Argan, Inc. (NYSE: AGX) today announced financial

results for its second quarter and six month period ended July 31,

2015.

Second Quarter 2015 Highlights:

- Revenues of $97.4 million for the

current quarter vs. $85.5 million in the first quarter ended April

30th.

- Revenues of $182.9 million for the six

months ended July 31, 2015 vs. $153.2 million for the six months

ended July 31, 2014.

- Net income attributable to our

stockholders was $11.3 million and $18.8 million for the quarter

and six months ended July 31, 2015 vs. $8.6 million and $12.0

million for the quarter and six months ended July 31, 2014.

- EBITDA attributable to our stockholders

was $19.4 million for the current quarter and $31.9 million for the

six months ended July 31, 2015.

- Cash, cash equivalents and short-term

investments totaled just under $300 million at quarter-end.

Our continued strong management of two large, gas-fired power

plant projects has resulted in increased revenues and gross profit

for the six months ending July 31, 2015 vs. the same period in

2014. Year to date revenues increased by $29.7 million to $182.9

million for the six months ended July 31, 2015. Our year to date

gross profit increased to $49.7 million, or 27% of corresponding

revenues, from $31.6 million, or 21% of corresponding revenues, for

the six month period July 31, 2014. For the current quarter,

revenues declined slightly to $97.4 million. However, our gross

profit for the current quarter increased to $28.5 million, or 29%

of corresponding revenues, from $21.6 million, or 21% of

corresponding revenues, for last year’s second quarter.

Due primarily to the strong performance of the power industry

services business, net income attributable to our stockholders for

the second quarter was $11.3 million, or $0.75 per diluted share,

compared with net income attributable to our stockholders of $8.6

million, or $0.58 per diluted share for the second quarter last

year. Net income attributable to our stockholders for the six

months ended July 31, 2015 was $18.8 million, or $1.26 per diluted

share, and was $12.0 million, or $0.82 per diluted share, for the

comparable period last year.

Likewise, consolidated EBITDA attributable to our stockholders

increased by $5.5 million to $19.4 million for the current quarter,

and increased by $12.5 million to $31.9 million for the six months

ended July 31, 2015.

Contract backlog increased during the current quarter to $660

million from $345 million at the end of the first quarter due to

the addition of our recently announced EPC contract with Moxie

Freedom. Subsequent to the quarter ended July 31, 2015, we added

contract value of approximately $650 million to our backlog as a

result of three EPC contracts; a $100 million contract with Exelon

and 2 contracts totaling $550 million with NTE Energy.

Commenting on Argan’s second quarter results, Rainer Bosselmann,

Chairman and Chief Executive Officer, stated, “Our effective

management of large gas-fired power projects has resulted in

consistently strong revenues and gross margins. We look forward to

the next three to five years, given our strong and improved

backlog.”

About Argan, Inc.

Argan’s primary business is providing a full range of services

to the power industry including the engineering, procurement and

construction of gas-fired and biomass-fired power plants, along

with related commissioning, operations management, maintenance,

project development and consulting services, through its Gemma

Power Systems and Atlantic Projects Company operations. Argan also

owns Southern Maryland Cable, which provides telecommunications

infrastructure services.

Certain matters discussed in this press release may constitute

forward-looking statements within the meaning of the federal

securities laws and are subject to risks and uncertainties

including, but not limited to: (1) the Company’s ability to

achieve its business strategy while effectively managing costs and

expenses; (2) the Company’s ability to successfully and

profitably integrate acquisitions; and (3) the continued

strong performance of our power industry services business. Actual

results and the timing of certain events could differ materially

from those projected in or contemplated by the forward-looking

statements due to a number of factors detailed from time to time in

Argan’s filings with the Securities and Exchange Commission. In

addition, reference is hereby made to cautionary statements with

respect to risk factors set forth in the Company’s most recent

reports on Form 10-K and 10-Q, and other SEC filings.

ARGAN, INC. AND SUBSIDIARIES Consolidated

Statements of Operations (Unaudited) Three

Months Ended July 31, Six Months Ended July 31,

2015 2014 2015 2014

REVENUES Power industry services $ 93,471,000 $ 100,418,000

$ 176,355,000 $ 150,242,000 Telecommunications infrastructure

services 3,963,000 1,612,000 6,566,000

2,979,000 Revenues 97,434,000 102,030,000

182,921,000 153,221,000

COST OF REVENUES Power

industry services 66,136,000 79,261,000 128,515,000 119,311,000

Telecommunications infrastructure services 2,805,000

1,205,000 4,746,000 2,296,000 Cost of revenues

68,941,000 80,466,000 133,261,000 121,607,000

GROSS PROFIT 28,493,000 21,564,000 49,660,000 31,614,000

Selling, general and administrative expenses 4,848,000

4,481,000 10,387,000 7,859,000

INCOME FROM

OPERATIONS 23,645,000 17,083,000 39,273,000 23,755,000 Other

income, net 128,000 41,000 212,000

63,000

INCOME BEFORE INCOME TAXES 23,773,000 17,124,000

39,485,000 23,818,000 Income tax expense 7,939,000

5,104,000 12,800,000 6,997,000

NET INCOME

15,834,000 12,020,000 26,685,000 16,821,000

Net income attributable to noncontrolling

interests

4,527,000 3,470,000 7,875,000 4,796,000

NET INCOME ATTRIBUTABLE TO THE STOCKHOLDERS OF ARGAN,

INC. $ 11,307,000 $ 8,550,000 $ 18,810,000 $ 12,025,000

EARNINGS PER SHARE ATTRIBUTABLE TO THE

STOCKHOLDERS OF ARGAN, INC.

Basic $ 0.77 $ 0.59 $ 1.28 $ 0.84 Diluted $ 0.75 $ 0.58 $ 1.26 $

0.82

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING Basic

14,747,000 14,399,000 14,693,000 14,350,000

Diluted 15,003,000 14,655,000 14,952,000

14,641,000

ARGAN, INC. AND SUBSIDIARIES

Reconciliations to EBITDA Consolidated Operations

(Unaudited) Three Months Ended July 31,

2015 2014 Net income $ 15,834,000 $ 12,020,000 Less

net income attributable to noncontrolling interests (4,527,000 )

(3,470,000 ) Interest expense (34,000 ) -- Income tax expense

7,852,000 5,104,000 Depreciation 140,000 141,000 Amortization of

purchased intangible assets 104,000 61,000 EBITDA

attributable to the stockholders of Argan, Inc. $ 19,369,000 $

13,856,000

Power Industry Services

(Unaudited)

Three Months Ended July 31, 2015 2014

Income before income taxes $ 24,787,000 $ 18,428,000 Less pre-tax

income attributable to noncontrolling interests (4,614,000 )

(3,470,000 ) Interest expense (34,000 ) -- Depreciation 95,000

96,000 Amortization of purchased intangible assets 104,000

61,000 EBITDA attributable to the stockholders of Argan,

Inc. $ 20,338,000 $ 15,115,000

Consolidated Operations

(Unaudited)

Six Months Ended July 31, 2015 2014 Net

income $ 26,685,000 $ 16,821,000 Less net income attributable to

noncontrolling interests (7,875,000 ) (4,796,000 ) Interest expense

(101,000 ) -- Income tax expense 12,756,000 6,997,000 Depreciation

258,000 283,000 Amortization of purchased intangible assets

164,000 121,000 EBITDA attributable to the stockholders of

Argan, Inc. $ 31,887,000 $ 19,426,000

Power Industry Services

(Unaudited)

Six Months Ended July 31, 2015 2014

Income before income taxes $ 41,787,000 $ 26,437,000 Less pre-tax

income attributable to noncontrolling interests (7,919,000 )

(4,796,000 ) Interest expense (101,000 ) -- Depreciation 170,000

192,000 Amortization of purchased intangible assets 164,000

121,000 EBITDA attributable to the stockholders of Argan,

Inc. $ 34,101,000 $ 21,954,000

Management uses EBITDA, a non-GAAP financial measure, for

planning purposes, including the preparation of operating budgets

and the determination of appropriate levels of operating and

capital investments. Management believes that EBITDA provides

additional insight for analysts and investors in evaluating the

Company's financial and operational performance and in assisting

investors in comparing the Company's financial performance to those

of other companies in the Company's industry. However, EBITDA is

not intended to be an alternative to financial measures prepared in

accordance with GAAP and should not be considered in isolation from

the Company’s GAAP results of operations. Pursuant to the

requirements of SEC Regulation G, reconciliations between the

Company's GAAP and non-GAAP financial results are included in the

presentations above and investors are advised to carefully review

and consider this information as well as the GAAP financial results

that are presented in the Company's SEC filings.

ARGAN, INC. AND SUBSIDIARIES CONSOLIDATED

BALANCE SHEETS July 31, 2015 January 31,

2015 ASSETS (Unaudited) (Note 1)

CURRENT ASSETS: Cash and cash equivalents $182,136,000

$333,691,000 Short-term investments 117,064,000 -- Accounts

receivable, net of allowance for doubtful accounts 38,839,000

27,330,000 Costs and estimated earnings in excess of billings

2,943,000 455,000 Notes receivable and accrued interest 6,281,000

1,786,000 Prepaid expenses and other current assets 2,856,000

1,092,000

TOTAL CURRENT ASSETS 350,119,000

364,354,000 Property, plant and equipment, net of accumulated

depreciation 5,189,000 6,518,000 Goodwill 22,887,000 18,476,000

Intangible assets, net of accumulated amortization 1,863,000

1,845,000

TOTAL ASSETS $380,058,000

$391,193,000

LIABILITIES AND EQUITY

CURRENT LIABILITIES: Accounts payable $ 32,392,000 $

37,691,000 Accrued expenses 24,022,000 15,976,000 Billings in

excess of costs and estimated earnings 114,587,000 161,564,000

Deferred income tax liabilities 656,000 201,000

TOTAL CURRENT LIABILITIES 171,657,000 215,432,000 Deferred

income tax liabilities 821,000 809,000

TOTAL

LIABILITIES 172,478,000 216,241,000

COMMITMENTS AND CONTINGENCIES STOCKHOLDERS’

EQUITY:

Preferred stock, par value $0.10 per share

– 500,000 shares authorized; no shares issued and outstanding

--

--

Common stock, par value $0.15 per share –

30,000,000 shares authorized; 14,792,702 and 14,634,434 shares

issued at July 31 and January 31, 2015, respectively; 14,789,469

and 14,631,201 shares outstanding at July 31 and January 31, 2015,

respectively

2,219,000

2,195,000

Additional paid-in capital 115,621,000 109,696,000 Retained

earnings 92,418,000 73,614,000 Treasury stock, at cost – 3,233

shares at July 31 and January 31, 2015 (33,000 ) (33,000 )

TOTAL

STOCKHOLDERS’ EQUITY 210,225,000 185,472,000 Noncontrolling

interests (2,645,000 ) (10,520,000 )

TOTAL EQUITY

207,580,000 174,952,000

TOTAL LIABILITIES AND

EQUITY $380,058,000 $391,193,000

Note 1 – The condensed consolidated

balance sheet as of January 31, 2015 has been derived from audited

consolidated financial statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150908006710/en/

Argan, Inc.Company Contact:Rainer Bosselmann,

301-315-0027orInvestor Relations Contact:Cynthia Flanders,

301-315-0027

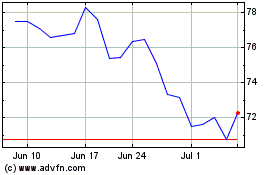

Argan (NYSE:AGX)

Historical Stock Chart

From Jun 2024 to Jul 2024

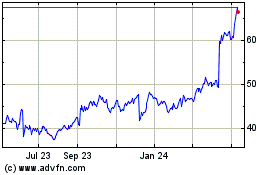

Argan (NYSE:AGX)

Historical Stock Chart

From Jul 2023 to Jul 2024