- Record second quarter revenue of $1.3 billion, rose 8% to

last year

- Operating profit of $101 million, up 55% to last

year

- Aerie achieved all-time high second quarter revenue, with

comps up 4%

- American Eagle continued to see strong momentum, with comps

increasing 5%

- Updates full-year operating income outlook to $455 to $465

million, the high-end of prior guidance range

American Eagle Outfitters, Inc. (NYSE: AEO) today announced

financial results for the second quarter fiscal 2024 ended August

3, 2024.

“Our Powering Profitable Growth strategy is off to a great

start, locking in a strong first half and setting us on track to

achieve the high end of our prior operating profit outlook for

2024. The second quarter marked our sixth consecutive quarter of

record revenue and we successfully leveraged our cost base –

advancing a number of strategic priorities to fuel growth across

brands and channels and drive operating efficiencies,” commented

Jay Schottenstein, AEO’s Executive Chairman of the Board and Chief

Executive Officer.

“I am pleased with the positive reception we’ve seen to our

early Fall collections. Our winning formula of outstanding quality

and style offered at a great value remains a cornerstone of our

brands, positioning us perfectly for today’s consumers. In a

dynamic macroeconomic environment, we will remain disciplined and

focused on delivering profitable growth and long-term shareholder

value,” he continued.

Second Quarter 2024 Results:

- Second quarter 2024 results are presented for the 13 weeks

ended August 3, 2024 compared to the 13 weeks ended July 29, 2023.

Comparable sales metrics are presented for the 13 weeks ended

August 3, 2024 compared to the 13 weeks ended August 5, 2023.

- Total net revenue of $1.3 billion rose 8%. This included an

approximately $55 million positive impact from the retail calendar

shift.

- Store revenue rose 7%. Digital revenue increased 12%.

- Aerie revenue of $416 million rose 9%, with comp sales up 4%.

American Eagle revenue of $828 million increased 8%, with comp

sales growing 5%.

- Gross profit of $499 million increased 10%, reflecting a gross

margin rate of 38.6%, expanding 90 basis points. Merchandise

margins increased, led by favorable product costs. Gross margin

expansion also reflected leverage on expenses, primarily in rent

and digital delivery costs.

- Selling, general and administrative expense of $345 million was

up 4% and leveraged 90 basis points. The improvement was driven by

leverage across compensation, including incentive costs, store and

corporate payroll. Professional fees and services and supplies and

maintenance costs, also improved as a rate to revenue.

- Operating income of $101 million increased 55%. This included

an approximately $20 million positive impact from the retail

calendar shift. The operating margin expanded 240 basis points to

7.8%.

- Diluted earnings per share was $0.39. Average diluted shares

outstanding were 198 million.

Inventory

Total ending inventory increased 4% to $664 million. Inventory

levels are healthy and well positioned for the balance of the

season.

Shareholder Returns

In the second quarter, the company returned $120 million in cash

to shareholders, bringing year-to-date returns to $180 million.

This included 4.5 million shares repurchased in the second quarter

for $96 million, bringing year-to-date repurchases to 6 million

shares and $131 million. The company continues to have 24 million

shares remaining for repurchase under the current

authorization.

Additionally, the company paid a quarterly cash dividend of

$0.125 per share, or approximately $24 million, bringing

year-to-date cash dividends to $49 million.

Capital Expenditures

Capital expenditures totaled $61 million in the second quarter

and $97 million year-to-date. For fiscal 2024, management continues

to expect capital expenditures to approximate $200 to $250

million.

Outlook

For the third quarter, the company expects operating income to

be in the range of $120 to $125 million. This reflects

approximately $20 million of profit that shifted into the second

quarter from the third quarter, due to the retail calendar. The

company expects comparable sales to increase in the range of 3% to

4%, with total revenue flat to up slightly, also reflecting the

impact from the retail calendar. SG&A is expected to leverage,

with dollars down slightly, driven by efficiencies across key focus

areas.

For the year, the company is updating its operating income

outlook to $455 to $465 million, the high end of prior guidance.

The company expects comparable sales to increase approximately 4%,

with total revenue up 2% to 3%, including the impact from one less

selling week, as previously discussed.

Webcast and Supplemental Financial Information

Management will host a conference call and real time webcast

today at 11:00 am Eastern Time. To listen to the call, dial

1-877-407-0789 or internationally dial 1-201-689-8562 or go to

www.aeo-inc.com to access the webcast and audio replay.

Additionally, a financial results presentation is posted on the

company’s website.

* * * *

About American Eagle Outfitters, Inc.

American Eagle Outfitters, Inc. (NYSE: AEO) is a leading global

specialty retailer offering high-quality, on-trend clothing,

accessories and personal care products at affordable prices under

its American Eagle® and Aerie® brands. Our purpose is to show the

world that there’s REAL power in the optimism of youth. The company

operates stores in the United States, Canada, Mexico and Hong Kong

and ships to approximately 80 countries worldwide through its

websites. American Eagle and Aerie merchandise also is available at

more than 300 international locations operated by licensees in

approximately 30 countries. To learn more about AEO and the

company’s commitment to Planet, People and Practices, please visit

www.aeo-inc.com.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995

This release and related statements by management contain

forward-looking statements (as such term is defined in the Private

Securities Litigation Reform Act of 1995), which represent

management’s expectations or beliefs concerning future events,

including, without limitation, third fiscal quarter and annual

fiscal 2024 results. Words such as “outlook,” "estimate,"

"project," "plan," "believe," "expect," "anticipate," "intend,"

“may,” “potential,” and similar expressions may identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. All forward-looking

statements made by the company are inherently uncertain because

they are based on assumptions and expectations concerning future

events and are subject to change based on many important factors,

some of which may be beyond the company’s control. Except as may be

required by applicable law, we undertake no obligation to publicly

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise and even if

experience or future changes make it clear that any projected

results expressed or implied therein will not be realized. The

following factors, in addition to the risks disclosed in Item 1A.,

Risk Factors, of our Annual Report on Form 10-K for the fiscal year

ended February 3, 2024 and in any other filings that we may make

with the Securities and Exchange Commission, in some cases have

affected, and in the future could affect, the company's financial

performance and could cause actual results to differ materially

from those expressed or implied in any of the forward-looking

statements included in this release or otherwise made by

management: the risk that the company’s operating, financial and

capital plans may not be achieved; our inability to anticipate

customer demand and changing fashion trends and to manage our

inventory commensurately; seasonality of our business; our

inability to achieve planned store financial performance; our

inability to react to raw material cost, labor and energy cost

increases; our inability to gain market share in the face of

declining shopping center traffic; our inability to respond to

changes in e-commerce and leverage omni-channel demands; our

inability to expand internationally; difficulty with our

international merchandise sourcing strategies; challenges with

information technology systems, including safeguarding against

security breaches; and global economic, public health, social,

political and financial conditions, and the resulting impact on

consumer confidence and consumer spending, as well as other changes

in consumer discretionary spending habits, which could have a

material adverse effect on our business, results of operations and

liquidity.

The use of the “company,” “AEO,” “we,” "us," and “our” in this

release refers to American Eagle Outfitters, Inc.

AMERICAN EAGLE OUTFITTERS, INC. CONSOLIDATED BALANCE

SHEETS (Unaudited; Dollars in thousands) August 3, 2024 July

29, 2023

Assets Current assets: Cash and cash equivalents

$

191,837

$

175,315

Merchandise inventory

663,659

636,972

Accounts receivable, net

231,750

271,333

Prepaid expenses and other

161,199

117,871

Total current assets

1,248,445

1,201,491

Operating lease right-of-use assets

1,153,354

1,038,505

Property and equipment, at cost, net of accumulated depreciation

722,193

758,736

Goodwill, net

225,213

264,964

Non-current deferred income taxes

87,245

21,990

Intangible assets, net

44,241

90,312

Other assets

59,625

55,909

Total assets

$

3,540,316

$

3,431,907

Liabilities and Stockholders’ Equity Current liabilities:

Accounts payable

$

259,734

$

238,660

Current portion of operating lease liabilities

307,570

309,517

Accrued compensation and payroll taxes

55,441

74,509

Unredeemed gift cards and gift certificates

51,791

51,156

Accrued income and other taxes

41,631

17,372

Other current liabilities and accrued expenses

78,219

71,262

Total current liabilities

794,386

762,476

Non-current liabilities: Non-current operating lease liabilities

1,015,455

970,862

Long-term debt, net

—

3,225

Other non-current liabilities

36,109

22,345

Total non-current liabilities

1,051,564

996,432

Commitments and contingencies

—

—

Stockholders’ equity: Preferred stock

—

—

Common stock

2,496

2,496

Contributed capital

353,608

334,447

Accumulated other comprehensive loss

(39,271

)

(11,566

)

Retained earnings

2,320,348

2,158,294

Treasury stock

(942,815

)

(810,672

)

Total stockholders’ equity

1,694,366

1,672,999

Total liabilities and stockholders’ equity

$

3,540,316

$

3,431,907

Current Ratio

1.57

1.58

AMERICAN EAGLE OUTFITTERS, INC. CONSOLIDATED STATEMENTS

OF OPERATIONS (Unaudited; Dollars and shares in thousands,

except per share amounts) GAAP Basis 13 Weeks Ended August 3, 2024

July 29, 2023 (In thousands) (Percentage of revenue) (In thousands)

(Percentage of revenue) Total net revenue

$

1,291,058

100.0

%

$

1,200,879

100.0

%

Cost of sales, including certain buying, occupancy and warehouse

expenses

792,162

61.4

747,863

62.3

Gross profit

498,896

38.6

453,016

37.7

Selling, general and administrative expenses

345,313

26.7

331,872

27.6

Depreciation and amortization expense

52,474

4.1

55,854

4.7

Operating income

101,109

7.8

65,290

5.4

Interest (income) expense, net

(730

)

(0.1

)

951

0.1

Other (income), net

(1,715

)

(0.1

)

(2,150

)

(0.2

)

Income before income taxes

$

103,554

8.0

$

66,489

5.5

Provision for income taxes

26,290

2.0

17,919

1.5

Net income

$

77,264

6.0

%

$

48,570

4.0

%

Net income per basic share

$

0.40

$

0.25

Net income per diluted share

$

0.39

$

0.25

Weighted average common shares outstanding - basic

193,661

195,329

Weighted average common shares outstanding - diluted

197,757

196,103

AMERICAN EAGLE OUTFITTERS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited; Dollars

and shares in thousands, except per share amounts) GAAP Basis 26

Weeks Ended August 3, 2024 July 29, 2023 (In thousands) (Percentage

of revenue) (In thousands) (Percentage of revenue) Total net

revenue

$

2,434,925

100.0

%

$

2,281,805

100.0

%

Cost of sales, including certain buying, occupancy and warehouse

expenses

1,471,791

60.5

1,415,610

62.0

Gross profit

963,134

39.5

866,195

38.0

Selling, general and administrative expenses

678,806

27.9

644,217

28.2

Impairment, Restructuring and Other Charges

-

0.0

21,275

1.0

Depreciation and amortization expense

105,384

4.3

112,582

4.9

Operating income

178,944

7.3

88,121

3.9

Interest (income) expense, net

(4,168

)

(0.2

)

1,642

0.1

Other (income), net

(3,111

)

(0.1

)

(5,461

)

(0.2

)

Income before income taxes

$

186,223

7.6

$

91,940

4.0

Provision for income taxes

41,209

1.6

24,918

1.1

Net income

$

145,014

6.0

%

$

67,022

2.9

%

Net income per basic share

$

0.74

$

0.34

Net income per diluted share

$

0.73

$

0.34

Weighted average common shares outstanding - basic

195,048

195,214

Weighted average common shares outstanding - diluted

199,406

196,822

AMERICAN EAGLE OUTFITTERS, INC. NET REVENUE BY

SEGMENT (Unaudited; Dollars in thousands) 13 Weeks Ended 26

Weeks Ended August 3, 2024 July 29, 2023 August 3, 2024 July 29,

2023 Net Revenue: American Eagle

$

827,638

$

767,018

$

1,552,382

$

1,438,110

Aerie

415,646

380,413

788,298

739,495

Other

57,457

108,318

112,441

217,675

Intersegment Elimination

(9,683

)

(54,870

)

(18,196

)

(113,475

)

Total Net Revenue

$

1,291,058

$

1,200,879

$

2,434,925

$

2,281,805

AMERICAN EAGLE OUTFITTERS, INC. STORE

INFORMATION (Unaudited) 13 Weeks Ended 26 Weeks Ended August 3,

2024 August 3, 2024 Consolidated stores at beginning of period

1,173

1,182

Consolidated stores opened during the period AE Brand (1)

3

6

Aerie (incl. OFFL/NE) (2)

9

10

Todd Snyder

2

2

Unsubscribed

-

-

Consolidated stores closed during the period AE Brand (1)

(6)

(14)

Aerie (incl. OFFL/NE) (2)

(3)

(7)

Unsubscribed

-

(1)

Total consolidated stores at end of period

1,178

1,178

Stores by Brand AE Brand (1)

843

Aerie (incl. OFFL/NE) (2)

313

Todd Snyder

17

Unsubscribed

5

Total consolidated stores at end of period

1,178

Total gross square footage at end of period (in '000)

7,240

7,240

International license locations at end of period (3)

313

313

(1) AE Brand includes AE stand alone locations, AE/Aerie

side-by side locations, AE/OFFL/NE side-by-side locations, and

AE/Aerie/OFFL/NE side-by-side locations. (2) Aerie (incl. OFFL/NE)

includes Aerie stand alone locations, OFFL/NE stand alone

locations, and Aerie/OFFL/NE side-by-side locations. (3)

International license locations (retail stores and concessions) are

not included in the consolidated store data or the total gross

square footage calculation.

Non-GAAP Measures This press

release includes information on non-GAAP financial measures

(“non-GAAP” or “adjusted”), including consolidated adjusted

operating income, excluding non-GAAP items. This financial measure

is not based on any standardized methodology prescribed by U.S.

generally accepted accounting principles (“GAAP”) and are not

necessarily comparable to similar measures presented by other

companies. Non-GAAP information is provided as a supplement to, not

as a substitute for, or as superior to, measures of financial

performance prepared in accordance with GAAP. Management believes

that this non-GAAP information is useful for an alternate

presentation of the company’s performance, when reviewed in

conjunction with the company’s GAAP consolidated financial

statements and provides a higher degree of transparency. 'These

amounts are not determined in accordance with GAAP and therefore,

should not be used exclusively in evaluating the company’s business

and operations. We encourage investors and others to review our

financial information in its entirety, not to rely on any single

financial measure and to view these non-GAAP financial measures in

conjunction with the related GAAP financial measures. The following

table reconciles the GAAP financial measures to the non-GAAP

financial measures discussed above. The Fiscal 2023 adjustments

relate to certain inventory provisions, asset impairments,

restructuring and other charges recognized in relation to Quiet

Platforms, as well as the company’s international and corporate

operations. Please refer to Note 16. “Impairment, Restructuring and

Other Charges,” to the Consolidated Financial Statements included

in the Company's Annual Report on Form 10-K filed with the

Securities and Exchange Commission on March 15, 2024 for further

information on the nature of these amounts.

AMERICAN

EAGLE OUTFITTERS, INC. 53 Weeks Ended February 3, 2024

(Dollars in thousands)

Operating Income GAAP Basis

$

222,717

% of Revenue

4.2

%

Add: Impairment, Restructuring and Other Charges

$

152,645

Non-GAAP Basis

$

375,362

% of Revenue

7.1

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240828093633/en/

Line Media 412-432-3300 LineMedia@ae.com

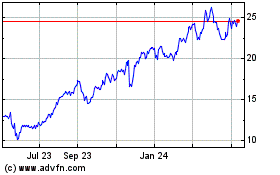

American Eagle Outfitters (NYSE:AEO)

Historical Stock Chart

From Dec 2024 to Jan 2025

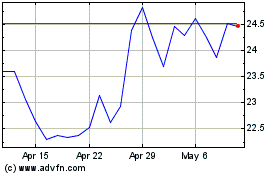

American Eagle Outfitters (NYSE:AEO)

Historical Stock Chart

From Jan 2024 to Jan 2025