0000919012Q2false--02-01http://fasb.org/us-gaap/2024#LeaseholdImprovementsMember340http://www.ae.com/20240803#ImpairmentRestructuringAndOtherCharges0000919012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-302023-07-290000919012us-gaap:IntersegmentEliminationMember2024-02-042024-08-030000919012aeo:GeneralCorporateExpensesMember2024-02-042024-08-030000919012aeo:QuietPlatformsMember2023-01-292024-02-030000919012us-gaap:OperatingSegmentsMemberaeo:AmericanEagleBrandMember2023-01-292023-07-290000919012us-gaap:AdditionalPaidInCapitalMember2024-08-030000919012us-gaap:IntersegmentEliminationMember2023-04-302023-07-290000919012us-gaap:OperatingSegmentsMemberaeo:AmericanEagleBrandMember2024-05-052024-08-0300009190122016-01-312017-01-280000919012us-gaap:RetainedEarningsMember2024-05-052024-08-030000919012us-gaap:OperatingSegmentsMemberaeo:AmericanEagleBrandMember2023-04-302023-07-290000919012country:US2023-04-302023-07-290000919012us-gaap:CorporateNonSegmentMember2023-01-292023-07-290000919012us-gaap:CommonStockMember2024-08-030000919012us-gaap:CorporateNonSegmentMember2023-04-302023-07-290000919012aeo:CreditAgreementMemberus-gaap:StandbyLettersOfCreditMember2024-08-030000919012aeo:AssetBasedRevolvingCreditFacilitiesMember2024-05-052024-08-030000919012us-gaap:RetainedEarningsMember2024-02-030000919012us-gaap:OperatingSegmentsMemberaeo:AerieBrandMember2024-05-052024-08-030000919012us-gaap:RetainedEarningsMember2023-04-302023-07-290000919012us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:InterestBearingDepositsMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-030000919012us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberaeo:AssetBasedRevolvingCreditFacilitiesMembersrt:MaximumMember2024-02-042024-08-030000919012us-gaap:TreasuryStockCommonMember2024-08-0300009190122019-02-032020-02-010000919012us-gaap:AdditionalPaidInCapitalMember2023-01-280000919012aeo:CreditAgreementMemberaeo:AssetBasedRevolvingCreditFacilitiesMember2022-06-012022-06-300000919012us-gaap:TreasuryStockCommonMember2024-05-040000919012us-gaap:PropertyPlantAndEquipmentMember2023-01-292023-07-290000919012us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-030000919012us-gaap:TreasuryStockCommonMember2023-04-290000919012aeo:ConvertibleSeniorNotesDueInTwoThousandTwentyFiveMember2020-04-012020-04-300000919012us-gaap:OperatingSegmentsMemberaeo:AmericanEagleBrandMember2024-02-042024-08-030000919012aeo:CreditAgreementMemberaeo:CreditAgreementLoansMember2024-08-030000919012us-gaap:TreasuryStockCommonMember2023-01-292023-07-290000919012us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2024-08-030000919012country:US2024-02-042024-08-030000919012us-gaap:RetainedEarningsMember2023-04-290000919012aeo:AssetBasedRevolvingCreditFacilitiesMemberaeo:AlternateBaseRateMembersrt:MinimumMember2024-02-042024-08-030000919012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-290000919012us-gaap:RetainedEarningsMember2023-01-280000919012aeo:GeneralCorporateExpensesMember2023-01-292023-07-290000919012aeo:TimeBasedRestrictedStockUnitsMember2024-08-030000919012us-gaap:CommonStockMember2023-01-280000919012country:US2023-01-292023-07-290000919012aeo:AssetBasedRevolvingCreditFacilitiesMember2024-02-042024-08-0300009190122023-01-280000919012us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-052024-08-030000919012us-gaap:CommonStockMember2023-04-302023-07-290000919012us-gaap:CommonStockMember2024-02-042024-08-030000919012us-gaap:AdditionalPaidInCapitalMember2024-05-052024-08-030000919012us-gaap:FurnitureAndFixturesMember2024-08-030000919012us-gaap:AdditionalPaidInCapitalMember2024-02-042024-08-030000919012aeo:ConvertibleSeniorNotesDueInTwoThousandTwentyFiveMember2023-02-102023-02-100000919012us-gaap:PropertyPlantAndEquipmentMember2024-05-052024-08-0300009190122024-08-030000919012us-gaap:RetainedEarningsMember2024-08-030000919012us-gaap:CashMember2024-02-030000919012us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-08-030000919012us-gaap:EmployeeStockOptionMember2024-08-030000919012us-gaap:CommonStockMember2023-07-2900009190122023-01-292023-07-290000919012us-gaap:TreasuryStockCommonMember2023-07-290000919012us-gaap:NonUsMember2023-04-302023-07-290000919012us-gaap:CommonStockMember2023-04-290000919012us-gaap:PropertyPlantAndEquipmentMember2024-02-042024-08-030000919012us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberaeo:AssetBasedRevolvingCreditFacilitiesMembersrt:MinimumMember2024-02-042024-08-030000919012us-gaap:TreasuryStockCommonMember2023-01-280000919012us-gaap:TreasuryStockCommonMember2024-02-030000919012srt:MaximumMember2024-08-030000919012aeo:AssetBasedRevolvingCreditFacilitiesMember2023-04-302023-07-290000919012us-gaap:OperatingSegmentsMemberaeo:AerieBrandMember2024-02-042024-08-030000919012us-gaap:AdditionalPaidInCapitalMember2023-07-290000919012us-gaap:RetainedEarningsMember2023-07-290000919012srt:MinimumMember2024-08-030000919012aeo:QuietPlatformsMember2023-01-292023-07-290000919012us-gaap:InterestBearingDepositsMember2024-08-030000919012us-gaap:NonUsMember2023-01-292023-07-290000919012us-gaap:TechnologyEquipmentMembersrt:MinimumMember2024-08-030000919012aeo:ConvertibleSeniorNotesDueInTwoThousandTwentyFiveMember2022-01-302023-01-280000919012us-gaap:CertificatesOfDepositMember2024-02-030000919012aeo:TimeBasedRestrictedStockUnitsMember2024-02-030000919012us-gaap:AdditionalPaidInCapitalMember2023-04-290000919012us-gaap:IntersegmentEliminationMember2023-01-292023-07-2900009190122023-04-290000919012us-gaap:TreasuryStockCommonMember2024-02-042024-08-030000919012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-2800009190122023-07-290000919012aeo:CreditAgreementMemberaeo:CreditAgreementLoansMember2023-07-290000919012us-gaap:CommonStockMemberaeo:ConvertibleSeniorNotesDueInTwoThousandTwentyFiveMember2023-02-102023-02-100000919012us-gaap:CommonStockMember2024-05-040000919012us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-040000919012us-gaap:RetainedEarningsMember2024-02-042024-08-030000919012us-gaap:InterestBearingDepositsMember2023-07-2900009190122024-02-042024-08-030000919012us-gaap:NonUsMember2024-02-042024-08-030000919012us-gaap:TreasuryStockCommonMember2023-04-302023-07-290000919012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-290000919012us-gaap:IntersegmentEliminationMember2024-05-052024-08-030000919012us-gaap:AdditionalPaidInCapitalMember2023-01-292023-07-290000919012us-gaap:PerformanceSharesMember2024-02-030000919012us-gaap:CommonStockMember2024-05-052024-08-030000919012us-gaap:CorporateNonSegmentMember2024-05-052024-08-030000919012us-gaap:NonUsMember2024-05-052024-08-030000919012us-gaap:OperatingSegmentsMember2024-05-052024-08-030000919012us-gaap:BuildingMember2024-08-030000919012aeo:CreditAgreementMemberus-gaap:StandbyLettersOfCreditMember2023-07-290000919012us-gaap:PerformanceSharesMember2024-08-030000919012us-gaap:InterestBearingDepositsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-08-030000919012us-gaap:OperatingSegmentsMember2023-04-302023-07-290000919012us-gaap:RetainedEarningsMember2024-05-0400009190122024-08-2800009190122024-05-052024-08-030000919012us-gaap:CommonStockMember2023-01-292023-07-290000919012us-gaap:OperatingSegmentsMember2024-02-042024-08-030000919012us-gaap:CommonStockMember2024-02-030000919012us-gaap:InterestBearingDepositsMember2024-02-030000919012us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-030000919012aeo:AssetBasedRevolvingCreditFacilitiesMember2023-01-292023-07-290000919012us-gaap:AdditionalPaidInCapitalMember2023-04-302023-07-290000919012aeo:ConvertibleSeniorNotesDueInTwoThousandTwentyFiveMember2020-04-300000919012us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-042024-08-030000919012aeo:GeneralCorporateExpensesMember2023-04-302023-07-290000919012us-gaap:CorporateNonSegmentMember2024-02-042024-08-030000919012us-gaap:CashMember2024-08-030000919012us-gaap:RetainedEarningsMember2023-01-292023-07-290000919012us-gaap:RevolvingCreditFacilityMember2024-08-030000919012us-gaap:OperatingSegmentsMember2023-01-292023-07-290000919012us-gaap:AdditionalPaidInCapitalMember2024-02-030000919012country:US2024-05-052024-08-030000919012aeo:ConvertibleSeniorNotesDueInTwoThousandTwentyFiveMember2023-01-292023-07-290000919012us-gaap:FairValueInputsLevel1Memberus-gaap:CashMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-030000919012us-gaap:PerformanceSharesMember2024-02-042024-08-0300009190122023-04-302023-07-2900009190122024-02-030000919012us-gaap:OperatingSegmentsMemberaeo:AerieBrandMember2023-04-302023-07-290000919012us-gaap:CashMember2023-07-290000919012us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-08-030000919012us-gaap:RevolvingCreditFacilityMember2023-07-290000919012aeo:CreditAgreementMemberaeo:AssetBasedRevolvingCreditFacilitiesMember2022-06-300000919012us-gaap:EmployeeStockOptionMember2024-02-042024-08-030000919012us-gaap:OperatingSegmentsMemberaeo:AerieBrandMember2023-01-292023-07-290000919012us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:CashMemberus-gaap:FairValueMeasurementsRecurringMember2024-08-030000919012us-gaap:AdditionalPaidInCapitalMember2024-05-040000919012aeo:GeneralCorporateExpensesMember2024-05-052024-08-030000919012us-gaap:PropertyPlantAndEquipmentMember2023-04-302023-07-290000919012us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-292023-07-2900009190122024-05-0400009190122023-01-292024-02-030000919012aeo:AssetBasedRevolvingCreditFacilitiesMemberaeo:AlternateBaseRateMembersrt:MaximumMember2024-02-042024-08-030000919012aeo:TimeBasedRestrictedStockUnitsMember2024-02-042024-08-030000919012us-gaap:TechnologyEquipmentMembersrt:MaximumMember2024-08-030000919012us-gaap:TreasuryStockCommonMember2024-05-052024-08-03aeo:Storexbrli:pureaeo:Segmentxbrli:sharesaeo:Countryaeo:TradingDayiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended August 3, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number: 1-33338

American Eagle Outfitters, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

|

No. 13-2721761 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

77 Hot Metal Street, Pittsburgh, PA |

|

15203-2329 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (412) 432-3300

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

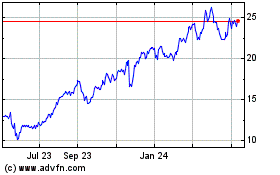

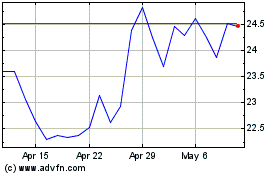

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.01 par value |

AEO |

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

☐ |

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: 192,063,586 shares of Common Stock were outstanding at August 28, 2024.

AMERICAN EAGLE OUTFITTERS, INC.

TABLE OF CONTENTS

|

|

|

|

|

Page Number |

|

PART I - FINANCIAL INFORMATION |

|

|

|

|

|

Forward Looking Statements |

4 |

|

|

|

Item 1. |

Financial Statements |

6 |

|

Consolidated Balance Sheets: August 3, 2024, February 3, 2024, and July 29, 2023 |

6 |

|

Consolidated Statements of Operations: 13 and 26 weeks ended August 3, 2024 and July 29, 2023 |

7 |

|

Consolidated Statements of Comprehensive Income: 13 and 26 weeks ended August 3, 2024 and July 29, 2023 |

8 |

|

Consolidated Statements of Stockholders' Equity: 13 and 26 weeks ended August 3, 2024 and July 29, 2023 |

9 |

|

Consolidated Statements of Cash Flows: 26 weeks ended August 3, 2024 and July 29, 2023 |

11 |

|

Notes to Consolidated Financial Statements |

12 |

Item 2. |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

27 |

Item 3. |

Quantitative and Qualitative Disclosures about Market Risk |

40 |

Item 4. |

Controls and Procedures |

40 |

|

|

|

|

PART II - OTHER INFORMATION |

|

|

|

|

Item 1. |

Legal Proceedings |

41 |

Item 1A. |

Risk Factors |

41 |

Item 2. |

Unregistered Sales of Equity Securities and Use of Proceeds |

41 |

Item 3. |

Defaults Upon Senior Securities |

N/A |

Item 4. |

Mine Safety Disclosures |

N/A |

Item 5. |

Other Information |

41 |

Item 6. |

Exhibits |

42 |

FORWARD LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (this "Quarterly Report") contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are based on the views and beliefs of management of American Eagle Outfitters, Inc. (the “Company," “AEO,” “we,” “us,” and “our"), as well as assumptions and estimates made by management. Any forward-looking statement speaks only as of the date on which such statement is made, and we do not intend to correct or update any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Actual results could differ materially from such forward-looking statements as a result of various risk factors, including those contained in this Quarterly Report and in the Company's Annual Report on Form 10-K for the fiscal year ended February 3, 2024 filed with the Securities and Exchange Commission (the "SEC") on March 15, 2024 (the "Fiscal 2023 Form 10-K") that may not be in the control of management. As used herein, “Fiscal 2024” refers to the 52-week period that will end on February 1, 2025. “Fiscal 2023” refers to the 53-week period ended February 3, 2024.

All statements other than statements of historical facts contained in this Quarterly Report are forward-looking statements. Words such as “estimate,” “project,” “plan,” “believe,” “expect,” “anticipate,” “intend,” “potential,” and similar expressions may identify forward-looking statements. Our forward-looking statements include, but are not limited to, statements about:

•the planned opening of approximately five to 15 American Eagle stores and approximately 25 to 40 Aerie and OFFLINE stores, which will be a mix of stand-alone and Aerie side-by-sides, during Fiscal 2024;

•the anticipated selection of approximately 80 to 90 American Eagle and Aerie stores in North America for remodeling during Fiscal 2024;

•the potential closure of approximately 10 to 20 American Eagle stores at the expiration of their lease term, primarily in North America, during Fiscal 2024;

•the success of our core American Eagle and Aerie brands through our omni-channel and licensed outlets within North America and internationally;

•the success of our business priorities and strategies;

•the continued validity of our trademarks;

•our performance during the back-to-school and holiday selling seasons;

•the reduction of operating expenses and capital expenditures;

•the accuracy of the estimates and assumptions we make pursuant to our critical accounting policies and estimates;

•the payment of a dividend in future periods;

•our ability to fund our current and long-term cash requirements through current cash holdings and available liquidity, including under our revolving credit facility;

•the possibility that product costs are adversely affected by foreign trade issues (including import tariffs and other trade restrictions with China and other countries), currency exchange rate fluctuations, increasing prices for raw materials, supply chain issues, political instability or other reasons;

•the possibility of changes in global economic and financial conditions, and resulting impacts on consumer confidence and consumer spending, as well as other changes in consumer discretionary spending habits;

•the effect of inflation on our business;

•the possibility that we may be required to take additional impairment or other restructuring charges;

•the impact of any global pandemic on general economic conditions; and

•the ability of our distribution centers and stores to maintain adequate staffing to meet increased customer demand.

Because these forward-looking statements involve risks and uncertainties, there are important factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, without limitation, the following:

•the risk that general macroeconomic conditions, including the effect of inflationary economic pressures and other business factors will continue to negatively impact discretionary consumer spending and, in turn, adversely impact our revenues and margins;

•the risk that our inability to anticipate and respond to changing consumer preferences and fashion trends and fluctuations in consumer demand in a timely manner could adversely impact our business and results of operations;

•the risk that seasonality may cause sales to fluctuate and negatively impact our results of operations;

•the risks associated with operating in a highly competitive industry, and facing significant pricing pressures from existing and new competitors;

•the risk that our results could be adversely affected by events beyond our control, such as natural disasters, public health crises, political crises and results of elections, negative global climate patterns, or other catastrophic events;

•the risk that impairment to goodwill, intangible assets, and other long-lived assets, including impairments relating to our Quiet Platforms business, could adversely impact our profitability;

•the risk that our inability to grow and optimize our digital channels and leverage omni-channel capabilities could adversely impact our business;

•the risk that failure to define, launch and communicate a brand-relevant customer experience could have a negative impact on our growth and profitability;

•the risks that our inability to execute on our key business priorities could have a negative impact on our growth and profitability;

•the risk that our current international operations and efforts to further expand internationally expose us to risks inherent in operating in other countries;

•the risk that failure to protect our reputation could have a material adverse effect on our brands;

•the risk that failure to manage growth in our omni-channel operations and the resulting impact on our distribution and fulfillment networks may have an adverse effect on our results of operations;

•the risks associated with our inability to implement and sustain adequate information technology systems could adversely impact our profitability and the loss of disruption of information technology systems could have a material adverse effect on our business;

•the risks related to our electronic processing of sensitive and confidential personal and business data, including cyberattacks, data breaches, other security incidents, or disruption of information technology systems or software;

•risks associated with our international merchandise sourcing strategy, such as import tariffs, increasing prices for raw materials, and political instability, all of which could impact our profitability;

•the risk that our inability to achieve planned store performance, gain market share in the face of declining shopping center traffic or attract customers to our stores could adversely impact our profitability and our results of operations;

•the risk that failure to properly manage and allocate our inventory could have an adverse effect on our business, sales, margins, financial condition, and results of operations;

•the risks associated with our significant lease obligations and are subject to risks associated with leasing substantial amounts of space, including future increases in occupancy costs and the need to generate significant cash flow to meet our lease obligations;

•the risk associated with our reliance on key personnel, the loss of whom could have a material adverse effect on our business;

•the risks associated with the increases in labor costs, including wages, could adversely impact our operational results, financial condition and results of operations;

•the risks associated with the current legal and regulatory environment could adversely affect our financial condition and results of operations;

•the risks associated with fluctuations in our tax obligations and effective tax rate could adversely affect us; and

•the risk that the unfavorable outcome of pending or future litigation could have an adverse impact on our business, financial condition and results of operations.

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

AMERICAN EAGLE OUTFITTERS, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited; Dollars and shares in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

August 3, |

|

|

February 3, |

|

|

July 29, |

|

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

|

(Unaudited) |

|

|

|

|

|

(Unaudited) |

|

Assets |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

191,837 |

|

|

$ |

354,094 |

|

|

$ |

175,315 |

|

Short-term investments |

|

|

— |

|

|

|

100,000 |

|

|

|

— |

|

Merchandise inventory |

|

|

663,659 |

|

|

|

640,662 |

|

|

|

636,972 |

|

Accounts receivable, net |

|

|

231,750 |

|

|

|

247,934 |

|

|

|

271,333 |

|

Prepaid expenses and other |

|

|

161,199 |

|

|

|

90,660 |

|

|

|

117,871 |

|

Total current assets |

|

|

1,248,445 |

|

|

|

1,433,350 |

|

|

|

1,201,491 |

|

Operating lease right-of-use assets |

|

|

1,153,354 |

|

|

|

1,005,293 |

|

|

|

1,038,505 |

|

Property and equipment, at cost, net of accumulated depreciation |

|

|

722,193 |

|

|

|

713,336 |

|

|

|

758,736 |

|

Goodwill, net |

|

|

225,213 |

|

|

|

225,303 |

|

|

|

264,964 |

|

Non-current deferred income taxes |

|

|

87,245 |

|

|

|

82,064 |

|

|

|

21,990 |

|

Intangible assets, net |

|

|

44,241 |

|

|

|

46,109 |

|

|

|

90,312 |

|

Other assets |

|

|

59,625 |

|

|

|

52,454 |

|

|

|

55,909 |

|

Total assets |

|

$ |

3,540,316 |

|

|

$ |

3,557,909 |

|

|

$ |

3,431,907 |

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

259,734 |

|

|

$ |

268,308 |

|

|

$ |

238,660 |

|

Current portion of operating lease liabilities |

|

|

307,570 |

|

|

|

284,508 |

|

|

|

309,517 |

|

Accrued compensation and payroll taxes |

|

|

55,441 |

|

|

|

152,353 |

|

|

|

74,509 |

|

Unredeemed gift cards and gift certificates |

|

|

51,791 |

|

|

|

66,285 |

|

|

|

51,156 |

|

Accrued income and other taxes |

|

|

41,631 |

|

|

|

46,114 |

|

|

|

17,372 |

|

Other current liabilities and accrued expenses |

|

|

78,219 |

|

|

|

73,604 |

|

|

|

71,262 |

|

Total current liabilities |

|

|

794,386 |

|

|

|

891,172 |

|

|

|

762,476 |

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

|

Non-current operating lease liabilities |

|

|

1,015,455 |

|

|

|

901,122 |

|

|

|

970,862 |

|

Long-term debt, net |

|

|

— |

|

|

|

— |

|

|

|

3,225 |

|

Other non-current liabilities |

|

|

36,109 |

|

|

|

28,856 |

|

|

|

22,345 |

|

Total non-current liabilities |

|

|

1,051,564 |

|

|

|

929,978 |

|

|

|

996,432 |

|

Commitments and contingencies |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

Preferred stock, $0.01 par value; 5,000 shares authorized; none

issued and outstanding |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Common stock, $0.01 par value; 600,000 shares authorized;

249,566 shares issued; 192,013, 196,936, and 197,481 shares

outstanding, respectively |

|

|

2,496 |

|

|

|

2,496 |

|

|

|

2,496 |

|

Contributed capital |

|

|

353,608 |

|

|

|

360,378 |

|

|

|

334,447 |

|

Accumulated other comprehensive loss |

|

|

(39,271 |

) |

|

|

(16,410 |

) |

|

|

(11,566 |

) |

Retained earnings |

|

|

2,320,348 |

|

|

|

2,214,159 |

|

|

|

2,158,294 |

|

Treasury stock, at cost, 57,553, 52,630, and 52,085 shares, respectively |

|

|

(942,815 |

) |

|

|

(823,864 |

) |

|

|

(810,672 |

) |

Total stockholders’ equity |

|

|

1,694,366 |

|

|

|

1,736,759 |

|

|

|

1,672,999 |

|

Total liabilities and stockholders’ equity |

|

$ |

3,540,316 |

|

|

$ |

3,557,909 |

|

|

$ |

3,431,907 |

|

Refer to Notes to Consolidated Financial Statements

AMERICAN EAGLE OUTFITTERS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited; Dollars and shares in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 Weeks Ended |

|

|

26 Weeks Ended |

|

|

|

August 3, |

|

|

July 29, |

|

|

August 3, |

|

|

July 29, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Total net revenue |

|

$ |

1,291,058 |

|

|

$ |

1,200,879 |

|

|

$ |

2,434,925 |

|

|

$ |

2,281,805 |

|

Cost of sales, including certain buying, occupancy and

warehousing expenses |

|

|

792,162 |

|

|

|

747,863 |

|

|

|

1,471,791 |

|

|

|

1,415,610 |

|

Gross profit |

|

|

498,896 |

|

|

|

453,016 |

|

|

|

963,134 |

|

|

|

866,195 |

|

Selling, general and administrative expenses |

|

|

345,313 |

|

|

|

331,872 |

|

|

|

678,806 |

|

|

|

644,217 |

|

Impairment, restructuring and other charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

21,275 |

|

Depreciation and amortization expense |

|

|

52,474 |

|

|

|

55,854 |

|

|

|

105,384 |

|

|

|

112,582 |

|

Operating income |

|

$ |

101,109 |

|

|

|

65,290 |

|

|

$ |

178,944 |

|

|

$ |

88,121 |

|

Interest (income) expense, net |

|

|

(730 |

) |

|

|

951 |

|

|

|

(4,168 |

) |

|

|

1,642 |

|

Other (income), net |

|

|

(1,715 |

) |

|

|

(2,150 |

) |

|

|

(3,111 |

) |

|

|

(5,461 |

) |

Income before income taxes |

|

|

103,554 |

|

|

|

66,489 |

|

|

|

186,223 |

|

|

|

91,940 |

|

Provision for income taxes |

|

|

26,290 |

|

|

|

17,919 |

|

|

|

41,209 |

|

|

|

24,918 |

|

Net income |

|

$ |

77,264 |

|

|

$ |

48,570 |

|

|

$ |

145,014 |

|

|

$ |

67,022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income per common share |

|

$ |

0.40 |

|

|

$ |

0.25 |

|

|

$ |

0.74 |

|

|

$ |

0.34 |

|

Diluted net income per common share |

|

$ |

0.39 |

|

|

$ |

0.25 |

|

|

$ |

0.73 |

|

|

$ |

0.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - basic |

|

|

193,661 |

|

|

|

195,329 |

|

|

|

195,048 |

|

|

|

195,214 |

|

Weighted average common shares outstanding - diluted |

|

|

197,757 |

|

|

|

196,103 |

|

|

|

199,406 |

|

|

|

196,822 |

|

Refer to Notes to Consolidated Financial Statements

AMERICAN EAGLE OUTFITTERS, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited; Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 Weeks Ended |

|

|

26 Weeks Ended |

|

|

|

August 3, |

|

|

July 29, |

|

|

August 3, |

|

|

July 29, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net income |

|

$ |

77,264 |

|

|

$ |

48,570 |

|

|

$ |

145,014 |

|

|

$ |

67,022 |

|

Other comprehensive (loss) income: |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

(23,549 |

) |

|

|

15,211 |

|

|

|

(22,861 |

) |

|

|

21,064 |

|

Other comprehensive (loss) income: |

|

|

(23,549 |

) |

|

|

15,211 |

|

|

|

(22,861 |

) |

|

|

21,064 |

|

Comprehensive income |

|

$ |

53,715 |

|

|

$ |

63,781 |

|

|

$ |

122,153 |

|

|

$ |

88,086 |

|

Refer to Notes to Consolidated Financial Statements

AMERICAN EAGLE OUTFITTERS, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited; Dollars and shares in thousands, except per share amounts)

13 Weeks Ended August 3, 2024 and July 29, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

Outstanding |

|

|

Common

Stock |

|

|

Contributed

Capital |

|

|

Retained

Earnings |

|

|

Treasury

Stock |

|

|

Accumulated Other

Comprehensive Loss |

|

|

Stockholders'

Equity |

|

Balance at April 29, 2023 |

|

|

197,450 |

|

|

$ |

2,496 |

|

|

$ |

324,396 |

|

|

$ |

2,130,108 |

|

|

$ |

(811,207 |

) |

|

$ |

(26,777 |

) |

|

$ |

1,619,016 |

|

Stock awards |

|

|

— |

|

|

|

— |

|

|

|

10,334 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

10,334 |

|

Repurchase of common stock from employees |

|

|

(8 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(83 |

) |

|

|

— |

|

|

|

(83 |

) |

Reissuance of treasury stock |

|

|

39 |

|

|

|

— |

|

|

|

(287 |

) |

|

|

(148 |

) |

|

|

618 |

|

|

|

— |

|

|

|

183 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

48,570 |

|

|

|

— |

|

|

|

— |

|

|

|

48,570 |

|

Other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

15,211 |

|

|

|

15,211 |

|

Cash dividends declared and dividend equivalents ($0.10 per share) |

|

|

— |

|

|

|

— |

|

|

|

490 |

|

|

|

(20,236 |

) |

|

|

— |

|

|

|

— |

|

|

|

(19,746 |

) |

Contributions from non-controlling interests |

|

|

— |

|

|

|

— |

|

|

|

(486 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(486 |

) |

Balance at July 29, 2023 |

|

|

197,481 |

|

|

$ |

2,496 |

|

|

$ |

334,447 |

|

|

$ |

2,158,294 |

|

|

$ |

(810,672 |

) |

|

$ |

(11,566 |

) |

|

$ |

1,672,999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at May 4, 2024 |

|

|

196,430 |

|

|

$ |

2,496 |

|

|

$ |

345,922 |

|

|

$ |

2,267,785 |

|

|

$ |

(848,125 |

) |

|

$ |

(15,722 |

) |

|

$ |

1,752,356 |

|

Stock awards |

|

|

— |

|

|

|

— |

|

|

|

6,626 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,626 |

|

Repurchase of common stock as part of publicly announced programs, including excise tax |

|

|

(4,500 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(95,993 |

) |

|

|

— |

|

|

|

(95,993 |

) |

Repurchase of common stock from employees |

|

|

(2 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(48 |

) |

|

|

— |

|

|

|

(48 |

) |

Reissuance of treasury stock |

|

|

85 |

|

|

|

— |

|

|

|

(161 |

) |

|

|

(78 |

) |

|

|

1,351 |

|

|

|

— |

|

|

|

1,112 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

77,264 |

|

|

|

— |

|

|

|

— |

|

|

|

77,264 |

|

Other comprehensive (loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(23,549 |

) |

|

|

(23,549 |

) |

Cash dividends declared and dividend equivalents ($0.125 per share) |

|

|

— |

|

|

|

— |

|

|

|

599 |

|

|

|

(24,623 |

) |

|

|

— |

|

|

|

— |

|

|

|

(24,024 |

) |

Contributions from non-controlling interests |

|

|

— |

|

|

|

|

|

|

622 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

622 |

|

Balance at August 3, 2024 |

|

|

192,013 |

|

|

$ |

2,496 |

|

|

$ |

353,608 |

|

|

$ |

2,320,348 |

|

|

$ |

(942,815 |

) |

|

$ |

(39,271 |

) |

|

$ |

1,694,366 |

|

Refer to Notes to Consolidated Financial Statements

AMERICAN EAGLE OUTFITTERS, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited; Dollars and shares in thousands, except per share amounts)

26 Weeks Ended August 3, 2024 and July 29, 2023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares

Outstanding |

|

|

Common

Stock |

|

|

Contributed

Capital |

|

|

Retained

Earnings |

|

|

Treasury

Stock |

|

|

Accumulated Other

Comprehensive Loss |

|

|

Stockholders'

Equity |

|

Balance at January 28, 2023 |

|

|

195,064 |

|

|

$ |

2,496 |

|

|

$ |

341,775 |

|

|

$ |

2,137,126 |

|

|

$ |

(849,604 |

) |

|

$ |

(32,630 |

) |

|

$ |

1,599,163 |

|

Stock awards |

|

|

— |

|

|

|

— |

|

|

|

24,984 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

24,984 |

|

Repurchase of common stock from employees |

|

|

(748 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(10,396 |

) |

|

|

— |

|

|

|

(10,396 |

) |

Reissuance of treasury stock |

|

|

2,066 |

|

|

|

— |

|

|

|

(27,481 |

) |

|

|

(3,330 |

) |

|

|

32,220 |

|

|

|

— |

|

|

|

1,409 |

|

Redemption of Convertible Senior Notes |

|

|

1,099 |

|

|

|

— |

|

|

|

(6,281 |

) |

|

|

(2,137 |

) |

|

|

17,108 |

|

|

|

— |

|

|

|

8,690 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

67,022 |

|

|

|

— |

|

|

|

— |

|

|

|

67,022 |

|

Other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

21,064 |

|

|

|

21,064 |

|

Cash dividends declared and dividend equivalents ($0.20 per share) |

|

|

— |

|

|

|

— |

|

|

|

1,016 |

|

|

|

(40,387 |

) |

|

|

— |

|

|

|

— |

|

|

|

(39,371 |

) |

Contributions from non-controlling interests |

|

|

— |

|

|

|

— |

|

|

|

434 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

434 |

|

Balance at July 29, 2023 |

|

|

197,481 |

|

|

$ |

2,496 |

|

|

$ |

334,447 |

|

|

$ |

2,158,294 |

|

|

$ |

(810,672 |

) |

|

$ |

(11,566 |

) |

|

$ |

1,672,999 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at February 3, 2024 |

|

|

196,936 |

|

|

$ |

2,496 |

|

|

$ |

360,378 |

|

|

$ |

2,214,159 |

|

|

$ |

(823,864 |

) |

|

$ |

(16,410 |

) |

|

$ |

1,736,759 |

|

Stock awards |

|

|

|

|

|

— |

|

|

|

27,062 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

27,062 |

|

Repurchase of common stock as part of publicly announced programs, including excise tax |

|

|

(6,000 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(130,941 |

) |

|

|

— |

|

|

|

(130,941 |

) |

Repurchase of common stock from employees |

|

|

(533 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(13,290 |

) |

|

|

— |

|

|

|

(13,290 |

) |

Reissuance of treasury stock |

|

|

1,610 |

|

|

|

— |

|

|

|

(35,166 |

) |

|

|

10,996 |

|

|

|

25,280 |

|

|

|

— |

|

|

|

1,110 |

|

Net income |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

145,014 |

|

|

|

— |

|

|

|

— |

|

|

|

145,014 |

|

Other comprehensive (loss) |

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(22,861 |

) |

|

|

(22,861 |

) |

Cash dividends declared and dividend equivalents ($0.250 per share) |

|

|

|

|

|

— |

|

|

|

1,204 |

|

|

|

(49,821 |

) |

|

|

— |

|

|

|

— |

|

|

|

(48,617 |

) |

Contributions from non-controlling interests |

|

|

|

|

|

— |

|

|

|

130 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

130 |

|

Balance at August 3, 2024 |

|

|

192,013 |

|

|

$ |

2,496 |

|

|

$ |

353,608 |

|

|

$ |

2,320,348 |

|

|

$ |

(942,815 |

) |

|

$ |

(39,271 |

) |

|

$ |

1,694,366 |

|

AMERICAN EAGLE OUTFITTERS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited; Dollars in thousands)

|

|

|

|

|

|

|

|

|

|

|

26 Weeks Ended |

|

|

|

August 3, |

|

|

July 29, |

|

|

|

2024 |

|

|

2023 |

|

Operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

145,014 |

|

|

$ |

67,022 |

|

Adjustments to reconcile net income to net cash from operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

109,764 |

|

|

|

115,296 |

|

Share-based compensation |

|

|

27,362 |

|

|

|

25,355 |

|

Deferred income taxes |

|

|

(8,145 |

) |

|

|

14,492 |

|

Loss on impairment of assets |

|

|

- |

|

|

|

10,759 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

14,638 |

|

|

|

(29,143 |

) |

Merchandise inventory |

|

|

(33,750 |

) |

|

|

(62,702 |

) |

Operating lease assets |

|

|

102,006 |

|

|

|

124,825 |

|

Operating lease liabilities |

|

|

(112,528 |

) |

|

|

(160,051 |

) |

Other assets |

|

|

(80,600 |

) |

|

|

20,509 |

|

Accounts payable |

|

|

(7,872 |

) |

|

|

3,899 |

|

Accrued compensation and payroll taxes |

|

|

(96,761 |

) |

|

|

22,389 |

|

Accrued and other liabilities |

|

|

(18,988 |

) |

|

|

(4,759 |

) |

Net cash provided by operating activities |

|

|

40,140 |

|

|

|

147,891 |

|

Investing activities: |

|

|

|

|

|

|

Capital expenditures for property and equipment |

|

|

(96,945 |

) |

|

|

(91,959 |

) |

Sale of available-for-sale investments |

|

|

100,000 |

|

|

|

- |

|

Other investing activities |

|

|

(8,384 |

) |

|

|

(6,492 |

) |

Net cash (used for) investing activities |

|

|

(5,329 |

) |

|

|

(98,451 |

) |

Financing activities: |

|

|

|

|

|

|

Repurchase of common stock as part of publicly announced programs |

|

|

(130,941 |

) |

|

|

- |

|

Repurchase of common stock from employees |

|

|

(13,290 |

) |

|

|

(10,396 |

) |

Proceeds from revolving line of credit |

|

|

- |

|

|

|

30,000 |

|

Principal payments on revolving line of credit |

|

|

- |

|

|

|

(27,000 |

) |

Net proceeds from stock options exercised |

|

|

2,963 |

|

|

|

1,095 |

|

Cash dividends paid |

|

|

(48,617 |

) |

|

|

(39,371 |

) |

Other financing activities |

|

|

(4,615 |

) |

|

|

(742 |

) |

Net cash (used for) financing activities |

|

|

(194,500 |

) |

|

|

(46,414 |

) |

Effect of exchange rates changes on cash |

|

|

(2,568 |

) |

|

|

2,080 |

|

Net change in cash and cash equivalents |

|

|

(162,257 |

) |

|

|

5,106 |

|

Cash and cash equivalents - beginning of period |

|

|

354,094 |

|

|

|

170,209 |

|

Cash and cash equivalents - end of period |

|

$ |

191,837 |

|

|

$ |

175,315 |

|

Refer to Notes to Consolidated Financial Statements

AMERICAN EAGLE OUTFITTERS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Interim Financial Statements

The accompanying Consolidated Financial Statements of American Eagle Outfitters, Inc., a Delaware corporation, at August 3, 2024 and July 29, 2023 and for the 13 and 26 week periods ended August 3, 2024 and July 29, 2023 have been prepared in accordance with generally accepted accounting principles in the United States of America (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. Certain notes and other information have been condensed or omitted from the interim Consolidated Financial Statements presented in this Quarterly Report. Therefore, these Consolidated Financial Statements should be read in conjunction with our Fiscal 2023 Form 10-K. In the opinion of the Company’s management, all adjustments (consisting of normal recurring adjustments and those described in the notes that follow) considered necessary for a fair presentation have been included. The existence of subsequent events has been evaluated through the filing date of this Quarterly Report.

The Company operates under the American Eagle® ("AE") brand and the Aerie® brand, which includes the OFFLINE by Aerie® brand. We also operate Todd Snyder New York ("Todd Snyder"), a premium menswear brand, and Unsubscribed, which focuses on consciously made slow fashion.

Founded in 1977, the Company is a leading multi-brand specialty retailer that operates nearly 1,500 retail stores in the United States ("U.S.") and internationally, online through our digital channels at www.ae.com and www.aerie.com, www.toddsnyder.com, www.unsubscribed.com and through more than 300 international store locations managed by third-party operators. Through its portfolio of brands, the Company offers high quality, on-trend clothing, accessories, and personal care products at affordable prices. We sell directly to consumers through our retail channel, which includes our stores and concession-based shop-within-shops. We operate stores in the U.S., Canada, Mexico, and Hong Kong. We also have license agreements with third parties to operate American Eagle and Aerie stores throughout Asia, Europe, India, Latin America, and the Middle East. The Company's online business, AEO Direct, ships to approximately 80 countries worldwide.

As e-commerce penetration and growth has normalized coming out of the COVID-19 pandemic, the supply chain landscape has continued to evolve. In Fiscal 2023, as part of its profit improvement initiative, the Company began to streamline and shift the operations of Quiet Platforms to better align with AEO's long term strategy. As a result of these changes, Quiet Platforms has refined its focus on its core capabilities as a regionalized fulfillment center network. The network and related growth plans have been updated to reflect this refined focus.

Historically, our operations have been seasonal, with a large portion of total net revenue and operating income occurring in the third and fourth fiscal quarters, reflecting increased demand during the back-to-school and year-end holiday selling seasons, respectively. Our quarterly results of operations also may fluctuate based upon such factors as the timing of certain holiday seasons, the number and timing of new store openings, the acceptability of seasonal merchandise offerings, the timing and level of markdowns, store closings and remodels, competitive factors, weather and general economic and political conditions.

2. Summary of Significant Accounting Policies

Principles of Consolidation

The Consolidated Financial Statements include the accounts of the Company and its wholly owned subsidiaries and consolidated entities where the Company's ownership percentage is less than 100%. Non-controlling interest is included as a component of contributed capital within the Consolidated Balance Sheets and Consolidated Statements of Stockholders' Equity and was not material for any period presented. All intercompany transactions and balances have been eliminated in consolidation. At August 3, 2024, the Company operated in two reportable segments, American Eagle and Aerie.

Fiscal Year

Our fiscal year is a 52- or 53-week year that ends on the Saturday nearest to January 31. As used herein, "Fiscal 2024" refers to the 52-week period that will end on February 1, 2025. “Fiscal 2023” refers to the 53-week period ended on February 3, 2024.

Estimates

The preparation of financial statements in conformity with GAAP requires the Company’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. On an ongoing basis, our management reviews its estimates based on currently available information. Changes in facts and circumstances may result in revised estimates.

Recent Accounting Pronouncements

In November 2023, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2023-07, Improvements to Reportable Segment Disclosures ("ASU 2023-07"), which requires that segment expenses deemed significant to the Chief Operating Decision Maker ("CODM") typically incorporated in measuring profit or loss of the segment should be disclosed. The guidance also requires that the difference between segment revenues and these significant segment expenses is disclosed. Any annually disclosed segment information is now required to be reported in interim periods as well. The guidance is effective for fiscal years beginning after December 15, 2023, and interim periods beginning after December 15, 2024. Public entities are required to apply the amendment retrospectively to prior periods presented in the financial statements. The Company plans to adopt ASU 2023-07 effective for its Fiscal 2024 and for the interim periods beginning in Fiscal 2025.

Refer to Note 12 to the Consolidated Financial Statements for additional information regarding Segment Reporting.

In December 2023, the FASB issued ASU 2023-09, Improvements to Income Tax Disclosures ("ASU 2023-09"), which requires increased transparency in tax disclosures, specifically by expanding requirements for rate reconciliation and income taxes paid information. Additionally, the amendment requires disclosures of income/(loss) from continuing operations before taxes disaggregated between domestic and foreign, and income tax expense/(benefit), disaggregated by federal, state, and foreign. Disclosure requirements about the nature and estimated range of the reasonably possible change in unrecognized tax benefits over the next year have been removed as part of this amendment. The guidance is effective for fiscal years beginning after December 15, 2024. The Company plans to adopt ASU 2023-09 effective for Fiscal 2025.

Refer to Note 10 to the Consolidated Financial Statements for additional information regarding Income Taxes.

Foreign Currency Translation

In accordance with Accounting Standards Codification ("ASC") 830, Foreign Currency Matters, the Company translates assets and liabilities denominated in foreign currencies into U.S. dollars (“USD”) (the reporting currency) at the exchange rates prevailing at the balance sheet date. The Company translates revenues and expenses denominated in foreign currencies into USD at the monthly average exchange rates for the period. Gains or losses resulting from foreign currency transactions are included in the consolidated results of operations, whereas related translation adjustments are reported as an element of other comprehensive income (loss) in accordance with ASC 220, Comprehensive Income.

We are exposed to the impact of foreign exchange rate risk primarily through our Canadian and Mexican operations where the functional currency is the Canadian dollar and Mexican peso, respectively. The impact of all other foreign currencies is currently immaterial to our consolidated financial results. During the 13 and 26 weeks ended August 3, 2024, an unrealized loss of $23.5 million and $22.9 million, respectively was included in other comprehensive (loss) income, which were primarily related to the fluctuations of the USD to Mexican peso and USD to Canadian dollar exchange rates.

Cash, Cash Equivalents and Short-term Investments

The Company considers all highly liquid investments purchased with an original maturity of three months or less to be cash equivalents. Short-term investments classified as available-for-sale include certificates of deposit with an original maturity greater than three months, but less than one year.

Refer to Note 3 to the Consolidated Financial Statements for information regarding cash, cash equivalents, and short-term investments.

Accounts Receivable

The Company's receivables are primarily generated from product sales and royalties from our licensees. The primary indicators of the credit quality of our receivables are aging, payment history, economic sector information and outside credit monitoring, and are assessed on a quarterly basis. Our credit loss exposure is mainly concentrated in our accounts receivable portfolio. Our allowance for credit losses is calculated using a loss-rate method based on historical

experience, current market conditions and reasonable forecasts. Historically, the Company’s reserves have approximated actual experience.

Merchandise Inventory

Merchandise inventory is valued at the lower of average cost or net realizable value, utilizing the retail method. Average cost includes merchandise design and sourcing costs and related expenses. The Company records merchandise receipts when control of the merchandise has transferred to the Company.

The Company reviews its inventory levels to identify slow-moving merchandise and generally uses markdowns to clear merchandise. Additionally, the Company estimates a markdown reserve for future planned permanent markdowns related to current inventory. Markdowns may occur when inventory exceeds customer demand for reasons of style, seasonal adaptation, changes in customer preference, lack of consumer acceptance of fashion items, competition, or if it is determined that the inventory in stock will not sell at its currently ticketed price. Such markdowns may have a material adverse impact on earnings, depending on the extent and amount of inventory affected.

The Company also estimates a shrinkage reserve for the period between the last physical count and the balance sheet date. The estimate for the shrinkage reserve, based on historical results, can be affected by changes in merchandise mix and changes in actual shrinkage trends.

Property and Equipment

Property and equipment is recorded on the basis of cost with depreciation computed utilizing the straight-line method over the asset’s estimated useful life. The useful lives of our major classes of assets are as follows:

|

|

|

Buildings |

|

25 years |

Leasehold improvements |

|

Lesser of 10 years or the term of the lease |

Fixtures and equipment Information technology |

|

Five years Three to five years |

As of August 3, 2024, the weighted average remaining useful life of our assets was approximately six years.

In accordance with ASC 360, Property, Plant, and Equipment (“ASC 360”), the Company’s management evaluates the value of leasehold improvements, store fixtures, and operating lease right-of-use ("ROU") assets associated with retail stores. The Company evaluates long-lived assets for impairment at the individual store level, which is the lowest level at which individual cash flows can be identified. Impairment losses are recorded on long-lived assets used in operations when events and circumstances indicate that the assets might be impaired and the projected undiscounted cash flows estimated to be generated by those assets are less than the carrying amounts. When events such as these occur, the impaired assets are adjusted to their estimated fair value and an impairment loss is recorded separately as a component of operating income within the Consolidated Statements of Operations.

Our impairment loss calculations require management to make assumptions and to apply judgment to estimate future cash flows and asset fair values. The significant assumption used in our fair value analysis is forecasted revenue. We do not believe that there is a reasonable likelihood that there will be a material change in the estimates or assumptions that we use to calculate long-lived asset impairment losses. However, if actual results are not consistent with our estimates and assumptions, our consolidated operating results could be adversely affected.

When the Company closes, remodels, or relocates a store prior to the end of its lease term, the remaining net book value of the assets related to the store is recorded as a write-off of assets within depreciation and amortization expense.

There were no long-lived asset impairment charges recorded during the 13 weeks ended August 3, 2024 and July 29, 2023. During the 26 weeks ended July 29, 2023, the Company recorded impairment of property and equipment of $10.8 million. No long-lived asset impairment charges were recorded during the 26 weeks ended August 3, 2024. Refer to Note 6 to the Consolidated Financial Statements for additional information regarding property and equipment and refer to Note 13 to the Consolidated Financial Statements for additional information regarding the impairment of these assets.

Goodwill and Intangible Assets

The Company’s goodwill is primarily related to the acquisition of its regionalized fulfillment center network, as well as its importing operations and Canadian business, and represents the excess of cost over fair value of net assets of businesses acquired. In accordance with ASC 350, Intangibles – Goodwill and Other, the Company evaluates goodwill for possible impairment at least annually as of the last day of the fiscal year and upon occurrence of certain triggering events or substantive changes in circumstances that indicate that the fair value of a reporting unit may be below its carrying value. If the carrying value of the reporting unit exceeds the fair value, an impairment charge is recorded in the

period of the evaluation based on that difference. The Company last performed an annual goodwill impairment test as of February 3, 2024. As a result of the annual impairment test, the Company concluded that the goodwill assigned to the Quiet Platforms reporting unit was impaired, resulting in a charge of $39.6 million recorded within impairment, restructuring and other charges on the Consolidated Statements of Operations for Fiscal 2023, due to insufficient prospective cash flows to support the carrying value of the business. Significant, subjective assumptions used in the Company’s fair value estimate included forecasted cost of sales, forecasted operating expense and the discount rate. No indicators of impairment were present during the 13 and 26 weeks ended August 3, 2024 and July 29, 2023.

Definite-lived intangible assets are initially recorded at fair value, with amortization computed utilizing the straight-line method over the assets’ estimated useful lives. The Company’s definite-lived intangible assets, which consist primarily of trademark assets, are generally amortized over 10 to 15 years.

The Company evaluates definite-lived intangible assets for impairment in accordance with ASC 360 when events or circumstances indicate that the carrying value of the asset may not be recoverable. Such an evaluation includes the estimation of undiscounted future cash flows to be generated by those assets. If the sum of the estimated future undiscounted cash flows is less than the carrying amounts of the assets, then the assets are impaired and are adjusted to their estimated fair value. During Fiscal 2023, the Company recorded a $40.5 million impairment charge within impairment, restructuring and other charges on the Consolidated Statements of Operations related to the definite-lived intangible assets of Quiet Platforms, due to insufficient prospective cash flows to support the carrying value of the assets. No definite-lived intangible asset impairment charges were recorded during the 13 and 26 weeks ended August 3, 2024 and July 29, 2023.

Refer to Note 7 to the Consolidated Financial Statements for additional information regarding goodwill and intangible assets.

Construction Allowances

As part of certain lease agreements for retail stores, the Company receives construction allowances from lessors, which are generally comprised of cash amounts. The Company records a receivable and an adjustment to the operating lease ROU asset at the lease commencement date (i.e., the date of initial possession of the store). The deferred lease credit is amortized as part of the single lease cost over the term of the original lease (including the pre-opening build-out period). The receivable is reduced as amounts are received from the lessor.

Self-Insurance Liability

The Company uses a combination of insurance and self-insurance mechanisms for certain losses related to employee medical benefits and worker’s compensation. Costs for self-insurance claims filed and claims incurred but not reported are accrued based on known claims and historical experience. Management believes that it has adequately reserved for its self-insurance liability, which is capped by stop-loss contracts with insurance companies. However, any significant variation of future claims from historical trends could cause actual results to differ from the accrued liability.

Leases

The Company leases all store premises, its Canadian distribution center in Mississauga, Ontario, its regional distribution facilities, some of its office space and certain information technology and office equipment. These leases are generally classified as operating leases.

Store leases generally provide for a combination of base rentals and contingent rent based on store sales. Additionally, most leases include lessor incentives such as construction allowances and rent holidays. The Company is typically responsible for tenant occupancy costs including maintenance costs, common area charges, real estate taxes and certain other expenses. When measuring operating lease ROU assets and operating lease liabilities, the Company only includes cash flows related to options to extend or terminate leases once those options are executed.

Some leases have variable payments. However, because they are not based on an index or rate, they are not included in the measurement of operating lease ROU assets and operating lease liabilities.

When determining the present value of future payments for an operating lease that does not have a readily determinable implicit rate, the Company uses its incremental borrowing rate as of the date of initial possession of the leased asset.

For leases that qualify for the short-term lease exemption, the Company does not record an operating lease liability or operating lease ROU asset. Short-term lease payments are recognized on a straight-line basis over the lease term of 12 months or less.

Co-Branded and Private Label Credit Cards

The Company offers a co-branded credit card and a private-label credit card under the AE and Aerie brands. These credit cards are issued by a third-party bank (the “Bank”) in accordance with a credit card agreement (the “Agreement”). The Company has no liability to the Bank for bad debt expense, provided that purchases are made in accordance with the Bank’s procedures. We receive funding from the Bank based on the Agreement and card activity, which includes payments for new account activations and usage of the credit cards. We recognize revenue for this funding as we fulfill our performance obligations under the Agreement. This revenue is recorded in other revenue, which is a component of total net revenue in our Consolidated Statements of Operations.

Customer Loyalty Program

The Company offers a highly digitized loyalty program called Real Rewards by American Eagle and Aerie™ (the “Program”). The Program features both shared and unique benefits for loyalty members and credit card holders. Under the Program, members accumulate points based on purchase activity and earn rewards by reaching certain point thresholds. Members earn rewards in the form of discount savings certificates. Rewards earned are valid through the stated expiration date, which is 60 days from the issuance date of the reward. Rewards not redeemed during the 60-day redemption period are forfeited.

Points earned under the Program on purchases at AE and Aerie are accounted for in accordance with ASC 606, Revenue from Contracts with Customers (“ASC 606”). The portion of the sales revenue attributed to the reward points is deferred and recognized when the reward is redeemed or when the points expire, using the relative stand-alone selling price method. Additionally, reward points earned using the co-branded credit card on non-AE or Aerie purchases are accounted for in accordance with ASC 606. As the points are earned, a current liability is recorded for the estimated cost of the reward, and the impact of adjustments is recorded in revenue.

The Company defers a portion of the sales revenue attributed to the loyalty points and recognizes revenue when the points are redeemed or expire, consistent with the requirements of ASC 606.

Credit Agreement

In June 2022, the Company entered into an amended and restated credit agreement (the “Credit Agreement”). The Credit Agreement provides senior secured asset-based revolving credit for loans and letters of credit up to $700 million, subject to customary borrowing base limitations (the "Credit Facility"). The Credit Facility expires on June 24, 2027.

Refer to Note 8 to the Consolidated Financial Statements for additional information regarding long-term debt and other credit arrangements.

Income Taxes

The Company calculates income taxes in accordance with ASC 740, Income Taxes (“ASC 740”), which requires the use of the liability method. Under this method, deferred tax assets and liabilities are recognized based on the difference between the Consolidated Financial Statements carrying amounts of existing assets and liabilities and their respective tax bases as computed pursuant to ASC 740. Deferred tax assets and liabilities are measured using the tax rates, based on certain judgments regarding enacted tax laws and published guidance, in effect in the years when those temporary differences are expected to reverse. A valuation allowance is established against the deferred tax assets when it is more likely than not that some portion or all of the deferred taxes may not be realized. Changes in the Company’s level and composition of earnings, tax laws or the deferred tax valuation allowance, as well as the results of tax audits, may materially impact the Company’s effective income tax rate.