Reiterating full-year 2024 Adj. EBITDA

guidance Non-Crop Revenues Grew 17%; Green Solutions

Revenues Grew 18% Y/o/Y

Business transformation continues to

accelerate, raising expected annual benefit to $20 million Company

reduced debt by $32.5 million

American Vanguard® Company, a diversified specialty and

agricultural products company that develops, manufactures, and

markets solutions for crop protection and nutrition, turf and

ornamental management and commercial pest control, today reported

financial results for the third quarter ended September 30,

2024.

Third Quarter 2024 Financial and Operational Highlights –

versus Third Quarter 2023:

- Net sales of $118.3 million ($130.7 million when excluding

Dacthal product recall impact) v. $149.5 million;

- Adjusted EBITDA1 of $1.8 million v. $11.4 million;

- Maintaining full-year 2024 Adjusted

EBITDA guidance of $40 million to $50 million

- EPS of $(0.92) v. ($0.01)

- Decreased debt by $32.5 million from $211.3 million in the

previous quarter

First nine months 2024 Financial and Operational Highlights –

versus first nine months 2023:

- Net sales of $381.7 million ($394.1 million when excluding

Dacthal product recall impact) v. $407.2 million;

- Adjusted EBITDA of $23.3 million v. $33.5 million;

- EPS of $(1.28) v. $0.02

Other Highlights:

- Raising expected full-year transformation related benefits to

$20 million from $15 million

- The Board is actively engaged in recruiting a CEO to build upon

the transformation momentum

Timothy J. Donnelly, Acting CEO of American Vanguard, stated “We

remain focused on transforming our Company into an efficient,

reliable and profitable supplier to the Ag industry. We are pleased

with the results that we are beginning to see from our business

transformation. While we continue to manage through macroeconomic

headwinds, we are seeing pockets of strength. For example, our

non-crop business grew 17% as compared to the year ago period, and

our green solutions portfolio grew 18% as compared to the year ago

period. The growth in these areas was offset by pressure from

generics, but the single biggest factor was a significant drop in

Aztec sales year over year. Sales in 2023 were unusually high as a

result of a previous supply shortage.”

Mr. Donnelly continued, “As we transform the business, we are

incurring one-time charges associated with positioning American

Vanguard for longer-term growth. During the quarter we incurred a

$8.1 million transformation charge. Additionally, during the

quarter we recorded a $16.2 million charge associated with the

collection and disposal of Dacthal. The Company benefitted from

this profitable product for many years, and we are now taking the

necessary steps to safely recall and dispose of it.”

David T. Johnson, Vice President, CFO and Treasurer, stated

“Despite the macro headwinds, the Company remains steadfast in its

transformation roadmap, which presents a clear path towards

achieving a 15% adjusted-EBITDA margin across the ag-cycle. We are

pleased to have been able to pay down a material amount of debt

during the quarter, decreasing our long-term debt to $179 million

from $211 million at the end of the previous quarter. We expect to

further improve our liquidity as we decrease our inventory in our

seasonally strong 4th quarter. We remain optimistic that we can

decrease inventory to 34% of sales by year end, down $25 million

versus last year. We are pleased with the hard work of our

employees in pursuing the business transformation projects.

Furthermore, through their hard work we were able to reduce

operating expenses, excluding transformation costs, for both the

three month and nine month periods ended September 30, 2024, as

compared to the prior year period.”

Mark Bassett, a board member who is temporarily working with the

Company’s Office of the CEO commented, “Within our transformation,

we are encouraged by the initial progress that we have made and see

an opportunity for even greater benefits than we had originally

calculated. We now expect to achieve $20 million in transformation

related benefits instead of our previous estimate of $15

million.”

Dr. Bassett concluded, “I want to reiterate our full year 2024

revenue (down 2% to flat, excluding the product recall charge) and

adjusted EBITDA ($40 - $50 million) targets. I view this

achievement as a testament to the resiliency of this Company,

especially in the wake of the current market conditions. We are

focused on returning American Vanguard to a position of consistent

free cash flow generation, which in the near-term will be allocated

towards further deleveraging, but over the medium to long-term we

expect to be able to apply these cash flows to growth

opportunities.”

About American Vanguard American Vanguard Corporation is

a diversified specialty and agricultural products company that

develops and markets products for crop protection and management,

turf and ornamentals management, and public and animal health. Over

the past 20 years, through product and business acquisitions, the

Company has expanded its operations into 21 countries and now has

more than 1,000 product registrations in 56 nations worldwide. Its

strategy rests on two growth initiatives – i) Core Business through

innovation of conventional products and ii) Green Solutions with

more than 120 biorational products – including fertilizers,

microbials, nutritionals and non-conventional products. American

Vanguard is included on the Russell 2000® and Russell 3000®

Indexes. To learn more about the Company, please reference

www.american-vanguard.com.

The Company, from time to time, may discuss forward-looking

information. Except for the historical information contained in

this release, all forward-looking statements are estimates by the

Company’s management and are subject to various risks and

uncertainties that may cause results to differ from management’s

current expectations. Such factors include weather conditions,

changes in regulatory policy and other risks as detailed from

time-to-time in the Company’s SEC reports and filings. All

forward-looking statements, if any, in this release represent the

Company’s judgment as of the date of this release.

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

data)

(Unaudited)

ASSETS

September 30, 2024

December 31, 2023

Current assets:

Cash

$

11,880

$

11,416

Receivables:

Trade, net of allowance for credit losses

of $8,661 and $7,107, respectively

146,145

182,613

Other

5,852

8,356

Total receivables, net

151,997

190,969

Inventories

246,037

219,551

Prepaid expenses

7,501

6,261

Income taxes receivable

7,690

3,824

Total current assets

425,105

432,021

Property, plant and equipment, net

73,494

74,560

Operating lease right-of-use assets,

net

21,448

22,417

Intangible assets, net of amortization

164,480

172,508

Goodwill

48,012

51,199

Deferred income tax assets

12,218

2,849

Other assets

14,701

11,994

Total assets

$

759,458

$

767,548

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

73,557

$

68,833

Customer prepayments

27,183

65,560

Accrued program costs

85,665

68,076

Accrued expenses and other payables

29,066

16,354

Operating lease liabilities, current

6,604

6,081

Income taxes payable

3,229

5,591

Total current liabilities

225,304

230,495

Long-term debt

178,749

138,900

Operating lease liabilities, long term

15,574

17,113

Deferred income tax liabilities

9,167

7,892

Other liabilities

2,756

3,138

Total liabilities

431,550

397,538

Commitments and contingent liabilities

(Note 12)

Stockholders' equity:

Preferred stock, $0.10 par value per

share; authorized 400,000 shares; none issued

—

—

Common stock, $0.10 par value per share;

authorized 40,000,000 shares; issued 34,525,983 shares at September

30, 2024 and 34,676,787 shares at December 31, 2023

3,452

3,467

Additional paid-in capital

114,196

110,810

Accumulated other comprehensive loss

(13,849

)

(5,963

)

Retained earnings

295,310

332,897

Less treasury stock at cost, 5,915,182

shares at September 30, 2024 and December 31, 2023

(71,201

)

(71,201

)

Total stockholders’ equity

327,908

370,010

Total liabilities and stockholders’

equity

$

759,458

$

767,548

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2024

2023

2024

2023

Net sales

$

118,307

$

149,516

$

381,659

$

407,191

Cost of sales

(101,014

)

(106,432

)

(284,185

)

(282,662

)

Gross profit

17,293

43,084

97,474

124,529

Operating expenses

Selling, general and administrative

(26,365

)

(29,813

)

(86,885

)

(85,954

)

Research, product development and

regulatory

(11,177

)

(9,080

)

(25,482

)

(27,363

)

Transformation

(8,139

)

—

(16,636

)

—

Operating (loss) income

(28,388

)

4,191

(31,529

)

11,212

Change in fair value of equity

investment

—

(247

)

513

(324

)

Interest expense, net

(4,378

)

(3,384

)

(11,988

)

(8,282

)

(Loss) income before income tax benefit

(expense)

(32,766

)

560

(43,004

)

2,606

Income tax benefit (expense)

7,024

(885

)

7,093

(2,066

)

Net (loss) income

$

(25,742

)

$

(325

)

$

(35,911

)

$

540

Net (loss) income per common

share—basic

$

(0.92

)

$

(0.01

)

$

(1.28

)

$

0.02

Net (loss) income per common

share—assuming dilution

$

(0.92

)

$

(0.01

)

$

(1.28

)

$

0.02

Weighted average shares

outstanding—basic

28,009

27,919

28,015

28,236

Weighted average shares

outstanding—assuming dilution

28,009

27,919

28,015

28,656

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

ANALYSIS OF SALES

(In thousands),

(Unaudited)

For the three months

ended September 30,

2024

2023

Change

% Change

Net sales:

U.S. crop

$

35,533

$

67,749

$

(32,216

)

-48

%

U.S. non-crop

22,454

19,250

3,204

17

%

U.S. total

57,987

86,999

(29,012

)

-33

%

International

60,320

62,517

(2,197

)

-4

%

Total net sales

$

118,307

$

149,516

$

(31,209

)

-21

%

Total cost of sales

$

(101,014

)

$

(106,432

)

$

5,418

-5

%

Total gross profit

$

17,293

$

43,084

$

(25,791

)

-60

%

Gross margin

15

%

29

%

Impact of Dacthal

Recall

2024

2023

Change

Net sales:

U.S. crop

$

(11,783

)

$

—

$

(11,783

)

U.S. non-crop

—

—

—

Total U.S.

(11,783

)

—

(11,783

)

International

(620

)

—

(620

)

Total net sales

$

(12,403

)

$

—

$

(12,403

)

Total cost of sales

(3,788

)

—

(3,788

)

Total gross profit

$

(16,191

)

$

—

$

(16,191

)

For the nine months

ended September 30,

2024

2023

Change

% Change

Net sales:

U.S. crop

$

155,075

$

185,823

$

(30,748

)

-17

%

U.S. non-crop

59,241

50,041

9,200

18

%

U.S. total

214,316

235,864

(21,548

)

-9

%

International

167,343

171,327

(3,984

)

-2

%

Total net sales

$

381,659

$

407,191

$

(25,532

)

-6

%

Total cost of sales

$

(284,185

)

$

(282,662

)

$

(1,523

)

1

%

Total gross profit

$

97,474

$

124,529

$

(27,055

)

-22

%

26

%

31

%

Impact of Dacthal

Recall

2024

2023

Change

Net sales:

U.S. crop

$

(11,783

)

$

—

$

(11,783

)

U.S. non-crop

—

—

—

Total U.S.

(11,783

)

—

(11,783

)

International

(620

)

—

(620

)

Total net sales

$

(12,403

)

$

—

$

(12,403

)

Total cost of sales

(3,788

)

—

(3,788

)

Total gross profit

$

(16,191

)

$

—

$

(16,191

)

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

For the Nine Months Ended

September 30,

2024

2023

Cash flows from operating activities:

Net (loss) income

$

(35,911

)

$

540

Adjustments to reconcile net (loss) income

to net cash used in operating activities:

Depreciation of property, plant and

equipment

6,655

6,396

Amortization of intangibles assets

9,947

10,009

Amortization of other long-term assets

199

1,445

Amortization of deferred loan fees

342

174

Provision for bad debts

1,278

952

Stock-based compensation

3,887

4,257

Change in deferred income taxes

(9,110

)

(977

)

Changes in liabilities for uncertain tax

positions or unrecognized tax benefits

106

467

Change in equity investment fair value

(513

)

324

Other

110

7

Foreign currency transaction losses

121

199

Changes in assets and liabilities

associated with operations:

Decrease (increase) in net receivables

33,475

(29,055

)

Increase in inventories

(29,429

)

(58,163

)

Increase in prepaid expenses and other

assets

(4,107

)

(633

)

Change in income tax receivable/payable,

net

(6,216

)

(4,046

)

Increase (decrease) in net operating lease

liability

(48

)

227

Increase in accounts payable

6,141

1,240

Decrease in customer prepayments

(38,375

)

(104,590

)

Increase in accrued program costs

17,721

29,779

Increase (decrease) in other payables and

accrued expenses

13,878

(4,406

)

Net cash used in operating activities

(29,849

)

(145,854

)

Cash flows from investing activities:

Capital expenditures

(6,106

)

(8,589

)

Proceeds from disposal of property, plant

and equipment

66

200

Intangible assets

(341

)

(759

)

Net cash used in investing activities

(6,381

)

(9,148

)

Cash flows from financing activities:

Payments under line of credit

agreement

(168,188

)

(62,800

)

Borrowings under line of credit

agreement

208,037

228,500

Receipt from the issuance of common stock

under ESPP

901

980

Net receipt from the exercise of stock

options

—

46

Net payment for tax withholding on

stock-based compensation awards

(1,416

)

(1,957

)

Repurchase of common stock

—

(15,539

)

Payment of cash dividends

(2,510

)

(2,550

)

Net cash provided by financing

activities

36,824

146,680

Net increase (decrease) in cash and cash

equivalents

594

(8,322

)

Effect of exchange rate changes on cash

and cash equivalents

(130

)

(477

)

Cash and cash equivalents at beginning of

period

11,416

20,328

Cash and cash equivalents at end of

period

$

11,880

$

11,529

AMERICAN VANGUARD CORPORATION

AND SUBSIDIARIES

RECONCILIATION OF NET INCOME

(LOSS) TO ADJUSTED EBITDA

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net (loss) income

$

(25,742

)

$

(325

)

$

(35,911

)

$

540

Income tax (benefit) expense

(7,024

)

885

(7,093

)

2,066

Interest expense, net

4,378

3,384

11,988

8,282

Depreciation and amortization

5,703

5,704

16,801

17,850

Stock-based compensation

1,135

1,716

3,887

4,257

Transformation costs & legal

reserves

7,159

—

17,402

—

Dacthal returns

16,191

—

16,191

—

Proxy contest activities

—

—

—

541

Adjusted EBITDA2

$

1,800

$

11,364

$

23,265

$

33,536

______________________________ 1 Adjusted earnings before

interest, taxes, depreciation, and amortization. Adjusted EBITDA is

not a financial measure calculated and presented in accordance with

U.S. generally accepted accounting principles (GAAP) and should not

be considered as an alternative to net income (loss), operating

income (loss) or any other financial measure so calculated and

presented, nor as an alternative to cash flow from operating

activities as a measure of liquidity. The items excluded from

adjusted EBITDA are detailed in the reconciliation attached to this

news release. Other companies (including the Company’s competitors)

may define adjusted EBITDA differently. 2 Adjusted earnings before

interest, taxes, depreciation, and amortization. Adjusted EBITDA is

not a financial measure calculated and presented in accordance with

U.S. generally accepted accounting principles (GAAP) and should not

be considered as an alternative to net income (loss), operating

income (loss) or any other financial measure so calculated and

presented, nor as an alternative to cash flow from operating

activities as a measure of liquidity. The items excluded from

adjusted EBITDA are detailed in the reconciliation attached to this

news release. Other companies (including the Company’s competitors)

may define adjusted EBITDA differently.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241111947698/en/

American Vanguard Corporation Anthony Young, Director of

Investor Relations anthonyy@amvac.com (949) 221-6119

Investor Representative Alpha IR Group Robert Winters

Robert.winters@alpha-ir.com (929) 266-6315

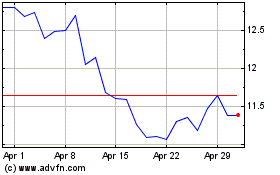

American Vanguard (NYSE:AVD)

Historical Stock Chart

From Nov 2024 to Dec 2024

American Vanguard (NYSE:AVD)

Historical Stock Chart

From Dec 2023 to Dec 2024