Luxembourg, February 9, 2023 - ArcelorMittal

(referred to as “ArcelorMittal” or the “Company”) (MT (New York,

Amsterdam, Paris, Luxembourg), MTS (Madrid)), the world’s leading

integrated steel and mining company, today announced results1,2 for

the three-month and twelve-month periods ended December 31,

2022.

2022 Key highlights:

- Health and safety focus: Protecting the health

and wellbeing of the employees remains the Company’s overarching

priority; LTIF rate of 0.70x in FY 2022 vs. 0.79x in FY 20213

- Strong full year financial performance: FY

2022 operating income of $10.3bn4,5 (vs. $17.0bn4,5 in FY 2021); FY

2022 EBITDA of $14.2bn (vs. $19.4bn in FY 2021)

- Healthy net income: FY 2022 adjusted net

income6 of $10.6bn (vs. $14.9bn in FY 2021); FY 2022 net income

includes share of JV and associates net income of $1.3bn (vs.

$2.2bn in FY 2021)

- Strong FCF generation: The Company generated

$6.4bn free cash flow (FCF) in FY 2022 ($10.2bn net cash provided

by operating activities less $3.5bn capex and $0.3bn minority

dividends), broadly stable as compared to FY 202117. 4Q 2022 FCF of

$2.1bn ($3.6bn net cash provided by operating activities less

$1.5bn capex)

- Financial strength: The Company ended 2022

with record low net debt of $2.2bn (vs. $4.0bn at the end of 2021).

Gross debt of $11.7bn at the end of 2022, and cash and cash

equivalents of $9.4bn

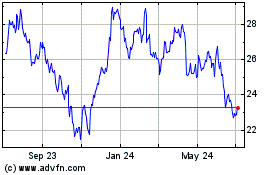

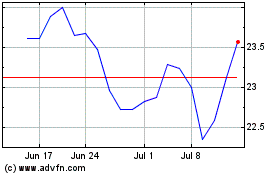

- Share repurchases driving enhanced value:

Share buybacks reduced the fully diluted shares outstanding by 11%

in 2022, bringing the total reduction to 30% since end of September

20207. FY 2022 basic EPS of $10.21/sh vs. $13.53/sh for FY 2021. FY

2022 adjusted basic EPS6 of $11.65; last 12 months ROE8 of 20.3%

and book value per share9 increased to $62/sh

Priorities & Outlook:

- Global leadership on addressing climate

change: During 2022, the Company progressed its plans to

reduce the CO2e intensity of its global production by 25% by 2030

- Texas HBI plant acquired, securing high-quality metallics for

low-carbon steelmaking

- $0.6bn investment in 1GW renewable energy project in India

underway

- 1st smart carbon CCU project inaugurated in Ghent

(Belgium)

- 4 specialist scrap metal recyclers acquired in Europe

- 1st low-carbon emissions steelmaking project in Dofasco

(Canada)

- The Company is progressing on key European decarbonization

projects

- Delivering strategic growth in support of higher

sustainable returns

- Texas HBI acquisition and Brazil CSP acquisition (to be

completed in 1Q 2023) estimated to add ~$0.5bn to normalized

EBITDA16

- Expansion of the AMNS India Hazira plant to ~15Mt capacity by

2026 now underway

- Ramp up of the 2.5Mt Mexico hot strip mill is ongoing with

$0.1bn EBITDA run-rate achieved in 4Q 2022

- Strategic capex envelope of high return projects is now

$4.2bn19 to be spent between 2021-2024 (of which $0.9bn has been

spent to date) and estimated to add ~$1.3bn to normalized EBITDA16;

FY 2023 capex expected to be between $4.5bn-$5.0bn

- Building a track record of consistently returning

capital to shareholders:

- Share buy backs completed in 2022 represented 11% of diluted

equity, bringing total purchases since September 2020 to 30% at an

average share price of €24.34

- There remains (~$0.1bn) of post-dividend FCF to be returned to

shareholders as per the capital return policy, and this is expected

to be completed in 1Q 2023. The remaining amounts under the

existing buy back program will be allocated to the 2023 capital

return (targeting 50% of post-dividend FCF as per the policy).To

provide sufficient headroom for the 2023 capital return, the

Company intends to seek additional authority from shareholders to

repurchase shares at the 2023 AGM in May

- The Board proposes to increase the annual base dividend to

shareholders to $0.44/sh (to be paid in 2 equal instalments in June

2023 and December 2023), subject to the approval of shareholders at

the 2023 AGM

- Outlook

- World ex-China apparent steel consumption ("ASC") in 2023 is

expected to recover by +2% to +3% as compared to 2022; the Company

expects its steel shipments in 2023 to grow by ~5% vs. 202211

- The Company expects positive FCF generation in 2023; capex is

expected to increase to within the $4.5bn-$5.0bn range, interest

costs are expected to increase to approximately $0.4bn, and lower

cash taxes (including non-recurrence of timing related payments

made in 2022 of $0.7bn)

- The Company expects working capital will follow the normal

seasonal patterns (including an investment in 1Q 2023) but expects

a release for the full year 2023

Financial highlights (on the basis of

IFRS1,2):

|

(USDm) unless otherwise shown |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

Sales |

16,891 |

18,975 |

20,806 |

79,844 |

76,571 |

|

Operating (loss)income |

(306) |

1,651 |

4,558 |

10,272 |

16,976 |

|

Net income attributable to equity holders of the parent |

261 |

993 |

4,045 |

9,302 |

14,956 |

|

Basic earnings per common share (US$) |

0.30 |

1.11 |

3.93 |

10.21 |

13.53 |

|

|

|

|

|

|

|

|

Operating (loss)income /tonne (US$/t) |

(24) |

122 |

289 |

184 |

270 |

|

EBITDA |

1,258 |

2,660 |

5,052 |

14,161 |

19,404 |

|

EBITDA /tonne (US$/t) |

100 |

196 |

320 |

253 |

308 |

|

|

|

|

|

|

|

|

Crude steel production (Mt) |

13.2 |

14.9 |

16.5 |

59.0 |

69.1 |

|

Steel shipments (Mt) |

12.6 |

13.6 |

15.8 |

55.9 |

62.9 |

|

Total group iron ore production (Mt) |

10.7 |

10.6 |

13.4 |

45.3 |

50.9 |

|

Iron ore production (Mt) (AMMC and Liberia only) |

7.5 |

6.9 |

7.2 |

28.6 |

26.2 |

|

Iron ore shipment (Mt) (AMMC and Liberia only) |

6.9 |

6.9 |

7.1 |

28.0 |

26.0 |

|

|

|

|

|

|

|

|

Number of shares outstanding (issued shares less treasury shares)

(millions) |

805 |

816 |

911 |

805 |

911 |

Commenting, Aditya Mittal, ArcelorMittal

Chief Executive Officer, said:“Despite the challenges that

emerged as the year unfolded, our full year results demonstrate the

benefits of our strengthened asset portfolio and the improvements

we have made to our cost base in recent periods. This, alongside

the mitigatory actions we took in the second half of the year to

adapt production levels and optimize energy consumption, has added

resilience to our business.

Our delivery of consistently positive free cash flow and balance

sheet strength has allowed us to grow and develop the business,

capturing growth opportunities in faster growing markets while also

making good progress in our ambition to be a leader in low-carbon

steel production. The acquisition of Texas HBI helps us secure

high-quality metallics for low-carbon steelmaking. We celebrated

the commissioning of the European steel industry’s first carbon

capture and re-use project in Belgium. Our two low-carbon customer

products, XCarb® green steel certificates and XCarb® recycled and

renewably produced, continue to gain momentum with customers; and

the XCarb® Innovation Fund made a series of investments in

compelling new low-carbon technologies.

As we look ahead, evidence suggests that the customer destock we

saw in the second half of 2022 has peaked, hence providing support

to apparent steel consumption and steel spreads. Although

geopolitical uncertainty remains high, we remain confident in the

strength and resilience of ArcelorMittal, and in our ability to

successfully execute our strategy of growth, decarbonization and

sustainable returns through all aspects of the cycle."

Sustainable development and safety

performance

Health and safety - Own personnel and

contractors lost time injury frequency rate3,12

Protecting the health and wellbeing of employees is the

Company’s overarching priority, with a particular focus on becoming

a fatality free and severe injury free company.

Health and safety performance based on own personnel and

contractors lost time injury frequency ("LTIF") rate was 0.86x in

the fourth quarter of 2022 ("4Q 2022") as compared to 0.54x in the

third quarter of 2022 ("3Q 2022) and 0.74x in the fourth quarter of

20213 ("4Q 2021"). Health and safety performance in the twelve

months of 2022 (“12M 2022” or "FY 2022") was 0.70x as compared to

0.79x in the twelve months of 2021 (“12M 2021” or "FY 2021").

Own personnel and contractors - Frequency

rate

|

Lost time injury frequency rate |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

NAFTA |

0.18 |

0.27 |

0.25 |

0.25 |

0.40 |

|

Brazil |

0.14 |

0.05 |

0.30 |

0.10 |

0.22 |

|

Europe |

1.14 |

1.03 |

1.09 |

1.11 |

1.19 |

|

ACIS |

1.07 |

0.50 |

0.92 |

0.74 |

0.94 |

|

Mining |

0.61 |

0.30 |

— |

0.84 |

0.32 |

|

Total |

0.86 |

0.54 |

0.74 |

0.70 |

0.79 |

Sustainable development highlights – leading the

decarbonization of the steel

industry10:

- On January 27, 2023, ArcelorMittal

announced an investment of $36 million in Boston Metal. The

transaction is the Company’s largest single initial investment to

date through its XCarb® Innovation Fund. The fund, launched in

March 2021, targets investing in the best and brightest

technologies that hold the potential to play a meaningful role in

the decarbonization of the steel industry, a process ArcelorMittal

intends to lead.

- On December 29, 2022, ArcelorMittal

announced that it had signed an agreement to acquire Polish scrap

metal recycling business Zaklad Przerobu Złomu (“Złomex”). Złomex

operates scrap yards in Krakow and Warsaw which last year processed

and shipped almost 400,000 tonnes of ferrous scrap metal. Złomex

supplies a range of steel mills and foundries with well-established

relationships and has also been a long-standing supplier to

ArcelorMittal’s steel plants in Dąbrowa Górnicza and Warsaw. This

follows ArcelorMittal’s announcement on December 6, 2022, that it

has acquired Riwald Recycling (‘Riwald’), a state-of-the-art

ferrous scrap metal recycling business based in the Netherlands.

Riwald processed over 330,000 tonnes of ferrous scrap metal in

2021. ArcelorMittal has acquired four scrap metal businesses during

2022, as the Company continually seeks to enhance its ability to

source scrap steel, a key raw material which supports the Company’s

ability to reduce its carbon emissions and to achieve carbon

neutrality by 2050.

- On December 8, 2022, ArcelorMittal

successfully inaugurated its first carbon capture and utilization

(‘CCU’) project in Ghent (Belgium). The €200 million ‘Steelanol’

project is a first of its kind for the European steel industry.

Utilizing cutting edge carbon recycling technology developed by our

project partner LanzaTech, the CCU plant uses biocatalysts to

transform carbon-rich waste gases from the steelmaking process into

advanced bioethanol. The advanced bioethanol can then be used as a

building block to produce a variety of chemical products including

transport fuels, paints, clothing and even cosmetic perfume, hence

helping to support the decarbonization efforts of the chemical

sector. Once production reaches full capacity the Steelanol plant

will produce 80 million litres of advanced ethanol, almost half of

the total current advanced ethanol demand for fuel mixing in

Belgium. Carbalyst smart carbon technologies (Ghent) when combined

with 2 Torero reactors is expected to achieve 0.3Mt CO2

saving.

- The Company improved its gender diversity in 2022 with 16% of

women in management (vs. 14% in 2021) and remains on track to reach

the target of 25% by 2030.

Analysis of results for the twelve months ended December

31, 2022 versus results for the twelve months ended December 31,

2021Total steel shipments for 12M 2022 were 55.9 million

metric tonnes (Mt), a decrease of -11.2% as compared to 62.9Mt in

12M 2021. Steel shipments on a scope adjusted basis (i.e. excluding

the shipments of ArcelorMittal Italia, deconsolidated as from April

14, 2021) and excluding the impact of Ukraine, decreased by

-4.5%.

Sales for 12M 2022 increased by +4.3% to $79.8 billion as

compared with $76.6 billion for 12M 2021, primarily due to higher

average steel selling prices (+16.6%), offset in part by lower

steel shipments.

Depreciation was higher at $2.6 billion for 12M 2022 as compared

to $2.5 billion in 12M 2021. The Company expects 12M 2023

depreciation at $2.6 billion.

Impairment charges for 12M 2022 of $1.0 billion relate to

ArcelorMittal Kryviy Rih. In 4Q 2022, the Company recognized a

$1,026 million impairment charge related to property, plant and

equipment with respect to ArcelorMittal Kriviy Rih (Ukraine) in the

ACIS segment, where the ongoing conflict with Russia resulted in

low levels of production, sales and income and created significant

uncertainty about the timing and ability of operations to return to

a normal level of activity. Recent attacks against Ukrainian power

infrastructures caused additional operational issues for

ArcelorMittal Kriviy Rih and the increasing geopolitical tensions

resulted in a substantial increase in the discount rate applied by

the Company in its value in use calculation. Impairment gain for

12M 2021 amounted to $218 million following improved cash flow

projections in the context of decarbonization plans in Sestao

(Spain) (partially reversing the impairment recognized in

2015).

Exceptional items for 12M 2022 of $0.3 billion included $0.5

billion of non-cash inventory related provisions (recognized in 3Q

2022) to reflect the net realizable value of inventory under IFRS

with declining market prices in Europe, partially offset by a $0.1

billion purchase gain on the acquisition of the Hot Briquetted Iron

(‘HBI’) plant in Texas and a $0.1 billion gain following the

settlement of a claim by ArcelorMittal for a breach of a supply

contract. Exceptional items for 12M 2021 of $123 million related to

expected costs for the decommissioning of the dam at the Serra Azul

mine in Brazil.

Operating income for 12M 2022 of $10.3 billion was lower as

compared to 12M 2021 of $17.0 billion primarily driven by negative

price-cost effect, elevated energy costs, lower steel shipments,

negative translation effect and combined impairment costs and

exceptional items totaling $1.3 billion as discussed above.

Income from associates, joint ventures and other investments for

12M 2022 was $1.3 billion as compared to $2.2 billion for 12M 2021

primarily due to the lower contributions from AMNS India and AMNS

Calvert. 12M 2022 includes the annual dividend from Erdemir of $117

million (vs. $89 million received in 12M 2021).

Net interest expense in 12M 2022 of $213 million was lower as

compared to $278 million in 12M 2021 due to higher interest income.

The Company expects interest costs to increase to $0.4 billion in

12M 2023 due to higher interest rates.

Foreign exchange and other net financing losses were $121

million for 12M 2022 as compared to losses of $877 million for 12M

2021. Foreign exchange gain for 12M 2022 was $191 million as

compared to a loss of $155 million in 12M 2021. 12M 2021 included

charges of $191 million related to repurchases of bonds and MCNs,

as well as a $163 million loss (primarily consisting of interest

and indexation charges) relating to a legal claim at ArcelorMittal

Brasil from the Votorantim acquisition.

ArcelorMittal recorded an income tax expense of $1,717 million

for 12M 2022 (including $363 million deferred tax benefit) as

compared to $2,460 million for 12M 2021 (including $493 million

deferred tax benefit) reflecting overall lower taxable profits.

ArcelorMittal’s net income for 12M 2022 was $9.3 billion as

compared to $15.0 billion for 12M 2021. Adjusted net income6 for

12M 2022 excluding impairments charges and exceptional items, was

$10.6 billion as compared to $14.9 billion for 12M 2021.

ArcelorMittal’s basic earnings per common share for 12M 2022 was

$10.21 basic earnings per common share, as compared to $13.53 basic

earnings per common share for 12M 2021. Adjusted basic earnings per

common share (excluding impairment charges and exceptional items)6

for 12M 2022 was $11.65/sh as compared to $13.45/sh for 12M

2021.

Analysis of results for 4Q 2022 versus 3Q 2022 and 4Q

2021Total steel shipments in 4Q 2022 were 12.6Mt, -6.9%

lower as compared with 13.6Mt in 3Q 2022. Reflecting the

significantly lower apparent demand due to destocking, 4Q 2022

steel shipments were -19.9% lower as compared with 15.8Mt in 4Q

2021 (-14.7% excluding the impact of Ukraine).

Sales in 4Q 2022 were $16.9 billion as compared to $19.0 billion

for 3Q 2022 and $20.8 billion for 4Q 2021. As compared to 3Q 2022,

the -11.0% decrease in sales was primarily due to lower average

steel selling prices (-6.8%) and lower steel shipment volumes.

Sales in 4Q 2022 were -18.8% lower as compared to 4Q 2021 primarily

due to lower average steel selling prices (-4.3%) and lower steel

shipments (-19.9%).

Depreciation for 4Q 2022 was $636 million as compared to $628

million for 3Q 2022 and $712 million in 4Q 2021.

Impairment charges for 4Q 2022 of $1.0 billion relate to

ArcelorMittal Kryviy Rih as discussed above.

Exceptional items for 4Q 2022 of $0.1 billion relates to a gain

following the settlement of a claim by ArcelorMittal for a breach

of a supply contract. Exceptional items for 3Q 2022 of $0.4 billion

included $0.5 billion of non-cash inventory related provisions to

reflect the net realizable value of inventory under IFRS with

declining market prices in Europe, partially offset by a $0.1

billion purchase gain on the acquisition of a Hot Briquetted Iron

(‘HBI’) plant in Texas. Exceptional items for 4Q 2021 were nil.

Operating loss for 4Q 2022 of $0.3 billion reflected the

impairment charges as discussed above, negative price-cost and

lower volumes, and compares to an operating income of $1.7 billion

in 3Q 2022 and $4.6 billion for 4Q 2021.

Income from associates, joint ventures and other investments for

4Q 2022 was $121 million as compared to $59 million for 3Q 2022 and

$383 million in 4Q 2021. 4Q 2022 results improved as compared to 3Q

2022 with improved contributions from Chinese investees.

Net interest expense in 4Q 2022 was higher at $72 million as

compared to $37 million in 3Q 2022 and higher than $49 million in

4Q 2021, due to the issuance, at the end of 3Q 2022 and in 4Q 2022

of new notes bearing higher interest rates.

Foreign exchange and other net financing gain in 4Q 2022 was

$449 million as compared to a loss of $247 million in 3Q 2022 and

$111 million in 4Q 2021. 4Q 2022 includes foreign exchange gain of

$497 million (following the -9.4% depreciation of the US dollar vs.

the euro at the period end rates) as compared to a loss of $108

million in 3Q 2022 and a loss of $30 million in 4Q 2021.

Due to a lower taxable profit, ArcelorMittal recorded an income

tax benefit of $35 million (including deferred tax benefit of $126

million) in 4Q 2022, as compared to an income tax expense of $371

million (including deferred tax benefit of $23 million) in 3Q 2022.

Income tax expense in 4Q 2021 was $632 million (including deferred

tax benefit of $46 million).

ArcelorMittal recorded a net income in 4Q 2022 of $261 million

as compared to $993 million in 3Q 2022 and $4,045 million for 4Q

2021. Adjusted net income6 in 4Q 2022 was $1,189 million as

compared to $1,374 million in 3Q 2022 and $3,827 million for 4Q

2021.

ArcelorMittal's basic earnings per common share for 4Q 2022 was

lower at $0.30 as compared to $1.11 in 3Q 2022 and $3.93 in 4Q

2021. Adjusted basic earnings per common share6 for 4Q 2022 was

lower at $1.37 as compared to $1.54 in 3Q 2022 and $3.72 in 4Q

2021.

Analysis of segment

operations2

NAFTA

|

(USDm) unless otherwise shown |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

Sales |

2,923 |

3,438 |

3,329 |

13,774 |

12,530 |

|

Operating income |

331 |

616 |

939 |

2,818 |

2,800 |

|

Depreciation |

(127) |

(114) |

(113) |

(427) |

(325) |

|

Exceptional items |

98 |

92 |

— |

190 |

— |

|

EBITDA |

360 |

638 |

1,052 |

3,055 |

3,125 |

|

Crude steel production (kt) |

2,025 |

2,126 |

2,046 |

8,271 |

8,487 |

|

Steel shipments* (kt) |

2,338 |

2,339 |

2,205 |

9,586 |

9,586 |

|

Average steel selling price (US$/t) |

1,021 |

1,191 |

1,341 |

1,215 |

1,128 |

* NAFTA steel shipments include shipments sourced by NAFTA from

Group subsidiaries and sold to the Calvert JV that are eliminated

on consolidation.

NAFTA segment crude steel production decreased by -4.8% to 2.0Mt

in 4Q 2022, as compared to 2.1Mt in 3Q 2022, mainly due to planned

maintenance, and decreased by -1.0% as compared to 4Q 2021.

Steel shipments in 4Q 2022 were stable at 2.3Mt, as compared to

3Q 2022 and increased by +6.0% as compared to 4Q 2021.

Sales in 4Q 2022 decreased by -15.0% to $2.9 billion, as

compared to $3.4 billion in 3Q 2022 primarily on account of lower

average steel selling prices (-14.2%). Sales declined by -12.2% in

4Q 2022 as compared to 4Q 2021 primarily on account of lower

average steel selling prices (-23.8%) offset in part by higher

steel shipment volumes (+6.0%) and the impact of ArcelorMittal

Texas HBI acquisition.

Exceptional items for 4Q 2022 of $0.1 billion relates to a gain

following the settlement of a claim by ArcelorMittal for a breach

of a supply contract. Exceptional items for 3Q 2022 of $0.1 billion

related to the purchase gain on the acquisition of the HBI plant in

Texas.

Operating income in 4Q 2022 declined -46.4% to $331 million as

compared to $616 million in 3Q 2022 and -64.8% lower as compared to

$939 million in 4Q 2021.

EBITDA in 4Q 2022 of $360 million was -43.5% lower as compared

to $638 million in 3Q 2022, primarily due to a negative price-cost

effect. EBITDA in 4Q 2022 was -65.8% lower as compared to $1,052

million in 4Q 2021 mainly due to a negative price-cost effect

offset in part by higher volumes.

Brazil18

|

(USDm) unless otherwise shown |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

Sales |

2,894 |

3,486 |

3,452 |

13,732 |

12,856 |

|

Operating income |

302 |

598 |

892 |

2,775 |

3,798 |

|

Depreciation |

(60) |

(57) |

(60) |

(246) |

(228) |

|

Exceptional items |

— |

— |

— |

— |

(123) |

|

EBITDA |

362 |

655 |

952 |

3,021 |

4,149 |

|

Crude steel production (kt) |

2,783 |

2,969 |

3,117 |

11,877 |

12,413 |

|

Steel shipments (kt) |

2,639 |

2,837 |

3,034 |

11,516 |

11,695 |

|

Average steel selling price (US$/t) |

1,036 |

1,137 |

1,049 |

1,114 |

1,030 |

Brazil segment crude steel production decreased by -6.3% to

2.8Mt in 4Q 2022 as compared to 3.0Mt in 3Q 2022. 4Q 2022 crude

production was -10.7% lower as compared to 4Q 2021 due to lower

demand from export markets.

Steel shipments of 2.6Mt in 4Q 2022 were -7.0% lower as compared

to 2.8Mt at 3Q 2022, primarily due to seasonally weaker domestic

shipments and lower exports, and -13.0% lower as compared to 4Q

2021, primarily due to lower exports, with domestic shipments

stable year-on-year.

Sales in 4Q 2022 decreased by -17.0% to $2.9 billion as compared

to $3.5 billion in 3Q 2022, primarily due to an -8.9% decrease in

average steel selling prices and lower shipments. Sales in 4Q 2022

were -16.2% lower than $3.5 billion at 4Q 2021 primarily on account

of -13.0% decline in shipments (primarily exports) and lower

average steel selling prices (-1.2%).

Operating income in 4Q 2022 of $302 million was lower as

compared to $598 million in 3Q 2022 and $892 million in 4Q

2021.

EBITDA in 4Q 2022 decreased by -44.8% to $362 million as

compared to $655 million in 3Q 2022, primarily due to a negative

price-cost effect and lower steel shipments (-7.0%). EBITDA in 4Q

2022 was -62.0% lower than $952 million in 4Q 2021 primarily due to

negative price-cost effect and lower steel shipments (-13.0%).

Europe

|

(USDm) unless otherwise shown |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

Sales |

10,077 |

10,694 |

12,079 |

47,263 |

43,334 |

|

Operating (loss)income |

(10) |

158 |

1,886 |

4,292 |

5,672 |

|

Depreciation |

(316) |

(300) |

(353) |

(1,268) |

(1,252) |

|

Impairment items |

— |

— |

218 |

— |

218 |

|

Exceptional items |

— |

(473) |

— |

(473) |

— |

|

EBITDA |

306 |

931 |

2,021 |

6,033 |

6,706 |

|

Crude steel production (kt) |

6,956 |

7,998 |

8,621 |

31,904 |

36,795 |

|

Steel shipments (kt) |

6,802 |

7,079 |

8,325 |

30,182 |

33,182 |

|

Average steel selling price (US$/t) |

1,085 |

1,150 |

1,110 |

1,191 |

986 |

Europe segment crude steel production declined by -13.0% to

7.0Mt in 4Q 2022 as compared to 8.0Mt in 3Q 2022. Production was

-19.3% lower as compared to 8.6Mt in 4Q 2021 given curtailed

production in light of weaker apparent demand driven by destocking.

As apparent demand conditions are now showing signs of improvement,

the Company is gradually restarting capacity.

Steel shipments declined by -3.9% to 6.8Mt in 4Q 2022 as

compared to 7.1Mt in 3Q 2022 due to lower apparent demand severely

impacted by destocking. Shipments declined by -18.3% as compared to

8.3Mt in 4Q 2021 primarily due to weaker apparent demand.

Exceptional items for 3Q 2022 of $473 million related to

non-cash inventory provisions to reflect the net realizable value

of inventory under IFRS with declining market prices.

Sales in 4Q 2022 decreased by -5.8% to $10.1 billion, as

compared to $10.7 billion in 3Q 2022, due to a -3.9% reduction in

steel shipments and -5.7% lower average selling prices. Sales

declined by -16.6% as compared to 4Q 2021 primarily due to lower

steel shipments (-18.3%) and lower average steel selling prices

(-2.3%).

Operating loss in 4Q 2022 was $10 million as compared to an

operating income of $158 million in 3Q 2022 and $1,886 million in

4Q 2021.

EBITDA in 4Q 2022 of $306 million declined as compared to $931

million in 3Q 2022, due to the impacts of a negative

price-cost effect and reduced steel shipments on account of lower

demand, offset in part by easing of energy costs.EBITDA in 4Q 2022

decreased significantly as compared to $2,021 million in 4Q 2021

due to a negative price cost effect, lower shipments and negative

translation effect.

ACIS

|

(USDm) unless otherwise shown |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

Sales |

1,229 |

1,569 |

2,539 |

6,368 |

9,854 |

|

Operating (loss)income |

(1,198) |

(55) |

439 |

(930) |

2,705 |

|

Depreciation |

(65) |

(93) |

(118) |

(369) |

(450) |

| Impairment

items |

(1,026) |

— |

— |

(1,026) |

— |

|

EBITDA |

(107) |

38 |

557 |

465 |

3,155 |

|

Crude steel production (kt) |

1,394 |

1,842 |

2,694 |

6,949 |

11,366 |

|

Steel shipments (kt) |

1,414 |

1,675 |

2,597 |

6,378 |

10,360 |

|

Average steel selling price (US$/t) |

720 |

773 |

810 |

817 |

780 |

ACIS segment crude steel production in 4Q 2022 was -24.3% lower

at 1.4Mt as compared to 1.8Mt in 3Q 2022 mainly due to operational

issues and power availability in Kazakhstan, and planned

maintenance shutdowns in South Africa. Crude steel production in 4Q

2022 was -48.3% below 2.7Mt in 4Q 2021 primarily due to lower steel

production in Ukraine due to the ongoing war.

Steel shipments in 4Q 2022 decreased by -15.6% to 1.4Mt as

compared to 1.7Mt in 3Q 2022 primarily due to weaker Kazakhstan

shipments driven by the lower production as discussed above.

Shipments were -45.6% lower as compared to 2.6Mt in 4Q 2021,

primarily due to lower production in Ukraine.

Sales in 4Q 2022 decreased by -21.7% to $1.2 billion as compared

to $1.6 billion in 3Q 2022, primarily due to lower steel shipments

as above and -6.9% lower average steel selling prices.

Impairment costs for 4Q 2022 of $1.0 billion relate to the

ArcelorMittal Kryviy Rih’s assets4.

Operating loss in 4Q 2022 of $1,198 million compares to an

operating loss of $55 million in 3Q 2022 and operating income of

$439 million in 4Q 2021. Performance was negatively impacted by the

impairment as discussed above.

EBITDA loss of $107 million in 4Q 2022 as compared to EBITDA of

$38 million in 3Q 2022, was primarily due to lower shipments and

lower selling prices.

Mining

|

(USDm) unless otherwise shown |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

Sales |

716 |

742 |

824 |

3,396 |

4,045 |

|

Operating income |

255 |

254 |

343 |

1,483 |

2,371 |

|

Depreciation |

(57) |

(57) |

(57) |

(234) |

(228) |

|

EBITDA |

312 |

311 |

400 |

1,717 |

2,599 |

|

|

|

|

|

|

|

|

Iron ore production (Mt) |

7.5 |

6.9 |

7.2 |

28.6 |

26.2 |

|

Iron ore shipment (Mt) |

6.9 |

6.9 |

7.1 |

28.0 |

26.0 |

Note: Mining segment comprises iron ore operations of

ArcelorMittal Mines Canada and ArcelorMittal Liberia.

Iron ore production increased in 4Q 2022 by +7.8% to 7.5Mt as

compared to 6.9Mt in 3Q 2022 and was higher than 7.2Mt in 4Q 2021.

Higher iron ore production at AMMC13 and Liberia in 4Q 2022 as

compared to 3Q 2022 was due to the recovery following the adverse

impact of exceptionally heavy rains in Canada in 3Q 2022.

Despite higher production, iron ore shipments were stable at

6.9Mt in 4Q 2022 as compared to 3Q 2022 due to severe storms in

Canada during December 2022 impacting port operations. 4Q 2022 iron

ore shipments of 6.9Mt were -2.5% lower as compared to 7.1Mt at 4Q

2021.

Operating income in 4Q 2022 was broadly stable at $255 million

as compared 3Q 2022 and lower by -25.7% as compared to $343 million

in 4Q 2021.

EBITDA in 4Q 2022 of $312 million was broadly stable as compared

to $311 million in 3Q 2022, with the effect of lower iron ore

reference prices (-4.8%) and lower quality premia offset in part by

lower freight and other costs. EBITDA in 4Q 2022 was lower as

compared to $400 million in 4Q 2021, primarily due to lower iron

ore reference prices (-10.7%), lower shipments (-2.5%) and lower

quality premia partially offset by lower freight costs.

Joint venturesArcelorMittal has

investments in various joint ventures and associate entities

globally. The Company considers the Calvert (50% equity interest)

and AMNS India (60% equity interest) joint ventures to be of

particular strategic importance, warranting more detailed

disclosures to improve the understanding of their operational

performance and value to the Company.

Calvert

|

(USDm) unless otherwise shown |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

Production (100% basis) (kt)* |

1,014 |

1,055 |

1,068 |

4,320 |

4,802 |

| Steel shipments

(100% basis) (kt)** |

905 |

1,030 |

1,052 |

4,229 |

4,547 |

|

EBITDA (100% basis)*** |

(1) |

2 |

270 |

589 |

1,091 |

* Production: all production of the hot strip mill including

processing of slabs on a hire work basis for ArcelorMittal group

entities and third parties, including stainless steel slabs.

** Shipments: including shipments of finished products processed

on a hire work basis for ArcelorMittal group entities and third

parties, including stainless steel products.

*** EBITDA of Calvert presented here on a 100% basis as a

stand-alone business and in accordance with the Company's policy,

applying the weighted average method of accounting for

inventory.

Following planned maintenance, Calvert’s hot strip mill ("HSM")

production during 4Q 2022 decreased by -3.9% to 1.0Mt, as compared

to 3Q 2022 and by -5.1% as compared to 1.1Mt in 4Q 2021.

Steel shipments in 4Q 2022 were -12.1% below 3Q 2022 due to

weaker demand.

EBITDA loss*** during 4Q 2022 of $1 million as compared to

EBITDA of $2 million in 3Q 2022 was primarily due to ongoing

negative price-cost effect resulted from the decline in sales

prices (for non-contract volumes), whilst inventory slab cost lags

the prevailing market prices. The impact of weighted average cost

of inventories versus replacement cost in 4Q 2022 was approximately

$0.2 billion.

AMNS India

|

(USDm) unless otherwise shown |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

Crude steel production (100% basis) (kt) |

1,624 |

1,663 |

1,847 |

6,685 |

7,393 |

| Steel shipments

(100% basis) (kt) |

1,593 |

1,634 |

1,731 |

6,470 |

6,914 |

|

EBITDA (100% basis) |

162 |

204 |

435 |

1,201 |

1,996 |

Crude steel production in 4Q 2022 decreased by -2.3% to 1.6Mt as

compared to 1.7Mt in 3Q 2022. Production was lower by -12.1% as

compared to 4Q 2021 due to lower exports following the imposition

of export duties on steel exports from India in 2Q 2022 (export

duties removed from the end of November 2022).

Steel shipments in 4Q 2022 decreased by -2.5% to 1.6Mt as

compared to 3Q 2022 and -8.0% lower as compared to 1.7Mt in 4Q 2021

due to the reasons discussed above.

EBITDA during 4Q 2022 of $162 million was lower as compared to

$204 million in 3Q 2022, due to lower steel shipments and lower

selling prices.

Liquidity and Capital

Resources

Net cash provided by operating activities for 4Q 2022 was $3,634

million as compared to $1,981 million in 3Q 2022 and $4,154 million

in 4Q 2021. Net cash provided by operating activities in 4Q 2022

includes a working capital release of $2,412 million as compared to

a working capital investment of $580 million in 3Q 2022 and $22

million release in 4Q 2021. 4Q 2022 working capital release (as

compared to 3Q 2022) was driven primarily by lower accounts

receivable (due to lower prices and lower volumes), and lower

inventories (due to the impact of lower production costs and

reduced inventory volumes).

Capex in 4Q 2022 increased to $1,500 million as compared with

$784 million in 3Q 2022 as projects gained momentum following

earlier impacts from project mobilization/contractor delays. Capex

of $3.5 billion in 12M 2022 is in line with the latest guidance and

compares with $3.0 billion in 12M 2021. In line with the rate of

spending in 2H 2022 capex in 2023 is expected in the range of

$4.5-5.0 billion. Decarbonization capex is expected to increase to

$0.4 billion in 2023 (vs. $0.2 billion in 2022). The previously

announced strategic pipeline (2021-2024) has now increased by $0.5

billion to $4.2 billion19, with the addition of a new production

unit for electrical steels at the Mardyck site in the north of

France, with $0.9 billion having been spent as of the end of 2022.

The Company expects strategic projects capex in 2023 between

$1.3-$1.6 billion as compared to $0.7 billion in 2022 largely due

to catch up on previously announced projects. Capex outside of

strategic capex and decarbonization projects including general

maintenance capex is expected to be $2.8-$3.0 billion in 2023 (vs.

$2.6 billion in 2022).

Net cash used in other investing activities in 4Q 2022 was $33

million primarily related to the $25 million investment in nuclear

innovation company TerraPower. Net cash used in other investing

activities in 3Q 2022 was $19 million mainly related to investment

in Form Energy Inc. 4Q 2021 cash outflow of $90 million primarily

related to a $45 million investment through the XCarb™ Innovation

Fund10 (including $30 million for the carbon recycling company,

LanzaTech).

Net cash provided by financing activities in 4Q 2022 of $1,578

million as compared to net cash used in financing activities in 3Q

2022 of $219 million and $2,990 million in 4Q 2021. On November 21,

2022, ArcelorMittal priced new USD notes issuance with two

tranches: a 5-year, $1.2 billion tranche at 6.55% and a 10-year,

$1.0 billion tranche at 6.80% (both offerings occurred on November

29, 2022). In 4Q 2022, the Company repurchased 10.3 million shares

for a total value of $225 million ($288 million including $63

million related to 3Q 2022 purchases settled early October 2022) as

part of its previously announced share buy back program and paid

minority dividends of $29 million mainly to minority shareholders

of Belgo Bekaert Arames (Brazil). In 3Q 2022, ArcelorMittal raised

a €600 million 4 year note which was offset by the repurchase of 31

million shares for a total value of $712 million (of which $649

million was paid by the end of September 2022 and $63 million

settled in early October 2022) and paid minority dividends of $124

million mainly to minority shareholders of AMMC.

Gross debt increased to $11.7 billion as of December 31, 2022,

as compared to $9.0 billion as of September 30, 2022, and $8.4

billion as of December 31, 2021. Net debt decreased by $1.7 billion

to $2.2 billion as of December 31, 2022, as compared to $3.9

billion as of September 30, 2022, and decreased by $1.8 billion

from $4.0 billion as of December 31, 2021.

As of December 31, 2022, the Company had liquidity of $14.9

billion as compared to $10.6 billion as of September 30, 2022,

consisting of cash and cash equivalents of $9.4 billion (as of

September 30, 2022, cash and cash equivalents was $5.1 billion) and

$5.5 billion of available credit lines14. As of December 31, 2022,

the average debt maturity was 5.7 years.

Recent developments

- On July 28, 2022,

ArcelorMittal announced it had signed an agreement with the

shareholders of CSP to acquire CSP for an enterprise value of

approximately $2.2 billion. Antitrust final clearance has now been

obtained and transaction is expected to close in 1Q 2023. CSP is a

world-class operation, producing high-quality slab at a globally

competitive cost.

Value plan

In 2022, the Company announced a new 3-year $1.5 billion value

plan focused on creating value through well-defined commercial and

operational initiatives. The plan did not include the impact of

strategic projects. The plan included commercial initiatives,

including volume/mix improvements and operational improvements

(primarily in variable costs). The plan aimed to protect the EBITDA

potential of the business from rising inflationary pressures;

improving its relative competitive position vis-a-vis its peers and

supporting sustainably higher profits.

The Value plan has progressed during 2022 and is on track.

Several actions were taken in 2022 which yielded improvement of

$0.4 billion (~25% of the plan). Examples of the initiatives

undertaken are as follows:

- Commercial: Projects

to improve cost to manufacture value-added products; and increase

higher added value mix (e.g. Magnelis products and Advanced High

Strength Steels)

- Operational:

Improvement of fuel rates in blast furnaces; substitution of

purchased coke through improved performance of coke oven batteries;

purchasing gains through local sourcing initiatives

With the ongoing focus to execute and deliver the value plan

initiatives the Company anticipates improvements >$1.1 billion

over the next 2 years.

Capital return

In line with the Company's capital return policy, the Board

proposes to increase the annual base dividend to shareholders to

$0.44/sh (to be paid in 2 equal instalments in June 2023 and

December 2023), subject to the approval of shareholders at the AGM

in May 2023.

Share buybacks will continue as per the Company's defined policy

to return 50% of post-dividend FCF to shareholders. The Company

will request the customary authorizations from shareholders at the

AGM in May 2023 to continue to repurchase shares.

Financial calendar for 2023

- General meeting of

shareholders: May 2, 2023: ArcelorMittal Annual General Meeting

("AGM")

- Earnings results

announcements: May 4, 2023 Earnings release 1Q 2023; July 27, 2023:

Earnings release 2Q and half year 2023; November 9, 2023: Earnings

release 3Q and nine-months 2023

Outlook

As anticipated, apparent demand conditions are now showing signs

of improvement as the destocking phase reaches maturity. Despite

continued headwinds to real demand, World ex-China apparent steel

consumption ("ASC") in 2023 is expected to recover by +2.0% to

+3.0% as compared to 2022 (when global ASC is estimated to have

contracted by -2.0% to -2.5%), due to non-recurrence of the

destocking effects that weighed on demand, particularly in the

final months of 2022. The Company expects its steel shipments in

2023 to grow by ~5% vs. 202211.

ArcelorMittal expects the following demand dynamics by key

region:

- In the US, although

real demand growth is expected to remain lackluster due to the

lagged impact of interest rates rises, the anticipated end to

destocking is expected to lead to an increase in apparent steel

consumption of +1.5% to +3.5% in 2023;

- In Europe, the

impact of significant destocking drove a contraction of apparent

consumption by -7.0% to -7.5% in 2022. As a result, whilst the

Company does assume a marginal decline in real demand in 2023,

apparent demand is expected to recover by +0.5% to +2.5% in 2023.

This would represent a significantly higher level of apparent

demand as compared to the peak of the destocking cycle in 4Q

2022;

- In Brazil, the

Company expects a gradual rebound in real steel consumption in 2023

and slowdown in the destock to support an ASC growth of +3.0% to

+5.0%;

- In India, the

Company expects another strong year with apparent steel consumption

growth in the range of +6.0% to +8.0%;

- In the CIS region

(which includes Commonwealth of Independent States and Ukraine),

whilst the Company forecasts some improvement in steel consumption

in Ukraine, this is more than offset by the expected decline in

Russian steel consumption due to the lagged impact of ongoing

sanctions, particularly lower oil and gas revenue, leading to an

expected decline in ASC of 0.0% to -2.0% for the region; and

- In China, economic

growth is expected to rebound strongly in 2023 as COVID-19

restrictions are now lifted. However, with continued weakness

expected in real estate during the year, steel consumption is

expected to stabilize in 2023 (+1.0% to -1.0%) with potential

upside dependent on government infrastructure stimulus.

The Company expects working capital will follow the normal

seasonal patterns (including an investment in 1Q 2023) but expects

a release for the full year 2023.

The Company expects positive FCF generation in 2023; capex is

expected to increase to within the $4.5-$5.0 billion range,

interest costs are expected to increase to approximately $0.4

billion, and lower cash taxes (including non-recurrence of timing

related payments made in 2022 of $0.7 billion).

ArcelorMittal Condensed Consolidated Statement of

Financial Position1

|

In millions of U.S. dollars |

Dec 31,2022 |

Sept 30,2022 |

Dec 31,2021 |

|

ASSETS |

|

|

|

| Cash and

cash equivalents |

9,414 |

5,067 |

4,371 |

| Trade

accounts receivable and other |

3,839 |

4,677 |

5,143 |

|

Inventories |

20,087 |

20,566 |

19,858 |

| Prepaid expenses and other current

assets |

3,778 |

6,114 |

5,567 |

|

Total Current Assets |

37,118 |

36,424 |

34,939 |

|

|

|

|

|

| Goodwill

and intangible assets |

4,903 |

4,035 |

4,425 |

|

Property, plant and equipment |

30,167 |

28,515 |

30,075 |

|

Investments in associates and joint ventures |

10,765 |

10,742 |

10,319 |

| Deferred

tax assets |

8,554 |

8,033 |

8,147 |

| Other

assets15 |

3,040 |

3,467 |

2,607 |

|

Total Assets |

94,547 |

91,216 |

90,512 |

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

Short-term debt and current portion of long-term debt |

2,583 |

2,580 |

1,913 |

| Trade

accounts payable and other |

13,532 |

13,384 |

15,093 |

| Accrued expenses and other current

liabilities |

6,283 |

6,556 |

7,161 |

|

Total Current Liabilities |

22,398 |

22,520 |

24,167 |

|

|

|

|

|

|

Long-term debt, net of current portion |

9,067 |

6,414 |

6,488 |

| Deferred

tax liabilities |

2,666 |

2,394 |

2,369 |

| Other

long-term liabilities |

4,826 |

5,971 |

6,144 |

|

Total Liabilities |

38,957 |

37,299 |

39,168 |

|

|

|

|

|

| Equity

attributable to the equity holders of the parent |

53,152 |

51,563 |

49,106 |

|

Non-controlling interests |

2,438 |

2,354 |

2,238 |

|

Total Equity |

55,590 |

53,917 |

51,344 |

|

Total Liabilities and Shareholders’ Equity |

94,547 |

91,216 |

90,512 |

ArcelorMittal Condensed Consolidated Statement of

Operations1

|

|

Three months ended |

Twelve months ended |

|

In millions of U.S. dollars unless otherwise

shown |

Dec 31, 2022 |

Sept 30, 2022 |

Dec 31, 2021 |

Dec 31, 2022 |

Dec 31, 2021 |

|

Sales |

16,891 |

18,975 |

20,806 |

79,844 |

76,571 |

|

Depreciation (B) |

(636) |

(628) |

(712) |

(2,580) |

(2,523) |

|

Impairment items4 (B) |

(1,026) |

— |

218 |

(1,026) |

218 |

|

Exceptional items5 (B) |

98 |

(381) |

— |

(283) |

(123) |

|

Operating (loss)income (A) |

(306) |

1,651 |

4,558 |

10,272 |

16,976 |

|

Operating margin % |

(1.8) % |

8.7 % |

21.9 % |

12.9 % |

22.2 % |

|

|

|

|

|

|

|

| Income

from associates, joint ventures and other investments |

121 |

59 |

383 |

1,317 |

2,204 |

| Net

interest expense |

(72) |

(37) |

(49) |

(213) |

(278) |

| Foreign

exchange and other net financing (loss) |

449 |

(247) |

(111) |

(121) |

(877) |

|

Income before taxes and non-controlling

interests |

192 |

1,426 |

4,781 |

11,255 |

18,025 |

|

Current tax expense |

(91) |

(394) |

(678) |

(2,080) |

(2,953) |

|

Deferred tax benefit |

126 |

23 |

46 |

363 |

493 |

| Income

tax benefit/(expense) (net) |

35 |

(371) |

(632) |

(1,717) |

(2,460) |

|

Income including non-controlling interests |

227 |

1,055 |

4,149 |

9,538 |

15,565 |

|

Non-controlling interests loss(income) |

34 |

(62) |

(104) |

(236) |

(609) |

|

Net income attributable to equity holders of the

parent |

261 |

993 |

4,045 |

9,302 |

14,956 |

|

|

|

|

|

|

|

|

Basic earnings per common share ($) |

0.30 |

1.11 |

3.93 |

10.21 |

13.53 |

|

Diluted earnings per common share ($) |

0.30 |

1.11 |

3.92 |

10.18 |

13.49 |

|

|

|

|

|

|

|

|

Weighted average common shares outstanding (in millions) |

865 |

892 |

1,030 |

911 |

1,105 |

|

Diluted weighted average common shares outstanding (in

millions) |

868 |

895 |

1,033 |

914 |

1,108 |

|

|

|

|

|

|

|

|

OTHER INFORMATION |

|

|

|

|

|

|

EBITDA (C = A-B) |

1,258 |

2,660 |

5,052 |

14,161 |

19,404 |

| EBITDA

Margin % |

7.4 % |

14.0 % |

24.3 % |

17.7 % |

25.3 % |

|

|

|

|

|

|

|

| Total

group iron ore production (Mt) |

10.7 |

10.6 |

13.4 |

45.3 |

50.9 |

| Crude

steel production (Mt) |

13.2 |

14.9 |

16.5 |

59.0 |

69.1 |

| Steel

shipments (Mt) |

12.6 |

13.6 |

15.8 |

55.9 |

62.9 |

ArcelorMittal Condensed Consolidated Statement of Cash

flows1

|

|

Three months ended |

Twelve months ended |

|

In millions of U.S. dollars |

Dec 31, 2022 |

Sept 30, 2022 |

Dec 31, 2021 |

Dec 31, 2022 |

Dec 31, 2021 |

|

Operating activities: |

|

|

|

|

|

|

Income attributable to equity holders of the

parent |

261 |

993 |

4,045 |

9,302 |

14,956 |

|

Adjustments to reconcile net income to net cash provided by

operations: |

|

|

|

|

|

|

Non-controlling interests (loss) / income |

(34) |

62 |

104 |

236 |

609 |

|

Depreciation and impairments items |

1,662 |

628 |

494 |

3,606 |

2,305 |

|

Exceptional items |

(98) |

381 |

— |

283 |

123 |

| Income

from associates, joint ventures and other investments |

(121) |

(59) |

(383) |

(1,317) |

(2,204) |

| Deferred

tax benefit |

(126) |

(23) |

(46) |

(363) |

(493) |

| Change

in working capital |

2,412 |

(580) |

22 |

(1,223) |

(6,409) |

| Other

operating activities (net) |

(322) |

579 |

(82) |

(321) |

1,018 |

|

Net cash provided by operating activities (A) |

3,634 |

1,981 |

4,154 |

10,203 |

9,905 |

|

Investing activities: |

|

|

|

|

|

| Purchase

of property, plant and equipment and intangibles (B) |

(1,500) |

(784) |

(1,145) |

(3,468) |

(3,008) |

| Other

investing activities (net) |

(33) |

(19) |

(90) |

(1,015) |

2,668 |

|

Net cash used in investing activities |

(1,533) |

(803) |

(1,235) |

(4,483) |

(340) |

|

Financing activities: |

|

|

|

|

|

| Net

proceeds / (payments) relating to payable to banks and long-term

debt |

1,923 |

592 |

100 |

3,283 |

(3,562) |

|

Dividends paid to ArcelorMittal shareholders |

— |

— |

— |

(332) |

(312) |

|

Dividends paid to minorities (C) |

(29) |

(124) |

(21) |

(331) |

(260) |

| Share buyback |

(288) |

(649) |

(1,820) |

(2,937) |

(5,170) |

|

Payments from Mandatorily Convertible Notes |

— |

— |

(1,196) |

— |

(1,196) |

| Lease

payments and other financing activities (net) |

(28) |

(38) |

(53) |

(160) |

(398) |

|

Net cash provided (used) by financing

activities |

1,578 |

(219) |

(2,990) |

(477) |

(10,898) |

| Net

increase / (decrease) in cash and cash equivalents |

3,679 |

959 |

(71) |

5,243 |

(1,333) |

| Cash and

cash equivalents transferred from assets held for sale |

— |

— |

— |

— |

3 |

| Effect

of exchange rate changes on cash |

656 |

(451) |

13 |

(158) |

(55) |

|

Change in cash and cash equivalents |

4,335 |

508 |

(58) |

5,085 |

(1,385) |

|

|

|

|

|

|

|

|

Free cash flow (D=A+B+C) |

2,105 |

1,073 |

2,988 |

6,404 |

6,637 |

Appendix 1: Product shipments by

region1,2

|

(000'kt) |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

Flat |

1,767 |

1,743 |

1,548 |

7,121 |

6,879 |

|

Long |

658 |

676 |

739 |

2,739 |

3,088 |

|

NAFTA |

2,338 |

2,339 |

2,205 |

9,586 |

9,586 |

|

Flat |

1,514 |

1,519 |

1,790 |

6,423 |

6,425 |

|

Long |

1,145 |

1,345 |

1,256 |

5,179 |

5,332 |

|

Brazil |

2,639 |

2,837 |

3,034 |

11,516 |

11,695 |

|

Flat |

4,751 |

4,978 |

5,788 |

21,387 |

23,485 |

|

Long |

1,933 |

1,967 |

2,421 |

8,321 |

9,236 |

|

Europe |

6,802 |

7,079 |

8,325 |

30,182 |

33,182 |

|

CIS |

916 |

1,170 |

2,067 |

4,221 |

7,883 |

|

Africa |

498 |

503 |

531 |

2,160 |

2,473 |

|

ACIS |

1,414 |

1,675 |

2,597 |

6,378 |

10,360 |

Note: “Others and eliminations” are not presented in the

table

Appendix 2a: Capital

expenditures1,2

|

(USDm) |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

NAFTA |

201 |

97 |

104 |

500 |

369 |

|

Brazil |

341 |

154 |

171 |

708 |

412 |

|

Europe |

564 |

242 |

473 |

1,204 |

1,282 |

|

ACIS |

151 |

135 |

266 |

483 |

619 |

|

Mining |

198 |

128 |

127 |

488 |

302 |

|

Total |

1,500 |

784 |

1,145 |

3,468 |

3,008 |

Note: “Others” are not presented in the table

Appendix 2b: Capital expenditure projects

Completed projects

|

Segment |

Site / unit |

Project |

Capacity / details |

Key date / completion |

|

NAFTA |

ArcelorMittal Dofasco (Canada) |

Hot strip mill modernization |

Replace existing three end of life coilers with two state of the

art coilers and new runout tables |

2Q 2022 (a) |

|

NAFTA |

ArcelorMittal Dofasco (Canada) |

#5 CGL conversion to AluSi® |

Addition of up to 160kt/year Aluminum Silicon (AluSi®) coating

capability to #5 Hot-Dip Galvanizing Line for the production of

Usibor® steels |

3Q 2022 (b) |

Ongoing projects

|

Segment |

Site / unit |

Project |

Capacity / details |

Key date / forecast completion |

|

Brazil |

ArcelorMittal Vega Do Sul |

Expansion project |

Increase hot dipped / cold rolled coil capacity and construction of

a new 700kt continuous annealing line (CAL) and continuous

galvanizing line (CGL) combiline |

4Q 2023 (c) |

|

Mining |

Liberia mine |

Phase 2 premium product expansion project |

Increase production capacity to 15Mt/year |

4Q 2024 (d) |

|

NAFTA |

Las Truchas mine (Mexico) |

Revamping and capacity increase to 2.3MT |

Revamping project with 1Mtpa pellet feed capacity increase (to 2.3

Mt/year) with DRI concentrate grade capability |

2H 2024 (e) |

|

Brazil |

Serra Azul mine |

4.5Mtpa direct reduction pellet feed plant |

Facilities to produce 4.5Mt/year DRI quality pellet feed by

exploiting compact itabiriteiron ore |

2H 2024 (f) |

|

Brazil |

Monlevade |

Sinter plant, blast furnace and melt shop |

Increase in liquid steel capacity by 1.0Mt/year; Sinter feed

capacity of 2.25Mt/year |

2H 2024 (g) |

|

ACIS |

ArcelorMittal Kryvyi Rih(Ukraine) |

Pellet Plant |

Facilities to produce 5.0Mtpa pellets, replacing two existing

sinter plants ensuring environmental compliance and improving

productivity |

On hold/ under review (h) |

|

Brazil |

Barra Mansa |

Section mill |

Increase capacity of HAV bars and sections by 0.4Mt/pa |

1Q 2024 (i) |

|

Others |

Andhra Pradesh (India) |

Renewable energy project |

975 MW of nominal capacity solar and wind power |

1H 2024 (j) |

|

Europe |

Mardyck (France) |

New Electrical Steels production facilities |

Facilities to produce 170kt NGO Electrical Steels (of which 145kt

for Auto applications) consisting of annealing and pickling line

(APL), reversing mill (REV) and annealing and varnishing (ACL)

lines |

2H 2024 (k) |

a) Investment in ArcelorMittal Dofasco (Canada) to modernize the

hot strip mill. The project is to install two new state of the art

coilers and runout tables to replace three end of life coilers. The

strip cooling system was upgraded and includes innovative power

cooling technology to improve product capability. The project was

completed in 2Q 2022 and is estimated to add ~$25 million of EBITDA

in 2023.

b) Investment to replace #5 Hot-Dip Galvanizing Line Galvanneal

coating capability with 160kt/year Aluminum Silicon (AluSi®)

capability for the production of ArcelorMittal’s patented Usibor®

Press Hardenable Steel for automotive structural and safety

components. With the investment, ArcelorMittal Dofasco becomes the

only Canadian producer of AluSi® coated Usibor®. This investment

complements additional strategic North America developments,

including a new EAF and caster at Calvert in the US and a new hot

strip mill in Mexico, and will allow to capitalize on increasing

Auto Aluminized PHS demand in North America. The project was

completed in 3Q 2022 and is estimated to add $40 million of EBITDA

on full completion and post ramp up (estimated by 2025).

c) In February 2021, ArcelorMittal announced the resumption of

the Vega Do Sul expansion to provide an additional 700kt of

cold-rolled annealed and galvanized capacity to serve the growing

domestic market. The ~$0.35 billion investment programme to

increase rolling capacity with construction of a new continuous

annealing line and CGL combiline (and the option to add a ca. 100kt

organic coating line to serve construction and appliance segments),

and upon completion, will strengthen ArcelorMittal’s position in

the fast growing automotive and industry markets through Advanced

High Strength Steel products. The project is expected to be

completed in 4Q 2023 and estimated to add >$0.1 billion of

EBITDA on full completion and post ramp up.

d) ArcelorMittal Liberia has been operating 5Mt direct shipping

ore (DSO) since 2011 (Phase 1). The Company restarted construction

of a Phase 2 project that envisages the construction of 15Mtpa of

concentrate sinter fines capacity and associated infrastructure.

Changed project scope and engineering, together with supply chain

delays has impacted the construction schedule. Detailed

construction design is well advanced. Main civil works started,

whilst contracting and mobilization for other construction packages

underway. Capex required to conclude the project is currently under

review given impact of enlarged scope and inflation. Under the

amendment to the Mineral Development Agreement (MDA) signed in

September 2021, the Company has further expansion opportunities up

to 30Mtpa. First concentrate is now estimated in 4Q 2024. The

project is estimated to add approximately $250 million of EBITDA on

full completion and post ramp up to 15Mtpa rate. Revised capex

estimates will be communicated in 1H 2023.

e) ArcelorMittal Mexico is investing ~$150 million to increase

pellet feed production by 1Mtpa to 2.3Mtpa and improve concentrate

grade in Las Truchas. This project will enable concentrate

production to the blast furnace (BF) route (2.0Mtpa) and DRI route

(0.3Mtpa) for a total of 2.3Mtpa. Primary target is to supply

ArcelorMittal Mexico steel operations with high quality feed.

Project start-up date delayed to 2H 2024 due to slower progress of

equipment deliveries and construction works, as well as delays to

obtain required construction permits. The project is estimated to

add approximately $50 million of EBITDA on full completion and post

ramp up.

f) Approximately $350 million investment at Serra Azul (Brazil)

to construct facilities to produce 4.5Mtpa of DRI quality pellet

feed to primarily supply ArcelorMittal Mexico steel operation. The

project will allow to mine the compact itabirite iron ore. Project

start-up date delayed to 2H 2024 due to slower than scheduled

mobilization leading to delayed construction works. The project is

estimated to add approximately $100 million of EBITDA on full

completion and post ramp up.

g) The Monlevade upstream expansion project consisting of the

sinter plant, blast furnace and meltshop has recommenced in late

2021, following the anticipated improvement in Brazil domestic

market. Capex required to complete the project is currently under

review and the revised capex estimates will be communicated in 1H

2023.

h) Investment in ArcelorMittal Kryvyi Rih to build a 5.0Mtpa

pellet plant. However the project is on hold and has been suspended

with the revised completion date and budget dependent on when the

project can be effectively resumed due to the Russian invasion of

Ukraine.

i) ~$0.25 billion investment in sections mill at Barra Mansa

(Brazil) with 400ktpa production capacity. The aim of the project

is to deliver higher added value products (HAV) (Merchant Bar and

Special Bars) to increase domestic market share in HAV products and

to enhance profitability. The project commenced in 2022 and is

expected to be completed by 1Q 2024 and estimated to add $0.1

billion of EBITDA on full completion and post ramp up.

j) This $0.6 billion investment, combining solar and wind power,

will be supported by Greenko’s hydro pumped storage project, which

helps to overcome the intermittent nature of wind and solar power

generation. The project is owned and funded by ArcelorMittal.

Greenko will design, construct and operate the facilities in Andhra

Pradesh, Southern India. AMNS India will enter into a 25 year

off-take agreement with ArcelorMittal to purchase 250 MW of

renewable electricity annually from the project, resulting in over

20% of the electricity requirement at AMNS India’s Hazira plant

coming from renewable sources, reducing carbon emissions by

approximately 1.5Mt per year. Necessary allotment of land has been

received from the Government of Andhra Pradesh. Private land

acquisition is in progress and key contracts for wind projects have

been executed and are in negotiation for the solar project. The

project commissioning is expected by mid-2024 and estimated to add

$70 million of EBITDA (excluding savings at AMNS India) upon

completion. The Company is studying the option to develop a second

phase which would double the installed capacity.

k) On March 17, 2022, ArcelorMittal announced an investment with

the support of the French government, to create a new production

unit for electrical steels at its Mardyck site in the north of

France. This new unit will specialize in the production of

electrical steels for the engines of electric vehicles and which

complements ArcelorMittal’s existing electrical steels plant in

Saint Chély d’Apcher, in the south of France. The new industrial

unit in Mardyck will have a 170,000-tonne production capacity and

is scheduled to start up in 3Q 2024. The $0.5 billion investment

program aims at implementing a production capacity of 170Kt

Non-Grain Orientated (NGO) Electrical Steels (of which 145kt for

automotive applications) consisting of annealing and pickling line

(APL), reversing mill (REV) and annealing and varnishing (ACL) line

to be installed in Mardyck (France). The completion will occur in 2

steps: the commissioning and start of ramp-up of the

end-of-streamline (Annealing & Coating Line and related

installations) is expected to be in 2H 2024; the start-up of the

Annealing and Pickling Line and the Reversing Mill is expected to

occur in 2Q 2025. The project is estimated potentially to add $100

million of EBITDA on full completion and post ramp up.

JV capex: Ongoing projects

|

JV |

Site / unit |

Project |

Capacity / details |

Key date / forecast completion |

|

VAMA |

Vama |

Current capacity increase by 40% to 2Mtpa |

New CGL capacity of 450,000 tons/year shall be added, VAMA to reach

1.6 Mtpa in CGL/CAL combined capacity and 2.0 Mtpa in PLTCM |

1H 2023 (l) |

|

AMNS Calvert |

Calvert |

New 1.5Mt EAF and caster |

New 1.5Mt EAF and caster |

2H 2023 (m) |

|

AMNS India |

Hazira |

Debottlenecking existing assets and capacity expansion; and other

investments ongoing |

AMNS India medium-term plans are to expand and grow initially to

~15Mt by early 2026 in Hazira (phase 1A); ongoing downstream

projects |

1H 2026 (n) |

l) VAMA, our 50:50 joint venture with Hunan Valin, is a

state-of-the-art facility focused on rolling steel for

high-demanding applications in particular automotive. The business

is performing well and plans to expand the current capacity by 40%

to 2Mtpa by 2023, financed from its own resources. The project is

at an advanced stage of implementation planned for completion in

mid-2023 with first coils having been produced in January 2023.

Phase 2 expansion further enable VAMA to meet growing demand of

high value add solutions from the Chinese automotive / NEV

market.

m) AMNS Calvert ("Calvert") is constructing a new 1.5Mt EAF and

caster (estimated completion in 2H 2023). The joint venture is to

invest $775 million. Option to add a further 1.5Mt EAF at lower

capex intensity is being studied.

n) AMNS India is debottlenecking its operations (steel shop and

rolling parts) to achieve capacity of 8.6Mt per annum by the end of

2024. AMNS India medium-term plans are to expand and grow initially

to ~15Mt in 1H 2026 in Hazira (phase 1A) including automotive

downstream and enhancements to iron ore operations, with estimated

capex of ~$7.4 billion (for $0.8 billion for debottlenecking, $1.0

billion for downstream projects and $5.6 billion for upstream

projects. Phase 1A plans include a CRM2 complex and galvanizing and

annealing line, 2 blast furnaces, steel shop, HSM, ancillary

equipment (including coke, sinter, networks, power, gas, oxygen

plant etc.); and raw material handling. Start of BF2 expected in

2025 and BF3 in 2026. Also included is BF1 net capacity increase

from 2Mtpa to 3Mtpa. There are further options to potentially grow

to 20Mt per annum (Phase 1B). On November 21, 2022, AMNS India

concluded a transaction to acquire port, power and other logistics

and infrastructure assets in India from the Essar Group for a net

value of ~$2.4 billion. In March 2021, AMNS India signed a

Memorandum of Understanding ("MoU") with the Government of Odisha

in view of building an integrated steel plant with a 12Mtpa

capacity in Kendrapara district of state Odisha. A pre-feasibility

study report was submitted to the state government in 3Q 2021, and

AMNS India is currently engaging with the government for further

studies and clearances. Further options to build a 6Mtpa integrated

steel plant are being assessed. The Thakurani mine is operating at

full 5.5Mtpa capacity since 1Q 2021, while the second Odisha pellet

plant was commissioned and started in September 2021, adding 6Mtpa

for a total 20Mtpa of pellet capacity. In addition, in September

2021, AMNS India commenced operations at Ghoraburhani - Sagasahi

iron ore mine in Odisha. The mine is set to gradually ramp up

production to a rated capacity of 7.2Mtpa and contribute

significantly to meeting AMNS India’s long-term raw material

requirements.

Appendix 3: Debt repayment schedule as of December 31,

2022

|

(USD billion) |

2023 |

2024 |

2025 |

2026 |

2027 |

>2027 |

Total |

|

Bonds |

1.2 |

0.9 |

1.0 |

1.0 |

1.2 |

2.5 |

7.8 |

|

Commercial paper |

0.8 |

— |

— |

— |

— |

— |

0.8 |

|

Other loans |

0.6 |

0.3 |

0.6 |

0.2 |

0.5 |

0.9 |

3.1 |

|

Total gross debt |

2.6 |

1.2 |

1.6 |

1.2 |

1.7 |

3.4 |

11.7 |

Appendix 4: Reconciliation of gross debt to net

debt

|

(USD million) |

Dec 31, 2022 |

Sept 30, 2022 |

Dec 31, 2021 |

| Gross

debt |

11,650 |

8,994 |

8,401 |

|

Less: Cash and cash equivalents |

(9,414) |

(5,067) |

(4,371) |

|

Net debt |

2,236 |

3,927 |

4,030 |

|

|

|

|

|

|

Net debt / LTM EBITDA |

0.2 |

0.2 |

0.2 |

Appendix 5: Adjusted net income and adjusted basic

EPS

|

(USDm) |

4Q 22 |

3Q 22 |

4Q 21 |

12M 22 |

12M 21 |

|

Net income attributable to equity holders of the

parent |

261 |

993 |

4,045 |

9,302 |

14,956 |

|

Impairment items 4 |

(1,026) |

— |

218 |

(1,026) |

218 |

| Exceptional

items 5 |

98 |

(381) |

— |

(283) |

(123) |

|

Adjusted net income |

1,189 |

1,374 |

3,827 |

10,611 |

14,861 |

|

|

|

|

|

|

|

|

Shares (Basic EPS) million shares |

865 |

892 |

1,030 |

911 |

1,105 |

|

|

|

|

|

|

|

|

Adjusted basic EPS $/share |

1.37 |

1.54 |

3.72 |

11.65 |

13.45 |

Appendix 6: Terms and

definitions

Unless indicated otherwise, or the context otherwise requires,

references in this earnings release to the following terms have the

meanings set out next to them below:Adjusted basic

EPS: refers to adjusted net income divided by the weighted

average common shares outstanding.Adjusted net

income: refers to reported net income less impairment

items and exceptional items Apparent steel

consumption: calculated as the sum of production plus

imports minus exports.Average steel selling

prices: calculated as steel sales divided by steel

shipments.Cash and cash equivalents: represents

cash and cash equivalents, restricted cash, and short-term

investments.Capex: represents the purchase of

property, plant and equipment and intangibles.Crude steel

production: steel in the first solid state after melting,

suitable for further processing or for

sale.Depreciation: refers to amortization and

depreciation.EPS: refers to basic or diluted

earnings per share. EBITDA: operating results plus