AAC Holdings Completes Acquisition of Las Vegas In-Network Inpatient & Outpatient Treatment Provider & Sober Living Beds for ...

May 04 2016 - 4:15PM

Business Wire

AAC Holdings, Inc. (NYSE: AAC), through one of its subsidiaries,

completed the previously announced acquisition of Solutions

Recovery, Inc., its affiliates and associated real estate assets

for an aggregate $6.75 million in cash and $6.25 million of

restricted shares of AAC Holdings’ common stock. The cash portion

of the purchase price was funded from borrowings on the Company’s

Deerfield subordinated debt facility. The acquisitions provide the

following:

- 100 Sober Living Beds (owned)

- 80 Licensed In-Network Detox,

Residential and Halfway House Beds (leased)

- 24 Sober Living Beds (leased)

- 2 Licensed, In-Network Outpatient

Centers (leased)

“Las Vegas is one of our highest demand markets, and we are now

better able to address the needs in this market with both

out-of-network and in-network inpatient and outpatient treatment

facilities,” said Michael Cartwright, Chairman and Chief Executive

Officer of AAC Holdings. “Similar to what we are pursuing with the

recent acquisition of sober living capacity in Arlington, Texas, we

expect the additional sober living capacity to support continued

growth and treatment options in both our Desert Hope outpatient

facility and the Solutions Recovery outpatient centers.”

Solutions Recovery provides detoxification, residential, and

intensive outpatient treatment as well as sober living services in

the greater Las Vegas area. Dave Marlon, the facility CEO, is

joining AAC along with the Solutions Recovery staff.

Solutions Recovery generated revenue of approximately $6.1

million for the year ended December 31, 2015. While Adjusted EBITDA

is currently minimal, the Company expects to generate approximately

$2 million of Adjusted EBITDA in the first twelve months of

ownership.

About American Addiction CentersAmerican Addiction

Centers is a leading provider of inpatient substance abuse

treatment services. AAC treats clients who are struggling with drug

addiction, alcohol addiction, and co-occurring mental/behavioral

health issues. AAC currently operate 30 substance abuse treatment

facilities. Located throughout the United States, these facilities

are focused on delivering effective clinical care and treatment

solutions. For more information, please find us at

AmericanAddictionCenters.org or follow us on Twitter

@AAC_Tweet.

Forward Looking StatementsThis release contains

forward-looking statements within the meaning of the federal

securities laws. These forward-looking statements are made only as

of the date of this release. In some cases, you can identify

forward-looking statements by terms such as “anticipates,”

“believes,” “could,” “estimates,” “expects,” “may,” “potential,”

“predicts,” “projects,” “should,” “will,” “would,” and similar

expressions intended to identify forward-looking statements,

although not all forward-looking statements contain these words.

Forward-looking statements may include information concerning AAC

Holdings, Inc.’s (collectively with its subsidiaries, “Holdings” or

the “Company”) possible or assumed future results of operations,

including descriptions of Holdings’ revenues, profitability,

outlook and overall business strategy. These statements involve

known and unknown risks, uncertainties and other factors that may

cause our actual results and performance to be materially different

from the information contained in the forward-looking statements.

These risks, uncertainties and other factors include, without

limitation: (i) our inability to operate our facilities; (ii) our

reliance on our sales and marketing program to continuously attract

and enroll clients; (iii) a reduction in reimbursement rates by

certain third-party payors for inpatient and outpatient services

and point of care and definitive lab testing; (iv) our failure to

successfully achieve growth through acquisitions and de novo

expansions; (v) uncertainties regarding the timing of the closing

of acquisitions; (vi) the possibility that a governmental entity

may prohibit, delay or refuse to grant approval for the

consummation of acquisitions; (vii) our failure to achieve

anticipated financial results from prior or pending acquisitions;

(viii) a disruption in our ability to perform diagnostic drug

testing services; (ix) maintaining compliance with applicable

regulatory authorities, licensure and permits to operate our

facilities and lab; (x) a disruption in our business related to the

recent indictment of certain of our subsidiaries and current and

former employees, including a former senior executive; (xi) our

inability to agree on conversion and other terms for the balance of

convertible debt; (xii) our inability to meet our covenants in our

loan documents; (xiii) our inability to obtain senior lender

consent to exceed the current $50 million limit in unsecured

subordinated debt; (xiv) our inability to integrate newly acquired

facilities; (xv) a disruption to our business and reputational and

potential economic risks associated with the civil securities

claims brought by shareholders; and (xvi) general economic

conditions, as well as other risks discussed in the “Risk Factors”

section of the Company’s Annual Report on Form 10-K, and other

filings with the Securities and Exchange Commission. As a result of

these factors, we cannot assure you that the forward-looking

statements in this release will prove to be accurate. Investors

should not place undue reliance upon forward looking

statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160504005378/en/

SCR PartnersInvestor Contact:Tripp Sullivan,

615-760-1104IR@contactAAC.comorMedia Contact:Cynthia

Johnson, 615-587-7728Mediarequest@contactAAC.com

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Oct 2024 to Nov 2024

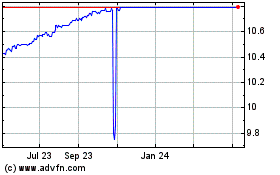

Ares Acquisition (NYSE:AAC)

Historical Stock Chart

From Nov 2023 to Nov 2024