Current Report Filing (8-k)

September 30 2022 - 7:31AM

Edgar (US Regulatory)

false000076418000007641802022-09-292022-09-290000764180mo:CommonStock0.3313ParValueMember2022-09-292022-09-290000764180mo:CommonStock1.000NotesDue2023Member2022-09-292022-09-290000764180mo:CommonStock1.700NotesDue2025Member2022-09-292022-09-290000764180mo:CommonStock2.200NotesDue2027Member2022-09-292022-09-290000764180mo:CommonStock3.125NotesDue2031Member2022-09-292022-09-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________________________________________

FORM 8-K

________________________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 29, 2022

________________________________________________________________________________________________________________

ALTRIA GROUP, INC.

(Exact name of registrant as specified in its charter)

______________________________________________________________________________________________________________

| | | | | | | | | | | | | | |

| | | | |

| Virginia | | 1-08940 | | 13-3260245 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| | | |

| 6601 West Broad Street, | Richmond, | Virginia | 23230 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: (804) 274-2200

_______________________________________________________________________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbols | Name of each exchange on which registered |

Common Stock, $0.33 1/3 par value | MO | New York Stock Exchange |

1.000% Notes due 2023 | MO23A | New York Stock Exchange |

1.700% Notes due 2025 | MO25 | New York Stock Exchange |

2.200% Notes due 2027 | MO27 | New York Stock Exchange |

3.125% Notes due 2031 | MO31 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 8.01. Other Events.

As previously disclosed, Altria Group, Inc. (“Altria,” “we” or “our”) agreed to certain non-competition obligations pursuant to our relationship agreement with JUUL Labs, Inc. (“JUUL”), which generally required that we participate in the e-vapor business only through JUUL. Altria also obtained the option to be released from such non-competition obligations in certain circumstances, including if the carrying value of our investment in JUUL is not more than 10% of its initial carrying value of $12.8 billion. At June 30, 2022, the carrying value of Altria’s investment in JUUL was $450 million. We exercised our option to be released from our JUUL non-competition obligations on September 29, 2022, resulting in (i) the permanent termination of our non-competition obligations to JUUL, (ii) the loss of our JUUL board designation rights (other than the right to appoint one independent director so long as our ownership continues to be at least 10%), our preemptive rights, our consent rights and certain other rights with respect to our investment in JUUL and (iii) the conversion of our JUUL shares to single vote common stock, significantly reducing our voting power.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ALTRIA GROUP, INC. |

| | |

| By: | /s/ W. HILDEBRANDT SURGNER, JR. |

| Name: | W. Hildebrandt Surgner, Jr. |

| Title: | Vice President, Corporate Secretary and |

| | Associate General Counsel |

DATE: September 30, 2022

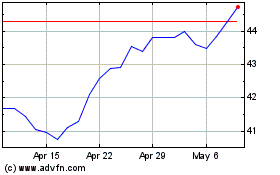

Altria (NYSE:MO)

Historical Stock Chart

From Aug 2024 to Sep 2024

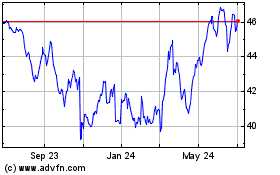

Altria (NYSE:MO)

Historical Stock Chart

From Sep 2023 to Sep 2024