Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 02 2024 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 OF THE SECURITIES EXCHANGE ACT OF 1934

December 2, 2024

Commission File Number 001-39007

Borr Drilling Limited

S. E. Pearman Building

2nd Floor 9 Par-la-Ville Road

Hamilton HM11

Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F Yes ☒ No ☐

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K on paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INFORMATION CONTAINED IN THIS FORM 6-K REPORT

On December 2, 2024, Borr Drilling Limited, an exempted company incorporated under the laws of Bermuda (the “Company”), filed a prospectus supplement to

its automatic shelf registration statement on Form F-3 (Registration No. 333-266328) covering the resale of up to 62,888,215 of the Company’s common shares, par value $0.10 per share (the “Prospectus Supplement”).

The Company is filing this Current Report on Form 6-K to provide a legal opinion of its counsel, Walkers, regarding the legality of the securities

covered by the Prospectus Supplement, which opinion is attached hereto as Exhibit 5.1.

Exhibits

|

|

|

|

|

|

|

Opinion of Walkers

|

|

|

|

Consent of Walkers (included in Exhibit 5.1)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date: December 2, 2024

| |

Borr Drilling Limited

|

| |

|

|

| |

By:

|

/s/ Mi Hong Yoon

|

| |

|

Name: Mi Hong Yoon

|

| |

|

Title: Director

|

Exhibit 5.1

|

|

2 December 2024 |

Our Ref: PO/CO/jm/L15498

|

|

|

Borr Drilling Limited

2nd Floor, S.E. Pearman Building

9 Par-la-Ville Road

Hamilton, HM11

Bermuda

|

|

Dear Addressees

BORR DRILLING LIMITED

We have been asked to provide this legal opinion to you with regard to the laws of Bermuda in connection with the Prospectus Supplement (as defined in

Schedule 1, which term does not include any other document or agreement whether or not specifically referred to therein or attached as an exhibit or schedule thereto) by Borr Drilling Limited (the “Company”).

For the purposes of giving this opinion, we have examined and relied upon the originals or copies of the documents listed in Schedule 1.

We are Bermuda Barristers and Attorneys and express no opinion as to any laws other than the laws of Bermuda in force and as interpreted at the date

of this opinion. We have not, for the purposes of this opinion, made any investigation of the laws, rules or regulations of any other jurisdiction. Except as explicitly stated herein, we express no opinion in relation to any representation or

warranty contained in the Documents (as defined in Schedule 1) nor upon matters of fact or the commercial terms of the transactions contemplated by the Documents.

Based upon the foregoing examinations and the assumptions and qualifications set out below and upon such searches as we have conducted and having

regard to legal considerations which we consider relevant, and under the laws of Bermuda, we give the following opinions in relation to the matters set out below.

|

1. |

The Company is an exempted company duly incorporated under the Companies Act, 1981 (as amended) (the “Companies Act”) and validly exists as a

company limited by shares in Bermuda. Based solely on the Certificate of Compliance referred to in Schedule 1, the Company is in good standing under the laws of Bermuda.

|

|

2. |

Based solely upon the review of the Register of Members of the Company certified by the secretary of the Company on 28 November 2024, the Sale Shares (as defined in Schedule 1) have

been validly issued and are fully-paid and non-assessable (meaning that no additional sums may be levied in respect of such Sale Shares on the holder thereof by the Company).

|

Walkers

The Scalpel, 11th Floor, 52 Lime Street,

London, EC3M 7AF, UK

T +44 (0)20 7220 4999 www.walkersglobal.com

Bermuda | British Virgin Islands | Cayman Islands | Dubai | Guernsey | Hong Kong | Ireland | Jersey | London | Singapore

|

|

|

The foregoing opinions are given based on the following assumptions.

|

|

1. |

The originals of all documents examined in connection with this opinion are authentic. The signatures, initials and seals on the Documents are genuine and are those of a person or

persons given power to execute the Documents under the Resolutions (as defined in Schedule 1). All documents purporting to be sealed have been so sealed. All copies are complete and conform to their originals. The Documents conform in every

material respect to the latest drafts of the same produced to us and, where provided in successive drafts, have been marked up to indicate all changes to such Documents.

|

|

2. |

The Memorandum and Bye-Laws reviewed by us will be the memorandum of association and bye-laws of the Company in effect upon the consummation of the sale of the Sale Shares.

|

|

3. |

The Company Records (as defined in Schedule 1) are complete and accurate and all matters required by law and the Memorandum and Bye-Laws to be recorded therein are completely and

accurately so recorded.

|

|

4. |

The accuracy and completeness of all factual representations made in the Prospectus and all other documents reviewed by us. |

|

5. |

The Company has received consideration in money or money’s worth for each Sale Shares and such price was not less than the stated par or nominal value of each Sale Shares.

|

|

6. |

The Resolutions (defined in Schedule 1) are and shall remain in full force and effect and have not been and will not be rescinded or amended. The Resolutions have been duly executed by

or on behalf of each director of the Company and the signatures and initials thereon are those of a person or persons in whose name the Resolutions have been expressed to be signed.

|

|

7. |

The issuance of the Sale Shares was duly authorised by the Company prior to the time of issuance of the Sale Shares.

|

|

8. |

The Sale Shares are registered in the Register of Members in the name of Cede & Co.

|

|

9. |

The Prospectus will be duly authorised, executed and delivered by or on behalf of all relevant parties prior to the sale of the Sale Shares and will be legal, valid, binding and

enforceable against all relevant parties in accordance with their terms under all relevant laws (other than the laws of Bermuda).

|

|

10. |

All preconditions to the obligations of the parties to the Prospectus will be satisfied or duly waived prior to the issue and sale of the Sale Shares and there will be no breach of the

terms of the Prospectus.

|

|

11. |

That on the date of issuance of each of the Sale Shares the Company had sufficient authorised but unissued common shares.

|

|

12. |

That shares of the Company are and will continue to be listed on an appointed stock exchange, as defined in the Companies Act 1981, as amended, and the consent to the issue and free

transfer of shares and securities of the Company given by the Bermuda Monetary Authority will be in effect at the time of the sale of the Sale Shares.

|

|

13. |

That there is no provision of any agreement which would or might affect any of the opinions set forth above.

|

|

14. |

There is nothing under any law (other than the laws of Bermuda) which would or might affect any of the opinions set forth above.

|

We have relied upon the statements and representations of directors, officers and other representatives of the Company as to factual matters.

Our opinion as to good standing is based solely upon receipt of the Certificate of Compliance (as defined in Schedule 1) issued by the Registrar of

Companies, which confirms only that the Company has neither failed to make any filing with any Bermuda governmental authority nor failed to pay any Bermuda government fee or tax, which might make it liable to be struck off the Register of Companies.

“Non-assessability” is not a legal concept under Bermuda law. Reference in this opinion to shares being “non-assessable” shall mean, in relation to

fully-paid shares of the Company and subject to any contrary provision in any agreement in writing between the Company and the holder of shares, that no member shall be:

|

(a) |

obliged to contribute further amounts to the capital of the Company, either in order to complete payment for their shares, to satisfy claims of creditors of the Company, or otherwise;

and

|

|

(b) |

bound by an alteration of the Memorandum or Bye-laws of the Company after the date on which they became a member, if and so far as the alteration requires them to take, or subscribe for

additional shares, or in any way increases their liability to contribute to the share capital of, or otherwise to pay money to, the Company.

|

This opinion is limited to the matters referred to herein and shall not be construed as extending to any other matter or document not referred to herein.

This opinion is given solely for your benefit and the benefit of your legal advisers acting in that capacity in relation to this transaction and may not be relied upon by any other person, other than persons entitled to rely upon it pursuant to the

provisions of the Securities Act, without our prior written consent.

This opinion shall be construed in accordance with the laws of Bermuda.

We hereby consent to the filing of this opinion as an exhibit to the Company’s Current Report on Form 6-K relating to the Sale Shares, which is

incorporated by reference in the Prospectus Supplement. We also consent to the identification of our firm in the section of the Prospectus Supplement entitled “Legal Matters”.

Yours faithfully

WALKERS

SCHEDULE 1

LIST OF DOCUMENTS EXAMINED

|

1. |

The Certificate of Incorporation as issued on 9 August 2016, Certificate of Incorporation on Change of Name, Memorandum of Association, Bye-laws of the Company as adopted on 27

September 2019 (together the “Memorandum and Bye-laws”), the Register of Members of the Company (the “Register of Members”) and the Register of Directors and

Officers, in each case of the Company, copies of which have been provided to us by its secretary in Bermuda (together the “Company Records”).

|

|

2. |

The public records of the Company on the Register of Companies, examined on 29 November 2024.

|

|

3. |

A Certificate of Compliance dated 28 November 2024 issued by the Registrar of Companies for the Ministry of Finance in relation to the Company (the “Certificate

of Compliance”).

|

|

4. |

A copy of executed written resolutions of the board of directors of the Company dated 29 November 2024 (the “Resolutions”).

|

|

5. |

Copies of the following documents (the “Documents”):

|

|

(a) |

the Prospectus Supplement dated 2 December 2024 to the prospectus dated 26 July 2022 issued by the Company and filed with the United States Securities and Exchange Commission (“SEC”) in respect of the sale of up to 62,888,215 common shares of par value $0.10 each (“Sale Shares”) in Borr Drilling Limited that may be sold by the selling

shareholders (the “Prospectus”).

|

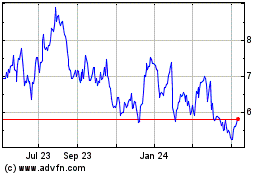

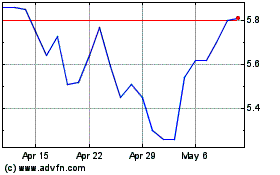

Borr Drilling (NYSE:BORR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Borr Drilling (NYSE:BORR)

Historical Stock Chart

From Dec 2023 to Dec 2024