Tekla Funds Announce Second Adjournment of Special Meetings and Urge Shareholder Participation to Limit the Need for Further Solicitation Efforts

August 30 2023 - 2:39PM

Business Wire

Tekla Healthcare Investors (HQH), Tekla Life Sciences Investors

(HQL), Tekla Healthcare Opportunities Fund (THQ) and Tekla World

Healthcare Fund (THW), (the “Funds”) today announced that their

joint first special meetings of shareholders (“Special Meetings”)

were adjourned for a second

time until September 12, 2023 at 9:00 a.m. EDT due to

lack of a quorum on the proposal to approve a new investment

advisory agreement with abrdn, Inc. Shareholders as of the June

16, 2023 record date who have not yet voted on the Proposal are

urged to do so promptly per the instructions below.

Please note that the shares that have been voted to date have

been voted overwhelmingly IN FAVOR of the Proposal by the

shareholders, but a quorum for the First Special Meeting has simply

not yet been achieved.

TO VOTE, shareholders may use the Proxy Card or email

with voting link previously provided or may vote in the manner set

forth in the Proxy Statement located here:

www.OkapiVote.com/TeklaSpecial. Shareholders who require voting

assistance should call Okapi Partners, the Funds’ proxy solicitor,

toll-free at (877) 285-5990. Representatives are available Monday -

Friday 9:00am to 10:00pm (EDT).

About Tekla

Tekla is an asset manager primarily focused on healthcare

investing. Since its inception, Tekla has maintained a singular

focus on the asset class. Its expertise comes from a diverse team

of individuals, many with advanced degrees in science and business,

investing experience and industry experience that help drive

investment decisions. For more information, please visit

www.teklacap.com.

About abrdn

abrdn is a global investment company that helps clients and

customers plan, save and invest for the future. abrdn’s purpose is

to enable its clients to be better investors. abrdn manages and

administers £500bn of assets for clients (as at 31 December 2022).

abrdn is structured around three businesses – Investments, Adviser

and Personal – focused on their changing needs. The capabilities in

abrdn’s Investments business are built on the strength of its

insight – generated from wide-ranging research, worldwide

investment expertise and local market knowledge. abrdn’s teams

collaborate across regions, asset classes and specialisms,

connecting diverse perspectives and working with clients to

identify investment opportunities that suit their needs. As at 31

December 2022, abrdn’s Investments business manages £376bn on

behalf of clients - including insurance companies, sovereign wealth

funds, independent wealth managers, pension funds, platforms, banks

and family offices. For more information, please visit

www.abrdn.com.

Additional Information about the Funds and

the transaction

This press release is not intended to, and does not, solicit any

proxy from any shareholder of the Funds. The solicitation of

proxies to effect the transaction described herein is made by a

definitive proxy statement.

The Funds and their trustees and officers, Tekla and its

officers and employees, and other persons may be deemed to be

participants in the solicitation of proxies with respect to the

approval of new investment management contracts described herein.

Fund shareholders may obtain more detailed information regarding

the direct and indirect interests of a Fund’s trustees and

officers, Tekla and its officers and employees, and other persons

by reading the proxy statement relating to the transaction that has

been filed with the Securities and Exchange Commission. Fund

shareholders should read the proxy statement because it contains

important information. The proxy statement is available for free at

the Securities and Exchange Commission’s website (www.sec.gov).

Statements in this press release that are not historical facts

are forward-looking statements as defined by the United States

securities laws. You should exercise caution in interpreting and

relying on forward-looking statements because they are subject to

uncertainties and other factors that are, in some cases, beyond a

Fund’s control and could cause actual results to differ materially

from those set forth in the forward-looking statements.

© 2023 Tekla Capital Management LLC | All

rights reserved | Legal Disclaimer

The material contained on this website is not intended to be

a recommendation or investment advice, does not constitute a

solicitation to buy or sell securities, and is not provided in a

fiduciary capacity. The information provided does not take into

account the specific objectives or circumstances of any particular

investor, or suggest any specific course of action. Investment

decisions should be made based on an investor’s objectives and

circumstances and in consultation with his or her advisors.

There can be no assurance that any closed-end fund will achieve

its investment objective(s). Past performance does not guarantee

future results. The net asset value of any closed-end fund will

fluctuate with the value of the underlying securities. Historically

closed-end funds have often traded at a discount to their net asset

value. The distribution rate and income amounts reflect past

amounts distributed and may not be indicative of future rates or

income amounts. Distribution rates and income amounts can change at

any time.

Investors should consider the investment objective and

policies, risk considerations, charges and ongoing expenses of an

investment carefully before investing. For more information, please

contact your marketing and distribution agent, Destra Capital

Advisors LLC at 877.855.3434.

NOT FDIC-INSURED | NOT BANK-GUARANTEED | MAY LOSE VALUE

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230830725247/en/

Destra Capital Advisors LLC 877.855.3434

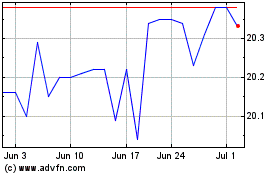

abrdn Healthcare Opportu... (NYSE:THQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

abrdn Healthcare Opportu... (NYSE:THQ)

Historical Stock Chart

From Nov 2023 to Nov 2024