- Solid performance demonstrating the resilience of the

business model

- Outlook supported by record investment decisions

Regulatory News:

Air Liquide (Paris:AI):

Key Figures

(in millions of euros)

Q3 2023

2023/2022 as

published

2023/2022

comparable(a)

Group Revenue

6,811

-17.4%

+1.5%

of which Gas & Services

6,483

-17.9%

+1.7%

of which Engineering &

Construction

110

-5.3%

-0.8%

of which Global Markets &

Technologies

218

-7.1%

-3.9%

(a) Change excluding the currency, energy

(natural gas and electricity) and significant scope impacts, see

reconciliation in the appendices.

Commenting on sales in the third quarter of 2023, François

Jackow, Chief Executive Officer of the Air Liquide Group,

stated:

“Air Liquide achieved a solid performance in the third

quarter, highlighting the resilience of its diversified business

model and its ability to prepare for future growth in a

challenging macroeconomic and geopolitical environment. The Group’s

performance this quarter was characterized by growth of its

activity on a comparable basis and a record level of

investment decisions. In line with its ADVANCE strategic plan, the

Group continued its actions to steadily improve operating

performance, in particular to generate efficiencies.

Revenue reached 6.81 billion euros, an increase of +1.5% on a

comparable basis in the third quarter. On a published basis, it

stood at -17.4%, mainly due to the drop in energy prices

(whose variations are contractually passed through to Large

Industries customers) as well as negative currency impacts.

The Gas & Services activity, which represented 95% of

the Group’s revenue, was up +1.7% on a comparable basis.

Industrial Merchant and Healthcare were the growth

drivers of this activity.

Constantly improving its operating performance, the Group has

notably generated significant efficiencies of 320 million

euros over nine months, which represents an increase of +22%,

despite an inflationary environment unfavorable to cost savings on

purchases. It also continued the dynamic management of its business

portfolio, while its ability to create value enabled it to adjust

its prices in Industrial Merchant. Cash flow(1) grew by

+8.6% excluding the currency impact.

The Group’s investment momentum was particularly

strong, reflecting its commitment to climate and paving

the way for future growth. The project backlog, at 4.2

billion euros, and investment decisions, at 1.3 billion

euros this quarter, reached record levels. With more than

40% of projects linked to the energy transition, 12-month

investment opportunities are also numerous and total 3.4 billion

euros.

In 2023, Air Liquide is confident in its ability to further

increase its operating margin and to deliver recurring net profit

growth, at constant exchange rates(2).”

Highlights

- Hydrogen

- Announcement of an investment of more

than 400 million euros for the construction of the Air

Liquide Normand’Hy electrolyzer, in the context of the signing

of a Memorandum of Understanding notably to provide renewable and

low-carbon hydrogen to the TotalEnergies refinery in Gonfreville,

Normandy. In the framework of the Important Project of Common

European Interest (IPCEI) approved by the European Commission,

the project received the support of the French State for an

amount of 190 million euros, as part of the “Plan de

Relance”.

- Partnership with INPEX Corporation, LSB

Industries Inc., Vopak Moda Houston LLC to study the development

of a large-scale low-carbon ammonia production and export

project in Houston in the United States, with direct access to

the Gulf of Mexico. As part of this project, Air Liquide will in

particular provide its ATR technology, one of the most suitable

solutions for large-scale production of low-carbon hydrogen (H2),

which is then combined with nitrogen (N2) to produce low-carbon

ammonia (NH3). Once transported, the ammonia can be converted back

into hydrogen to help decarbonize industry and mobility.

- Air Liquide is a partner of a record

number of six out of seven renewable and low-carbon hydrogen

hubs (Clean Hydrogen Hubs) selected for funding negotiation by

the U.S. Department of Energy to receive up to 7 billion USD in

Bipartisan Infrastructure Law (BIL) funding.

- Signature with Trillium Energy Solutions

of a Memorandum of Understanding (MoU) to develop the hydrogen

fueling market for heavy-duty vehicles in the United States,

focusing on both hydrogen supply and fueling infrastructure.

- Energy transition & sustainable

development

- Through an investment of more than 140

million euros, announcement in October of the establishment in

Bécancour, Québec, Canada, of a breakthrough production platform of

low-carbon industrial gases to primarily supply, through long term

contracts, customers manufacturing battery components for

electric vehicles. Completing the Group’s 20 MW PEM

electrolyzer, this infrastructure will include a new air separation

unit powered by hydroelectricity to produce renewable oxygen and

nitrogen, as well as liquid storage capacity, connected by a

local pipeline network to best serve its customers.

- Announcement in October of the signing

with Vattenfall, one of the European leaders in the production and

distribution of electricity in Europe, of a long-term renewable

electricity purchase agreement (PPA) in Benelux for an installed

offshore wind capacity of approximately 115 MW. In total, Air

Liquide has now signed PPAs for a total installed capacity of 270

MW in Benelux. It will provide energy representing more than 70% of

the Group's existing electricity consumption in this region, which

includes Belgium, the Netherlands and Luxembourg.

- Air Liquide’s biodiversity commitments

are recognized by Act4nature International, an initiative led

by business networks, scientific partners and environmental

NGOs.

- Corporate

- Amelia Irion is appointed Human

Resources Director of the Air Liquide Group. This appointment

complements several Changes within the Air Liquide Executive

Committee since September 1, 2023.

Group revenue amounted to 6,811

million euros in the 3rd quarter 2023 and posted a comparable

growth of +1.5%, which demonstrated the resilience of the

portfolio of activities in a challenging environment. The Group’s

revenue as published was down -17.4%, impacted by

very unfavorable energy (-13.3%) and currency (-6.3%) impacts, the

significant perimeter impact being slightly positive at +0.7%.

Gas & Services revenue in the 3rd quarter 2023

reached 6,483 million euros, up by +1.7% on a

comparable basis.

- Gas & Services revenue in the Americas totaled

2,556 million euros in the 3rd quarter, up +1.8% on a

comparable basis. Large Industries sales (-5.2%) were impacted by

relatively low demand and customer turnarounds. Revenue in the

Industrial Merchant business posted growth of +3.6%, driven by

higher prices (+5.1%) and resilient gas volumes. In Healthcare, the

increase in prices in proximity care in the United States and the

dynamism of the businesses in Latin America contributed to the very

strong increase in sales (+11.7%). Electronics revenue was down by

-10.2% compared to very high sales in the 3rd quarter 2022, in a

context of slowing demand from memory manufacturers.

- Revenue in Europe was up +2.9% on a comparable

basis during the 3rd quarter 2023 and reached 2,331 million

euros. In Large Industries, activity stabilized in a difficult

environment, with sales up slightly by +0.5%. The +6.5% growth In

Industrial Merchant sales benefited from a price impact maintained

at a high level (+9.9%) and resilient volumes excluding helium and

liquefied CO2, whose supply has been tight. Healthcare business

revenue increased by +5.2%, driven by the dynamism of Home

Healthcare and the increase in medical gas prices in line with

inflation.

- Revenue in Asia Pacific amounted to 1,313

million euros in the 3rd quarter 2023, a -2.0%

decrease on a comparable basis. Large Industries sales (-6.4%) were

impacted by relatively low demand and customer turnarounds. The

Industrial Merchant business posted strong sales growth of +6.8%,

supported by high price rises (+ 5,7 %) and a sharp increase in

volumes in China. Electronics revenue was down -5.2% compared to

very high sales in the 3rd quarter 2022, in the context of a sharp

slowdown in the memory market, which penalized sales of specialty

and advanced Materials.

- Revenue in the Middle East and Africa posted a sharp

increase of +7.8% to 283 million euros

in the 3rd quarter 2023. All business lines grew. Large Industries

benefited from solid activity. In Industrial Merchant, a high price

impact (+11.9%) and a strong increase in volumes made it possible

to fully absorb the impact of the divestiture of businesses in the

Middle East in the 3rd quarter 2022 and achieve solid sales

growth.

In the 3rd quarter 2023, sales growth in the Industrial

Merchant activity (+4.9%) was solid and continued to

benefit from a high price impact which stood at

+6.5%. Gas volumes remained resilient, affected by an

unfavorable working day impact. Sales of Large Industries

were down by -1.7% on a comparable basis, impacted by

customer turnarounds and a relatively low demand which had globally

stabilized since the 1st quarter 2023. Healthcare revenue

posted a strong growth of +7.3%, driven by the dynamic

development of Home Healthcare and price increases of medical gases

in an inflationary environment. Electronics revenue was down

-5.0% compared to very high sales in the 3rd quarter 2022,

in a context of marked slowdown in the memory sector which

penalized particularly specialty and advanced materials sales.

Consolidated revenue from Engineering & Construction

amounted to 110 million euros in the 3rd quarter and

remained stable (-0.8%) compared to the 3rd quarter

2022.

Global Markets & Technologies revenue reached 218

million euros in the 3rd quarter 2023, down by -3.9% on

a comparable basis. However, revenue saw an organic growth

of +6.3% excluding the impact of divestitures finalized in

the 4th quarter 2022.

Industrial and financial investment decisions totaled a

very high level of 1.3 billion euros in the 3rd

quarter 2023 and 3.1 billion euros since the beginning of the year,

thus exceeding 3 billion euros for the first time at the end of

September. The investment backlog hit a record high

of 4.2 billion euros.

The additional contribution to sales of unit start-ups

and ramp-ups totaled 200 million euros at the end of the 3rd

quarter. The contribution expected for full-year 2023 has

been revised to approximately 270 million euros.

The portfolio of 12-month investment opportunities

remained high, at 3.4 billion euros at the end of

September 2023 and the portfolio beyond 12 months was

strengthened.

The price impact in the Industrial Merchant activity

stood at +6.5% in the 3rd quarter 2023 and was in

addition to the record price increase of +18.0% in the 3rd quarter

2022. Prices were also increasing in the other Gas &

Services business lines. Efficiencies(3) amounted to

320 million euros in the first nine months of the year, up

sharply by +22.1% compared to the same period in 2022. The

Group continued the active management of its portfolio in

2023 with the integration of 11 small acquisitions and the

divestitures of its business in Trinidad and Tobago and of its

stake in the company Hydrogenics in the first half.

Cash flow from operating activities before changes in

working capital reached 4,754 million euros at the end

of September 2023, an increase of +4.1% and +8.6% excluding

currency impact. It notably ensures the payment of

industrial investments, which totaled 2,431 million

euros.

Net debt amounted to 10,168 million euros, a

decrease of 382 million euros compared to 10,550 million euros as

of June 30, 2023.

In the 3rd quarter of 2023, the Group continued to deploy its

energy transition strategy, particularly with investment

decisions concerning new low-carbon and renewable industrial

gas production units. Furthermore, Air Liquide's commitments

made in 2022 regarding biodiversity were recognized and

validated by the Act4nature International initiative.

Analysis of 3rd quarter 2023 revenue

Unless otherwise stated, all variations in revenue outlined

below are on a comparable basis, excluding currency, energy

(natural gas and electricity) and significant scope impacts.

REVENUE

Revenue

(in millions of euros)

Q3 2022

Q3 2023

2023/2022

published

change

2023/2022

comparable

change

Gas & Services

7,897

6,483

-17.9%

+1.7%

Engineering & Construction

115

110

-5.3%

-0.8%

Global Markets & Technologies

235

218

-7.1%

-3.9%

TOTAL REVENUE

8,247

6,811

-17.4%

+1.5%

Revenue by Quarter

(in millions of euros)

Q1 2023

Q2 2023

Q3 2023

Gas & Services

6,893

6,512

6,483

Engineering & Construction

87

93

110

Global Markets & Technologies

194

201

218

TOTAL REVENUE

7,174

6,806

6,811

2023/2022 Group published

change

+4.2%

-7.0%

-17.4%

2023/2022 Group comparable

change

+6.2%

+3.8%

+1.5%

2023/2022 Gas & Services comparable

change

+6.7%

+4.1%

+1.7%

Group

Group revenue amounted to 6,811 million euros in

the 3rd quarter 2023 and posted a comparable growth of +1.5%

which demonstrated the resilience of the portfolio of activities in

a challenging environment.

Sales of the Global Markets & Technologies activity

were down by -3.9% on a comparable basis and posted an

organic growth of +6.3% which excludes the impact of

divestitures finalized in the 4th quarter 2022. Engineering

& Construction consolidated sales were stable

(-0.8%) compared with the 3rd quarter 2022.

The Group’s revenue as published was down -17.4%,

impacted by very unfavorable energy (-13.3%) and currency (-6.3%)

impacts, the significant perimeter impact being slightly positive

at +0.7%.

Gas & Services

Gas & Services revenue in the 3rd quarter of 2023

reached 6,483 million euros, up by +1.7% on a

comparable basis.

In the 3rd quarter 2023, sales growth in the Industrial

Merchant activity (+4.9%) was solid and continued to

benefit from a high price impact which stood at

+6.5%. Gas volumes remained resilient, affected by an

unfavorable working day impact. Sales of Large Industries

were down by -1.7% on a comparable basis, impacted by

customer turnarounds and a relatively low demand which had globally

stabilized since the 1st quarter 2023. Healthcare revenue

posted a strong growth of +7.3%, driven by the dynamic

development of Home Healthcare and price increases of medical gases

in an inflationary environment. Electronics revenue was down

-5.0% compared to very high sales in the 3rd quarter 2022,

in a context of marked slowdown in the memory sector which

penalized particularly specialty and advanced materials sales.

As published revenue for Gas & Services were down

-17.9% in the 3rd quarter, impacted by strongly negative

energy and currency impacts which respectively stood at -13.9% and

-6.4%. The significant scope impact was positive but limited to

+0.7%.

Revenue by geography and business

line

(in millions of euros)

Q3 2022

Q3 2023

2023/2022

published

change

2023/2022

comparable

change

Americas

2,936

2,556

-12.9%

+1.8%

Europe

3,266

2,331

-28.6%

+2.9%

Asia Pacific

1,474

1,313

-10.9%

-2.0%

Middle East & Africa

221

283

+28.1%

+7.8%

GAS & SERVICES REVENUE

7,897

6,483

-17.9%

+1.7%

Large Industries

3,112

1,882

-39.5%

-1.7%

Industrial Merchant

3,092

2,988

-3.4%

+4.9%

Healthcare

999

1,013

+1.4%

+7.3%

Electronics

694

600

-13.4.%

-5.0%

Americas

Gas & Services revenue in the Americas totaled 2,556

million euros in the 3rd quarter, up +1.8%. Large

Industries sales (-5.2%) were impacted by relatively low demand and

customer turnarounds. Revenue in the Industrial Merchant business

posted growth of +3.6%, driven by higher prices (+5.1%) and

resilient gas volumes. In Healthcare, the increase in prices in

proximity care in the United States and the dynamism of the

businesses in Latin America contributed to the very strong increase

in sales (+11.7%). Electronics revenue was down by -10.2% compared

to very high sales in the 3rd quarter 2022, in a context of slowing

demand from memory manufacturers.

Americas Gas & Services Q3 2023 Revenue

- Sales in Large Industries were down -5.2% in the

3rd quarter 2023, impacted in particular by customer turnarounds

and the divestiture of the activity in Trinidad and Tobago.

Business was also marked by relatively low demand from customers in

the Chemicals and Steel industries.

- The Industrial Merchant business posted sales growth of

+3.6%. Price impact was maintained at a high level at

+5.1%. Gas volumes (excluding hardgoods) were resilient

(-0.7%) and penalized by an unfavorable working day impact of

around -1%. Volumes were notably up in the Construction and

Aeronautics sectors.

- Sales in the Healthcare business saw very strong growth

(+11.7%) in the 3rd quarter 2023. The main contributors to

this growth were the rise in prices in Proximity Care in the United

States and the dynamism of Home Healthcare and Medical Gases in

Latin America.

- Revenue from Electronics was down -10.2% compared

to very high sales in the 3rd quarter 2022, which were up +10.3%.

Sales of specialty and advanced materials were strongly impacted by

the memory manufacturer production slowdown. Growth in sales of

Carrier Gases continued its steady rise.

Americas

- Through an investment of more than 140

million euros, Air Liquide announced that it will establish in

Bécancour (Canada), a breakthrough platform supplying low-carbon

industrial gases including hydrogen, oxygen, nitrogen and argon. In

addition to the existing Group’s 20 MW PEM electrolyzer,

currently the world’s largest in operation, the infrastructure

created by Air Liquide will include a new air separation

unit producing renewable oxygen and nitrogen and a local

pipeline network. This Air Liquide low-carbon production platform,

in line with the industrial and port zone's drive to decarbonize,

will primarily supply customers manufacturing battery components

for electric vehicles via long term contracts.

- In the context of the U.S.

government’s announcement to support seven regional Clean

Hydrogen Hubs to accelerate low-carbon hydrogen development,

Air Liquide is a partner in a record 6 out of the 7 Hubs.

This achievement is a recognition of Air Liquide’s commitment to

hydrogen development. Air Liquide’s participation in these regional

hubs supports its ambition to create a reliable hydrogen network in

the industry and bring it to scale.

- Air Liquide and Trillium Energy

Solutions, a leading supplier of sustainable fueling

infrastructure in the U.S., have signed a Memorandum of

Understanding (MoU) to pursue the development of the

heavy-duty hydrogen fueling market in the U.S.. This

significant collaboration marks a pivotal milestone in accelerating

the decarbonization of the transportation sector while bolstering

the hydrogen mobility market. The ambition through this partnership

is to initially support the development of 150 tons per day of

hydrogen production and the refueling infrastructure

capable of supplying more than 2,000 heavy-duty

vehicles.

Europe

Revenue in Europe was up +2.9% during the 3rd quarter

2023 and reached 2,331 million euros. In Large Industries,

activity stabilized in a difficult environment, with sales up

slightly by +0.5%. The +6.5% growth in Industrial Merchant sales

benefited from a price impact maintained at a high level (+9.9%)

and resilient volumes excluding helium and liquefied CO2, whose

supply has been tight. Healthcare business revenue increased by

+5.2%, driven by the dynamism of Home Healthcare and the increase

in medical gas prices in line with inflation.

Europe Gas & Services Q3 2023 Revenue

- Revenue for Large Industries rose slightly by

+0.5% compared to the 3rd quarter 2022. Hydrogen volumes for

Refining increased, while demand from Steel and Chemicals customers

remained weak, with natural gas prices remaining higher than to

their pre-energy crisis level. Sales of cogeneration units were

down, penalized by electricity prices that were below their very

high level of the 3rd quarter 2022. The combined effect, which was

exceptionally high in the 3rd quarter 2022 due to the steep

increase in energy prices, was not significant this quarter, as

relatively stable volumes neutralized the effect of the sharp drop

in energy prices(4).

- Industrial Merchant sales saw strong growth of

+6.5%, driven by a price impact that remained high

(+9.9%) and which came on top of the record increase of

+29.9% in the 3rd quarter 2022. Volumes excluding helium and

liquefied CO2, whose supply has been tight for several months,

remained resilient (-1%). They were penalized by one working day

less during the 3rd quarter, with an impact on volumes estimated at

around -1%. Volumes were up in the Automotive, Manufacturing and

Pharmaceuticals markets, and down notably in the Food sector.

- In the Healthcare business, sales were up sharply by

+5.2%. They benefited notably from the dynamism of the Home

Healthcare business, in particular for the treatment of diabetes

and sleep apnea. Growth in Medical Gas revenue was supported by

rising prices in an inflationary context and increased

volumes.

Europe

- On the occasion of the signing of a Memorandum of Understanding

to supply the TotalEnergies refinery in Gonfreville,

Normandy, France, with renewable and low-carbon hydrogen,

Air Liquide announced an investment of over 400 million

euros for the construction of its Normand’Hy

electrolyzer. With a capacity of 200 MW, it will be the

largest PEM electrolyzer ever built and will integrate equipment

manufactured in the frame of the joint-venture between Air Liquide

and Siemens Energy. Connected to the Air Liquide local hydrogen

network, this electrolyzer will contribute to the decarbonization

of the industry and transportation. Normand’hy was recognized as an

Important Project of Common European Interest (IPCEI) by the

European Commission and received support from the French State

for an amount of 190 million euros.

Asia Pacific

Revenue in Asia Pacific amounted to 1,313 million

euros in the 3rd quarter 2023, a -2.0% decrease. Large

Industries sales (-6.4%) were impacted by relatively low demand and

customer turnarounds. The Industrial Merchant business posted

strong sales growth of +6.8%, supported by high price rises and a

sharp increase in volumes in China. Electronics revenue was down

-5.2% compared to very high sales in 3rd quarter 2022, in the

context of a sharp slowdown in the memory market, which penalized

sales of specialty and advanced Materials.

Asia Pacific Gas & Services Q3 2023 Revenue

- Revenue for Large Industries decreased by -6.4%

during the 3rd quarter. Trends observed in the 1st half-year

continued, demand remaining weak in the region. Sales of air gases

were impacted by customer turnarounds, including one extended

stoppage in China.

- Industrial Merchant sales were up sharply by

+6.8%. They benefited from high price rises of

+5.7% in addition to the strong +9.3% increase in the 3rd

quarter 2022. In China, the marked increase in volumes,

particularly in the Manufacturing sector, explains the dynamic

growth in sales.

- Revenue from the Electronics business was down

-5.2% albeit compared to record sales in the 3rd quarter

2022, which benefited from growth of +21.8%. Volumes of specialty

and advanced Materials were temporarily penalized by the slowdown

in demand from memory manufacturers. Equipment & Installation

sales were also down compared to a high level in 2022. Sales of

Carrier Gases, whose business model resilience is comparable to

that of Large Industries, remained very solid.

Middle East and Africa

Revenue in the Middle East and Africa posted a sharp increase of

+7.8% to 283 million euros in the 3rd

quarter 2023. All business lines grew. Large Industries benefited

from solid activity. In Industrial Merchant, a high price impact

(+11.9%) and a strong increase in volumes made it possible to fully

absorb the impact of the divestiture of businesses in the Middle

East in the 3rd quarter 2022 and achieve solid sales growth. In the

Healthcare business, the development of diabetes treatment in Saudi

Arabia and non recurring sales in Egypt were the main drivers of

strong sales growth.

Engineering & Construction

Consolidated revenue from Engineering & Construction

amounted to 110 million euros in the 3rd quarter and

remained stable (-0.8%) compared to the 3rd quarter

2022.

Order intake in the 3rd quarter reached their highest level in

10 years at 647 million euros and mainly included projects

for the Group. These include notably a large-scale electrolyzer

(200 MW) for Large Industries and several air separation units for

the Gas & Services activities.

Global Markets & Technologies

Global Markets & Technologies posted a -3.9% decrease

in revenue to 218 million euros in the 3rd quarter 2023.

However, excluding the impact of the divestitures of the mobility

biogas distribution and the manufacture of small-scale cryogenic

tank businesses in the 4th quarter 2022, revenue saw organic

growth of +6.3%. Sales of technological equipment, in

particular Turbo-Braytons, were up sharply and the ramp-up of the

hydrogen liquefier in the United States contributed to the dynamic

growth of Hydrogen mobility.

Order intake for Group projects and for third-party customers

amounted to 224 million euros and includes Turbo-Brayton LNG

reliquefaction units, biogas processing equipment and cryogenic

equipment for an advanced research laboratory.

Investment Cycle

INVESTMENT DECISIONS AND INVESTMENT BACKLOG

Industrial and financial investment decisions totaled a

very high level of 1.3 billion euros in the 3rd quarter 2023

and 3.1 billion euros since the beginning of the year, thus

exceeding 3 billion euros for the first time at the end of

September.

Industrial investment decisions included three major

projects and reached a record level of 1,273 million

euros over the quarter, up sharply compared to 1,074 million

euros in the 3rd quarter 2022. In Large Industries, two

significant projects related to the energy transition were decided

this quarter: a first large-scale electrolyzer (200 MW) to produce

low-carbon and renewable hydrogen in France and a new renewable air

gas production unit in Canada for battery material manufacturers.

These two projects are part of the decarbonization of dynamic

industrial basins. In Electronics, decisions included

investments in carrier gas production units in Asia, in Europe and

in the Americas, including a large-scale unit. In Industrial

Merchant, new contracts were awarded for gas generators on

customer sites. In Healthcare, investments in distribution

equipment were approved to support the growth of medical gas sales,

particularly in South Africa and the United States.

Financial investment decisions amounted to 30 million

euros in the 3rd quarter and included in particular small

acquisitions in Industrial Merchant in Canada and China,

which will strengthen the density of Group local presence and thus

improve the business efficiency.

The investment backlog hit a record high of 4.2

billion euros. The breakdown is well balanced between Large

Industries projects located in all regions and those in

Electronics, mainly in Asia and America.

START-UPS

The main start-ups in the 3rd quarter 2023 included an Air

Separation Unit (ASU) for a Large Industries customer manufacturing

battery materials in Germany, a carrier gas production unit for a

Semiconductor customer in the United States and the Group’s first

biomethane unit in China.

The additional contribution to sales of unit start-ups

and ramp-ups totaled 200 million euros at the end of the 3rd

quarter. The contribution expected for full-year 2023 has

been revised to approximately 270 million euros, reflecting

the delayed start-up of a major unit for a Large Industries

customer in the Americas and a more moderate contribution from the

ramp-up of units already in operation, in the context of a slowdown

in demand in industry and Semiconductors. These sales are delayed

to 2024.

INVESTMENT OPPORTUNITIES

The portfolio of 12-month investment opportunities

remained high, at 3.4 billion euros at the end of

September 2023. The development of projects in the energy

transition, which represent more than 40% of the portfolio, was

very dynamic in Europe and the Americas. Investment opportunities

in Electronics are not only in Asia but also in Europe and the

United States, supported by incentive programs (Chips Acts). The

portfolio beyond 12 months was strengthened and includes in

particular significant projects related to the Inflation Reduction

Act and the Chips Act in the United States and the energy

transition in Europe and Canada.

Operating Performance

In an inflationary environment, the Group continues its

active price management. Thus, the price impact in the

Industrial Merchant activity stood at +6.5% in the 3rd

quarter 2023 and was in addition to the record price increase of

+18.0% in the 3rd quarter 2022. Prices were also increasing in

the other Gas & Services business lines.

Efficiencies(5) totaled 114 million euros

in the 3rd quarter. They amounted to 320 million euros in

the first nine months of the year, up sharply by +22.1%

compared to the same period in 2022 and they are in advance

compared with the annual target of 400 million euros. At the end of

September, they represent a saving of 1.9% of the cost base.

Industrial efficiencies increased and accounted for more

than 50% of the total. They included in Large Industries energy

efficiency and production optimization projects and in Industrial

Merchant supply chain improvements. The Group's digital

transformation continued: in Large Industries with the

contribution of remote operation centers (Smart Innovative

Operations, SIO), in Industrial Merchant and in Healthcare with the

implementation of tools to optimize delivery routes for bulk and,

increasingly, cylinders. The continued implementation of shared

service centers also contributes to efficiencies as well as the

global continuous improvement program which is supported by a

digital platform facilitating the replication of best

initiatives.

During the first 9 months of the year, the Group continued the

active management of its portfolio with the integration of

11 small acquisitions, in Industrial Merchant, Home Healthcare and

Hydrogen Mobility. Furthermore, in the first half, the Group

divested its business in Trinidad and Tobago and its stake in the

company Hydrogenics.

Cash flow from operating activities before changes in

working capital reached 4,754 million euros at the end

of September 2023, an increase of +4.1% and +8.6% excluding

currency impact. It notably ensures the payment of

industrial investments, which totaled 2,431 million

euros.

Net debt amounted to 10,168 million euros, a

decrease of 382 million euros compared to 10,550 million euros as

of June 30, 2023.

In the 3rd quarter of 2023, the Group continued to deploy its

energy transition strategy, particularly with investment

decisions concerning new low-carbon and renewable industrial

gas production units. Furthermore, Air Liquide's commitments

made in 2022 regarding biodiversity were recognized and

validated by the Act4nature International initiative.

Outlook

Air Liquide achieved a solid performance in the third

quarter, highlighting the resilience of its diversified business

model and its ability to prepare for future growth in a

challenging macroeconomic and geopolitical environment. The Group’s

performance this quarter was characterized by growth of its

activity on a comparable basis and a record level of

investment decisions. In line with its ADVANCE strategic plan, the

Group continued its actions to steadily improve operating

performance, in particular to generate efficiencies.

Revenue reached 6.81 billion euros, an increase of +1.5% on a

comparable basis in the third quarter. On a published basis, it

stood at -17.4%, mainly due to the drop in energy prices

(energy costs being contractually passed through to Large

Industries customers) as well as negative currency impacts.

The Gas & Services activity, which represented 95% of

the Group’s revenue, was up +1.7% on a comparable basis.

Industrial Merchant and Healthcare were the growth

drivers of this activity.

Constantly improving its operating performance, the Group has

notably generated significant efficiencies of 320 million

euros over nine months, which represents an increase of +22%,

despite an inflationary environment unfavorable to cost savings on

purchases. It also continued the dynamic management of its business

portfolio, while its ability to create value enabled it to adjust

its prices in Industrial Merchant. Cash flow(6) grew by

+8.6% excluding the currency impact.

The Group’s investment momentum was particularly

strong, reflecting its commitment to climate and paving

the way for future growth. The project backlog, at 4.2

billion euros, and investment decisions, at 1.3 billion

euros this quarter, reached record levels. With more than

40% of projects linked to the energy transition, 12-month

investment opportunities are also numerous and total 3.4 billion

euros.

In 2023, Air Liquide is confident in its ability to further

increase its operating margin and to deliver recurring net profit

growth, at constant exchange rates(7).

Appendices - Performance indicators

Performance indicators used by the Group that are not directly

defined in the financial statements have been prepared in

accordance with the AMF position 2015-12 about alternative

performance measures.

The performance indicators are the following:

- Currency, energy and significant scope impacts

- Comparable sales change

- Efficiencies

Definition of Currency, energy and significant scope

impacts

Since industrial and medical gases are rarely exported, the

impact of currency fluctuations on activity levels and results is

limited to euro translation impacts with respect to the financial

statements of subsidiaries located outside the euro zone. The

currency effect is calculated based on the aggregates for the

period converted at the exchange rate for the previous period.

In addition, the Group passes on variations in the cost of

energy (electricity and natural gas) to its customers via indexed

invoicing integrated into their medium and long-term contracts.

This indexing can lead to significant variations in sales (mainly

in the Large Industries Business Line) from one period to another

depending on fluctuations in prices on the energy market.

An energy impact is calculated based on the sales of each

of the main subsidiaries in Large Industries. Their consolidation

allows the determination of the energy impact for the Group as a

whole. The foreign exchange rate used is the average annual

exchange rate for the year N-1. Thus, at the subsidiary level, the

following formula provides the energy impact, calculated for

natural gas and electricity respectively:

Energy impact = Share of sales indexed to energy year (N-1) x

(Average energy price in year (N) - Average energy price in year

(N-1))

This indexation effect of electricity and natural gas does not

impact the operating income recurring.

The significant scope effect corresponds to the impact on

sales of all acquisitions or disposals of a significant size for

the Group. These changes in scope of consolidation are

determined:

- for acquisitions during the period, by deducting from the

aggregates for the period the contribution of the acquisition,

- for acquisitions during the previous period, by deducting from

the aggregates for the period the contribution of the acquisition

between January 1 of the current period and the anniversary date of

the acquisition,

- for disposals during the period, by deducting from the

aggregates for the previous period the contribution of the disposed

entity as of the anniversary date of the disposal,

- for disposals during the previous period, by deducting from the

aggregates for the previous period the contribution of the disposed

entity.

Note: exceptionally, the acquisition of Sasol air separation

units in 2021 had an impact in 2 steps on Group sales. After the

acquisition of the assets in June 2021 (1st step), devices were

installed on the units in 2022 in order to measure the energy

consumed which, from October 2022 (2nd step), could be re-invoiced

to the customer according to the standard Large Industries

contractual frame. For the sake of transparency in financial

communication, sales related to energy consumed and contractually

re-invoiced to the customer are identified within the significant

scope and are therefore excluded from the comparable growth. This

element will thus be accounted for in the significant scope during

12 months from October 2022.

Comparable sales change

Comparable sales change excludes the currency, energy and

significant scope impacts described above.

(in millions of euros)

Q3 2023

Q3 2023/2022

Published

Growth

Currency

impact

Natural gas

impact

Electricity

impact

Significant

scope

impact

Q3 2023/2022

Comparable

Growth

Revenue

Group

6,811

-17.4%

(518)

(829)

(268)

53

+1.5%

Impacts in %

-6.3%

-10.0%

-3.3%

+0.7%

Gas & Services

6,483

-17.9%

(505)

(829)

(268)

53

+1.7%

Impacts in %

-6.4%

-10.5%

-3.4%

+0.7%

(in millions of euros)

YTD 2023

YTD 2023/2022

Published

Growth

Currency

impact

Natural gas

impact

Electricity

impact

Significant

scope

impact

YTD 2023/2022

Comparable

Growth

Revenue

Group

20,791

-7.4%

(820)

(1,388)

(379)

100

+3.7%

Impacts in %

-3.6%

-6.2%

-1.7%

+0.4%

Gas & Services

19,888

-7.5%

(799)

(1,388)

(379)

100

+4.0%

Impacts in %

-3.7%

-6.5%

-1.7%

+0.4%

Efficiencies

Efficiencies represent a sustainable cost reduction

resulting from an action plan on a specific project. Efficiencies

are identified and managed on a per project basis. Each project is

followed by a team composed in alignment with the nature of the

project (purchasing, operations, human resources...).

Year to date revenue

By Geography

Revenue

(in millions of euros)

YTD 2022

YTD 2023

YTD

Published

change

YTD

Comparable

change

Americas

7,953

7,715

-3.0%

+4.9%

Europe

8,690

7,306

-15.9%

+4.1%

Asia Pacific

4,220

4,076

-3.4%

+1.8%

Middle East & Africa

634

791

+24.7%

+6.5%

GAS & SERVICES REVENUE

21,497

19,888

-7.5%

+4.0%

Engineering & Construction

336

290

-13.9%

-11.6%

Global Markets & Technologies

621

613

-1.1%

+1.0%

GROUP REVENUE

22,454

20,791

-7.4%

+3.7%

By Business Line

Revenue

(in millions of euros)

YTD 2022

YTD 2023

YTD

Published

change

YTD

Comparable

change

Large Industries

8,052

5,942

-26.2%

-2.9%

Industrial Merchant

8,602

9,038

+5.1%

+9.5%

Healthcare

2,924

3,047

+4.2%

+7.9%

Electronics

1,919

1,861

-3.0%

+2.2%

GAS & SERVICES REVENUE

21,497

19,888

-7.5%

+4.0%

Sales and investments key figures synthesis

The following tables gather data already available in

this report. They complement the key figures indicated in

the table on the first page.

Sales

Gas & Services

Q3 2023 split of revenue and comparable

growth in %

Total

Large

Industries

Industrial

Merchant

Electronics

Healthcare

Americas

100%

16%

70%

4%

10%

+1.8%

-5.2%

+3.6%

-10.2%

+11.7%

Europe

100%

36%

32%

2%

30%

+2.9%

+0.5%

+6.5%

N.C.

+5.2%

Asia Pacific

100%

34%

29%

33%

4%

-2.0%

-6.4%

+6.8%

-5.2%

N.C.

Middle-East and Africa

100%

N.C.

N.C.

N.C.

N.C.

+7.8%

Gas & Services

100%

29%

46%

9%

16%

+1.7%

-1.7%

+4.9%

-5.0%

+7.3%

Engineering & Construction

-0.8%

Global Markets & Technologies

-3.9%

GROUP TOTAL

+1.5%

N.C.: Not communicated.

Investments

(in billion euros)

YTD 2023

12-month portfolio of investment

opportunities(a)

3.4

Investment decisions since the beginning

of the year(b)

3.1

Investment backlog(a)

4.2

Additional contribution to revenue of unit

start-ups and ramp-ups(b) (in million euros)

200

(a) At the end of the reporting

period.

(b) Cumulated from the beginning of the

calendar year until the end of the reporting period.

The slideshow that accompanies this release is available as

of 7:20 am (Paris time) at

www.airliquide.com.

Throughout the year, follow Air Liquide

on LinkedIn.

CONTACTS

Investor Relations

IRTeam@airliquide.com

+33 1 40 62 51 50

Media Relations

media@airliquide.com

+33 1 40 62 58 49

UPCOMING EVENTS

2023 Full Year results:

February 20, 2024

A world leader in gases, technologies and services for Industry

and Health, Air Liquide is present in 73 countries with

approximately 67,100 employees and serves more than 3.9 million

customers and patients. Oxygen, nitrogen and hydrogen are essential

small molecules for life, matter and energy. They embody Air

Liquide’s scientific territory and have been at the core of the

company’s activities since its creation in 1902.

Taking action today while preparing the

future is at the heart of Air Liquide’s strategy. With ADVANCE, its

strategic plan for 2025, Air Liquide is targeting a global

performance, combining financial and extra-financial dimensions.

Positioned on new markets, the Group benefits from major assets

such as its business model combining resilience and strength, its

ability to innovate and its technological expertise. The Group

develops solutions contributing to climate and the energy

transition—particularly with hydrogen—and takes action to progress

in areas of healthcare, digital and high technologies.

Air Liquide’s revenue amounted to more

than 29.9 billion euros in 2022. Air Liquide is listed on the

Euronext Paris stock exchange (compartment A) and belongs to the

CAC 40, CAC 40 ESG, EURO STOXX 50, FTSE4Good and DJSI Europe

indexes.

______________________________________ 1 Cash flows from

operating activities before changes in working capital. 2 Operating

margin excluding energy pass through impact. Net profit recurring

excluding exceptional and significant transactions that have no

impact on the operating income recurring. 3 See definition in the

appendices. 4 See the presentation dedicated to the combined effect

available on the Group website. 5 See definition in the appendices.

6 Cash flows from operating activities before changes in working

capital. 7 Operating margin excluding energy pass through impact.

Net profit recurring excluding exceptional and significant

transactions that have no impact on the operating income

recurring.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231024207863/en/

Investor Relations IRTeam@airliquide.com +33 1 40 62 51

50

Media Relations media@airliquide.com +33 1 40 62 58

49

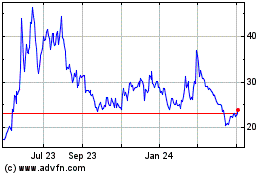

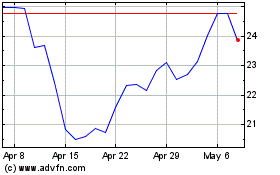

C3 AI (NYSE:AI)

Historical Stock Chart

From Jun 2024 to Jul 2024

C3 AI (NYSE:AI)

Historical Stock Chart

From Jul 2023 to Jul 2024