UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 22, 2014

BRADY CORPORATION

(Exact name of registrant as specified in its charter) Commission File Number 1-14959

|

| | |

| | |

Wisconsin | | 39-0971239 |

(State of Incorporation) | | (IRS Employer Identification No.) |

6555 West Good Hope Road

Milwaukee, Wisconsin 53223

(Address of Principal Executive Offices and Zip Code)

(414) 358-6600

(Registrant’s Telephone Number) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 2.02 | RESULTS OF OPERATIONS AND FINANCIAL CONDITION |

On May 22, 2014, Brady Corporation (the “Company”) issued a press release announcing its fiscal 2014 third quarter financial results. A copy of the press release is being furnished to the Securities and Exchange Commission as Exhibit 99.1 attached hereto and is incorporated herein by reference.

|

| |

Item 9.01 | FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits

The following are filed as Exhibits to this Report.

|

| |

Exhibit No. | Description of Exhibit |

99.1 | Press Release of Brady Corporation, dated May 22, 2014, relating to third quarter fiscal 2014 financial results.

|

99.2 | Informational slides provided by Brady Corporation, dated May 22, 2014, relating to third quarter fiscal 2014 financial results. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | BRADY CORPORATION |

| | |

| | |

Date: May 22, 2014 | | /s/ Thomas J. Felmer |

| | Thomas J. Felmer |

| | Interim President & Chief Executive Officer and Chief Financial Officer |

EXHIBIT INDEX

|

| |

EXHIBIT NUMBER | DESCRIPTION |

99.1 | Press Release of Brady Corporation, dated May 22, 2014, relating to third quarter fiscal 2014 financial results.

|

99.2 | Informational slides provided by Brady Corporation, dated May 22, 2014, relating to third quarter fiscal 2014 financial results. |

EXHIBIT 99.1

For More Information:

Investor contact: Aaron Pearce 414-438-6895

Media contact: Carole Herbstreit 414-438-6882

For Immediate Release

Brady Corporation Reports Fiscal 2014 Third Quarter Results

| |

• | Third quarter organic revenue growth was 2.5 percent. |

| |

• | GAAP earnings from continuing operations per diluted Class A Nonvoting Common Share were $0.39 in the third quarter of fiscal 2014 compared to $0.42 in the same quarter of the prior year. Non-GAAP earnings from continuing operations per diluted Class A Nonvoting Common Share* were $0.43 during the third quarter ended April 30, 2014 compared to $0.55 in the same quarter of the prior year. |

| |

• | Brady repurchased approximately 893,000 shares in the third quarter for a total of $23.3 million. |

| |

• | On May 1, 2014, Brady received $53 million of cash in connection with the completion of the first phase of the divestiture of the die-cut business. |

MILWAUKEE (May 22, 2014)--Brady Corporation (NYSE: BRC) (“Brady” or “Company”), a world leader in identification solutions, today reported its financial results for the fiscal 2014 third quarter ended April 30, 2014.

Quarter Ended April 30, 2014 Financial Results:

Sales from continuing operations for the quarter ended April 30, 2014 increased 2.3 percent to $309.6 million compared to the third quarter of fiscal 2013. Total organic sales increased 2.5 percent.

Net earnings from continuing operations for the quarter ended April 30, 2014 were $20.2 million compared to $21.7 million in the same quarter last year. The income tax rate on continuing operations in the third quarter of fiscal 2014 was approximately 16.8 percent compared to 22.4 percent in the third quarter of fiscal 2013. Non-GAAP net earnings from continuing operations* for the fiscal 2014 third quarter ended April 30, 2014, were $22.3 million compared to $28.5 million in the same quarter last year.

Net earnings from continuing operations per Class A Nonvoting Common Share were $0.39 for the third quarter ended April 30, 2014 compared to $0.42 in the same quarter last year. Non-GAAP earnings from continuing operations per diluted Class A Nonvoting Common Share* were $0.43 in the third quarter of fiscal 2014 and $0.55 per share in the third quarter of fiscal 2013.

Nine-Month Period Ended April 30, 2014 Financial Results:

Sales from continuing operations for the nine-month period ended April 30, 2014 were up 7.2 percent to $908.3 million. Organic sales were down 0.1 percent. By segment, organic sales were up 3.6 percent in Identification Solutions and down 6.3 percent in Workplace Safety.

Net earnings from continuing operations for the nine-month period ended April 30, 2014, were $48.8 million compared to $37.3 million in the same nine-month period last year. Non-GAAP net earnings from continuing operations* for the nine-month period ended April 30, 2014, were $58.5 million compared to $74.7 million in the same nine-month period last year.

Net earnings from continuing operations per Class A Nonvoting Common Share were $0.93 for the nine-month period ended April 30, 2014 compared to $0.72 in the same nine-month period last year. Non-GAAP earnings from continuing operations per diluted Class A Nonvoting Common Share* were $1.12 in the nine-month period ended April 30, 2014 and $1.44 per share in the same period of the previous fiscal year.

Commentary and Guidance:

“We were encouraged by our revenue growth in the third quarter. We believe that our investments to drive organic growth are paying off as organic sales grew 2.5 percent this quarter. Organic sales were up 4.8 percent in Identification Solutions and down 1.9 percent in Workplace Safety this quarter. This 1.9 percent decline in our Workplace Safety business is a much smaller rate of decline compared to previous quarters as we continue to add new customers, increase revenues over the internet and have recently returned our catalog advertising to historical levels,” said Brady’s Chief Financial Officer and Interim President and Chief Executive Officer, Thomas J. Felmer. “Our strong balance sheet enabled us to repurchase approximately 893,000 shares of Brady’s stock at an average price of $26.14 per share during the quarter ended April 30, 2014 and on May 1, 2014, we received $53 million of cash as we completed the first phase of our Die-Cut divestiture, closing on the sale of businesses in Germany, Thailand, Korea and Malaysia.”

Felmer continued, “We anticipate low single-digit organic sales growth from continuing operations in the fourth quarter of fiscal 2014 and we expect net earnings from continuing operations per diluted Class A Nonvoting Common Share to range from $0.45 to $0.55, exclusive of restructuring charges and certain other items.”

A webcast regarding Brady’s fiscal 2014 third quarter financial results will be available at www.bradycorp.com beginning at 9:30 a.m. Central Time today.

Brady Corporation is an international manufacturer and marketer of complete solutions that identify and protect premises, products and people. Brady’s products help customers increase safety, security, productivity and performance and include high-performance labels, signs, safety devices, printing systems and software, and precision die-cut materials. Founded in 1914, the company has a diverse customer base in electronics, telecommunications, manufacturing, electrical, construction, education, medical and a variety of other industries. Brady is headquartered in Milwaukee, Wisconsin and as of July 31, 2013, employed approximately 7,400 people in its worldwide businesses. Brady’s fiscal 2013 sales were approximately $1.15 billion. Brady stock trades on the New York Stock Exchange under the symbol BRC. More information is available on the Internet at www.bradycorp.com.

* See accompanying notes for non-GAAP measures.

###

In this news release, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations.

The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady's control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from: Implementation of the Workplace Safety strategy; the length or severity of the current worldwide economic downturn or timing or strength of a subsequent recovery; future financial performance of major markets Brady serves, which include, without limitation, telecommunications, hard disk drive, manufacturing, electrical, construction, laboratory, education, governmental, public utility, computer, healthcare and transportation; future competition; changes in the supply of, or price for, parts and components; increased price pressure from suppliers and customers; Brady's ability to retain significant contracts and customers; fluctuations in currency rates versus the U.S. dollar; risks associated with international operations; difficulties associated with exports; risks associated with obtaining governmental approvals and maintaining regulatory compliance; Brady's ability to develop and successfully market new products; risks associated with identifying, completing, and integrating acquisitions; risks associated with divestitures and businesses held for sale; risks associated with restructuring plans; environmental, health and safety compliance costs and liabilities; risk associated with loss of key talent; risk associated with product liability claims; technology changes and potential security violations to the Company's information technology systems; Brady's ability to maintain compliance with its debt covenants; increase in our level of debt; potential write-offs of Brady's substantial intangible assets; unforeseen tax consequences; risk, associated with our ownership structure; and numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady's U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2013.

These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward-looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF EARNINGS

(Dollars in thousands, except per share data)

|

| | | | | | | | | | | | | | | |

| (Unaudited) | | (Unaudited) |

| Three months ended April 30, | | Nine months ended April 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Net sales | $ | 309,577 |

| | $ | 302,483 |

| | $ | 908,301 |

| | $ | 847,200 |

|

Cost of products sold | 154,457 |

| | 143,082 |

| | 452,797 |

| | 395,723 |

|

Gross margin | 155,120 |

| | 159,401 |

| | 455,504 |

| | 451,477 |

|

Operating expenses: | | | | | | | |

Research and development | 8,648 |

| | 8,062 |

| | 25,675 |

| | 24,162 |

|

Selling, general and administrative | 116,666 |

| | 111,864 |

| | 340,825 |

| | 320,874 |

|

Restructuring charges | 3,039 |

| | 8,540 |

| | 14,202 |

| | 10,473 |

|

Total operating expenses | 128,353 |

| | 128,466 |

| | 380,702 |

| | 355,509 |

|

| | | | | | | |

Operating income | 26,767 |

| | 30,935 |

| | 74,802 |

| | 95,968 |

|

| | | | | | | |

Other income and (expense): | | | | | | | |

Investment and other income | 872 |

| | 1,133 |

| | 1,887 |

| | 2,427 |

|

Interest expense | (3,381 | ) | | (4,186 | ) | | (10,777 | ) | | (12,755 | ) |

| | | | | | | |

Earnings from continuing operations before income taxes | 24,258 |

| | 27,882 |

| | 65,912 |

| | 85,640 |

|

| | | | | | | |

Income tax expense | 4,074 |

| | 6,202 |

| | 17,077 |

| | 48,340 |

|

| | | | | | | |

Earnings from continuing operations | $ | 20,184 |

| | $ | 21,680 |

| | $ | 48,835 |

| | $ | 37,300 |

|

| | | | | | | |

Earnings (loss) from discontinued operations, net of income taxes | 3,904 |

| | (17,447 | ) | | 15,606 |

| | (14,564 | ) |

| | | | | | | |

Net earnings | $ | 24,088 |

| | $ | 4,233 |

| | $ | 64,441 |

| | $ | 22,736 |

|

| | | | | | | |

Earnings from continuing operations per Class A Nonvoting Common Share: | | | | | | | |

Basic | $ | 0.39 |

| | $ | 0.42 |

| | $ | 0.94 |

| | $ | 0.72 |

|

Diluted | $ | 0.39 |

| | $ | 0.42 |

| | $ | 0.93 |

| | $ | 0.72 |

|

| | | | | | | |

Earnings from continuing operations per Class B Voting Common Share: | | | | | | | |

Basic | $ | 0.39 |

| | $ | 0.42 |

| | $ | 0.92 |

| | $ | 0.71 |

|

Diluted | $ | 0.39 |

| | $ | 0.42 |

| | $ | 0.92 |

| | $ | 0.70 |

|

| | | | | | | |

Earnings (loss) from discontinued operations per Class A Nonvoting Common Share: | | | | | | | |

Basic | $ | 0.07 |

| | $ | (0.34 | ) | | $ | 0.30 |

| | $ | (0.28 | ) |

Diluted | $ | 0.07 |

| | $ | (0.34 | ) | | $ | 0.30 |

| | $ | (0.28 | ) |

| | | | | | | |

Earnings (loss) from discontinued operations per Class B Voting Common Share: | | | | | | | |

Basic | $ | 0.07 |

| | $ | (0.34 | ) | | $ | 0.30 |

| | $ | (0.29 | ) |

Diluted | $ | 0.07 |

| | $ | (0.34 | ) | | $ | 0.29 |

| | $ | (0.28 | ) |

| | | | | | | |

Net earnings per Class A Nonvoting Common Share: | | | | | | | |

Basic | $ | 0.46 |

| | $ | 0.08 |

| | $ | 1.24 |

| | $ | 0.44 |

|

Diluted | $ | 0.46 |

| | $ | 0.08 |

| | $ | 1.23 |

| | $ | 0.44 |

|

Dividends | $ | 0.195 |

| | $ | 0.19 |

| | $ | 0.585 |

| | $ | 0.57 |

|

| | | | | | | |

Net earnings per Class B Voting Common Share: | | | | | | | |

Basic | $ | 0.46 |

| | $ | 0.08 |

| | $ | 1.22 |

| | $ | 0.42 |

|

Diluted | $ | 0.46 |

| | $ | 0.08 |

| | $ | 1.21 |

| | $ | 0.42 |

|

Dividends | $ | 0.195 |

| | $ | 0.19 |

| | $ | 0.568 |

| | $ | 0.553 |

|

| | | | | | | |

Weighted average common shares outstanding (in thousands): | | | | | | | |

Basic | 51,933 |

| | 51,415 |

| | 52,071 |

| | 51,210 |

|

Diluted | 52,000 |

| | 52,041 |

| | 52,304 |

| | 51,685 |

|

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands)

|

| | | | | | | |

| (Unaudited) |

| April 30, 2014 | | July 31, 2013 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 78,715 |

| | $ | 91,058 |

|

Accounts receivable—net | 178,197 |

| | 169,261 |

|

Inventories: | | | |

Finished products | 71,397 |

| | 64,544 |

|

Work-in-process | 17,099 |

| | 14,776 |

|

Raw materials and supplies | 20,873 |

| | 15,387 |

|

Total inventories | 109,369 |

| | 94,707 |

|

Assets held for sale | 109,540 |

| | 119,864 |

|

Prepaid expenses and other current assets | 46,661 |

| | 37,600 |

|

Total current assets | 522,482 |

| | 512,490 |

|

Other assets: | | | |

Goodwill | 620,998 |

| | 617,236 |

|

Other intangible assets | 142,846 |

| | 156,851 |

|

Deferred income taxes | 12,361 |

| | 8,623 |

|

Other | 22,760 |

| | 21,325 |

|

Property, plant and equipment: | | | |

Cost: | | | |

Land | 7,917 |

| | 7,861 |

|

Buildings and improvements | 97,600 |

| | 91,471 |

|

Machinery and equipment | 284,905 |

| | 266,787 |

|

Construction in progress | 11,595 |

| | 11,842 |

|

| 402,017 |

| | 377,961 |

|

Less accumulated depreciation | 271,790 |

| | 255,803 |

|

Property, plant and equipment—net | 130,227 |

| | 122,158 |

|

Total | $ | 1,451,674 |

| | $ | 1,438,683 |

|

LIABILITIES AND STOCKHOLDERS’ INVESTMENT | | | |

Current liabilities: | | | |

Notes payable | $ | 75,552 |

| | $ | 50,613 |

|

Accounts payable | 87,528 |

| | 82,519 |

|

Wages and amounts withheld from employees | 44,742 |

| | 42,413 |

|

Liabilities held for sale | 24,536 |

| | 34,583 |

|

Taxes, other than income taxes | 8,409 |

| | 8,243 |

|

Accrued income taxes | 10,808 |

| | 7,056 |

|

Other current liabilities | 31,628 |

| | 36,806 |

|

Current maturities on long-term debt | 61,264 |

| | 61,264 |

|

Total current liabilities | 344,467 |

| | 323,497 |

|

Long-term obligations, less current maturities | 162,468 |

| | 201,150 |

|

Other liabilities | 80,742 |

| | 83,239 |

|

Total liabilities | 587,677 |

| | 607,886 |

|

Stockholders’ investment: | | | |

Class A nonvoting common stock—Issued 51,261,487 and 51,261,487 shares, respectively and outstanding 47,935,602 and 48,408,544 shares, respectively | 513 |

| | 513 |

|

Class B voting common stock—Issued and outstanding, 3,538,628 shares | 35 |

| | 35 |

|

Additional paid-in capital | 314,625 |

| | 306,191 |

|

Earnings retained in the business | 572,474 |

| | 538,512 |

|

Treasury stock—3,245,885 and 2,626,276 shares, respectively of Class A nonvoting common stock, at cost | (87,682 | ) | | (69,797 | ) |

Accumulated other comprehensive income | 63,687 |

| | 56,063 |

|

Other | 345 |

| | (720 | ) |

Total stockholders’ investment | 863,997 |

| | 830,797 |

|

Total | $ | 1,451,674 |

| | $ | 1,438,683 |

|

BRADY CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands)

|

| | | | | | | |

| (Unaudited) |

| Nine months ended April 30, |

| 2014 | | 2013 |

Operating activities: | | | |

Net earnings | $ | 64,441 |

| | $ | 22,736 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Depreciation and amortization | 33,782 |

| | 36,037 |

|

Non-cash portion of stock-based compensation expense | 5,033 |

| | 6,964 |

|

Non-cash portion of restructuring charges | 267 |

| | 3,701 |

|

Loss on write-down of assets held for sale | — |

| | 15,658 |

|

Loss on sales of businesses | — |

| | 3,138 |

|

Deferred income taxes | (8,310 | ) | | 33,780 |

|

Changes in operating assets and liabilities (net of effects of business acquisitions/divestitures): | | | |

Accounts receivable | 2,949 |

| | (6,410 | ) |

Inventories | (9,435 | ) | | (91 | ) |

Prepaid expenses and other assets | (2,772 | ) | | 541 |

|

Accounts payable and accrued liabilities | (13,027 | ) | | (22,226 | ) |

Income taxes | 2,912 |

| | (4,198 | ) |

Net cash provided by operating activities | 75,840 |

| | 89,630 |

|

| | | |

Investing activities: | | | |

Purchases of property, plant and equipment | (29,808 | ) | | (26,082 | ) |

Acquisition of business, net of cash acquired | — |

| | (301,157 | ) |

Sales of businesses, net of cash retained | — |

| | 10,178 |

|

Other | (647 | ) | | (1,245 | ) |

Net cash used in investing activities | (30,455 | ) | | (318,306 | ) |

| | | |

Financing activities: | | | |

Payment of dividends | (30,479 | ) | | (29,344 | ) |

Proceeds from issuance of common stock | 10,894 |

| | 10,246 |

|

Purchase of treasury stock | (23,335 | ) | | (5,121 | ) |

Proceeds from borrowing on notes payable | 63,000 |

| | 220,000 |

|

Repayment of borrowing on notes payable | (39,000 | ) | | (173,000 | ) |

Proceeds from borrowings on line of credit | 3,187 |

| | 11,491 |

|

Repayment of borrowing on line of credit | (2,401 | ) | | — |

|

Principal payments on debt | (42,514 | ) | | (42,514 | ) |

Income tax on the exercise of stock options and deferred compensation distributions, and other | (978 | ) | | 1,794 |

|

Net cash used in financing activities | (61,626 | ) | | (6,448 | ) |

| | | |

Effect of exchange rate changes on cash | 3,898 |

| | 6,258 |

|

| | | |

Net decrease in cash and cash equivalents | (12,343 | ) | | (228,866 | ) |

Cash and cash equivalents, beginning of period | 91,058 |

| | 305,900 |

|

| | | |

Cash and cash equivalents, end of period | $ | 78,715 |

| | $ | 77,034 |

|

| | | |

Supplemental disclosures of cash flow information: | | | |

Cash paid during the period for: | | | |

Interest, net of capitalized interest | $ | 11,417 |

| | $ | 13,194 |

|

Income taxes, net of refunds | 18,842 |

| | 26,786 |

|

Acquisitions: | | | |

Fair value of assets acquired, net of cash | — |

| | $ | 169,830 |

|

Liabilities assumed | — |

| | (57,860 | ) |

Goodwill | — |

| | 189,187 |

|

Net cash paid for acquisitions | — |

| | $ | 301,157 |

|

BRADY CORPORATION AND SUBSIDIARIES

SEGMENT INFORMATION

(Dollars in thousands)

|

| | | | | | | | | | | | | | | |

| Three months ended April 30, | | Nine months ended April 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

SALES TO EXTERNAL CUSTOMERS | | | | | | | |

ID Solutions | $ | 206,448 |

| | $ | 197,417 |

| | $ | 610,726 |

| | $ | 528,044 |

|

Workplace Safety | 103,129 |

| | 105,066 |

| | 297,575 |

| | 319,156 |

|

Total | $ | 309,577 |

| | $ | 302,483 |

| | $ | 908,301 |

| | $ | 847,200 |

|

| | | | | | | |

SALES INFORMATION | | | | | | | |

ID Solutions | | | | | | | |

Organic | 4.8 | % | | (1.9 | )% | | 3.6 | % | | 0.3 | % |

Currency | (0.2 | )% | | (1.0 | )% | | (0.3 | )% | | (1.4 | )% |

Acquisitions | —% |

| | 25.3 | % | | 12.4 | % | | 12.2 | % |

Total | 4.6 | % | | 22.4 | % | | 15.7 | % | | 11.1 | % |

Workplace Safety | | | | | | | |

Organic | (1.9 | )% | | (9.0 | )% | | (6.3 | )% | | (6.4 | )% |

Currency | 0.1 | % | | (1.1 | )% | | (0.5 | )% | | (1.0 | )% |

Acquisitions | —% |

| | 5.0 | % | | —% |

| | 5.3 | % |

Total | (1.8 | )% | | (5.1 | )% | | (6.8 | )% | | (2.1 | )% |

Total Company | | | | | | | |

Organic | 2.5 | % | | (4.8 | )% | | (0.1 | )% | | (2.5 | )% |

Currency | (0.2 | )% | | (1.0 | )% | | (0.4 | )% | | (1.2 | )% |

Acquisitions | —% |

| | 17.0 | % | | 7.7 | % | | 9.4 | % |

Total | 2.3 | % | | 11.2 | % | | 7.2 | % | | 5.7 | % |

| | | | | | | |

SEGMENT PROFIT | | | | | | | |

ID Solutions | $ | 44,302 |

| | $ | 46,787 |

| | $ | 132,795 |

| | $ | 126,011 |

|

Workplace Safety | 14,771 |

| | 23,453 |

| | 47,813 |

| | 74,881 |

|

Total | $ | 59,073 |

| | $ | 70,240 |

| | $ | 180,608 |

| | $ | 200,892 |

|

SEGMENT PROFIT AS A PERCENT OF SALES | | | | | | | |

ID Solutions | 21.5 | % | | 23.7 | % | | 21.7 | % | | 23.9 | % |

Workplace Safety | 14.3 | % | | 22.3 | % | | 16.1 | % | | 23.5 | % |

Total | 19.1 | % | | 23.2 | % | | 19.9 | % | | 23.7 | % |

|

| | | | | | | | | | | | | | | |

| Three Months Ended April 30, | | Nine Months Ended April 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Total segment profit | $ | 59,073 |

| | $ | 70,240 |

| | $ | 180,608 |

| | $ | 200,892 |

|

Unallocated amounts: | | | | | | | |

Administrative costs | (29,267 | ) | | (30,765 | ) | | (91,604 | ) | | (94,451 | ) |

Restructuring charges | (3,039 | ) | | (8,540 | ) | | (14,202 | ) | | (10,473 | ) |

Investment and other income | 872 |

| | 1,133 |

| | 1,887 |

| | 2,427 |

|

Interest expense | (3,381 | ) | | (4,186 | ) | | (10,777 | ) | | (12,755 | ) |

Earnings from continuing operations before income taxes | $ | 24,258 |

| | $ | 27,882 |

| | $ | 65,912 |

| | $ | 85,640 |

|

GAAP TO NON-GAAP MEASURES

(Dollars in Thousands, Except Per Share Amounts)

|

| | | | | | | | | | | | |

| | In accordance with the U.S. Securities and Exchange Commission’s Regulation G, the following provides definitions of the non-GAAP measures used in the earnings release and the reconciliation to the most closely related GAAP measure. |

| |

|

| | | | | | | | | | | | | | | | | | |

| | Earnings from Continuing Operations Before Income Taxes Excluding Certain Items: |

| | Brady is presenting the Non-GAAP measure "Earnings from Continuing Operations Before Income Taxes Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this profit measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Earnings from Continuing Operations Before Income Taxes to Earnings from Continuing Operations Before Income Taxes Excluding Certain Items: |

| |

| |

| |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | Three Months Ended April 30, | | Nine Months Ended April 30, |

| | | | | 2014 | | 2013 | | 2014 | | 2013 |

| | Earnings from Continuing Operations Before Income Taxes (GAAP Measure) | $ | 24,258 |

| | $ | 27,882 |

| | $ | 65,912 |

| | $ | 85,640 |

|

| | | Cost of goods sold: | | | | | | | |

| | Purchase accounting expense related to inventory | — |

| | — |

| | — |

| | 1,530 |

|

| | | Selling, general and administrative: | | | | | | | |

| | PDC acquisition-related expenses | — |

| | — |

| | — |

| | 3,600 |

|

| | | Restructuring charges | 3,039 |

| | 8,540 |

| | 14,202 |

| | 10,473 |

|

| | | Non-cash income tax charges related to PDC funding | — |

| | — |

| | — |

| | — |

|

| | Earnings from Continuing Operations Before Income Taxes Excluding Certain Items (non-GAAP measure) | $ | 27,297 |

| | $ | 36,422 |

| | $ | 80,114 |

| | $ | 101,243 |

|

|

| | | | | | | | | | | | | | | | | |

Income Taxes on Continuing Operations Excluding Certain Items: |

Brady is presenting the Non-GAAP measure "Income Taxes on Continuing Operations Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Income Taxes on Continuing Operations to Income Taxes on Continuing Operations Excluding Certain Items: |

| | | | | | | | | |

| | | | | | | | | |

| | | Three Months Ended April 30, | | Nine Months Ended April 30, |

| | | 2014 | | 2013 | | 2014 | | 2013 |

Income Taxes on Continuing Operations (GAAP measure) | $ | 4,074 |

| | $ | 6,202 |

| | $ | 17,077 |

| | $ | 48,340 |

|

| Cost of goods sold: | | | | | | | |

Purchase accounting expense related to inventory | — |

| | — |

| | — |

| | 581 |

|

| Selling, general and administrative: | | | | | | | |

PDC acquisition-related expenses | — |

| | — |

| | — |

| | 641 |

|

| Restructuring charges | 968 |

| | 1,691 |

| | 4,584 |

| | 2,000 |

|

| Non-cash income tax charges related to PDC funding | — |

| | — |

| | — |

| | (25,000 | ) |

Income Taxes on Continuing Operations Excluding Certain Items (non-GAAP measure) | $ | 5,042 |

| | $ | 7,893 |

| | $ | 21,661 |

| | $ | 26,562 |

|

GAAP TO NON-GAAP MEASURES

(Dollars in Thousands, Except Per Share Amounts)

|

| | | | | | | | | | | | | | | | | | |

| | Net Earnings from Continuing Operations Excluding Certain Items: | | |

| | Brady is presenting the Non-GAAP measure "Net Earnings from Continuing Operations Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Net Earnings from Continuing Operations to Net Earnings from Continuing Operations Excluding Certain Items: |

| |

| |

| |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | Three Months Ended April 30, | | Nine Months Ended April 30, |

| | | 2014 | | 2013 | | 2014 | | 2013 |

| | Net Earnings from Continuing Operations (GAAP measure) | $ | 20,184 |

| | $ | 21,680 |

| | $ | 48,835 |

| | $ | 37,300 |

|

| | | Cost of goods sold: | | | | | | | |

| | Purchase accounting expense related to inventory | — |

| | — |

| | — |

| | 949 |

|

| | | Selling, general and administrative: | | | | | | | |

| | PDC acquisition-related expenses | — |

| | — |

| | — |

| | 2,959 |

|

| | | Restructuring charges | 2,071 |

| | 6,849 |

| | 9,618 |

| | 8,473 |

|

| | | Non-cash income tax charges related to PDC funding | — |

| | — |

| | — |

| | 25,000 |

|

| | Net Earnings from Continuing Operations Excluding Certain Items (non-GAAP measure) | $ | 22,255 |

| | $ | 28,529 |

| | $ | 58,453 |

| | $ | 74,681 |

|

|

| | | | | | | | | | | | | | | | | |

Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items: |

Brady is presenting the Non-GAAP measure "Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share to Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items: |

| | | | | | | | | |

| | | | | | | | | |

| | | Three Months Ended April 30, | | Nine Months Ended April 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share (GAAP measure) | $ | 0.39 |

| | $ | 0.42 |

| | $ | 0.93 |

| | $ | 0.72 |

|

| Cost of goods sold: | | | | | | | |

Purchase accounting expense related to inventory | — |

| | — |

| | — |

| | 0.02 |

|

| Selling, general and administrative: | | | | | | | |

PDC acquisition-related expenses | — |

| | — |

| | — |

| | 0.06 |

|

| Restructuring charges | 0.04 |

| | 0.13 |

| | 0.18 |

| | 0.16 |

|

| Non-cash income tax charges related to PDC funding | — |

| | — |

| | — |

| | 0.48 |

|

Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items (non-GAAP measure) | $ | 0.43 |

| | $ | 0.55 |

| | $ | 1.12 |

| | $ | 1.44 |

|

F’14 Q3 Financial Results May 22, 2014

2 FORWARD-LOOKING STATEMENTS 2 In this presentation, statements that are not reported financial results or other historic information are “forward-looking statements.” These forward-looking statements relate to, among other things, the Company's future financial position, business strategy, targets, projected sales, costs, earnings, capital expenditures, debt levels and cash flows, and plans and objectives of management for future operations. The use of words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “project” or “plan” or similar terminology are generally intended to identify forward-looking statements. These forward-looking statements by their nature address matters that are, to different degrees, uncertain and are subject to risks, assumptions, and other factors, some of which are beyond Brady's control, that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. For Brady, uncertainties arise from: Implementation of the Workplace Safety strategy; the length or severity of the current worldwide economic downturn or timing or strength of a subsequent recovery; future financial performance of major markets Brady serves, which include, without limitation, telecommunications, hard disk drive, manufacturing, electrical, construction, laboratory, education, governmental, public utility, computer, healthcare and transportation; future competition; changes in the supply of, or price for, parts and components; increased price pressure from suppliers and customers; Brady's ability to retain significant contracts and customers; fluctuations in currency rates versus the U.S. dollar; risks associated with international operations; difficulties associated with exports; risks associated with obtaining governmental approvals and maintaining regulatory compliance; Brady's ability to develop and successfully market new products; risks associated with identifying, completing, and integrating acquisitions; risks associated with divestitures and businesses held for sale; risks associated with restructuring plans; environmental, health and safety compliance costs and liabilities; risk associated with loss of key talent; risk associated with product liability claims; technology changes and potential security violations to the Company's information technology systems; Brady's ability to maintain compliance with its debt covenants; increase in our level of debt; potential write-offs of Brady's substantial intangible assets; unforeseen tax consequences; risk, associated with our ownership structure; and numerous other matters of national, regional and global scale, including those of a political, economic, business, competitive, and regulatory nature contained from time to time in Brady's U.S. Securities and Exchange Commission filings, including, but not limited to, those factors listed in the “Risk Factors” section within Item 1A of Part I of Brady’s Form 10-K for the year ended July 31, 2013. These uncertainties may cause Brady's actual future results to be materially different than those expressed in its forward-looking statements. Brady does not undertake to update its forward-looking statements except as required by law.

3 THIRD QUARTER HIGHLIGHTS • Returned to organic sales growth • Launched several exciting new products, including the BMP21+ • Repurchased approximately 893,000 shares • Received $53M from phase one of the sale of the Die-Cut business on May 1, 2014. 3

4 Q3 F’14 - FINANCIAL SUMMARY Sales up 2.3% to $309.6M vs. $302.5M in Q3 of F’13. • Organic sales growth of 2.5% and foreign currency decreased sales by 0.2%. Gross profit margin of 50.1% in Q3 of F’14 compared with 52.7% in Q3 of F’13. SG&A expense of $116.7M (37.7% of sales) in Q3 of F’14 vs. $111.9M (37.0% of sales) in Q3 of F’13. Net earnings from continuing operations of $20.2M in Q3 of F’14 vs. $21.7M in Q3 of F’13. • Non-GAAP Net Earnings from Continuing Operations* was $22.3M in Q3 of F’14 vs. $28.5M in Q3 of F’13. Net earnings from continuing operations per Class A Diluted Nonvoting Share was $0.39 in Q3 of F’14 vs. $0.42 in Q3 of F’13. • Non-GAAP Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share* was $0.43 in Q3 of F’14 vs. $0.55 in Q3 of F’13. * Non-GAAP Net Earnings from Continuing Operations and Non-GAAP Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share Excluding Certain Items are non-GAAP measures. See slides #19 and #20.

5 Q4 F’14 GUIDANCE Q4 F’14 Diluted EPS from Continuing Operations $0.45 to $0.55 (excluding restructuring charges and certain other items). Guidance Assumptions – Continuing Operations: • Low single-digit organic sales growth from continuing operations in the fourth quarter of fiscal 2014. • Full-year depreciation and amortization expense of approximately $45M to $50M. • Full-year restructuring charges of approximately $22M. • Full-year capital expenditures of approximately $40M. • Full year free cash flow of approximately 100 - 120% of net income.

6 SALES OVERVIEW $273 $256 $272 $270 $272 $273 $302 $311 $308 $291 $310 $200 $250 $300 $350 Q1 F'12 Q2 F'12 Q3 F'12 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Organic Sales 5.1% (0.7%) 0.9% 1.9% (0.8%) (1.8%) (4.8%) (2.1%) (2.1%) (1.1%) 2.5% • 2.5% organic sales growth. • (0.2%) decrease due to currency translation. • Continued organic growth in ID Solutions and improving organic sales trends in Workplace Safety. ID Solutions – Organic growth of 4.8% Workplace Safety – Organic decline of (1.9%) Die-Cut – Business is all in discontinued operations and excluded from reported sales amounts. Q3 F’14 SALES: Q3 F’14 SALES COMMENTARY: SALES (Millions of USD)

7 GROSS PROFIT MARGIN & SG&A EXPENSE 7 $99 $95 $98 $100 $99 $110 $112 $107 $113 $111 $117 36% 37% 36% 37% 36% 40% 37% 34% 37% 38% 38% 20.0% 25.0% 30.0% 35.0% 40.0% 45.0% $50 $100 $150 $200 Q1 F'12 Q2 F'12 Q3 F'12 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 GROSS PROFIT & GPM% (Millions of USD) SG&A & SG&A as % of SALES (Millions of USD) GPM of 50.1% in Q3 of F’14 compared to 52.7% in Q3 of F’13. Price adjustments in Workplace Safety along with negative mix and costs from facility consolidation activities driving the reduced gross profit margin when compared to the prior year. GROSS PROFIT MARGIN: SG&A up from $111.9M in Q3 of F’13 to $116.7M in Q3 of F’14. SG&A increase resulting from increased investments in both Workplace Safety and ID Solutions to drive organic growth opportunities and increased incentive compensation when compared to the prior year. SG&A EXPENSE: $150 $141 $150 $147 $150 $142 $159 $158 $158 $143 $155 55% 55% 55% 55% 55% 52% 53% 51% 51% 49% 50% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% 55.0% 60.0% $100 $150 $200 Q1 F'12 Q2 F'12 Q3 F'12 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14

8 NET EARNINGS & EPS FROM CONTINUING OPERATIONS – Non-GAAP* Q3 F’14 Non-GAAP net earnings from continuing operations* of $22.3M compared to $28.5M in Q3 of F’13. Comparability impacted by a reversal of incentive compensation expense in Q3 of F’13 and a lower tax rate in Q3 of F’14. Q3 F’14 Non-GAAP diluted EPS from continuing operations* of $0.43 compared to $0.55 in Q3 of F’13. $28 $27 $29 $30 $26 $20 $29 $28 $23 $13 $22 $0 $10 $20 $30 $40 Q1 F'12Q2 F'12Q3 F'12Q4 F'12Q1 F'13Q2 F'13Q3 F'13Q4 F'13Q1 F'14Q2 F'14Q3 F'14 $0.53 $0.51 $0.56 $0.57 $0.51 $0.38 $0.55 $0.54 $0.44 $0.25 $0.43 $0.00 $0.20 $0.40 $0.60 Q1 F'12 Q2 F'12 Q3 F'12 Q4 F'12 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 8 NET EARNINGS FROM CONTINUING OPERATIONS, EXCLUDING CERTAIN ITEMS* (Millions of USD) Q3 F’14 – Non-GAAP Earnings* Q3 F’14 – Non-GAAP EPS* * Non-GAAP Net Earnings from Continuing Operations and Non-GAAP Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share are non-GAAP measures. See slides #19 and #20. NET EARNINGS FROM CONTINUING OPERATIONS PER CLASS A DILUTED NONVOTING SHARE, EXCLUDING CERTAIN ITEMS*

9 (millions of USD) 3 Mos. Ended April 30, 2014 9 Mos. Ended April 30, 2014 Cash Balance - Beginning of Period 79.1$ 91.1$ Cash Flow from Operating Activities 34.0 75.8 Capital Expenditures (12.2) (29.8) Repurchase of Stock (23.3) (23.3) Dividends (10.1) (30.5) Debt (Repayments) Borrowings - Net 9.1 (17.7) Effect of Exchange Rate on Cash 2.8 3.9 Other (0.7) 9.2 Cash Balance - April 30, 2014 78.7$ 78.7$ CASH GENERATION Cash flow from operating activities of $34.0M in Q3 of F’14. Main cash uses in the quarter for share buybacks, dividends, and capital expenditures. Repurchased 892,814 shares at an average price of $26.14/share in Q3 of F’14. SIGNIFICANT CASH FLOWS:

10 NET DEBT & EBITDA 0.1 0.0 0.1 1.4 1.3 1.2 1.2 1.2 1.3 0.0x 0.5x 1.0x 1.5x Q 1 F '1 2 Q 3 F '1 2 Q 1 F '1 3 Q 3 F '1 3 Q 1 F '1 4 Q 3 F '1 4 NET DEBT / TTM EBITDA* April 30, 2014 Cash = $78.7M, Debt = $299.3M (net debt = $220.6M), and TTM EBITDA of $165.6M. Net Debt/EBITDA* = 1.3x. Balance sheet and cash flow provides flexibility for future cash uses. STRONG BALANCE SHEET: NET DEBT (Millions of USD) $20 $4 $10 $297 $261 $222 $210 $209 $221 $0 $50 $100 $150 $200 $250 $300 Q1 F '1 2 Q2 F '1 2 Q3 F '1 2 Q4 F '1 2 Q1 F '1 3 Q2 F '1 3 Q3 F '1 3 Q4 F '1 3 Q1 F '1 4 Q2 F '1 4 Q3 F '1 4 * EBITDA is a non-GAAP measure. See appendix for the reconciliation of net income to EBITDA.

11 Q3 NEW PRODUCT INTRODUCTION: BMP-21™ Plus & BMP-21™ Lab Tough on the outside, Smart on the inside - Rugged performance, high- visibility printer for wire identification applications and another version for laboratory applications. STRATEGIC PARTNERSHIPS: Smart Labels for Healthcare Applications Thinfilm Partnership – Brady signed a partnership with Thinfilm. The initial collaboration is focused on electronic sensing for use in identification products in industrial and healthcare markets. These sensing products are an ideal complement to Brady’s existing products in these areas. RFID Applications for Harsh Environments Partnership with Tego - Brady and Tego collaborated on the development of an innovative flexible RFID tag for both metal and non- metal applications integrating Tego’s rugged, high-memory chip technology, into Brady’s customized, high-performance label materials designed to withstand extreme environments. NEW PRODUCTS & STRATEGIC PARTNERSHIPS

12 IDENTIFICATION SOLUTIONS Q3 F’14 vs. Q3 F’3 PERFORMANCE (Millions of USD) Q3 F’14 Q3 F’13 Change Sales $206.4 $ 197.4 + 4.6% Segment Profit 44.3 46.8 - 5.3% Segment Profit % 21.5% 23.7% - 2.2 pts SALES & SEGMENT PROFIT % (Millions of USD) $162 $168 $197 $211 $210 $195 $206 27% 21% 24% 23% 24% 19% 21% 0.0% 10.0% 20.0% $0 $50 $100 $150 $200 $250 $300 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14 Revenues up 4.6%: Organic=+4.8% and Fx= (0.2%) Organic revenue growth in all regions, with the strongest growth in EMEA and Asia-Pacific. Business in the U.S. improved in March and April. PDC organic sales growth of approximately 1% in Q3 of F’14. Sales negatively impacted by declining hospital admissions. Segment profit comparison impacted by incentive compensation which was an expense reversal in the prior year. Q3 F’14 SUMMARY: Improving economic conditions in the U.S. and Europe. Expect low single-digit organic sales growth for the balance of F’14. OUTLOOK:

13 WORKPLACE SAFETY Revenues down (1.8%): Organic= (1.9%) and Fx= 0.1%. Improved results in Europe with low single-digit organic sales growth in Q3 of F’14. Australian business trends improving, but organic sales still declined mid-single digits in Q3 of F’14. Organic sales in the U.S. improved throughout the quarter, ending down mid single-digits. Increased catalog advertising spend in all major geographies. Q3 F’14 SUMMARY: Organic sales growth anticipated in Q4 of F’14. Investing in: • Best-in-class online/digital • Enhanced product offerings • Enhanced industry-specific expertise for workplace safety critical industries OUTLOOK: Q3 F’14 vs. Q3 F’13 PERFORMANCE (Millions of USD) Q3 F’14 Q3 F’13 Change Sales $ 103.1 $ 105.1 - 1.8% Segment Profit 14.8 23.5 - 37.0% Segment Profit % 14.3% 22.3% - 8.0 pts SALES & SEGMENT PROFIT % (Millions of USD) $110 $104 $105 $100 $98 $96 $103 25% 23% 22% 20% 19% 15% 14% 0% 10% 20% $0 $50 $100 $150 $200 $250 Q1 F'13 Q2 F'13 Q3 F'13 Q4 F'13 Q1 F'14 Q2 F'14 Q3 F'14

14 WPS – STRATEGIC FOCUS AREAS 14 1. Expand focus on e-commerce 2. Expand offering of differentiated identification and workplace safety products 3. Enhance industry-specific expertise 4. Increase catalog advertising in all major geographies.

15 INVESTOR RELATIONS Brady Contact: Aaron Pearce Investor Relations 414-438-6895 Aaron_Pearce@Bradycorp.com See our web site at www.investor.bradycorp.com

16 TOTAL COMPANY INCOME STATEMENTS COMPARABLE INCOME STATEMENTS (Millions of USD) * Non-GAAP Net Earnings from Continuing Operations, Excluding Restructuring and Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share Excluding Restructuring are non-GAAP measures. See slides #19 and #20. 2014 2013 Change Sales 309.6$ 302.5$ 7.1$ Gross Margin 155.1 159.4 (4.3) % of Sales 50.1% 52.7% (2.6) pts Research and Development (8.6) (8.1) (0.5) Selling, General and Admin. (116.7) (111.9) (4.8) % of Sales (37.7%) (37.0%) 0.7 pts Restructuring Charges (3.0) (8.5) 5.5 - - - Operating Income 26.8 30.9 (4.1) Interest and Other (2.5) (3.0) 0.5 Income Taxes (4.1) (6.2) 2.1 - - - Net Earnings from Continuing Operations 20.2$ 21.7$ (1.5)$ - - - % of Sales 6.5% 7.2% (0.7) pts Earnings from Continuing Operations per Class A Nonvoting Common Share 0.39$ 0.42$ (0.03)$ - - - Net Earnings from Continuing Operations, Excluding Restructuring (Non-GAAP measure)* 22.3$ 28.5$ (6.2)$ - - - % of Sales 7.2% 9.4% (2.2) pts Net Earnings from Continuing Operations Per Class A Diluted Nonvoting Share, Excluding Restructuring (Non-GAAP measure)* 0.43$ 0.55$ (0.12)$ - - - Three Months Ended April 30, -

17 DEBT STRUCTURE 17 (Thousands of USD) Int. Rate Fixed vs. Variable April 30, 2014 Balance July 31, 2013 Balance Revolver Borrowings (due Feb. 2017): USD-denominated (L+1.125) 1.24% Variable 63,000$ 39,000$ China Borrowings: USD-denominated notes payable 1.55% Variable 12,552 11,613 Private Placements: USD-denominated 2004 Series 5.14% Fixed 18,750 18,750 USD-denominated 2006 Series 5.30% Fixed 52,285 78,429 USD-denominated 2007 Series 5.33% Fixed 49,114 65,485 EUR-denominated 2010 Series (7-yr.) 3.71% Fixed 41,433 39,900 EUR-denominated 2010 Series (10-yr.) 4.24% Fixed 62,149 59,850 TOTAL DEBT 299,283$ 313,027$

18 Q1 Q2 Q3 Q4 Total 23,928$ 16,424$ 24,088$ 64,440$ Interest expense 3,720 3,676 3,381 10,777 Income taxes 11,130 2,933 3,799 17,862 Depreciation and amortization 10,878 11,464 11,440 33,782 49,656$ 34,497$ 42,708$ 126,861$ Q1 Q2 Q3 Q4 Total 27,188$ (8,684)$ 4,233$ (177,271)$ (154,534)$ Interest expense 4,163 4,406 4,186 3,886 16,641 Income taxes 13,481 30,626 7,595 (4,417) 47,285 Depreciation and amortization 10,675 11,371 13,991 12,688 48,725 Intangible asset write-down in restructuring charges — — 3,207 — 3,207 Loss on write-down of assets held for sale — — 15,658 — 15,658 Impairment charges — — — 204,448 204,448 55,507$ 37,719$ 48,870$ 39,334$ 181,430$ Fiscal 2013 EBITDA: Net earnings (loss) EBITDA: Brady is presenting EBITDA because it is used by many of our investors and lenders, and is presented as a convenience to them. EBITDA represents net earnings (loss) before interest expense, income taxes, depreciation, amortization and impairment charges. EBITDA is not a calculation based on generally accepted accounting principles ("GAAP"). The amounts included in the EBITDA calculation, however, are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. EBITDA should not be considered as an alternative to net earnings or operating income as an indicator of the Company's operating performance, or as an alternative to net cash provided by operating activities as a measure of liquidity. The EBITDA measure presented may not always be comparable to similarly titled measures reported by other companies due to differences in the components of the calculation. Fiscal 2014 EBITDA: Net earnings EBITDA (non-GAAP measure) EBITDA (non-GAAP measure) 18 EBITDA - Total Company (‘000s of USD) EBITDA RECONCILIATION

19 NON-GAAP NET EARNINGS FROM CONTINUING OPERATIONS 19 Reconciliation of Non-GAAP Net Earnings from Continuing Operations (‘000s of USD) 2014 2013 2014 2013 20,184$ 21,680$ 48,835$ 37,300$ Cost of goods sold: Purchase accounting expense related to inventory — — — 949 Selling, general and administrative: PDC acquisition-related expenses — — — 2,959 Restructuring charges 2,071 6,849 9,618 8,473 Non-cash income tax charges related to PDC funding — — — 25,000 22,255$ 28,529$ 58,453$ 74,681$ Net Earnings from Continuing Operations Excluding Certain Items (non-GAAP measure) Brady is presenting the Non-GAAP measure "Net Earnings from Continuing Operations Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Net Earnings from Continuing Operations to Net Earnings from Continuing Operations Excluding Certain Items: Net Earnings from Continuing Operations (GAAP measure) Three Months Ended April 30, Nine Months Ended April 30,

20 NON-GAAP NET EARNINGS FROM CONTINUING OPERATIONS PER DILUTED CLASS A NONVOTING SHARE 20 Reconciliation of Non-GAAP Net Earnings from Continuing Operations per Diluted Class A Nonvoting Share 2014 2013 2014 2013 $ 0.39 $ 0.42 $ 0.93 $ 0.72 Cost of goods sold: Purchase accounting expense related to inventory — — — 0.02 Selling, general and administrative: PDC acquisition-related expenses — — — 0.06 estructuring charges 0.04 0.13 0.18 0.16 Non-cash income tax charges related to PDC funding — — — 0.48 0.43$ 0.55$ 1.12$ 1.44$ Common Share Excluding Certain Items (non-GAAP measure) Net Earnings from Continuing Operations Per Diluted Class A Brady is presenting the Non-GAAP measure "Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items." This is not a calculation based upon GAAP. The amounts included in this Non-GAAP measure are derived from amounts included in the Consolidated Financial Statements and supporting footnote disclosures. We do not view these items to be part of our sustainable results. We believe this measure provides an important perspective of underlying business trends and results and provides a more comparable measure from year to year. The table below provides a reconciliation of Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share to Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share Excluding Certain Items: Net Earnings from Continuing Operations Per Diluted Class A Nonvoting Common Share (GAAP measure) Three Months Ended April 30, Nine Months Ended April 30,

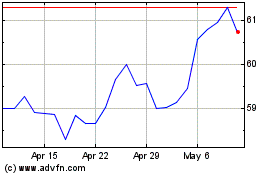

Brady (NYSE:BRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

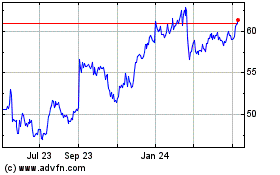

Brady (NYSE:BRC)

Historical Stock Chart

From Jul 2023 to Jul 2024