false

0001853044

0001853044

2024-02-21

2024-02-21

0001853044

AERT:ClassOrdinarySharesParValue0.0001PerShareMember

2024-02-21

2024-02-21

0001853044

AERT:RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2024-02-21

2024-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or Section 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): February 21, 2024

Aeries Technology, Inc. (f/k/a Worldwide Webb Acquisition Corp.)

(Exact name of registrant

as specified in its charter)

| Cayman Islands |

|

001-40920 |

|

98-1587626 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

|

60 Paya Lebar Road, #08-13

Paya Lebar Square

Singapore |

|

409051 |

| (Address of principal executive offices) |

|

(Zip Code) |

(919) 228-6404

(Registrant’s

telephone number, including area code)

Not Applicable

(Former name or former

address, if changed since last report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following

provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A ordinary shares, par value $0.0001 per share |

|

AERT |

|

Nasdaq Capital Market |

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

AERTW |

|

Nasdaq Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities

Exchange Act of 1934.

Emerging growth company

☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On February 21, 2024, Aeries Technology, Inc.

(f/k/a Worldwide Webb Acquisition Corp.) (the “Company”) issued a press release

containing its financial results for the quarter ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1

and is incorporated herein by reference. The Company previously filed its Quarterly Report on Form 10-Q for the quarter ended December

31, 2023 on February 20, 2024.

The information in this Current Report on Form

8-K and the exhibits attached hereto is being furnished and shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless

of any general incorporation language in such filing.

Item

9.01 Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: February 21, 2024 |

|

| |

AERIES TECHNOLOGY, INC. |

| |

A Cayman Islands exempted company |

| |

|

| |

By: |

/s/ Rajeev Nair |

| |

Name: |

Rajeev Nair |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

Aeries Technology Reports Results for Third

Fiscal Quarter 2024

Revenues for the third fiscal quarter of 2024

were $18.9 million, up 49% compared with the same period in 2023

February 21, 2024, NEW YORK –

Aeries Technology (Nasdaq: AERT), a global professional services and consulting partner, today announced financial results for

the quarter ended December 31, 2023.

“We saw strong topline results in the quarter driven by new customer

adoption of the Aeries platform,” said Sudhir Panikassery, CEO of Aeries Technology. “We are seeing more mid-market prospects

interested in our solutions as the network effect of our clients and their sponsors continues to pick up speed, and we believe that the

clear benefit of our differentiated Aeries engagement model is a key factor.”

Three Months Ended December 31, 2023

(Third Fiscal Quarter 2024) Financial Highlights

Revenues: Revenues for the third fiscal quarter of 2024 were

$18.9 million, up 49% compared to $12.7 million for the third fiscal quarter of 2023.

Income from Operations: Income from operations for the third

fiscal quarter of 2024 was $0.7 million, up 150% compared to $0.3 million for the third fiscal quarter of 2023.

Net Income (Loss): Net loss for the third fiscal quarter of

2024 was $(16.3) million compared to $(0.3) million for the third fiscal quarter of 2023. Net loss included a $16.4 million dollar non-cash

charge related to the Forward Purchase Agreements in connection with our SPAC business combination.

Adjusted EBITDA: Adjusted EBITDA for the third fiscal quarter

of 2024 was $2.4 million compared to $2.4 million for the third fiscal quarter of 2023.

Financial Outlook

The Company is reiterating its previously stated guidance for calendar

year 2024:

| ● | Revenue of between $95-105 million |

| ● | Adjusted EBITDA of between $16-20 million |

The Company’s guidance contains forward-looking statements and

actual results may differ materially as a result of known and unknown uncertainties and risks, including those set forth below under the

heading “Forward-Looking Statements.” The Company previously provided a reconciliation of its guidance for adjusted EBITDA

to its most directly comparable GAAP measure and the Company hereby withdraws that reconciliation and any associated guidance. Forward-looking

non-GAAP financial measures are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to

the inherent difficulty in projecting and quantifying the various adjusting items necessary for such reconciliations, such as stock-based

compensation expense, amortization and depreciation expenses and taxes, that have not yet occurred, are out of Aeries’ control,

or cannot be reasonably predicted. Accordingly, a reconciliation of our guidance for adjusted EBITDA is not available without unreasonable

effort.

Conference Call Details

As previously announced, the company will host

a conference call to discuss their financial results on Thursday, February 22, 2024 at 8:00 AM ET. The call will be accessible by

telephone at 1-877-300-8521 (domestic) or 1-412-317-6026 (international). The call will also be available live via webcast on the company’s

investor relations website at https://ir.aeriestechnology.com.

A telephone replay of the conference call will

be available following its conclusion at 1-844-512-2921 (domestic) or 1-412-317-6671 (international) with access code 10186664 and will

be available until 11:59 PM ET, February 29, 2024. An archive of the webcast will also be available on the company’s investor

relations website at https://ir.aeriestechnology.com.

About Aeries Technology

Aeries Technology (Nasdaq: AERT) is a

global professional services and consulting partner for businesses in transformation mode and their stakeholders, including private equity

sponsors and their portfolio companies, with customized engagement models that are designed to provide the right mix of deep vertical

specialty, functional expertise, and digital systems and solutions to scale, optimize and transform a client’s business operations.

Founded in 2012, Aeries Technology now has over 1,600 professionals specializing in Technology Services and Solutions, Business Process

Management, and Digital Transformation initiatives, geared towards providing tailored solutions to drive business success. Aeries Technology’s

approach to staffing and developing its workforce has earned it the Great Place to Work Certification.

Non-GAAP Financial Measures

The Company uses non-GAAP financial information and believes it is

useful to investors as it provides additional information to facilitate comparisons of historical operating results, identify trends in

its underlying operating results and provide additional insight and transparency on how it evaluates the business. The Company uses non-GAAP

financial measures to budget, make operating and strategic decisions, and evaluate its performance. The Company has detailed the non-GAAP

adjustments that it makes in the non-GAAP definitions below. The adjustments generally fall within the categories of non-cash items. The

Company believes the non-GAAP measures presented herein should always be considered along with, and not as a substitute for or superior

to, the related GAAP financial measures. In addition, similarly titled items used by other companies may not be comparable due to variations

in how they are calculated and how terms are defined. For further information, see “Reconciliation of Non—GAAP Financial Measures”

below, including the reconciliations of these non-GAAP measures to their most directly comparable GAAP financial measures.

The Company defines Adjusted EBITDA as net income from operations before

interest, income taxes, depreciation and amortization adjusted to exclude stock-based compensation and business combination related costs.

Adjusted EBITDA is one of the key performance indicators the company uses in evaluating our operating performance and in making financial,

operating, and planning decisions. The Company believes adjusted EBITDA is useful to investors in the evaluation of Aeries’ operating

performance as such information was used by the Company’s management for internal reporting and planning procedures, including aspects

of our consolidated operating budget and capital expenditures.

Forward-Looking Statements

All statements in this release that are not based

on historical fact are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. Words such as “anticipate,” “believe,” “continue,” “could,”

“estimate”, “expect”, “hope”, “intend”, “may”, “might”, “should”,

“would”, “will”, “understand” and similar words are intended to identify forward looking statements.

These forward-looking statements include but are not limited to, statements regarding our future operating results, outlook, guidance

and financial position, our business strategy and plans, our objectives for future operations, potential acquisitions and macroeconomic

trends. While management has based any forward-looking statements included in this release on its current expectations, the information

on which such expectations were based may change. These forward-looking statements rely on a number of assumptions concerning future

events and are subject to a number of risks, uncertainties and other factors, many of which are outside of the control of Aeries and

its subsidiaries, which could cause actual results to materially differ from such statements. Such risks, uncertainties, and other factors

include, but are not limited to, changes in the business, market, financial, political and legal conditions in India, Singapore, the

United States, Mexico, the Cayman Islands and other countries, including developments with respect to inflation, interest rates and the

global supply chain, including with respect to economic and geopolitical uncertainty in many markets around the world, the potential

of decelerating global economic growth and increased volatility in foreign currency exchange rates; the potential for our business development

efforts to maximize our potential value; the ability to recognize the anticipated benefits of the business combination with Worldwide

Webb Acquisition Corp., which may be affected by, among other things, competition, our ability to grow and manage growth profitably and

retain its key employees; the ability to maintain the listing of our Class A ordinary shares and our public warrants on Nasdaq, and the

potential liquidity and trading of our securities; changes in applicable laws or regulations and other regulatory developments in the

United States, India, Singapore, Mexico, the Cayman Islands and other countries; our ability to develop and maintain effective internal

controls, including our ability to remediate the material weakness in our internal controls over financial reporting; our success in

retaining or recruiting, or changes required in, our officers, key employees or directors; our financial performance; our ability to

continue as a going concern; our ability to make acquisitions, divestments or form joint ventures or otherwise make investments and the

ability to successfully complete such transactions and integrate with our business; the period over which we anticipate our existing

cash and cash equivalents will be sufficient to fund our operating expenses and capital expenditure requirements; the conflicts between

Russia and Ukraine, and Israel and Hamas, and any restrictive actions that have been or may be taken by the U.S. and/or other countries

in response thereto, such as sanctions or export controls; risks related to cybersecurity and data privacy; the impact of inflation;

the impact of the COVID-19 pandemic and other similar pandemics and disruptions in the future; and the fluctuation of economic conditions,

global conflicts, inflation and other global events on Aeries’ results of operations and global supply chain constraints. Further

information on risks, uncertainties and other factors that could affect our financial results are included in Aeries’ periodic

and current reports filed with the U.S. Securities and Exchange Commission. Furthermore, Aeries operates in a highly competitive and

rapidly changing environment where new and unanticipated risks may arise. Accordingly, investors should not place any reliance on forward-looking

statements as a prediction of actual results. Aeries disclaims any intention to, and undertakes no obligation to, update or revise forward-looking

statements.

Contacts

Ryan Gardella

AeriesIR@icrinc.com

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(In thousands, except

percentages)

(Unaudited)

| | |

Three months ended

December 31, | | |

Nine months ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues, net | |

$ | 18,897 | | |

$ | 12,691 | | |

$ | 52,805 | | |

$ | 38,027 | |

| Cost of revenue | |

| 12,851 | | |

| 10,373 | | |

| 37,488 | | |

| 28,685 | |

| Gross profit | |

$ | 6,046 | | |

$ | 2,318 | | |

$ | 15,317 | | |

$ | 9,342 | |

| Gross Margin | |

| 32 | % | |

| 18 | % | |

| 29 | % | |

| 25 | % |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general & administrative expenses | |

| 5,313 | | |

| 2,025 | | |

| 12,321 | | |

| 7,898 | |

| Total operating expenses | |

$ | 5,313 | | |

$ | 2,025 | | |

$ | 12,321 | | |

$ | 7,898 | |

| Income (loss) from operations | |

$ | 733 | | |

$ | 293 | | |

$ | 2,996 | | |

$ | 1,444 | |

| Operating Margin | |

| 4 | % | |

| 2 | % | |

| 6 | % | |

| 4 | % |

| Other income (expense) | |

| | | |

| | | |

| | | |

| | |

| Change in fair value of derivative liabilities | |

| (16,395 | ) | |

| - | | |

| (16,395 | ) | |

| - | |

| Interest income | |

| 83 | | |

| 80 | | |

| 217 | | |

| 175 | |

| Interest expense | |

| (115 | ) | |

| (52 | ) | |

| (314 | ) | |

| (166 | ) |

| Other income (expense), net | |

| (50 | ) | |

| 106 | | |

| 70 | | |

| 518 | |

| Total other income (expense) | |

| (16,477 | ) | |

| 134 | | |

| (16,422 | ) | |

| 527 | |

| Income before income taxes | |

| (15,744 | ) | |

| 427 | | |

| (13,426 | ) | |

| 1,971 | |

| Provision for income taxes | |

| (557 | ) | |

| (742 | ) | |

| (1,454 | ) | |

| (1,150 | ) |

| Net income | |

| (16,301 | ) | |

| (315 | ) | |

| (14,878 | ) | |

| 821 | |

| Net Margin | |

| -86 | % | |

| -2 | % | |

| -28 | % | |

| 2 | % |

| Less: Net income / (loss) attributable to noncontrolling interest | |

| (44 | ) | |

| (45 | ) | |

| 137 | | |

| 125 | |

| Less: Net income / (loss) attributable to redeemable noncontrolling interests | |

| 154 | | |

| - | | |

| 154 | | |

| - | |

| Net income attributable to the shareholders’ of Aeries Technology, Inc. | |

| (16,411 | ) | |

| (270 | ) | |

| (15,171 | ) | |

| 696 | |

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

(In thousands, except

percentages)

(Unaudited)

| | |

Three

months ended

December 31, | | |

Nine

months ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Net income | |

$ | (16,301 | ) | |

$ | (315 | ) | |

$ | (14,880 | ) | |

$ | 821 | |

| Income tax expense | |

| 557 | | |

| 742 | | |

| 1,454 | | |

| 1,150 | |

| Interest income | |

| (83 | ) | |

| (80 | ) | |

| (217 | ) | |

| (175 | ) |

| Interest expenses | |

| 115 | | |

| 52 | | |

| 314 | | |

| 166 | |

| Depreciation and amortization | |

| 343 | | |

| 285 | | |

| 1,004 | | |

| 873 | |

| EBITDA | |

$ | (15,369 | ) | |

$ | 684 | | |

$ | (12,325 | ) | |

$ | 2,835 | |

| Adjustments | |

| | | |

| | | |

| | | |

| | |

| (+) Stock-based compensation | |

| - | | |

| 1,425 | | |

| 1,626 | | |

| 2,482 | |

| (+) Business combination related costs | |

| 1,333 | | |

| 325 | | |

| 2,504 | | |

| 550 | |

| (-) Change in fair value of derivative liabilities | |

| 16,395 | | |

| - | | |

| 16,395 | | |

| - | |

| Adjusted EBITDA | |

$ | 2,359 | | |

$ | 2,434 | | |

$ | 8,200 | | |

$ | 5,867 | |

| (/) Revenue | |

| 18,897 | | |

| 12,691 | | |

| 52,805 | | |

| 38,027 | |

| Adjusted EBITDA Margin | |

| 12.5 | % | |

| 19.2 | % | |

| 15.5 | % | |

| 15.4 | % |

CASH FLOW

(In thousands)

(Unaudited)

| | |

Nine

months Ended

December 31, | |

| | |

2023 | | |

2022 | |

| Cash at the beginning of period | |

$ | 1,131 | | |

$ | 351 | |

| Net cash provided by operating activities | |

| 25 | | |

| 2,318 | |

| Net cash used in investing activities | |

| (1,070 | ) | |

| (1,418 | ) |

| Net cash provided by financing activities | |

| 6,474 | | |

| 444 | |

| Effects of exchange rates on cash | |

| (17 | ) | |

| (51 | ) |

| Cash at the end of period | |

$ | 6,543 | | |

$ | 1,644 | |

v3.24.0.1

Cover

|

Feb. 21, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 21, 2024

|

| Entity File Number |

001-40920

|

| Entity Registrant Name |

Aeries Technology, Inc.

|

| Entity Central Index Key |

0001853044

|

| Entity Tax Identification Number |

98-1587626

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

60 Paya Lebar Road

|

| Entity Address, Address Line Two |

#08-13

|

| Entity Address, Address Line Three |

Paya Lebar Square

|

| Entity Address, City or Town |

Singapore

|

| Entity Address, Country |

SG

|

| Entity Address, Postal Zip Code |

409051

|

| City Area Code |

(919)

|

| Local Phone Number |

228-6404

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A ordinary shares, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A ordinary shares, par value $0.0001 per share

|

| Trading Symbol |

AERT

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50

|

| Trading Symbol |

AERTW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AERT_ClassOrdinarySharesParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=AERT_RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

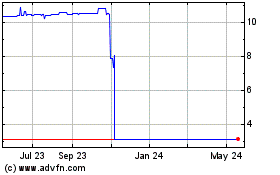

Worldwide Webb Acquisition (NASDAQ:WWACU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Worldwide Webb Acquisition (NASDAQ:WWACU)

Historical Stock Chart

From Dec 2023 to Dec 2024