Amplify Energy Corp. (NYSE: AMPY) (“Amplify,” the “Company,” “us,”

or “our”) announced today that it has entered into a definitive

merger agreement (the “Merger Agreement” and the transactions

contemplated thereby, the “Transaction”) with privately held

Juniper Capital (“Juniper”) to combine with certain Juniper

portfolio companies which own substantial oil-weighted producing

assets and significant leasehold interests in the DJ and Powder

River Basins. Under the terms of the Merger Agreement, Amplify will

issue Juniper approximately 26.7 million shares of Amplify common

stock(1), par value $0.01 per share, and assume approximately $133

million in net debt(2). Pro forma for the Transaction, Amplify

shareholders will retain approximately 61% of Amplify’s outstanding

equity and approximately 39% will be owned by Juniper. The

transaction is expected to close in the second quarter of 2025,

subject to customary closing conditions, including obtaining the

requisite shareholder and regulatory approvals.

Strategic Rationale and

Benefits

-

Substantially Increases ScaleThe transaction

adds approximately 19 MMBoe of Proved Developed Reserves, with a

PV10 value of over $330 MM(3), and also adds approximately 287,000

net acres in the DJ and Powder River Basins in Wyoming adjacent to

some of the largest publicly traded U.S. oil companies. Over

115,000 of the net acres are operated and held-by-production, with

a high average working interest of approximately 90%. The large

held-by-production position and multi-year term on a majority of

the undeveloped acreage is expected to allow Amplify to

opportunistically develop the assets over time.

- Materially Improves

Operating Metrics and Corporate EfficiencyIn the third

quarter of 2024, average daily production of the acquired assets

was approximately 7,900 net Boe (81% oil, 90% liquids)(4). These

assets generate strong margins with low operating costs, which we

expect to improve operating metrics across the combined company. In

addition, the acquired assets will be integrated into the existing

platform with minimal incremental overhead costs, and the Company

intends to continue streamlining the organization as it optimizes

its portfolio of assets.

- Increases Organic Growth OpportunitiesAmplify

has identified hundreds of potential high-quality, operated

drilling locations to complement Amplify’s existing development

inventory. Target formations include the Codell formation in the DJ

Basin, near properties held by EOG Resources, and multiple

formations including the Parkman, Turner, Niobrara and Mowry in the

Powder River Basin near properties held by EOG Resources, Devon,

Occidental and other large operators.

- Significant Accretion and

SynergiesThe transaction is expected to be significantly

accretive to free cash flow(5) in 2025 and over a 5-year time

horizon. Amplify expects to benefit from material synergies

including from optimizing overhead at the combined operations and

from income tax savings related to the stepped-up basis of the

acquired companies.

- Creates a Focal Area for

Further Consolidation OpportunitiesThe large acreage

position and operating footprint in premier Rocky Mountain Basins

provide the Company with a new core area for future consolidation

opportunities with the potential for accretive bolt-on acquisitions

from smaller private companies or non-core assets of larger

operators. Additionally, the more broadly scaled pro forma asset

base will afford Amplify flexibility in optimizing cash flow and

production across its portfolio.

Martyn Willsher, Amplify’s President and Chief

Executive Officer commented, “We are excited to partner with the

Juniper Capital team in this transformational merger to create

immediate and long-term value for Amplify’s shareholders. This

transaction adds a new oil-rich area with significant current

production and substantial upside to the Company’s asset base.

Juniper’s assets in the Rockies complement Amplify’s ongoing

development of our Beta Field and our strong cash flow from our

legacy onshore assets. We believe that the Rockies area will

experience substantial growth in the coming years, and we look

forward to developing this position, while becoming more

organizationally focused and efficient.”

Edward Geiser, Juniper’s Managing Partner,

added, “The combination of our Rockies assets with Amplify’s

existing operations creates a differentiated public company with

strong cash flow and deep inventory. The combined company will have

the flexibility to grow organically within its existing asset base

and to pursue strategic consolidation in highly economic areas

where few other large companies are currently focused. We believe

Martyn and his team at Amplify are optimally suited to lead the

combined operations, and we are excited about being a long-term

investor in the Company.”

Board of Directors and

Management

Edward (“Eddie”) Geiser and Josh Schmidt, both

partners at Juniper Capital, will join Amplify’s Board of

Directors, replacing two of Amplify’s existing Board members.

Amplify’s management team will lead the combined company and will

supplement the operational team with key hires to support the

Rockies assets.

Chris Hamm, Amplify’s Chairman commented, “We

are delighted to welcome Eddie and Josh to the Amplify Board. The

Juniper team has a long track record of success in the oil and gas

industry, most notably their efforts in leading Ranger Oil

Corporation’s highly successful consolidation strategy in the Eagle

Ford. We look forward to benefiting from their experience and

working closely with them to drive incremental value to Amplify’s

shareholders.”

Advisors

Houlihan Lokey Capital, Inc. served as Amplify’s

financial advisor for this transaction and Kirkland &

Ellis, LLP served as Amplify’s legal advisors. Wells Fargo served

as Juniper’s financial advisor for this transaction and Gibson,

Dunn & Crutcher LLP served as Juniper’s legal advisors.

About Amplify Energy

Amplify Energy Corp. is an independent oil and

natural gas company engaged in the acquisition, development,

exploitation and production of oil and natural gas properties.

Amplify’s operations are focused in Oklahoma, the Rockies

(Bairoil), federal waters offshore Southern California (Beta), East

Texas / North Louisiana, and the Eagle Ford (Non-op). For more

information, visit www.amplifyenergy.com.

Conference Call

Amplify will host an investor teleconference

today at 10:00 a.m. Central Time to discuss the transaction.

Interested parties may join the call by dialing (888) 999-5318 at

least 15 minutes before the call begins and providing the

Conference ID: AEC. A presentation providing additional details on

the transaction will be available on the Amplify website

www.amplifyenergy.com prior to the call.

Forward-Looking Statements

This press release includes “forward-looking

statements.” All statements, other than statements of historical

fact, included in this press release that addresses activities,

events or developments that the Company expects, believes or

anticipates will or may occur in the future are forward-looking

statements. Terminology such as “could,” “believe,” “anticipate,”

“intend,” “estimate,” “expect,” “may,” “continue,” “predict,”

“potential,” “project” and similar expressions are intended to

identify forward-looking statements. These statements include, but

are not limited to, statements about the Company’s expectations of

plans, goals, strategies (including measures to implement

strategies), objectives and anticipated results with respect

thereto. These statements address activities, events or

developments that we expect or anticipate will or may occur in the

future, including things such as projections of results of

operations, plans for growth, goals, future capital expenditures,

competitive strengths, references to future intentions and other

such references. These forward-looking statements involve risks and

uncertainties and other factors that could cause the Company’s

actual results or financial condition to differ materially from

those expressed or implied by forward-looking statements. Without

limiting the generality of the foregoing, forward-looking

statements contained in this press release specifically include the

expectations of plans, strategies, objectives and growth and

anticipated financial and operational performance of the Company

and its affiliates, including whether the conditions to the Mergers

can be satisfied, whether the Mergers will be completed, as

expected or at all, and the timing of Closing. Please read the

Company’s filings with the Securities and Exchange Commission (the

“SEC”), including “Risk Factors” in the Company’s Annual Report on

Form 10-K, and if applicable, the Company’s Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K, which are available on

the Company’s Investor Relations website at

https://www.amplifyenergy.com/investor-relations/default.aspx or on

the SEC’s website at http://www.sec.gov, for a discussion of risks

and uncertainties that could cause actual results to differ from

those in such forward-looking statements. You are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date of this press release. All

forward-looking statements in this press release are qualified in

their entirety by these cautionary statements. Except as required

by law, the Company undertakes no obligation and does not intend to

update or revise any forward-looking statements, whether as a

result of new information, future results or otherwise.

Cautionary Note on Reserves and Resource

Estimates

The SEC permits oil and gas companies, in their

filings with the SEC, to disclose only proved, probable and

possible reserves. Any reserve estimates provided in this press

release that are not specifically designated as being estimates of

proved reserves may include estimated reserves or locations not

necessarily calculated in accordance with, or contemplated by, the

SEC’s latest reserve reporting guidelines. You are urged to

consider closely the oil and gas disclosures in the Company’s

Annual Report on Form 10-K and our other reports and filings with

the SEC.

Additional Information and Where to Find

It

This press release relates to the proposed

Transaction between Amplify and Juniper. In connection with the

proposed Transaction, Amplify will file with the SEC a proxy

statement on Schedule 14A (the “Proxy Statement”). Amplify will

also file other documents regarding the proposed Transaction with

the SEC. The Proxy Statement will be sent or given to the Amplify’s

stockholders and will contain important information about the

Transaction and related matters. INVESTORS ARE URGED TO READ THE

PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO)

AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

WITH RESPECT TO THE TRANSACTION AND THE OTHER AGREEMENTS

CONTEMPLATED BY THE MERGER AGREEMENT. You may obtain a free copy of

the Proxy Statement (if and when it becomes available) and other

relevant documents filed by Amplify with the SEC at the SEC’s

website at www.sec.gov. You may also obtain Amplify’s documents on

its website at

https://www.amplifyenergy.com/investor-relations/default.aspx.

Participants in the

Solicitation

Amplify, Juniper and certain of their respective

directors, executive officers and employees may be deemed to be

participants in the solicitation of proxies in connection with

certain matters related to the Transaction and may have direct or

indirect interests in the Transaction. Information about Amplify’s

directors and executive officers is set forth in Amplify’s Proxy

Statement on Schedule 14A for its 2024 Annual Meeting of

Stockholders, filed with the SEC on April 5, 2024, its Annual

Report on Form 10-K for the fiscal year ended December 31, 2023,

filed with the SEC on March 7, 2024, and its other documents filed

with the SEC. Other information regarding the participants in the

proxy solicitations and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in

the Proxy Statement and other relevant materials to be filed with

the SEC regarding the proposed transaction when they become

available. Investors should read the Proxy Statement carefully when

it becomes available before making any voting or investment

decisions. Investors may obtain free copies of these documents

using the sources indicated above.

Footnotes

1) Share consideration calculated based on fully

diluted Amplify shares as of January 13, 2025 including

approximately 39.9 MM shares outstanding plus approximately 1.9 MM

unvested equity awards previously granted under the Amplify

employee incentive plans and measured at target. 2) Net debt

consists of $140 MM outstanding as of 12/31/2024 less $2 MM of cash

and pro-forma of $5 MM of cash to be contributed by Juniper before

the closing date.3) Reserves and PV10 based on DeGolyer and

MacNaughton midyear prepared report effective as of 10/1/2024 and

utilizing strip pricing as of 10/25/2024; (NYMEX WTI, HH) - Bal24:

$71.69, $2.75; 2025: $69.68, $3.25; 2026: $67.55, $3.62. PV-10 is a

non-GAAP financial measure that represents the present value of

estimated future cash inflows from proved oil and natural gas

reserves that are calculated using the unweighted arithmetic

average first-day-of-the-month prices for the prior 12 months, less

future development and operating costs, discounted at 10% per annum

to reflect the timing of future cash flows. The most directly

comparable GAAP measure to PV-10 is standardized measure. PV-10

differs from standardized measure in its treatment of estimated

future income taxes, which are excluded from PV-10. Amplify

believes the presentation of PV-10 provides useful information

because it is widely used by investors in evaluating oil and

natural gas companies without regard to specific income tax

characteristics of such entities. PV-10 is not intended to

represent the current market value of our estimated proved

reserves. PV-10 should not be considered in isolation or as a

substitute for the standardized measure as defined under GAAP. The

Company also presents PV-10 at strip pricing, which is PV-10

adjusted for price sensitivities. As GAAP does not prescribe a

comparable GAAP measure for PV-10 of reserves adjusted for pricing

sensitivities, it is not practicable for us to reconcile PV-10 at

strip pricing to a standardized measure or any other GAAP

measure.4) Based on preliminary third quarter 2024 unaudited

results.5) Free cash flow is a non-GAAP financial measure that is

derived from the standardized measures of net income or net cash

provided by operating activities. Free cash flow is an important

non-GAAP financial measure for Amplify’s investors since it serves

as an indicator of the Company’s success in providing a cash return

on investment. The GAAP measures most directly comparable to free

cash flow are net income and net cash provided by operating

activities. The Company does not provide guidance on the items used

to reconcile between forecasted free cash flow to forecasted net

income and net cash provided by operating activities due to the

uncertainty regarding timing and estimates of certain items.

Therefore, we cannot reconcile forecasted free cash flow to net

income or net cash provided by operating activities without

unreasonable effort.

Contacts

Jim Frew -- Senior Vice President and Chief

Financial Officer(832) 219-9044jim.frew@amplifyenergy.com

Michael Jordan -- Director, Finance and

Treasurer(832) 219-9051michael.jordan@amplifyenergy.com

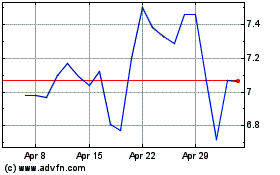

Amplify Energy (NYSE:AMPY)

Historical Stock Chart

From Jan 2025 to Feb 2025

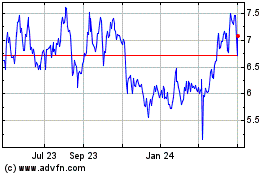

Amplify Energy (NYSE:AMPY)

Historical Stock Chart

From Feb 2024 to Feb 2025