America Movil Ups KPN Stake to 28% - Analyst Blog

June 29 2012 - 5:45AM

Zacks

America

Movil’s (AMX) month-long pursuit to up

its stake in Koninklijke KPN NV has finally ended on a positive

note. The Mexican Telecom giant increased its stakes in KPN to the

target of 27.7%. The company issued a tender

offer to acquire the remaining 2.8% for EUR8 per share that expired

on Wednesday. The offer was accepted by 39.66% of all outstanding

shares, which was more than enough to raise the company’s interest

beyond the target of 28%.

In May, America Movil offered to

increase its minority stake in Koninklijke KPN NV (a Dutch

telecommunications company) to 28% at €8.0 per share, for an offer

totaling €2.64 billion. However, Koninklijke KPN rejected this,

citing the offer as under valued. To debar America Movil from

raising further stakes, Koninklijke KPN was also planning a

spin-off of its German mobile subsidiary E-Plus, allowing potential

merger prospects with Telefonica S.A.’s (TEF)

German subsidiary O2.

According to reports, the merger of

these two German units would have generated €4 billion in annual

synergies, thus making it attractive for investors. Koninklijke KPN

considered this prospective merger as a significant strategy that

would divert shareholders’ attention from America Movil’s offer.

The company believed that the merger of E Plus and O2 would have

enhanced KPN’s share value, and make America Movil’s offer less

attractive or push the offer price higher. However, KPN recently

called off its spin off plans citing failure in reaching an

agreement with O2 given the current economic

backdrop.

Acquisition plays a key role in

driving growth at America Movil. Last year, the company acquired

Pay-TV firm Net Servicos, the largest multi-service cable company

in Latin America. In January, the company collaborated with Claxson

Interactive Group to acquire DLA Inc. which offers video-on-demand

service on cable-TV channels in Latin America.

America Movil also entered into a

partnership with AT&T (T) in November last

year, to expand its reach in emerging markets in Asia and the

Middle East. America Movil will use AT&T's global network

infrastructure to provide Internet services worldwide. In exchange,

the company will offer virtual private network services to

AT&T’s multinational clients operating in Latin America.

Going forward, America Movil’s

Tracfone plans to acquire Simple Mobile, subjected to regulatory

approval. Recently, America Movil also acquired a 4.1% stake in

Austria’s biggest telecom company Telekom Austria.

We expect the company to continue

focusing on its acquisition strategies in order to stay afloat in a

highly-competitive telecom market and tap the opportunities in

wireless services and pay-TV business.

We currently maintain a long-term

Neutral recommendation on America Movil. For the short term (1-3

months), the stock has a Zacks #3 Rank (Hold).

AMER MOVIL-ADR (AMX): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

TELEFONICA S.A. (TEF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

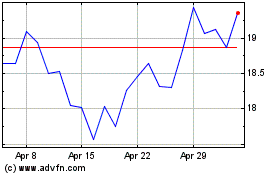

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From May 2024 to Jun 2024

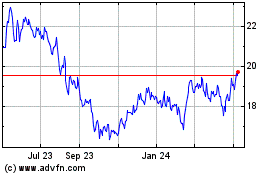

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

From Jun 2023 to Jun 2024