true

0001898604

S-1/A

0001898604

2024-09-09

2024-09-09

0001898604

dei:BusinessContactMember

2024-09-09

2024-09-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

YOSH:Segment

xbrli:pure

As

filed with the U.S. Securities and Exchange Commission on September 9, 2024

Registration

No. 333-278840

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Amendment

No. 1

to

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

Yoshiharu

Global Co.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

5812 |

|

87-3941448 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

6940

Beach Blvd., Suite D-705

Buena

Park, CA 90621

(714)

694-2403

(Address,

including zip code, and telephone number, including area code, of registrant’s principal

executive offices)

James

Chae

Chief

Executive Officer

6940

Beach Blvd., Suite D-705

Buena

Park, CA 90621

(714)

694-2403

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Please

send copies of all communications to:

Matthew

Ogurick, Esq.

Pryor

Cashman LLP

7

Times Square

New

York, New York 10036

Approximate

date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

|

☐ |

|

Accelerated

filer |

|

☐ |

| Non-accelerated

filer |

|

☒ |

|

Smaller

reporting company |

|

☒ |

| |

|

|

|

Emerging

growth company |

|

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

|

SUBJECT

TO COMPLETION DATED SEPTEMBER 9, 2024 |

400,000

Shares

Yoshiharu

Global Co.

This

prospectus relates to the resale, from time to time, by Alumni Capital LP (“Alumni Capital” or the “Selling Stockholder”)

of up to 400,000 shares of our Class A common stock, par value $0.0001 per share (“Class A Common Stock”). All share

numbers herein are adjusted for the one-for-ten (1:10) reverse stock split of our Class A Common Stock that we effectuated with an effective

time of 11:59 p.m. Eastern Time on November 27, 2023 (the “Reverse Stock Split”). Our Class A Common Stock began trading

on The Nasdaq Capital Market (“Nasdaq”) on a split-adjusted basis beginning on November 28, 2023.

The

shares of Class A Common Stock to which this prospectus relates consist of shares that have been or may be issued to the Selling Stockholder

pursuant to a securities purchase agreement between us and the Selling Stockholder dated January 4, 2024, as amended by an amendment

to securities purchase agreement dated April 18, 2024 (the “Purchase Agreement”). In connection with the Purchase Agreement,

we committed to issue to the Selling Stockholder 12,476 shares of Class A Common Stock within two business days of the execution

of the Purchase Agreement (the “Initial Commitment Shares”) and an additional 12,476 shares of Class A Common Stock

within two business days from the effective date of the registration statement which contains this prospectus (the “Additional

Commitment Shares” and together with the Initial Commitment Shares, collectively, the “Commitment Shares”).

We

are not selling any securities under this prospectus and we will not receive any proceeds from the sale of the shares by the Selling

Stockholder. However, the Purchase Agreement provides that we may sell up to an aggregate of $5,000,000 of our Class A Common Stock to

the Selling Stockholder under the Purchase Agreement, from time to time in our discretion after the date the registration statement that

includes this prospectus is declared effective and after satisfaction of other conditions in the Purchase Agreement.

The

Selling Stockholder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended

(the “Securities Act”). The Selling Stockholder may sell the shares of Class A Common Stock described in this prospectus

in a number of different ways and at varying prices. See “Plan of Distribution” for more information about how the

Selling Stockholder may sell the shares of Class A Common Stock being registered pursuant to this prospectus.

We

will pay the expenses of registering the shares of Class A Common Stock offered by this prospectus, but all selling and other expenses

incurred by the Selling Stockholder will be paid by the Selling Stockholder. The Selling Stockholder may sell our shares of Class A Common

Stock offered by this prospectus from time to time on terms to be determined at the time of sale through ordinary brokerage transactions

or through any other means described in this prospectus under “Plan of Distribution.” The prices at which the Selling

Stockholder may sell shares will be determined by the prevailing market price for our Class A Common Stock or in negotiated transactions.

We

are an “emerging growth company” and “smaller reporting company” as defined under the federal securities laws

and, under applicable Securities and Exchange Commission rules, we have elected to comply with certain reduced public company reporting

and disclosure requirements.

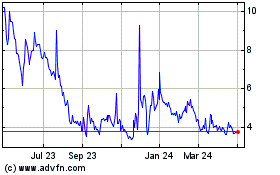

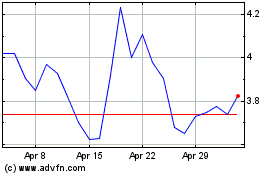

Our

Class A Common Stock is listed on Nasdaq under the symbol “YOSH.” The last reported closing price for our Class A Common

Stock on Nasdaq on September 6, 2024 was $4.48 per share.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 10 of this prospectus to

read about factors you should consider before investing in our securities.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the accuracy or adequacy of the disclosures in the prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

The

registration statement on Form S-1 of which this prospectus forms a part and that we have filed with the U.S. Securities and Exchange

Commission (the “SEC”), includes exhibits that provide more detail of the matters discussed in this prospectus. You should

read this prospectus and the related exhibits filed with the SEC, together with the additional information described under the heading

“Where You Can Find More Information.”

You

should rely only on the information contained in this prospectus and the related exhibits, any prospectus supplement or amendment thereto,

or to which we have referred you, before making your investment decision. Neither we, nor the selling stockholder named herein (the “Selling

Stockholder”), nor any financial advisor engaged by us or the Selling Stockholder in connection with this offering, have authorized

anyone to provide you with additional information or information different from that contained in this prospectus. Neither the delivery

of this prospectus nor the sale of our securities means that the information contained in this prospectus is correct after the date of

this prospectus.

You

should not assume that the information contained in this prospectus, any prospectus supplement or amendments thereto, as well as information

we have previously filed with the SEC, is accurate as of any date other than the date on the front cover of the applicable document.

Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus is an offer

to sell only the securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so.

The

Selling Stockholder is not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale

is not permitted. Neither we nor the Selling Stockholder have done anything that would permit this offering or possession or distribution

of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the

jurisdiction of the United States who come into possession of this prospectus are required to inform themselves about and to observe

any restrictions relating to this offering and the distribution of this prospectus applicable to that jurisdiction.

No

person is authorized in connection with this prospectus to give any information or to make any representations about us, the securities

offered hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus.

If any other information or representation is given or made, such information or representation may not be relied upon as having been

authorized by us. To the extent there is a conflict between the information contained in this prospectus and any prospectus supplement

having a later date, the statement in the prospectus supplement having the later date modifies or supersedes the earlier statement.

If

required, each time the Selling Stockholder offers shares of Class A Common Stock, we will provide you with, in addition to this prospectus,

a prospectus supplement that will contain specific information about the terms of that offering. We may also authorize the Selling Stockholder

to use one or more free writing prospectuses to be provided to you that may contain material information relating to that offering. We

may also use a prospectus supplement and any related free writing prospectus to add, update or change any of the information contained

in this prospectus or in documents we have incorporated by reference. This prospectus, together with any applicable prospectus supplements,

any related free writing prospectuses and the documents incorporated by reference into this prospectus, includes all material information

relating to this offering. To the extent that any statement that we make in a prospectus supplement is inconsistent with statements made

in this prospectus, the statements made in this prospectus will be deemed modified or superseded by those made in a prospectus supplement.

Please carefully read both this prospectus and any prospectus supplement together with the additional information described below under

the section entitled “Incorporation of Certain Information by Reference” before buying any of the securities offered.

Unless

the context otherwise requires, the terms “Yoshiharu,” “the Company,” “we,” “us” and

“our” refer to Yoshiharu Global Co.

Unless

otherwise indicated, information contained in this prospectus or incorporated by reference herein concerning our industry and the markets

in which we operate is based on information from independent industry and research organizations, other third-party sources (including

industry publications, surveys and forecasts), and management estimates. Management estimates are derived from publicly available information

released by independent industry analysts and third-party sources, as well as data from our internal research, and are based on assumptions

made by us upon reviewing such data and our knowledge of such industry and markets, which we believe to be reasonable. Although we believe

the data from these third-party sources is reliable, we have not independently verified any third-party information. In addition, projections,

assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject

to uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Special

Note Regarding Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed

in the estimates made by the independent parties and by us.

We

own or have rights to certain trademarks that we use in conjunction with the operations of our business. Each trademark, trade name,

service mark or copyright of any other company appearing or incorporated by reference in this prospectus belongs to its holder. Solely

for convenience, trademarks, trade names, service marks and copyrights referred to in this prospectus may appear with or without the

“©”, “®” or “™” symbols, but the inclusion, or not, of such references are not intended

to indicate, in any way, that we, or the applicable owner, will not assert, to the fullest extent possible under applicable law, our

or their, as applicable, rights to these trademarks, trade names service marks or copyrights. We do not intend our use or display of

other companies’ trademarks, trade names, service marks or copyrights to imply a relationship with, or endorsement or sponsorship

of us by, such other companies.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider

in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including the

information set forth under the headings “Risk Factors” as included elsewhere in this prospectus and our financial

statements and the related notes and the section entitled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations”, in our Annual Report on Form 10-K for the year ended December 31, 2023 as amended, our Quarterly

Report on Form 10-Q for the quarter ended March 31, 2024, and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024,

which all are incorporated by reference herein.

Overview

of Our Company

We

are a fast-growing Japanese restaurant operator and were borne out of the idea of introducing the modernized Japanese dining experience

to customers all over the world. Specializing in Japanese ramen, we gained recognition as a leading ramen restaurant in Southern California

within six months of our 2016 debut and have continued to expand our top-notch restaurant service across Southern California, currently

operating ten restaurants with an additional two new restaurant stores under construction/development. Further, we acquired

three existing restaurants in Las Vegas in early second quarter 2024.

We

take pride in our warm, hearty, smooth, and rich bone broth, which is slowly boiled for over twelve hours. Customers can taste and experience

supreme quality and deep flavors. Combining the broth with the fresh, savory, and highest-quality ingredients, we serve the perfect,

ideal ramen, as well as offer customers a wide variety of sushi rolls, bento menu and other favorite Japanese cuisine. Our acclaimed

signature Tonkotsu Black Ramen has become a customer favorite with its slow cooked pork bone broth and freshly made, tender chashu (braised

pork belly).

Our

mission is to bring our Japanese ramen and cuisine to the mainstream, by providing a meal that customers find comforting. Since the inception

of the business, we have been making our own ramen broth and other key ingredients such as pork chashu and flavored eggs from scratch,

whereby upholding the quality and taste of our foods, including the signature texture and deep, rich flavor of our handcrafted broth.

Moreover, we believe that slowly cooking the bone broth makes it high in collagen and rich in nutrients. We also strive to present food

that is not only healthy, but also affordable. We feed, entertain and delight our customers, with our active kitchens and bustling dining

rooms providing happy hours, student and senior discounts, and special holiday events. As a result of our vision, customers can comfortably

enjoy our food in a friendly and welcoming atmosphere.

In

September 2022, we consummated our initial public offering (the “IPO”) of 2,940,000 shares of our Class A common stock, par

value $0.0001 per share (“Class A Common Stock”) at a public offering price of $4.00 per share, generating gross proceeds

of $11,760,000. Net proceeds from the IPO were approximately $10.3 million after deducting underwriting discounts and commissions and

other offering expenses of approximately $1.5 million.

We

granted the underwriters a 45-day option to purchase up to 441,000 additional shares (equal to 15% of the shares of Class A Common Stock

sold in the IPO) to cover over-allotments, if any, which the underwriters did not exercise. In addition, we issued to the representative

of the underwriters warrants to purchase a number of shares of Class A Common Stock equal to 5.0% of the aggregate number of shares of

Class A Common Stock sold in the IPO (including shares of Class A Common Stock sold upon exercise of the over-allotment option). The

representative’s warrants are exercisable at any time and from time to time, in whole or in part, during the four-and-½-year

period commencing six months from the date of commencement of the sales of the shares of Class A Common Stock in connection with the

IPO, at an initial exercise price per share of $5.00 (equal to 125% of the initial public offering price per share of Class A Common

Stock). No representative’s warrants have been exercised.

On

September 9, 2022, our Class A Common Stock began trading on the Nasdaq Capital Market under the symbol “YOSH.”

On

November 22, 2023, we filed a Certificate of Amendment (the “Certificate of Amendment”) to our Amended and Restated Certificate

of Incorporation to effect a reverse stock split of our Class A Common Stock and Class B common stock, par value $0.0001 per share (“Class

B Common Stock” and, together with Class A common Stock, “Common Stock”), in the ratio of 1-for-10 (the “Reverse

Stock Split”) effective at 11:59 p.m. eastern on November 27, 2023. The Class A Common Stock began trading on a split-adjusted

basis at the market open on Tuesday, November 28, 2023.

No

fractional shares were issued as a result of the Reverse Stock Split. Instead, any fractional shares that would have resulted from the

Reverse Stock Split were rounded up to the next whole number. As a result, a total of 34,846 shares of Class A Common Stock were issued

and total of 1,230,246 shares of Class A Common Stock were outstanding as of December 31, 2023. The Reverse Stock Split affects all stockholders

uniformly and did not alter any stockholder’s percentage interest in our outstanding Common Stock, except for adjustments that

may result from the treatment of fractional shares. The number of authorized shares of Common Stock and number of authorized, issued,

and outstanding shares of the preferred stock were not changed.

Supply

Chain Disruption and Inflation

Our

profitability depends in part on our ability to anticipate and react to changes in food and supply costs, especially in light of recent

supply chain disruptions. We believe we have experienced higher costs due to increased commodity prices and challenges sourcing our supplies

due in part to global supply chain disruptions. Although historically, and as of June 30, 2024, global supply chain disruptions

have not materially adversely affected our business, a substantial increase in the cost of, or inability to procure, the food products

most critical to our menu, such as canola oil, rice, meats, fish and other seafood, as well as fresh vegetables, could materially and

adversely affect our business, financial condition or results from operations. Because we provide moderately priced food, we may choose

not to, or may be unable to, pass along commodity price increases to consumers. These potential changes in supply costs could materially

adversely affect our business, financial condition or results of operations.

Historically

and as of the date hereof, inflation has not had a material effect on our results of operations. Severe increases in inflation, however,

could affect the global and U.S. economies and could have a materially adverse impact on our business, financial condition or results

of operations. Furthermore, future volatile, negative, or uncertain economic conditions and recessionary periods or periods of significant

inflation may adversely impact consumer spending at our restaurants, which would materially adversely affect our business, financial

condition and results of operations. Such effects can be especially pronounced during periods of economic contraction or slow economic

growth. To the extent that we are unable to offset such cost inflation through increased menu prices or increased efficiencies in our

operations and cost savings, there could be a negative impact on our business, sales and margin performance, net income, cash flows and

the trading price of our common shares. We have been able to offset to some extent these inflationary and other cost pressures through

actions such as increasing menu prices and supply chain initiatives, however, we expect these inflationary and other cost pressures to

continue into the year 2024.

Our

Strengths

Experienced

Management Team Dedicated to Growth.

Our

team is led by experienced and passionate senior management who are committed to our mission. We are led by our Chief Executive Officer,

James Chae. Mr. Chae founded Yoshiharu in 2016 and has helped grow the business since that time. Mr. Chae leads a team of talented professionals

with deep financial, operational, culinary, and real estate experience.

Compelling

Value Proposition with Broad Appeal.

Guests

can enjoy our signature ramen dishes or select from our variety of fresh sushi rolls, bento, and other Japanese cuisine. The high-quality

dishes at affordable prices are the result of our efficient operations. In addition, we believe our commitment to high-quality and fresh

ingredients in our food is at the forefront of current dining trends as customers continue to seek healthy food options.

Attractive

Restaurant-Level Economics.

At

Yoshiharu, we believe our rapid customer turnover, combined with our ability to deliver in 2 major day parts with lunch and dinner, allows

for robust and efficient sales in each of our restaurants. Our average unit volume (“AUV”, as defined herein) was $1.2 million

in 2022 and $1.1 million in 2023.

Quality

of Food and Excellence in Customer Service.

We

place a premium on serving high-quality, authentic Japanese cuisine. We believe in customer convenience and satisfaction and have created

strong, loyal and repeat customers who help expand the Yoshiharu network to their friends, family and co-workers.

Our

Growth Strategies

Pursue

New Restaurant Development.

We

have pursued a disciplined new corporate owned growth strategy. Having expanded our concept and operating model across varying restaurant

sizes and geographies, we plan to leverage our expertise opening new restaurants to fill in existing markets and expand into new geographies.

While we currently aim to achieve in excess of 100% annual unit growth rate over the next three to five years, we cannot predict the

time period of which we can achieve any level of restaurant growth or whether we will achieve this level of growth at all. Our ability

to achieve new restaurant growth is impacted by a number of risks and uncertainties beyond our control, including those described under

the caption “Risk Factors.” In particular, see “Risk Factors—Our long-term success is highly dependent

on our ability to successfully identify and secure appropriate sites and timely develop and expand our operations in existing and new

markets” for specific risks that could impede our ability to achieve new restaurant growth in the future. We believe there

is a significant opportunity to employ this strategy to open additional restaurants in our existing markets and in new markets with similar

demographics and retail environments.

Deliver

Consistent Comparable Restaurant Sales Growth.

We

have achieved positive comparable restaurant sales growth in recent periods. We believe we will be able to generate future comparable

restaurant sales growth by growing traffic through increased brand awareness, consistent delivery of a satisfying dining experience,

new menu offerings, and restaurant renovations. We will continue to manage our menu and pricing as part of our overall strategy to drive

traffic and increase average check. We are also exploring initiatives to grow sales of alcoholic beverages at our restaurants, including

the potential of a larger format restaurant with a sake bar concept. In addition to the strategies stated above, we expect to initiate

sales of franchises in 2024.

Increase

Profitability.

We

have invested in our infrastructure and personnel, which we believe positions us to continue to scale our business operations. As we

continue to grow, we expect to drive higher profitability both at a restaurant-level and corporate-level by taking advantage of our increasing

buying power with suppliers and leveraging our existing support infrastructure. Additionally, we believe we will be able to optimize

labor costs at existing restaurants as our restaurant base matures and AUVs increase. We believe that as our restaurant base grows, our

general and administrative costs will increase at a slower rate than our sales.

Heighten

Brand Awareness.

We

intend to continue to pursue targeted local marketing efforts and plan to increase our investment in advertising. We also are exploring

the development of instant ramen noodles which we would distribute through retail channels. We intend to explore partnerships with grocery

retailers to provide for small-format Yoshiharu kiosks in stores to promote a limited selection of Yoshiharu cuisine.

Experienced

Management Team Dedicated to Growth.

Our

team is led by experienced and passionate senior management who are committed to our mission. We are led by our Chief Executive Officer,

James Chae. Mr. Chae founded Yoshiharu in 2016 and leads a team of talented professionals with deep financial, operational, culinary,

and real estate experience.

Properties

As

of June 30, 2024, we operated 14 restaurant stores with an additional 2 restaurant stores

under construction /development. We operate a variety of restaurant formats, including in-line and end-cap restaurants located

in retail centers of varying sizes. Our restaurants currently average approximately 1,792 square feet. We lease the property for

our corporate offices and all of the properties on which we operate our restaurants.

The

table below shows the locations of our restaurants as of June 30, 2024:

| Store

Location |

|

Address |

|

Year

Launched |

| Orange |

|

1891

N Tustin St, Orange, CA 92865 |

|

2016 |

| Buena

Park |

|

6970

Beach Blvd, #F206 Buena Park, CA 90621 |

|

2017 |

| Whittier |

|

8426

Laurel Ave, STE A Whittier, CA 90605 |

|

2017 |

| Chino |

|

4004

Grand Ave STE C Chino, CA 91710 |

|

2019 |

| Eastvale |

|

4910

Hamner Ave STE 150, Eastvale, CA 91752 |

|

2020 |

| Irvine |

|

3935

Portola Pkwy, Irvine, CA 92602 |

|

2021 |

| La

Mirada |

|

12806

La Mirada Blvd, La Mirada, CA 90638 |

|

2022 |

| Cerritos |

|

11533

South St, Cerritos, CA 90703 |

|

2022 |

| Corona |

|

440

N Mckinley St STE 101, Corona, CA 92879 |

|

2023 |

| Garden

Grove |

|

9812

Chapman Avenue Garden Grove, CA 92841 |

|

2023 |

| Laguna

|

|

32341

Golden Lantern, STE B, Laguna Niguel, CA 92677 |

|

1Q

2024 |

| Las

Vegas |

|

6125

S. Fort Apache Road, Suite 200, Las Vegas, NV 89148 |

|

2Q

2024 |

| Las

Vegas |

|

280

E Flamingo Road, Suite C, Las Vegas, NV 89169 |

|

2Q

2024 |

| Las

Vegas |

|

6572

N Decatur Blvd., Las Vegas, NV 89131 |

|

2Q

2024 |

| Menifee |

|

27311

Newport Road, Suite 320, Menifee, CA 92584 |

|

3Q

2024* |

| San

Clemente |

|

638

Camino de Los Mares STE 16, San Clemente, CA 92673 |

|

3Q

2024* |

*

Under construction.

We

are obligated under non-cancelable leases for the majority of our restaurants, as well as our corporate offices. The majority of our

restaurant leases have lease terms of 10 years, inclusive of customary extensions which are at the option of the company. Our restaurant

leases generally require us to pay a proportionate share of real estate taxes, insurance, common area maintenance charges, and other

operating costs. Some restaurant leases provide for contingent rental payments based on sales thresholds, although we generally do not

expect to pay significant rent on these properties based on the thresholds in those leases. We do not own any real property.

We

opened one restaurant in each year from 2019 through 2021, and we opened two restaurants in 2022 and 2023. We also opened a new restaurant

in February 2024, and currently have two new locations under construction/development. Further, we acquired three existing restaurants

in Las Vegas in the second quarter of 2024.

We

anticipate approximately $450,000 in costs per new location in development, and have spent approximately $780,000

for the two locations under construction/development as of June 30, 2024.

In

2019, we closed our West Hollywood and Lynwood, California restaurants due to underperformance. We cannot provide assurance that we will

be able to open any specific number of restaurants in any year. See “Risk Factors—Risks Related to Our Business and Industry—Our

long-term success is highly dependent on our ability to successfully identify and secure appropriate sites and timely develop and expand

our operations in existing and new markets.”

Site

Development and Expansion

Site

Selection Process

We

consider site selection to be instrumental to our success. As part of our strategic site selection process, we receive potential site

locations from networks of local brokers, which are then reviewed by our Development Team. This examination consists of an analysis of

the lease terms and conditions, a profitability evaluation, as well as multiple site visits during all times of the day, e.g., lunch,

late afternoon, dinner, weekdays and weekends, to test for traffic. The Development Team holds regular meetings for site approval with

other members of our senior management team in order to get a balanced perspective on a potential site.

Our

current real estate strategy focuses on high-traffic retail centers in markets with a diverse population and above-average household

income for the state. We believe we are attractive lessees for landlords given our ability to drive strong traffic comprised of above-average

household income guests, and we imagine our bargaining power will become stronger as we accumulate more stores. In site selection, we

also consider factors such as residential and commercial population density, restaurant visibility, traffic patterns, accessibility,

availability of suitable parking, proximity to highways, universities, shopping areas and office parks, the degree of competition within

the market area, and general availability of restaurant-level employees. We also invest in site analytics tools for demographic analysis

and data collection for both existing and new market areas, which we believe allows us to further understand the market area and determine

whether to open new restaurants in that location.

Our

flexible physical footprint, which has allowed us to open restaurants in size ranging from 1,500 to 2,500 square feet, allows us to open

in-line and end-cap restaurant formats at strip malls and shopping centers and penetrate markets in both suburban and urban areas. We

believe we have the ability to open additional restaurants in our existing metropolitan areas. We also believe there is significant opportunity

to employ the strategy in new markets with similar demographics across the U.S. and globally.

Expansion

Strategy

We

plan to pursue a multi-facet expansion strategy by opening new corporate restaurants or acquiring existing restaurants in both new and

existing markets, as well as utilizing the franchise market. We believe this expansion will be crucial to executing our growth strategy

and building awareness of Yoshiharu as a leading Japanese casual dining brand. Expansion into new markets occurs in parallel with ongoing

evaluation of existing markets, with the goal of maintaining a pipeline of top-tier development opportunities. As described under the

heading Site Selection Process above, we use a systematic approach to identify and review existing and new markets.

Upon

selecting a new market, we typically build one restaurant to prove concept viability in that market. We have developed a remote management

system whereby our senior operations team is able to monitor restaurants in real-time from our headquarters using approximately eight

cameras installed in each restaurant. We utilize this remote management system to maintain operational quality while minimizing inefficiencies

caused by a lack of economies of scale in new markets.

Due

to our relatively small restaurant count, new restaurants have an outsized impact on our financial performance. In order to mitigate

risk, we look to expand simultaneously in new and existing markets. We base our site selection on our most successful existing restaurants

and frequently reevaluate our strategy, pacing and markets. We believe we are in the early stages of our growth story and that our restaurant

model is designed to generate strong cash flow, attractive restaurant-level financial results and high returns on invested capital, which

we believe provides us with a strong foundation for expansion.

Restaurant

Design

Restaurant

design is handled by our Development Team in conjunction with outsourced vendor relationships, e.g., architects and general contractors.

Our restaurant size currently averages approximately 1,500 square feet. Seating in our restaurant is comprised of a combination of table

seating and bar seats with an average seating capacity of 40-50 guests.

We

are developing two main restaurant layouts. The standard restaurants will be built using our current layout and design which we believe

evokes a modern and on-trend Japanese dining atmosphere. The second layout is a larger floor plan where we will utilize a full service

restaurant and bar. We believe our see-through kitchens reflecting the cooks preparing first-hand meals, amplify the lively bustle provided

by the great casual atmosphere, and serve to highlight the ambiance of getting great food in a modern Japanese style ambiance.

Construction

Construction

of a new restaurant takes approximately 12 to 24 weeks once construction permits are issued. Our Development Team oversees the build-out

process from engaging architects and contractors to design and build out the restaurant. The capital resources required to develop each

new restaurant are significant. On average, we estimate our restaurant build-outs to cost approximately $350,000 - $550,000 per standard

location, net of tenant allowances and pre-opening costs and assuming that we do not purchase the underlying real estate, but this figure

could be significantly higher depending on the market, restaurant size, and condition of the premises upon delivery by landlord. On average,

we estimate that our restaurants require a cash build-out cost of approximately $350,000-$550,000 per restaurant, net of landlord tenant

improvement allowances and pre-opening costs and assuming that we do not purchase the underlying real estate. Actual costs may vary significantly

depending upon a variety of factors, including the site and size of the restaurant and conditions in the local real estate and labor

markets.

Restaurant

Management and Operations

Restaurant

Management and Employees

Our

restaurants typically employ one restaurant manager, one or two supervisors, and approximately 8 to 12 additional team members. Managers,

supervisors and management trainees are cross-trained throughout the restaurant in order to create competency across critical restaurant

functions, both in the dining area and in the kitchen.

In

addition, our senior operations team monitors restaurants in real-time from our headquarters using our remote management system of approximately

eight cameras installed in each restaurant. These team members are responsible for different components of the restaurant: cleanliness,

service, and food quality.

Training

and Employee Programs

We

devote significant resources to identifying, selecting, and training restaurant-level employees. Our training covers leadership, team

building, food safety certification, alcohol safety programs, sexual harassment training, and other topics. Management trainees undergo

training for approximately 8 to 16 weeks in order to develop a deep understanding of our operations. In addition, we are developing extensive

training manuals that cover all aspects of restaurant-level operations.

Our

traveling “opening team” provides training to team members in advance of opening a new restaurant. We believe the opening

team facilitates a smooth opening process and efficient restaurant operations from the first day a restaurant opens to the public. The

opening team is typically on-site at new restaurants from two weeks before opening to four weeks after opening.

Food

Preparation, Quality and Safety

We

are committed to consistently providing our guests high quality, freshly prepared food. For other items we believe hand preparation achieves

the best quality. Hand preparation of menu items includes, but is not limited to, frying tempura, slicing meat and fish and making pork

bone broth. We believe guests can taste the difference in freshly prepared food and that adhering to these standards is a competitive

advantage for our brand.

Food

safety is essential to our success and we have established procedures to help ensure that our guests enjoy safe, quality food. We require

each employee to complete food handler safety certification upon hiring. We have taken various additional steps to mitigate food quality

and safety risks, including undergoing internal safety audits. We also consider food safety and quality assurance when selecting our

distributors and suppliers.

Menu

We

offer a diverse menu, including our signature ramen dishes, as well as sushi rolls, bento boxes, and other Japanese cuisine. The menu

appeals to a wide range of customers, and we continue to improve upon the quality, taste and presentation. Additionally, we are able

to serve the menu in a delivery and pickup format, as our food is designed to be enjoyed on premise or at customers’ homes or offices.

We have entered the catering business through relationships with businesses who place large format orders (i.e., Bento boxes for corporate

meetings or office lunches), for delivery or pick-up. We expect that our catering business, which has a higher-than-average order value,

to grow due to the early success we have experienced in the corporate channel.

New

Menu Introductions

We

focus advertising efforts on new menu offerings to broaden our appeal to guests and drive traffic. Our menu changes twice per year to

introduce new items and remove underperforming items. We promote these new menu additions through various social media platforms, our

website and in-restaurant signage.

Marketing

and Advertising

We

use a variety of marketing and advertising channels to build brand awareness, attract new guests, increase dining frequency, support

new restaurant openings, and promote Yoshiharu as an authentic Japanese restaurant with high-quality cuisine and a distinctive dining

experience. Our primary advertising channels include digital, social, and print.

Social

Media

We

maintain a presence on several social media platforms including Facebook and Instagram, allowing us to regularly communicate with guests,

alert guests of new offerings, and conduct promotions. Our dining experience is built to provide our guests social media shareable moments,

which we believe extends our advertising reach.

Suppliers

We

carefully select suppliers based on product quality and authenticity and their understanding of our brand, and we seek to develop long-term

relationships with them. All supply arrangements are negotiated and managed at the Yoshiharu corporate-level.

Food.

Our Vice President of Operations identifies and procures high-quality ingredients at competitive prices. Each store separately makes

an order to the specific vendor, and the invoices are submitted and paid by Yoshiharu at the corporate-level. We source mainly through

the following Japanese-related distributors: JFC, a subsidiary of Kikkoman Corporation, Wismettac, a subsidiary of Nishimoto Co., Ltd.,

and Mutual Trading Co., Inc., a California corporation.

Paper.

Our Vice President of Operations negotiates long term supply agreements for our logo-branded paper including takeout bags and bowls,

chopsticks, as well as uniforms. We make a portion of our purchases annually in bulk at fixed prices, and deliver them to our warehouse

in Anaheim, California. Each restaurant Manager receives the necessary paper supplies from our warehouse.

Management

Information Systems

We

utilize systems provided by Toast, Inc. for point of sale, contactless ordering, handheld ordering, online ordering and delivery, as

well as marketing and payroll management. We believe that Toast’s systems provide us and our customers with streamlined operations

and allows us to efficiently turn tables and improve the sales conversion cycle, while reducing third-party commissions for online orders.

Restaurant

Industry Overview

According

to the National Restaurant Association (the “NRA”), restaurant industry sales in 2023 were over $1.0 trillion, up from $966

billion in 2022 and is forecast to grow to $1.1 trillion in 2024.

The

restaurant industry is divided into several primary segments, including limited-service and full-service restaurants, which are generally

categorized by price, quality of food, service, and location. Yoshiharu sits at the intersection of these two segments offering the experience

and food quality of a full-service restaurant and the speed of service of a limited-service restaurant. We primarily compete with other

full-service restaurants, which, according to the NRA, had approximately$305 billion of sales in calendar year 2022, up from $266 billion

in 2021. The limited-service segment generated approximately $370 billion in calendar year 2022, or a roughly $30 billion increase from

the prior year.

According

to the 2023 State of the Restaurant report, full-service restaurant sales are expected to increase to $324 billion in calendar year 2023,

an increase of 6.2% from 2022 and the limited-service segment is forecast to reach $395 billion in 2023, resulting in a 6.8% increase

from 2022.

We

believe that increased multiculturalism in the United States, driven in part by growth in the Asian demographic, contributes to a favorable

macro environment for Yoshiharu’s future growth. According to the U.S. Census Bureau, the Asian population is projected to be one

of the fastest growing demographics in the United States, increasing in size from 20 million people in calendar year 2020 to 24.4 million

people by calendar year 2030. During this time, the Asian population’s share of the nation’s total population is projected

to increase by 15%, from approximately 6% to 6.9%.

Additionally,

we believe that Yoshiharu is well-positioned to grow our share of the restaurant market as consumers seek quality, value, healthier options,

and authentic global and regional cuisine in their dining choices. According to the National Restaurant Association 2023 State of the

Industry report, roughly 45% of family and casual dining restaurants plan to add new menu items identified as healthy or nutritious in

2023.

We

cannot provide assurance that we will benefit from these long-term demographic trends, although we believe the projected growth in the

Asian population and the Asian influence on dining trends will result in an increase in demand for Japanese and Asian foods.

Competition

We

face significant competition from a variety of locally owned restaurants regional, and national chain restaurants offering both Asian

and non-Asian cuisine, as well as takeaway options from grocery stores. Direct competition for Yoshiharu comes primarily from Asian restaurants

including other ramen noodles restaurants. Jinya Ramen Bar operates approximately 40 locations in the United States and also franchises

their restaurants. We believe that we compete primarily based on product quality, dining experience, ambience, location, convenience,

value perception, and price. Our competition continues to intensify as competitors increase the breadth and depth of their product offerings

and open new restaurants.

Seasonality

Due

to Yoshiharu’s menu breadth and diversification of offerings, we do not experience significant seasonality.

Employees

and Human Capital

We

have 290 employees including part time; 270 of the employees are restaurant-level employees, and the rest perform business

development, finance, marketing, investor relations, and administrative functions. We believe that our success is dependent upon, among

other things, the services of our senior management, the loss of which could have a material adverse effect upon our prospects. None

of our employees are represented by a labor union or covered by a collective bargaining agreement.

As

we continue to grow, we will add additional restaurant-level, marketing, and administrative personnel.

Properties

Our

executive offices are located at 6940 Beach Blvd., Suite D-705, Buena Park, CA 90621 and our telephone number is (714) 694-2403. We consider

our current office space adequate for our current operations.

Legal

Proceedings

From

time to time, we are also involved in various other claims and legal actions that arise in the ordinary course of business. Although

the results of litigation and claims cannot be predicted with certainty, we do not believe that the ultimate resolution of these actions

will have a material adverse effect on our financial position, results of operations, liquidity or capital resources.

Future

litigation may be necessary to defend ourselves and our partners by determining the scope, enforceability and validity of third party

proprietary rights or to establish our proprietary rights. The results of any current or future litigation cannot be predicted with certainty,

and regardless of the outcome, litigation can have an adverse impact on us because of defense and settlement costs, diversion of management

resources and other factors.

Reverse

Stock Split

On

November 20, 2023, our stockholders approved a proposal at our annual meeting of stockholders (the “Annual Meeting”) further

amending our Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to effect

a reverse stock split of our Common Stock at a ratio between one-for-two (1:2) and one-for-forty (1:40), without reducing the authorized

number of our shares of Common Stock. Following the Annual Meeting, our Board of Directors approved a final split ratio of one-for-ten

(1:10). Following such approval, on November 22, 2023, we filed an amendment to the Certificate of Incorporation with the Secretary of

State of the State of Delaware to effect the reverse stock split, with an effective time of 11:59 p.m. Eastern Time on November 27, 2023

(the “Reverse Stock Split”). Our Class A Common Stock began trading on Nasdaq on a split-adjusted basis beginning on November

28, 2023. Unless otherwise noted, all share and per share information relating to our Common Stock in this prospectus has been adjusted

to reflect the 1-for-10 Reverse Stock Split.

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS

Act”). We will remain an “emerging growth company” until the earliest of: (i) the last day of the fiscal year in which

we have $1.07 billion or more in annual gross revenues; (ii) the date on which we become a “large accelerated filer” (which

means the year-end at which the total market value of our common equity securities held by non-affiliates is $700 million or more as

of the last business day of our most recently completed second fiscal quarter); (iii) the date on which we have issued more than $1 billion

of non-convertible debt securities over a three-year period; and (iv) the last day of the fiscal year following the fifth anniversary

of our initial public offering. We have elected to take advantage of certain of the scaled disclosure available for emerging growth companies

in this prospectus as well as our filings under the Exchange Act of 1934 (“the Exchange Act”), including, but not limited

to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure

obligations regarding executive compensation and financial statements in our periodic reports and proxy statements, and exemptions from

the requirements of holding a nonbinding advisory vote to approve executive compensation and shareholder approval of any golden parachute

payments not previously approved. We will take advantage of these reporting exemptions until we are no longer an “emerging growth

company.” The JOBS Act provides that an “emerging growth company” can take advantage of an extended transition period

for complying with new or revised accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore,

we are subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

Corporate

Information

We

were incorporated in the State of Delaware on December 9, 2021. Our executive offices are located at 6940 Beach Blvd., Suite D-705, Buena

Park, CA 90621 and our telephone number is (714) 694-2403.

Available

Information

Our

website address is https://ir.yoshiharuramen.com/. Any information contained on, or that can be accessed through, our website

is not incorporated by reference into, nor is it in any way part of this prospectus and should not be relied upon in connection with

making any decision with respect to an investment in our securities. We are required to file annual, quarterly and current reports, proxy

statements and other information with the SEC. You may obtain any of the documents filed by us with the SEC, at no cost from the SEC’s

website at www.sec.gov.

THE

OFFERING

| Shares

of Class A Common Stock offered by us |

|

Up

to 400,000 shares of our Class A Common Stock, consisting of:

|

|

|

● |

12,476

shares of Class A Common Stock we committed to

issue to the Selling Stockholder as consideration for its commitment to purchase shares of our Class A Common Stock under the Purchase

Agreement within two business days from the execution of the Purchase Agreement (the “Initial Commitment Shares”); |

| |

|

|

|

|

|

● |

12,476

shares of Class A Common Stock we committed to

issue to the Selling Stockholder as consideration for its commitment to purchase shares of our Class A Common Stock under the Purchase

Agreement within two business days from effectiveness of the registration statement that includes this prospectus (the “Additional

Commitment Shares,” and together with the Initial Commitment Shares, the “Commitment Shares”); and |

| |

|

|

|

|

|

● |

Up

to a maximum of 375,048 shares of Class A Common Stock that we may sell to the Selling Stockholder from time to time at our

sole discretion, pursuant to the Purchase Agreement, as described below. |

| Class

A Common Stock outstanding(1) |

|

1,242,722

shares of Class A Common Stock. |

| |

|

|

| Class

A Common Stock outstanding after this offering(1) |

|

1,642,722

shares of Class A Common Stock. |

| |

|

|

| Use

of proceeds |

|

We

will not receive any proceeds from the sale by the Selling Stockholder of the shares of Class A Common Stock being offered by this

prospectus. However, we may receive gross proceeds of up to $5,000,000 from the sale of our Class A Common Stock to the Selling Stockholder

under the Purchase Agreement. We will not receive any cash proceeds from the issuance of the Commitment Shares to the Selling Stockholder

under the Purchase Agreement. We intend to use any proceeds from the Selling Stockholder that we receive under the Purchase Agreement

for working capital, strategic and general corporate purposes. See “Use of Proceeds” on page 17 for more information. |

| |

|

|

| Risk

factors |

|

An

investment in our securities is highly speculative and involves substantial risk. Please carefully consider the risks described under

the heading “Risk Factors” on page 10 and other information included and incorporated by reference in this prospectus

for a discussion of factors to consider before deciding to invest in the securities offered hereby. Additional risks and uncertainties

not presently known to us or that we currently deem to be immaterial may also impair our business and operations. |

| |

|

|

| Transfer

agent and registrar |

|

The

registrar and transfer agent for our Class A Common Stock is VStock Transfer, LLC, located at 18 Lafayette Place Woodmere, New York

11598. |

| |

|

|

| Nasdaq

symbol and trading |

|

Our

Class A Common Stock is listed on Nasdaq under the symbol “YOSH.” |

| (1) |

Unless otherwise indicated,

all references in this prospectus to the number of shares of our Class A Common Stock outstanding and the number of shares of our Common

Stock to be outstanding after this offering is based on 1,242,722 shares outstanding as of September 6, 2024, and excludes: |

| |

|

| |

● |

14,700

shares of Class A Common Stock issuable upon the exercise of warrants exercisable at a weighted average exercise price of $50.00 per

share as of June 30, 2024. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should carefully

consider the risks described below and those discussed under the Section captioned “Risk Factors” contained in our Annual

Report on Form 10-K for the year ended December 31, 2023, as amended, as revised or supplemented by our subsequent quarterly reports

on Form 10-Q or our current reports on Form 8-K, each as filed with the SEC and which are incorporated by reference in this prospectus,

together with other information in this prospectus, the information and documents incorporated by reference herein, and in any free writing

prospectus that we have authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial

condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our Class A Common Stock

to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled “Special

Note Regarding Forward-Looking Statements.”

Risks

Related to This Offering

It

is not possible to predict the actual number of shares we will sell under the Purchase Agreement to the Selling Stockholder, or the actual

gross proceeds resulting from those sales.

Subject

to certain limitations in the Purchase Agreement and compliance with applicable law, we have the discretion to deliver notices to the

Selling Stockholder at any time throughout the term of the Purchase Agreement. The actual number of shares of Class A Common Stock are

sold to the Selling Stockholder may depend based on a number of factors, including the market price of our Class A Common Stock during

the sales period. Actual gross proceeds may be less than $5,000,000, which may impact our future liquidity. Because the price

per share of each share sold to the Selling Stockholder will fluctuate during the sales period, it is not currently possible to predict

the number of shares that will be sold or the actual gross proceeds to be raised in connection with those sales.

Moreover,

although the Purchase Agreement provides that we may sell up to an aggregate of $5,000,000 of our Class A Common Stock to the Selling

Stockholder, we are registering 400,000 shares of our common stock, which exceeds the 237,885 shares of our Class A Common Stock representing

the maximum number of shares we may issue and sell under the Purchase Agreement (the “Exchange Cap Limitation”), for resale

under this prospectus. The Exchange Cap Limitation includes the 12,476 Initial Commitment Shares we have committed to issue, as well

as 12,476 Additional Commitment Shares issuable within two business days from the effective date of the registration statement which

contains this prospectus. If we elect to sell to the Selling Stockholder all of the 162,113 remaining shares of Class A Common Stock

being registered for resale under this prospectus that are available for sale by us to the Selling Stockholder in purchases under the

Purchase Agreement, depending on the market prices of our Class A Common Stock for each purchase made pursuant to the Purchase Agreement,

the actual gross proceeds from the sale of the shares may be substantially less than the $5,000,000 total commitment available to us

under the Purchase Agreement. If it becomes necessary for us to issue and sell to the Selling Stockholder under the Purchase Agreement

more shares than the Exchange Cap Limitation or more shares than being registered for resale under this prospectus in order to receive

aggregate gross proceeds equal to the total commitment of $5,000,000 under the Purchase Agreement, we must first (i) obtain stockholder

approval to issue shares of Class A Common Stock in excess of the Exchange Cap under the Purchase Agreement in accordance with applicable

Nasdaq rules, unless the average per share purchase price paid by the Selling Stockholder for all shares of Class A Common Stock sold

under the Purchase Agreement equals or exceeds the Nasdaq minimum price, in which case the Exchange Cap Limitation will not apply under

applicable Nasdaq rules, and (ii) file with the SEC one or more additional registration statements to register under the Securities Act

the resale by the Selling Stockholder of any such additional shares of our Class A Common Stock over the 400,000 shares registered in

this Registration Statement that we wish to sell from time to time under the Purchase Agreement, which the SEC must declare effective,

in each case before we may elect to sell any additional shares of our Class A Common Stock to the Selling Stockholder under the Purchase

Agreement.

Any

issuance and sale by us under the Purchase Agreement of a substantial amount of shares of Class A Common Stock in addition to the 400,000

shares of our Class A Common Stock being registered for resale by the Selling Stockholder under this prospectus could cause additional

substantial dilution to our stockholders. The number of shares of our Class A Common Stock ultimately offered for sale by the Selling

Stockholder is dependent upon the number of shares of Class A Common Stock, if any, we ultimately sell to the Selling Stockholder under

the Purchase Agreement.

Investors

who buy shares in this offering at different times will likely pay different prices.

Investors

who purchase shares of Class A Common Stock in this offering at different times will likely pay different prices, and so may experience

different levels of dilution and different outcomes in their investment results. In connection with the Purchase Agreement, we will have

discretion, subject to market demand, to vary the timing, prices, and numbers of shares of Class A Common Stock sold to the Selling Stockholder.

Similarly, the Selling Stockholder may sell such shares at different times and at different prices. Investors may experience a decline

in the value of the shares they purchase from the Selling Stockholder in this offering as a result of sales made by us in future transactions

to the Selling Stockholder at prices lower than the prices they paid.

The

issuance of Class A Common Stock to the Selling Stockholder may cause substantial dilution to our existing shareholders and the sale

of such shares acquired by the Selling Stockholder could cause the price of our Class A Common Stock to decline.

We

are registering for resale by the Selling Stockholder up to 400,000 shares of Class A Common Stock. The number of shares of our

Class A Common Stock ultimately offered for resale by the Selling Stockholder under this prospectus is dependent upon the number of shares

of Class A Common Stock issued to the Selling Stockholder pursuant to the Purchase Agreement. Depending on a variety of factors, including

market liquidity of our Class A Common Stock, the issuance of shares to the Selling Stockholder may cause the trading price of our Class

A Common Stock to decline.

The

sale of a substantial number of shares of our Class A Common Stock by the Selling Stockholder in this offering, or anticipation of such

sales, could cause the trading price of our Class A Common Stock to decline or make it more difficult for us to sell equity or equity-related

securities in the future at a time and at a price that we might otherwise desire.

We

may require additional financing to sustain our operations and without it we may not be able to continue operations.

Subject

to the terms and conditions of the Purchase Agreement, we may, at our discretion, direct the Selling Stockholder to purchase up to $5,000,000

of shares of our Class A Common Stock under the Purchase Agreement from time-to-time. Although the Purchase Agreement provides that

we may sell up to an aggregate of $5,000,000 of our Class A Common Stock to the Selling Stockholder and we are registering 400,000 shares

of our Class A Common Stock, only 212,933 shares of our Class A Common Stock is available under the Exchange Cap (representing the remaining

maximum number of shares we may issue and sell under the Purchase Agreement under the Exchange Cap Limitation less 24,952 Commitment

Shares). The purchase price per share for the shares of Class A Common Stock that we may elect to sell to the Selling Stockholder

under the Purchase Agreement will fluctuate based on the market prices of our Class A Common Stock for each purchase made pursuant to

the Purchase Agreement, if any. Accordingly, it is not currently possible to predict the number of shares that will be sold to the Selling

Stockholder, the actual purchase price per share to be paid by the Selling Stockholder for those shares, if any, or the actual gross

proceeds to be raised in connection with those sales.

Assuming

a purchase price of $5.63 per share (which represents the closing price of our Class A Common Stock on Nasdaq on January 4, 2024), the

purchase by the Selling Stockholder of all of the remaining 212,933 shares available under the Exchange Cap (less the amount of

the Commitment Shares) would result in aggregate gross proceeds to us of approximately $1.2 million which is substantially less than

the $5 million total commitment amount available to us under the Purchase Agreement.

Accordingly,

in order to receive aggregate gross proceeds equal to the $5,000,000 total commitment amount available to us under the Purchase

Agreement, we would need to issue and sell to the Selling Stockholder under the Purchase Agreement more than the Exchange Cap, which

would require us to first obtain stockholder approval to issue shares of Class A Common Stock in excess of the Exchange Cap under

the Purchase Agreement in accordance with applicable Nasdaq rules

If and when we receive stockholder

approval to issue shares of Class A Common Stock in excess of the Exchange Cap, assuming a purchase price of $4.48 per share (which represents

the closing price of our Class A Common Stock on Nasdaq on September 6, 2024), the purchase by the Selling Stockholder of the 375,048

being registered hereby (less the amount of the Commitment Shares) would result in aggregate gross proceeds to us of approximately $1.7

million which is substantially less than the $5 million total commitment amount available to us under the Purchase Agreement.

Accordingly, in order to receive aggregate

gross proceeds equal to the $5,000,000 total commitment amount available to us under the Purchase Agreement, we would also need to

file with the SEC one or more additional registration

statements to register under the Securities Act the resale by the Selling Stockholder any such additional shares of our Class A Common

Stock we wish to sell from time to time under the Purchase Agreement, which the SEC must declare effective, in each case before we may

elect to sell any additional shares of our Class A Common Stock to the Selling Stockholder under the Purchase Agreement.

The

extent to which we rely on the Selling Stockholder as a source of funding will depend on a number of factors including, the prevailing

market price of our Class A Common Stock and the extent to which we are able to secure working and other capital from other sources.

If obtaining sufficient funding from the Selling Stockholder were to prove unavailable or prohibitively dilutive, we may need to secure

another source of funding in order to satisfy our working and other capital needs. Even if we were to sell to the Selling Stockholder

all of the shares of Class A Common Stock available for sale to the Selling Stockholder under the Purchase Agreement, we may still need

additional capital to fully implement our business, operating and development plans. Should the financing we require to sustain our working

capital needs be unavailable or prohibitively expensive when we require it, the consequences may be a material adverse effect on our

business, operating results, financial condition and prospects.

Future

sales and issuances of our Class A Common Stock or other securities might result in significant dilution and could cause the price of

our Class A Common Stock to decline.

To

raise capital, we may sell Class A Common Stock, convertible securities or other equity securities in one or more transactions other

than those contemplated by the Purchase Agreement, at prices and in a manner we determine from time to time. We may sell shares or other

securities in another offering at a price per share that is less than the price per share paid by investors in this offering, and investors

purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which

we sell additional shares of our Class A Common Stock, or securities convertible or exchangeable into Class A Common Stock, in future

transactions may be higher or lower than the price per share paid by investors in this offering.

We

cannot predict what effect, if any, sales of shares of our Class A Common Stock in the public market or the availability of shares for

sale will have on the market price of our Class A Common Stock. However, future sales of substantial amounts of our Class A Common Stock

in the public market, including shares issued upon exercise of outstanding options, warrants and convertible preferred shares, or the

perception that such sales may occur, could adversely affect the market price of our Class A Common Stock.

Our

management will have broad discretion over the use of the net proceeds from our sale of shares of Class A Common Stock to the Selling

Stockholder, and you may not agree with how we use the proceeds and the proceeds may not be invested successfully.

Our

management will have broad discretion with respect to the use of proceeds from the sale of any shares of our Class A Common Stock to

the Selling Stockholder, including for any of the purposes described in the section of this prospectus entitled “Use of Proceeds.”

You will be relying on the judgment of our management regarding the application of the proceeds from the sale of any shares of our Class

A Common Stock to the Selling Stockholder. The results and effectiveness of the use of proceeds are uncertain, and we could spend the

proceeds in ways that you do not agree with or that do not improve our results of operations or enhance the value of our Class A Common

Stock. Our failure to apply these funds effectively could harm our business, delay the development of our pipeline product candidates

and cause the price of our Class A Common Stock to decline.

Due

to the recent implementation of the Reverse Stock Split, the liquidity of our Class A Common Stock may be adversely effected.

Our

Class A Common Stock began trading on Nasdaq on a Reverse Stock Split-adjusted basis beginning on November 28, 2023. The liquidity

of the shares of our Class A Common Stock may be affected adversely by any reverse stock split given the reduced number of shares of

our Class A Common Stock that are outstanding following the Reverse Stock Split, especially if the market price of our Class A Common

Stock does not increase as a result of the Reverse Stock Split. Following the Reverse Stock Split, the resulting market price of our

Class A Common Stock may not attract new investors and may not satisfy the investing requirements of those investors. Although we believe

that a higher market price of our Class A Common Stock may help generate greater or broader investor interest, there can be no assurance

that the Reverse Stock Split resulted in a share price that will attract new investors, including institutional investors. In addition,

there can be no assurance that the market price of our Class A Common Stock will satisfy the investing requirements of those investors.

As a result, the trading liquidity of our Class A Common Stock may not necessarily improve.

If

we are unable to satisfy the applicable continued listing requirements of Nasdaq, our Class A Common Stock could be delisted.

On

August 21, 2024, we received a written notice (the “Notice”) from the Listing Qualifications Department of Nasdaq indicating

that Nasdaq had determined that our amount of stockholders’ equity had fallen below

the $2,500,000 required minimum for continued listing set forth in Nasdaq Listing Rule 5550(b)(1). The Notice also noted that we

do not meet the alternatives of market value of listed securities or net income from continuing operations, and therefore, we no longer

complied with Nasdaq’s Listing Rules..

Under

Nasdaq Listing Rules, we have until October 7, 2024 to provide Nasdaq with a specific plan to achieve and sustain compliance with all

Nasdaq listing requirements. If Nasdaq accepts our plan for compliance, Nasdaq may grant an extension of up to 180 calendar days from

the date of the Notice to evidence compliance. If Nasdaq does not accept our plan to achieve compliance, we will have the opportunity

to appeal the decision to a Nasdaq Hearings Panel. A hearing request will stay the suspension and delisting of our securities pending

the Nasdaq Hearings Panel’s decision. There can be no assurance that we will regain compliance with Nasdaq Listing Rule

5550(b)(1), that we will be able meet the continued listing requirements during any compliance period that may be granted by Nasdaq,

or that we will be able to meet continued listing

requirements in the future. In determining whether to afford a company a cure period prior to commencing suspension or delisting procedures,

Nasdaq analyzes all relevant facts including any past deficiencies, and thus our prior deficiencies could be used as a factor by Nasdaq

in any future decision to delist our securities from trading on its exchange.

If