Exelon Corp. Tops 1Q Earnings - Analyst Blog

May 01 2013 - 5:02AM

Zacks

Exelon Corporation (EXC) announced first

quarter 2013 operating earnings of 70 cents per share, lower than

the year-ago figure of 85 cents per share but ahead of the Zacks

Consensus Estimate by 2 cents. However, the company succeeded in

reaching its top end of the guidance.

This excludes unrealized gains related to nuclear decommissioning

trust fund investments of 4 cents, gain on plant retirements and

divestitures of 2 cents. It also excludes mark-to-market impact of

economic hedging activities of 27 cents, constellation merger and

integration costs of 3 cents, amortization of commodity contract

intangibles of 14 cents, re-measurement of like-kind exchange tax

position of 31 cents and nuclear uprate project cancellation of 2

cents per share.

Including these gain and charges, GAAP loss per share reported by

the company was 1 cent versus earnings per share of 28 cents.

The results reflect lower energy margins at Generation, higher

operating and maintenance expenses, higher depreciation and

amortization expense and increased average diluted common shares

outstanding due to the merger with Constellation Energy (“CEG”).

However, these negatives were partially offset by addition of

Constellation Energy’s contribution to Generation’s energy margins,

contribution of Baltimore Gas and Electric’s (“BGE”) financial

results, higher nuclear volume due to fewer planned and unplanned

outage days and impact of favorable weather in the Commonwealth

Edison Company (“ComEd”) and PECO Energy Company (“PECO”)

territories.

Total Revenue

Exelon's total operating revenue for first quarter 2013 was $6,894

million, reflecting year-over-year growth of 42.5%. Reported

quarter revenue also surpassed the Zacks Consensus Estimate of

$6,560 million.

Quarterly Highlights

During the quarter, total operating expenses increased sharply

55.3% year over year to $5,779 million mainly due to higher

purchase power and fuel, and operating and maintenance costs.

However, increase in operating expenses was offset by increase in

revenue, resulting in an operating income of $1,124 million, up

from $1,102 million in first quarter of 2012.

Segment Update

Generation: Segment generated net income of $336

million, down 17.8% year over year. Exelon-operated nuclear plants

achieved a 96.4% capacity factor for the first quarter of 2013.

Commonwealth Edison Company (ComEd): Segment net

income was $89 million, up from $88 million in the year ago period.

The results were driven by favorable weather in ComEd’s service

territory. However, this was partially offset by lower realized

prices resulting from changes in customer mix.

PECO Energy Company (PECO): Segment net income

increased to $123 million from $100 million reported in the

year-ago period driven by favorable weather in PECO’s service

territory.

BaltimoreGas and Electric (BGE): Segment generated

net income of $74 million.

Financial Update

The company exited the quarter with cash and cash equivalents of

$679 million, down from $1,411 million at the end of 2012.

Long-term debt as of Mar 31, 2013 totaled $16,210 million, down

from $17,190 million at the end of Dec 31, 2012.

Cash provided by operating activities in first quarter of 2013 was

$859 million versus $994 million in the comparable period last

year. Capital expenditure during the reported quarter was $1,447

million versus $1,496 million in the comparable year-ago

period.

Hedges

Exelon's hedging program involves the hedging of commodity risks

for expected generation, typically on a ratable basis over a

three-year period. The proportion of expected generation hedged as

of Mar 31, 2013, is 98% - 101% for 2013, 70% - 73% for 2014, and

33% - 36% for 2015.

Peer Comparison

Recently, Mich.-based CMS Energy Corporation (CMS)

announced first-quarter 2013 earnings per share of 53 cents on both

adjusted and GAAP basis, beating the Zacks Consensus Estimate of 46

cents. Earnings were 43.2% higher than 37 cents earned in the

year-ago quarter.

Zacks Rank

Exelon Corp. presently retains a short-term Zacks Rank #3 (Hold).

Stocks worth considering are ALLETE, Inc. (ALE)

and Calpine Corp. (CPN), both with a Zacks Rank #2

(Buy).

ALLETE INC (ALE): Free Stock Analysis Report

CMS ENERGY (CMS): Free Stock Analysis Report

CALPINE CORP (CPN): Free Stock Analysis Report

EXELON CORP (EXC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

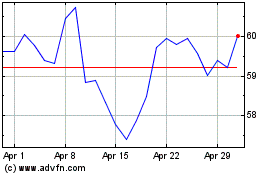

Allete (NYSE:ALE)

Historical Stock Chart

From May 2024 to Jun 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2023 to Jun 2024