UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2024

Commission File Number: 001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th floor, Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil.

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

Contents

| Declaration of the officers on the interim condensed individual and consolidated financial statements |

3 |

| Declaration of the officers on the independent auditor’s report |

4 |

| Summary report of the statutory audit committee |

5 |

| Independent auditor report |

6 |

| Statements of financial position |

8 |

| Statements of operations |

10 |

| Statements of comprehensive income |

12 |

| Statements of changes in equity |

13 |

| Statements of cash flows |

14 |

| Statements of value added |

15 |

| Notes to the interim condensed individual and consolidated

financial statements |

16 |

| | |

| |  |

| 2 | |

|

AZUL

S.A.

Declaration of the officers

September 30, 2024 |

| |

|

Declaration of the officers on

the interim condensed individual and consolidated financial statements

In accordance with item VI of article 27 of CVM Resolution

No. 80, of March 29, 2022, the Board of Directors declares that it reviewed, discussed and agreed with the interim condensed individual

and consolidated financial statements for the three and nine months ended September 30, 2024.

Barueri, November 13, 2024.

John Peter Rodgerson

CEO

Alexandre Wagner Malfitani

Vice President of Finance and Investor Relations

Antonio Flavio Torres Martins Costa

Technical Vice President

Abhi Manoj Shah

Vice President of Revenue

| | |

| |  |

| 3 | |

|

AZUL

S.A.

Declaration of the officers

September 30, 2024 |

| |

|

Directors' statement on the independent

auditor's report

In accordance with item V of article 27 of CVM Resolution

No. 80, of March 29, 2022, the Board of Directors declares that it reviewed, discussed and agreed with the opinion expressed in the independent

auditor's report of the interim condensed individual and consolidated financial statements relating to for the three and nine months ended

September 30, 2024.

Barueri, November 13, 2024.

John Peter Rodgerson

CEO

Alexandre Wagner Malfitani

Vice President of Finance and Investor Relations

Antonio Flavio Torres Martins Costa

Technical Vice President

Abhi Manoj Shah

Vice President of Revenue

| | |

| |  |

| 4 | |

|

AZUL

S.A.

Summary report of the statutory

audit committee

September 30, 2024

|

| |

|

Opinion of the statutory audit

committee

In compliance with the legal provisions, the Statutory

Audit Committee declares that it has reviewed, discussed and agreed to the reviewed the management report and the interim condensed individual

and consolidated financial statements for the three and nine months ended September 30, 2024 independent auditor's reports issued by Grant

Thornton Auditores Independentes Ltda. recommending its approval to the Board of Directors.

Barueri, November 13, 2024.

Sergio Eraldo de Salles Pinto

Member, Coordinator of the Audit Committee and Financial

Specialist

Gilberto Peralta

Member of the Audit Committee

Renata Faber Rocha Ribeiro

Member of the Audit Committee

| | |

| |  |

| 5 | |

Independent auditor's report on review of interim financial

information

|

Grant

Thornton Auditores

Independentes Ltda.

Av. Eng. Luiz Carlos Berrini, 105 -

12o andar, Itaim Bibi - São Paulo (SP) Brasil

T +55

11 3886-5100

www.grantthornton.com.br

|

To the Shareholders, Board of Directors, and Management

of

Azul S.A.

São Paulo – SP

Introduction

We have reviewed the accompanying individual

and consolidated interim financial information of Azul S.A.(the Company), comprised in the Quarterly Information Form for the quarter

ended September 30, 2024, comprising the balance sheet as of September 30, 2024, and the respective statements of income and of comprehensive

income for the three and nine-month periods then ended and of changes in shareholders’ equity and of cash flows for the period of

nine months then ended, including the footnotes.

Management is responsible for the preparation

of the individual and consolidated interim financial information in accordance with NBC TG 21 – Interim Financial Reporting and

with the international standard IAS 34 – Interim Financial Reporting, as issued by the International Accounting Standards Board

(IASB), such as for the presentation of these information in accordance with the standards issued by the Brazilian Securities and Exchange

Commission, applicable to the preparation of interim financial information. Our responsibility is to express a conclusion on this interim

financial information based on our review.

Review scope

We conducted our review in accordance with

the Brazilian and International standards on reviews of interim information (NBC TR 2410 – Review of Interim Financial Information

Performed by the Independent Auditor of the Entity and ISRE 2410 – Review of Interim Financial Information Performed by the Independent

Auditor of the Entity, respectively). A review of interim financial information consists of making inquiries, primarily of persons responsible

for financial and accounting matters, and applying analytical and other review procedures. A review is significantly less in scope than

an audit conducted in accordance with Brazilian and International Standards on Auditing and consequently does not enable us to obtain

assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an

audit opinion.

Conclusion on the individual

and consolidated interim financial information

Based on our review, nothing has come to our

attention that causes us to believe that the individual and consolidated interim financial information included in the quarterly information

form referred to above has not been prepared, in all material respects, in accordance with NBC TG 21 and IAS 34 applicable to the preparation

of interim financial information and presented in accordance with the standards issued by the Brazilian Securities and Exchange Commission.

Other matters

Statements of value added

The quarterly information referred to above

includes the individual and consolidated statements of value added for the nine months period ended September 30, 2024, prepared under

the responsibility of the Company's management and presented as supplementary information for the purposes of IAS 34. These statements

were submitted to the same review procedures in conjunction with the review of the Company's interim financial information to conclude

they are reconciliated to the interim financial information and to the accounting records, as applicable, and whether the structure and

content are in accordance with the criteria established in the NBC TG 09 - Statement of Value Added.Based on our review, nothing has come

to our attention that causes us to believe that the accompanying statements of value added were not prepared, in all material respects,

in accordance with the criteria defined in that standard and consistently in relation to the individual and consolidated interim financial

information taken as a whole.

Audit and review of values

corresponding to the comparative year and period

The amounts corresponding to the year ended

December 31, 2023, and the three- and nine-month periods ending September 30, 2023, presented for comparison purposes were, respectively,

audited and reviewed by another independent auditor, whose reports on the audit and reviews were, respectively, issued on April 12, 2024,

and December 07, 2023, without modifications.

São Paulo, November 13, 2024

Grant Thornton Auditores Independentes Ltda.

CRC 2SP-025.583/O-1

Élica Daniela da Silva Martins

Accountant CRC 1SP-223.766/O-0

|

AZUL

S.A.

Statements of financial position

September 30, 2024 and December

31, 2023

(In thousands of Brazilian reais

– R$)

|

| |

|

| |

|

Parent

company |

Consolidated |

| Assets |

Note |

September

30, 2024 |

December

31, 2023 |

September

30, 2024 |

December

31, 2023 |

| |

|

|

|

|

| Current

assets |

|

| |

| Cash and

cash equivalents |

5 |

1,759 |

2,809 |

1,082,155 |

1,897,336 |

| Short-term

investments |

6 |

- |

- |

56,980 |

- |

| Accounts

receivable |

7 |

- |

- |

1,356,737 |

1,109,408 |

| Aircraft

sublease |

8 |

- |

- |

- |

14,592 |

| Inventories |

9 |

- |

- |

1,026,505 |

799,208 |

| Deposits |

10 |

- |

7,802 |

596,415 |

515,692 |

| Taxes

recoverable |

11 |

56 |

4,984 |

221,546 |

219,433 |

| Derivative

financial instruments |

23 |

- |

- |

- |

21,909 |

| Related

parties |

29 |

916,240 |

216,388 |

- |

- |

| Advances

to suppliers |

12 |

- |

- |

194,608 |

221,051 |

| Other

assets |

|

5,143 |

2,079 |

476,205 |

245,518 |

| Total

current assets |

|

923,198 |

234,062 |

5,011,151 |

5,044,147 |

| |

| Non-current

assets |

|

| |

| Long-term

investments |

6 |

- |

- |

966,819 |

780,312 |

| Aircraft

sublease |

8 |

- |

- |

- |

16,210 |

| Deposits |

10 |

- |

70 |

2,220,211 |

1,777,803 |

| Related

parties |

29 |

1,591,305 |

1,578,332 |

- |

- |

| Other

assets |

|

- |

- |

518,016 |

143,781 |

| Investments |

14 |

759,569 |

760,782 |

- |

- |

| Property

and equipment |

15 |

- |

- |

2,973,462 |

2,295,851 |

| Right-of-use

assets |

16 |

- |

- |

10,195,226 |

9,011,558 |

| Intangible

assets |

17 |

- |

- |

1,519,266 |

1,463,247 |

| Total

non-current assets |

|

2,350,874 |

2,339,184 |

18,393,000 |

15,488,762 |

| |

|

|

|

|

| Total

assets |

|

3,274,072 |

2,573,246 |

23,404,151 |

20,532,909 |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

| | |

| |  |

| 8 | |

|

AZUL

S.A.

Statements of financial position

September 30, 2024 and December

31, 2023

(In thousands of Brazilian reais

– R$)

|

| |

|

| |

|

Parent

company |

Consolidated |

| Liabilities

and equity |

Note |

September

30, 2024 |

December

31, 2023 |

September

30, 2024 |

December

31, 2023 |

| |

| Current

liabilities |

|

|

|

|

|

| |

| Loans

and financing |

18 |

144,026 |

- |

1,560,684 |

1,100,051 |

| Reverse

factoring |

22 |

- |

- |

49,971 |

290,847 |

| Leases |

19 |

873,979 |

216,388 |

4,793,423 |

3,687,392 |

| Convertible

debt instruments |

20 |

69,019 |

25,807 |

69,019 |

25,807 |

| Accounts

payable |

21 |

49,122 |

10,651 |

3,703,328 |

2,277,841 |

| Airport

taxes and fees |

24 |

- |

- |

691,833 |

588,404 |

| Air traffic

liability and loyalty program |

25 |

- |

- |

5,813,008 |

5,205,876 |

| Salaries

and benefits |

26 |

3,015 |

2,344 |

564,330 |

474,797 |

| Taxes

payable |

27 |

733 |

506 |

168,854 |

142,168 |

| Derivative

financial instruments |

23 |

- |

- |

117,416 |

68,905 |

| Provisions |

28 |

- |

- |

662,549 |

736,430 |

| Related

parties |

29 |

150 |

52,129 |

- |

- |

| Other

liabilities |

|

- |

- |

327,473 |

150,362 |

| Total

current liabilities |

|

1,140,044 |

307,825 |

18,521,888 |

14,748,880 |

| |

| Non-current

liabilities |

|

|

|

|

|

| |

| Loans

and financing |

18 |

- |

- |

10,965,989 |

8,598,861 |

| Leases |

19 |

1,467,030 |

1,443,351 |

12,977,520 |

11,459,019 |

| Convertible

debt instruments |

20 |

1,171,121 |

1,175,803 |

1,171,121 |

1,175,803 |

| Accounts

payable |

21 |

105,672 |

119,841 |

1,199,235 |

1,320,927 |

| Airport

taxes and fees |

24 |

- |

- |

747,952 |

1,171,679 |

| Taxes

payable |

27 |

- |

- |

78,026 |

112,287 |

| Derivative

financial instruments |

23 |

- |

- |

- |

840 |

| Deferred

income tax and social contribution |

13 |

- |

39,526 |

- |

39,526 |

| Provisions |

28 |

42 |

30 |

2,967,835 |

2,404,423 |

| Related

parties |

29 |

813,332 |

683,763 |

- |

- |

| Provision

for loss on investment |

14 |

24,612,826 |

20,130,955 |

- |

- |

| Other

liabilities |

|

- |

- |

810,580 |

828,512 |

| Total

non-current liabilities |

|

28,170,023 |

23,593,269 |

30,918,258 |

27,111,877 |

| |

| Equity |

30 |

|

|

|

|

| |

| Issued

capital |

|

2,315,628 |

2,314,821 |

2,315,628 |

2,314,821 |

| Advance

for future capital increase |

|

- |

789 |

- |

789 |

| Capital

reserve |

|

2,055,462 |

2,029,610 |

2,055,462 |

2,029,610 |

| Treasury

shares |

|

(4,334) |

(9,041) |

(4,334) |

(9,041) |

| Other

comprehensive income |

|

3,106 |

3,106 |

3,106 |

3,106 |

| Accumulated

losses |

|

(30,405,857) |

(25,667,133) |

(30,405,857) |

(25,667,133) |

| |

(26,035,995) |

(21,327,848) |

(26,035,995) |

(21,327,848) |

| |

| Total

liabilities and equity |

|

3,274,072 |

2,573,246 |

23,404,151 |

20,532,909 |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

| | |

| |  |

| 9 | |

|

AZUL

S.A.

Statements of operations

Periods the three and nine months

ended September 30, 2024 and 2023

(In thousands of Brazilian reais – R$, except

basic and diluted loss per share)

|

| |

|

| |

|

Parent

company |

| |

Three-month

periods ended |

Nine-month

periods ended |

| |

Note |

September

30, 2024 |

September

30, 2023 |

September

30, 2024 |

September

30, 2023 |

| |

| Administrative

expenses |

|

(15,639) |

(18,591) |

(44,952) |

(44,410) |

| Other

income (expenses), net |

|

602 |

(46) |

470 |

71,668 |

| |

| |

34 |

(15,037) |

(18,637) |

(44,482) |

27,258 |

| |

| Equity |

14 |

372,113 |

(1,428,795) |

(4,516,661) |

(1,883,707) |

| |

| Operating

profit (loss) |

|

357,076 |

(1,447,432) |

(4,561,143) |

(1,856,449) |

| |

| |

| Financial

income |

|

615 |

1,331 |

3,234 |

3,160 |

| Financial

expenses |

|

(82,309) |

(411,375) |

(225,508) |

(538,411) |

| Derivative

financial instruments, net |

|

(183,050) |

304,672 |

174,121 |

34,835 |

| Foreign

currency exchange, net |

|

28,854 |

(62,094) |

(168,954) |

29,246 |

| |

| Financial

result |

35 |

(235,890) |

(167,466) |

(217,107) |

(471,170) |

| |

| |

| Profit (loss)

before income IR and CSLL |

|

121,186 |

(1,614,898) |

(4,778,250) |

(2,327,619) |

| |

Deferred income tax and social contribution |

13 |

- |

- |

39,526 |

- |

| |

| Net

profit (loss) for the period |

|

121,186 |

(1,614,898) |

(4,738,724) |

(2,327,619) |

| |

| Basic

earnings (loss) per common share – R$ |

31 |

- |

(0.06) |

(0.18) |

(0.09) |

| Diluted

earnings (loss) per common share – R$ |

31 |

- |

(0.06) |

(0.18) |

(0.09) |

| Basic

earnings (loss) per preferred share – R$ |

31 |

0.35 |

(4.64) |

(13.63) |

(6.69) |

| Diluted

earnings (loss) per preferred share – R$ |

31 |

0.35 |

(4.64) |

(13.63) |

(6.69) |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

| | |

| |  |

| 10 | |

|

AZUL

S.A.

Statements of operations

Periods the three and nine months

ended September 30, 2024 and 2023

(In thousands of Brazilian reais – R$, except

basic and diluted loss per share)

|

| |

|

| |

|

| |

|

Consolidated |

| |

Three-month

periods ended |

Nine-month

periods ended |

| |

Note |

September

30, 2024 |

September

30, 2023 |

September

30, 2024 |

September

30, 2023 |

| |

| Passenger

revenue |

|

4,762,755 |

4,579,198 |

12,978,859 |

12,687,363 |

| Other

revenues |

|

366,842 |

337,242 |

1,001,895 |

961,600 |

| Total

revenue |

33 |

5,129,597 |

4,916,440 |

13,980,754 |

13,648,963 |

| |

| Cost of

services |

34 |

(3,539,660) |

(3,794,289) |

(10,387,888) |

(11,277,114) |

| |

| Gross

profit |

|

1,589,937 |

1,122,151 |

3,592,866 |

2,371,849 |

| |

| |

| Selling

expenses |

|

(249,814) |

(215,976) |

(664,912) |

(586,742) |

| Administrative

expenses |

|

(162,694) |

(180,733) |

(437,004) |

(370,620) |

| Other

income (expenses), net |

|

(150,250) |

(53,614) |

(221,857) |

(273,401) |

| |

34 |

(562,758) |

(450,323) |

(1,323,773) |

(1,230,763) |

| |

| Operating

profit |

|

1,027,179 |

671,828 |

2,269,093 |

1,141,086 |

| |

| |

| Financial

income |

|

56,535 |

39,433 |

152,453 |

143,883 |

| Financial

expenses |

|

(1,320,716) |

(1,883,867) |

(3,878,968) |

(4,339,550) |

| Derivative

financial instruments, net |

|

(305,137) |

466,360 |

53,303 |

(44,228) |

| Foreign

currency exchange, net |

|

664,010 |

(908,652) |

(3,373,158) |

771,190 |

| Financial

result |

35 |

(905,308) |

(2,286,726) |

(7,046,370) |

(3,468,705) |

| |

| |

| Profit (loss)

before income IR and CSLL |

|

121,871 |

(1,614,898) |

(4,777,277) |

(2,327,619) |

| |

Current income tax and social contribution |

13 |

(685) |

- |

(973) |

- |

| Deferred

income tax and social contribution |

13 |

- |

- |

39,526 |

- |

| |

| Net

profit (loss) for the period |

|

121,186 |

(1,614,898) |

(4,738,724) |

(2,327,619) |

| |

| Basic

earnings (loss) per common share – R$ |

31 |

- |

(0.06) |

(0.18) |

(0.09) |

| Diluted

earnings (loss) per common share – R$ |

31 |

- |

(0.06) |

(0.18) |

(0.09) |

| Basic

earnings (loss) per preferred share – R$ |

31 |

0.35 |

(4.64) |

(13.63) |

(6.69) |

| Diluted

earnings (loss) per preferred share – R$ |

31 |

0.35 |

(4.64) |

(13.63) |

(6.69) |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

| | |

| |  |

| 11 | |

|

AZUL

S.A.

Statements of comprehensive (loss) income

Periods the three and nine months ended September 30,

2024 and 2023

(In thousands of Brazilian reais

– R$)

|

| |

|

| |

Parent

company and Consolidated |

| |

Three-month

periods ended |

Nine-month

periods ended |

| |

September

30, 2024 |

September

30, 2023 |

September

30, 2024 |

September

30, 2023 |

| |

|

|

|

|

| Net profit

(loss) for the period |

121,186 |

(1,614,898) |

(4,738,724) |

(2,327,619) |

| |

|

|

|

|

| Other comprehensive

income |

- |

- |

- |

- |

| |

|

|

|

|

| Total

comprehensive income |

121,186 |

(1,614,898) |

(4,738,724) |

(2,327,619) |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements

| | |

| |  |

| 12 | |

|

AZUL

S.A.

Statements of changes in equity

Periods the nine months ended

September 30, 2024 and 2023

(In thousands of Brazilian reais

– R$)

|

| |

|

| Description |

Note |

Issued

capital |

AFAC (a) |

Treasury

shares |

Capital

reserve |

Other comprehensive income |

Accumulated losses |

Total |

| |

| At December 31, 2023 |

|

2,314,821 |

789 |

(9,041) |

2,029,610 |

3,106 |

(25,667,133) |

(21,327,848) |

| |

| Net loss for the period |

|

- |

- |

- |

- |

- |

(4,738,724) |

(4,738,724) |

| |

|

|

|

|

|

|

|

| Total comprehensive income |

|

- |

- |

- |

- |

- |

(4,738,724) |

(4,738,724) |

| |

| Share repurchase, disposal and transfers |

30 |

- |

- |

4,707 |

(7,303) |

- |

- |

(2,596) |

| Share-based payment (b) |

32 |

807 |

(789) |

- |

33,155 |

- |

- |

33,173 |

| |

| At September 30, 2024 |

|

2,315,628 |

- |

(4,334) |

2,055,462 |

3,106 |

(30,405,857) |

(26,035,995) |

| Description |

Note |

Issued

capital |

AFAC (a) |

Treasury

shares |

Capital

reserve |

Other

comprehensive income |

Accumulated

losses |

Total |

| |

| At December 31, 2022 |

|

2,313,941 |

61 |

(10,204) |

1,970,098 |

5,281 |

(23,286,677) |

(19,007,500) |

| |

| Net loss for the period |

|

- |

- |

- |

- |

- |

(2,327,619) |

(2,327,619) |

| |

|

|

|

|

|

|

|

| Total comprehensive

income |

|

- |

- |

- |

- |

- |

(2,327,619) |

(2,327,619) |

| |

| Share repurchase, disposal

and transfers |

30 |

- |

- |

(6,826) |

- |

- |

- |

(6,826) |

| Share-based

payment (b) |

32 |

880 |

728 |

7,989 |

46,222 |

- |

- |

55,819 |

| |

| At September 30, 2023 |

|

2,314,821 |

789 |

(9,041) |

2,016,320 |

5,281 |

(25,614,296) |

(21,286,126) |

| (a) | Advance for future capital increase.

|

| (b) | Refers to the receipt of the exercise

of share options and the vesting of share-based compensation plans (Stock Options and RSU), net of income tax relating to the transfer

of RSU. |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

| | |

| |  |

| 13 | |

|

AZUL

S.A.

Statements of cash flows

Periods the nine months ended

September 30, 2024 and 2023

(In thousands of Brazilian reais

– R$)

|

| |

|

| |

|

Parent

company |

Consolidated |

| |

Nine-month

periods ended |

| |

|

September

30, 2024 |

September

30, 2023 |

September

30, 2024 |

September

30, 2023 |

| Cash

flows from operating activities |

|

|

|

|

| |

Loss for

the period |

(4,738,724) |

(2,327,619) |

(4,738,724) |

(2,327,619) |

| Result

reconciliation items |

|

|

|

|

| |

Depreciation

and amortization |

- |

- |

1,852,037 |

1,820,347 |

| |

Gain

(loss) from impairment of assets |

- |

- |

(21,366) |

- |

| |

Derivative

financial results, net |

(174,121) |

(34,835) |

(53,303) |

44,228 |

| |

Share-based

payment |

- |

2,362 |

33,014 |

58,043 |

| |

Foreign

currency exchange, net |

167,600 |

(32,796) |

3,292,158 |

(748,434) |

| |

Financial

result |

235,757 |

416,342 |

3,694,275 |

4,173,463 |

| |

Provisions,

net |

12 |

3,192 |

(114,666) |

(134,099) |

| |

Recovery

of expenses and write-offs of other assets |

- |

- |

(855,441) |

169,999 |

| |

Result

from modification of lease and provision |

- |

- |

(113,101) |

(99,281) |

| |

Result

of write-offs of fixed assets, right of use, intangible assets and inventories |

- |

- |

(22,683) |

20,318 |

| |

Deferred

income tax and social contribution |

(39,526) |

- |

(39,526) |

- |

| |

Sale and

leaseback |

- |

- |

(59,496) |

- |

| |

Equity |

4,516,661 |

1,883,707 |

- |

- |

| Reconciled

result |

(32,341) |

(89,647) |

2,853,178 |

2,976,965 |

| |

| Changes

in operating assets and liabilities |

|

|

|

|

| |

Accounts

receivable |

- |

- |

131,335 |

262,715 |

| |

Aircraft

sublease |

- |

- |

- |

19,485 |

| |

Inventories |

- |

- |

(184,482) |

(30,396) |

| |

Deposits |

(6) |

- |

(286,294) |

(295,785) |

| |

Taxes recoverable |

4,928 |

4,587 |

(1,676) |

11,448 |

| |

Derivative

financial results, net |

- |

- |

(51,238) |

(154,699) |

| |

Other assets |

5,822 |

(2,901) |

(224,733) |

(87,558) |

| |

Accounts

payable |

(3,697) |

104,080 |

615,285 |

(318,594) |

| |

Airport

taxes and fees |

- |

- |

78,731 |

373,434 |

| |

Air traffic

liability and loyalty program |

- |

- |

756,811 |

184,409 |

| |

Salaries

and benefits |

671 |

(2,734) |

146,866 |

73,567 |

| |

Taxes payable |

(195) |

(3,174) |

(42,737) |

(26,654) |

| |

Provisions |

- |

- |

(308,894) |

(269,232) |

| |

Other liabilities |

- |

- |

123,509 |

2,794 |

| |

|

|

|

|

| Total

changes in operating assets and liabilities |

7,523 |

99,858 |

752,483 |

(255,066) |

| |

|

|

|

|

| |

Interest

paid |

(96,069) |

(58,790) |

(1,796,940) |

(1,180,995) |

| |

|

|

|

|

| Net

cash provided (used) by operating activities |

(120,887) |

(48,579) |

1,808,721 |

1,540,904 |

| |

|

|

|

|

| Cash

flows from investing activities |

|

|

|

|

| |

Short and

long-term investments |

- |

- |

(106,037) |

- |

| |

Restricted

cash |

- |

- |

- |

(256,536) |

| |

Sale and

leaseback |

- |

- |

22,677 |

- |

| |

Property

and equipment |

- |

- |

(531,110) |

(148,994) |

| |

Capitalized

maintenance |

- |

- |

(347,964) |

(194,864) |

| |

Intangible

assets |

- |

- |

(120,141) |

(129,382) |

| Net

cash used by investing activities |

- |

- |

(1,082,575) |

(729,776) |

| |

| Cash

flows from financing activities |

|

|

|

|

| |

Loans

and financing |

|

|

|

|

| |

Proceeds |

250,000 |

- |

2,299,918 |

4,733,292 |

| |

Repayment |

(106,429) |

- |

(1,147,155) |

(1,438,970) |

| |

Costs |

(4,446) |

- |

(47,168) |

(488,812) |

| |

Reverse

factoring |

- |

- |

(447,627) |

(727,368) |

| |

Lease |

- |

- |

(2,200,675) |

(1,673,192) |

| |

Convertible

debt instruments |

- |

(542,496) |

- |

(542,496) |

| |

Related

parties |

(16,876) |

590,594 |

- |

- |

| |

Advance

for future capital increase |

18 |

789 |

18 |

789 |

| |

Capital

increase |

- |

819 |

- |

819 |

| |

Treasury

shares |

(2,596) |

(6,826) |

(2,596) |

(6,826) |

| Net

cash provided (used) by financing activities |

119,671 |

42,880 |

(1,545,285) |

(142,764) |

| |

| |

Exchange

rate changes on cash and cash equivalents |

166 |

(123) |

3,958 |

62,680 |

| |

|

|

|

|

| Increase

(decrease) in cash and cash equivalents |

(1,050) |

(5,822) |

(815,181) |

731,044 |

| |

| Cash

and cash equivalents at the beginning of the period |

2,809 |

8,117 |

1,897,336 |

668,348 |

| Cash

and cash equivalents at the end of the period |

1,759 |

2,295 |

1,082,155 |

1,399,392 |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

| | |

| |  |

| 14 | |

|

AZUL

S.A.

Statements of value added

Periods the nine months ended September

30, 2024 and 2023

(In thousands of Brazilian reais – R$)

|

| |

|

| |

|

Parent

company |

Consolidated |

| |

Nine-month

periods ended |

| |

Note |

September

30, 2024 |

September

30, 2023 |

September

30, 2024 |

September

30, 2023 |

| Gross

sales revenue |

|

|

|

|

|

| |

Passenger

revenue |

33 |

- |

- |

12,980,807 |

12,689,847 |

| |

Other

revenues |

33 |

- |

- |

1,087,494 |

1,081,176 |

| |

Expected

loss with accounts receivable |

7 |

- |

- |

496 |

(2,907) |

| |

- |

- |

14,068,797 |

13,768,116 |

| Inputs

acquired from third parties |

|

|

|

|

|

| |

Aircraft

fuel |

|

- |

- |

(4,220,787) |

(4,377,466) |

| |

Materials,

energy, third-party services and others |

|

(17,973) |

54,224 |

(3,449,888) |

(4,431,011) |

| |

Insurances |

|

(4,541) |

- |

(67,252) |

(46,375) |

| |

34 |

(22,514) |

54,224 |

(7,737,927) |

(8,854,852) |

| |

| Gross

value added |

|

(22,514) |

54,224 |

6,330,870 |

4,913,264 |

| |

| Retentions |

34 |

|

|

|

|

| |

Depreciation

and amortization |

|

- |

- |

(1,852,037) |

(1,820,347) |

| |

Impairment

of assets |

|

- |

- |

21,366 |

- |

| |

| Net

value added |

|

(22,514) |

54,224 |

4,500,199 |

3,092,917 |

| |

| Value

added received in transfers |

|

|

|

|

|

| |

| |

Equity |

14 |

(4,516,661) |

(1,883,707) |

- |

- |

| |

Financial

income |

35 |

3,234 |

3,160 |

152,453 |

143,883 |

| |

(4,513,427) |

(1,880,547) |

152,453 |

143,883 |

| |

| Value

added to be distributed |

|

(4,535,941) |

(1,826,323) |

4,652,652 |

3,236,800 |

| |

| Distribution

of value added: |

|

|

|

|

|

| |

Personnel (a) |

|

|

|

|

|

| |

| |

Salaries

and wages |

|

17,465 |

20,816 |

1,321,727 |

1,170,043 |

| |

Benefits |

|

2,465 |

5,468 |

278,588 |

225,764 |

| |

F.G.T.S. |

|

424 |

432 |

118,011 |

103,011 |

| |

34 |

20,354 |

26,716 |

1,718,326 |

1,498,818 |

| |

Taxes,

fees and contributions |

|

|

|

|

|

| |

| |

Federal (b) |

|

(37,912) |

250 |

230,141 |

248,673 |

| |

State |

|

- |

- |

38,301 |

38,547 |

| |

Municipal |

|

- |

- |

9,265 |

4,137 |

| |

(37,912) |

250 |

277,707 |

291,357 |

| |

Third

party capital |

|

|

|

|

|

| |

| |

Financial

expenses |

35 |

225,508 |

538,411 |

3,878,968 |

4,339,550 |

| |

Derivative

financial instruments, net |

35 |

(174,121) |

(34,835) |

(53,303) |

44,228 |

| |

Foreign

currency exchange, net |

35 |

168,954 |

(29,246) |

3,373,158 |

(771,190) |

| |

Rentals |

34 |

- |

- |

196,520 |

161,656 |

| |

220,341 |

474,330 |

7,395,343 |

3,774,244 |

| |

| |

Own

capital |

|

|

|

|

|

| |

| |

Loss for the period |

|

(4,738,724) |

(2,327,619) |

(4,738,724) |

(2,327,619) |

| (a) | Not including INSS in the amount

of R$1,494 in the parent company R$260,127 in the consolidated, as it is in the federal tax line. |

| (b) | Includes deferred income tax and

social contribution accounted for in the parent company. |

The accompanying notes are an integral part of these

interim condensed individual and consolidated financial statements.

| | |

| |  |

| 15 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

Azul S.A. (“Azul”), together with its subsidiaries

(“Company”) is a corporation governed by its bylaws, as per Law No. 6404/76 and by the corporate governance level 2 listing

regulation of B3 S.A. – Brasil, Bolsa, Balcão (“B3”). The Azul was incorporated on January 3, 2008, and its core

business comprises the operation of regular and non-regular airline passenger services, cargo or mail, passenger charter, provision of

maintenance and hangarage services for aircraft, engines, parts and pieces, aircraft acquisition and lease, development of frequent-flyer

programs, development of related activities and equity holding in other companies since the beginning of its operations on December 15,

2008.

The Azul carries out its activities through its subsidiaries,

mainly Azul Linhas Aéreas Brasileiras S.A. (“ALAB”) and Azul Conecta Ltda. (“Conecta”), which hold authorization

from government authorities to operate as airlines and ATS Viagens e Turismo Ltda (“Azul Viagens”) for tourism services.

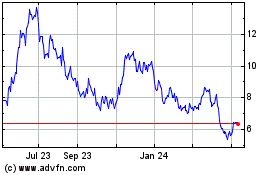

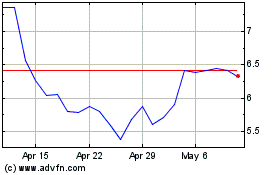

The Azul shares are traded on B3 and on the New York

Stock Exchange (“NYSE”) under tickers AZUL4 and AZUL, respectively.

The Azul is headquartered at Avenida Marcos Penteado

de Ulhôa Rodrigues, 939, 8th floor, in the city of Barueri, state of São Paulo, Brazil.

| 1.1 | Organizational

structure |

The Company organizational structure as of September

30, 2024 is as follows:

| | |

| |  |

| 16 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

The table below lists the operational activities in

which the Azul subsidiaries are engaged, as well as the changes in ownership that occurred in period, when applicable.

| |

|

|

|

|

% equity interest |

Company |

Type of investment |

Main activity |

State |

Country |

September 30, 2024 |

December 31, 2023 |

| Azul IP Cayman Holdco Ltd. (Azul Cayman Holdco) |

Direct |

Holding of equity interests in other companies |

George Town |

Cayman Islands |

25% |

25% |

| Azul IP Cayman Ltd. (Azul Cayman) |

Indirect |

Intellectual property owner |

George Town |

Cayman Islands |

100% |

100% |

| IntelAzul S.A. (IntelAzul) |

Direct |

Frequent-flyer program |

São Paulo |

Brazil |

100% |

100% |

| Azul IP Cayman Holdco Ltd. (Azul Cayman Holdco) |

Indirect |

Holding of equity interests in other companies |

George Town |

Cayman Islands |

25% |

25% |

| Azul Linhas Aéreas Brasileiras S.A. (ALAB) |

Direct |

Airline operations |

São Paulo |

Brazil |

100% |

100% |

| Azul IP Cayman Holdco Ltd. (Azul Cayman Holdco) |

Indirect |

Holding of equity interests in other companies |

George Town |

Cayman Islands |

25% |

25% |

| Azul Conecta Ltda. (Conecta) |

Indirect |

Airline operations |

São Paulo |

Brazil |

100% |

100% |

| ATS Viagens e Turismo Ltda. (Azul Viagens) |

Indirect |

Travel packages |

São Paulo |

Brazil |

100% |

100% |

| ATSVP Viagens Portugal, Unipessoal LDA (Azul Viagens Portugal) |

Indirect |

Travel packages |

Lisbon |

Portugal |

100% |

100% |

| Azul IP Cayman Holdco Ltd. (Azul Cayman Holdco) |

Indirect |

Holding of equity interests in other companies |

George Town |

Cayman Islands |

25% |

25% |

| Cruzeiro Participações S.A (Cruzeiro) |

Indirect |

Holding of equity interests in other companies |

São Paulo |

Brazil |

100% |

100% |

| Azul Investments LLP (Azul Investments) |

Indirect |

Funding |

Delaware |

USA |

100% |

100% |

| Azul SOL LLC (Azul SOL) |

Indirect |

Aircraft financing |

Delaware |

USA |

100% |

100% |

| Azul Finance LLC (Azul Finance) |

Indirect |

Aircraft financing |

Delaware |

USA |

100% |

100% |

| Azul Finance 2 LLC (Azul Finance 2) |

Indirect |

Aircraft financing |

Delaware |

USA |

100% |

100% |

| Blue Sabiá LLC (Blue Sabiá) |

Indirect |

Aircraft financing |

Delaware |

USA |

100% |

100% |

| Canela Investments LLC (Canela) |

Indirect |

Aircraft financing |

Delaware |

USA |

100% |

100% |

| Canela Turbo Three LLC (Canela Turbo) |

Indirect |

Aircraft financing |

Delaware |

USA |

100% |

100% |

| Azul Saira LLC (Azul Saira) |

Indirect |

Aircraft financing |

Delaware |

USA |

100% |

100% |

| Azul Secured Finance LLP (Azul Secured) |

Indirect |

Funding |

Delaware |

USA |

100% |

100% |

| Azul Secured Finance 2 LLP (Azul Secured 2) |

Indirect |

Funding |

Delaware |

USA |

100% |

- |

Azul Secured Finance 2 LLP was incorporated on September

17, 2024.

The Company’s operating revenues depend substantially

on the general volume of passenger and cargo traffic, which is subject to seasonal changes. Our passenger revenues are generally higher

during the summer and winter holidays, in January and July respectively, and in the last two weeks of December, which corresponds to the

holiday season. Considering the distribution of fixed costs, this seasonality tends to cause variations in operating results between periods

of the fiscal year.

| | |

| |  |

| 17 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

The Company's interim condensed individual and consolidated

financial statements were prepared on going concern basis, which assumes that the Company will be able to fulfill its payment obligations

in accordance with contracted maturities, which is confirmed by a positive trend in generating operating cash flows.

On performing the Company's going concern assessment,

management considered the financial position and results of operations up to September 30, 2024, as well as other foreseen or occurred

events up to the date of issuance of these interim condensed individual and consolidated financial statements.

Management understands that even with the existence

of a certain degree of uncertainty regarding the Company's ability to fulfill its obligations, the renegotiations carried out between

the Company and its creditors, including lessors and suppliers of aircraft services and parts (“OEMs”), as disclosed in note

39 Subsequent Events, corroborate Management's judgment regarding the Company's reasonable expectation of having sufficient resources

to continue operating in the foreseeable future.

Additionally, Management's conclusion is based on the

Company's business plan approved by the Board of Directors in December 2023 and the liability restructuring process described in these

interim condensed individual and consolidated financial statements. The Company's business plans include planned future actions, macroeconomic

and aviation sector assumptions, such as level of demand for air transport with corresponding increase in traffic and fares, estimated

exchange rates and fuel prices.

Management confirms that all relevant information specific

to the interim condensed individual and consolidated financial statements is being disclosed, and corresponds to that used by it in the

development of its business management activities.

Until September 30, 2024, Azul's Management continued

the process of restructuring its debts, as presented in detail in this interim condensed individual and consolidated financial statements

(note 18 and 19).

During the quarter ended June 30, 2024, there was an

extreme weather event with heavy rains in the central region of the State of Rio Grande do Sul in Brazil, making it impossible to provide

air services due to flooding and the consequent closure of Salgado Filho Airport in Porto Alegre, the main airport in the region. The

Company dedicated humanitarian efforts with the aim of supporting actions carried out by local authorities who acted in response to the

emergency with the affected population. In order to face this scenario, the Company began to monitor and establish operational and financial

strategies to get through this period until the resumption of operations, increasing flights to nearby cities, in order to serve affected

passengers.

In October 2024, air services were gradually resumed

at Salgado Filho international airport.

| | |

| |  |

| 18 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

| 2.4 | Net working

capital and capital structure |

As of September 30, 2024, the Company's working capital

and liquid equity position are as shown below:

| Description |

|

September 30, 2024 |

December 31, 2023 |

Variation |

| |

|

| Net working capital |

|

(13,510,737) |

(9,704,733) |

(3,806,004) |

| Equity |

|

(26,035,995) |

(21,327,848) |

(4,708,147) |

The negative variation in the balance of net working

capital is mainly due to the increase in liabilities in foreign currency, due to the 12.5% devaluation of the real against the US dollar

and the postponement of accounts payable payments.

The negative variation of equity is mainly due to the

Company's negative financial result, which exceeds by R$4,777,277 the operating profit due to foreign currency exchange and interest on

leases, loans and financing.

3.

BASIS OF PREPARATION AND PRESENTATION OF THE INTERIM CONDENSED INDIVIDUAL AND CONSOLIDATED FINANCIAL STATEMENTS

The Company’s interim condensed individual and

consolidated financial statements have been prepared in accordance with accounting practices adopted in Brazil and the International Financial

Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”), specifically IAS

34 – Interim Financial Reporting. The accounting practices adopted in Brazil include those included in the Brazilian corporation

law and the technical pronouncements, guidelines and interpretations issued by the Accounting Pronouncements Committee (“CPC”),

approved by the Federal Accounting Council (“CFC”) and the Brazilian Securities and Exchange Commission (“CVM”).

The Company’s

interim condensed individual and consolidated financial statements have been prepared based on the real

(“R$”) as a functional and presentation currency. All currencies shown are expressed in thousands unless otherwise noted.

The Company operates mainly through its aircraft and

other assets that support flight operations, making up its cash generating unit (CGU) and its only reportable segment: air transport.

The preparation of the Company's interim condensed

individual and consolidated financial statements requires Management to make judgments, use estimates and adopt assumptions that affect

the reported amounts of assets, liabilities, revenues, and expenses. However, the uncertainty related to these judgments, assumptions

and estimates can lead to results that require a significant adjustment to the carrying amount of assets, liabilities, income and expenses

in future years.

| | |

| |  |

| 19 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

When preparing these interim condensed individual and

consolidated financial statements of the Company, Management used the following disclosure criteria to understand the changes observed

in the equity and in its performance, since the end of the last fiscal year ended December 31, 2023, disclosed on April 12, 2024: (i)

regulatory requirements; (ii) relevance and specificity of the information on the operations; (iii) informational needs of users of the

interim condensed individual and consolidated financial statements; and (iv) information from other entities participating in the passenger

air transport market.

As a consequence of the improvements made to the

presentation of some items in the statements of cash flows and costs and expenses by nature, the following reclassifications were carried

out to ensure comparability of balances from the previous period:

| |

Parent company |

| |

September 30, 2023 |

| Statements of Cash Flows |

As

reported |

Reclassifications |

Reclassified |

| |

| Changes in operating assets and liabilities |

|

| |

| Prepaid expenses |

(2,989) |

2,989 |

- |

| Other assets |

88 |

(2,989) |

(2,901) |

| Total |

(2,901) |

- |

(2,901) |

| |

Consolidated |

| |

September 30, 2023 |

| Statements of Cash Flows |

As

reported |

Reclassifications |

Reclassified |

| |

| Changes in operating assets and liabilities |

|

|

|

| |

| Prepaid expenses |

(85,683) |

85,683 |

- |

| Other assets |

(1,875) |

(85,683) |

(87,558) |

| Advances to suppliers |

(989,754) |

989,754 |

- |

| Accounts payable |

671,160 |

(989,754) |

(318,594) |

| Total |

(406,152) |

- |

(406,152) |

The interim condensed individual and consolidated financial

statements have been prepared based on the historical cost, except for the items significant:

Fair value:

·

Short-term investments –TAP Bond;

·

Derivative financial instruments; and

·

Debenture conversion right.

Other:

·

Investments accounted for under the equity method.

| | |

| |  |

| 20 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

| 3.1 | Approval and

authorization for issue of the interim condensed individual and consolidated financial statements |

The approval and authorization for issue of these interim

condensed individual and consolidated financial statements occurred at the Board of Directors’ meeting held on November 13, 2024.

| 4. | MAIN ACCOUNTING PROCEDURES |

The interim condensed individual and consolidated financial

statements of the company was prepared based on the main accounting procedures: practices and methods of calculating estimates adopted

and presented in detail in the financial statements for the year ended December 31, 2023 and disclosed on April 12, 2024 and, therefore,

must be read together.

| 4.1 | New, changes

and interpretations of relevant accounting standards and pronouncements |

The following accounting standards

came into effect on January 1, 2024 and did not significantly impact the Company's balance sheet or income statement.

| Norm |

Charge |

| |

| CPC 26 (R1) – equivalent to IAS 1 |

Classification of liabilities as current and non-current |

| CPC 06 (R2) – equivalent to IFRS 16 |

Lease liabilities in a sale and leaseback transaction |

| CPC 03 (R2) – equivalent to IAS 7 and CPC 40 – equivalent to IFRS 7 |

Reverse factoring |

| CPC 40 – equivalent to IFRS 7 |

Reverse factoring |

| CPC 09 (R1) |

Clarification of the requirements for applying the standard and concept for preparation and dissemination. |

| 4.2 | Foreign currency

transactions |

Foreign currency transactions are recorded at the exchange

rate in effect at the date the transactions take place. Monetary assets and liabilities designated in foreign currency are determined

based on the exchange rate in effect on the balance sheet date, and any difference resulting from currency conversion is recorded under

the heading “Foreign currency exchange, net” in the statements of operation.

The exchange rates to Brazilian reais are as follows:

| |

|

Final exchange rates |

| Description |

|

|

|

September 30, 2024 |

December 31, 2023 |

Variation % |

| |

| U.S. dollar |

|

5.4481 |

4.8413 |

12.5% |

| Euro |

|

6.0719 |

5.3516 |

13.5% |

| |

|

|

|

|

|

|

| |

Average exchange rates |

| |

Three-month periods ended |

Nine-month periods ended |

| Description |

September 30, 2024 |

September 30, 2023 |

Variation % |

September 30, 2024 |

September 30, 2023 |

Variation % |

| |

| U.S. dollar |

5.5472 |

4.8803 |

13.7% |

5.2445 |

5.0083 |

4.7% |

| Euro |

6.1351 |

5.3122 |

15.5% |

5.7036 |

5.4249 |

5.1% |

| | |

| |  |

| 21 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

| 5. | CASH AND CASH EQUIVALENTS |

| |

|

Parent company |

Consolidated |

| Description |

Weighted

average rate p.a. |

September 30, 2024 |

December 31, 2023 |

September 30, 2024 |

December 31, 2023 |

| |

|

|

| Cash and bank deposits |

- |

1,017 |

1,709 |

160,088 |

271,857 |

| Cash equivalents: |

|

| Bank Deposit Certificate – CDB |

97.1% of CDI |

- |

- |

654,268 |

1,354,020 |

| Repurchase agreements |

94.0% of CDI |

742 |

1,100 |

111,382 |

268,432 |

| Time Deposit (a) |

5.0% |

- |

- |

42,184 |

2,985 |

| Investment funds |

11.0% |

- |

- |

114,233 |

42 |

| |

1,759 |

2,809 |

1,082,155 |

1,897,336 |

(a)

Investment in U.S. dollar.

| 6. | SHORT AND LONG-TERM INVESTMENTS |

| |

|

|

Consolidated |

| Description |

Weighted average

rate p.a. |

Maturity |

September 30, 2024 |

December 31, 2023 |

| |

|

|

|

| TAP Bond |

7.5% |

Mar-26 |

912,923 |

780,312 |

| Investment funds |

18.3% |

Jun-26 |

110,876 |

- |

| |

1,023,799 |

780,312 |

| |

|

| Current |

|

56,980 |

- |

| Non-current |

|

966,819 |

780,312 |

| | |

| |  |

| 22 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

| |

Consolidated |

| Description |

September 30, 2024 |

December 31, 2023 |

| Local currency |

|

| |

|

| Credit card companies |

340,784 |

498,609 |

| Cargo and travel agencies |

315,534 |

282,654 |

| Travel package financing entities |

- |

29,203 |

| Loyalty program partners |

88,034 |

114,932 |

| Others |

33,917 |

40,121 |

| |

|

| Total local currency |

778,269 |

965,519 |

| |

|

| Foreign currency |

|

| |

|

| Credit card companies |

16,580 |

18,556 |

| Reimbursement receivable for maintenance reserves |

80,624 |

57,528 |

| Airline partner companies |

4,213 |

8,612 |

| Clearinghouse - agencies and cargo |

28,452 |

30,533 |

| Others |

475,337 |

55,894 |

| |

|

| Total foreign currency |

605,206 |

171,123 |

| |

|

| |

|

| Total |

1,383,475 |

1,136,642 |

| |

|

| Allowance for losses |

(26,738) |

(27,234) |

| Total net |

1,356,737 |

1,109,408 |

The increase in “Other” accounts receivable

in foreign currency mainly refers to contractual guarantees from aeronautical manufacturers.

In Brazil, credit card receivables are not exposed

to credit risk of the cardholder. The balances can easily be converted into cash, when necessary, through advance payment with credit

card companies.

During the nine months ended September 30, 2024, the

Company anticipated the receipt of R$8,859,779 in accounts receivable from credit card administrators, without right of return, with an

average cost of 0.9% p.m. on the anticipated amount. On the same date, the balance of accounts receivable is net of R$3,027,182 due to

such advances (R$3,349,391 on December 31, 2023).

The breakdown of accounts receivable by maturity, net

of allowances for losses:

| |

Consolidated |

| Description |

September 30, 2024 |

December 31, 2023 |

| |

|

|

| Not past due |

1,067,988 |

970,145 |

| Over 1 to 90 days |

175,553 |

122,040 |

| Over 90 days |

113,196 |

17,223 |

| Total |

1,356,737 |

1,109,408 |

| | |

| |  |

| 23 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

The movement of allowances for losses is presented

below:

| |

Consolidated |

| Description |

September 30, 2024 |

September 30, 2023 |

| |

|

|

| Balances at the beginning the period |

(27,234) |

(24,084) |

| Additions |

(22,176) |

(24,390) |

| Reversal |

22,257 |

20,446 |

| Write-off of uncollectible amounts |

415 |

1,037 |

| Balances at the end of the period |

(26,738) |

(26,991) |

| |

|

Consolidated |

| Description |

|

September 30, 2024 |

December 31, 2023 |

| |

|

| 2024 |

|

- |

15,386 |

| 2025 |

|

- |

15,386 |

| 2026 |

|

- |

4,001 |

| |

| Gross sublease |

|

- |

34,773 |

| Accrued interest |

|

- |

(3,971) |

| Net sublease |

|

- |

30,802 |

| |

| Current |

|

- |

14,592 |

| Non-current |

|

- |

16,210 |

As of September 30, 2024, the Company did not

have sublease contracts.

| |

|

Consolidated |

| Description |

|

September 30, 2024 |

December 31, 2023 |

| |

| Maintenance materials and parts |

|

1,049,360 |

825,499 |

| Flight attendance, uniforms and others |

|

33,593 |

21,367 |

| Provision for losses |

|

(56,448) |

(47,658) |

| Total net |

|

1,026,505 |

799,208 |

| | |

| |  |

| 24 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

| |

Parent company |

Consolidated |

| Description |

September 30, 2024 |

December 31, 2023 |

September 30, 2024 |

December 31, 2023 |

| |

| Security deposits |

- |

7,872 |

548,674 |

418,537 |

| Maintenance reserves |

- |

- |

2,563,937 |

2,153,310 |

| |

| Total |

- |

7,872 |

3,112,611 |

2,571,847 |

| |

| Provision for loss |

- |

- |

(295,985) |

(278,352) |

| |

| Total net |

- |

7,872 |

2,816,626 |

2,293,495 |

| |

| Current |

- |

7,802 |

596,415 |

515,692 |

| Non-current |

- |

70 |

2,220,211 |

1,777,803 |

The movement of security deposits and maintenance

reserves is as follows:

| |

Parent company |

Consolidated |

| Description |

Security

deposits |

Security deposits |

Maintenance reserves |

Total |

| |

| At December 31, 2023 |

7,872 |

418,537 |

1,874,958 |

2,293,495 |

| |

| Additions |

- |

133,627 |

257,686 |

391,313 |

| Returns |

(8,887) |

(47,013) |

(108,542) |

(155,555) |

| Provision movement |

6 |

- |

18,346 |

18,346 |

| Use by the lessor |

- |

- |

(10,511) |

(10,511) |

| Foreign currency exchange |

1,009 |

43,523 |

236,015 |

279,538 |

| |

| At September 30, 2024 |

- |

548,674 |

2,267,952 |

2,816,626 |

| |

| At September 30, 2024 |

|

|

|

|

| Current |

- |

60,729 |

535,686 |

596,415 |

| Non-current |

- |

487,945 |

1,732,266 |

2,220,211 |

| |

| At December 31, 2023 |

|

| Current |

7,802 |

64,788 |

450,904 |

515,692 |

| Non-current |

70 |

353,749 |

1,424,054 |

1,777,803 |

The movement of the allowance for maintenance reserves

losses is as follows:

| |

|

Consolidated |

| Description |

|

|

September 30, 2024 |

September 30, 2023 |

| |

| Balances at the beginning of the period |

|

|

(278,352) |

(446,342) |

| Additions |

|

|

(57,752) |

(44,277) |

| Reversals |

|

|

69,029 |

16,402 |

| Use by the lessor |

|

|

7,069 |

64,623 |

| Foreign currency exchange |

|

|

(35,979) |

20,204 |

| Balances at the end of the period |

|

(295,985) |

(389,390) |

| | |

| |  |

| 25 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

| |

Parent company |

Consolidated |

| Description |

September 30, 2024 |

December 31, 2023 |

September 30, 2024 |

December 31, 2023 |

| |

|

|

| PIS and COFINS |

- |

- |

75,845 |

73,029 |

| IRPJ and CSLL |

38 |

4,917 |

17,263 |

8,315 |

| ICMS |

- |

- |

17,516 |

19,940 |

| Taxes withheld |

18 |

67 |

114,683 |

121,216 |

| Allowance for withheld taxes losses |

- |

- |

(4,607) |

(3,875) |

| Others |

- |

- |

846 |

808 |

| |

|

| |

56 |

4,984 |

221,546 |

219,433 |

| |

Consolidated |

| Description |

September 30, 2024 |

December 31, 2023 |

| |

|

|

| Local currency |

82,159 |

118,442 |

| Foreign currency |

112,449 |

102,609 |

| |

194,608 |

221,051 |

These amounts are presented net of allowance for losses

in the amount of R$49,120 (R$28,676 as of December 31, 2023).

| | |

| |  |

| 26 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

| 13. | INCOME TAX AND CONTRIBUTION |

| 13.1 | Breakdown

of deferred taxes |

| |

|

Parent company |

Consolidated |

| Description |

December 31, 2023 |

Profit or loss |

September 30, 2024 |

December 31, 2023 |

Profit or loss |

September 30, 2024 |

| |

| Deffered liabilities |

|

| |

| |

Breakage |

- |

- |

- |

(195,923) |

(50,891) |

(246,814) |

| |

Foreign currency exchange |

(191,219) |

(224,828) |

(416,047) |

(191,219) |

(224,828) |

(416,047) |

| |

Leases |

- |

- |

- |

(3,034,585) |

(396,164) |

(3,430,749) |

| |

Others |

- |

- |

- |

(1,057) |

- |

(1,057) |

| |

| |

Total |

(191,219) |

(224,828) |

(416,047) |

(3,422,784) |

(671,883) |

(4,094,667) |

| |

| Deffered assets |

|

|

|

|

|

|

| |

| |

Impairment |

- |

- |

- |

48,889 |

(7,265) |

41,624 |

| |

Financial instruments |

- |

- |

- |

21,112 |

18,809 |

39,921 |

| |

Foreign currency exchange |

149,986 |

264,207 |

414,193 |

149,986 |

264,207 |

414,193 |

| |

Provisions |

1,707 |

(575) |

1,132 |

1,403,989 |

168,015 |

1,572,004 |

| |

Leases |

- |

- |

- |

4,199,370 |

613,528 |

4,812,898 |

| |

Others |

- |

722 |

722 |

- |

- |

- |

| |

| |

151,693 |

264,354 |

416,047 |

5,823,346 |

1,057,294 |

6,880,640 |

| |

| |

Deferred tax asset reducer |

- |

- |

- |

(2,440,088) |

(345,885) |

(2,785,973) |

| |

| |

Total |

151,693 |

264,354 |

416,047 |

3,383,258 |

711,409 |

4,094,667 |

| |

| Total income tax and deferred social contribution |

(39,526) |

39,526 |

- |

(39,526) |

39,526 |

- |

| |

| | |

| |  |

| 27 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

| 13.2 | Reconciliation

of the effective income tax rate |

| |

Parent company |

| |

Three-month periods ended |

Nine-month periods ended |

| Description |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

| |

| Profit (loss) before income tax and social contribution |

121,186 |

(1,614,898) |

(4,778,250) |

(2,327,619) |

| Combined nominal tax rate |

34% |

34% |

34% |

34% |

| Taxes calculated at nominal rates |

(41,203) |

549,065 |

1,624,605 |

791,390 |

| |

| Adjustments to determine the effective rate |

|

|

|

|

| Equity |

126,518 |

(485,790) |

(1,535,665) |

(640,460) |

| Unrecorded and recorded benefit no tax losses and temporary differences |

(13,024) |

(160,797) |

(80,171) |

(132,351) |

| Mark to market of convertible instruments |

(62,237) |

103,588 |

59,201 |

11,844 |

| Permanent differences |

(10,054) |

(6,066) |

(28,444) |

(30,423) |

| |

- |

- |

39,526 |

- |

| |

Deferred income tax and social contribution |

- |

- |

39,526 |

- |

| |

- |

- |

39,526 |

- |

| |

Consolidated |

| |

Three-month periods ended |

Nine-month periods ended |

| Description |

September 30, 2024 |

September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

| |

|

|

|

|

| Profit (loss) before income tax and social contribution |

121,871 |

(1,614,898) |

(4,777,277) |

(2,327,619) |

| Combined nominal tax rate |

34% |

34% |

34% |

34% |

| Taxes calculated at nominal rates |

(41,436) |

549,065 |

1,624,274 |

791,390 |

| |

| Adjustments to determine the effective rate |

|

|

|

|

| Unrecorded and recorded benefit no tax losses and temporary differences |

124,048 |

(670,442) |

(1,634,079) |

(829,964) |

| Mark to market of convertible instruments |

(62,237) |

103,588 |

59,201 |

11,844 |

| Permanent differences |

(11,462) |

9,736 |

(31,152) |

10,173 |

| Others |

(9,598) |

8,053 |

20,309 |

16,557 |

| |

(685) |

- |

38,553 |

- |

| |

| Current income tax and social contribution |

(685) |

- |

(973) |

- |

| Deferred income tax and social contribution |

- |

- |

39,526 |

- |

| |

(685) |

- |

38,553 |

- |

| | |

| |  |

| 28 | |

| AZUL S.A.

Notes to the interim condensed individual and consolidated financial statements September 30, 2024 (In thousands of Brazilian reais – R$, unless otherwise indicated) |

| | |

The Company has tax losses that are available indefinitely

for offset against 30% of future taxable profits on which deferred income tax and social contribution assets have not been created, as

it is not likely that future taxable profits will be available for the Company to use them, as below:

| |

Parent company |

Consolidated |

| Description |

September 30, 2024 |

December 31, 2023 |

September 30, 2024 |

December 31, 2023 |

| |

| Tax losses and negative bases |

1,113,643 |

924,637 |

20,742,901 |

18,325,916 |

| |

| Tax loss (25%) |

278,411 |

231,159 |

5,185,725 |

4,581,479 |

| Negative social contribution base (9%) |

100,228 |

83,217 |

1,866,861 |

1,649,332 |

| |

|

Company equity interest |

|

| Description |

|

Paid-up capital |

Voting capital |

Equity |

| |

|

|

|

|

| December 31, 2023 |

|

|

|

|

| ALAB |

|

100% |

100% |

(20,130,955) |

| IntelAzul |

|

100% |

100% |

(20,209) |

| Goodwill – IntelAzul |

|

100% |

100% |

780,991 |

| Azul Cayman Holdco |

|

25% |

25% |

- |

| Total |

|

|

|

(19,370,173) |

| |

| September 30, 2024 |

|

|

|

|

| ALAB |

|

100% |

100% |

(24,612,826) |

| IntelAzul |

|

100% |

100% |

(21,422) |

| Goodwill – IntelAzul |

|

100% |

100% |

780,991 |

| Azul Cayman Holdco |

|

25% |

25% |

- |

| Total |

|

|

|

(23,853,257) |

| 14.2 | Movement of

the investments |

| Description |

|

ALAB |

IntelAzul |

Total |

| |

|

|

|

| |

| December 31, 2023 |

|

(20,130,955) |

760,782 |

(19,370,173) |

| |

| Equity |

|

(4,515,448) |

(1,213) |