AES Corp Misses Earnings - Analyst Blog

May 09 2013 - 8:10AM

Zacks

The AES

Corporation (AES) reported first quarter 2013 adjusted

earnings per share of 26 cents, below the Zacks Consensus Estimate

of 28 cents. Adjusted earnings for the reported quarter also

decreased 29.7% from the year-ago figure of 37 cents.

On a GAAP basis, the company reported earnings of 14 cents compared

with 44 cents in the year-ago quarter. The 12-cent variance between

adjusted and GAAP earnings came from a 1 cent and 4 cents charge

related to unrealized derivative and debt retirement losses,

respectively. It also included a 5 cents loss from impairments and

a 2 cents loss from foreign currency transaction.

The company realized lower numbers across all its business units

barring the U.S.

Revenue

In the reported quarter, revenues were $4,265.0 million, failing to

match our projection of $5,197.0 million by 17.9% and also declined

almost 7.0% from the year-ago quarterly revenues of $4,586.0

million.

Lower revenue recognition across all its segments, except MCAC

(Mexico, Central America and the Caribbean), led to the lower

numbers.

Operating Highlights

In the reported quarter, total cost of sales was $3,510.0 million

compared with $3,514.0 million in the first quarter 2012. This

marginal decrease was mainly due to a 7.9% cut in regulated sales

costs.

General and administrative expenses declined to $61.0 million from

$87.0 million in the year-ago quarter level.

Operating income stood at $299.0 million, down 61% from $769.0

million in the same period last year. Although the company managed

to control its costs, a lower top line led to a fall in profit in

the reported quarter.

Interest expense was $377.0 million versus $416.0 million in the

first quarter 2012.

Financial Condition

AES Corporation reported cash and cash equivalents of $2,301.0

million as of Mar 31, 2013 versus $1,966.0 million as of Dec 31,

2012.

The company generated $618.0 million in cash from operating

activities at the end of the first quarter compared with $534.0

million in the year-ago period.

Long-term liabilities as of Mar 31, 2013 decreased to $25.6 billion

from $25.9 billion as of Dec 31, 2012.

Outlook

AES Corporation reaffirmed its adjusted earnings guidance for 2013

in the range of $1.24 to $1.32 per share. The company maintained

its 2012-2015 total return target in the band of 6% to 8%.

Proportionate free cash flow is estimated in the range of $750.0

million to $1,050.0 million in 2013. Cash flow from operating

activities for 2013 is projected to be between $2,500.0 million and

$3,100.0 million.

Other Utility Company Releases

Mich.-based CMS Energy Corporation (CMS) announced

first-quarter 2013 earnings per share of 53 cents on both adjusted

and GAAP basis, beating the Zacks Consensus Estimate of 46 cents.

Earnings were also 43.2% higher than 37 cents earned in the

year-ago quarter. A colder-than-normal weather spiked natural gas

deliveries, driving better-than-expected results in the reported

quarter.

American Electric Power Company Inc.’s (AEP) first

quarter 2013 adjusted earnings of 80 cents per share came in line

with the Zacks Consensus Estimate as well as the year-ago profit.

The company witnessed solid residential and commercial sales during

the quarter, stemming from positive regulated rate recovery.

However, this was partly offset by weak industrial sales.

ALLETE Inc. (ALE) reported first quarter 2013

earnings of 83 cents per share compared with 66 cents per share in

the year-ago quarter. ALLETE’s earnings beat the Zacks Consensus

Estimate by 10.6%. Earnings received a boost from increased

electric sales due to a cold winter, start-up of renewable services

and higher returns from investments in American Transmission

Company.

Zacks Rank

AES Corporation currently retains a Zacks Rank #3 (Hold). American

Electric and ALLETE carry a Zacks Rank #2 (Buy), while CMS Energy

carries a Zacks Rank #1 (Strong Buy) and are worth buying now.

AMER ELEC PWR (AEP): Free Stock Analysis Report

AES CORP (AES): Free Stock Analysis Report

ALLETE INC (ALE): Free Stock Analysis Report

CMS ENERGY (CMS): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

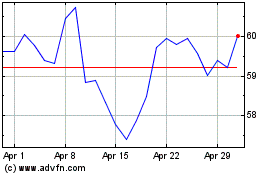

Allete (NYSE:ALE)

Historical Stock Chart

From May 2024 to Jun 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2023 to Jun 2024