UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or

13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 2)

BLUE APRON HOLDINGS, INC.

(Name of Subject Company (issuer))

BASIL MERGER CORPORAION

(Offeror)

a wholly owned subsidiary of

WONDER GROUP, INC.

(Parent of Offeror)

(Names of Filing Persons (identifying status

as offeror, issuer or other person))

Class A common stock, $0.0001 par value

per share

(Title of Class of Securities)

09523Q 309

(CUSIP Number of Class of Securities)

Andrew

Gasper

Chief Governance Officer and Secretary

Wonder Group, Inc.

4 World Trade

150 Greenwich Street, 57th Floor

New York, New York 10007

Telephone: (908) 986-2038

(Name, address, and telephone numbers of person

authorized to receive notices and communications on behalf of filing persons)

Copy to:

Kris Withrow

David Michaels

Aman Singh

Fenwick & West LLP

801 California Street

Mountain View, California 94041

Telephone: (650) 988-8500

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| |

x |

Third-party tender offer subject to Rule 14d-1. |

| |

¨ |

Issuer tender offer subject to Rule 13e-4. |

| |

¨ |

Going-private transaction subject to Rule 13e-3. |

| |

¨ |

Amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing

is a final amendment reporting the results of the tender offer: x

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| |

¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This Amendment No. 2 to the Tender Offer Statement on Schedule

TO (this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO filed with the Securities and Exchange

Commission on October 13, 2023 (as amended and supplemented from time to time, the “Schedule

TO”) and relates to the offer by Basil Merger Corporation, a Delaware corporation and a wholly owned subsidiary of Wonder Group, Inc.,

a Delaware corporation (“Wonder”), to purchase all of the issued and outstanding shares of Class A common stock, par

value $0.0001 per share (the “Shares”), of Blue Apron Holdings, Inc., a Delaware corporation (“Blue Apron”),

which constitute all of the issued and outstanding shares of capital stock of Blue Apron, at a purchase price of $13.00 per Share,

net to the stockholder in cash, without interest and less any applicable tax withholding, upon the terms and subject to the conditions

set forth in the Offer to Purchase, dated October 13, 2023 (the “Offer to Purchase”), and in the related Letter of Transmittal

(which, together with the Offer to Purchase, each as amended or supplemented from time to time, collectively constitute the “Offer”),

copies of which are attached to the Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively.

Except as otherwise set forth in this Amendment, the information set

forth in the Schedule TO remains unchanged and is incorporated herein by reference to the extent relevant to the items in this Amendment.

Capitalized terms used but not defined herein have the respective meanings ascribed to them in the Schedule TO.

Items 1 through 9 and Item 11.

The Offer to Purchase and Items 1 through 9 and Item 11 of the Schedule

TO are hereby amended and supplemented as follows:

“The Offer and related withdrawal rights expired as scheduled

at one minute past 11:59 p.m., Eastern time, on November 9, 2023 (such date and time, the “Expiration Time”), and was

not further extended. The Depositary has advised Purchaser that, as of the Expiration Time, a total of 5,136,073 Shares had been validly tendered

and not validly withdrawn pursuant to the Offer, which Shares, together with all other Shares beneficially owned by Purchaser and its

affiliates, represented approximately 66.63% of the issued and outstanding Shares as of the Expiration Time. Accordingly, the Minimum Condition

has been satisfied. Purchaser has accepted for payment, and will promptly pay for, all Shares that were validly tendered and not validly

withdrawn pursuant to the Offer prior to the Expiration Time.

Following consummation of the Offer, on November 13, 2023, Wonder

completed its acquisition of Blue Apron pursuant to the terms of the Merger Agreement through the merger of Purchaser with and into Blue

Apron, and without a vote of stockholders of Blue Apron in accordance with Section 251(h) of the DGCL, with Blue Apron surviving

as a wholly owned subsidiary of Wonder.

Following the Merger, all Shares ceased trading prior to the opening

of trading on Nasdaq on November 13, 2023 and will be delisted from Nasdaq and deregistered under the Exchange Act.

A copy of the press release issued by Wonder on November 13, 2023

announcing the expiration and results of the Offer and the consummation of the Merger is attached as Exhibit (a)(1)(H) to the

Schedule TO and incorporated herein by reference.”

Item 12. Exhibits.

Item 12 of the Schedule TO is hereby amended and supplemented by adding

the following exhibit:

SIGNATURES

After due inquiry and to the best knowledge and

belief of the undersigned, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

| Date: November 13, 2023 |

BASIL MERGER CORPORATION |

| |

|

| |

/s/ Jay Naik |

| |

Name: Jay Naik |

| |

Title: President |

| |

|

| |

WONDER GROUP, INC. |

| |

|

| |

/s/ Jay Naik |

| |

Name: Jay Naik |

| |

Title: President |

Exhibit (a)(1)(h)

Wonder Announces

Closing of Blue Apron Acquisition to Enhance its Leading Platform for Mealtime

Customers in

New York City and New Jersey can now buy Blue Apron meals via delivery and pick-up from Wonder locations

NEW YORK – Wonder Group, a company

founded by entrepreneur Marc Lore that is redefining at-home dining and food delivery, today will close its previously announced acquisition

of Blue Apron (Nasdaq: APRN), the pioneer of the meal kit industry in the United States.

The acquisition will further enhance

Wonder’s creation of the super app for mealtime, serving a broad range of dining occasions that feature cuisines from some of the

world’s best chefs and restaurants.

Having pioneered a new category of “Fast

Fine” dining through its collection of vertically-integrated, delivery-first restaurants, Wonder will now begin offering Blue Apron

items to its customers in New York City and New Jersey, a key offering in the company’s strategic roadmap that will expand the

ways consumers can access and experience great tasting food.

“Our mission at Wonder is to make

great food more accessible, and the integration of Blue Apron onto our Wonder platform provides a major opportunity to double-down on

that promise to our customers,” said Wonder Group Founder and Chief Executive Officer, Marc Lore. “As we continue to revolutionize

the food industry through our creation of Fast Fine dining, we’re excited to continue expanding on the ways we can offer unique

and elevated dining experiences through more choice, flexibility and convenience.”

“Empowering people to create incredible

culinary experiences at home is a hallmark of Blue Apron,” said Blue Apron President and Chief Executive Officer, Linda Findley.

“Now, as part of the Wonder family, we are excited to expand the ways our customers access and experience our top-rated recipes

and quality ingredients. Through faster, more convenient delivery options and greater menu choice, customers have even more ways to create

incredible home meal moments anytime, anywhere.”

Beginning today, Blue Apron customers

within Wonder delivery zones will have their subscription boxes delivered by Wonder couriers. This enhanced, direct delivery is provided

to customers at no additional cost. Service to Blue Apron customers will continue as normal.

Additionally, Wonder customers throughout

New York and New Jersey now have access to Blue Apron on the Wonder app. This rotating offering of Meal Kits and Heat & Eat

options are available starting today at Wonder Upper West Side, Chelsea, Downtown Brooklyn, Westfield and Hoboken, available for delivery

or pickup.

The launch menu, with plans to expand

in the future, features some of Blue Apron’s top-rated recipes with the same quality ingredients. Heat & Eat meals are

microwave-ready to heat up in 5 minutes or less - with no prep work or clean up required - while the Meal Kits offer Blue Apron’s

traditional cooking experience without any commitment to a subscription.

| ● | Meal Kits Boxes include the following

recipes: |

| ○ | Shawarma Chicken & Couscous

Bowl // Salmon & Avocado Rice Bowl |

| ○ | Sheet Pan Pesto Salmon // One Pan

Udon Noodle & Spicy Peanut Stir Fry |

| ○ | Gnocchi Mac & Cheese //

Chicken & Chickpea Curry |

| ● | Heat & Eat microwavable

single serve portions include: |

| ○ | Cheesy Mexican Chicken &

Rice |

| ○ | Cheesy Truffle Cavatappi |

| ○ | Egg Noodles & Beef Meatballs |

Wonder’s

tender offer to acquire all of the issued and outstanding shares of Class A common stock of Blue Apron (the “Common Stock”),

which constituted all of the issued and outstanding shares of capital stock of Blue Apron, at a purchase price of $13.00 per share of

Common Stock (the “Offer Price”), net to the stockholder in cash, without interest and less any applicable tax withholding,

expired as scheduled at one minute after 11:59 p.m., Eastern time, on November 9, 2023. Computershare Trust Company, N.A., the depositary

and paying agent for the tender offer, has advised Wonder that as of the expiration of the tender offer, a total of 5,136,073 shares

of Common Stock were validly tendered and not validly withdrawn, representing approximately 66.7% of the issued and outstanding shares

of Common Stock. Such shares of Common Stock have been accepted for payment and will be promptly paid for in accordance with the terms

of the tender offer.

Following completion

of the tender offer, Wonder will complete the acquisition of Blue Apron later today through the previously planned merger of its wholly

owned subsidiary, Basil Merger Corporation, with and into Blue Apron (the “Merger”), and all shares of Common Stock that

have not been validly tendered will be converted into the right to receive the Offer Price. As a result of the Merger, Blue Apron will

become a wholly owned subsidiary of Wonder. Blue Apron’s Class A common stock will be delisted from The Nasdaq Stock Market.

About

Wonder Group

Wonder

is revolutionizing the food industry by creating the mealtime super app, operating a collection of vertically-integrated, delivery-first

restaurants and pioneering a new category of “Fast Fine” dining. Featuring some of the world’s best chefs including

Bobby Flay, Jose Andres, Nancy Silverton, Michael Symon, Marcus Samuelsson and others, along with award-winning restaurants from across

the country including Tejas Barbeque, Di Fara Pizza, Barrio Cafe, Maydan and more, customers can experience any combination of these

chefs and restaurants all together in one order for the first time. Everything is made-to-order in a Wonder location and delivered to

your door by a Wonder courier, or available for pick-up and dine-in as well. Wonder brings an elevated, curated dining experience to

you every time. Visit www.wonder.com to learn more.

About

Blue Apron

Blue

Apron’s vision is Better Living Through Better Food™. Launched in 2012, Blue Apron offers fresh, chef-designed meals that

empower home cooks to embrace their culinary curiosity, challenge their abilities in the kitchen and see what a difference cooking quality

food can make in their lives. Blue Apron is focused on bringing incredible recipes to its customers, deepening its commitment to its

employees, continuing to reduce food and packaging waste, and addressing its carbon impact. Visit www.blueapron.com to learn more.

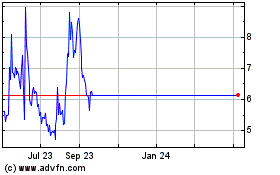

Blue Apron (NYSE:APRN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Blue Apron (NYSE:APRN)

Historical Stock Chart

From Feb 2024 to Feb 2025