UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of October, 2024

Commission File Number: 001-38049

Azul S.A.

(Name of Registrant)

Edifício Jatobá, 8th floor, Castelo Branco Office Park

Avenida Marcos Penteado de Ulhôa Rodrigues, 939

Tamboré, Barueri, São Paulo, SP 06460-040, Brazil.

+55 (11) 4831 2880

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ¨ No x

| Material Fact October | 2024 |

Azul Obtains Additional Funding

and

Crystalizes Lessor/OEM Agreements

São Paulo, October 28, 2024 –

Azul S.A., “Azul” (B3: AZUL4, NYSE: AZUL) announces today that it has negotiated an agreement with its existing bondholders

for up to U$$500 million in additional funding. This agreement considerably strengthens Azul’s liquidity and financial position

and crystallizes the previously announced agreement with lessors and OEMs to eliminate the equity instrument in exchange for 100 million

AZUL4 shares.

The transaction includes the following components:

| · | an

agreement to provide up to US$500 million in superpriority new financing from existing bondholders; with US$150 million to be provided

this week and US$250 million expected before year end, with the potential to unlock a further US$100 million thereafter; |

| · | agreements to improve cash flow

by more than US$150 million by reducing certain lessors and OEMs obligations over the next 18 months; |

| · | a collaborative effort to seek

additional cash flow improvements of approximately US$100 million per year; and |

| · | potential equitization of up

to US$800 million of existing second out debt, conditional on the US$100 million improvement above, leading to an additional reduction

of almost US$100 million in interest payments per year, in each case, subject to certain terms and

conditions, including the negotiation of definitive documentation. |

Lessor,

OEM and Vendor Negotiations

Azul announced on October 7, 2024, that

it had successfully reached commercial agreements with lessors and OEMs that now represent approximately 98% of the existing equity issuance

obligations, subject to certain conditions and applicable corporate approvals. Under these agreements, lessors and OEMs agreed to eliminate

their pro-rata share of the current balance of the equity issuance obligations totaling R$3.1 billion and, in exchange, to receive up

to 100 million new preferred shares of Azul (AZUL4) in a one-time issuance. These commercial agreements with lessors and OEMs had a financing

condition which is satisfied by the superpriority capital raise described herein and will become effective upon receipt of funding and

finalization of definitive binding documentation with lessors and OEMs.

Transaction

Support

Azul has entered into a transaction support

agreement (“Transaction Support Agreement”) dated October 27, 2024, between Azul, certain of its subsidiaries and an ad hoc

group of holders of existing 2028, 2029 and 2030 secured notes and existing convertible debentures (“Supporting Bondholders”),

pursuant to which the Supporting Bondholders have agreed to provide financing and to support the transactions described herein, subject

to certain terms and conditions, including finalization of certain terms and the negotiation of definitive documentation.

Supporting Bondholders represent more than

66.7% of the existing 2028 first out secured notes, more than 66.7% of the existing 2029 second out secured notes, more than 66.7% of

the existing 2030 second out secured notes, and 95.6% of the existing convertible debentures.

Financing

from Existing Bondholders

Supporting Bondholders agreed to provide

US$150 million in financing with a 90-day maturity, during which period Azul will work towards finalizing and satisfying the conditions

to obtain the additional superpriority financing referred to below, when an additional US$250 million in financing will be disbursed,

with the potential for another US$ 100 million conditional on additional cash flow improvements.

| Material Fact October | 2024 |

The financing will be issued by Azul Secured

Finance II LLP and guaranteed by Azul S.A. and certain of its subsidiaries and will be secured by: (i) certain receivables generated by,

and intellectual property used in, the Azul Cargo business, (ii) a pledge of certain financial assets held by Azul, (iii) certain credit

and debit card receivables generated by Azul’s passenger airline business, and (iv) the shared collateral that currently secures

the existing 2028, 2029 and 2030 notes, which is shared pursuant to requisite consents obtained from the holders of the relevant existing

secured indebtedness.

Agreement

to Provide Superpriority Financing from Existing Bondholders

Prior to the issuance of the superpriority

funding, Azul expects to conduct exchange offers and consent solicitations in respect of the existing 2028, 2029 and 2030 notes, pursuant

to which Azul would offer existing holders the opportunity to exchange into new 2028, 2029 and 2030 notes with the same terms as the existing

notes, except that the superpriority funding will be above the existing 2028, 2029 and 2030 notes in priority of payment from the relevant

collateral that would secure the new 2028, 2029 and 2030 notes, including the payment of a consent fee to consenting holders of existing

2028 notes payable post-close through the issuance of an exchangeable bond. Any holders that do not participate in such contemplated exchange

offers and consent solicitations would remain with existing, but unsecured, 2028, 2029 and 2030 notes. The terms of the new 2029 and 2030

notes to be issued in such exchange offers would also contemplate the potential equitization referred to below.

Equitization

of Second Out Notes

The Transaction Support Agreement provides

a framework for a potential phased equitization of existing 2029 and 2030 second out secured debt, subject to certain conditions, including

that substantially all of the second out debt agrees to participate in the proposed equitization transaction pursuant to an exchange offer

transaction.

Subject to consummation of such exchange

offer, the contemplated equitization would take place in a series of stages, subject to satisfaction of certain material conditions, and

would include a combination of equitization through preferred shares/ADRs and convertible debt instruments.

In addition, as part of these transactions,

the terms of the existing convertible debentures will be amended. Holders of the new 2029 and 2030 notes to be issued in the exchange

offer would remain secured by the relevant collateral pending such potential equitization.

Azul is continuing to negotiate with its

commercial partners to obtain the additional concessions required to satisfy the conditions to which the transactions described herein

are subject. and Azul will keep the market updated on any further developments.

Important

Notes

This

communication is for information purposes only and is not intended to be published or distributed, directly or indirectly, in the

United States or in any other jurisdiction. This communication is not and shall not constitute (i)

an offer to buy, or a solicitation of an offer to sell, any securities, (ii) the solicitation of consents from any holders of any securities,

or (iii) an offer to sell, or the solicitation of an offer to buy, any securities. There shall be no offering or sale of securities, and

no solicitation of consents from any holders of any securities, in any jurisdiction in which such offer, sale or solicitation would be

unlawful. Any offer or solicitation will only be made pursuant to a separate disclosure or solicitation document and only to such persons

and in such jurisdictions as permitted under applicable law. No offering of securities not been registered under the Securities Act of

1933, as amended (“Securities Act”) and securities shall not offered or sold absent registration under, pursuant to an exemption

from, or in a transaction not subject to, the registration requirements of the Securities Act. The securities referred to herein have

not been, and will not be, issued or placed, distributed, offered or traded in the Brazilian capital markets, and no issuance of securities

has been registered with the Brazilian Securities Commission (Comissão de Valores Mobiliários) (“CVM”).

No securities will be offered or sold in Brazil, except in circumstances, which do not constitute a public offering, placement, distribution

or negotiation of securities in the Brazilian capital markets regulated by Brazilian legislation.

| Material Fact October | 2024 |

Forward-Looking

Statements

This communication includes forward-looking

statements within the meaning of the U.S. federal securities laws. These forward-looking statements are based mainly on our current expectations

and estimates of future events and trends that affect or may affect our business, financial condition, results of operations, cash flow,

liquidity, prospects and the trading price of our securities, including the potential impacts of the material transactions referred to

in this communication. Although we believe that any forward-looking statements are based upon reasonable assumptions in light of information

currently available to us, any such forward-looking statements are subject to many significant risks, uncertainties and assumptions, including

those factors discussed under the heading “Risk Factors” in the Company’s annual report on Form 20-F for the year ended

December 31, 2023 and any other cautionary statements which may be made or referred to in connection with any such forward-looking statements.

In

this communication, the words “believe,” “understand,” “may,” “will,” “aim,”

“estimate,” “continue,” “anticipate,” “seek,” “intend,” “expect,”

“should,” “could,” “forecast” and similar words are intended to identify forward-looking statements.

You should not place undue reliance on such statements, which speak only as of the date they were made. Except as required by applicable

law, we do not undertake any obligation to update publicly or to revise any forward-looking statements after the date of this communication

because of new information, future events or other factors. Our independent public auditors have neither examined nor compiled the forward-looking

statements and, accordingly, do not provide any assurance with respect to such statements. In light of the risks and uncertainties described

above, the future events and circumstances discussed in this communication might not occur and are not guarantees of future performance.

Because of these uncertainties, you should not make any investment decision based upon these forward-looking statements.

About

Azul

Azul S.A. (B3: AZUL4, NYSE: AZUL), the largest

airline in Brazil by number of flight departures and cities served, offers 1,000 daily flights to over 160 destinations. With an operating

fleet of over 180 aircraft and more than 16,000 Crewmembers, the Company has a network of 300 non-stop routes. Azul was named by Cirium

(leading aviation data analysis company) as the most on-time airline in the world in 2022, being the first Brazilian airline to obtain

this honor. In 2020 Azul was awarded best airline in the world by TripAdvisor, first time a Brazilian Flag Carrier earns number one ranking

in the Traveler’s Choice Awards.

For more information visit www.voeazul.com.br/ir.

Contact:

Investor Relations

Tel: +55 11 4831 2880

invest@voeazul.com.br

Media Relations

Tel: +55 11 4831 1245

imprensa@voeazul.com.br

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: October 28, 2024

Azul S.A.

By: /s/ Alexandre Wagner Malfitani

Name: Alexandre Wagner Malfitani

Title: Chief Financial Officer

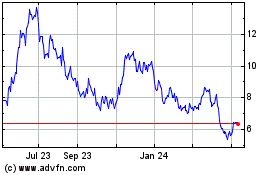

Azul (NYSE:AZUL)

Historical Stock Chart

From Nov 2024 to Dec 2024

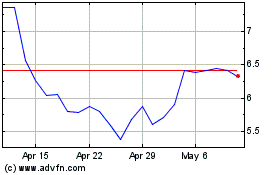

Azul (NYSE:AZUL)

Historical Stock Chart

From Dec 2023 to Dec 2024