DTE Energy Beats Earnings & Sales - Analyst Blog

April 26 2013 - 10:51AM

Zacks

DTE Energy Company (DTE) reported first quarter

2013 earnings per share of $1.34, easily beating the Zacks

Consensus Estimate of $1.03. Results improved 47.3% year over

year.

Earnings were driven by normal weather compared to a very mild

winter in 2012, operating cost improvements at the utilities, and

solid performance from the non-utility businesses.

Operating Statistics

Total revenue at DTE Energy was $2.5 billion, up 12.4% year over

year. The reported quarter’s revenue also comfortably surpassed the

Zacks Consensus Estimate of $2.3 billion.

Fuel, purchased power and gas expenses increased 15.2% year over

year to $1 billion. Operation and maintenance expenses were up 1.9%

year over year to $735 million.

The increase in expenses was offset by the revenue climb, thereby

resulting in an operating income of $410 million, up 31.4% year

over year.

Segment Update

DTE Electric: Segment earnings were $115 million

or 66 cents per share, up from $96 million or 56 cents in the

prior-year quarter.

DTE Gas: Segment profit was $96 million or 55

cents per share, up from $52 million or 31 cents per share in first

quarter 2012.

Non-Utility Operations

Gas Storage and Pipelines: The segment generated

profit of $17 million or 10 cents per share, flat year over

year.

Power and Industrial Projects: The segment posted

a profit of $12 million or 7 cents per share, up from $8 million or

5 cents per share in the year-ago period.

Energy Trading: The segment posted a profit of $7

million or 4 cents per share versus a loss of $2 million or 1 cent

per share in the prior-year period.

Corporate and Other: Loss in the quarter was $13

million or 8 cents per share versus a loss of 15 cents or 10 cents

per share.

Financial Update

As of Mar 31, 2013, cash and cash equivalents were $218 million, up

from $65 million as of Dec 31, 2012. At the end of first quarter

2013, long-term debt, net of current portion, was $7.2 billion

versus $7 billion at year-end 2012.

During the quarter, net cash from operating activities was $597

million, down from $620 million in the first quarter of 2012.

Guidance

The company expects earnings per share for 2013 in the range of

$3.85 to $4.15. DTE Energy expects cash from operations of $1.8

billion for 2013.

In the long term, the company expects earnings growth in the range

of 5.0% to 6.0%.

Zacks Rank

DTE Energy presently retains a short-term Zacks Rank #4 (Sell).

Stocks in the energy sector worth considering are ALLETE,

Inc. (ALE), Calpine Corp. (CPN),

Cleco Corporation (CNL), all with a Zacks Rank #2

(Buy).

ALLETE INC (ALE): Free Stock Analysis Report

CLECO CORP (CNL): Free Stock Analysis Report

CALPINE CORP (CPN): Free Stock Analysis Report

DTE ENERGY CO (DTE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

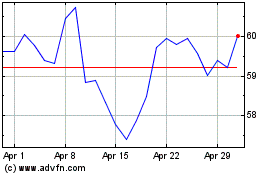

Allete (NYSE:ALE)

Historical Stock Chart

From May 2024 to Jun 2024

Allete (NYSE:ALE)

Historical Stock Chart

From Jun 2023 to Jun 2024