false 0001316835 0001316835 2023-12-05 2023-12-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 5, 2023

BUILDERS FIRSTSOURCE, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-40620 |

|

52-2084569 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

6031 Connection Drive, Suite 400, Irving, Texas 75039

(Address of Principal Executive Offices)

(214) 880-3500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

| Common stock, par value $0.01 per share |

|

BLDR |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 7.01. Regulation FD

Builders FirstSource, Inc. (the “Company”) is hosting an Investor Day on December 5, 2023 at 8:30 a.m. Eastern Time (7:30 a.m. Central Time) in Atlanta, Georgia. A copy of the presentation materials to be used by the Company at its Investor Day is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated in Item 7.01 of this Current Report by this reference. The presentation materials will also be available on the Company’s website at investors.bldr.com under the “Events & Presentations” tab.

The information contained in this Item 7.01, including the information set forth in the presentation materials furnished as Exhibit 99.1 to, and incorporated in, this Current Report, is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of Section 18. The information in Exhibit 99.1 furnished pursuant to this Item 7.01 shall not be incorporated by reference into any registration statement or other documents pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange Act except as otherwise expressly stated in any such filing.

ITEM 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

| BUILDERS FIRSTSOURCE, INC. |

|

|

| By: |

|

/s/ Timothy D. Johnson |

|

|

Name: |

|

Timothy D. Johnson |

|

|

Title: |

|

Executive Vice President, General Counsel and Corporate Secretary |

Dated: December 5, 2023

Exhibit 99.1 OUTPERFORM TODAY. TRANSFORM TOMORROW. Investor Day 2023 A T

L A N T A , G A 1 2 . 0 5 . 2 3

Welcome and Opening Remarks HEATHER KOS • SVP, Investor Relations

I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 2

Safe Harbor and Non-GAAP Financial Measures Cautionary Notice Statements

in this presentation and the schedules hereto that are not purely historical facts or that necessarily depend upon future events, including statements about expected market share gains, forecasted financial performance or other statements about

anticipations, beliefs, expectations, hopes, intentions or strategies for the future, may be forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. In addition, oral statements made by our

directors, officers and employees to the investor and analyst communities, media representatives and others, depending upon their nature, may also constitute forward-looking statements. All forward-looking statements are based upon currently

available information and the Company’s current assumptions, expectations and projections about future events. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are by nature inherently

uncertain, and actual results or events may differ materially from the results or events described in the forward-looking statements as a result of many factors. Builders FirstSource, Inc. undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise. Any forward-looking statements involve risks and uncertainties, many of which are beyond the Company’s control or may be currently unknown to the

Company, that could cause actual events or results to differ materially from the events or results described in the forward-looking statements, including risks or uncertainties related to the Company’s growth strategies, including

acquisitions, organic growth and digital strategies, or the dependence of the Company’s revenues and operating results on, among other things, the homebuilding industry and, to a lesser extent, repair and remodel activity, which in each case

is dependent on economic conditions, including inflation, interest rates, consumer confidence, labor and supply shortages, and also lumber and other commodity prices. Builders FirstSource, Inc. may not succeed in addressing these and other risks.

Further information regarding factors that could affect our financial and other results can be found in the risk factors section of Builders FirstSource, Inc.’s most recent annual report on Form 10-K filed with the Securities and Exchange

Commission (“SEC”) and may also be described from time to time in the other reports the Company files with the SEC. Consequently, all forward-looking statements in this release are qualified by the factors, risks and uncertainties

contained therein. Use of Non-GAAP Financial Measures This presentation includes financial measures and terms not calculated in accordance with accounting principles generally accepted in the United States (“GAAP”) in order to provide

investors with an alternative method for assessing our operating results in a manner that enables investors to more thoroughly evaluate our current performance as compared to past performance. We believe these non-GAAP measures provide investors

with a better baseline for modeling our future earnings expectations. Our management uses these non-GAAP measures for the same purpose. We believe that our investors should have access to the same set of tools that we use in analyzing our results.

These non-GAAP measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to GAAP results. Our calculations of adjusted net income, adjusted net income per share,

adjusted EBITDA, free cash flow and net leverage are not necessarily comparable to similarly titled measures reported by other companies. The company provided detailed explanations and reconciliations of these non-GAAP financial measures in the

earnings release included in its Form 8-K filed with the Securities and Exchange Commission on November 1, 2023. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 3

Today’s Agenda Welcome and Opening Remarks Elevating Commercial

Excellence 8:30 AM 10:10 AM HEATHER KOS • SVP, Investor Relations MIKE FARMER • President, Commercial Operations Differentiated, Established Market Leader Accelerating Industry-Leading DAVE RUSH • President & Chief Executive

Officer Digital Offerings TIM PAGE • EVP, Digital Solutions Driving Operational Excellence: Financial Excellence and Long-Term Targets Winning Together as PETER JACKSON • Chief Financial Officer STEVE HERRON • Chief Operating

Officer Closing Remarks Delivering Sustainability While Continuing DAVE RUSH • President & Chief Executive Officer to Build Our High-Performing Culture TIM JOHNSON • EVP, Legal, Safety & ESG AMY BASS MESSERSMITH • Chief

People Officer Q&A 1 Q&A 11:30 AM Depart for Automated Truss Facility Tour 10:00 AM Break In-person Attendees: Digital Product Demonstrations Available 1 Boxed lunches to be provided for in-person attendees. I N V E S T O R D A Y 2 0 2 3

– © B U I L D E R S F I R S T S O U R C E 4

Differentiated, Established Market Leader DAVE RUSH • President

& Chief Executive Officer I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 5

Key Messages Creating opportunity by addressing builder problems and 1

delivering value-added products and solutions across cycles; strong track record and experienced management team Investing for growth through new digital innovations and 2 building science that will deliver greater efficiency across homebuilding and

enhance product and service offerings Leveraging robust FCF generation from resilient 3 business model and broad product portfolio to fuel disciplined capital deployment Executing our profitable growth strategy and 4 compounding long-term

shareholder value * Non-GAAP financial measures; see Appendix for reconciliations to the most directly comparable GAAP financial measures. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 6

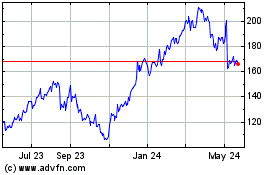

Builders FirstSource Snapshot (NYSE: BLDR) KEY STATS NATIONAL REACH.

LOCAL EXPERTISE. Irving, TX ~$16.5B ~30K $16.8 – 17.1B $2.7 – 2.8B $1.8 – 2.0B 1 2 2 2 2 Headquarters Market-Cap Employees Net Sales Adj. EBITDA FCF ~51% Value-Added 20% Product Mix 24% 24% Product 2023E Net Sales End Locations:

13% Category Market Truss 67% Breakdown Millwork 25% 27% Yard ~570 89 48 43 Specialty Building Products & Services Single-Family Locations of Top 100 of Top 50 States Lumber & Lumber Sheet Goods Multi-Family (>280 Value-Added MSAs Served

MSAs Served Served Manufactured Products Repair & Remodel / Other 3 Product Operations ) Windows, Doors & Millwork Largest U.S. Supplier of Building Products, Prefabricated Components, and Value-Added Services to the Professional Builder 1 2

3 Source: FactSet as of 11/17/2023. 2023 estimate as provided on Q3 2023 earnings call on 11/1/23. Includes components (truss & wall panel) and millwork operations. * Non-GAAP financial measures; see Appendix for reconciliations to the most

directly comparable GAAP financial measures. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 7

Company History – Respect the Past, Embrace the Future Builders

FirstSource BFS and BMC Acquired WTS Successfully acquired ProBuild, merge, creating nation’s Paradigm, a software Builders’ Supply navigated creating a national premier supplier of building solutions and services & Lumber Co. Great

Recession professional dealer with materials and services, provider for the building acquired by and housing market ~400 locations across operating ~550 locations products industry – major JLL Partners collapse 40 states across 40 states step

in digital journey 1998 2008 – 2011 JUL 2015 JAN 2021 AUG 2021 2005 2012 DEC 2015 JULY 2021 SINCE 2021 INVESTOR DAY Completed listing Commenced Exceeded $1B in Stock Building Supply revenues for first time transfer to NYSE IPO of Builders

completed merger with BMC, 14 Tuck-in Acquisitions in 5 years FirstSource on Nasdaq to form BMC Stock Holdings to further expand national reach and capabilities Continuing to Take Transformative Actions to Accelerate Our Lead I N V E S T O R D A Y 2

0 2 3 – © B U I L D E R S F I R S T S O U R C E 8

Our Mission, Vision, and Values MISSION VALUES VISION To be the best

supplier of At the center of everything we do – from the boardroom to the To make the dream of home building materials and jobsite, they define the Builders FirstSource culture and guide ownership more achievable services by having a people-

our priorities, decisions, and actions with a focus on S.P.I.C.E. for everyone, positioning first culture, exceptional Builders FirstSource as the customer service, and most valuable partner in innovative solutions that the industry create superior

value SAFETY PEOPLE INTEGRITY CUSTOMERS EXCELLENCE for stakeholders We make We lead with We are We deliver We challenge safety our a people-first honest exceptional the status quo top priority culture and reliable customer service Outperform Today.

Transform Tomorrow. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 9

Since 2021 Investor Day, We Continue to Transform the Homebuilding

Industry Key Accomplishments ▪ Delivered organic sales growth and Continued Leadership Focus margin expansion ▪ Support BFS’ exceptional leadership team with ▪ Drove strong M&A execution and track record an average of

>30 years industry experience per ▪ Accelerated digital transformation field leader, providing deep bench strength ▪ Foster commercial and operational excellence Transformative Actions Underway ▪ Drive continued growth of

value-added solutions, ▪ Diversifying value-added products and services driving sustained double-digit Adjusted EBITDA ▪ Evolving and improving product mix with a focus on margins with less reliance on lumber digital tools and

capabilities ▪ Maintain fortress balance sheet and compound ▪ Investing in manufacturing automation ($130M since value through disciplined capital allocation 2020) to drive operational excellence and address labor challenges Consistent

and Clear Strategy to Compound Shareholder Value * Non-GAAP financial measures; see Appendix for reconciliations to the most directly comparable GAAP financial measures. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R

C E 10

Well-Positioned for Above-Market Growth in the Future 1,2 $16.8-17.1B

BLDR 2023E Revenue Total Addressable Market ( % BLDR Share) Positive Momentum and Clear Path Toward Additional Share Gains Driven by Growing wallet share with 1 existing customers ~11% ~1% ~2% ~$110B ~$140B 2 Expanding product offerings 3 ~$175B

Single-Family Multi- 5 R&R U.S. New Construction 4 Family Building Materials Increasing value-added products 3 Capturing market share in 4 under-penetrated geographies 13% 13% 5 Delivering our digital solutions 67% 2023E Revenue 2023E Revenue

2023E Revenue 1 2 2023 estimate as provided on Q3 2023 earnings call on 11/1/23. Percent of 2023E Revenue will not foot to 100% for Single-Family, Multi-Family and R&R because Other is not included. 3 Source: TAM generated using U.S. Census,

Dodge, HIRI, and Company estimates of all building materials and not just the products that we sell; ~$134k assumed materials cost per home based on 4 5 Company estimates as of November 2023. Share is based on TTM September 2023 Company sales.

Source: DODGE; TTM estimate as of November 2023. Source: HIRI estimate for Professional Repair & Remodel; TTM estimate as of November 2023. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 11

Long-Term Housing Tailwinds Remain Supportive Housing Starts (000s) YoY

Growth in Households (000s) Housing Starts Cumulative Underbuilt Homes By 2022 Population Estimates, Only 10.4% of the 3,500 Cohort Aged 25-34 Are Homeowners 2,550 3,000 2,150 Underbuilt by ~1.7M – 3.5M 2,500 1,750 20-year Average Homes Since

2010 2,000 1,350 1,500 950 1,000 550 500 150 0 (250) Annual Average Rate on 30-year Fixed-Rate Mortgages (%) Demographic and Economic Factors 10.0 ▪ Homes have been underbuilt by ~1.7M – 3.5M since 2010, creating 9.0 a long-term tailwind

8.0 25-year Average 7.0 ▪ Current interest rates are elevated relative to historical averages, 6.0 delaying household formation 5.0 4.0 ▪ Existing home inventory for sale at a historic low, driving home 3.0 buyers to new build 2.0 1.0

▪ Strong case for housing to have room to run if we can be more efficient as an industry 1 Source: U.S. Census and MortgageNewsDaily, Evercore ISI Research, management estimates. As of 11/17/2023 the 30YR FRM was 7.37% sourced from

MortgageNewsDaily.com. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 12 1998 1999 2003 2000 2004 2001 2005 2002 2006 2003 2007 2004 2005 2008 2006 2009 2007 2010 2008 2011 2009 2010 2012 2011 2013 2012 2014 2013

2015 2014 2016 2015 2016 2017 2017 2018 2018 2019 2019 2020 2020 2021 2021 2022 2022 1 2023 2023 2023E 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Our Sustainable Competitive Advantages PEOPLE SCALE PRODUCT DIGITAL

▪ Hire, train, and retain best ▪ Remain focused in top ▪ Focus on value-add to ▪ Continue to lead the people in industry through MSAs – currently serving address customer needs industry in developing talent leadership

programs, 89 of top 100 MSAs (e.g., cycle time, labor, digital solutions to solve including BFS University availability, and quality) builder pain points ▪ Gain share in underserved ▪ Promote from within: ▪ Capitalize on automation

▪ Win through value pricing, markets through tuck-ins >2,000 internal promotions investments for efficiency industry-leading logistics, since 2021 Investor Day advantage in offsite labor-saving solutions, and ▪ Maximize capacity

fabrication innovative tools utilization ▪ Leverage systems, processes, and tools for ▪ Leverage unique ▪ Enhance myBLDR.com continuous improvement capabilities to provide ▪ Gain share of wallet turnkey solutions –

Rigorous talent and through Digital strategy succession planning – Development plans for key talent – Train and develop at all levels Innovation Enhances Scale for End-to-End Solutions I N V E S T O R D A Y 2 0 2 3 – © B U I L

D E R S F I R S T S O U R C E 13

Our -TEAM Operating System Continues to Drive Strategic Growth

Priorities Building People Experienced field leadership and management working to develop the next generation of talent supported by a strong, inclusive culture and values- driven approach Building Excellence Drive >$100M in annual efficiencies

through our scale, continuing to invest in automation and process improvement, and leveraging the largest sales organization and offsite manufacturing network in the industry Building Growth Grow our business by continuing to invest in value-added

products and digital innovations to help address our customers’ pain points and deliver greater efficiency across homebuilding Delivering Superior Value through Operational Excellence I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R

S F I R S T S O U R C E 14

Clear Strategic Pillars Driving Long-Term Profitable Growth Organic

Invest in Continue to Disciplined Growth of Innovation Build Our High- Capital Value-Added and Drive Performing Allocation Products and Operational Culture Services Excellence Continuing to Compound Value Creation with Strong Execution I N V E S T O

R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 15

Significant Upside Potential in Value-Added Products and Services

▪ Accelerate Market Penetration – Capture Single-Family potential, especially in underserved regions and product categories – Grow Multi-Family and pro-remodeling segments in targeted markets ▪ Offer Innovative Solutions for

Customer Labor Challenges – Increase offsite assembly, other innovative solutions, and jobsite productivity, while fueling our profitable growth; strong tailwind to our manufactured products ▪ Deploy Capital to Grow and Increase

Value-Added Solutions – Truss & Panel: Well-positioned facilities allow us to respond to market demand – Millwork: Add capacity in key markets to meet growing demand ® – READY-FRAME : Expand our geographic scale from coast

to coast ▪ Continue to Pursue Solutions Across the Value-Added Continuum Now Future OFFSITE FAB INSTALL TURNKEY SHELL MODULAR Evolving Further Along the Value-Added Continuum is Essential in Our Long-Term Strategy I N V E S T O R D A Y 2 0 2 3

– © B U I L D E R S F I R S T S O U R C E 16

Future Opportunity – Focused Investment in Building Science Path

to Success ▪ Partnering with key customers and intentionally engaging with cutting-edge homebuilding products and technology ▪ Investing in promising early-stage technologies provides opportunities to leverage our market-leading

distribution platform in exchange for a financial or ownership interest ▪ Utilizing dedicated internal resources to conduct our own research into new building materials, tools, and methodologies keeps us ahead of potential threats and

opportunities Continue to Lead the Homebuilding Industry with Cutting-Edge Innovation I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 17

Commitment to Operational Excellence and Innovation Create Value

through Continuous Innovation and Efficiency are Improvement Initiatives Key Differentiators ▪ Investment in value-added solutions ▪ PIM and SKU Consolidation Scale and Integration▪ Leader in truss automation ▪ Strategic

Centralization ▪ Customer service tracking ▪ Pricing and cost harmonization ▪ ERP and MDM ▪ Automation Technology ▪ Automation and Digital ▪ Delivery optimization ▪ Nex Gen: ML, AI 1 ▪ ~$275M of

cumulative productivity savings ▪ Planning and Sourcing ▪ Back-office Efficiency Process Improvement ▪ Operating Metric benchmarking ▪ Playbooks / SMEs Investing in Innovation and Enhancing Digital Solutions for Our Customers

1 Note: PIM: Product Information Management, ML: Machine Learning, AI: Artificial Intelligence, MDM: Master Data Management. Represents sum of $123M of 2022 productivity savings and expected 2023 productivity savings at the midpoint. I N V E S T O R

D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 18

Continuing to Build Our High-Performing Culture Key Focus Areas ▪

Promote career growth through enhanced leadership development programs and proprietary courseware – ~20,000 professional development and leadership training classes completed since 2021 Investor Day ▪ Roll out improved work/life benefit

solutions that meet the needs of our workforce ▪ Strengthen talent acquisition through: – Enhanced talent acquisition partnerships • Building Talent Foundation, military and veteran associations, Historically Black Colleges &

Universities (HBCUs), vocational and training programs • Sponsorship of HBS Women in Hardware A Culture Focused on Building Leadership and Careers I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 19

Accelerating Our ESG Journey Key ESG Accomplishments ✓ Launched

inaugural ESG report in May 2022 and released latest report in May 2023 Environmental Social Governance ✓ Disclosed our Scope 1 and Scope 2 greenhouse gas emissions for the Focus on Green, Commitment to Safety and Disciplined Pursuit first

time in 2023 Sustainable Building – Giving Back to Communities of Long-Term Stakeholder 2 ✓ ~30% RIR reduction across the “Green Works” in Which We Live and Work Value Creation company in 2023 ✓ >90% sustainable

forestry certified ▪ Leader in offsite manufacturing▪ Ensuring safety remains core to ▪ Seasoned board comprised of vendors 1 our culture industry business leaders – Independent study confirms ✓ ~33 average hours of

training value creation of components vs. – “Drive to Zero” program ‒ 90% independence (100% per leader traditional stick frame – faster, non-employee director – Management incentives tied less waste, and safer

independence) to safety ✓ >$4M charitable contributions 2 ‒ Fully engaged with diverse, in 2023 – >10% annual RIR reduction effective skillset ▪ Giving back to communities we serve by fostering volunteer opportunities

for our team members Remain Committed to Making a Positive Impact 1 2 Source: 2023 CSR Report and company data. SBCA Framing the American Dream study. Recordable Incident Rate. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S

O U R C E 20

Experienced Leadership Team Focused on Execution Dave Rush Peter

Jackson Steve Herron Amy Bass Tim Johnson Tim Page Chief Executive Chief Financial Chief Operating EVP, Legal, Safety, EVP, Digital Messersmith Officer Officer Officer and ESG Solutions Chief People Officer Mike Farmer Mike Hiller Scott Robins Mike

McCrobie Joe Barnes Jami Beckmann Heather Kos President, President, President, President, EVP, Sourcing & SVP, Chief SVP, Investor Commercial Operations Central Division West Division East Division Supply Chain Accounting Officer Relations

Energized Management Team Driving Positive Momentum I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 21

Experienced and Diversified Board of Directors Skills Matrix Business

Development / M&A 100% Finance 90% Public Company Director 80% Paul Levy Mark Alexander Cory Boydston Dirkson Charles Cleveland Christophe Director & Chairman Founder, Chairman, Former CFO, Ashton Founder and CEO, Former President,

Operational Excellence 70% Managing Director, & CEO, Landmark Woods USA LLC Loar Group, Inc. US&S, Inc. JLL Partners, Inc. Property Group Joined: 1998 2021 2021 2022 2005 Leadership Experience 70% Industry Experience 60% Board Attributes 90%

William Hayes Brett Milgrim James O’Leary Dave Rush Craig Steinke Independence Former EVP, CFO, Co-Chairman, Chairman, CEO, CEO and Director of & Treasurer, LabCorp Loar Group, Inc. Kinematics Builders FirstSource Service Logic, LLC

Manufacturing Company 63.6 Years 9.5 Years 2019 1999 2021 2022 2006 Average Age Average Tenure I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 22

Disciplined Capital Allocation 1 2022-2023E Capital Deployed: $6.1B

Consistent Capital Allocation Priorities $0.8B 1. Maintain Strong Balance Sheet $0.9B ▪ Target Base Business leverage ratio of 1.0x to 2.0x 2. Organic Growth ▪ Drive productivity and growth with growth investments $4.4B 3. Inorganic

Growth ▪ Pursue margin accretive deals with strategic, tuck-in M&A 4. Return Capital to Shareholders Cumulative (Since 12/31/21) ▪ Continue opportunistic share repurchases Share Repurchases Tuck-in M&A Organic Growth 2 Deployable

Capital Goal of $5.5B to $8.5B from 2024E to 2026E 1 2023 estimate as provided on Q3 2023 earnings call on 11/1/23. 2 Deployable capital includes Organic Growth, which is inclusive of capital expenditures. Target assumes 1.0x to 2.0x Base Business

leverage ratio. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 23

Our Digital Platform to Fuel Long-Term Growth Digitizing Homebuilding

and DIGITAL INNOVATIONS INDUSTRY LEADER Materials Sourcing ~$110B 1 SINGLE-FAMILY HOMES – U.S. NEW CONSTRUCTION 1 2 3 BUILDING MATERIALS (TTM Sept. 2023) SHARE GROWTH Faster, Increased Design Greater Control Providing digital solutions to

solve ACCELERATOR More Accurate Functionality for Homebuilders builder pain points and Complete with Supply Chain and Other Project Being a key player in emerging Materials List Integration Participants digital homebuilder space Generating pull

through sales opportunities On Track to Deliver $1B of Revenue Growth from Incremental Sales by 2026 1 Source: TAM generated using U.S. Census, Dodge, HIRI, and Company estimates of all building materials and not just the products that we sell;

~$134k assumed materials cost per home based on Company estimates as of November 2023. Share is based on TTM September 2023 Company sales. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 24

New 2026E Base Business Targets 2021-2025E Targets PROGRESS 2024E-2026E

(Announced at Dec. 2021 1 TO DATE TARGETS Investor Day) Revenue ~10% CAGR ~3% CAGR ~9% CAGR Adj. EBITDA ~15% CAGR ~13% CAGR ~12% CAGR ~50 bps ~115 bps ~30 bps Adj. EBITDA Expansion Expansion Expansion Margin Annually Annually Annually Adj. EPS ~30%

CAGR ~45% CAGR ~17% CAGR 2 Deployable Capital of $5.5B to $8.5B from 2024E to 2026E 1 2 Through 2023E. Deployable capital includes Organic Growth, which is inclusive of capital expenditures. Target assumes 1.0x to 2.0x Base Business leverage ratio.

* Non-GAAP financial measures; see Appendix for reconciliations to the most directly comparable GAAP financial measures. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 25

Driving Operational Excellence: Winning Together as STEVE HERRON

• Chief Operating Officer I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 26

Driving Operational Excellence: Winning Together as STEVE HERRON

• Chief Operating Officer I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 27

Key Messages Building our people with a deep focus on safety, 1 talent

development, training, and retention to maximize customer service Building excellence through clear operational and 2 productivity improvement initiatives to deliver innovative products and services addressing customer needs Building growth with an

emphasis on organic growth 3 initiatives and select, disciplined tuck-in acquisitions I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 28 28

Building People SAFETY TRAINING ENGAGEMENT Continuously driving

Consistent onboarding Tracking team member safety initiatives to full and new team member engagement annually integration within our training culture ~5% YoY Implemented Engagement ▪ Incentive structure tied to >100 improvement leadership

high potential safety results goal leaders development identified program Industry-leading safety Disciplined annual protocols and track record Launched manager / review process ~55% sales-in-training focused on employee ~30% of locations YoY

reduction programs development path are 365 days in RIR incident free in 2023 Commitment to Safety and Development of High-Performing Workforce I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 29

Building Excellence OPERATIONS COST COMMERCIAL EXCELLENCE PRODUCTIVITY

EXCELLENCE Fully integrated sales Producing highest Continuous team to best serve quality products to drive improvement mindset customers; incentives customer satisfaction ▪ Technology (e.g., digital aligned to growth strategy and automation)

aimed at continuously improving Leveraging Creating the construction process “playbooks” best practices Improved 90%▪ Driving greater and scale with on-time delivery discipline with LEAN a structured approach principles to

continually provide ▪ Advancing belt solutions for customers certifications through Improved in-full 96% clear training program Capture significant growth performance opportunity in install Driving Steady Improvements within Operations to

Generate Strong Annual Productivity Savings I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 30

Case Study | Optimizing Footprint to Lower Costs and Leverage

Scale… Background Operational Excellence in Action Results Merger with BMC▪ Consolidated 3 distribution yards due to general overlap $2.5M-$3.0M – Minimal impact to growth capacity Annual Overhead ▪ #1 player in vibrant, Cost

Reduction highly competitive ▪ Consolidated 2 component plants; invested in automation Atlanta market to retain and increase growth capacity >15% ▪ Combined company ▪ Invested in new state-of-the-art millwork plant, while

Increase in Truss Direct was operating with closing a smaller, sub-optimal site – new site Labor Efficiencies 12 distribution yards, advantages: 4 truss plants, and – Increases growth capacity and efficiencies via optimized layout 15% 4

millwork plants rd – Shifts lumber re-load from 3 -party vendors to internal control Working Capital Days Reduction …While Retaining Growth Capacity I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E

31

Supply Chain Optimization Efforts COST CATEGORY RISK MANAGEMENT

MANAGEMENT MITIGATION ▪ Executing opportunities to ▪ Aligning costs to ▪ Maximizing spend with utilize our scale and revenue and driving the right supply partners achieve lower landed consistently higher ▪ Standardizing SKUs

for cost by: margins greater efficiency ‒ Shifting a higher ▪ Protecting costs during percentage of moulding ▪ Improving industry-best long selling cycles mix from domestic millwork lead times distribution to import ‒

Multi-Family can take (e.g. JIT program for the (>$15M for 2023E) 9-18 months vs. normal Dallas market) 2-4 months selling cycle ‒ Reducing inbound shipping for Single-Family costs by establishing in- house freight management capabilities

and tools (>$4M for 2023E) Leveraging Our Scale to Have the Industry Best Cost Position I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 32

Delivering Productivity through Targeted Initiatives ACHIEVEMENTS SINCE

2021 INVESTOR DAY Near-Term Efficiency Targets 1 § Productivity: ~$275M of cumulative productivity § Improve fleet utilization with ~20% improvement savings, exceeding our $100M annual target driven in truck turnaround times by improved

procurement and SG&A efficiencies § Reduce error rate by 10% in order entry 2 § Truss: improved board foot per hour ~45% since and manufacturing the BMC merger in January 2021 § Reduce inventory shrinkage by 10% through §

Millwork: improved doors per hour by ~5% and specific kaizen events in component plants increased overall Millwork capacity by 21% with the installation of 7 new high-speed door lines Repeatable Playbook to Drive Strong Annual Productivity in

Controllable Spend 1 Represents sum of $123M of 2022 productivity savings and expected 2023 productivity savings at the midpoint of the guidance range. 2 Adjusted to be on a same store basis. I N V E S T O R D A Y 2023 – © B UI L DE RS F

I RS T S O URCE 33

Building Growth INNOVATION CORE GROWTH M&A Delivering an end-to-end

Laser-focused on Disciplined and prudent digital platform to customer-centric tuck-in M&A within a fragmented market to transform homebuilding, innovation – partnering increase: extending market with our largest customers leadership to

drive to create and deliver ▪ Market strength revenue growth industry-leading product ▪ Value-added product mix and labor solutions ▪ Coverage in desirable Investing in value-added markets High solutions to solve builder Truss

Speed ▪ Customer stickiness pain points, including Automation Door through expanded reach Lines labor availability and time and solutions to build Digital Building Profitable Growth through Organic and Inorganic Opportunities I N V E S T O R D

A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 34

Capitalizing on Industry-Leading Value-Added Footprint ▪ Current

footprint and capabilities – Components (truss & wall panels): >160 operations – ~$130M Added >30 new operations since 2021 Truss Plant Investment – Millwork: >120 operations – Added >25 new operations since

2021 Since 2020 ▪ Fully integrated all truss plants to serve both Single- and Multi-Family projects – Truss: Operating >725 setups: over 60% have some level of automation, including 4 setups with robotics ▪ Remain committed to

quality assurance and >280 value-added 120 operations as we continue to scale Truss Plants ▪ Continuing to optimize plants with new equipment ~4x the Size of Nearest – Truss: Upgrading 15 locations, including 3 robotic lines (2024)

Competitor – Millwork: Upgrading 11 locations (2024) Driving Best-in-Class, Lean Manufacturing I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 35

Capturing Significant Growth Opportunity in Install Operations 2023E

Install Sales 1 ~$2.5B (~15% of Total Revenue) ▪ Value-added opportunity for both BFS and customers – Providing bundled solutions with labor as a Top Product Opportunities service to address customers’ shortage of labor

availability – crucial across all markets – Offering multiple turnkey solutions for various residential construction sites (e.g., apartment complexes, single-family homes, etc.) MILLWORK WINDOWS FRAMING SIDING ▪ Continuing to grow

share in a down market – labor sales up 45% YoY ▪ Organic and inorganic growth opportunity Install Capability in Approximately Two-Thirds of Our Markets – Opportunity to Further Grow 1 Represents net sales from installation and

construction services, including the impact from the materials installed. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 36

Key Takeaways 1 2 3 Building growth Building our people Building

excellence with an emphasis on with a deep focus on through clear operational organic growth initiatives safety, talent development, and productivity and select, disciplined training, and retention to improvement initiatives to tuck-in acquisitions

maximize customer service deliver innovative products and services addressing customer needs I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 37

Delivering Sustainability While Continuing to Build Our High Performing

Culture TIM JOHNSON • EVP, Legal, Safety & ESG AMY BASS MESSERSMITH • Chief People Officer I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 38

Key Messages Driving a clear and differentiated ESG strategy 1 to

outperform today and transform tomorrow Empowering customers with industry-leading solutions 2 to enable a sustainable future and drive profitable growth Building on our strong, inclusive culture and 3 values-driven approach to attract, retain and

develop the best talent in the industry I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 39

ESG Strategic Framework Customers Operations Communities Team Members

Provide innovative Operate effectively Make a positive Foster a workplace solutions for and efficiently impact in the where safety, careers, more sustainable to drive long-term local communities and diverse operations value we serve perspectives

thrive Industry Leader in Sustainability with Cleaner, Safer, and More Efficient Homebuilding Solutions I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 40

Sustainably Innovating to Create Customer Value… ▪ Leader

in offsite manufacturing – Addresses real customer needs, including labor availability and speed to build – Independent study confirms value creation of components vs. traditional stick frame 1 • Faster: ~2.5x faster to build homes

with components vs. stick framing 1 • Less Waste: ~25% less board footage per average US home (~14.5 cubic yards of less waste per home) 1 • Safer: reduces on-site cutting and ladder time – Drives outstanding retention of customers

▪ Increasing Digital innovations and adoption will accelerate and expand the importance of offsite manufacturing ▪ Investment in value-added solutions remains a key pillar of our strategy, driving product and service innovation,

differentiation, and growth opportunities – Focusing on organic growth of value-added components and solutions, which together will deliver strong sales CAGR with solid ESG benefits – Accelerating value-added through acquisitions;

>$800M annual revenues in truss and millwork acquisitions since the BMC merger …while Driving Sustainable Profitable Growth 1 SBCA Framing the American Dream study. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O

U R C E 41

Operating More Sustainably with a Clear Focus on Our Environmental

Impact Committed to Continuing to Reduce Our Environmental Footprint Sustainable Sourcing ▪ Implementing nationwide delivery routing system to maximize vehicle efficiency and minimize emissions Sourcing >90% of wood ▪ Introducing

alternative fuel vehicles from the Sustainable Forestry Initiative (SFI) ▪ Utilizing water-based paints to reduce hazardous waste risk and Forest Stewardship Council (FSC) ▪ Upgrading lighting to LEDs to save energy and reduce emissions

>5.4M ▪ Optimizing material usage and reducing construction waste Trees Saved ® Providing Energy Star by utilizing manufactured components and continually providing 1 Since 2019 qualified windows more efficient materials and doors

Commitment to Identifying Specific GHG Reduction Targets No Later Than 2025 Industry-Leader in Providing an Eco-Friendly Approach to Homebuilding 1 Source: Independent third-party study on lumber reduction from READY-FRAME® and SBCA Framing the

American Dream study. Internal calculation based on production data for Builders FirstSource READY-FRAME® precut framing packages, roof and floor trusses since January 1, 2019. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R

S T S O U R C E 42

Dedicated to Serving Our Local Communities BFS Cares Enduring

Partnership with LLS Created to help team members facing financial hardship immediately after a natural disaster or unforeseen personal hardship 17 $11M #1 years of raised for National ▪ Provides a tax-free grant ranging from support LLS

through fundraising $500 – $5,000 collected from individual team 2023 team member donations and support from the company Established ▪ Since 2017, over 1,300 grants totaling ~$900,000 BFS Foundation have helped team members during times

of to Enhance financial hardship Charitable Efforts Additional Charitable Partnerships On Track to Deliver Over $4M in Charitable Giving in 2023 I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 43

Continuing to Build Our High-Performing Culture AMY BASS MESSERSMITH

• Chief People Officer I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 44

Industry-Leading Approach to Talent Development Drives Competitive

Differentiation WE’RE A WE MAKE PEOPLE FIRST A LOCAL TEAM. IMPACT. WE GROW WE GIVE CAREERS BACK. FROM WITHIN. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 45

Attracting Top Talent and Team Member Retention and Development DEFINED

CLEAR ELEVATED TOTAL DROVE A CULTURE WE ARE A VALUES-DRIVEN CAREER PATHS REWARDS OF ENGAGEMENT ORGANIZATION ▪ Formalized compensation ▪ Developed and articulate ▪ Established -TEAM SAFETY philosophy, pay grades, a differentiated

employee University and job levels value proposition (EVP) We make safety our top priority ‒ High-potential and ▪ Aligned short and ▪ Executed engagement emerging-leader PEOPLE long-term incentive survey action plans classes

approaches, organizational ▪ Embedded respect and We lead with a people-first culture structure, and support ▪ Supported processes inclusiveness into every that inform all aspects ▪ Detailed review of touchpoint of the team

INTEGRITY of the team member benefit plan designs member experience experience and programs We are honest and reliable ‒ Attraction ▪ Established Team Member ‒ Onboarding Services to ensure CUSTOMERS >2K internal promotions

responsiveness and timely SINCE ‒ Development We deliver exceptional customer service issue 2021 ‒ Succession resolution INVESTOR ~20K leadership training EXCELLENCE ‒ Bench planning / DAY classes completed offboarding We challenge

the status quo A Culture Focused on Creating a Better Future I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 46

-TEAM University: Our All-Encompassing Learning Platform LEADING

ORGANIZATIONS LEADING TEAMS Extensive >47K >46K ~33 on-the-job Total annual online Total annual Average hours training hours for all in-person training of training annually training team members in hours for leaders per leader for all team

members addition to on-the-job LEADING OTHERS training LEADING SELF Fully Committed to the Continuous Professional Development of All Team Members I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 47

Signature Programs Reinforce Authenticity of Employee Value Proposition

WE’RE A PEOPLE WE GROW CAREERS WE MAKE A WE GIVE FIRST TEAM. FROM WITHIN. LOCAL IMPACT. BACK. ▪ World-Class Safety Culture▪ -TEAM University▪ Feedback Driven ▪ BFS Cares Engagement Surveys ▪ First Team

Recognition▪ Leadership Development▪ Leukemia & Lymphoma ▪ Best Practice Councils Society ▪ Enhance Work & Life Benefits▪ Differentiated Career Paths ▪ Local Employee ▪ Expanded Military Resource

Groups Connections ▪ -TEAM Operating System▪ Local Community Causes & Volunteer Day I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 48

Key Takeaways 1 2 3 Building on our strong, Driving a clear and

Empowering customers inclusive culture and differentiated ESG with industry-leading values-driven approach strategy to outperform solutions to enable a to attract, retain, and today and transform sustainable future and develop the best talent

tomorrow drive profitable growth in the industry I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 49

Q&A I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F

I R S T S O U R C E 50

BREAK I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I

R S T S O U R C E 51

Elevating Commercial Excellence MIKE FARMER • President,

Commercial Operations I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 52

K Ke ey y M Me es ss sa ag ge es s Leveraging largest sales

organization and offsite 1 manufacturing network in industry to deepen customer relationships and drive long-term revenue growth Improving data-driven sales process with 2 continuous improvement mindset to elevate commercial excellence Strengthening

relationships with homebuilders 3 to solidify industry leadership and capture incremental market share I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 53

Our Sales Organization is a Competitive Advantage Key Stats

Industry-Leading Sales Organization >13 years average tenure of our Outside Sales Team ~1,850 ~1,950 Solving Builder Pain Points by Leveraging Our OUTSIDE SALES INSIDE SALES Network of Value-Added Components REPRESENTATIVES REPRESENTATIVES

>160 component (truss & wall panel) operations today ~115K ~90% Clear Sales Incentives Aligned with CUSTOMERS CUSTOMER Long-Term Profitable Growth SERVED RETENTION >95% of sales team members are commission based ~85% Diversified Customer

Base CUSTOMERS BUYING Largest customer is ~5% of sales, which minimizes 2 OR MORE reliance on any one customer CATEGORIES I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 54

Commercial Excellence is Core to Long-Term Growth Sales Ops Leading

software enables greater customer visibility, system controls to reduce overrides, optimized market coverage Value-Based Selling Market Pricing Mature pricing process, promoting pricing excellence, Fully integrated sales force helps solve customer

best practices, and national deal support pain points and supports margin expansion Sales Analytics Category Management Customer profitability, margin transparency Supplier partnership and negotiating, cost Commercial and pricing support, focus on

customer value transparency and timely pass through Excellence Data-Driven Process to Further Enhance Commercial Excellence I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 55

Building a Culture of Sales Excellence Actions Benefits ▪

Leveraging largest Share gains, including customer data set in new customer wins, homebuilding industry increased wallet share, and stickiness + ▪ Driving deeper Sales Value-Based Sales Market Category understanding of Partner with customers

Analytics Selling Operations Pricing Management customer-level to improve efficiency profitability and reduce cycle times ▪ Exploring early-stage Faster and better- Sales and Pricing Proactive Market AI opportunity to informed decisions

Excellence Management empower sales force effectiveness Supporting Industry’s Largest Sales Force with the Industry’s Best Data and Analytics I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E

56

Taking Proactive Steps to Enhance Pricing and Returns Actions Benefits

▪ Driving pricing Improved gross consistency within margin profile with markets value-added mix + ▪ Using data to drive National customer Sales Value-Based Sales Market Category better relationships alignment with local Analytics Selling

Operations Pricing Management with suppliers market needs ▪ Helping local teams Shift from “gatherer” understand cost and to “hunter” mindset Proactive Market Sales and Pricing profitability drivers Management

Excellence Optimizing Growth and Margins through Enhanced Focus on Pricing Management I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 57

Strengthening National Builder Relationships to Grow with Our Partners

Expanding Leading with Value- National Builders Relationships Added Solutions Demonstrating Resilience Continuing to build our Providing customer-centric in Current Market footprint and strengthen solutions that drive efficiency, national presence

reduce waste, and improve ▪ Leveraging strong balance sheets cycle times and cash flow to manage through market slowdown Leveraging Scale Acting Nationally ▪ Buying down rates and negotiating & Product Portfolio to Grow Locally

forward contracts to keep building Partnering with our Centralizing administration process moving ahead customers to help address to allow local teams to focus ▪ Capitalizing on market disruption labor challenges on serving customers to grow

market share more effectively Building a Growing Franchise to Support Largest Customers While Expanding Margins I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 58

Commercial Excellence in Action SOLVING PAIN POINTS Customer Segment

Value Proposition BFS BENEFITS FOR CUSTOMERS ▪ National – Leader in overall scale and offsite manufacturing across an aligned, nationwide footprint We are the easiest to do that matches to the builder need in our markets business with

given our product expertise and ▪ Regional – Leveraging our 1,800+ outside sellers to Value-Added Growth portfolio, footprint, and maintain relationships and strengthen builder capabilities Mix Improvement tenured sales team members

▪ Custom – Local coverage and expertise to support higher-touch custom homes and enhance builder image Creating value for a range Margin of homebuilders through ▪ Pro Remodeling – Inside and outside sales bolster Improvement

our offsite fabrication remodelers via dedicated locations and services in network and install business, key markets which address labor Share Growth ▪ Multi-Family – Value-added network provides footprint to availability challenges and

deliver our best-in-class design capabilities and capacity speed time to build to go where Multi-Family builders go Driving Meaningful Growth Through Commercial Excellence and Operational Efficiency I N V E S T O R D A Y 2 0 2 3 – © B U I

L D E R S F I R S T S O U R C E 59

Key Takeaways 1 2 3 Strengthening Leveraging largest sales Improving

data-driven relationships with organization and offsite sales process with homebuilders to solidify manufacturing network continuous improvement industry leadership and in industry to deepen mindset to elevate capture incremental customer

relationships commercial excellence market share and drive long-term revenue growth I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 60

Accelerating Industry- Leading Digital Offerings TIM PAGE • EVP,

Digital Solutions I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 61

Key Messages Significant progress on our digital journey, delivering on

1 our commitments to customers and shareholders Continued industry leadership, providing cutting-edge 2 digital solutions with a relentless focus on customer success and value to empower the next generation of homebuilding Strong commitment to value

creation, achieving 3 meaningful progress toward goal of $1B in incremental product revenue by 2026 I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 62

Creating a Better Way to Build as Demand for Modern, Digital Solutions

Continues to Grow Addressing industry …with industry-leading …to become the premier partner pain points… digital solutions… for builders and suppliers ▪ Lengthy design cycle remains þ Streamlined design in a

Increase Wallet Share with static in 2D blueprints dynamic, 3D digital model Existing Customers Driving Grow Market Share with ▪ Offline information storage þ Online collaboration provides New Customers $1B results in misunderstanding of

stakeholder alignment and project timeline and cost visibility throughout the project Expand across other Incremental Builder Segments Product ▪ Ongoing change requests þ Seamless connection from Revenue Expand Shoppable result in an

inefficient job site design through material by 2026 Product Catalog procurement and construction Transforming the Industry for Current and Next Generation of Homebuilders I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U

R C E 63

Digital Platform Expected to Fuel Long-Term Growth …and Continue

to Set the Pace for the Industry Laid Out a Bold Plan at 2021 Investor Day… KEY ACCOMPLISHMENTS FOREFRONT OF DIGITAL TRANSFORMATION ✓ Introduced myBLDR.com customer portal, hub for ✓ Industry leader; 3-5-year head start vs.

competitors greater functionality and improved user interface ✓ ~2-year head start on customer adoption ✓ Expanded 2D and 3D modeling and estimation ✓ Continuing to expand the digital solutions portfolio capabilities, with ~25K

automated takeoffs from customer plans on Paradigm technology in full year ✓ Delivering new capabilities that competitors don’t offer 1 2023 (+220% year-over-year ) ✓ Customer-centric focus with strong relationships ✓

Deployed Digital Twin technology and 3D Home upstream and downstream Configure pilot ✓ Set the stage for sales and operations adoption Building on Our Vision to Digitize the Industry 1 Represents the year-over-year change in automated

takeoffs on a year-to-date basis as of November 2023. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 64

Driving Value for Key Stakeholders Through Distinct Competitive

Advantages Value for Key Stakeholders Competitive Advantages Scale and market ~4K sales team HOMEBUYER position to reach with direct and Improved homebuying experience, design choices, understanding of a fragmented trusted homebuilder cost

implications, and ability to store construction documents customer base relationships HOMEBUILDER Well-positioned Technical knowledge early in value chain spanning construction Competitive advantage in the selling process, shorter design cycle /

with planning and process reduced costs, construction efficiencies, and supplier / trade connectivity design services INTEGRATED SUPPLY PARTNERS Unmatched Aspiration for digital distribution platform transformation with Lower cost channel, extended

reach to potential homebuyers, with required supply access to capital operational efficiencies, and improved business insights partnerships Capitalizing on Scale to Drive Innovation and Transformation I N V E S T O R D A Y 2 0 2 3 – © B U

I L D E R S F I R S T S O U R C E 65

Three Pillars of Our Digital Strategy Technology Adoption Growth

Delivering digital Helping customers Extending market tools to transform accelerate their leadership to drive homebuilding digital journey revenue growth Increased Confidence to Achieve $1B in Incremental Revenue by 2026 I N V E S T O R D A Y 2 0 2

3 – © B U I L D E R S F I R S T S O U R C E 66

Expanding Digital Solutions to Deliver End-to-End Capabilities –

Establishing New 3D Digital Channel Current Industry Model Future State: Our New 3D Digital Channel Semi-Automated 2D 3D Modeling Within Expansion to a Whole Estimating within a a “Shoppable Digital House Take-Off with Collaboration Platform

– Twin Experience” Access to a Homebuilding myBLDR.com Marketplace Home Configure 3D Digital Twin & Take-off Product Catalog Best in our space at leveraging Use technology to improve Merging of technologies Improves homebuilder cost

current industry practices to fulfill homebuilder value and provides a new 3D channel and timeline transparency homebuilder product requirements service, create location for working with BFS that by expanding our 3D take-off productivity and value

chain will also integrate with to all materials required to collaboration structural design build a home I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 67

Digital Tools Solve Homebuilder Pain Points Deploy Technologies that

Create Significant Value for Homebuilders 2D PLAN 3D DIGITAL TWIN myBLDR HOME PLAN DRAFTING LIBRARY BUILD RENDER OPTIMIZE HOME Framing Truss MEPs CONFIGURE Offer Customers More Control Over Design, Saving Both Customers and Their Clients Time and

Money I N V E S T O R D A Y 2023 – © B UI L DE RS F I RS T S O URCE 68

Significant Progress on Our myBLDR.com Platform ▪ Access point

for delivering our Digital Tools in a collaborative customer experience ▪ With continued development, we will connect a homebuilder’s processes within one platform ✓ Plan intake and mark-up ✓ Ability to make structural and

finish selections ✓ Review frame walk with trade partners ✓ Request an estimate across all BFS categories ✓ Review quotes, purchase material, and track orders ✓ Set the schedule, aligning material receipt and labor

✓ View BFS invoices and track full project cost Documents Configure Build Materials Schedule Budget Crews I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 69

Customer Testimonial Video I N V E S T O R D A Y 2 0 2 3 – ©

B U I L D E R S F I R S T S O U R C E 70

Signs that Digital Adoption is Taking Hold ~5K ~5K Adoption Drivers

UNIQUE USERS PER NEW PLANS ADDED ▪ Expand adoption across leadership team MONTH in myBLDR.com myBLDR.com ▪ Track progress through area scorecards ▪ Host digital “roadshows” to raise awareness; AUTOMATED TAKE-OFF invest

in local markets ESTIMATES COMPLETED ~25K ▪ Collaborate with Customer Advisory Group YEAR-TO-DATE SALES FORCE TRAINED myBLDR.com Next-Gen Customer Portal TO SELL DIGITAL TOOLS ~30% $200M BY YEAR END ▪ Access point for delivering Digital

Tools and more collaborative 2024E customer experience INCREMENTAL PRODUCT ▪ With continued development, will be able to connect homebuilder’s Home Configure Pilot processes within one easy-to-use platform 3D REVENUE ACCESSIBLE VIA

myBLDR.com Growing Need for Digital Solutions Driving Increased Customer Adoption I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 71

Case Study | Early Technology Adoption Construction Trade Outcomes

Front Light Building x BFS Digital Tools Challenges ✓ Better quality ▪ Need to address where ✓ Cost efficiency trade tools were inconsistent with job ✓ Reduced cycle time requirements Home Configure Render Virtual Tour BIM

Preview ✓ Take-off accuracy ▪ Stress on trade activity ▪ At forefront of construction industry innovation connecting ✓ Waste reduction has been elevated design tools to the jobsite seamlessly over last 3 years due to

✓ Customer satisfaction labor shortages and ▪ Revolutionizing how customers see their new homes come (“see” your dream home) supply chain constraints to life by letting them see and experience the Digital Twin and house in

3D ✓ Greater confidence ▪ Inability to align between builders, ▪ Co-developed digital “construction” in 3 simple steps stakeholders on a suppliers, trades, and single platform ▪ 1 Start with a 2D plan homebuyers

2 ▪ Create a digital twin and receive cost estimates ▪ 3 Utilize 3D visualization technology prior to construction Where Smart Technology Meets Smart Building I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R

C E 72

Growth: Monetizing Digital Assets to Increase Profitability Connecting

the Dots… …to Deliver Exceptional Value ▪ Comprehensive customer solutions Expand Deliver Enhance Grow Shoppable Fee-Based Existing Market Share ▪ Industry-leading innovation Product Digital Customer with New Catalog

Solutions Stickiness Customers ▪ Consistent shareholder value creation ▪ Sustainable, above-market growth rates Industry Leadership Drives Consistent Shareholder Value Creation I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S

F I R S T S O U R C E 73

Interview with an Early Technology Adopter TIM PAGE • EVP,

Digital Solutions MATT GREEN • President & CEO, Front Light Building I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 74

Key Takeaways 1 2 3 Strong commitment Significant progress on Continued

industry to value creation, our digital journey, leadership, providing achieving meaningful delivering on our cutting-edge digital progress toward commitments to solutions with a relentless goal of $1B in customers and focus on customer success

incremental product shareholders and value to empower revenue by 2026 the next generation of homebuilding I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 75

Financial Excellence and Long-Term Targets PETER JACKSON • Chief

Financial Officer I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 76

Key Messages Proven track record of execution and exceptional 1

financial results Continuous focus on margin expansion and 2 robust cash flow generation Fortress balance sheet fuels clear capital allocation 3 priorities to compound value for all stakeholders Well-positioned for profitable growth as we 4 continue

to lead the industry I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 77

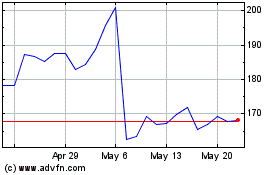

Strong Historical Financial Performance and Margin Growth 1 Sales ($B)

Adj. EBITDA ($B) 12% CAGR (2019-2023E) 37% CAGR (2019-2023E) $22.7 7.7% 8.7% 11.2% 13.1% 13.5% $19.9 $5.0 $4.4 $17.0 $4.2 $0.6 $3.1 $2.1 $12.8 $2.8 $10.9 $0.3 $0.6 $1.3 $17.7 $16.4 $15.7 $12.5 $1.1 $11.5 $0.8 $2.3 $2.2 $1.8 $0.9 $1.1 ($0.6) ($0.1) 3

3 2019 2020 2021 2022 2023E 2019 2020 2021 2022 2023E SF Starts 888K 991K 1,127K 1,005K ~925K 1 2 Base Business Single Family Housing Starts (000s) Commodity <>$400mbf Adj. EBITDA Margin on Base Business CAGR Delivering Exceptional Results

With or Without Commodity Impact 1 Adjusted EBITDA and Adjusted EBITDA margin are Non-GAAP financial measures. See the non-GAAP Financial Measures slide in this presentation for a definition thereof and a discussion of certain 2 3 matters regarding

non-GAAP guidance. Source: U.S. Census and Freddie Mac, Evercore ISI Research, management estimates. 2023 estimate as provided on Q3 2023 earnings call on 11/1/23. * Non-GAAP financial measures; see Appendix for reconciliations to the most directly

comparable GAAP financial measures. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 78

Solid Progress Against Base Business Targets Progress to Date

2021-2025E Targets 1 (Announced at Dec. 2021 Investor Day) (2021-2023E ) Revenue ($B) ~10% CAGR ~3% CAGR Adjusted EBITDA ($B) ~15% CAGR ~13% CAGR Adjusted EBITDA Margin ~50 bps ~115 bps (Annual Expansion) Adjusted EPS ~30% CAGR ~45% CAGR Compounding

Strong Financial Results in a Lower Starts Environment 1 2023 estimate as provided on Q3 2023 earnings call on 11/1/23. * Non-GAAP financial measures; see Appendix for reconciliations to the most directly comparable GAAP financial measures. I N V E

S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 79

Positioned to Outperform in All Market Scenarios Optionality to Manage

Across Environments BFS ADVANTAGES Weaker Economy Stronger Economy ✓ Manage fixed costs and overhead✓ Accelerate digital and technology Industry-Leading transformation ✓ Right-size network and optimize capacity Scale across

plants and yards✓ Identify and accelerate strong ROI projects ✓ Accelerate productivity projects ✓ Utilize excess FCF to increase share Operational repurchases ✓ Moderate CapEx where appropriate Excellence ✓

Leverage cost discipline to capitalize on ✓ Opportunistically capture market share economies of scale and expand margins Significant FCF Generation Ongoing Actions Efficient capacity Balance need Strong cash flow Working capital Fortress

Balance utilization and for variable cost generation and closely aligned to Sheet footprint reduction and focused capital demand signals optimization future capacity expenditures Multiple Levers to Further Compound Value for All Stakeholders *

Non-GAAP financial measures; see Appendix for reconciliations to the most directly comparable GAAP financial measures. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 80

Strong Cash Flow Generation and Disciplined Working Capital Management

High Cash-Generating Effective Capital Substantial FCF ($B) & Adj. Net Income (%) Business $3.3 Allocation ▪ Low CapEx requirement: ▪ Strong FCF provides financial 1.5% to 2% of sales flexibility and multiple paths for capital

deployment ▪ Release large amount of $1.8 - $2.0 working capital that flexes ▪ Support growth both $1.5 with the size of the top line: organically and strategic ~10% incremental and tuck-in acquisitions decremental to sales ▪

Ongoing and disciplined ▪ Cash conversion is generally repurchases at attractive 105% 101% $0.3 76% around two-thirds of Adjusted long-term cost basis 49% EBITDA or 100% of Adjusted Net Income on the Base 1 2020PF 2021 2022 2023E Business Free

Cash Flow Adj. Net Income Robust FCF Generation Creates Shareholder Value 1 2023 estimate as provided on Q3 2023 earnings call on 11/1/23.. * Non-GAAP financial measures; see Appendix for reconciliations to the most directly comparable GAAP

financial measures. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 81

Fortress Balance Sheet and Liquidity Provide Financial Resilience

Weighted Average Debt Maturity Low Net Leverage Profile 1 of ~7 Years ($B) 4.2x $2.0 $1.8 3.1x 5.3% 2.5x Avg. Rate (as of 11/21/23) 1.4x 1.3x 1.3x 1.3x $0.5 1.0x 0.7x 0.8x ~$0.2 2 2017 2018 2019 2020PF 2021 2022 2023E 2023 2024 2025 2026 2027 2028

2029 2030 2031 2032 ABL Senior Notes Base Business Leverage 1 Excludes finance leases and other finance obligations. Solid shading on ABL reflects forecast at year-end 2023. 2032 balance includes $1.3B of 4.25% and $0.7B of 6.375% notes. 2 2023

estimate as provided on Q3 2023 earnings call on 11/1/23. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 82

Capital Allocation Continues to Drive Value Creation Consistent Capital

1 2022-2023E Deployed: $6.1B Allocation Priorities 1. Maintain Strong Balance Sheet $0.8B 2022-2025E ▪ Target Base Business leverage ratio $0.9B of 1.0x to 2.0x Deployable 2. Organic Growth Capital Goal ▪ Drive productivity and growth

with growth investments ~41% $7B-$10B $4.4B Shares Repurchased from 3. Inorganic Growth Announced at Dec. 2021 August 2021 through Q3 2023 ▪ Pursue margin accretive deals with Investor Day strategic, tuck-in M&A 4. Return Capital to

Shareholders Cumulative (Since 12/31/21)▪ Continue opportunistic share Share Repurchases Tuck-in M&A Organic Growth repurchases On Track to Deliver Deployable Capital Goal by 2025 1 2 2023 estimate as provided on Q3 2023 earnings call on

11/1/23. Deployable capital includes Organic Growth, which is inclusive of capital expenditures. Target assumes 1.0x to 2.0x Base Business leverage ratio. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E

83

Clear and Strategic Approach to Tuck-in M&A FINANCIAL STRATEGIC

FILTERS CRITERIA 1 2 3 Fit Product Size IRR > Cost ▪ Growth mindedness▪ Value add / specialty ▪ Advance leadership of Capital (e.g., Components, position in desirable ▪ Cultural alignment Millwork, Install) geographies

▪ Key leaders aligned ▪ Lumber only as an ▪ Enhance relative Clear add-on or foundation market strength (RMS) Synergy for growth (i.e., leader) in key products Opportunities I N V E S T O R D A Y 2 0 2 3 – © B U I L D E

R S F I R S T S O U R C E 84

Strong Track Record of Disciplined M&A Since 2021 DRIVING STRONG

OPERATIONAL AND FINANCIAL BENEFITS Specialty Building ~45% ~51% Products & Services Value- Value- 19% 20% 24% 24% Key Impacts Added Added 6% Lumber & Lumber Product Product Q4 Sheet Goods Growth in Mix Mix 2023E ▪ Continue to leverage

M&A 2021 Value Added Windows, Doors 25% as an accelerator of our Products 25% 36% & Millwork 27% growth strategy Manufactured Products ▪ Fill in market gaps ▪ Explore end markets / 19% 20% Single-Family service expansion 7%

Multi-Family 6% Q4 Growth in ▪ Optimize buy vs. build 2023E 13% 2021 Repair & Multi-Family capabilities (i.e., Greenfield) 67% as % of Mix Remodel/Other 75% Successful Acquisitions 14 Completed Since 2021 Investor Day Disciplined M&A

Playbook Driving Strong Returns I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 85

New 2026E Base Business Targets NEW 2024E-2026E TARGETS KEY DRIVERS

▪ Low- to mid-single-digit market growth ▪ Grow top-line faster than market as Single-Family returns to 1.1M starts Revenue ~9% CAGR▪ Digital ramp up and value-added products expansion ▪ Continued tuck-in M&A Adj. EBITDA

~12% CAGR ▪ Favorable value-added product mix ▪ Merger synergies ▪ Operational and commercial excellence ▪ Increased operating leverage Adj. EBITDA Margin ~30 bps Expansion Annually ▪ Organic and ongoing in-organic

growth ▪ Ongoing share buybacks Adj. EPS ~17% CAGR ▪ Leverage of 1.0x to 2.0x 1 Deployable Capital of $5.5B to $8.5B from 2024E to 2026E 1 Deployable capital includes Organic Growth, which is inclusive of capital expenditures. Target

assumes 1.0x to 2.0x Base Business leverage ratio. * Non-GAAP financial measures; see Appendix for reconciliations to the most directly comparable GAAP financial measures. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U

R C E 86

1 Base Business Net Sales Bridge ($B) $1.2-$1.4 $21.2-$21.8 $2.0-$2.2

$1.6-$1.8 $16.4 >150 bps of Annual Above Market Growth ▪ Digital Investments ▪ Product Initiatives ▪ Additional Market Share Capture 2 ~9% Base Business Revenue CAGR Target from 2024E through 2026E 1 Estimate assumes $400/mbf

lumber & sheet good pricing. 2 2023 estimate as provided on Q3 2023 earnings call on 11/1/23. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 87

1 Base Business Adjusted EBITDA Bridge ($M) $150-$200 $3,000-$3,200

$150-$200 $300-$350 $200-$250 $2,200 30-33% Long-term Normalized 3 Gross Margins 2 ~12% Base Business Adjusted EBITDA CAGR Target from 2024E through 2026E 1 2 3 Estimate assumes $400/mbf lumber & sheet good pricing. 2023 estimate as provided on

Q3 2023 earnings call on 11/1/23. Assumes a Normalized Environment with Expected Single-Family Housing Starts of 1.0-1.1M. * Non-GAAP financial measures; see Appendix for reconciliations to the most directly comparable GAAP financial measures. I N V

E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 88

Allocating Capital to its Highest and Best Use Organic Growth Tuck-in

M&A Share Repurchases ~$3.0B-$6.0B Deployable 1 ~$1.5B Capital of $5.5B-$8.5B ~$1.0B (2024E-2026E) Accelerate investments in Pursue tuck-in acquisitions to Ongoing and disciplined digital and value-added augment current capabilities repurchases

at attractive products and add market share long-term cost basis 1 Deployable capital includes Organic Growth, which is inclusive of capital expenditures. Target assumes 1.0x to 2.0x Base Business leverage ratio. I N V E S T O R D A Y 2 0 2 3

– © B U I L D E R S F I R S T S O U R C E 89

1 Base Business Adjusted EPS Bridge $2.10-$2.20 $18.20-$18.60

$0.95-$1.00 $0.95-$1.00 $1.65-$1.75 $1.00-$1.10 $11.55 2 3 ~17% Base Business Adjusted EPS CAGR Target from 2024E through 2026E 1 2 3 Estimate assumes $400/mbf lumber & sheet good pricing. 2023 estimate as provided on Q3 2023 earnings call on

11/1/23. Assumes $3B cumulative share buyback over three years, subject to Board approval; 1.0x leverage. * Non-GAAP financial measures; see Appendix for reconciliations to the most directly comparable GAAP financial measures. Adjusted Net Income

per Diluted Share is defined as Adjusted Net Income divided by weighted average diluted common shares outstanding. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 90

Continue to Drive Long-Term Shareholder Value Creation Sales CAGR Adj.

EBITDA CAGR Adj. EBITDA Margin Adj. EBITDA Margin 2023E EV / Adj. EBITDA 4 (2015 to 2023E) (2015 to 2023E) (2023E) Expansion vs. Peers (2015 to 2023E) 18.5% 16.5x 15.9% 39% 1,026 bps 26% 8.6x 7.7x 7.0% 15.7% 13.5% 10.8% 305 bps 8% 90 bps BLDR

Building BLDR Building BLDR Building BLDR Building Building Base Products Industrial Base Products Industrial Base Products Industrial Base Products Industrial Products Industrial 1 2 3 1 2 3 1 2 3 1 2 3 2 3 Business Distributors Distributors

Business Distributors Distributors Business Distributors Distributors Business Distributors Distributors BLDR Distributors Distributors 1 2 Source: FactSet. Note: 2023 estimate as provided on Q3 2023 earnings call on 11/1/23. Estimate assumes

$400/mbf lumber & sheet good pricing. Building Products Distributors represent median 3 4 values for IBP, GMS, BECN and SITE. Industrial Distributors represent median value for FAST, GWW, MSM and WSO. Source FactSet. Multiples based on

Enterprise Value as of 11/9/2023. * Non-GAAP financial measures; see Appendix for reconciliations to the most directly comparable GAAP financial measures. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E

91

Key Takeaways 1 2 3 4 Fortress balance Well-positioned for Proven track

record Continuous focus on sheet fuels clear profitable growth of execution and margin expansion capital allocation as we continue to exceptional and robust cash priorities to lead the industry financial results flow generation compound value for

all stakeholders I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 92

Closing Remarks DAVE RUSH • President & Chief Executive

Officer I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 93

Builders FirstSource Investment Thesis Creating opportunity by

addressing builder Leveraging robust FCF generation 1 3 problems and delivering value-added from resilient business model and broad products and solutions across cycles; strong product portfolio to fuel disciplined track record and experienced

management team capital deployment Investing for growth through new digital Executing our profitable growth 4 2 innovations and building science that will strategy and compounding long-term deliver greater efficiency across homebuilding shareholder

value and enhance product and service offerings Revenue CAGR ~9% 1 Deployable Capital of 2024E to 2026E Adj. EBITDA CAGR ~12% Base Business $5.5B to $8.5B Adj. EBITDA Margin Expansion Annually ~30 bps Targets from 2024E to 2026E Adj. EPS Growth CAGR

~17% 1 Deployable Capital includes Organic Growth, which is inclusive of capital expenditures. Target assumes 1.0x to 2.0x Base Business leverage ratio. * Non-GAAP financial measures; see Appendix for reconciliation to the most directly comparable

GAAP financial measures. I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F I R S T S O U R C E 94

Q&A I N V E S T O R D A Y 2 0 2 3 – © B U I L D E R S F

I R S T S O U R C E 95

APPENDIX Non-GAAP Reconciliations I N V E S T O R D A Y 2 0 2 3 –

© B U I L D E R S F I R S T S O U R C E 96

Non-GAAP to GAAP Reconciliation Tables BUILDERS FIRSTSOURCE, INC. AND

SUBSIDIARIES Reconciliation of Adjusted Non-GAAP Financial Measures to their GAAP Equivalents (unaudited) Fiscal Year Nine Months Ended (Pro Forma) (Pro Forma) September 30, (in millions) 2019 2020 2021 2022 2023 Reconciliation to Adjusted EBITDA:

GAAP net income $ 331.7 $ 484.8 $ 1,725.4 $ 2,749.4 $ 1,189.9 Acquisition and related expense 8.3 50.0 118.0 47.8 26.9 Technology implementation expense 11.8 - 7.9 29.0 51.6 (1) Debt issuance and refinancing cost - 29.4 8.1 27.4 0.7 Amortization

expense 34.1 42.2 358.1 302.6 252.9 Tax-effect of adjustments to net income (13.0) (29.2) (118.1) (97.6) (79.7) Adjusted net income $ 372.9 $ 577.2 $ 2,099.4 $ 3,058.6 $ 1,442.3 Weighted average diluted common shares 184.4 207.0 203.5 163.5 130.7

Diluted adjusted net income per share: $ 2.02 $ 2.79 $ 10.32 $ 18.71 $ 11.03 Reconciling items: Depreciation expense $ 138.1 $ 155.4 $ 189.3 $ 194.6 $ 163.2 Interest expense, net 128.7 128.6 127.8 171.0 145.3 Income tax expense 110.6 177.5 644.2

920.1 430.4 Stock compensation expense 24.7 33.0 25.0 31.3 35.5 (2) Other management-identified adjustments 2.1 0.2 (25.4) 1.0 (2.9) Adjusted EBITDA $ 777.1 $ 1,071.9 $ 3,060.3 $ 4,376.6 $ 2,213.8 Adjusted EBITDA margin 7.1% 8.4% 15.4% 19.3% 17.1%