Budweiser Brewer Hit By Pandemic, but Sees Bright Spots in U.S., China

May 07 2020 - 5:27AM

Dow Jones News

By Saabira Chaudhuri

A coronavirus-fueled shutdown of bars, nightclubs and other

drinking venues around the world hammered sales for Anheuser-Busch

InBev SA in the first quarter, a trend the Budweiser brewer warned

would get much worse before it gets better.

AB InBev, the world's largest brewer, reported sharply lower

volumes for the quarter as sales in China were badly hit by the

coronavirus pandemic, starting in late January when parts of the

country went into lockdown. Since then, the U.S., Brazil and many

other major beer markets have gone into lockdown, too, as the virus

spread. AB InBev said it expects the impact from this on its

second-quarter results to be "materially worse" than its first.

The brewer's global volumes dropped by 32% in April, a far

steeper decline than the 9.3% drop it reported for the first

quarter, which ended March 31. It didn't issue financial guidance

for the rest of the year.

Still, the company, which makes one out of every four beers sold

globally, flagged signs of a recovery in China. Volumes in April

were down just 17% from the previous April. That compares with a

first-quarter decline of 46.5% from the year-earlier quarter. It

also reported higher sales in the quarter in the U.S., where

consumers have been buying far more booze to drink at home,

offsetting a slump from sales at bars and other out-of-home

channels.

Buoyed by those two key markets, AB InBev shares were trading up

almost 3% in midmorning Europe trading.

The U.S. has been a relative bright spot for global brewers,

with 80% of industry sales on average made through grocery and

liquor stores rather than the other out-of-home channels. Recent

data from research firm Nielsen showed alcohol sales in stores

outstripping growth in overall consumer-goods products.

By contrast, in countries like Colombia and Brazil, AB InBev

relies on bars, clubs and restaurants for more than 50% of its

volumes.

Overall for the quarter, the brewer swung to a loss of $2.25

billion compared with a profit of $3.57 billion a year earlier.

Results were dragged lower by a large mark-to-market loss tied to

the hedging of its share-based employee payment programsas the

company's share price tumbled in the quarter. That was almost

double the mark-to-market gain it saw a year earlier.

Revenue fell 5.8% on an organic basis to $11 billion, lower than

the 5.4% drop analysts had expected.

In the U.S., AB InBev said net sales grew 1.9% but its brands'

overall market share dropped by 50 basis points in the quarter.

While hard seltzer sales have surged, AB InBev's stable of brands

including Bud Light Seltzer, is smaller and launched later than

rival brands.

The company said consumers continued to choose premium over

mainstream beer even as they buy larger packs to drink at home. It

said drinkers are opting for its bigger brands, a trend flagged by

other food makers like Nestlé SA and Kraft Heinz Co. Both have said

consumers are reaching for familiar brands amid the uncertainty

wrought by the pandemic.

The results come after rival Molson Coors Brewing Co. last week

reported net sales dropped 8.7% for the quarter and warned that the

uplift from grocery and liquor stores wouldn't be enough to offset

the slump at bars and restaurants, dragging on sales through at

least the end of the year.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

May 07, 2020 05:12 ET (09:12 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

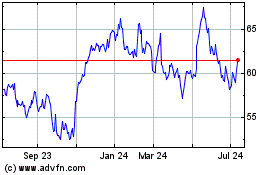

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Oct 2024 to Nov 2024

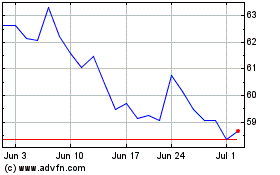

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Nov 2023 to Nov 2024