Current Report Filing (8-k)

April 13 2020 - 4:06PM

Edgar (US Regulatory)

0000108312 False 0000108312 2020-04-10 2020-04-10 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 10, 2020

_______________________________

Woodward, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

|

Delaware

|

000-8408

|

36-1984010

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

1081 Woodward Way

Fort Collins, Colorado 80524

(Address of Principal Executive Offices) (Zip Code)

(970) 482-5811

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001455

|

WWD

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On April 13, 2020, Woodward, Inc. (the "Company") announced that, as part of its actions in response to the ongoing global economic challenges and uncertainties attributable to the coronavirus (COVID-19) pandemic and the resulting impact on the broader macroeconomic environment and its business, the Company made the strategic decision to shift a seasoned veteran of the Company, Robert ("Bob") F. Weber, Junior, 66, back into the critical role of Vice Chairman, Chief Financial Officer, effective as of April 13, 2020. Mr. Weber has served as Vice Chairman since October 2011, served as Chief Financial Officer from August 2005 until September 2019, and as Treasurer from August 2005 through November 2018. Mr. Weber previously announced his intention to retire in 2020, but in January 2020, the Company announced that he had postponed his retirement indefinitely, and he remained with the Company as Vice Chairman. Mr. Weber's biographical information is included in the Company's Form 10-K for the fiscal year ended September 30, 2019 and his compensation information is included in the Company's proxy statement filed with the Securities and Exchange Commission on December 13, 2019. At this time, no changes are expected to Mr. Weber's employment arrangements other than salary reductions for officers and company-wide measures as previously announced by the Company in light of COVID-19. Mr. Weber has no familial relationships nor related person transactions with the Company that would require disclosure under Items 401(d) or 404(a) of Regulation S-K in connection with his appointment described above.

Jonathan ("Jack") W. Thayer, 49, the Company's current CFO, will depart the Company contemporaneously with Mr. Weber's return to the Chief Financial Officer role. Mr. Thayer has served at the Company since May 2016, first as a member of the board of directors and then as Vice Chairman, Corporate Operations beginning in January 2019, then taking on the additional role of Chief Financial Officer in October 2019. The Company is grateful to Mr. Thayer for his leadership and his contributions to the Company, both as a director and an officer.

In connection with his departure, Mr. Thayer entered into a Separation Agreement and Release pursuant to which Mr. Thayer will receive a cash severance of $575,000, payable in a lump sum. Mr. Thayer will also receive retirement treatment under the Company's cash long-term incentive ("Cash LTI") plan with a deemed retirement date of September 30, 2020 and resulting payments, if any, based on the achievement of previously established targets for each of the three open Cash LTI performance cycles and prorated at 33% for cycle ending 2022, 67% for cycle ending 2021, and 100% for cycle ending 2020. In addition, all stock options previously granted to Mr. Thayer, other than an award granted in October 2019, will be modified to provide for continued vesting post-termination based on the original schedule and an extension of the exercise period for the remaining ten-year term of the option. Further, the Company will provide relocation benefits to relocate his residence from Fort Collins, Colorado back to Baltimore, Maryland, including a reimbursement of any shortfall in the difference between his original purchase price and the sale price of his real property in Fort Collins, as well as the purchase at his original purchase price of personal property acquired for his Fort Collins residence. If the real property is not sold within 90 days, the Company will purchase the property from Mr. Thayer at his original purchase price. Additionally, the Company will provide Mr. Thayer a one-time payment of $37,000, approximating the pre-tax costs of (and in lieu of providing) continued healthcare benefits for a twelve month period. The severance benefits are conditioned upon Mr. Thayer executing and not revoking the Separation Agreement and Release, which includes a twelve month non-competition provision and a full release of claims against the Company, as well as non-disparagement and non-solicitation provisions.

A copy of the Separation Agreement and Release will be filed with the Company's Form 10-Q for the quarter ended June 30, 2020.

A copy of the press release announcing these events is filed herewith as Exhibit 99.1 and such press release is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press Release of Woodward, Inc., dated April 13, 2020.

(d) Exhibits.

99.1 Press Release of Woodward, Inc., dated April 13, 2020.

(d) Exhibits.

99.1 Press Release of Woodward, Inc., dated April 13, 2020.

(d) Exhibits.

99.1 Press Release of Woodward, Inc., dated April 13, 2020.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Woodward, Inc.

|

|

|

|

|

|

|

|

|

|

Dated: April 13, 2020

|

By:

|

/s/ A. Christopher Fawzy

|

|

|

|

A. Christopher Fawzy

|

|

|

|

Corporate Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer

|

|

|

|

|

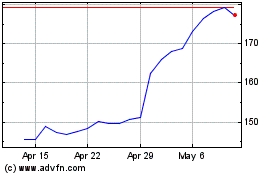

Woodward (NASDAQ:WWD)

Historical Stock Chart

From Mar 2024 to Apr 2024

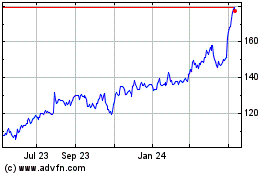

Woodward (NASDAQ:WWD)

Historical Stock Chart

From Apr 2023 to Apr 2024