New Software Tool Helps Arrow Electronics CFO Cut Costs

September 03 2019 - 6:36PM

Dow Jones News

By Nina Trentmann

The finance chief of Arrow Electronics Inc. is turning to

software to help eke out $130 million in annual cost savings across

the electronics distributor's operations, an effort that could be

widened should the company's outlook worsen as a consequence of the

trade tensions between the U.S. and China.

The Centennial, Colo.-based company in mid-July reduced its

forecast following lower sales. It booked a net loss of $549

million in the second quarter, compared with a $170 million profit

in the same quarter a year earlier. Arrow cited lower demand across

all component products, all regions and most industries in an

earnings release in early August.

"We don't want a sustained impact on operating income and

earnings per share," Chief Financial Officer Chris Stansbury said

Tuesday in an interview. "Barring the dampening effects on demand

from tariffs and trade wars, Arrow would have expected operating

income to be up year over year," Mr. Stansbury said.

Arrow plans to take out $130 million in costs by the end of the

year and its new enterprise resource planning system is expected to

play a key role in achieving that target, Mr. Stansbury said.

The company's ERP system ties together a range of business

processes in a common data, or network, structure. ERP systems

combine information on finance, inventory management, supply chain

management and human resource management.

Arrow now operates three versions of the same ERP program in

three business regions, the Americas, Europe and Asia. The

integration of previously separate systems into the three they have

now allows the CFO to take a more global look at the company's

operations, Mr. Stansbury said.

The company is focusing on back-office functions such as finance

and human resources alongside warehousing and operations to bring

down its costs, Mr. Stansbury said. It will also wind down its

personal computer and mobility asset disposition business, a repair

and recycling unit. Engineering and front-line sales staff won't

see cuts, Mr. Stansbury said.

"The ERP has allowed us to do all these cost cuts," Mr.

Stansbury said. "We would not have been able to do them without

it."

Analysts expect much of the savings to come from job cuts.

"Their biggest cost is people," said Shawn Harrison, a vice

president at Longbow Research LLC. "The one area where they are not

cutting back is their engineering and design teams."

The company employed about 20,100 people as of Dec. 31,

according to Arrow's annual report.

The new ERP system will help the company during the current

phase of economic uncertainty, Mr. Harrison said. Arrow gets better

visibility of its accounts receivables and of its accounts payables

thanks to the software, he said.

The system might also boost efficiency across departments,

reducing the potential need for additional cuts in a year or two,

said Steven Fox, a managing director at Cross Research LLC.

"If there are secondary economic effects, we obviously have to

go at it again," Mr. Stansbury said. He added the current cost

savings actions wouldn't be sufficient to fully offset the

company's lost profits.

Trade tensions between the U.S. and China hurt Arrow's

customers, Mr. Stansbury said. "I don't think tariffs will go

away," he said, adding that "it is a moving target."

Arrow passes along the cost of tariffs to its customers in the

form of higher prices, Mr. Stansbury said. "The pain from tariffs

comes in the form of lower demand, leading to lower sales, leading

to lower ability to drive profits over our fixed expense base," he

said.

The company has about 200,000 customers world-wide, many of them

small- and medium-size industrial companies. "What they see in

their business is a direct read of manufacturing trends globally,"

Longbow's Mr. Harrison said.

U.S. factory activity contracted for the first time in three

years in August. New factory orders, employment and production all

declined last month from July, according to manufacturing figures

released Tuesday by the Institute for Supply Management.

--Mark Maurer contributed to this article.

Write to Nina Trentmann at Nina.Trentmann@wsj.com

(END) Dow Jones Newswires

September 03, 2019 18:21 ET (22:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Aug 2024 to Sep 2024

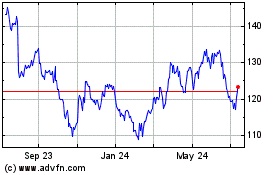

Arrow Electronics (NYSE:ARW)

Historical Stock Chart

From Sep 2023 to Sep 2024