American Express 1Q Revenue Rises as Americans Keep Spending

April 20 2023 - 7:38AM

Dow Jones News

By Will Feuer

American Express Co. posted a 22% jump in revenue for the first

three months of the year as Americans kept spending, particularly

on travel, entertainment and restaurants.

The New York City-based credit-card company logged net income of

$1.82 billion, or $2.40 a share, down from $2.10 billion, or $2.73

a share, a year earlier. Analysts surveyed by FactSet were

expecting earnings of $2.66 a share.

Revenue, net of interest expense, rose to $14.28 billion from

$11.74 billion a year ago. Analysts surveyed by FactSet were

expecting revenue of $13.98 billion.

Chief Executive Stephen Squeri said travel and entertainment

spending rose 39%. "We saw a record level of reservations booked on

our Resy restaurant platform," he said. Spending on goods and

services rose 9%, adjusted for foreign exchange.

"Our customers have been resilient thus far in the face of

slower macroeconomic growth, elevated inflation and higher interest

rates, with credit performance remaining best-in-class," he

said.

The company provisioned $1.06 billion for credit losses in the

quarter, compared with a benefit of $33 million in the year-ago

period.

Costs rose 22% to $11.1 billion in the quarter, driven by

customer-engagement expenses and increased usage of travel-related

benefits. Americans stockpiled credit card points during the

pandemic, executives have said, and many are now working through a

backlog of those points.

The company backed its full-year guidance.

Write to Will Feuer at Will.Feuer@wsj.com

(END) Dow Jones Newswires

April 20, 2023 07:23 ET (11:23 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

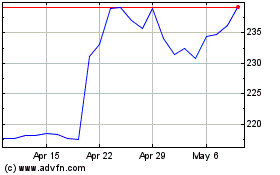

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2024 to May 2024

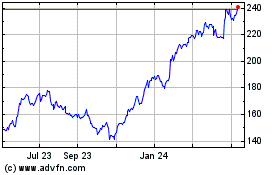

American Express (NYSE:AXP)

Historical Stock Chart

From May 2023 to May 2024