Current Report Filing (8-k)

November 14 2022 - 7:04AM

Edgar (US Regulatory)

0001828723false00018287232022-11-112022-11-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 11, 2022

___________________________________

Altus Power, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-39798 (Commission File Number) | 85-3448396 (I.R.S. Employer Identification Number) |

2200 Atlantic Street, 6th Floor Stamford, CT 06902 |

(Address of principal executive offices and zip code) |

(203) 698-0090 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A common stock, par value $.0001 | AMPS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.01 – Completion of Acquisition or Disposition of Assets

Altus Power, Inc. (“Altus Power” or the “Company”) closed on the purchase of approximately 88 MWs of operating solar assets of D.E. Shaw Renewables Investments, L.L.C. (“DESRI”) through acquisitions of the membership interests in its single purpose entities: DESRI II Acquisition Holdings, LLC and DESRI V Acquisition Holdings, LLC (collectively, the “Target Companies”). The entering into of definitive agreements (collectively, the “Transaction Agreements”) related to this transaction, and others, was originally announced on September 27, 2022. The purchase price for these assets is approximately an aggregate of $201 million base purchase price of which the Company paid an aggregate of $82 million in cash at closing and held back an aggregate $20 million as security for indemnification claims which are expected to be paid within twelve to eighteen months after closing. The purchase price also comprises certain assumed liabilities of the Target Companies, the value of which will be determined pursuant to a valuation following closing, and as such the aggregate purchase price is subject to change. The purchase price is also subject to adjustments for working capital and other items, which are expected to be resolved within 60 days of closing. To the extent any of the assumed liabilities consist of debt, the Company expects to refinance that debt as part of the financing commitments described in Item 7.01 of this current report on Form 8-K, if we are able to close on such financing commitments.

Copies of the Transaction Agreements are filed as Exhibit 2.1 and Exhibit 2.2 to this Current Report on Form 8-K (this “Form 8-K”) and are incorporated herein by reference. The foregoing description of the Transaction Agreements does not purport to be complete and is qualified in its entirety by reference to the Transaction Agreements.

Item 2.02 - Results of Operations and Financial Condition

On November 11, 2022, Altus Power issued a press release announcing its results for the fiscal quarter ended September 30, 2022. A copy of the press release is attached as Exhibit 99.1 to this Form 8-K and is incorporated by reference herein.

The information in this Item 2.02 t o this Form 8-K and the exhibits attached hereto pursuant to this Item shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), regardless of any general incorporation language in such filing.

Item 7.01 - Regulation FD Disclosure.

On November 14, 2022, representatives of Altus Power will make presentations to investors using slides containing the information attached to this Report on Form 8-K as Exhibit 99.2 (the “Earnings Presentation”) and incorporated herein by reference. The Company expects to use the Earnings Presentation, in whole or in part, and possibly with modifications, in connection with presentations to investors, analysts and others. The Earnings Presentation is intended to be read in conjunction with the earnings call to be held on November 14, 2022.

As of November, 11, 2022, Altus Power has also obtained commitments with a syndicate of banks for a revolving credit facility of up to $200 million with a term of five years. This facility is expected to enhance the Company's financial flexibility and enhance liquidity. These bank commitments are subject to definitive documentation and there is no guarantee as to when or if the definitive agreements will be completed and closed or if the Company will be able to obtain this financing.

By filing this Current Report on Form 8-K and furnishing the information contained herein, the Company makes no admission as to the materiality of any information in this report that is required to be disclosed solely by reason of Regulation FD.

The information presented in this Item 7.01 of this Form 8-K and exhibits attached hereto pursuant to this Item shall not be deemed to be “filed” for purposes of Section 18 of the Securities Act , or otherwise subject to the liabilities of that section, unless the Company specifically states that the information is to be considered “filed” under the Exchange Act or specifically incorporates it by reference into a filing under the Securities Act or the Exchange Act.

Item 9.01 - Financial Statements and Exhibits

(a) The Company will provide the financial statements required to be filed by Item 9.01(a) of Form 8-K by amendment to this Current Report on Form 8-K not later than 71 calendar days after the required filing date for this Current Report on Form 8-K.

(b) The Company will provide the pro forma financial statements required to be filed by Item 9.01(b) of Form 8-K by amendment to this Current Report on Form 8-K not later than 71 calendar days after the required filing date for this Current Report on Form 8-K.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 2.1 | | |

| 2.2 | | |

| 99.1 | | |

| 99.2 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*Portions of this exhibit have been omitted pursuant to Item 601(b)(2) of Regulation S-K because they are both not material and would likely cause competitive harm to the registrant if publicly disclosed. The schedules and similar attachments to this exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Company undertakes to promptly provide an unredacted copy of the exhibit or a copy of the omitted schedules and similar attachments on a supplemental basis to the SEC or its staff, if requested.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 14th day of November, 2022.

| | | | | |

Altus Power, Inc. |

| |

By: | /s/ Gregg J. Felton |

Name: | Gregg J. Felton |

Title: | Co-Chief Executive Officer and Director |

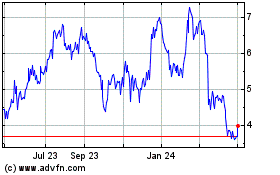

Altus Power (NYSE:AMPS)

Historical Stock Chart

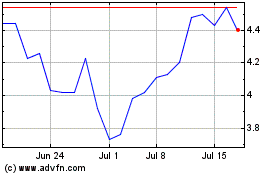

From Aug 2024 to Sep 2024

Altus Power (NYSE:AMPS)

Historical Stock Chart

From Sep 2023 to Sep 2024