0000906345false00009063452024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 1, 2024

CAMDEN PROPERTY TRUST

(Exact name of Registrant as Specified in Charter)

| | | | | | | | |

| TX | 1-12110 | 76-6088377 |

(State or Other Jurisdiction of

Incorporation) | (Commission File Number) | (I.R.S. Employer

Identification Number) |

11 Greenway Plaza, Suite 2400, Houston, TX 77046

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (713) 354-2500

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Shares of Beneficial Interest, $.01 par value | CPT | NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected to not use the extended transition period for complying with any new or revised financial accounting standards provided pursuant of Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 1, 2024, Camden Property Trust (the "Company") issued a press release announcing its consolidated financial results for the three and six months ended June 30, 2024. This press release refers to supplemental financial information available on the Company’s website. Copies of the press release and the supplemental information are furnished as Exhibits 99.1 and 99.2, respectively, to this report. This information shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and is not incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

Exhibit Number | Title |

| |

| Press Release issued by Camden Property Trust dated August 1, 2024 |

| Supplemental Financial Information dated August 1, 2024 |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 1, 2024

CAMDEN PROPERTY TRUST

By: /s/ Michael P. Gallagher

Michael P. Gallagher

Senior Vice President - Chief Accounting Officer

CAMDEN PROPERTY TRUST ANNOUNCES SECOND QUARTER 2024 OPERATING RESULTS

Houston, Texas (August 1, 2024) - Camden Property Trust (NYSE:CPT) (the "Company") announced today operating results for the three and six months ended June 30, 2024. Net Income Attributable to Common Shareholders (“EPS”), Funds from Operations (“FFO”), Core Funds from Operations ("Core FFO"), and Core Adjusted Funds from Operations (“Core AFFO”) for the three and six months ended June 30, 2024 are detailed below. A reconciliation of EPS to FFO, Core FFO, and Core AFFO is included in the financial tables accompanying this press release.

| | | | | | | | | | | | | | |

| Three Months Ended June 30, | Six Months Ended June 30, |

| | |

| Per Diluted Share | 2024 | 2023 | 2024 | 2023 |

| EPS | $0.40 | $0.84 | $1.17 | $1.22 |

| FFO | $1.71 | $1.67 | $3.37 | $3.33 |

| Core FFO | $1.71 | $1.70 | $3.41 | $3.36 |

| Core AFFO | $1.44 | $1.51 | $2.94 | $3.01 |

| | | | | | | | | | | |

| Three Months Ended | 2Q24 Guidance | 2Q24 Guidance |

| Per Diluted Share | June 30, 2024 | Midpoint | Variance |

| EPS | $0.40 | $0.36 | $0.04 |

| FFO | $1.71 | $1.66 | $0.05 |

| Core FFO | $1.71 | $1.67 | $0.04 |

| | | | | | | | | | | |

| Quarterly Growth | Sequential Growth | Year-To-Date Growth |

| Same Property Results | 2Q24 vs. 2Q23 | 2Q24 vs. 1Q24 | 2024 vs. 2023 |

| Revenues | 1.4% | 0.5% | 2.0% |

| Expenses | 2.5% | 0.8% | 2.7% |

| Net Operating Income ("NOI") | 0.9% | 0.4% | 1.6% |

| | | | | | | | | | | |

| Same Property Results | 2Q24 | 2Q23 | 1Q24 |

| Occupancy | 95.3% | 95.5% | 95.0% |

For 2024, the Company defines same property communities as communities wholly-owned and stabilized since January 1, 2023, excluding communities under redevelopment and properties held for sale. A reconciliation of net income to NOI and same property NOI is included in the financial tables accompanying this press release.

Operating Statistics - Same Property Portfolio

| | | | | | | | | | | | | | |

New Lease and Renewal Data - Date Signed (1) | July 2024* | July 2023 | 2Q24 | 2Q23 |

| Signed New Lease Rates | (1.6)% | 1.6% | (1.8)% | 2.4% |

| Signed Renewal Rates | 4.0% | 5.2% | 3.7% | 6.0% |

| Signed Blended Lease Rates | 0.9% | 3.3% | 0.8% | 4.0% |

New Lease and Renewal Data - Date Effective (2) | July 2024* | July 2023 | 2Q24 | 2Q23 |

| Effective New Lease Rates | (1.5)% | 2.0% | (2.6)% | 2.3% |

| Effective Renewal Rates | 3.7% | 6.4% | 3.3% | 6.4% |

| Effective Blended Lease Rates | 1.2% | 4.1% | 0.0% | 4.0% |

*Preliminary data as of July 31, 2024

(1) Average change in same property new lease and renewal rates vs. expiring lease rates when signed.

(2) Average change in same property new lease and renewal rates vs. expiring lease rates when effective.

| | | | | | | | | | | | | | |

| Occupancy, Bad Debt and Turnover Data | July 2024* | July 2023 | 2Q24 | 2Q23 |

| Occupancy | 95.6% | 95.6% | 95.3% | 95.5% |

| Bad Debt | N/A | 1.7% | 0.8% | 1.5% |

| Annualized Gross Turnover | 59% | 65% | 53% | 54% |

| Annualized Net Turnover | 47% | 53% | 42% | 45% |

*Preliminary data as of July 31, 2024

Development Activity

During the quarter, construction was completed at Camden Woodmill Creek in The Woodlands, TX. Construction commenced at Camden South Charlotte in Charlotte, NC and Camden Blakeney in Charlotte, NC. Additionally, leasing continued at Camden Durham in Durham, NC and Camden Long Meadow Farms in Richmond, TX.

Development Communities - Construction Completed and Project in Lease-Up ($ in millions)

| | | | | | | | | | | | | | |

| | Total | Total | % Leased |

| Community Name | Location | Homes | Cost | as of 7/31/2024 |

| Camden Woodmill Creek | The Woodlands, TX | 189 | | $70.9 | 65 | % |

Development Communities - Construction Ongoing ($ in millions)

| | | | | | | | | | | | | | |

| | Total | Total | % Leased |

| Community Name | Location | Homes | Estimated Cost | as of 7/31/2024 |

| Camden Durham | Durham, NC | 420 | | $145.0 | 69 | % |

| Camden Long Meadow Farms | Richmond, TX | 188 | | 75.0 | 32 | % |

| Camden Village District | Raleigh, NC | 369 | | 138.0 | |

| Camden South Charlotte | Charlotte, NC | 420 | | 163.0 | |

| Camden Blakeney | Charlotte, NC | 349 | | 154.0 | |

| Total | | 1,746 | $675.0 | |

Share Repurchase

During the quarter, Camden repurchased 44,692 common shares at an average price of $96.52 per share for a total of $4.3 million. Year to date, Camden repurchased 515,974 common shares at an average price of $96.88 for approximately $50.0 million. The Company currently has approximately $450.0 million remaining under its stock repurchase program.

Liquidity Analysis

As of June 30, 2024, Camden had nearly $1.3 billion of liquidity comprised of approximately $93.9 million in cash and cash equivalents, and $1.2 billion of availability under its unsecured credit facility. At quarter-end, the Company had approximately $297.9 million left to fund under its existing wholly-owned development pipeline.

Hurricane Impact

Subsequent to the quarter-end, Hurricane Beryl impacted several of our multifamily communities in the Houston, TX area. We are currently in the preliminary stage of assessing the effect of this event and expect the storm-related expenses for this incident to be in the range of approximately $2.0 million to $3.0 million, net of insurance proceeds. These estimates are preliminary and may change as we receive additional information.

Earnings Guidance

Camden provided initial earnings guidance for 2024 based on its current and expected views of the apartment market and general economic conditions, and provided guidance for third quarter 2024 as detailed below. Expected EPS excludes gains, if any, from future real estate transactions.

| | | | | | | | | | | | | | | | | |

| 3Q24 | 2024 | 2024 Midpoint |

| Per Diluted Share | Range | Range | Current | Prior | Change |

| EPS | $0.31 - $0.35 | $1.83 - $1.93 | $1.88 | $1.86 | $0.02 |

| FFO | $1.63 - $1.67 | $6.67 - $6.77 | $6.72 | $6.69 | $0.03 |

Core FFO(1) | $1.66 - $1.70 | $6.74 - $6.84 | $6.79 | $6.74 | $0.05 |

(1) The Company's 2024 core FFO guidance includes approximately $0.07 per share of non-core adjustments for casualty-related expenses, legal costs, loss on early retirement of debt, severance, and expensed pursuit costs.

| | | | | | | | | | | | | | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | 2024 | 2024 Midpoint |

| Same Property Growth Guidance | Range | Current | Prior | Change |

| Revenues | | 1.00% - 2.00% | 1.50% | 1.50% | 0.00% |

| Expenses | | 2.35% - 3.35% | 2.85% | 3.25% | (0.40)% |

| NOI | | (0.25%) - 1.75% | 0.75% | 0.50% | 0.25% |

Camden intends to update its earnings guidance to the market on a quarterly basis. Additional information on the Company’s 2024 financial outlook including key assumptions for same property growth and a reconciliation of expected EPS to expected FFO and expected Core FFO are included in the financial tables accompanying this press release.

Conference Call

Friday, August 2, 2024 at 10:00 AM CT

Domestic Dial-In Number: (888) 317-6003; International Dial-In Number: (412) 317-6061; Passcode: 5174172

Webcast: https://investors.camdenliving.com

The Company strongly encourages interested parties to join the call via webcast in order to view any associated videos, slide presentations, etc. The dial-in phone line will be reserved for accredited analysts and investors who plan to pose questions to Management during the Q&A session of the call.

Supplemental financial information is available in the Investors section of the Company’s website under Earnings Releases or by calling Camden’s Investor Relations Department at (713) 354-2787.

Forward-Looking Statements

In addition to historical information, this press release contains forward-looking statements under the federal securities law. These statements are based on current expectations, estimates, and projections about the industry and markets in which Camden operates, management's beliefs, and assumptions made by management. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties which are difficult to predict. Factors which may cause the Company’s actual results or performance to differ materially from those contemplated by forward-looking statements are described under the heading “Risk Factors” in Camden’s Annual Report on Form 10-K and in other filings with the Securities and Exchange Commission (SEC). Forward-looking statements made in today’s press release represent management’s current opinions at the time of this publication, and the Company assumes no obligation to update or supplement these statements because of subsequent events.

About Camden

Camden Property Trust, an S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Camden owns and operates 172 properties containing 58,250 apartment homes across the United States. Upon completion of 5 properties currently under development, the Company’s portfolio will increase to 59,996 apartment homes in 177 properties. Camden has been recognized as one of the 100 Best Companies to Work For® by FORTUNE magazine for 17 consecutive years, most recently ranking #24. For additional information, please contact Camden’s Investor Relations Department at (713) 354-2787 or access our website at camdenliving.com.

| | | | | | | | |

| | |

| CAMDEN | | OPERATING RESULTS |

| | (In thousands, except per share amounts) |

| | |

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| OPERATING DATA | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Property revenues (a) | $387,150 | $385,499 | | $770,291 | $763,662 |

| | | | | |

| Property expenses | | | | | |

| Property operating and maintenance | 90,126 | | 87,742 | | | 179,170 | | 173,027 | |

| Real estate taxes | 48,763 | | 49,855 | | | 98,264 | | 99,251 | |

| Total property expenses | 138,889 | | 137,597 | | | 277,434 | | 272,278 | |

| | | | | |

| Non-property income | | | | | |

| Fee and asset management | 2,606 | | 718 | | | 3,890 | | 1,296 | |

| Interest and other income | 1,598 | | 431 | | | 3,366 | | 493 | |

| Income on deferred compensation plans | 1,073 | | 2,844 | | | 6,892 | | 8,756 | |

| Total non-property income | 5,277 | | 3,993 | | | 14,148 | | 10,545 | |

| | | | | |

| Other expenses | | | | | |

| Property management | 9,846 | | 8,751 | | | 19,240 | | 17,048 | |

| Fee and asset management | 475 | | 420 | | | 918 | | 833 | |

| General and administrative | 18,154 | | 15,863 | | | 34,847 | | 31,219 | |

| Interest | 32,227 | | 33,578 | | | 64,764 | | 66,421 | |

| Depreciation and amortization | 145,894 | | 143,054 | | | 290,696 | | 285,498 | |

| | | | | |

| Expense on deferred compensation plans | 1,073 | | 2,844 | | | 6,892 | | 8,756 | |

| Total other expenses | 207,669 | | 204,510 | | | 417,357 | | 409,775 | |

| | | | | |

| Loss on early retirement of debt | — | | (2,513) | | | (921) | | (2,513) | |

| Gain on sale of operating property | — | | 48,919 | | | 43,806 | | 48,919 | |

| | | | | |

| | | | | |

| | | | | |

| Income from continuing operations before income taxes | 45,869 | | 93,791 | | | 132,533 | | 138,560 | |

| Income tax expense | (1,059) | | (851) | | | (1,964) | | (2,001) | |

| | | | | |

| | | | | |

| | | | | |

| Net income | 44,810 | | 92,940 | | | 130,569 | | 136,559 | |

| Less income allocated to non-controlling interests | (1,893) | | (1,841) | | | (3,763) | | (3,543) | |

| Net income attributable to common shareholders | $42,917 | | $91,099 | | | $126,806 | | $133,016 | |

| | | | | |

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME | | | | | |

| Net income | $44,810 | $92,940 | | $130,569 | $136,559 |

| Other comprehensive income | | | | | |

| Unrealized gain on cash flow hedging activities | — | | — | | | 85 | | — | |

| | | | | |

| Reclassification of net loss on cash flow hedging activities, prior service cost and net loss on post retirement obligation | 361 | | 358 | | | 1,450 | | 717 | |

| Comprehensive income | 45,171 | | 93,298 | | | 132,104 | | 137,276 | |

| Less income allocated to non-controlling interests | (1,893) | | (1,841) | | | (3,763) | | (3,543) | |

| Comprehensive income attributable to common shareholders | $43,278 | | $91,457 | | | $128,341 | | $133,733 | |

| | | | | |

| PER SHARE DATA | | | | | |

| | | | | |

| Total earnings per common share - basic | $0.40 | | $0.84 | | | $1.17 | | $1.22 | |

| Total earnings per common share - diluted | 0.40 | | 0.84 | | | 1.17 | | 1.22 | |

| | | | | |

| | | | | |

| | | | | |

| Weighted average number of common shares outstanding: | | | | | |

| Basic | 108,406 | | 108,663 | | | 108,556 | | 108,616 | |

| Diluted | 108,424 | | 109,392 | | | 108,577 | | 108,636 | |

(a) We elected to combine lease and non-lease components and thus present rental revenue in a single line item in our consolidated statements of income and comprehensive income. For the three months ended June 30, 2024, we recognized $387.2 million of property revenue which consisted of approximately $344.6 million of rental revenue and approximately $42.6 million of amounts received under contractual terms for other services considered to be non-lease components within our lease contracts. This compares to property revenue of $385.5 million recognized for the three months ended June 30, 2023, made up of approximately $343.1 million of rental revenue and approximately $42.4 million of amounts received under contractual terms for other services considered to be non-lease components within our lease contracts. For the six months ended June 30, 2024, we recognized $770.3 million of property revenue which consisted of approximately $686.2 million of rental revenue and approximately $84.1 million of amounts received under contractual terms for other services considered to be non-lease components within our lease contracts. This compared to the $763.7 million of property revenue recognized for the six months ended June 30, 2023, made up of approximately $680.3 million of rental revenue and approximately $83.4 million of amounts received under contractual terms for other services considered to be non-lease components within our lease contracts. Revenue related to utility rebilling to residents was $10.5 million and $10.3 million for the three months ended June 30, 2024 and 2023, respectively and was $21.2 million and $20.8 million for the six months ended June 30 2024 and 2023, respectively.

Note: Please refer to the following pages for definitions and reconciliations of all non-GAAP financial measures presented in this document.

| | | | | | | | |

| | |

| CAMDEN | | FUNDS FROM OPERATIONS |

| | (In thousands, except per share and property data amounts) |

| | |

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| FUNDS FROM OPERATIONS | | | | | |

| | | | | |

| Net income attributable to common shareholders | $42,917 | | $91,099 | | | $126,806 | | $133,016 | |

| Real estate depreciation and amortization | 142,895 | | 140,013 | | | 284,742 | | 279,400 | |

| | | | | |

| | | | | |

| Income allocated to non-controlling interests | 1,893 | | 1,841 | | | 3,763 | | 3,543 | |

| Gain on sale of operating properties | — | | (48,919) | | | (43,806) | | (48,919) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Funds from operations | $187,705 | | $184,034 | | | $371,505 | | $367,040 | |

| | | | | |

Plus: Casualty-related expenses, net of (recoveries) | (1,587) | | 981 | | | (64) | | 939 | |

Plus: Severance | — | | — | | | 506 | | — | |

Plus: Legal costs and settlements, net of recoveries | 1,114 | | — | | | 1,966 | | 84 | |

Plus: Loss on early retirement of debt | — | | 2,513 | | | 921 | | 2,513 | |

Plus: Expensed development & other pursuit costs | 660 | | 471 | | | 660 | | 471 | |

| | | | | |

Less: Miscellaneous (income)/expense | — | | (364) | | | — | | (364) | |

| Core funds from operations | $187,892 | | $187,635 | | | $375,494 | | $370,683 | |

| | | | | |

Less: recurring capitalized expenditures (a) | (29,595) | | (21,034) | | | (51,620) | | (38,613) | |

| | | | | |

| Core adjusted funds from operations | $158,297 | | $166,601 | | | $323,874 | | $332,070 | |

| | | | | |

| PER SHARE DATA | | | | | |

| Funds from operations - diluted | $1.71 | | $1.67 | | | $3.37 | | $3.33 | |

| Core funds from operations - diluted | 1.71 | | 1.70 | | | 3.41 | | 3.36 | |

| Core adjusted funds from operations - diluted | 1.44 | | 1.51 | | | 2.94 | | 3.01 | |

| Distributions declared per common share | 1.03 | | 1.00 | | | 2.06 | | 2.00 | |

| | | | | |

| | | | | |

| Weighted average number of common shares outstanding: | | | | | |

| FFO/Core FFO/Core AFFO - diluted | 110,018 | | 110,262 | | | 110,171 | | 110,232 | |

| | | | | |

| PROPERTY DATA | | | | | |

Total operating properties (end of period) (b) | 172 | | 172 | | | 172 | | 172 | |

Total operating apartment homes in operating properties (end of period) (b) | 58,250 | | 58,961 | | | 58,250 | | 58,961 | |

| Total operating apartment homes (weighted average) | 58,244 | | 59,039 | | | 58,290 | | 58,938 | |

| | | | | |

.

(a) Capital expenditures necessary to help preserve the value of and maintain the functionality at our communities.

(b) Includes joint ventures and properties held for sale, if any.

Note: Please refer to the following pages for definitions and reconciliations of all non-GAAP financial measures presented in this document.

| | | | | | | | |

| | |

| CAMDEN | | BALANCE SHEETS |

| | (In thousands) |

| | |

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Jun 30,

2024 | Mar 31,

2024 | Dec 31,

2023 | Sep 30,

2023 | Jun 30,

2023 |

| ASSETS | | | | | |

| Real estate assets, at cost | | | | | |

| Land | $1,716,515 | | $1,706,983 | | $1,711,873 | | $1,732,804 | | $1,727,182 | |

| Buildings and improvements | 11,148,312 | | 11,014,440 | | 10,993,390 | | 10,963,667 | | 10,848,837 | |

| 12,864,827 | | 12,721,423 | | 12,705,263 | | 12,696,471 | | 12,576,019 | |

| Accumulated depreciation | (4,582,440) | | (4,439,710) | | (4,332,524) | | (4,254,388) | | (4,113,095) | |

| Net operating real estate assets | 8,282,387 | | 8,281,713 | | 8,372,739 | | 8,442,083 | | 8,462,924 | |

| Properties under development, including land | 439,758 | | 477,481 | | 486,864 | | 499,761 | | 516,543 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total real estate assets | 8,722,145 | | 8,759,194 | | 8,859,603 | | 8,941,844 | | 8,979,467 | |

| Accounts receivable – affiliates | 9,903 | | 10,350 | | 11,905 | | 12,057 | | 12,121 | |

Other assets, net (a) | 245,625 | | 233,137 | | 244,182 | | 237,594 | | 239,958 | |

| | | | | |

| Cash and cash equivalents | 93,932 | | 92,693 | | 259,686 | | 14,600 | | 20,326 | |

| Restricted cash | 7,969 | | 8,230 | | 8,361 | | 8,369 | | 8,531 | |

| Total assets | $9,079,574 | | $9,103,604 | | $9,383,737 | | $9,214,464 | | $9,260,403 | |

| | | | | |

| | | | | |

| | | | | |

| LIABILITIES AND EQUITY | | | | | |

| Liabilities | | | | | |

| Notes payable | | | | | |

| Unsecured | $3,222,569 | | $3,223,285 | | $3,385,309 | | $3,323,057 | | $3,352,415 | |

| Secured | 330,241 | | 330,184 | | 330,127 | | 330,071 | | 330,015 | |

| Accounts payable and accrued expenses | 212,247 | | 213,896 | | 222,599 | | 211,759 | | 192,613 | |

| Accrued real estate taxes | 90,702 | | 46,612 | | 96,517 | | 128,794 | | 93,642 | |

| Distributions payable | 113,506 | | 113,556 | | 110,427 | | 110,463 | | 110,465 | |

Other liabilities (b) | 183,377 | | 182,443 | | 186,987 | | 175,341 | | 189,711 | |

| Total liabilities | 4,152,642 | | 4,109,976 | | 4,331,966 | | 4,279,485 | | 4,268,861 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Equity | | | | | |

| Common shares of beneficial interest | 1,157 | | 1,157 | | 1,156 | | 1,156 | | 1,156 | |

| Additional paid-in capital | 5,924,608 | | 5,919,851 | | 5,914,868 | | 5,911,627 | | 5,907,828 | |

| Distributions in excess of net income attributable to common shareholders | (710,633) | | (641,663) | | (613,651) | | (727,117) | | (666,218) | |

| Treasury shares | (359,975) | | (356,880) | | (320,364) | | (320,702) | | (320,675) | |

Accumulated other comprehensive income/(loss) (c) | 283 | | (78) | | (1,252) | | (699) | | (1,057) | |

| Total common equity | 4,855,440 | | 4,922,387 | | 4,980,757 | | 4,864,265 | | 4,921,034 | |

| Non-controlling interests | 71,492 | | 71,241 | | 71,014 | | 70,714 | | 70,508 | |

| Total equity | 4,926,932 | | 4,993,628 | | 5,051,771 | | 4,934,979 | | 4,991,542 | |

| Total liabilities and equity | $9,079,574 | | $9,103,604 | | $9,383,737 | | $9,214,464 | | $9,260,403 | |

| | | | | |

| | | | | |

| | | | | |

|

| | | | | |

| (a) Includes net deferred charges of: | $3,703 | | $4,286 | | $5,879 | | $6,481 | | $7,033 | |

| | | | | |

| | | | | |

| | | | | |

| (b) Includes deferred revenues of: | $894 | | $958 | | $1,030 | | $1,167 | | $1,239 | |

| | | | | |

| (c) Represents the unrealized net loss and unamortized prior service costs on post retirement obligations, and unrealized net gain/(loss) on cash flow hedging activities. |

| | | | | |

| | | | | | | | |

|

| CAMDEN | | NON-GAAP FINANCIAL MEASURES |

| | DEFINITIONS & RECONCILIATIONS |

| | (In thousands, except per share amounts) |

| | |

(Unaudited)

This document contains certain non-GAAP financial measures management believes are useful in evaluating an equity REIT's performance. Camden's definitions and calculations of non-GAAP financial measures may differ from those used by other REITs, and thus may not be comparable. The non-GAAP financial measures should not be considered as an alternative to net income as an indication of our operating performance, or to net cash provided by operating activities as a measure of our liquidity.

FFO

The National Association of Real Estate Investment Trusts (“NAREIT”) currently defines FFO as net income (computed in accordance with accounting principles generally accepted in the United States of America ("GAAP")), excluding depreciation and amortization related to real estate, gains (or losses) from the sale of certain real estate assets (depreciable real estate), impairments of certain real estate assets (depreciable real estate), gains or losses from change in control, and adjustments for unconsolidated joint ventures to reflect FFO on the same basis. Our calculation of diluted FFO also assumes conversion of all potentially dilutive securities, including certain non-controlling interests, which are convertible into common shares. We consider FFO to be an appropriate supplemental measure of operating performance because, by excluding gains or losses on dispositions of depreciable real estate, and depreciation, FFO can assist in the comparison of the operating performance of a company’s real estate investments between periods or to different companies.

Core FFO

Core FFO represents FFO as further adjusted for items not considered part of our core business operations, such as casualty-related expenses, net of recoveries, severance, legal costs and settlements, net of recoveries, loss on early retirement of debt, expensed transaction, development and other pursuit costs, net of recoveries, net below market lease amortization, pandemic resident relief, (gain)/loss on sale of land, advocacy contributions, and miscellaneous (income)/expense adjustments. We consider Core FFO to be a helpful supplemental measure of operating performance as it excludes not only depreciation expense of real estate assets, but it also excludes certain items which by their nature are not comparable period over period and therefore tends to obscure actual operating performance. Our definition of Core FFO may differ from other REITs, and there can be no assurance our basis for computing this measure is comparable to other REITs.

Core Adjusted FFO

In addition to FFO & Core FFO, we compute Core Adjusted FFO ("Core AFFO") as a supplemental measure of operating performance. Core AFFO is calculated utilizing Core FFO less recurring capital expenditures which are necessary to help preserve the value of and maintain the functionality at our communities. Our definition of recurring capital expenditures may differ from other REITs, and there can be no assurance our basis for computing this measure is comparable to other REITs. A reconciliation of FFO to Core FFO and Core AFFO is provided below:

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Net income attributable to common shareholders | $42,917 | | $91,099 | | | $126,806 | | $133,016 | |

| Real estate depreciation and amortization | 142,895 | | 140,013 | | | 284,742 | | 279,400 | |

| | | | | |

| | | | | |

| Income allocated to non-controlling interests | 1,893 | | 1,841 | | | 3,763 | | 3,543 | |

| | | | | |

| Gain on sale of operating properties | — | | (48,919) | | | (43,806) | | (48,919) | |

| | | | | |

| | | | | |

| Funds from operations | $187,705 | | $184,034 | | | $371,505 | | $367,040 | |

| | | | | |

Plus: Casualty-related expenses, net of (recoveries) | (1,587) | | 981 | | | (64) | | 939 | |

Plus: Severance | — | | — | | | 506 | | — | |

Plus: Legal costs and settlements, net of recoveries | 1,114 | | — | | | 1,966 | | 84 | |

Plus: Loss on early retirement of debt | — | | 2,513 | | | 921 | | 2,513 | |

Plus: Expensed development & other pursuit costs | 660 | | 471 | | | 660 | | 471 | |

| | | | | |

Less: Miscellaneous (income)/expense | — | | (364) | | | — | | (364) | |

| Core funds from operations | $187,892 | | $187,635 | | | $375,494 | | $370,683 | |

| | | | | |

| Less: recurring capitalized expenditures | (29,595) | | (21,034) | | | (51,620) | | (38,613) | |

| | | | | |

| Core adjusted funds from operations | $158,297 | | $166,601 | | | $323,874 | | $332,070 | |

| | | | | |

| Weighted average number of common shares outstanding: | | | | | |

| EPS diluted | 108,424 | | 109,392 | | | 108,577 | | 108,636 | |

| FFO/Core FFO/ Core AFFO diluted | 110,018 | | 110,262 | | | 110,171 | | 110,232 | |

| | | | | |

| | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | |

|

| CAMDEN | | NON-GAAP FINANCIAL MEASURES |

| | DEFINITIONS & RECONCILIATIONS |

| | (In thousands, except per share amounts) |

| | |

(Unaudited)

Reconciliation of FFO, Core FFO, and Core AFFO per share

| | | | | | | | | | | | | | | | | |

| | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Total Earnings Per Common Share - Diluted | $0.40 | | $0.84 | | | $1.17 | | $1.22 | |

| Real estate depreciation and amortization | 1.29 | | 1.26 | | | 2.57 | | 2.52 | |

| | | | | |

| Income allocated to non-controlling interests | 0.02 | | 0.01 | | | 0.03 | | 0.03 | |

| Gain on sale of operating property | — | | (0.44) | | | (0.40) | | (0.44) | |

| | | | | |

| | | | | |

| FFO per common share - Diluted | $1.71 | | $1.67 | | | $3.37 | | $3.33 | |

| | | | | |

Plus: Casualty-related expenses, net of (recoveries) | (0.02) | | 0.01 | | | — | | 0.01 | |

Plus: Severance | — | | — | | | — | | — | |

Plus: Legal costs and settlements, net of recoveries | 0.01 | | — | | | 0.02 | | — | |

Plus: Loss on early retirement of debt | — | | 0.02 | | | 0.01 | | 0.02 | |

Plus: Expensed development & other pursuit costs | 0.01 | | — | | | 0.01 | | — | |

| | | | | |

Less: Miscellaneous (income)/expense | — | | — | | | — | | — | |

| Core FFO per common share - Diluted | $1.71 | | $1.70 | | | $3.41 | | $3.36 | |

| | | | | |

| Less: recurring capitalized expenditures | (0.27) | | (0.19) | | | (0.47) | | (0.35) | |

| | | | | |

| Core AFFO per common share - Diluted | $1.44 | | $1.51 | | | $2.94 | | $3.01 | |

| | | | | |

Expected FFO & Core FFO

Expected FFO and Core FFO is calculated in a method consistent with historical FFO and Core FFO, and is considered appropriate supplemental measures of expected operating performance when compared to expected earnings per common share (EPS). A reconciliation of the ranges provided for diluted EPS to expected FFO and expected Core FFO per diluted share is provided below:

| | | | | | | | | | | | | | | | | |

| 3Q24 | Range | | 2024 | Range |

| Low | High | | Low | High |

| Expected earnings per common share - diluted | $0.31 | | $0.35 | | | $1.83 | | $1.93 | |

| Expected real estate depreciation and amortization | 1.30 | | 1.30 | | | 5.17 | | 5.17 | |

| | | | | |

| Expected income allocated to non-controlling interests | 0.02 | | 0.02 | | | 0.07 | | 0.07 | |

| | | | | |

| Expected (gain) on sale of operating properties | — | | — | | | (0.40) | | (0.40) | |

| | | | | |

| | | | | |

| Expected FFO per share - diluted | $1.63 | | $1.67 | | | $6.67 | | $6.77 | |

| Anticipated Adjustments to FFO | 0.03 | | 0.03 | | | 0.07 | | 0.07 | |

| Expected Core FFO per share - diluted | $1.66 | | $1.70 | | | $6.74 | | $6.84 | |

| | | | | |

| | | | | |

| Note: This table contains forward-looking statements. Please see paragraph regarding forward-looking statements earlier in this document. |

| | | | | | | | |

|

| CAMDEN | | NON-GAAP FINANCIAL MEASURES |

| | DEFINITIONS & RECONCILIATIONS |

| | (In thousands, except per share amounts) |

| | |

(Unaudited)

Net Operating Income (NOI)

NOI is defined by the Company as property revenue less property operating and maintenance expenses less real estate taxes. NOI is further detailed in the Components of Property NOI schedules on page 11 of the supplement. The Company considers NOI to be an appropriate supplemental measure of operating performance to net income attributable to common shareholders because it reflects the operating performance of our communities without allocation of corporate level property management overhead or general and administrative costs. Our definition of NOI may differ from other REITs and there can be no assurance our basis for computing this measure is comparable to other REITs. A reconciliation of net income to net operating income is provided below:

| | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Net income | $44,810 | | $92,940 | | | $130,569 | | $136,559 | |

| Less: Fee and asset management income | (2,606) | | (718) | | | (3,890) | | (1,296) | |

| Less: Interest and other income | (1,598) | | (431) | | | (3,366) | | (493) | |

| Less: Income on deferred compensation plans | (1,073) | | (2,844) | | | (6,892) | | (8,756) | |

| Plus: Property management expense | 9,846 | | 8,751 | | | 19,240 | | 17,048 | |

| Plus: Fee and asset management expense | 475 | | 420 | | | 918 | | 833 | |

| Plus: General and administrative expense | 18,154 | | 15,863 | | | 34,847 | | 31,219 | |

| Plus: Interest expense | 32,227 | | 33,578 | | | 64,764 | | 66,421 | |

| Plus: Depreciation and amortization expense | 145,894 | | 143,054 | | | 290,696 | | 285,498 | |

| | | | | |

| Plus: Expense on deferred compensation plans | 1,073 | | 2,844 | | | 6,892 | | 8,756 | |

| Plus: Loss on early retirement of debt | — | | 2,513 | | | 921 | | 2,513 | |

| Less: Gain on sale of operating property | — | | (48,919) | | | (43,806) | | (48,919) | |

| | | | | |

| | | | | |

| | | | | |

| Plus: Income tax expense | 1,059 | | 851 | | | 1,964 | | 2,001 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| NOI | $248,261 | | $247,902 | | | $492,857 | | $491,384 | |

| | | | | |

| "Same Property" Communities | $235,481 | | $233,450 | | | $470,115 | | $462,828 | |

| Non-"Same Property" Communities | 8,935 | | 7,124 | | | 18,078 | | 13,294 | |

| Development and Lease-Up Communities | 449 | | (4) | | | 451 | | (7) | |

| | | | | |

| Disposition/Other | 3,396 | | 7,332 | | | 4,213 | | 15,269 | |

| NOI | $248,261 | | $247,902 | | | $492,857 | | $491,384 | |

| | | | | | | | |

|

| CAMDEN | | NON-GAAP FINANCIAL MEASURES |

| | DEFINITIONS & RECONCILIATIONS |

| | (In thousands, except per share amounts) |

| | |

(Unaudited)

EBITDAre and Adjusted EBITDAre

Earnings Before Interest, Taxes, Depreciation, and Amortization for Real Estate (“EBITDAre”) and Adjusted EBITDAre are supplemental measures of our financial performance. EBITDAre is calculated in accordance with the definition adopted by NAREIT as earnings before interest, taxes, depreciation and amortization plus or minus losses and gains on the disposition of depreciated property, including gains (losses) on change of control, plus impairment write-downs of depreciated property with adjustments to reflect the Company’s share of EBITDAre of unconsolidated joint ventures.

Adjusted EBITDAre represents EBITDAre as further adjusted for non-core items. Adjusted EBITDAre excludes equity in (income) loss of joint ventures, (gain) loss on land, and loss on early retirement of debt. The Company considers EBITDAre and Adjusted EBITDAre to be appropriate supplemental measures of operating performance to net income because it represents income before non-cash depreciation and the cost of debt, and excludes gains or losses from property dispositions. Annualized Adjusted EBITDAre is Adjusted EBITDAre as reported for the period multiplied by 4 for quarter results or 2 for 6 month results. A reconciliation of net income to EBITDAre and adjusted EBITDAre is provided below:

| | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Net income | $44,810 | | $92,940 | | | $130,569 | | $136,559 | |

| Plus: Interest expense | 32,227 | | 33,578 | | | 64,764 | | 66,421 | |

| | | | | |

| Plus: Depreciation and amortization expense | 145,894 | | 143,054 | | | 290,696 | | 285,498 | |

| | | | | |

| | | | | |

| Plus: Income tax expense | 1,059 | | 851 | | | 1,964 | | 2,001 | |

| | | | | |

| | | | | |

| Less: Gain on sale of operating property | — | | (48,919) | | | (43,806) | | (48,919) | |

| | | | | |

| | | | | |

| | | | | |

| EBITDAre | $223,990 | | $221,504 | | | $444,187 | | $441,560 | |

Plus: Casualty-related expenses, net of (recoveries) | (1,587) | | 981 | | | (64) | | 939 | |

Plus: Severance | — | | — | | | 506 | | — | |

Plus: Legal costs and settlements, net of recoveries | 1,114 | | — | | | 1,966 | | 84 | |

| Plus: Loss on early retirement of debt | — | | 2,513 | | | 921 | | 2,513 | |

Plus: Expensed development & other pursuit costs | 660 | | 471 | | | 660 | | 471 | |

| | | | | |

| | | | | |

Less: Miscellaneous (income)/expense | — | | (364) | | | — | | (364) | |

| Adjusted EBITDAre | $224,177 | | $225,105 | | | $448,176 | | $445,203 | |

| Annualized Adjusted EBITDAre | $896,708 | | $900,420 | | | $896,352 | | $890,406 | |

| | | | | |

Net Debt to Annualized Adjusted EBITDAre

The Company believes Net Debt to Annualized Adjusted EBITDAre to be an appropriate supplemental measure of evaluating balance sheet leverage. Net Debt is defined by the Company as the average monthly balance of Total Debt during the period, less the average monthly balance of Cash and Cash Equivalents during the period. The following tables reconcile average Total debt to Net debt and computes the ratio to Adjusted EBITDAre for the following periods:

Net Debt:

| | | | | | | | | | | | | | | | | |

| Average monthly balance for the | | Average monthly balance for the |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Unsecured notes payable | $3,220,334 | | $3,364,180 | | | $3,232,903 | | $3,316,971 | |

| Secured notes payable | 330,222 | | 391,732 | | | 330,194 | | 453,409 | |

| Total debt | 3,550,556 | | 3,755,912 | | | 3,563,097 | | 3,770,380 | |

| Less: Cash and cash equivalents | (54,686) | | (6,775) | | | (60,347) | | (8,650) | |

| Net debt | $3,495,870 | | $3,749,137 | | | $3,502,750 | | $3,761,730 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Net Debt to Annualized Adjusted EBITDAre: | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Net debt | $3,495,870 | | $3,749,137 | | | $3,502,750 | | $3,761,730 | |

| Annualized Adjusted EBITDAre | 896,708 | | 900,420 | | | 896,352 | | 890,406 | |

| Net Debt to Annualized Adjusted EBITDAre | 3.9x | 4.2x | | 3.9x | 4.2x |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Page |

| |

| |

| Press Release Text | |

| Financial Highlights | |

| Operating Results | |

| Funds from Operations | |

| Balance Sheets | |

| Portfolio Statistics | |

| Components of Property Net Operating Income | |

| Sequential Components of Property Net Operating Income | |

| "Same Property" Second Quarter Comparisons | |

| "Same Property" Sequential Quarter Comparisons | |

| "Same Property" Year to Date Comparisons | |

| |

| "Same Property" Operating Expense Detail & Comparisons | |

| |

| Current Development Communities | |

| Development Pipeline | |

| |

| Dispositions | |

| Debt Analysis | |

| Debt Maturity Analysis | |

| Debt Covenant Analysis | |

| |

| |

| Capitalized Expenditures & Maintenance Expense | |

| |

| Non-GAAP Financial Measures - Definitions & Reconciliations | |

| Other Definitions | |

| Other Data | |

| Community Table | |

In addition to historical information, this document contains forward-looking statements under the federal securities law. These statements are based on current expectations, estimates, and projections about the industry and markets in which Camden (the “Company”) operates, management's beliefs, and assumptions made by management. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties which are difficult to predict. Factors which may cause the Company’s actual results or performance to differ materially from those contemplated by forward-looking statements are described under the heading “Risk Factors” in Camden’s Annual Report on Form 10-K and in other filings with the Securities and Exchange Commission (SEC). Forward-looking statements made in this document represent management’s opinions at the time of this publication, and the Company assumes no obligation to update or supplement these statements because of subsequent events.

CAMDEN PROPERTY TRUST ANNOUNCES SECOND QUARTER 2024 OPERATING RESULTS

Houston, Texas (August 1, 2024) - Camden Property Trust (NYSE:CPT) (the "Company") announced today operating results for the three and six months ended June 30, 2024. Net Income Attributable to Common Shareholders (“EPS”), Funds from Operations (“FFO”), Core Funds from Operations ("Core FFO"), and Core Adjusted Funds from Operations (“Core AFFO”) for the three and six months ended June 30, 2024 are detailed below. A reconciliation of EPS to FFO, Core FFO, and Core AFFO is included in the financial tables accompanying this press release.

| | | | | | | | | | | | | | |

| Three Months Ended June 30, | Six Months Ended June 30, |

| | |

| Per Diluted Share | 2024 | 2023 | 2024 | 2023 |

| EPS | $0.40 | $0.84 | $1.17 | $1.22 |

| FFO | $1.71 | $1.67 | $3.37 | $3.33 |

| Core FFO | $1.71 | $1.70 | $3.41 | $3.36 |

| Core AFFO | $1.44 | $1.51 | $2.94 | $3.01 |

| | | | | | | | | | | |

| Three Months Ended | 2Q24 Guidance | 2Q24 Guidance |

| Per Diluted Share | June 30, 2024 | Midpoint | Variance |

| EPS | $0.40 | $0.36 | $0.04 |

| FFO | $1.71 | $1.66 | $0.05 |

| Core FFO | $1.71 | $1.67 | $0.04 |

| | | | | | | | | | | |

| Quarterly Growth | Sequential Growth | Year-To-Date Growth |

| Same Property Results | 2Q24 vs. 2Q23 | 2Q24 vs. 1Q24 | 2024 vs. 2023 |

| Revenues | 1.4% | 0.5% | 2.0% |

| Expenses | 2.5% | 0.8% | 2.7% |

| Net Operating Income ("NOI") | 0.9% | 0.4% | 1.6% |

| | | | | | | | | | | |

| Same Property Results | 2Q24 | 2Q23 | 1Q24 |

| Occupancy | 95.3% | 95.5% | 95.0% |

For 2024, the Company defines same property communities as communities wholly-owned and stabilized since January 1, 2023, excluding communities under redevelopment and properties held for sale. A reconciliation of net income to NOI and same property NOI is included in the financial tables accompanying this press release.

Operating Statistics - Same Property Portfolio

| | | | | | | | | | | | | | |

New Lease and Renewal Data - Date Signed (1) | July 2024* | July 2023 | 2Q24 | 2Q23 |

| Signed New Lease Rates | (1.6)% | 1.6% | (1.8)% | 2.4% |

| Signed Renewal Rates | 4.0% | 5.2% | 3.7% | 6.0% |

| Signed Blended Lease Rates | 0.9% | 3.3% | 0.8% | 4.0% |

New Lease and Renewal Data - Date Effective (2) | July 2024* | July 2023 | 2Q24 | 2Q23 |

| Effective New Lease Rates | (1.5)% | 2.0% | (2.6)% | 2.3% |

| Effective Renewal Rates | 3.7% | 6.4% | 3.3% | 6.4% |

| Effective Blended Lease Rates | 1.2% | 4.1% | 0.0% | 4.0% |

*Preliminary data as of July 31, 2024

(1) Average change in same property new lease and renewal rates vs. expiring lease rates when signed.

(2) Average change in same property new lease and renewal rates vs. expiring lease rates when effective.

| | | | | | | | | | | | | | |

| Occupancy, Bad Debt and Turnover Data | July 2024* | July 2023 | 2Q24 | 2Q23 |

| Occupancy | 95.6% | 95.6% | 95.3% | 95.5% |

| Bad Debt | N/A | 1.7% | 0.8% | 1.5% |

| Annualized Gross Turnover | 59% | 65% | 53% | 54% |

| Annualized Net Turnover | 47% | 53% | 42% | 45% |

*Preliminary data as of July 31, 2024

Development Activity

During the quarter, construction was completed at Camden Woodmill Creek in The Woodlands, TX. Construction commenced at Camden South Charlotte in Charlotte, NC and Camden Blakeney in Charlotte, NC. Additionally, leasing continued at Camden Durham in Durham, NC and Camden Long Meadow Farms in Richmond, TX.

Development Communities - Construction Completed and Project in Lease-Up ($ in millions)

| | | | | | | | | | | | | | |

| | Total | Total | % Leased |

| Community Name | Location | Homes | Cost | as of 7/31/2024 |

| Camden Woodmill Creek | The Woodlands, TX | 189 | | $70.9 | 65 | % |

Development Communities - Construction Ongoing ($ in millions)

| | | | | | | | | | | | | | | |

| | Total | Total | % Leased | |

| Community Name | Location | Homes | Estimated Cost | as of 7/31/2024 | |

| Camden Durham | Durham, NC | 420 | | $145.0 | 69 | % | |

| Camden Long Meadow Farms | Richmond, TX | 188 | | 75.0 | 32 | % | |

| Camden Village District | Raleigh, NC | 369 | | 138.0 | | |

| Camden South Charlotte | Charlotte, NC | 420 | | 163.0 | | |

| Camden Blakeney | Charlotte, NC | 349 | | 154.0 | | |

| Total | | 1,746 | $675.0 | | |

Share Repurchase

During the quarter, Camden repurchased 44,692 common shares at an average price of $96.52 per share for a total of $4.3 million. Year to date, Camden repurchased 515,974 common shares at an average price of $96.88 for approximately $50.0 million. The Company currently has approximately $450.0 million remaining under its stock repurchase program.

Liquidity Analysis

As of June 30, 2024, Camden had nearly $1.3 billion of liquidity comprised of approximately $93.9 million in cash and cash equivalents, and $1.2 billion of availability under its unsecured credit facility. At quarter-end, the Company had approximately $297.9 million left to fund under its existing wholly-owned development pipeline.

Hurricane Impact

Subsequent to the quarter-end, Hurricane Beryl impacted several of our multifamily communities in the Houston, TX area. We are currently in the preliminary stage of assessing the effect of this event and expect the storm-related expenses for this incident to be in the range of approximately $2.0 million to $3.0 million, net of insurance proceeds. These estimates are preliminary and may change as we receive additional information.

Earnings Guidance

Camden provided initial earnings guidance for 2024 based on its current and expected views of the apartment market and general economic conditions, and provided guidance for third quarter 2024 as detailed below. Expected EPS excludes gains, if any, from future real estate transactions.

| | | | | | | | | | | | | | | | | |

| 3Q24 | 2024 | 2024 Midpoint |

| Per Diluted Share | Range | Range | Current | Prior | Change |

| EPS | $0.31 - $0.35 | $1.83 - $1.93 | $1.88 | $1.86 | $0.02 |

| FFO | $1.63 - $1.67 | $6.67 - $6.77 | $6.72 | $6.69 | $0.03 |

Core FFO(1) | $1.66 - $1.70 | $6.74 - $6.84 | $6.79 | $6.74 | $0.05 |

(1) The Company's 2024 core FFO guidance includes approximately $0.07 per share of non-core adjustments for casualty-related expenses, legal costs, loss on early retirement of debt, severance, and expensed pursuit costs.

| | | | | | | | | | | | | | | | | |

| | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | 2024 | 2024 Midpoint |

| Same Property Growth Guidance | Range | Current | Prior | Change |

| Revenues | | 1.00% - 2.00% | 1.50% | 1.50% | 0.00% |

| Expenses | | 2.35% - 3.35% | 2.85% | 3.25% | (0.40)% |

| NOI | | (0.25%) - 1.75% | 0.75% | 0.50% | 0.25% |

Camden intends to update its earnings guidance to the market on a quarterly basis. Additional information on the Company’s 2024 financial outlook including key assumptions for same property growth and a reconciliation of expected EPS to expected FFO and expected Core FFO are included in the financial tables accompanying this press release.

Conference Call

Friday, August 2, 2024 at 10:00 AM CT

Domestic Dial-In Number: (888) 317-6003; International Dial-In Number: (412) 317-6061; Passcode: 5174172

Webcast: https://investors.camdenliving.com

The Company strongly encourages interested parties to join the call via webcast in order to view any associated videos, slide presentations, etc. The dial-in phone line will be reserved for accredited analysts and investors who plan to pose questions to Management during the Q&A session of the call.

Supplemental financial information is available in the Investors section of the Company’s website under Earnings Releases or by calling Camden’s Investor Relations Department at (713) 354-2787.

Forward-Looking Statements

In addition to historical information, this press release contains forward-looking statements under the federal securities law. These statements are based on current expectations, estimates, and projections about the industry and markets in which Camden operates, management's beliefs, and assumptions made by management. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties which are difficult to predict. Factors which may cause the Company’s actual results or performance to differ materially from those contemplated by forward-looking statements are described under the heading “Risk Factors” in Camden’s Annual Report on Form 10-K and in other filings with the Securities and Exchange Commission (SEC). Forward-looking statements made in today’s press release represent management’s current opinions at the time of this publication, and the Company assumes no obligation to update or supplement these statements because of subsequent events.

About Camden

Camden Property Trust, an S&P 500 Company, is a real estate company primarily engaged in the ownership, management, development, redevelopment, acquisition, and construction of multifamily apartment communities. Camden owns and operates 172 properties containing 58,250 apartment homes across the United States. Upon completion of 5 properties currently under development, the Company’s portfolio will increase to 59,996 apartment homes in 177 properties. Camden has been recognized as one of the 100 Best Companies to Work For® by FORTUNE magazine for 17 consecutive years, most recently ranking #24. For additional information, please contact Camden’s Investor Relations Department at (713) 354-2787 or access our website at camdenliving.com.

| | | | | | | | |

| | |

| CAMDEN | | FINANCIAL HIGHLIGHTS |

| | (In thousands, except per share, property data amounts and ratios) |

| | |

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Property revenues | $387,150 | $385,499 | | $770,291 | $763,662 |

| | | | | |

| Adjusted EBITDAre | 224,177 | 225,105 | | 448,176 | 445,203 |

| | | | | |

| Net income attributable to common shareholders | 42,917 | 91,099 | | 126,806 | 133,016 |

| Per share - basic | 0.40 | 0.84 | | 1.17 | 1.22 |

| Per share - diluted | 0.40 | 0.84 | | 1.17 | 1.22 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Funds from operations | 187,705 | 184,034 | | 371,505 | 367,040 |

| Per share - diluted | 1.71 | 1.67 | | 3.37 | 3.33 |

| | | | | |

| Core funds from operations | 187,892 | 187,635 | | 375,494 | 370,683 |

| Per share - diluted | 1.71 | 1.70 | | 3.41 | 3.36 |

| | | | | |

| Core adjusted funds from operations | 158,297 | 166,601 | | 323,874 | 332,070 |

| Per share - diluted | 1.44 | 1.51 | | 2.94 | 3.01 |

| | | | | |

| Dividends per share | 1.03 | 1.00 | | 2.06 | 2.00 |

| Dividend payout ratio (FFO) | 60.2 | % | 59.9 | % | | 61.1 | % | 60.1 | % |

| | | | | |

| | | | | |

| Interest expensed | 32,227 | 33,578 | | 64,764 | 66,421 |

| Interest capitalized | 4,786 | 4,994 | | 9,760 | 9,963 |

| Total interest incurred | 37,013 | 38,572 | | 74,524 | 76,384 |

| | | | | |

| | | | | |

| | | | | |

Net Debt to Annualized Adjusted EBITDAre (a) | 3.9x | 4.2x | | 3.9x | 4.2x |

| Interest expense coverage ratio | 7.0x | 6.7x | | 6.9x | 6.7x |

| Total interest coverage ratio | 6.1x | 5.8x | | 6.0x | 5.8x |

| Fixed charge expense coverage ratio | 7.0x | 6.7x | | 6.9x | 6.7x |

| Total fixed charge coverage ratio | 6.1x | 5.8x | | 6.0x | 5.8x |

| Unencumbered real estate assets (at cost) to unsecured debt ratio | 3.7x | 3.5x | | 3.7x | 3.5x |

| | | | | |

Same property NOI growth (b) (c) | 0.9 | % | 6.2 | % | | 1.6 | % | 7.1 | % |

| (# of apartment homes included) | 55,866 | | 48,137 | | 55,866 | 48,137 | |

| | | | | |

| Same property turnover | | | | | |

| Gross turnover of apartment homes (annualized) | 53 | % | 54 | % | | 49 | % | 49 | % |

| Net turnover (excludes on-site transfers and transfers to other Camden communities) | 42 | % | 45 | % | | 38 | % | 41 | % |

| | | | | |

| As of June 30, | | As of June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| Total assets | $9,079,574 | | $9,260,403 | | | $9,079,574 | | $9,260,403 | |

| Total debt | $3,552,810 | | $3,682,430 | | | $3,552,810 | | $3,682,430 | |

Common and common equivalent shares, outstanding end of period (d) | 110,051 | | 110,277 | | | 110,051 | | 110,277 | |

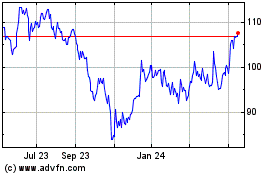

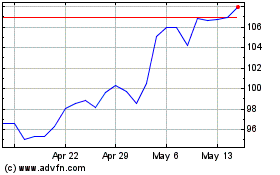

| Share price, end of period | $109.11 | | $108.87 | | | $109.11 | | $108.87 | |

Book equity value, end of period (e) | $4,926,932 | | $4,991,542 | | | $4,926,932 | | $4,991,542 | |

Market equity value, end of period (f) | $12,007,665 | | $12,005,857 | | | $12,007,665 | | $12,005,857 | |

(a) Net Debt is defined by the Company as the average monthly balance of Total Debt during the period, less the average monthly balance of Cash and Cash Equivalents during the period. Annualized Adjusted EBITDAre is Adjusted EBITDAre as reported for the period multiplied by either 4 for quarter results or 2 for 6 month results.

(b) "Same Property" Communities are communities which were wholly-owned by the Company and stabilized since January 1, 2023, excluding communities under redevelopment and properties held for sale.

(c) "Same Property" results exclude results from other miscellaneous revenues and expenses, including the amortization of net below market leases, casualty-related expenses net of recoveries, and severance related costs.

(d) Includes at June 30, 2024: 108,457 common shares (including 31 common share equivalents related to share awards), plus 1,594 common share equivalents upon the assumed conversion of non-controlling units.

(e) Includes: common shares, common units, common share equivalents, and non-qualified deferred compensation share awards.

(f) Includes: common shares, common units, and common share equivalents.

Note: Please refer to pages 24 - 27 for definitions and reconciliations of all non-GAAP financial measures presented in this document.

| | | | | | | | |

| | |

| CAMDEN | | OPERATING RESULTS |

| | (In thousands, except per share amounts) |

| | |

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| OPERATING DATA | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Property revenues (a) | $387,150 | $385,499 | | $770,291 | $763,662 |

| | | | | |

| Property expenses | | | | | |

| Property operating and maintenance | 90,126 | | 87,742 | | | 179,170 | | 173,027 | |

| Real estate taxes | 48,763 | | 49,855 | | | 98,264 | | 99,251 | |

| Total property expenses | 138,889 | | 137,597 | | | 277,434 | | 272,278 | |

| | | | | |

| Non-property income | | | | | |

| Fee and asset management | 2,606 | | 718 | | | 3,890 | | 1,296 | |

| Interest and other income | 1,598 | | 431 | | | 3,366 | | 493 | |

| Income on deferred compensation plans | 1,073 | | 2,844 | | | 6,892 | | 8,756 | |

| Total non-property income | 5,277 | | 3,993 | | | 14,148 | | 10,545 | |

| | | | | |

| Other expenses | | | | | |

| Property management | 9,846 | | 8,751 | | | 19,240 | | 17,048 | |

| Fee and asset management | 475 | | 420 | | | 918 | | 833 | |

| General and administrative | 18,154 | | 15,863 | | | 34,847 | | 31,219 | |

| Interest | 32,227 | | 33,578 | | | 64,764 | | 66,421 | |

| Depreciation and amortization | 145,894 | | 143,054 | | | 290,696 | | 285,498 | |

| | | | | |

| Expense on deferred compensation plans | 1,073 | | 2,844 | | | 6,892 | | 8,756 | |

| Total other expenses | 207,669 | | 204,510 | | | 417,357 | | 409,775 | |

| | | | | |

| Loss on early retirement of debt | — | | (2,513) | | | (921) | | (2,513) | |

| Gain on sale of operating property | — | | 48,919 | | | 43,806 | | 48,919 | |

| | | | | |

| | | | | |

| | | | | |

| Income from continuing operations before income taxes | 45,869 | | 93,791 | | | 132,533 | | 138,560 | |

| Income tax expense | (1,059) | | (851) | | | (1,964) | | (2,001) | |

| | | | | |

| | | | | |

| | | | | |

| Net income | 44,810 | | 92,940 | | | 130,569 | | 136,559 | |

| Less income allocated to non-controlling interests | (1,893) | | (1,841) | | | (3,763) | | (3,543) | |

| Net income attributable to common shareholders | $42,917 | | $91,099 | | | $126,806 | | $133,016 | |

| | | | | |

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME | | | | | |

| Net income | $44,810 | $92,940 | | $130,569 | $136,559 |

| Other comprehensive income | | | | | |

| Unrealized gain on cash flow hedging activities | — | | — | | | 85 | | — | |

| | | | | |

| Reclassification of net loss on cash flow hedging activities, prior service cost and net loss on post retirement obligation | 361 | | 358 | | | 1,450 | | 717 | |

| Comprehensive income | 45,171 | | 93,298 | | | 132,104 | | 137,276 | |

| Less income allocated to non-controlling interests | (1,893) | | (1,841) | | | (3,763) | | (3,543) | |

| Comprehensive income attributable to common shareholders | $43,278 | | $91,457 | | | $128,341 | | $133,733 | |

| | | | | |

| PER SHARE DATA | | | | | |

| | | | | |

| Total earnings per common share - basic | $0.40 | | $0.84 | | | $1.17 | | $1.22 | |

| Total earnings per common share - diluted | 0.40 | | 0.84 | | | 1.17 | | 1.22 | |

| | | | | |

| | | | | |

| | | | | |

| Weighted average number of common shares outstanding: | | | | | |

| Basic | 108,406 | | 108,663 | | | 108,556 | | 108,616 | |

| Diluted | 108,424 | | 109,392 | | | 108,577 | | 108,636 | |

(a) We elected to combine lease and non-lease components and thus present rental revenue in a single line item in our consolidated statements of income and comprehensive income. For the three months ended June 30, 2024, we recognized $387.2 million of property revenue which consisted of approximately $344.6 million of rental revenue and approximately $42.6 million of amounts received under contractual terms for other services considered to be non-lease components within our lease contracts. This compares to property revenue of $385.5 million recognized for the three months ended June 30, 2023, made up of approximately $343.1 million of rental revenue and approximately $42.4 million of amounts received under contractual terms for other services considered to be non-lease components within our lease contracts. For the six months ended June 30, 2024, we recognized $770.3 million of property revenue which consisted of approximately $686.2 million of rental revenue and approximately $84.1 million of amounts received under contractual terms for other services considered to be non-lease components within our lease contracts. This compared to the $763.7 million of property revenue recognized for the six months ended June 30, 2023, made up of approximately $680.3 million of rental revenue and approximately $83.4 million of amounts received under contractual terms for other services considered to be non-lease components within our lease contracts. Revenue related to utility rebilling to residents was $10.5 million and $10.3 million for the three months ended June 30, 2024 and 2023, respectively and was $21.2 million and $20.8 million for the six months ended June 30 2024 and 2023, respectively.

Note: Please refer to pages 24 - 27 for definitions and reconciliations of all non-GAAP financial measures presented in this document.

| | | | | | | | |

| | |

| CAMDEN | | FUNDS FROM OPERATIONS |

| | (In thousands, except per share and property data amounts) |

| | |

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2024 | 2023 | | 2024 | 2023 |

| FUNDS FROM OPERATIONS | | | | | |

| | | | | |

| Net income attributable to common shareholders | $42,917 | | $91,099 | | | $126,806 | | $133,016 | |

| Real estate depreciation and amortization | 142,895 | | 140,013 | | | 284,742 | | 279,400 | |

| | | | | |

| | | | | |

| Income allocated to non-controlling interests | 1,893 | | 1,841 | | | 3,763 | | 3,543 | |

| Gain on sale of operating properties | — | | (48,919) | | | (43,806) | | (48,919) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Funds from operations | $187,705 | | $184,034 | | | $371,505 | | $367,040 | |

| | | | | |

| | | | | |

| | | | | |

Plus: Casualty-related expenses, net of (recoveries) | (1,587) | | 981 | | | (64) | | 939 | |

Plus: Severance | — | | — | | | 506 | | — | |

Plus: Legal costs and settlements, net of recoveries | 1,114 | | — | | | 1,966 | | 84 | |

Plus: Loss on early retirement of debt | — | | 2,513 | | | 921 | | 2,513 | |

Plus: Expensed development & other pursuit costs | 660 | | 471 | | | 660 | | 471 | |

| | | | | |

| | | | | |

Less: Miscellaneous (income)/expense | — | | (364) | | | — | | (364) | |

| Core funds from operations | $187,892 | | $187,635 | | | $375,494 | | $370,683 | |

| | | | | |

Less: recurring capitalized expenditures (a) | (29,595) | | (21,034) | | | (51,620) | | (38,613) | |

| | | | | |

| Core adjusted funds from operations | $158,297 | | $166,601 | | | $323,874 | | $332,070 | |

| | | | | |

| PER SHARE DATA | | | | | |

| Funds from operations - diluted | $1.71 | | $1.67 | | | $3.37 | | $3.33 | |

| Core funds from operations - diluted | 1.71 | | 1.70 | | | 3.41 | | 3.36 | |

| Core adjusted funds from operations - diluted | 1.44 | | 1.51 | | | 2.94 | | 3.01 | |

| Distributions declared per common share | 1.03 | | 1.00 | | | 2.06 | | 2.00 | |

| | | | | |

| | | | | |

| Weighted average number of common shares outstanding: | | | | | |

| FFO/Core FFO/Core AFFO - diluted | 110,018 | | 110,262 | | | 110,171 | | 110,232 | |

| | | | | |

| PROPERTY DATA | | | | | |

Total operating properties (end of period) (b) | 172 | | 172 | | | 172 | | 172 | |

Total operating apartment homes in operating properties (end of period) (b) | 58,250 | | 58,961 | | | 58,250 | | 58,961 | |

| Total operating apartment homes (weighted average) | 58,244 | | 59,039 | | | 58,290 | | 58,938 | |

| | | | | |

.

(a) Capital expenditures necessary to help preserve the value of and maintain the functionality at our communities.

(b) Includes joint ventures and properties held for sale, if any.

Note: Please refer to pages 24 - 27 for definitions and reconciliations of all non-GAAP financial measures presented in this document.

| | | | | | | | |

| | |

| CAMDEN | | BALANCE SHEETS |

| | (In thousands) |

| | |

(Unaudited)

| | | | | | | | | | | | | | | | | |

| Jun 30,

2024 | Mar 31,

2024 | Dec 31,

2023 | Sep 30,

2023 | Jun 30,

2023 |

| ASSETS | | | | | |

| Real estate assets, at cost | | | | | |

| Land | $1,716,515 | | $1,706,983 | | $1,711,873 | | $1,732,804 | | $1,727,182 | |

| Buildings and improvements | 11,148,312 | | 11,014,440 | | 10,993,390 | | 10,963,667 | | 10,848,837 | |

| 12,864,827 | | 12,721,423 | | 12,705,263 | | 12,696,471 | | 12,576,019 | |

| Accumulated depreciation | (4,582,440) | | (4,439,710) | | (4,332,524) | | (4,254,388) | | (4,113,095) | |

| Net operating real estate assets | 8,282,387 | | 8,281,713 | | 8,372,739 | | 8,442,083 | | 8,462,924 | |

| Properties under development, including land | 439,758 | | 477,481 | | 486,864 | | 499,761 | | 516,543 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Total real estate assets | 8,722,145 | | 8,759,194 | | 8,859,603 | | 8,941,844 | | 8,979,467 | |

| Accounts receivable – affiliates | 9,903 | | 10,350 | | 11,905 | | 12,057 | | 12,121 | |

Other assets, net (a) | 245,625 | | 233,137 | | 244,182 | | 237,594 | | 239,958 | |

| | | | | |

| Cash and cash equivalents | 93,932 | | 92,693 | | 259,686 | | 14,600 | | 20,326 | |

| Restricted cash | 7,969 | | 8,230 | | 8,361 | | 8,369 | | 8,531 | |

| Total assets | $9,079,574 | | $9,103,604 | | $9,383,737 | | $9,214,464 | | $9,260,403 | |

| | | | | |

| | | | | |

| | | | | |

| LIABILITIES AND EQUITY | | | | | |

| Liabilities | | | | | |

| Notes payable | | | | | |

| Unsecured | $3,222,569 | | $3,223,285 | | $3,385,309 | | $3,323,057 | | $3,352,415 | |

| Secured | 330,241 | | 330,184 | | 330,127 | | 330,071 | | 330,015 | |

| Accounts payable and accrued expenses | 212,247 | | 213,896 | | 222,599 | | 211,759 | | 192,613 | |

| Accrued real estate taxes | 90,702 | | 46,612 | | 96,517 | | 128,794 | | 93,642 | |

| Distributions payable | 113,506 | | 113,556 | | 110,427 | | 110,463 | | 110,465 | |

Other liabilities (b) | 183,377 | | 182,443 | | 186,987 | | 175,341 | | 189,711 | |

| Total liabilities | 4,152,642 | | 4,109,976 | | 4,331,966 | | 4,279,485 | | 4,268,861 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Equity | | | | | |

| Common shares of beneficial interest | 1,157 | | 1,157 | | 1,156 | | 1,156 | | 1,156 | |

| Additional paid-in capital | 5,924,608 | | 5,919,851 | | 5,914,868 | | 5,911,627 | | 5,907,828 | |

| Distributions in excess of net income attributable to common shareholders | (710,633) | | (641,663) | | (613,651) | | (727,117) | | (666,218) | |

| Treasury shares | (359,975) | | (356,880) | | (320,364) | | (320,702) | | (320,675) | |

Accumulated other comprehensive income/(loss) (c) | 283 | | (78) | | (1,252) | | (699) | | (1,057) | |

| Total common equity | 4,855,440 | | 4,922,387 | | 4,980,757 | | 4,864,265 | | 4,921,034 | |

| Non-controlling interests | 71,492 | | 71,241 | | 71,014 | | 70,714 | | 70,508 | |

| Total equity | 4,926,932 | | 4,993,628 | | 5,051,771 | | 4,934,979 | | 4,991,542 | |

| Total liabilities and equity | $9,079,574 | | $9,103,604 | | $9,383,737 | | $9,214,464 | | $9,260,403 | |

| | | | | |

| | | | | |

| | | | | |

|

| | | | | |

| (a) Includes net deferred charges of: | $3,703 | | $4,286 | | $5,879 | | $6,481 | | $7,033 | |

| | | | | |

| | | | | |

| | | | | |

| (b) Includes deferred revenues of: | $894 | | $958 | | $1,030 | | $1,167 | | $1,239 | |

| | | | | |

| (c) Represents the unrealized net loss and unamortized prior service costs on post retirement obligations, and unrealized net gain/(loss) on cash flow hedging activities. |

| | | | | |

| | | | | | | | |

| | |

| CAMDEN | | PORTFOLIO STATISTICS |

| | |

(Unaudited)

COMMUNITY PORTFOLIO AT JUNE 30, 2024 (in apartment homes)

| | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| "Same Property" | Non-"Same Property" | Completed in Lease-up | Under Construction | | Grand Total | |

D.C. Metro (a) | 6,192 | | — | | — | | — | | | 6,192 | | |

| Houston, TX | 9,154 | | — | | 189 | | 188 | | | 9,531 | | |

| Phoenix, AZ | 4,029 | | 397 | | — | | — | | | 4,426 | | |

| Dallas, TX | 6,224 | | — | | — | | — | | | 6,224 | | |

| SE Florida | 2,781 | | 269 | | — | | — | | | 3,050 | | |

| Atlanta, GA | 3,744 | | 526 | | — | | — | | | 4,270 | | |

| Orlando, FL | 3,954 | | — | | — | | — | | | 3,954 | | |

| Tampa, FL | 3,104 | | — | | — | | — | | | 3,104 | | |

| Denver, CO | 2,873 | | — | | — | | — | | | 2,873 | | |

| Charlotte, NC | 3,123 | | 387 | | — | | 769 | | | 4,279 | | |

| Raleigh, NC | 3,252 | | — | | — | | 789 | | | 4,041 | | |

| Austin, TX | 3,360 | | 326 | | — | | — | | | 3,686 | | |

| San Diego/Inland Empire, CA | 1,797 | | — | | — | | — | | | 1,797 | | |

| Los Angeles/Orange County, CA | 1,521 | | 290 | | — | | — | | | 1,811 | | |

| Nashville, TN | 758 | | — | | — | | — | | | 758 | | |

| Total Portfolio | 55,866 | | 2,195 | | 189 | | 1,746 | | | 59,996 | | |

(a) D.C. Metro includes Washington D.C., Maryland, and Northern Virginia.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SECOND QUARTER NOI CONTRIBUTION PERCENTAGE BY REGION | | WEIGHTED AVERAGE OCCUPANCY FOR THE QUARTER ENDED (c) |

| | | | | | | | | |

| | | | | | | | | |

| "Same Property" Communities | Operating Communities (b) | | | Jun 30,

2024 | Mar 31,

2024 | Dec 31,

2023 | Sep 30,

2023 | Jun 30,

2023 |

D.C. Metro (a) | 13.5 | % | 13.2 | % | | | 96.9 | % | 96.6 | % | 96.7 | % | 96.6 | % | 96.5 | % |

| Houston, TX | 12.4 | % | 11.9 | % | | | 95.0 | % | 94.6 | % | 94.4 | % | 95.2 | % | 94.8 | % |

| Phoenix, AZ | 8.4 | % | 8.7 | % | | | 94.7 | % | 95.2 | % | 94.5 | % | 94.5 | % | 94.0 | % |

| Dallas, TX | 8.5 | % | 8.1 | % | | | 95.0 | % | 94.6 | % | 94.3 | % | 95.4 | % | 95.5 | % |

| SE Florida | 6.7 | % | 7.1 | % | | | 96.6 | % | 96.5 | % | 96.1 | % | 95.8 | % | 96.3 | % |

| Atlanta, GA | 6.3 | % | 6.8 | % | | | 93.1 | % | 92.7 | % | 92.3 | % | 93.6 | % | 92.9 | % |

| Orlando, FL | 6.7 | % | 6.4 | % | | | 95.4 | % | 95.3 | % | 94.9 | % | 95.5 | % | 96.6 | % |

| Tampa, FL | 6.4 | % | 6.2 | % | | | 95.6 | % | 96.1 | % | 95.5 | % | 95.9 | % | 96.3 | % |

| Denver, CO | 5.9 | % | 5.6 | % | | | 96.6 | % | 96.4 | % | 96.4 | % | 96.6 | % | 96.3 | % |

| Charlotte, NC | 5.6 | % | 6.0 | % | | | 95.1 | % | 93.6 | % | 94.7 | % | 95.6 | % | 95.4 | % |

| Raleigh, NC | 5.2 | % | 4.9 | % | | | 95.0 | % | 94.7 | % | 95.0 | % | 95.6 | % | 95.8 | % |

| Austin, TX | 4.6 | % | 4.9 | % | | | 93.4 | % | 92.7 | % | 93.1 | % | 94.3 | % | 93.7 | % |

| San Diego/Inland Empire, CA | 4.6 | % | 4.4 | % | | | 96.1 | % | 95.1 | % | 95.5 | % | 96.1 | % | 95.6 | % |

| Los Angeles/Orange County, CA | 3.7 | % | 4.4 | % | | | 93.8 | % | 92.7 | % | 93.1 | % | 95.4 | % | 94.6 | % |

| Nashville, TN | 1.5 | % | 1.4 | % | | | 95.3 | % | 93.9 | % | 93.4 | % | 95.3 | % | 96.5 | % |

| Total Portfolio | 100.0 | % | 100.0 | % | | | 95.2 | % | 94.8 | % | 94.7 | % | 95.4 | % | 95.2 | % |

(b) Operating communities represent all fully-consolidated communities for the period, excluding communities under construction.

(c) Occupancy figures include all stabilized operating communities owned during the period, including those held through unconsolidated joint venture investments.

| | | | | | | | |

| | |

| CAMDEN | | COMPONENTS OF PROPERTY |

| | NET OPERATING INCOME |

| | (In thousands, except property data amounts) |

| | |

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Apartment | | Three Months Ended June 30, | | Six Months Ended June 30, |

| Property Revenues | Homes | | 2024 | | 2023 | | Change | | 2024 | | 2023 | | Change |

"Same Property" Communities (a) | 55,866 | | | $366,424 | | | $361,226 | | | $5,198 | | | $730,902 | | | $716,844 | | | $14,058 | |

Non-"Same Property" Communities (b) | 2,195 | | | 14,215 | | | 11,923 | | | 2,292 | | | 28,182 | | | 22,458 | | | 5,724 | |

Development and Lease-Up Communities (c) | 1,935 | | | 1,358 | | | — | | | 1,358 | | | 1,960 | | | — | | | 1,960 | |

| | | | | | | | | | | | | |

Disposition/Other (d) | — | | | 5,153 | | | 12,350 | | | (7,197) | | | 9,247 | | | 24,360 | | | (15,113) | |

| Total Property Revenues | 59,996 | | | $387,150 | | | $385,499 | | | $1,651 | | | $770,291 | | | $763,662 | | | $6,629 | |

| | | | | | | | | | | | | |

| Property Expenses | | | | | | | | | | | | | |

"Same Property" Communities (a) | 55,866 | | | $130,943 | | | $127,776 | | | $3,167 | | | $260,787 | | | $254,016 | | | $6,771 | |

Non-"Same Property" Communities (b) | 2,195 | | | 5,280 | | | 4,799 | | | 481 | | | 10,104 | | | 9,164 | | | 940 | |

Development and Lease-Up Communities (c) | 1,935 | | | 909 | | | 4 | | | 905 | | | 1,509 | | | 7 | | | 1,502 | |

| | | | | | | | | | | | | |

Disposition/Other (d) | — | | | 1,757 | | | 5,018 | | | (3,261) | | | 5,034 | | | 9,091 | | | (4,057) | |

| Total Property Expenses | 59,996 | | | $138,889 | | | $137,597 | | | $1,292 | | | $277,434 | | | $272,278 | | | $5,156 | |

| | | | | | | | | | | | | |

| Property Net Operating Income | | | | | | | | | | | | | |