to

$103.9 million, or 25.7 percent of sales, from $91.7 million, or

26.5 percent of sales, in the same quarter a year ago. The decline

in gross margin as a percent of sales resulted from the steep rise

in the cost of nickel, a primary raw material for the company.

During the quarter, average nickel prices on the London Metal

Exchange were 100 percent higher than the quarter a year ago. Cost

of sales in the first quarter of fiscal 2006 included a charge of

$26.2 million to value inventories using the last-in, first-out

(LIFO) method of accounting, due primarily to rising nickel costs.

In the first quarter a year ago, cost of sales included a $3.7

million credit to value inventories using LIFO. Carpenter's

surcharge mechanism is structured to recover high raw material

costs, although with a lag effect. Additionally, gross margin as a

percent of sales was negatively impacted by a 68 percent increase

in the amount of surcharge collected during the recent first

quarter versus a year ago. While the surcharge protects the

absolute gross profit dollars, it does have a dilutive effect on

gross margin as a percent of sales. In the recent first quarter,

the dilutive effect on gross margin was approximately 120 basis

points. Partially offsetting the impact of higher raw material

costs on margins were increased base prices, higher volumes and

ongoing cost reductions generated by lean and variation reduction

initiatives. Carpenter generated a 15 percent increase in operating

income to a first quarter record of $73.1 million, or 18.1 percent

of sales from $63.7 million, or 18.4 percent of sales, generated a

year ago. Operating income in the recent first quarter reflected

$1.6 million of due diligence expenses associated with the review

of an acquisition target. Outlook "The strength in aerospace and

other key markets should continue to drive our performance through

the balance of this fiscal year," said Torcolini. "We are

continuing with our relentless focus on lean and variation

reduction to create additional operating leverage as we capitalize

on these strong market conditions. "We remain committed to refining

our business operating model so that we will continue to generate

returns in excess of our cost of capital through all phases of a

business cycle." Torcolini concluded, "Based on current market

conditions and expectations for steady growth, we anticipate

another record year of sales and net income in fiscal 2007.

Additionally, we expect free cash flow to exceed $200 million."

Segment Results - First Quarter Specialty Metals Net sales for the

quarter ended September 30, 2006 for the Specialty Metals segment,

which includes Specialty Alloys Operations, Dynamet, and Carpenter

Powder Products business units, were $377.2 million, compared to

$321.3 million in the same quarter a year ago. Sales of specialty

alloys, stainless steels and titanium experienced strong growth in

the quarter. Sales of specialty alloys increased 20 percent to $172

million in the first quarter from a year ago. Solid demand from the

aerospace and oil and gas markets were the primary contributors to

the increase. Stainless steel sales were $144 million or 13 percent

higher than a year ago. Higher sales to the automotive and

industrial markets contributed to the increase. Sales of titanium

increased 33 percent to $48 million. Robust demand from the

aerospace market for wire products used in the manufacture of

aerospace structural fasteners was the primary contributor to the

growth. Partially offsetting the increase was reduced sales to the

medical market. Operating income for the Specialty Metals segment

was $71.9 million in the recent first quarter, compared to $61.0

million in the same quarter a year ago. The change in operating

income reflected increased sales of higher value materials, higher

base prices, and a continued focus on operational improvements.

Engineered Products Segment Net sales for this segment, which

includes sales of ceramic components and fabricated metal,

increased 12 percent to $28.0 million from $25.1 million a year

ago. Increased sales of ceramic cores used in the casting of jet

engine turbine blades primarily drove the improvement. In the first

quarter, operating income for the Engineered Products segment was

$5.4 million compared to $5.2 million in the same quarter a year

ago. The increase was attributable to higher sales and better

operating efficiencies. Other Items In the first quarter of fiscal

2007, selling and administrative expenses were $30.8 million, or

7.6 percent of sales, compared to $28.0 million, or 8.1 percent of

sales, in the same quarter a year ago. The increase was primarily

related to $1.6 million of due diligence expenses associated with

the review of an acquisition target and $0.8 million from executive

recruitment fees. Interest expense for the quarter was $5.8

million, compared with $6.0 million in the first quarter a year

ago. Other income in the quarter was $5.9 million, compared with

$3.0 million in last year's first quarter. The change in other

income is primarily due to increased interest income from higher

balances of invested cash. Carpenter's income tax provision in the

recent first quarter was $22.0 million, or 30.1 percent of pre-tax

income, versus $20.6 million, or 33.9 percent, in the same quarter

a year ago. The tax provision in the recent first quarter was

favorably impacted by the reversal of certain deferred tax

valuation allowances due to changes in specific state tax laws and

an improved outlook regarding the ability to use those benefits.

The company expects that its full year tax rate will be in the

range of 33 to 35 percent. Cash Flow and Liquidity Carpenter has

maintained the ability to provide cash to meet its needs through

cash flow from operations, management of working capital, and the

flexibility to use outside sources of financing to supplement

internally generated funds. Free cash flow in the recent first

quarter was $50.8 million, compared with free cash flow of $0.7

million in the quarter a year ago. Conference Call Carpenter will

host a conference call and webcast today, October 26, at 10:00 AM,

Eastern Time, to discuss the results of operations for the first

quarter of fiscal 2007. Please call 610-208-2800 for details of the

conference call. Access to the call will also be made available at

Carpenter's web site (www.cartech.com) and through CCBN

(www.ccbn.com). A replay of the call will be made available at

www.cartech.com or at www.ccbn.com. Carpenter produces and

distributes specialty alloys, including stainless steels, titanium

alloys, and superalloys, and various engineered products.

Information about Carpenter can be found on the Internet at

www.cartech.com. Except for historical information, all other

information in this news release consists of forward-looking

statements within the meaning of the Private Securities Litigation

Act of 1995. These forward-looking statements are subject to risks

and uncertainties that could cause actual results to differ from

those projected, anticipated or implied. The most significant of

these uncertainties are described in Carpenter's filings with the

Securities and Exchange Commission including its annual report on

Form 10-K for the year ended June 30, 2006, and the exhibits

attached to those filings. They include but are not limited to: 1)

the cyclical nature of the specialty materials business and certain

end-use markets, including aerospace, industrial, automotive,

consumer, medical, and energy including power generation, or other

influences on Carpenter's business such as new competitors, the

consolidation of customers, and suppliers or the transfer of

manufacturing capacity from the United States to foreign countries;

2) the ability of Carpenter to achieve cost savings, productivity

improvements or process changes; 3) the ability to recoup increases

in the cost of energy and raw materials or other factors; 4)

domestic and foreign excess manufacturing capacity for certain

metals; 5) fluctuations in currency exchange rates; 6) the degree

of success of government trade actions; 7) the valuation of the

assets and liabilities in Carpenter's pension trusts and the

accounting for pension plans; 8) possible labor disputes or work

stoppages; 9) the potential that our customers may substitute

alternate materials or adopt different manufacturing practices that

replace or limit the suitability of our products; and 10) the

ability to successfully acquire and integrate acquisitions. Any of

these factors could have an adverse and/or fluctuating effect on

Carpenter's results of operations. The forward-looking statements

in this document are intended to be subject to the safe harbor

protection provided by Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. Carpenter undertakes no obligation to update or revise

any forward-looking statements. -0- *T PRELIMINARY CONSOLIDATED

STATEMENT OF INCOME (in millions, except per share data) Three

Months Ended September 30 ------------------ 2006 2005 --------

------- NET SALES $404.5 $346.0 Cost of sales 300.6 254.3 --------

------- Gross profit 103.9 91.7 Selling and administrative expenses

30.8 28.0 -------- ------- Operating income 73.1 63.7 Interest

expense 5.8 6.0 Other income, net (5.9) (3.0) -------- -------

Income before income taxes 73.2 60.7 Income taxes 22.0 20.6

-------- ------- NET INCOME $51.2 $40.1 ======== ======= EARNINGS

PER COMMON SHARE: Basic $1.99 $1.59 ======== ======= Diluted $1.94

$1.54 ======== ======= WEIGHTED AVERAGE COMMON SHARES OUTSTANDING:

Basic 25.5 25.0 ======== ======= Diluted 26.3 25.9 ======== =======

Cash dividends per common share 0.225 $0.15 ======== ======= *T -0-

*T PRELIMINARY CONSOLIDATED STATEMENT OF CASH FLOWS (in millions)

Three Months Ended September 30 ------------------ 2006 2005

--------- -------- OPERATING ACTIVITIES: Net income $51.2 $40.1

Adjustments to reconcile net income to net cash provided from

operations: Depreciation 11.5 11.0 Amortization 0.4 0.6 Deferred

income taxes (6.1) 0.3 Net pension expense 1.2 2.7 Net loss on

asset disposals 0.1 0.2 Changes in working capital and other:

Receivables 5.1 4.3 Inventories (8.6) (25.6) Other current assets

(8.0) 0.5 Accounts payable 25.4 (12.4) Accrued current liabilities

(3.5) (10.1) Other, net (4.7) (1.3) --------- -------- Net cash

provided from operating activities 64.0 10.3 --------- --------

INVESTING ACTIVITIES: Purchases of plant, equipment and software

(7.3) (5.7) Proceeds from disposals of plant and equipment 0.2 0.2

Purchases of marketable securities (309.2) (73.9) Sales of

marketable securities 100.4 72.3 --------- -------- Net cash used

for investing activities (215.9) (7.1) --------- -------- FINANCING

ACTIVITIES: Payments on long-term debt (0.1) -- Dividends paid

(6.1) (4.1) Tax benefits on share-based compensation 0.1 --

Proceeds from common stock options exercised 0.1 3.1 ---------

-------- Net cash used for financing activities (6.0) (1.0)

--------- -------- Effect of exchange rate changes on cash and cash

equivalents (1.0) 0.2 --------- -------- (DECREASE) INCREASE IN

CASH AND CASH EQUIVALENTS (158.9) 2.4 Cash and cash equivalents at

beginning of period 413.4 163.8 --------- -------- Cash and cash

equivalents at end of period $254.5 $166.2 ========= ======== *T

-0- *T PRELIMINARY CONSOLIDATED BALANCE SHEET (in millions)

September 30 June 30 2006 2006 ------------ ----------- ASSETS

Current assets: Cash and cash equivalents $254.5 $413.4 Marketable

securities 290.0 81.2 Accounts receivable, net 229.8 234.7

Inventories 233.7 224.3 Deferred income taxes 15.5 13.7 Other

current assets 40.6 32.0 ------------ ----------- Total current

assets 1,064.1 999.3 Property, plant and equipment, net 536.4 541.1

Prepaid pension cost 247.0 247.1 Goodwill 46.4 46.4 Trademarks and

trade names, net 19.9 20.1 Other assets 33.9 33.9 ------------

----------- Total assets $1,947.7 $1,887.9 ============ ===========

LIABILITIES Current liabilities: Accounts payable $162.9 $137.4

Accrued liabilities 130.7 133.8 Current portion of long-term debt

0.2 0.2 ------------ ----------- Total current liabilities 293.8

271.4 Long-term debt, net of current portion 332.9 333.1 Accrued

postretirement benefits 99.4 102.2 Deferred income taxes 183.2

189.0 Other liabilities 47.3 45.9 ------------ ----------- Total

liabilities 956.6 941.6 ------------ ----------- STOCKHOLDERS'

EQUITY Convertible preferred stock 17.8 18.0 Common stock 132.6

132.5 Capital in excess of par value - common stock 294.8 294.2

Reinvested earnings 594.9 549.8 Common stock in treasury, at cost

(36.7) (37.3) Deferred compensation (1.5) (1.5) Accumulated other

comprehensive loss (10.8) (9.4) ------------ ----------- Total

stockholders' equity 991.1 946.3 ------------ ----------- Total

liabilities and stockholders' equity $1,947.7 $1,887.9 ============

=========== *T -0- *T PRELIMINARY SEGMENT FINANCIAL DATA (in

millions) Three Months Ended September 30 ------------------ 2006

2005 --------- -------- Net sales: Specialty Metals $377.2 $321.3

Engineered Products 28.0 25.1 Intersegment (0.7) (0.4) ---------

-------- Consolidated net sales $404.5 $346.0 ========= ========

Operating income: Specialty Metals $71.9 $61.0 Engineered Products

5.4 5.2 Corporate costs (7.9) (5.1) Pension earnings, interest

& deferrals 3.6 2.6 Intersegment 0.1 -- --------- --------

Consolidated operating income $73.1 $63.7 ========= ========

Carpenter operates in two business segments, Specialty Metals and

Engineered Products. Specialty Metals includes our Specialty

Alloys, Dynamet and Carpenter Powder Products business operations.

These operations have been aggregated into one reportable segment

because of the similarities in products, processes, customers,

distribution methods and economic characteristics. The service cost

component of net pension expense, which represents the estimated

cost of future pension liabilities earned associated with active

employees, is included in the operating results of the business

segments. The residual net pension expense, which is comprised of

the expected return on plan assets, interest costs on the projected

benefit obligations of the plans, and amortization of actuarial

gains and losses and prior service costs, is included under the

heading "Pension earnings, interest & deferrals." *T -0- *T

PRELIMINARY SELECTED FINANCIAL MEASURES (in millions, except per

share data) Three Months Ended September 30 ------------------ FREE

CASH FLOW 2006 2005 --------- -------- Net cash provided from

operations $64.0 $10.3 Purchases of plant, equipment and software

(7.3) (5.7) Proceeds from disposals of plant and equipment 0.2 0.2

Dividends paid (6.1) (4.1) --------- -------- Free cash flow $50.8

$0.7 ========= ======== Free cash flow is a measure of cash

generated which management evaluates for alternative uses. *T

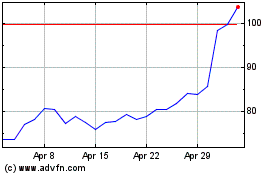

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

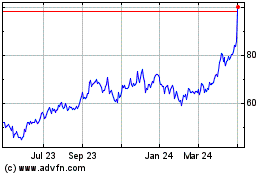

Carpenter Technology (NYSE:CRS)

Historical Stock Chart

From Jul 2023 to Jul 2024