Benson Hill, Inc. (NYSE: BHIL, the “Company” or “Benson Hill”),

a seed innovation company, announced that, following stockholder

approval at the Company’s annual meeting held this morning, its

board of directors (the “Board”) has approved a reverse stock split

of the Company’s common stock, par value $0.0001 per share (the

“Common Stock”), at a ratio of one-for-thirty five (1-for-35) (the

“Reverse Stock Split”). The Company anticipates that the Reverse

Stock Split will take effect at 4:01 p.m. Eastern Time/3:01 p.m.

Central Time today (the “Effective Time”) and will be reflected in

the market at the start of trading on the New York Stock Exchange

(“NYSE”) tomorrow, Friday, July 19, 2024, on a split-adjusted

basis. The Company’s shares will continue to trade on the NYSE

under the symbol “BHIL” under a new CUSIP number (082490202). The

Company’s publicly traded warrants will continue to be traded

over-the-counter under the symbol BHILW under the same CUSIP number

(082490111).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240718626604/en/

Benson Hill Announces one-for-thirty five

(1-for-35) Reverse Stock Split following stockholder approval at

the Company’s annual meeting held this morning. (Graphic: Business

Wire)

The Reverse Stock Split is being implemented, in part, to enable

the Company to regain compliance with the continued listing

requirements of the NYSE, which require, among other things, that

the average closing price of the Common Stock for any 30

consecutive trading-day period not fall below $1.00 per share.

Once the Reverse Stock Split is implemented, each thirty five

(35) outstanding shares of pre-split Common Stock will be

automatically combined and reclassified into one (1) share of

post-split Common Stock. The Company anticipates that the Reverse

Stock Split will likely increase the Common Stock’s per share stock

price by roughly the same factor. Following the Effective Time, as

a result of the Reverse Stock Split the total number of shares of

Common Stock issued and outstanding will be reduced from

approximately 213 million to approximately 6 million. The Reverse

Stock Split will not change the number of authorized shares of

Common Stock, the terms of the Common Stock, or the relative voting

power of the Company’s stockholders. The Reverse Stock Split does

not otherwise affect the Company’s business, operations, or

reporting requirements with the Securities and Exchange Commission

(the “SEC”).

No fractional shares will be issued in connection with the

Reverse Stock Split. In lieu of issuing fractional shares, the

Company will pay, or cause to be paid, to each stockholder who

otherwise would have been entitled to a fraction of a share an

amount in cash (without interest or deduction) equal to the closing

price of the Common Stock on July 18, 2024, as reported on the

NYSE, multiplied by the fractional share amount.

Following the Effective Time, the number of shares of Common

Stock issuable upon exercise or vesting of outstanding equity

awards, options and warrants, and the per share exercise or

purchase price related thereto, if any, will be equitably adjusted

in accordance with the terms of such securities and applicable

equity incentive plans.

All shares of Common Stock are held in uncertificated form. As a

result, registered stockholders are not required to take any action

to receive post-Reverse Stock Split shares. Stockholders owning

shares through an account at a brokerage firm, bank, dealer,

custodian or other similar organization acting as nominee will have

their positions automatically adjusted to reflect the Reverse Stock

Split, subject to such broker’s particular processes, and likewise

will not be required to take any action in connection with the

Reverse Stock Split.

For additional information regarding the Reverse Stock Split,

investors may refer to the Company’s Definitive Proxy Statement

filed with the SEC on June 14, 2024, as amended or supplemented,

which is available on the SEC’s website at www.sec.gov.

About Benson Hill

Benson Hill is a seed innovation company that unlocks nature’s

genetic diversity in soy quality traits through a combination of

its proprietary genetics, its AI-driven CropOS® technology

platform, and its Crop Accelerator. Benson Hill collaborates with

strategic partners to create value throughout the agribusiness

supply chain to meet the demand for better feed, food, and fuel.

For more information, visit bensonhill.com or on X, formerly known as Twitter,

at @bensonhillinc.

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release may be considered

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements generally relate to future events or the Company’s

future financial or operating performance and may be identified by

words such as “may,” “should,” “expect,” “intend,” “will,”

“estimate,” “anticipate,” “believe,” “predict,” or similar words.

Forward-looking statements include statements relating to

management’s expectations, hopes, beliefs, intentions or strategies

regarding the future. In addition, any statements that refer to

projections, forecasts or other characterizations of future events

or circumstances, including any underlying assumptions, are

forward-looking statements. Forward-looking statements are based

upon assumptions made by the Company as of the date hereof and are

subject to risks, uncertainties, and other factors that could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements. Forward-looking statements in

this press release include, among other things, statements

regarding: the Reverse Stock Split and its anticipated impacts and

benefits, including the expectation that it will increase the per

share trading price of the Company’s common stock in a manner

sufficient for the Company to regain compliance with the NYSE’s

minimum share price requirement; expectations regarding the

timeline to implement the Reverse Stock Split; the anticipated

impact of the Reverse Stock Split on the Company’s outstanding

equity awards, options and warrants; and any implication that the

Company will be able to maintain compliance with the NYSE’s other

continued listing standards. Factors that may cause actual results

to differ materially from current expectations include, but are not

limited to: the risk that the Reverse Stock Split will fail to

accomplish its anticipated results, including by failing to

increase the per share trading price of the Company’s common stock

for a sufficient period of time for the Company to regain

compliance with the NYSE’s minimum share price requirement; risks

that the Reverse Stock Split may not be implemented on the

Company’s expected timeline; ongoing risks that Company may fail to

comply with other NYSE continued listing requirements; risks

relating to the proper and timely execution of the Reverse Stock

Split by the Company and various third parties, including the

Company’s transfer agent; and other risks and uncertainties set

forth in the sections entitled “Risk Factors” and “Cautionary Note

Regarding Forward-Looking Statements” in our Annual Report on Form

10-K for the year ended December 31, 2023, which is available on

the SEC's website at www.sec.gov.

There may be additional risks about which the Company is presently

unaware or that the Company currently believes are immaterial that

could also cause actual results to differ from those contained in

the forward-looking statements. The reader should not place undue

reliance on forward-looking statements, which speak only as of the

date they are made. The Company expressly disclaims any duty to

update these forward-looking statements, whether as a result of new

information, future events or otherwise, except as otherwise

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240718626604/en/

Investors: Tana Murphy: (314) 579-3184 /

investors@bensonhill.com Media: Christi Dixon: (636) 359-0797 /

cdixon@bensonhill.com

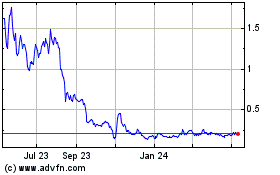

Benson Hill (NYSE:BHIL)

Historical Stock Chart

From Oct 2024 to Nov 2024

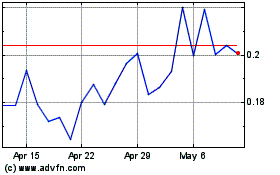

Benson Hill (NYSE:BHIL)

Historical Stock Chart

From Nov 2023 to Nov 2024