00018369812022Q2False12/31P3DP4YP4Y00018369812022-01-012022-06-300001836981us-gaap:CommonStockMember2022-01-012022-06-300001836981bbai:RedeemableWarrantsMember2022-01-012022-06-3000018369812022-08-05xbrli:shares00018369812022-06-30iso4217:USD00018369812021-12-31iso4217:USDxbrli:shares00018369812022-04-012022-06-3000018369812021-04-012021-06-3000018369812021-01-012021-06-300001836981us-gaap:CommonStockMember2022-03-310001836981us-gaap:AdditionalPaidInCapitalMember2022-03-310001836981us-gaap:TreasuryStockMember2022-03-310001836981us-gaap:RetainedEarningsMember2022-03-3100018369812022-03-310001836981us-gaap:RetainedEarningsMember2022-04-012022-06-300001836981us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-300001836981us-gaap:CommonStockMember2022-04-012022-06-300001836981us-gaap:CommonStockMember2022-06-300001836981us-gaap:AdditionalPaidInCapitalMember2022-06-300001836981us-gaap:TreasuryStockMember2022-06-300001836981us-gaap:RetainedEarningsMember2022-06-300001836981us-gaap:CommonStockMember2021-03-310001836981us-gaap:AdditionalPaidInCapitalMember2021-03-310001836981us-gaap:TreasuryStockMember2021-03-310001836981us-gaap:RetainedEarningsMember2021-03-3100018369812021-03-310001836981us-gaap:RetainedEarningsMember2021-04-012021-06-300001836981us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300001836981us-gaap:CommonStockMember2021-06-300001836981us-gaap:AdditionalPaidInCapitalMember2021-06-300001836981us-gaap:TreasuryStockMember2021-06-300001836981us-gaap:RetainedEarningsMember2021-06-3000018369812021-06-300001836981us-gaap:CommonStockMember2021-12-310001836981us-gaap:AdditionalPaidInCapitalMember2021-12-310001836981us-gaap:TreasuryStockMember2021-12-310001836981us-gaap:RetainedEarningsMember2021-12-310001836981us-gaap:RetainedEarningsMember2022-01-012022-06-300001836981us-gaap:AdditionalPaidInCapitalMember2022-01-012022-06-300001836981us-gaap:TreasuryStockMember2022-01-012022-06-300001836981us-gaap:CommonStockMember2020-12-310001836981us-gaap:AdditionalPaidInCapitalMember2020-12-310001836981us-gaap:TreasuryStockMember2020-12-310001836981us-gaap:RetainedEarningsMember2020-12-3100018369812020-12-310001836981us-gaap:RetainedEarningsMember2021-01-012021-06-300001836981us-gaap:AdditionalPaidInCapitalMember2021-01-012021-06-3000018369812021-12-060001836981bbai:BigBearHoldingsMember2021-12-062021-12-06bbai:segment00018369812021-12-072021-12-070001836981bbai:ForwardSharePurchaseAgreementsMember2021-12-060001836981bbai:TotalInvestorShareLiabilityMember2022-01-012022-03-310001836981us-gaap:UnsecuredDebtMember2021-12-072021-12-0700018369812021-12-070001836981bbai:BigBearHoldingsMember2021-12-072021-12-070001836981bbai:CertainAdvisorsMember2021-12-072021-12-070001836981bbai:AEIndustrialPartnersFundIILPMember2021-12-07xbrli:pure0001836981bbai:ProModelMember2022-04-070001836981bbai:ProModelMember2022-04-072022-04-070001836981bbai:ProModelMemberus-gaap:CommonStockMember2022-04-072022-04-070001836981bbai:ProModelMemberus-gaap:TechnologyBasedIntangibleAssetsMember2022-04-072022-04-070001836981us-gaap:CustomerRelationshipsMemberbbai:ProModelMember2022-04-072022-04-070001836981bbai:ProModelMember2022-04-012022-06-300001836981bbai:ProModelMember2021-04-012021-06-300001836981bbai:ProModelMember2022-01-012022-06-300001836981bbai:ProModelMember2021-01-012021-06-300001836981us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberbbai:PrivateWarrantsMember2022-06-300001836981us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberbbai:PrivateWarrantsMember2022-06-300001836981us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberbbai:PrivateWarrantsMember2022-06-300001836981us-gaap:FairValueMeasurementsRecurringMemberbbai:PrivateWarrantsMember2022-06-300001836981us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PutOptionMember2022-06-300001836981us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PutOptionMember2022-06-300001836981us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PutOptionMember2022-06-300001836981us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PutOptionMember2022-06-300001836981us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberbbai:PrivateWarrantsMember2021-12-310001836981us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberbbai:PrivateWarrantsMember2021-12-310001836981us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberbbai:PrivateWarrantsMember2021-12-310001836981us-gaap:FairValueMeasurementsRecurringMemberbbai:PrivateWarrantsMember2021-12-310001836981us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PutOptionMember2021-12-310001836981us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:PutOptionMember2021-12-310001836981us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:PutOptionMember2021-12-310001836981us-gaap:FairValueMeasurementsRecurringMemberus-gaap:PutOptionMember2021-12-310001836981bbai:PrivateWarrantsMember2021-12-310001836981us-gaap:PutOptionMember2021-12-310001836981bbai:PrivateWarrantsMember2022-01-012022-06-300001836981us-gaap:PutOptionMember2022-01-012022-06-300001836981bbai:PrivateWarrantsMember2022-06-300001836981us-gaap:PutOptionMember2022-06-300001836981bbai:AnalyticsMember2022-06-300001836981bbai:CyberAndEngineeringMember2021-12-310001836981bbai:AnalyticsMember2021-12-310001836981bbai:CyberAndEngineeringMemberbbai:ProModelAcquisitionMember2022-01-012022-06-300001836981bbai:AnalyticsMemberbbai:ProModelAcquisitionMember2022-01-012022-06-300001836981bbai:ProModelAcquisitionMember2022-01-012022-06-300001836981bbai:CyberAndEngineeringMember2022-01-012022-06-300001836981bbai:AnalyticsMember2022-01-012022-06-300001836981bbai:CyberAndEngineeringMember2022-06-300001836981us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2022-06-300001836981us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2021-12-310001836981us-gaap:ConvertibleDebtMember2022-06-300001836981us-gaap:ConvertibleDebtMember2021-12-310001836981bbai:BankOfAmericaRevolverMember2022-06-300001836981bbai:BankOfAmericaRevolverMember2021-12-310001836981bbai:DOFinancingLoanMember2022-06-300001836981bbai:DOFinancingLoanMember2021-12-310001836981bbai:BankOfAmericaSeniorRevolverMemberus-gaap:RevolvingCreditFacilityMember2021-12-070001836981bbai:BankOfAmericaSeniorRevolverMember2021-12-070001836981bbai:BankOfAmericaSeniorRevolverMemberus-gaap:BaseRateMember2021-12-072021-12-070001836981bbai:BankOfAmericaSeniorRevolverMemberus-gaap:FederalFundsEffectiveSwapRateMember2021-12-072021-12-070001836981bbai:BankOfAmericaSeniorRevolverMemberbbai:BloombergShortTermYieldIndexRateMember2021-12-072021-12-070001836981us-gaap:OtherNoncurrentAssetsMember2022-06-300001836981us-gaap:ConvertibleNotesPayableMember2021-12-070001836981us-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2021-12-070001836981us-gaap:ConvertibleNotesPayableMember2022-05-292022-05-290001836981us-gaap:ConvertibleNotesPayableMember2022-05-282022-05-280001836981us-gaap:ConvertibleNotesPayableMember2022-05-29utr:D0001836981us-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2022-05-290001836981us-gaap:ConvertibleNotesPayableMemberus-gaap:CommonStockMember2021-12-072021-12-070001836981us-gaap:ConvertibleNotesPayableMember2021-12-072021-12-07bbai:vote0001836981bbai:ConvertibleDebtParValueMember2021-12-070001836981us-gaap:CommonStockMember2022-05-292022-05-290001836981us-gaap:ConvertibleNotesPayableMember2022-06-300001836981bbai:DOFinancingLoanMember2021-12-080001836981srt:MinimumMember2022-06-300001836981srt:MaximumMember2022-06-300001836981bbai:ForwardSharePurchaseAgreementsMember2021-12-062021-12-060001836981bbai:DerivativeInstrumentPeriodOneMemberbbai:ForwardSharePurchaseAgreementsMember2021-12-060001836981bbai:ForwardSharePurchaseAgreementsMemberbbai:DerivativeInstrumentPeriodTwoMember2021-12-060001836981bbai:DerivativeInstrumentPeriodThreeMemberbbai:ForwardSharePurchaseAgreementsMember2021-12-060001836981bbai:HighbridgeInvestorsMember2021-12-062021-12-060001836981bbai:TenorMember2021-12-062021-12-060001836981bbai:GlazerInvestorsMember2021-12-062021-12-0600018369812021-12-062021-12-0600018369812022-01-012022-03-310001836981bbai:RepurchasePriceObligationLiabilityPriceOneMember2022-01-012022-03-310001836981us-gaap:PutOptionMember2021-12-310001836981us-gaap:PutOptionMember2021-01-012021-12-310001836981bbai:PublicWarrantsMember2021-02-110001836981bbai:PublicWarrantsMember2021-02-112021-02-110001836981srt:MinimumMember2021-02-112021-02-110001836981bbai:PublicWarrantsMember2022-06-300001836981bbai:PublicWarrantsMember2021-12-310001836981bbai:PrivateWarrantsMember2022-06-300001836981bbai:PrivateWarrantsMember2021-12-310001836981bbai:PrivateWarrantsMember2022-01-012022-06-300001836981bbai:PrivateWarrantsMember2021-01-012021-12-310001836981bbai:PrivateWarrantsMember2022-04-012022-06-300001836981bbai:PublicWarrantsMember2022-01-012022-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMemberbbai:BoardOfDirectorsMemberbbai:ClassAUnitsMember2022-01-012022-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMemberbbai:BoardOfDirectorsMemberbbai:ClassAUnitsMember2022-04-012022-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMemberbbai:BoardOfDirectorsMemberbbai:ClassAUnitsMember2021-04-012021-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMemberbbai:BoardOfDirectorsMemberbbai:ClassAUnitsMember2021-01-012021-06-300001836981bbai:IncentiveUnitsMemberbbai:ClassBUnitIncentivePlanMember2021-02-28bbai:tranche0001836981us-gaap:ShareBasedCompensationAwardTrancheOneMemberbbai:IncentiveUnitsMemberbbai:ClassBUnitIncentivePlanMember2021-02-012021-02-280001836981bbai:ClassBUnitsMember2021-02-162021-02-160001836981bbai:ClassBUnitIncentivePlanMember2021-07-292021-07-290001836981bbai:IncentiveUnitsMemberbbai:ClassBUnitIncentivePlanMember2021-07-292021-07-290001836981us-gaap:ShareBasedCompensationAwardTrancheTwoMemberbbai:IncentiveUnitsMember2021-07-292021-12-310001836981us-gaap:ShareBasedCompensationAwardTrancheTwoMemberbbai:IncentiveUnitsMember2021-01-012021-12-310001836981us-gaap:ShareBasedCompensationAwardTrancheTwoMemberbbai:IncentiveUnitsMember2022-01-012022-06-30bbai:employee0001836981bbai:IncentiveUnitsMember2022-01-012022-06-300001836981us-gaap:ShareBasedCompensationAwardTrancheTwoMemberbbai:IncentiveUnitsMember2022-04-012022-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMemberbbai:IncentiveUnitsMember2022-04-012022-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMemberbbai:IncentiveUnitsMember2021-04-012021-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMemberbbai:IncentiveUnitsMember2022-01-012022-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMemberbbai:IncentiveUnitsMember2021-01-012021-06-300001836981us-gaap:CostOfSalesMemberbbai:IncentiveUnitsMember2022-04-012022-06-300001836981us-gaap:CostOfSalesMemberbbai:IncentiveUnitsMember2021-04-012021-06-300001836981us-gaap:CostOfSalesMemberbbai:IncentiveUnitsMember2022-01-012022-06-300001836981us-gaap:CostOfSalesMemberbbai:IncentiveUnitsMember2021-01-012021-06-300001836981bbai:IncentiveUnitsMember2022-04-012022-06-300001836981bbai:IncentiveUnitsMember2021-04-012021-06-300001836981bbai:IncentiveUnitsMember2021-01-012021-06-300001836981us-gaap:ShareBasedCompensationAwardTrancheTwoMemberbbai:IncentiveUnitsMember2021-12-310001836981us-gaap:ShareBasedCompensationAwardTrancheTwoMemberbbai:IncentiveUnitsMember2022-06-300001836981us-gaap:EmployeeStockOptionMember2022-01-012022-06-300001836981us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:EmployeeStockOptionMember2022-01-012022-06-300001836981us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-01-012022-06-300001836981bbai:ShareBasedPaymentArrangementTrancheFourMemberus-gaap:EmployeeStockOptionMember2022-01-012022-06-300001836981us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:EmployeeStockOptionMember2022-01-012022-06-300001836981us-gaap:EmployeeStockOptionMember2022-06-132022-06-130001836981us-gaap:EmployeeStockOptionMember2022-03-302022-03-300001836981us-gaap:EmployeeStockOptionMember2022-06-130001836981us-gaap:EmployeeStockOptionMember2022-03-3000018369812021-01-012021-12-310001836981us-gaap:EmployeeStockOptionMember2022-06-300001836981us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001836981us-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001836981us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2022-01-012022-06-300001836981us-gaap:RestrictedStockUnitsRSUMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2022-01-012022-06-300001836981us-gaap:RestrictedStockUnitsRSUMemberbbai:ShareBasedPaymentArrangementTrancheFourMember2022-01-012022-06-300001836981us-gaap:ShareBasedCompensationAwardTrancheOneMemberbbai:NonEmployeeDirectorMemberus-gaap:RestrictedStockUnitsRSUMember2022-01-012022-06-300001836981us-gaap:RestrictedStockUnitsRSUMember2021-12-310001836981us-gaap:RestrictedStockUnitsRSUMember2022-06-300001836981us-gaap:PerformanceSharesMember2021-12-072021-12-070001836981us-gaap:PerformanceSharesMember2022-01-012022-06-300001836981us-gaap:PerformanceSharesMember2021-12-310001836981us-gaap:PerformanceSharesMember2022-06-300001836981us-gaap:PerformanceSharesMember2022-04-012022-06-300001836981bbai:A2021EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2022-01-012022-01-010001836981bbai:A2021EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2022-01-012022-06-300001836981bbai:A2021EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2022-06-300001836981bbai:A2021EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2022-05-010001836981bbai:A2021EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2022-05-012022-05-010001836981us-gaap:EmployeeStockMember2022-06-300001836981us-gaap:EmployeeStockMember2022-01-012022-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-04-012022-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-04-012021-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-06-300001836981us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-06-300001836981us-gaap:CostOfSalesMember2022-04-012022-06-300001836981us-gaap:CostOfSalesMember2021-04-012021-06-300001836981us-gaap:CostOfSalesMember2022-01-012022-06-300001836981us-gaap:CostOfSalesMember2021-01-012021-06-300001836981us-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-06-300001836981us-gaap:ResearchAndDevelopmentExpenseMember2021-04-012021-06-300001836981us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-06-300001836981us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-06-300001836981us-gaap:RestrictedStockUnitsRSUMember2022-06-300001836981us-gaap:PerformanceSharesMember2022-06-300001836981us-gaap:TimeAndMaterialsContractMember2022-04-012022-06-300001836981us-gaap:TimeAndMaterialsContractMember2021-04-012021-06-300001836981us-gaap:TimeAndMaterialsContractMember2022-01-012022-06-300001836981us-gaap:TimeAndMaterialsContractMember2021-01-012021-06-300001836981us-gaap:FixedPriceContractMember2022-04-012022-06-300001836981us-gaap:FixedPriceContractMember2021-04-012021-06-300001836981us-gaap:FixedPriceContractMember2022-01-012022-06-300001836981us-gaap:FixedPriceContractMember2021-01-012021-06-300001836981bbai:CostPlusMember2022-04-012022-06-300001836981bbai:CostPlusMember2021-04-012021-06-300001836981bbai:CostPlusMember2022-01-012022-06-300001836981bbai:CostPlusMember2021-01-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMemberbbai:CyberAndEngineeringMember2022-04-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMemberbbai:AnalyticsMember2022-04-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMember2022-04-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMemberbbai:CyberAndEngineeringMember2022-04-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMemberbbai:AnalyticsMember2022-04-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMember2022-04-012022-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CyberAndEngineeringMember2022-04-012022-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AnalyticsMember2022-04-012022-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-04-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CyberAndEngineeringMemberbbai:AllOthersMember2022-04-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AnalyticsMemberbbai:AllOthersMember2022-04-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AllOthersMember2022-04-012022-06-300001836981bbai:CyberAndEngineeringMember2022-04-012022-06-300001836981bbai:AnalyticsMember2022-04-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMemberbbai:CyberAndEngineeringMember2021-04-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMemberbbai:AnalyticsMember2021-04-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMember2021-04-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMemberbbai:CyberAndEngineeringMember2021-04-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMemberbbai:AnalyticsMember2021-04-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMember2021-04-012021-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CyberAndEngineeringMember2021-04-012021-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AnalyticsMember2021-04-012021-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-04-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CyberAndEngineeringMemberbbai:AllOthersMember2021-04-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AnalyticsMemberbbai:AllOthersMember2021-04-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AllOthersMember2021-04-012021-06-300001836981bbai:CyberAndEngineeringMember2021-04-012021-06-300001836981bbai:AnalyticsMember2021-04-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMemberbbai:CyberAndEngineeringMember2022-01-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMemberbbai:AnalyticsMember2022-01-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMember2022-01-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMemberbbai:CyberAndEngineeringMember2022-01-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMemberbbai:AnalyticsMember2022-01-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMember2022-01-012022-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CyberAndEngineeringMember2022-01-012022-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AnalyticsMember2022-01-012022-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-01-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CyberAndEngineeringMemberbbai:AllOthersMember2022-01-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AnalyticsMemberbbai:AllOthersMember2022-01-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AllOthersMember2022-01-012022-06-300001836981bbai:CyberAndEngineeringMember2022-01-012022-06-300001836981bbai:AnalyticsMember2022-01-012022-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMemberbbai:CyberAndEngineeringMember2021-01-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMemberbbai:AnalyticsMember2021-01-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerAMember2021-01-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMemberbbai:CyberAndEngineeringMember2021-01-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMemberbbai:AnalyticsMember2021-01-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CustomerBMember2021-01-012021-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CyberAndEngineeringMember2021-01-012021-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AnalyticsMember2021-01-012021-06-300001836981bbai:CustomerCMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:CyberAndEngineeringMemberbbai:AllOthersMember2021-01-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AnalyticsMemberbbai:AllOthersMember2021-01-012021-06-300001836981us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberbbai:AllOthersMember2021-01-012021-06-300001836981bbai:CyberAndEngineeringMember2021-01-012021-06-300001836981bbai:AnalyticsMember2021-01-012021-06-300001836981us-gaap:ContractsAccountedForUnderPercentageOfCompletionMember2022-04-012022-06-300001836981us-gaap:ContractsAccountedForUnderPercentageOfCompletionMember2021-04-012021-06-300001836981us-gaap:ContractsAccountedForUnderPercentageOfCompletionMember2022-01-012022-06-300001836981us-gaap:ContractsAccountedForUnderPercentageOfCompletionMember2021-01-012021-06-300001836981bbai:CyberAndEngineeringMember2022-04-012022-06-300001836981bbai:AnalyticsMember2022-04-012022-06-300001836981bbai:CyberAndEngineeringMember2021-04-012021-06-300001836981bbai:AnalyticsMember2021-04-012021-06-300001836981bbai:CyberAndEngineeringMember2021-01-012021-06-300001836981bbai:AnalyticsMember2021-01-012021-06-300001836981bbai:CyberAndEngineeringMember2020-01-012020-06-300001836981bbai:AnalyticsMember2020-01-012020-06-3000018369812020-01-012020-06-300001836981us-gaap:CorporateMember2022-06-300001836981us-gaap:CorporateMember2021-12-310001836981srt:AffiliatedEntityMemberbbai:BusinessFinancialAndManagementConsultingServicesMember2022-01-012022-06-300001836981srt:AffiliatedEntityMemberbbai:BusinessFinancialAndManagementConsultingServicesMember2021-01-012021-06-300001836981bbai:BoardOfDirectorsMembersrt:AffiliatedEntityMember2022-04-012022-06-300001836981bbai:BoardOfDirectorsMembersrt:AffiliatedEntityMember2022-01-012022-06-300001836981bbai:BoardOfDirectorsMembersrt:AffiliatedEntityMember2021-04-012021-06-300001836981bbai:BoardOfDirectorsMembersrt:AffiliatedEntityMember2021-01-012021-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2022

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ______ to ______

Commission file number 001-40031

BigBear.ai Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 85-4164597 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

6811 Benjamin Franklin Drive, Suite 200, Columbia, MD | | 21046 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(410) 312-0885 |

| Registrant's telephone number, including area code |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

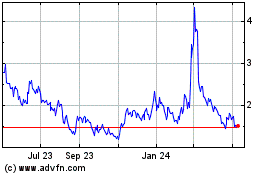

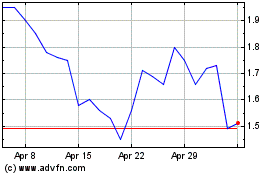

| Common stock, $0.0001 par value | | BBAI | | New York Stock Exchange |

| Redeemable warrants, each full warrant exercisable for one share of common stock at an exercise price of $11.50 per share | | BBAI.WS | | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | x | Smaller reporting company | o |

| | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

There were 126,265,764 shares of our common stock, $0.0001 par value per share, outstanding as of August 5, 2022.

BIGBEAR.AI HOLDINGS, INC.

Quarterly Report on Form 10-Q

June 30, 2022

TABLE OF CONTENTS

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

BIGBEAR.AI HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS

(unaudited; in thousands, except share and per share data)

| | | | | | | | | | | |

| |

| June 30,

2022 | | December 31,

2021 |

Assets | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 29,829 | | | $ | 68,900 | |

| Restricted cash | — | | | 101,021 | |

Accounts receivable, less allowance for doubtful accounts of $87 as of June 30, 2022 and $43 as of December 31, 2021 | 28,546 | | | 28,605 | |

Contract assets | 1,252 | | | 628 | |

Prepaid expenses and other current assets | 8,097 | | | 7,028 | |

Total current assets | 67,724 | | | 206,182 | |

Non-current assets: | | | |

Property and equipment, net | 1,433 | | | 1,078 | |

Goodwill | 67,164 | | | 91,636 | |

Intangible assets, net | 89,456 | | | 83,646 | |

| | | |

Other non-current assets | 727 | | | 780 | |

Total assets | $ | 226,504 | | | $ | 383,322 | |

| | | |

Liabilities and equity | | | |

Current liabilities: | | | |

Accounts payable | $ | 6,354 | | | $ | 5,475 | |

Short-term debt, including current portion of long-term debt | 1,921 | | | 4,233 | |

Accrued liabilities | 15,978 | | | 10,735 | |

Contract liabilities | 3,714 | | | 4,207 | |

| Derivative liabilities | — | | | 44,827 | |

Other current liabilities | 881 | | | 541 | |

Total current liabilities | 28,848 | | | 70,018 | |

Non-current liabilities: | | | |

Long-term debt, net | 191,341 | | | 190,364 | |

Deferred tax liabilities | 390 | | | 248 | |

Other non-current liabilities | 136 | | | 324 | |

Total liabilities | 220,715 | | | 260,954 | |

| | | |

Commitments and contingencies (Note K) | | | |

| | | |

Stockholders’ equity: | | | |

Common stock, par value $0.0001; 500,000,000 shares authorized and 126,263,451 shares issued at June 30, 2022 and 135,566,227 at December 31, 2021 | 14 | | | 14 | |

| Additional paid-in capital | 270,184 | | | 253,744 | |

| | | |

Treasury stock, at cost 9,952,803 shares at June 30, 2022 and — shares at December 31, 2021 | (57,350) | | | — | |

Accumulated deficit | (207,059) | | | (131,390) | |

Total stockholders’ equity | 5,789 | | | 122,368 | |

Total liabilities and stockholders’ equity | $ | 226,504 | | | $ | 383,322 | |

The accompanying notes to the consolidated financial statements are an integral part of these statements.

BIGBEAR.AI HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited; in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | | | | |

| 2022 | | 2021 | | 2022 | | 2021 | | | | | |

Revenues | $ | 37,613 | | | $ | 36,311 | | | $ | 74,003 | | | $ | 71,881 | | | | | | |

Cost of revenues | 28,023 | | | 27,148 | | | 54,546 | | | 52,438 | | | | | | |

Gross margin | 9,590 | | | 9,163 | | | 19,457 | | | 19,443 | | | | | | |

Operating expenses: | | | | | | | | | | | | |

Selling, general and administrative | 26,952 | | | 10,405 | | | 48,972 | | | 20,519 | | | | | | |

Research and development | 2,535 | | | 1,867 | | | 5,409 | | | 2,795 | | | | | | |

Transaction expenses | 186 | | | — | | | 1,585 | | | — | | | | | | |

| Goodwill impairment | 35,252 | | | — | | | 35,252 | | | — | | | | | | |

Operating loss | (55,335) | | | (3,109) | | | (71,761) | | | (3,871) | | | | | | |

Interest expense | 3,554 | | | 1,849 | | | 7,109 | | | 3,709 | | | | | | |

Net decrease in fair value of derivatives | (199) | | | — | | | (1,462) | | | — | | | | | | |

| | | | | | | | | | | | |

| Other (income) expense | (26) | | | — | | | 4 | | | (1) | | | | | | |

Loss before taxes | (58,664) | | | (4,958) | | | (77,412) | | | (7,579) | | | | | | |

Income tax benefit | (1,820) | | | (1,783) | | | (1,743) | | | (1,967) | | | | | | |

Net loss | $ | (56,844) | | | $ | (3,175) | | | $ | (75,669) | | | $ | (5,612) | | | | | | |

| | | | | | | | | | | | |

Basic net loss per share | $ | (0.45) | | | $ | (0.03) | | | $ | (0.59) | | | $ | (0.05) | | | | | | |

Diluted net loss per share | $ | (0.45) | | | $ | (0.03) | | | $ | (0.59) | | | $ | (0.05) | | | | | | |

| | | | | | | | | | | | |

Weighted-average shares outstanding: | | | | | | | | | | | | |

Basic | 126,223,903 | | | 105,000,000 | | | 129,037,598 | | | 105,000,000 | | | | | | |

Diluted | 126,223,903 | | | 105,000,000 | | | 129,037,598 | | | 105,000,000 | | | | | | |

The accompanying notes to the consolidated financial statements are an integral part of these statements.

BIGBEAR.AI HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(unaudited; in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Three Months Ended June 30, 2022 |

| Common Stock | | Additional | | Treasury | | Accumulated | | Total stockholders’ |

| Shares | | Amount | | paid in capital | | stock | | deficit | | equity |

| As of March 31, 2022 | 125,603,424 | | | $ | 14 | | | $ | 257,602 | | | $ | (57,350) | | | $ | (150,215) | | | $ | 50,051 | |

| Net loss | — | | | — | | | — | | | — | | | (56,844) | | | (56,844) | |

| Equity-based compensation expense | — | | | — | | | 5,080 | | | — | | | — | | | 5,080 | |

| | | | | | | | | | | |

| Issuance of common stock as consideration for the acquisition of ProModel Corporation | 649,976 | | | — | | | 7,501 | | | — | | | — | | | 7,501 | |

| Exercise of warrants | 51 | | | — | | | 1 | | | — | | | — | | | 1 | |

| | | | | | | | | | | |

| As of June 30, 2022 | 126,253,451 | | | $ | 14 | | | $ | 270,184 | | | $ | (57,350) | | | $ | (207,059) | | | $ | 5,789 | |

| | | | | | | | | | | |

| Three Months Ended June 30, 2021 |

| Common Stock | | Additional | | Treasury | | Accumulated | | Total stockholders’ |

| Shares | | Amount | | paid in capital | | stock | | deficit | | equity |

| As of March 31, 2021 | 105,000,000 | | | $ | 11 | | | $ | 108,249 | | | $ | — | | | $ | (10,275) | | | $ | 97,985 | |

| Net loss | — | | | — | | | — | | | — | | | (3,175) | | | (3,175) | |

| Equity-based compensation expense | — | | | — | | | 31 | | | — | | | — | | | 31 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| As of June 30, 2021 | 105,000,000 | | | $ | 11 | | | $ | 108,280 | | | $ | — | | | $ | (13,450) | | | $ | 94,841 | |

| | | | | | | | | | | |

| Six Months Ended June 30, 2022 |

| Common Stock | | Additional | | Treasury | | Accumulated | | Total stockholders’ |

| Shares | | Amount | | paid in capital | | stock | | deficit | | equity |

| As of December 31, 2021 | 135,556,227 | | | $ | 14 | | | $ | 253,744 | | | $ | — | | | $ | (131,390) | | | $ | 122,368 | |

| Net loss | — | | | — | | | — | | | — | | | (75,669) | | | (75,669) | |

| Equity-based compensation expense | — | | | — | | | 8,938 | | | — | | | — | | | 8,938 | |

| Repurchase of shares as a result of Forward Share Purchase Agreements | (9,952,803) | | | — | | | — | | | (57,350) | | | — | | | (57,350) | |

| Issuance of common stock as consideration for the acquisition of ProModel Corporation | 649,976 | | | — | | | 7,501 | | | — | | | — | | | 7,501 | |

| Exercise of warrants | 51 | | | — | | | 1 | | | — | | | — | | | 1 | |

| | | | | | | | | | | |

| As of June 30, 2022 | 126,253,451 | | | $ | 14 | | | $ | 270,184 | | | $ | (57,350) | | | $ | (207,059) | | | $ | 5,789 | |

| | | | | | | | | | | |

| Six Months Ended June 30, 2021 |

| Common Stock | | Additional | | Treasury | | Accumulated | | Total stockholders’ |

| Shares | | Amount | | paid in capital | | stock | | deficit | | equity |

As of December 31, 2020(1) | 105,000,000 | | | $ | 11 | | | $ | 108,224 | | | $ | — | | | $ | (7,838) | | | $ | 100,397 | |

| Net loss | — | | | — | | | — | | | — | | | (5,612) | | | (5,612) | |

| Equity-based compensation expense | — | | | — | | | 56 | | | — | | | — | | | 56 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| As of June 30, 2021 | 105,000,000 | | | $ | 11 | | | $ | 108,280 | | | $ | — | | | $ | (13,450) | | | $ | 94,841 | |

| | | | | | | | | | | |

(1) The units of the Company prior to the Merger (as defined in Note A—Description of the Business) have been retroactively restated to reflect the exchange ratio established in the Merger (computed as 105,000,000 shares of Common Stock to 100 Company units).

The accompanying notes to the consolidated financial statements are an integral part of these statements.

BIGBEAR.AI HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited; in thousands)

| | | | | | | | | | | | | | | | |

| Successor | | | |

| Six Months Ended June 30, | | | | | |

| 2022 | | 2021 | | | | | |

Cash flows from operating activities: | | | | | | | | |

| Net loss | $ | (75,669) | | | $ | (5,612) | | | | | | |

Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | | | | | | | | |

Depreciation and amortization expense | 3,726 | | | 3,673 | | | | | | |

Amortization of debt issuance costs | 1,047 | | | 286 | | | | | | |

Equity-based compensation expense | 8,938 | | | 56 | | | | | | |

| Goodwill impairment | 35,252 | | | — | | | | | | |

Provision for doubtful accounts | 44 | | | — | | | | | | |

Deferred income tax expense (benefit) | (1,594) | | | (1,996) | | | | | | |

| | | | | | | | |

Net decrease in fair value of derivatives | (1,462) | | | — | | | | | | |

| | | | | | | | |

Changes in assets and liabilities: | | | | | | | | |

Decrease (increase) in accounts receivable | 758 | | | (1,580) | | | | | | |

(Increase) decrease in contract assets | (226) | | | 1,557 | | | | | | |

Decrease (increase) in prepaid expenses and other assets | 535 | | | (4,299) | | | | | | |

Increase in accounts payable | 874 | | | 2,251 | | | | | | |

(Decrease) increase in accrued liabilities | (2,509) | | | 5,227 | | | | | | |

(Decrease) increase in contract liabilities | (2,048) | | | 494 | | | | | | |

| | | | | | | | |

Increase in other liabilities | 338 | | | 275 | | | | | | |

Net cash (used in) provided by operating activities | (31,996) | | | 332 | | | | | | |

Cash flows from investing activities: | | | | | | | | |

Acquisition of businesses, net of cash acquired | (4,376) | | | (224) | | | | | | |

Purchases of property and equipment | (508) | | | (282) | | | | | | |

| | | | | | | | |

Net cash used in investing activities | (4,884) | | | (506) | | | | | | |

Cash flows from financing activities: | | | | | | | | |

| | | | | | | | |

| Repurchase of shares as a result of forward share purchase agreements | (100,896) | | | — | | | | | | |

Repayment of short-term borrowings | (2,312) | | | — | | | | | | |

| Payments for taxes related to net share settlement of equity awards | (4) | | | — | | | | | | |

| Repayment of term loan | — | | | (550) | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Net cash used in financing activities | (103,212) | | | (550) | | | | | | |

Net decrease in cash and cash equivalents and restricted cash | (140,092) | | | (724) | | | | | | |

Cash and cash equivalents and restricted cash at the beginning of period | 169,921 | | | 9,704 | | | | | | |

Cash and cash equivalents and restricted cash at the end of the period | $ | 29,829 | | | $ | 8,980 | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Supplemental schedule of non-cash investing and financing activities: | | | | | | | | |

| Issuance of common stock as consideration for the acquisition of ProModel Corporation | $ | 7,501 | | | $ | — | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Reconciliation of cash and cash equivalents and restricted cash: | June 30, 2022 | | December 31, 2021 | | | | | |

| Cash and cash equivalents | $ | 29,829 | | | $ | 68,900 | | | | | | |

| Restricted cash | — | | | 101,021 | | | | | | |

| Cash and cash equivalents and restricted cash at end of the period | $ | 29,829 | | | $ | 169,921 | | | | | | |

The accompanying notes to the consolidated financial statements are an integral part of these statements.

BIGBEAR.AI HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited; in thousands of U.S. dollars unless stated otherwise)

Note A—Description of the Business

BigBear.ai Holdings, Inc. (“BigBear.ai”, “BigBear.ai Holdings”, or the “Company”) is a leader in the use of Artificial Intelligence (“AI”) and Machine Learning (“ML”) for decision support. Our products and services are widely used by government agencies in the United States to support many of the nation’s most critical defense and intelligence capabilities. We also support several commercial customers by integrating our solutions to turn data into actionable information for operational decision making. Unless otherwise indicated, references to “we”, “us” and “our” refer collectively to BigBear.ai Holdings, Inc. and its consolidated subsidiaries. We operate in two reportable segments: Cyber & Engineering and Analytics.

On December 7, 2021, the previously announced merger (“Merger”) with GigCapital4, Inc. (“GigCapital4”) was consummated pursuant to the business combination agreement (the “Agreement”) dated June 4, 2021, as amended in July 2021 and December 2021, by and between GigCapital4 Merger Sub Corporation (the “Merger Sub”), a wholly owned subsidiary of GigCapital4, BigBear.ai Holdings, and Parent. Immediately prior to the stockholder vote for the Merger, GigCapital4 executed a series of Forward Share Purchase Agreements (“FPAs”) with certain investors (the “Investors”). Included within the FPAs was a provision that each of the Investors would not redeem their shares and instead would hold the shares for a period of up to three months following the consummation of the Merger, at which time they would have the right to sell the shares to the Company for $10.15 per share. During the three months ended March 31, 2022, the Company repurchased all 9,952,803 shares of its common stock at the Investors’ request (refer to Note L—Written Put Option for detail).

Upon the closing of the Merger, GigCapital4 was renamed to BigBear.ai, Holdings Inc., the U.S. Securities and Exchange Commission (“SEC”) registrant. As a result of the Merger, the Company received aggregate gross proceeds of $101,958 from GigCapital4’s trust account and PIPE Proceeds, and issued $200,000 of unsecured convertible notes that were convertible into 17,391,304 shares of the Company’s common stock at the initial Conversion Price of $11.50, subject to adjustment (refer to Note H—Debt for detail). Proceeds from the Merger were partially used to fund the $114,393 repayment of the Antares Loan and Merger transaction costs and other costs paid through the funds flow of $9,802, consisting of marketing, legal and other professional fees.

The Merger is accounted for as a reverse recapitalization in which GigCapital4 is treated as the acquired company. For accounting purposes, the Merger is treated as the equivalent of BigBear.ai Holdings issuing equity for the net assets of GigCapital4 followed by a recapitalization. A reverse recapitalization does not result in a new basis of accounting, and the consolidated financial statements of the combined entity (BigBear.ai) represent the continuation of the consolidated financial statements of BigBear.ai Holdings in many respects.

Immediately prior to the closing of the Merger, but following the consummation of GigCapital4’s domestication to a Delaware corporation, the authorized capital stock of GigCapital4 consisted of 501,000,000 shares, including (i) 500,000,000 shares of common stock and (ii) 1,000,000 shares of preferred stock. 135,566,227 shares of common stock and no shares of the preferred stock were outstanding as of December 31, 2021. At the effective time of the Merger, 100 units of BigBear.ai Holdings were cancelled and automatically deemed for all purposes to represent the Parent’s right to receive, in the aggregate, $75 million in cash and shares in GigCapital4, and Parent exchanged its 100 units of BigBear.ai Holdings for 105,000,000 shares of BigBear.ai’s common stock. In addition, 8,000,000 shares of PIPE financing were issued and 1,495,320 shares were issued to certain advisors. AE Industrial Partners, LP (“AE”) became the majority stockholder of the Company, via its ownership of PCISM Ultimate Holdings, LLC (subsequently renamed to BBAI Ultimate Holdings, LLC, “Parent”), following the close of the Merger (83.5%).

Note B—Summary of Significant Accounting Policies

Basis of Presentation

We prepared these consolidated financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information, the instructions to Form 10-Q and Article 10 of SEC Regulation S-X. Accordingly, they do not include all information and notes required by GAAP for complete financial statements. Amounts presented within the consolidated financial statements and accompanying notes are presented in thousands of U.S. dollars unless stated otherwise, except for percentages, units, shares, per unit, and per share amounts.

In the opinion of management, these consolidated financial statements reflect all adjustments that are of a normal recurring nature necessary for a fair presentation of our results of operations, financial condition, and cash flows for the interim periods presented.

BIGBEAR.AI HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited; in thousands of U.S. dollars unless stated otherwise)

The preparation of these consolidated financial statements requires us to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. We base these estimates on historical experience and on various other assumptions that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying amounts of assets and liabilities that are not readily apparent from other sources. Our actual results may differ materially from these estimates. Significant estimates inherent in the preparation of our consolidated financial statements include, but are not limited to, accounting for revenue and cost recognition; evaluation of goodwill; intangible assets; and other assets for impairment; income taxes; equity-based compensation; fair value measurements; and contingencies. We eliminate intercompany balances and transactions in consolidation.

The results of operations for the interim periods presented are not necessarily indicative of results to be expected for the full year or future periods. These consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2021.

Emerging Growth Company

Section 102(b)(1) of the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) exempts emerging growth companies from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standards. The JOBS Act provides that an emerging growth company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such an election to opt out is irrevocable. The Company has elected not to opt out of such extended transition period, which means that when a standard is issued or revised and it has different application dates for public or private companies, the Company, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard.

This may make comparison of the Company’s financial statements with another public company that is neither an emerging growth company nor an emerging growth company that has opted out of using the extended transition period difficult or impossible because of the potential differences in accounting standards used.

Recently Adopted Accounting Pronouncements

In October 2021, the FASB issued ASU No. 2021-08, Business Combinations (“ASC 805”), Accounting for Contract Assets and Contract Liabilities from Contracts with Customers (“ASU 2021-08”). Upon the issuance of ASU No. 2014-09, Revenue from Contracts with Customers (“ASC 606”), which provides a single comprehensive accounting model on revenue recognition for contracts with customers, stakeholders indicated that there are differing views on whether the concept of a performance obligation introduced by ASC 606 should be used to determine whether a contract liability is recognized in a business combination from revenue contracts. Before the adoption date of ASC 606, a liability for deferred revenue was generally recognized in an acquirer’s financial statements if it represented a legal obligation. The amendments in ASU 2021-08 address how to determine whether a contract liability is recognized by the acquirer in a business combination. Additionally, stakeholders raised questions about how to apply ASC 805 to contracts with a customer acquired in a business. Under current practice, the timing of payment for a revenue contract may subsequently affect the amount of post-acquisition revenue recognized by the acquirer. For example, if two revenue contracts with identical performance obligations are acquired but one contract is paid upfront before the acquisition and the other contract is paid over the contract term after the acquisition, the amount of revenue recognized by the acquirer after the business combination likely would differ between the two acquired contracts. The amendments in ASU 2021-08 resolve this inconsistency by providing specific guidance on how to recognize and measure acquired contract assets and contract liabilities from revenue contracts in a business combination. The new guidance will be effective for the years beginning after December 15, 2022. The Company prospectively adopted ASU 2021-08 as of January 1, 2022.

Note C—Business Combinations

ProModel Acquisition

On April 7, 2022, the Company’s subsidiary BigBear.ai, LLC acquired 100% of the equity interest in ProModel Corporation (“ProModel Corporation”), a leader in simulation-based predictive and prescriptive analytic software for process improvement enabling organizations to make better decisions, for approximately $16.0 million, subject to certain adjustments. This acquisition complements the Company’s previous acquisition of ProModel’s Government Services business, ProModel Government

BIGBEAR.AI HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited; in thousands of U.S. dollars unless stated otherwise)

Solutions Inc. (“ProModel Government Solutions”), which closed on December 21, 2020. The acquisition was funded through a combination of cash on hand and the issuance of 649,976 shares of the Company’s common stock. ProModel Corporation is aligned under the Company’s Analytics business segment.

The purchase agreement with the sellers of ProModel Corporation also stipulates that certain funds would be held in escrow (“Indemnity Escrow Deposit”, “Distribution Withholding Deposit”, and “Adjustment Escrow Deposit”), for the benefit of the seller. Pursuant to and subject to the terms and conditions of the Escrow Agreement, the Adjustment Escrow Amount of $200, the Distribution Withholding Escrow Amount of $100, and the Indemnity Escrow Amount of $100 shall be held in escrow until released in accordance with the purchase agreement and the Escrow Agreement.

The following table summarizes the preliminary fair value of the consideration transferred and the preliminary estimated fair values of the major classes of assets acquired and liabilities assumed as of the acquisition date.

| | | | | |

| April 7, 2022 |

| Cash paid | $ | 8,470 | |

| Equity issued | 7,501 | |

| Purchase consideration | $ | 15,971 | |

| Assets: | |

| Cash | $ | 4,094 | |

| Accounts receivable | 743 | |

| Prepaid expenses and other current assets | 1,600 | |

| Contract assets | 398 | |

| |

| Property and equipment | 83 | |

| Other non-current assets | 21 | |

| Intangible assets | 9,300 | |

| Total assets acquired | $ | 16,239 | |

| Liabilities: | |

| Accounts payable | 5 | |

| Accrued liabilities | 7,752 | |

| Contract liabilities | 1,555 | |

| Deferred tax liabilities | 1,736 | |

| Total liabilities acquired | $ | 11,048 | |

| Fair value of net identifiable assets acquired | 5,191 | |

| Goodwill | $ | 10,780 | |

The following table summarizes the intangible assets acquired by class: | | | | | |

| April 7, 2022 |

| Technology | $ | 3,500 | |

| Customer relationships | 5,800 | |

| Total intangible assets | $ | 9,300 | |

The acquired technology and customer relationship intangible assets have a weighted-average estimated useful lives of 7 years and 20 years, respectively.

The amounts above represent the current preliminary fair value estimates as the measurement period is still open as of June 30, 2022. The Company is finalizing the valuation analysis.

The fair value of the acquired technology was determined using the relief from royalty (“RFR”) method. The fair value of the acquired customer relationships was determined using the excess earnings method.

The acquisition was accounted for as a business combination, whereby the excess of the purchase consideration over the fair value of identifiable net assets was allocated to goodwill. The goodwill reflects the potential synergies and expansion of the Company’s

BIGBEAR.AI HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited; in thousands of U.S. dollars unless stated otherwise)

offerings across product lines and markets complementary to its existing products and markets. For tax purposes, the goodwill related to the acquisition is deductible.

Pro Forma Financial Data (Unaudited)

The following table presents the pro forma consolidated results of operations of BigBear.ai for the three and six-month periods ended June 30, 2022 and June 30, 2021 as though the acquisition of ProModel Corporation had been completed as of January 1, 2021.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | |

| 2022 | | 2021 | | 2022 | | 2021 | | | | |

Net revenue | $ | 37,613 | | | $ | 37,819 | | | $ | 75,248 | | | $ | 74,783 | | | | | |

| Net loss | (56,844) | | | (1,479) | | | (78,145) | | | (4,950) | | | | | |

| Transaction expenses | 186 | | | — | | | 1,585 | | | — | | | | | |

The amounts included in the pro forma information are based on the historical results and do not necessarily represent what would have occurred if all the business combinations had taken place as of January 1, 2021, nor do they represent the results that may occur in the future. Accordingly, the pro forma financial information should not be relied upon as being indicative of the results that would have been realized had the acquisition occurred as of the date indicated or that may be achieved in the future.

The Company incurred $186 and $1,585 of transaction expenses attributable to the acquisition of ProModel Corporation during the three and six months ended June 30, 2022.

Note D—Fair Value of Financial Instruments

Cash and cash equivalents, accounts receivable, contract assets, prepaid expenses and other current assets, accounts payable, short-term debt, including the current portion of long-term debt, accrued expenses, contract liabilities, and other current liabilities are reflected on the consolidated balance sheets at amounts that approximate fair value because of the short-term nature of these financial assets and liabilities.

Private warrants and written put options are valued using a modified Black-Scholes option pricing model (“OPM”), which is considered to be a Level 3 fair value measurement. See Note N—Warrants for information on the Level 3 inputs used to value the private warrants and Note L—Written Put Option for information on the Level 3 inputs used to value the written put options.

The table below presents the financial liabilities measured at fair value on a recurring basis:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

| | June 30, 2022 |

| Balance Sheet Caption | Level 1 | | Level 2 | | Level 3 | | Total |

| Private warrants | Other non-current liabilities | $ | — | | | $ | — | | | $ | 138 | | | $ | 138 | |

| Written put options | Derivative liabilities | — | | | — | | | — | | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | |

| | December 31, 2021 |

| Balance Sheet Caption | Level 1 | | Level 2 | | Level 3 | | Total |

| Private warrants | Other non-current liabilities | $ | — | | | $ | — | | | $ | 319 | | | $ | 319 | |

| Written put options | Derivative liabilities | — | | | — | | | 44,827 | | | 44,827 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

BIGBEAR.AI HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited; in thousands of U.S. dollars unless stated otherwise)

The changes in the fair value of the Level 3 liabilities are as follows:

| | | | | | | | | | | |

| Level 3 |

| Private warrants | | Written put options |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| December 31, 2021 | $ | 319 | | | $ | 44,827 | |

| | | |

| Changes in fair value | (138) | | | (1,281) | |

| Settlements | (43) | | | (43,546) | |

| June 30, 2022 | $ | 138 | | | $ | — | |

Note E—Goodwill

During the second quarter of the fiscal year ending December 31, 2022, the Company identified factors indicating that the fair value of both the Cyber & Engineering and Analytics reporting units may be less than their respective carrying amounts and performed a qualitative goodwill impairment assessment. These factors were related to a shift in the Federal Government’s focus to address immediate needs in Ukraine, causing a slowdown in the pace of contract awards. This resulted in lower revenues than anticipated during the current period and causing future revenue projections to be revised. As a result, the Company determined that a quantitative goodwill impairment assessment should be performed. The Company utilized a combination of the discounted cash flow (“DCF”) method of the Income Approach and the Market Approach. Under the Income Approach, the future cash flows of the Company’s reporting units were projected based on estimates of future revenues, gross margins, operating income, excess net working capital, capital expenditures, and other factors. The Company utilized estimated revenue growth rates and cash flow projections. The discount rates utilized in the DCF method were based on a weighted-average cost of capital (“WACC”) determined from relevant market comparisons and adjusted for specific reporting unit risks and capital structure. A terminal value estimated growth rate was applied to the final year of the projected period and reflected the Company’s estimate of perpetual growth. The Company then calculated the present value of the respective cash flows for each reporting unit to arrive at an estimate of fair value under the Income Approach. The Market Approach is comprised of the Guideline Public Company and the Guideline Transactions Methods. The Guideline Public Company Method focuses on comparing the Company to selected reasonably similar (or guideline) publicly traded companies. Under this method, valuation multiples are: (i) derived from the operating data of selected guideline companies; (ii) evaluated and adjusted based on the strengths and weaknesses of the Company relative to the selected guideline companies; and (iii) applied to the operating data of the Company to arrive at an indication of value. In the Guideline Transactions Method, consideration is given to prices paid in recent transactions that have occurred in the Company’s industry or in related industries. The Company then reconciled the estimated fair value of its reporting units to its total public market capitalization as of the valuation date. The carrying value of the Cyber & Engineering reporting unit exceeded its fair value and accordingly the Company recorded a non-tax-deductible goodwill impairment charge of $35,252, which was included within the consolidated statement of operations for the three and six months ended June 30, 2022. As of June 30, 2022, the estimated fair value of the Analytics reporting unit exceeded its carrying value by 8.3%. An increase in the WACC of approximately 1% or a reduction in the forecasted revenues of approximately 3% would result in an impairment of the goodwill within the Analytics reporting unit using the Income Approach.

The table below presents the changes in the carrying amount of goodwill by reporting unit:

| | | | | | | | | | | | | | | | | |

| | Cyber &

Engineering | | Analytics | | Total |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| As of December 31, 2021 | $ | 35,252 | | | $ | 56,384 | | | $ | 91,636 | |

| Goodwill arising from the ProModel Corporation acquisition | — | | | 10,780 | | | 10,780 | |

| Goodwill impairment | (35,252) | | | — | | | (35,252) | |

| | | | | |

| | | | | |

| As of June 30, 2022 | $ | — | | | $ | 67,164 | | | $ | 67,164 | |

Accumulated impairment losses to goodwill were $35,252 as of June 30, 2022 and are related to the Cyber & Engineering reporting unit.

BIGBEAR.AI HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited; in thousands of U.S. dollars unless stated otherwise)

Note F—Prepaid expenses and other current assets

The table below presents details on prepaid expenses and other current assets: | | | | | | | | | | | |

| June 30, 2022 | | December 31, 2021 |

| Prepaid expenses | $ | 4,732 | | | $ | 2,217 | |

| Prepaid insurance | 2,099 | | | 4,265 | |

Pre-contract costs(1) | 1,266 | | | 546 | |

| Total prepaid expenses and other current assets | $ | 8,097 | | | $ | 7,028 | |

(1) Costs incurred to fulfill a contract in advance of the contract being awarded are included in prepaid expenses and other current assets if we determine that those costs relate directly to a contract or to an anticipated contract that we can specifically identify and contract award is probable, the costs generate or enhance resources that will be used in satisfying performance obligations, and the costs are recoverable (referred to as pre-contract costs).

Pre-contract costs that are initially capitalized in prepaid assets and other current assets are generally recognized as cost of revenues consistent with the transfer of products or services to the customer upon the receipt of the anticipated contract. All other pre-contract costs, including start-up costs, are expensed as incurred. As of June 30, 2022 and December 31, 2021, $1,266 and $546 of pre-contract costs were included in prepaid expenses and other current assets, respectively.

Note G—Accrued Liabilities

The table below presents details on accrued liabilities:

| | | | | | | | | | | |

| |

| June 30, 2022 | | December 31, 2021 |

Payroll accruals | $ | 12,876 | | | $ | 9,011 | |

Accrued interest | 597 | | | 842 | |

| Other accrued expenses | 2,505 | | | 882 | |

Total accrued liabilities | $ | 15,978 | | | $ | 10,735 | |

Note H—Debt

The table below presents the Company’s debt balances:

| | | | | | | | | | | |

| |

| June 30, 2022 | | December 31, 2021 |

| Convertible Notes | $ | 200,000 | | | $ | 200,000 | |

| Bank of America Senior Revolver | — | | | — | |

| | | |

| | | |

| D&O Financing Loan | 1,921 | | | 4,233 | |

| Total debt | 201,921 | | | 204,233 | |

| Less: unamortized issuance costs | 8,659 | | | 9,636 | |

| Total debt, net | 193,262 | | | 194,597 | |

| Less: current portion | 1,921 | | | 4,233 | |

| Long-term debt, net | $ | 191,341 | | | $ | 190,364 | |

Bank of America Senior Revolver

On December 7, 2021 (the “Closing Date”), the Company entered into the senior credit agreement with Bank of America, N.A. (the “Bank of America Credit Agreement”), providing the Company with a $50.0 million senior secured revolving credit facility (the “Senior Revolver”). Proceeds from the Senior Revolver will be used to fund working capital needs, capital expenditures, and other general corporate purposes. The Senior Revolver matures on December 7, 2025 (the “Maturity Date”).

The Senior Revolver is secured by a pledge of 100% of the equity of certain of the Company’s wholly owned subsidiaries and a security interest in substantially all of the Company’s tangible and intangible assets. The Senior Revolver includes borrowing capacity available for letters of credit and for borrowings on same-day notice, referred to as the “swing loans.” Any issuance of letters of credit or making of a swing loan will reduce the amount available under the revolving credit facility. The Company may increase the commitments under the Senior Revolver in an aggregate amount of up to the greater of $18.8 million or 100% of

BIGBEAR.AI HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited; in thousands of U.S. dollars unless stated otherwise)

consolidated adjusted EBITDA plus any additional amounts so long as certain conditions, including compliance with the applicable financial covenants for such period, in each case on a pro forma basis, are satisfied.

Borrowings under the Senior Revolver bear interest, at the Company’s option, at:

(i)A Base Rate plus a Base Rate Margin of 2.00%. Base Rate is a fluctuating rate per annum equal to the higher of (a) the Federal Funds Rate plus 0.50%, (b) the prime rate of Bank of America, N.A., and (c) Bloomberg Short-Term Yield Index (“BSBY”) Rate plus 1.00%; or

(ii)The BSBY Rate plus a BSBY Margin of 1.00%.

The Base Rate Margin and BSBY Margin became subject to adjustment based on the Company’s Secured Net Leverage Ratio after March 31, 2022. The Company is also required to pay unused commitment fees and letter of credit fees under the Bank of America Credit Agreement.

The Bank of America Credit Agreement requires the Company to meet certain financial and other covenants. The Company was not in compliance with the Fixed Charge Coverage ratio requirement as of June 30, 2022, and as a result is currently unable to draw on the facility. The Company notified Bank of America N.A. of the covenant violation, and on August 9, 2022, entered into the First Amendment (the “Amendment”) to the Bank of America Credit Agreement, which, among other things, waived the requirement that the Company demonstrate compliance with the minimum Fixed Charge Coverage ratio provided for in the Credit Agreement for the quarter ended June 30, 2022. See Note T—Subsequent Events of the consolidated financial statements included in this Quarterly Report on Form 10-Q for additional information regarding the Amendment.

Based on current forecasts, management believes that it is reasonably likely that the Company may fail to meet the covenant requirements of the Bank of America Credit Agreement in future periods and therefore, may be unable to draw on the facility. Management performed a cash flow analysis to identify the Company’s projected approximate cash flow and liquidity needs for the next 12 months. Based on the Company’s projected cash flow and liquidity needs, we believe that our cash from operating activities generated from continuing operations during the year will be adequate for the next 12 months to meet our anticipated uses of cash flow, including payroll obligations, working capital, operating lease obligations, capital expenditures and debt service costs, and it is considered unlikely that the Company would require access to draw funds on the Senior Revolver in the foreseeable future.

As of June 30, 2022, the Company had not drawn on the Line of Credit. Unamortized debt issuance costs of $476 as of June 30, 2022, are recorded on the balance sheet and are presented in other non-current assets.

Convertible Notes

Upon consummation of the Merger, the Company issued $200.0 million of unsecured convertible notes (the “Convertible Notes”) to certain investors. The Convertible Notes bear interest at a rate of 6.0% per annum, payable semi-annually, and not including any interest payments that are settled with the issuance of shares, were initially convertible into 17,391,304 shares of the Company’s common stock at an initial Conversion Price of $11.50. The Conversion Price is subject to adjustments. On May 29, 2022, pursuant to the Convertible Note indenture, the conversion rate applicable to the Convertible Notes was adjusted to 94.2230 (previously 86.9565) shares of common stock per $1,000 principal amount of Convertible Notes because the average of the daily volume-weighted average price of the common stock during the preceding 30 trading days was less than $10.00 (the “Conversion Rate Reset”). After giving effect to the Conversion Rate Reset, the Conversion Price is $10.61 and the Convertible Notes are convertible into 18,844,600 shares, not including any interest payments that are settled with the issuance of shares. The Convertible Note financing matures on December 15, 2026.

The Company may, at its election, force conversion of the Convertible Notes after December 15, 2022 and prior to October 7, 2026 if the trading price of the Company’s common stock exceeds 130% of the conversion price for 20 out of the preceding 30 trading days and the 30-day average daily trading volume ending on, and including, the last trading day of the immediately preceding calendar quarter is greater than or equal to $3.0 million for the first two years after the initial issuance of the Convertible Notes and $2.0 million thereafter. Upon such conversion, the Company will be obligated to pay all regularly scheduled interest payments, if any, due on the converted Convertible Notes on each interest payment date occurring after the conversion date for such conversion to, but excluding, the maturity date (such interest payments, an “Interest Make-Whole Payments”). In the event that a holder of the Convertible Notes elects to convert the Convertible Notes (a) prior to December 15, 2024, the Company will be obligated to pay an amount equal to twelve months of interest or (b) on or after December 15, 2024

BIGBEAR.AI HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited; in thousands of U.S. dollars unless stated otherwise)

but prior to December 15, 2025, any accrued and unpaid interest plus any remaining amounts that would be owed up to, but excluding, December 15, 2025. The Interest Make-Whole Payments will be payable in cash or shares of the common stock at the Company’s election, as set forth in the Indenture.

Following certain corporate events that occur prior to the maturity date or if the Company exercises its mandatory conversion right in connection with such corporate events, the conversion rate will be increased in certain circumstances for a holder who elects, or has been forced, to convert its Convertible Notes in connection with such corporate events.

If a Fundamental Change (as defined in the Convertible Note indenture) occurs prior to the maturity date, holders of the Convertible Notes will have the right to require the Company to repurchase all or any portion of their Convertible Notes in principal amounts of one thousand dollars or an integral multiple thereof, at a repurchase price equal to the principal amount of the Convertible Notes to be repurchased, plus accrued and unpaid interest to, but excluding, the repurchase date.

The Convertible Notes require the Company to meet certain financial and other covenants. As of June 30, 2022, the Company was in compliance with all covenants.

On May 29, 2022, pursuant to the conversion rate adjustment provisions in the Convertible Note indenture, the Conversion Price was adjusted to $10.61 (or 94.2230 shares of common stock per one thousand dollars of principal amount of Convertible Notes). Subsequent to the adjustment, the Convertible Notes are convertible into 18,844,600 shares, not including any interest payments that are settled with the issuance of shares.

As of June 30, 2022, the Company has an outstanding balance of $200.0 million related to the Convertible Notes, which is recorded on the balance sheet net of approximately $8.7 million of unamortized debt issuance costs.

D&O Financing Loan

On December 8, 2021, the Company entered into a $4,233 loan (the “D&O Financing Loan”) with AFCO Credit Corporation to finance the Company’s directors and officers insurance premium. The D&O Financing Loan has an interest rate of 1.50% per annum and a maturity date of December 8, 2022.

Note I—Leases

The Company is obligated under operating leases for certain real estate and office equipment assets. Certain leases contained predetermined fixed escalation of minimum rents at rates ranging from 2.5% to 5.4% per annum and renewal options that could extend certain leases to up to an additional five years.

Note J—Income Taxes

The table below presents the effective income tax rate for the following periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | | | | |

| 2022 | | 2021 | | 2022 | | 2021 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Effective tax rate | 3.1 | % | | 36.0 | % | | 2.3 | % | | 26.0 | % | | | | | |

The Company was taxed as a corporation for federal, state, and local income tax purposes for the three and six months ended June 30, 2022 and as a limited liability company which elected to be taxed as a corporation for federal, state, and local income tax purposes for the three and six months ended June 30, 2021. The effective tax rate for the three and six months ended June 30, 2022 differs from the U.S. federal income tax rate of 21.0% primarily due to state and local income taxes, permanent differences between book and taxable income, certain discrete items and the change in valuation allowance primarily resulting from the ProModel Corporation acquisition. The effective tax rate for the three and six months ended June 30, 2021 differs from the U.S. federal income tax rate of 21.0% primarily due to non-deductible transaction expenses, offset by state and local corporate income taxes.

BIGBEAR.AI HOLDINGS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited; in thousands of U.S. dollars unless stated otherwise)

Note K—Commitments and Contingencies

Contingencies in the Normal Course of Business

Under certain contracts with the U.S. government and certain governmental entities, contract costs, including indirect costs, are subject to audit by and adjustment through negotiation with governmental representatives. Revenue is recorded in amounts expected to be realized on final settlement of any such audits.

Legal Proceedings

The Company is subject to litigation, claims, investigations and audits arising from time to time in the ordinary course of business. Although legal proceedings are inherently unpredictable, the Company believes that it has valid defenses with respect to any matters currently pending against the Company and intends to defend itself vigorously. The outcome of these matters, individually and in the aggregate, is not expected to have a material impact on the Company’s consolidated balance sheets, consolidated statements of operations, or cash flows

Note L—Written Put Option

Immediately prior to the stockholder vote for the Merger, GigCapital4 executed a series of FPAs with Highbridge Tactical Credit Master Fund. L.P. and Highbridge SPAC Opportunity Fund, L.P. (the “Highbridge Investors”), Tenor Opportunity Master Fund Ltd. (“Tenor”), and Glazer Capital, LLC and Meteora Capital, LLC (the “Glazer Investors”, together with the Highbridge Investors and Tenor, the “Investors”). The FPAs provide that each of the Investors would not redeem their shares and instead would hold the shares for a period of up to three months following the consummation of the Merger, at which time they would have the right to sell the shares to the Company for $10.15 per share (the “Written Put Option”). The Investors had the right to sell shares on the open market before the end of the three-month period provided that the share price was at least $10.00 per share. If the Investors sold any shares in the open market within the first month of the three-month period and at a price greater than $10.05 per share, the Company would pay the Investors $0.05 per share sold.

The following table indicates the aggregate number of shares of common stock subject to the FPAs by each Investor:

| | | | | |

| December 6, 2021 |

| Highbridge Investors | 2,453,195 |

| Tenor | 2,499,608 |

| Glazer Investors | 5,000,000 |

| Total shares | 9,952,803 |