false

0001157647

0001157647

2025-01-28

2025-01-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January

28, 2025

WESTERN

NEW ENGLAND BANCORP, INC.

(Exact

name of registrant as specified in its charter)

| Massachusetts |

|

001-16767 |

|

73-1627673 |

| (State

or other jurisdiction of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

| 141

Elm Street |

|

| Westfield, Massachusetts |

01085 |

| (Address

of principal executive offices) |

(zip

code) |

Registrant's

telephone number, including area code: (413) 568-1911

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common

Stock, $0.01 par value per share |

WNEB |

NASDAQ |

Indicate

by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02. |

Results of Operations and Financial Condition. |

On January

28, 2025, Western New England Bancorp, Inc. (the “Company”) issued a press release announcing its financial results for the

quarter and twelve months ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 hereto and is hereby

incorporated by reference into this Item 2.02.

|

Item 7.01. |

Regulation FD Disclosure. |

On January 28, 2025, the Company

made available an investor presentation to be used during investor meetings. The slide show for the investor presentation is attached

to this report as Exhibit 99.2.

The

information contained in this Item 7.01 and Exhibits 99.1 and 99.2 attached hereto, is being furnished and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of that section, nor will such information or exhibits be deemed incorporated by reference into any filing made by the

Company under the Exchange Act or the Securities Act of 1933, as amended, whether made before or after the date hereof and regardless

of any general incorporation language in such filings, except to the extent expressly set forth by specific reference in such filing.

The furnishing of the information included in Item 7.01 of this Current Report on Form 8-K shall

not be deemed an admission as to the materiality of any information herein that is required to be disclosed solely by reason of Regulation

FD.

|

Item 9.01. |

Financial Statements and Exhibits. |

(a) Not applicable.

(b) Not applicable.

(c) Not applicable.

(d) Exhibits.

The exhibits required by this item are set forth on the Exhibit Index

attached hereto.

|

Exhibit

Number |

|

Description |

| |

|

|

| 99.1 |

|

Press Release of Western New England Bancorp, Inc. dated January 28, 2025. |

| 99.2 |

|

Investor Presentation dated January 28, 2025 for Western New England Bancorp, Inc. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

WESTERN NEW ENGLAND BANCORP, INC. |

| |

|

|

|

| |

By: |

/s/ Guida R. Sajdak |

|

| |

|

Guida R. Sajdak |

|

| |

|

Chief Financial Officer |

Dated: January 28, 2025

Western New England Bancorp, Inc. 8-K

Exhibit 99.1

For

further information contact:

James

C. Hagan, President and CEO

Guida

R. Sajdak, Executive Vice President and CFO

Meghan

Hibner, First Vice President and Investor Relations Officer

413-568-1911

WESTERN

NEW ENGLAND BANCORP, INC. REPORTS RESULTS FOR THREE MONTHS AND

YEAR

ENDED DECEMBER 31, 2024 AND DECLARES QUARTERLY CASH DIVIDEND

Westfield,

Massachusetts, January 28, 2025: Western New England Bancorp, Inc. (the “Company” or “WNEB”) (NasdaqGS:

WNEB), the holding company for Westfield Bank (the “Bank”), announced today the unaudited results of operations for

the three and twelve months ended December 31, 2024. For the three months ended December 31, 2024, the Company reported net income

of $3.3 million, or $0.16 per diluted share, compared to net income of $2.5 million, or $0.12 per diluted share, for the three

months ended December 31, 2023. On a linked quarter basis, net income was $3.3 million, or $0.16 per diluted share, for the three

months ended December 31, 2024, as compared to net income of $1.9 million, or $0.09 per diluted share, for the three months ended

September 30, 2024. For the twelve months ended December 31, 2024, net income was $11.7 million, or $0.56 per diluted share, compared

to net income of $15.1 million, or $0.70 per diluted share, for the twelve months ended December 31, 2023.

The

Company also announced that the Board of Directors declared a quarterly cash dividend of $0.07 per share on the Company’s

common stock. The dividend will be payable on or about February 26, 2025 to shareholders of record on February 12, 2025.

James

C. Hagan, President and Chief Executive Officer, commented, “I am pleased to report the results for the fourth quarter of

2024. Our strong, diversified, core deposit base was integral in effectively managing our funding costs over the last two years

during a rising rate environment. Our disciplined approach to managing our funding costs resulted in an increase in net interest

income for the second consecutive quarter in 2024.

As

we continue to manage the balance sheet, we remain focused on identifying initiatives to mitigate top line pressures and improve

efficiencies over the Company’s long-term. In 2024, total deposits increased $118.9 million, or 5.6%, and core deposits

represented 68.9% of total deposits as compared to 2023. The loan-to-deposit ratio decreased to 91.5%. We continue to focus on

extending credit within our markets and servicing the needs of our existing customer base while ensuring new opportunities present

the appropriate levels of risk and return.

Our

asset quality remains strong, with nonaccrual loans at 0.26% of total loans, and classified loans, which we define as special

mention and substandard loans, at 1.9% of total loans as of December 31, 2024. Our loan portfolio continues to perform well and

we continue to proactively identify and manage credit risk within the loan portfolio, consistent with our prudent credit culture.

The

Company is considered to be well-capitalized and we remain disciplined in our capital management strategies. During the twelve

months ended December 31, 2024, we repurchased 934,282 shares of the Company’s common stock at an average price per share

of $7.94. We continue to believe that buying back shares represents a prudent use of the Company’s capital. We are pleased

to be able to continue to return value to shareholders through share repurchases. Although the banking environment has been challenged,

our capital management strategies have been critical to sustaining growth in book value per share, which increased to $11.30,

while tangible book value per share, a non-GAAP financial measure, increased $0.33, or 3.2%, to $10.63 at December 31, 2024.”

Hagan

concluded, “Over the last few years, the banking industry as a whole experienced challenging headwinds, however, our team

remains focused on serving our customers and supporting our community. Our commitment to strong capital and liquidity levels gives

us a strong foundation to take advantage of opportunities in the markets we serve and to enhance shareholder value in the long

term.”

Key

Highlights:

Loans

and Deposits

Total

loans increased $42.9 million, or 2.1%, from $2.0 billion at December 31, 2023 to $2.1 billion at December 31, 2024. Residential

real estate loans, including home equity loans, increased $53.5 million, or 7.4%, commercial real estate loans decreased $4.0

million, or 0.4%, commercial and industrial loans decreased $5.7 million, or 2.7%, and consumer loans decreased $1.1 million,

or 19.8%.

Total

deposits increased $118.9 million, or 5.6%, from $2.1 billion at December 31, 2023 to $2.3 billion at December 31, 2024. Core

deposits, which the Company defines as all deposits except time deposits, increased $26.7 million, or 1.7%, from $1.5 billion,

or 71.5% of total deposits, at December 31, 2023, to $1.6 billion, or 68.9% of total deposits, at December 31, 2024. Time deposits

increased $92.2 million, or 15.1%, from $611.4 million at December 31, 2023 to $703.6 million at December 31, 2024. Brokered time

deposits, which are included in time deposits, totaled $1.7 million at December 31, 2024 and at December 31, 2023. The loan-to-deposit

ratio decreased from 94.6% at December 31, 2023 to 91.5% at December 31, 2024.

Liquidity

The

Company’s liquidity position remains strong with solid core deposit relationships, cash, unencumbered securities, a diversified

deposit base and access to diversified borrowing sources. At December 31, 2024, the Company had $1.1 billion in immediately available

liquidity, compared to $643.6 million in uninsured deposits, or 28.4% of total deposits, representing a coverage ratio of 171.8%.

Uninsured

deposits of the Bank’s customers are eligible for FDIC pass-through insurance if the customer opens an IntraFi Insured Cash

Sweep account or a reciprocal time deposit through the Certificate of Deposit Account Registry System. IntraFi allows for up to

$250.0 million per customer of pass-through FDIC insurance, which would more than cover each of the Bank’s deposit customers

if such customer desired to have such pass-through insurance.

Allowance

for Credit Losses and Credit Quality

At

December 31, 2024, the allowance for credit losses was $19.5 million, or 0.94% of total loans and 362.9% of nonperforming loans,

compared to $20.3 million, or 1.00% of total loans and 315.6% of nonperforming loans, at December 31, 2023. At December 31, 2024,

nonperforming loans totaled $5.4 million, or 0.26% of total loans, compared to $6.4 million, or 0.32% of total loans, at December

31, 2023. Total delinquent loans decreased $1.0 million, or 16.7%, from $6.0 million, or 0.30% of total loans, at December 31,

2023 to $5.0 million, or 0.24% of total loans, at December 31, 2024. At December 31, 2024 and December 31, 2023, the Company did

not have any other real estate owned.

Net

Interest Margin

The

net interest margin was 2.41% for the three months ended December 31, 2024, compared to 2.40% for the three months ended September

30, 2024. The net interest margin, on a tax-equivalent basis, was 2.43% for the three months ended December 31, 2024, compared

to 2.42% for the three months ended September 30, 2024.

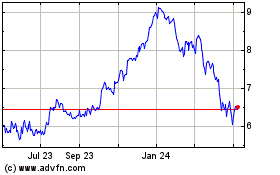

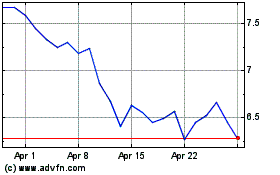

Stock

Repurchase Program

On

May 22, 2024, the Board of Directors authorized a new stock repurchase plan (the “2024 Plan”) under which the Company

may repurchase up to 1.0 million shares, or approximately 4.6%, of the Company’s then-outstanding shares of common stock.

During

the three months ended December 31, 2024, the Company repurchased 220,000 shares of common stock under the 2024 Plan, with an

average price per share of $9.00. During the twelve months ended December 31, 2024, the Company repurchased 934,282 shares of

common stock under the 2024 Plan and the previously existing share repurchase plan, as applicable, with an average price per share

of $7.94. As of December 31, 2024, there were 472,318 shares of common stock available for repurchase under the 2024 Plan.

The

repurchase of shares under the stock repurchase program is administered through an independent broker. The shares of common

stock repurchased under the 2024 Plan have been and will continue to be purchased from time to time at prevailing market prices,

through open market or privately negotiated transactions, or otherwise, depending upon market conditions. There is no guarantee

as to the exact number, or value, of shares that will be repurchased by the Company, and the Company may discontinue repurchases

at any time that the Company’s management (“Management”) determines additional repurchases are not warranted.

The timing and amount of additional share repurchases under the 2024 Plan will depend on a number of factors, including the Company’s

stock price performance, ongoing capital planning considerations, general market conditions, and applicable legal requirements.

Book

Value and Tangible Book Value

The

Company’s book value per share was $11.30 at December 31, 2024, compared to $10.96 at December 31, 2023, while tangible

book value per share, a non-GAAP financial measure, increased $0.33, or 3.2%, from $10.30 at December 31, 2023 to $10.63 at December

31, 2024. See pages 20-22 for the related tangible book value calculation and a reconciliation of GAAP to non-GAAP financial measures.

Net

Income for the Three Months Ended December 31, 2024 Compared to the Three Months Ended September 30, 2024

The

Company reported an increase in net income of $1.4 million, or 72.7%, from $1.9 million, or $0.09 per diluted share, for the three

months ended September 30, 2024, to $3.3 million, or $0.16 per diluted share, for the three months ended December 31, 2024. Net

interest income increased $545,000, or 3.7%, the provision for credit losses decreased $1.7 million, non-interest income increased

$113,000, or 3.6%, and non-interest expense increased $520,000, or 3.6%. Return on average assets and return on average equity

were 0.49% and 5.48%, respectively, for the three months ended December 31, 2024, compared to 0.29% and 3.19%, respectively, for

the three months ended September 30, 2024.

Net

Interest Income and Net Interest Margin

On

a sequential quarter basis, net interest income, our primary driver of revenues, increased $545,000, or 3.7%, to $15.3 million

for the three months ended December 31, 2024, from $14.7 million for the three months ended September 30, 2024. The increase in

net interest income was primarily due to an increase in interest income of $746,000, or 2.7%, partially offset by an increase

in interest expense of $201,000, or 1.5%.

The

net interest margin was 2.41% for the three months ended December 31, 2024, compared to 2.40% for the three months ended September

30, 2024. The net interest margin, on a tax-equivalent basis, was 2.43% for the three months ended December 31, 2024, compared

to 2.42% for the three months ended September 30, 2024. During the three months ended December 31, 2024 and during the three months

ended September 30, 2024, the Company had a fair value hedge which contributed to an increase in the net interest margin of one

basis point for the three months ended December 31, 2024, compared to an increase of seven basis points during the three months

ended September 30, 2024. Excluding the interest income attributed to the fair value hedge, the net interest margin increased

seven basis points from 2.33% for the three months ended September 30, 2024 to 2.40% for the three months ended December 31, 2024,

respectively. The fair value hedge matured in October of 2024.

The

average yield on interest-earning assets, without the impact of tax-equivalent adjustments, was 4.52% for the three months ended

December 31, 2024, compared to 4.54% for the three months ended September 30, 2024. Excluding the impact of the fair value hedge

discussed above, the average yield on interest-earnings assets, without the impact of tax-equivalent adjustments, increased four

basis points to 4.51% during the three months ended December 31, 2024, compared to 4.47% during the three months ended September

30, 2024. The average loan yield, without the impact of tax-equivalent adjustments, was 4.86% for the three months ended December

31, 2024, compared to 4.90% for the three months ended September 30, 2024. Excluding the impact of the fair value hedge discussed

above, the average yield on loans, without the impact of tax-equivalent adjustments, increased two basis points to 4.84% during

the three months ended December 31, 2024, compared to 4.82% during the three months ended September 30, 2024. During the three

months ended December 31, 2024, average interest-earning assets increased $75.8 million, or 3.1% to $2.5 billion, primarily due

to an increase in average loans of $24.2 million, or 1.2%, an increase in average short-term investments, consisting of cash and

cash equivalents, of $44.8 million, or 139.7%, and an increase in average securities of $6.8 million, or 1.9%.

The

average cost of total funds, including non-interest bearing accounts and borrowings, decreased four basis points from 2.24% for

the three months ended September 30, 2024 to 2.20% for the three months ended December 31, 2024. The average cost of core deposits,

which the Company defines as all deposits except time deposits, increased five basis points to 0.98% for the three months ended

December 31, 2024, from 0.93% for the three months ended September 30, 2024. The average cost of time deposits decreased 13 basis

points from 4.44% for the three months ended September 30, 2024, to 4.31% for the three months ended December 31, 2024. The average

cost of borrowings, including subordinated debt, decreased one basis point from 5.05% for the three months ended September 30,

2024 to 5.04% for the three months ended December 31, 2024. Average demand deposits, an interest-free source of funds, increased

$20.0 million, or 3.6%, from $559.2 million, or 25.7% of total average deposits, for the three months ended September 30, 2024,

to $579.2 million, or 25.6% of total average deposits, for the three months ended December 31, 2024.

Provision

for (Reversal of) Credit Losses

During

the three months ended December 31, 2024, the Company recorded a reversal of credit losses of $762,000, compared to a provision

for credit losses of $941,000 during the three months ended September 30, 2024. The provision for credit losses includes a reversal

of credit losses on loans of $553,000 and a reversal of credit losses on unfunded loan commitments of $209,000. The reversal of

credit losses on loans was due to changes in the economic environment and related adjustments to the quantitative components of

the CECL methodology as well as changes in the loan portfolio mix. The provision for credit losses was determined by a number

of factors: the continued strong credit performance of the Company’s loan portfolio, changes in the loan portfolio mix and

Management’s consideration of existing economic conditions and the economic outlook from the Federal Reserve’s actions

to control inflation. The decrease in reserves on unfunded loan commitments was due to an decrease in commercial real estate unfunded

loan commitments of $19.5 million, or 10.0%, from $195.3 million at September 30, 2024 to $175.8 million at December 31,

2024. Management continues to monitor macroeconomic variables related to increasing interest rates, inflation and the concerns

of an economic downturn, and believes it is appropriately reserved for the current economic environment.

During

the three months ended December 31, 2024, the Company recorded net recoveries of $128,000, compared to net charge-offs of $98,000

for the three months ended September 30, 2024.

Non-Interest

Income

On

a sequential quarter basis, non-interest income increased $113,000, or 3.6%, to $3.3 million for the three months ended December

31, 2024, from $3.1 million for the three months ended September 30, 2024. During the three months ended December 31, 2024, service

charges and fees on deposits decreased $40,000, or 1.7%, to $2.3 million from the three months ended September 30, 2024. Income

from bank-owned life insurance (“BOLI”) increased $16,000, or 3.4%, from the three months ended September 30, 2024

to $486,000 for the three months ended December 31, 2024. During the three months ended December 31, 2024, the Company reported

$187,000 in other income from loan-level swap fees on commercial loans, compared to $74,000 during the three months ended September

30, 2024. During the three months ended December 31, 2024, the Company reported a loss of $11,000 from mortgage banking activities,

compared to income from mortgage banking activities of $246,000, during the three months ended September 30, 2024. During the

three months ended December 31, 2024, the Company reported unrealized losses on marketable equity securities of $9,000, compared

to unrealized gains of $10,000, during the three months ended September 30, 2024. During the three months ended December 31, 2024,

the Company reported gains on non-marketable equity investments of $300,000 and did not have comparable income during the three

months ended September 30, 2024.

Non-Interest

Expense

For

the three months ended December 31, 2024, non-interest expense increased $520,000, or 3.6%, to $14.9 million from $14.4 million

for the three months ended September 30, 2024. Salaries and related benefits increased $317,000, or 3.9%, primarily related to

incentive compensation accrual adjustments due to revised payout estimates and an increase in health insurance benefits. FDIC

insurance expense increased $51,000, or 15.1%, occupancy expense increased $39,000, or 3.2%, primarily due to snow removal costs

of $47,000, advertising expense increased $39,000, or 14.4%, data processing expense increased $31,000, or 3.6%, software expenses

increased $30,000, or 4.9%, furniture and equipment expense increased $22,000, or 4.6%, and other non-interest expense increased

$116,000, or 8.8%. These increases were partially offset by a decrease in professional fees of $69,000, or 12.8%, and a decrease

in debit card processing and ATM network costs of $56,000, or 8.6%.

For

the three months ended December 31, 2024 and the three months ended September 30, 2024, the efficiency ratio was 80.6%. For the

three months ended December 31, 2024, the adjusted efficiency ratio, a non-GAAP financial measure, was 81.9% compared to 80.7%

for the three months ended September 30, 2024. The increase in the adjusted efficiency ratio was driven by higher expenses during

the three months ended December 31, 2024. See pages 20-22 for the related adjusted efficiency ratio calculation and a reconciliation

of GAAP to non-GAAP financial measures.

Income

Tax Provision

Income

tax expense for the three months ended December 31, 2024 was $1.1 million, with an effective tax rate of 24.6%, compared to $618,000,

with an effective tax rate of 24.5%, for the three months ended September 30, 2024.

Net

Income for the Three Months Ended December 31, 2024 Compared to the Three Months Ended December 31, 2023

The

Company reported net income of $3.3 million, or $0.16 per diluted share, for the three months ended December 31, 2024, compared

to net income of $2.5 million, or $0.12 per diluted share, for the three months ended December 31, 2023. Net interest income decreased

$903,000, or 5.6%, provision for credit losses decreased $1.2 million, non-interest income increased $540,000, or 19.9%, and non-interest

expense increased $141,000, or 1.0%, during the same period. Return on average assets and return on average equity were 0.49%

and 5.48%, respectively, for the three months ended December 31, 2024, compared to 0.39% and 4.31%, respectively, for the three

months ended December 31, 2023.

Net

Interest Income and Net Interest Margin

Net

interest income decreased $903,000, or 5.6%, to $15.3 million, for the three months ended December 31, 2024, from $16.2 million

for the three months ended December 31, 2023. The decrease in net interest income was due to an increase in interest expense of

$2.7 million, or 25.7%, partially offset by an increase in interest and dividend income of $1.8 million, or 6.8%. During the three

months ended December 31, 2024 and the three months ended December 31, 2023, the Company had a fair value hedge which contributed

$74,000 to interest income during the three months ended December 31, 2024, compared to $459,000 during the three months ended

December 31, 2023. The fair value hedge matured in October of 2024. The increase in interest expense was a result of competitive

pricing on deposits due to the continued high interest rate environment and the unfavorable shift in the deposit mix from low

cost core deposits to high cost time deposits.

The

net interest margin was 2.41% for the three months ended December 31, 2024, compared to 2.64% for the three months ended December

31, 2023. The net interest margin, on a tax-equivalent basis, was 2.43% for the three months ended December 31, 2024, compared

to 2.66% for the three months ended December 31, 2023. The decrease in the net interest margin was primarily due to an increase

in the average cost of interest-bearing liabilities and the unfavorable shift in the deposit mix from low cost core deposits to

high cost time deposits, which was partially offset by an increase in the average yield on interest-earning assets. During the

three months ended December 31, 2024, the Company had a fair value hedge which contributed to an increase in the net interest

margin of one basis point, compared to an increase of eight basis points during the three months ended December 31, 2023. The

fair value hedge matured in October of 2024.

The

average yield on interest-earning assets, without the impact of tax-equivalent adjustments, was 4.52% for the three months ended

December 31, 2024, compared to 4.38% for the three months ended December 31, 2023. The average loan yield, without the impact

of tax-equivalent adjustments, was 4.86% for the three months ended December 31, 2024, compared to 4.71% for the three months

ended December 31, 2023. During the three months ended December 31, 2024, average interest-earning assets increased $89.9 million,

or 3.7%, to $2.5 billion, primarily due to an increase in average loans of $45.7 million, or 2.3%, an increase in average short-term

investments, consisting of cash and cash equivalents, of $34.0 million, or 79.3%, an increase in average securities of $6.4 million,

or 1.8%, and an increase in average other investments of $3.8 million, or 31.4%.

The

average cost of total funds, including non-interest bearing accounts and borrowings, increased 39 basis points from 1.81% for

the three months ended December 31, 2023, to 2.20% for the three months ended December 31, 2024. The average cost of core deposits,

which the Company defines as all deposits except time deposits, increased 22 basis points to 0.98% for the three months ended

December 31, 2024, from 0.76% for the three months ended December 31, 2023. The average cost of time deposits increased 53 basis

points from 3.78% for the three months ended December 31, 2023 to 4.31% for the three months ended December 31, 2024. The average

cost of borrowings, including subordinated debt, increased 21 basis points from 4.83% for the three months ended December 31,

2023 to 5.04% for the three months ended December 31, 2024. Average demand deposits, an interest-free source of funds, decreased

$9.6 million, or 1.6%, from $588.7 million, or 27.0% of total average deposits, for the three months ended December 31, 2023,

to $579.2 million, or 25.6% of total average deposits, for the three months ended December 31, 2024.

Provision

for (Reversal of) Credit Losses

During

the three months ended December 31, 2024, the Company recorded a reversal of credit losses of $762,000, compared to a provision

for credit losses of $486,000 during the three months ended December 31, 2023. The decrease was primarily due to a decrease in

unfunded commercial real estate loan commitments, as well as changes in the economic environment and related adjustments to the

quantitative components of the CECL methodology. The provision for credit losses was determined by a number of factors: the continued

strong credit performance of the Company’s loan portfolio, changes in the loan portfolio mix and Management’s consideration

of existing economic conditions and the economic outlook from the Federal Reserve’s actions to control inflation. Management

continues to monitor macroeconomic variables related to increasing interest rates, inflation and the concerns of an economic downturn,

and believes it is appropriately reserved for the current economic environment.

The

Company recorded net recoveries of $128,000 for the three months ended December 31, 2024, as compared to net charge-offs of $136,000

for the three months ended December 31, 2023.

Non-Interest

Income

Non-interest

income increased $540,000, or 19.9%, from $2.7 million for the three months ended December 31, 2023, to $3.3 million for the three

months ended December 31, 2024. Service charges and fees on deposits increased $18,000, or 0.8%, and income from BOLI increased

$54,000, or 12.5%, from the three months ended December 31, 2023 to the three months ended December 31, 2024. During the three

months ended December 31, 2024, the Company reported $187,000 in other income from loan-level swap fees on commercial loans and

did not have comparable income during the three months ended December 31, 2023. During the three months ended December 31, 2024,

the Company reported a loss of $11,000 from mortgage banking activities and did not have comparable loss during the three months

ended December 31, 2023. During the three months ended December 31, 2024 and the three months ended December 31, 2023, the Company

reported $9,000 and $1,000, respectively, in unrealized losses on marketable equity securities. During the three months ended

December 31, 2024, the Company reported a gain on non-marketable equity investments of $300,000 and did not have comparable non-interest

income during the three months ended December 31, 2023.

Non-Interest

Expense

For

the three months ended December 31, 2024, non-interest expense increased $141,000, or 1.0%, to $14.9 million from $14.8 million

for the three months ended December 31, 2023. During the three months ended December 31, 2023, the Company reached an agreement-in-principle

to settle purported class action lawsuits concerning the Company’s deposit products and related disclosures, specifically

involving overdraft fees and insufficient funds fees. This agreement-in-principle reflects our business decision to avoid the

costs, uncertainties and distractions of further litigation. Excluding the legal settlement accrual of $510,000 during the three

months ended December 31, 2023, non-interest expense increased $651,000, or 4.6%, from $14.3 million for the three months ended

December 31, 2023 to $14.9 million for the three months ended December 31, 2024.

Salaries

and related benefits increased $690,000, or 8.9%, to $8.4 million, primarily related to incentive compensation accrual adjustments

due to revised payout estimates and annual merit increases. Data processing expense increased $112,000, or 14.2%, occupancy expense

increased $58,000, or 4.8%, FDIC insurance expense increased $51,000, or 15.1%, software related expenses increased $44,000, or

7.4%, debit card processing and ATM network costs increased $34,000, or 6.0%, and furniture and equipment related expenses increased

$11,000, or 2.2%. These increases were partially offset by a decrease in professional fees of $203,000, or 30.1%, a decrease in

advertising expense of $67,000, or 17.8%, and a decrease in other non-interest expense of $589,000, or 29.1%. Excluding the $510,000

legal settlement accrual, other non-interest expense decreased $79,000, or 5.2%.

For

the three months ended December 31, 2024, the efficiency ratio was 80.6%, compared to 78.3% for the three months ended December

31, 2023. For the three months ended December 31, 2024, the adjusted efficiency ratio, a non-GAAP financial measure, was 81.9%

compared to 78.3% for the three months ended December 31, 2023. The increase in the efficiency ratio and the non-GAAP adjusted

efficiency ratio was primarily driven by lower revenues during the three months ended December 31, 2024, compared to the three

months ended December 31, 2023. See pages 20-22 for the related adjusted efficiency ratio calculation and a reconciliation of

GAAP to non-GAAP financial measures.

Income

Tax Provision

For

the three months ended December 31, 2024, income tax expense was $1.1 million, with an effective tax rate of 24.6%, compared to

$1.1 million, with an effective tax rate of 30.6%, for the three months ended December 31, 2023. For the three months ended December

31, 2023, the effective tax rate was negatively impacted by discrete items totaling $285,000.

Net

Income for the Twelve Months Ended December 31, 2024 Compared to the Twelve Months Ended December 31, 2023

For

the twelve months ended December 31, 2024, the Company reported net income of $11.7 million, or $0.56 per diluted share, compared

to $15.1 million, or $0.70 per diluted share, for the twelve months ended December 31, 2023. Net interest income decreased $8.1

million, or 11.9%, provision for credit losses decreased $1.5 million, non-interest income increased $2.0 million, or 18.4%, and

non-interest expense increased $78,000, or 0.1%, during the same period in 2023. Return on average assets and return on average

equity were 0.45% and 4.93% for the twelve months ended December 31, 2024, respectively, compared to 0.59% and 6.47% for the twelve

months ended December 31, 2023, respectively.

Net

Interest Income and Net Interest Margin

During

the twelve months ended December 31, 2024, net interest income decreased $8.1 million, or 11.9%, to $59.8 million, compared to

$67.9 million for the twelve months ended December 31, 2023. The decrease in net interest income was primarily due to an increase

in interest expense of $16.8 million, or 50.6%, partially offset by an increase in interest and dividend income of $8.7 million,

or 8.6%.

The

net interest margin for the twelve months ended December 31, 2024 was 2.45%, compared to 2.82% for the twelve months ended December

31, 2023. The net interest margin, on a tax-equivalent basis, was 2.47% for the twelve months ended December 31, 2024, compared

to 2.84% for the twelve months ended December 31, 2023.

The

average yield on interest-earning assets, without the impact of tax-equivalent adjustments, increased 30 basis points from 4.20%

for the twelve months ended December 31, 2023 to 4.50% for the twelve months ended December 31, 2024. The average yield on loans,

without the impact of tax-equivalent adjustments, increased 32 basis points from 4.54% for the twelve months ended December 31,

2023 to 4.86% for the twelve months ended December 31, 2024. During the twelve months ended December 31, 2024, average interest-earning

assets increased $33.5 million, or 1.4%, to $2.4 billion, compared to the twelve months ended December 31, 2023, primarily due

to an increase in average loans of $29.0 million, or 1.4%, an increase in average short-term investments, consisting of cash and

cash equivalents, of $12.8 million, or 62.5%, and an increase in average other investments of $2.2 million, or 18.1%, partially

offset by a decrease in average securities of $10.6 million, or 2.9%.

During

the twelve months ended December 31, 2024, the average cost of funds, including non-interest-bearing demand accounts and borrowings,

increased 70 basis points from 1.44% for the twelve months ended December 31, 2023 to 2.14%. For the twelve months ended December

31, 2024, the average cost of core deposits, including non-interest-bearing demand deposits, increased 24 basis points from 0.65%

for the twelve months ended December 31, 2023, to 0.89%. The average cost of time deposits increased 129 basis points from 3.03%

for the twelve months ended December 31, 2023 to 4.32% for the twelve months ended December 31, 2024. The average cost of borrowings,

which include borrowings and subordinated debt, increased 16 basis points from 4.84% for the twelve months ended December 31,

2023 to 5.00% for the twelve months ended December 31, 2024.

For

the twelve months ended December 31, 2024, average demand deposits, an interest-free source of funds, decreased $41.4 million,

or 6.9%, from $602.7 million, or 27.8% of total average deposits, for the twelve months ended December 31, 2023, to $561.3 million,

or 25.8% of total average deposits.

Provision

for (Reversal of) Credit Losses

During

the twelve months ended December 31, 2024, the Company recorded a reversal of credit losses of $665,000, compared to a provision

for credit losses of $872,000 during the twelve months ended December 31, 2023. The decrease in reserves was primarily due to

changes in the economic environment and related adjustments to the quantitative components of the CECL methodology. During the

twelve months ended December 31, 2024, the Company recorded net recoveries of $87,000, compared to net charge-offs of $2.0 million

for the twelve months ended December 31, 2023. The charge-offs during the twelve months ended December 31, 2023 were related to

one commercial relationship acquired in October 2016 from Chicopee Bancorp, Inc. Specifically, the Company recorded a $1.9 million

charge-off on the acquired commercial relationship, which represented the non-accretable credit mark that was required to be grossed-up

to the loan’s amortized cost basis with a corresponding increase to the allowance for credit losses under the CECL implementation.

The

decrease in the provision for credit losses was primarily due to changes in the loan mix as well as economic environment and related

adjustments to the quantitative components of the CECL methodology. The provision for credit losses was determined by a number

of factors: the continued strong credit performance of the Company’s loan portfolio, changes in the loan portfolio mix and

Management’s consideration of existing economic conditions and the economic outlook from the Federal Reserve’s actions

to control inflation. Management continues to monitor macroeconomic variables related to increasing interest rates, inflation

and the concerns of an economic downturn, and believes it is appropriately reserved for the current economic environment.

Non-Interest

Income

For

the twelve months ended December 31, 2024, non-interest income increased $2.0 million, or 18.4%, from $10.9 million for the twelve

months ended December 31, 2023 to $12.9 million. During the twelve months ended December 31, 2023, the Company recorded a non-recurring

final termination expense of $1.1 million related to the defined benefit pension plan termination. During the twelve months ended,

December 31, 2023, the Company also recorded a non-taxable gain of $778,000 on BOLI death benefits and did not have a comparable

gain during the twelve months ended December 31, 2024. Excluding the defined benefit pension plan termination expense and the

BOLI death benefit, non-interest income increased $1.6 million, or 14.6%.

During

the twelve months ended December 31, 2024, service charges and fees increased $346,000, or 3.9%, and income from BOLI increased

$91,000, or 5.0%, from $1.8 million for the twelve months ended December 31, 2023 to $1.9 million. During the twelve months ended

December 31, 2024, the Company recorded other income from loan-level swap fees on commercial loans of $261,000 and did not have

comparable income during the twelve months ended December 31, 2023. During the twelve months ended December 31, 2024, the Company

reported a gain of $1.3 million on non-marketable equity investments, compared to a gain of $590,000 during the twelve months

ended December 31, 2023. During the twelve months ended December 31, 2024, the Company reported a loss on the disposal of premises

and equipment of $6,000, compared to a loss of $3,000 during the twelve months ended December 31, 2023. During the twelve months

ended December 31, 2023, the Company also reported unrealized losses on marketable equity securities of $1,000, compared to unrealized

gains on marketable equity securities of $13,000 during the twelve months ended December 31, 2024.

Non-Interest

Expense

For

the twelve months ended December 31, 2024, non-interest expense increased $78,000, or 0.1%, to $58.4 million from the twelve months

ended December 31, 2023. During the twelve months ended December 31, 2023, the Company reached an agreement-in-principle to settle

purported class action lawsuits concerning the Company’s deposit products and related disclosures, specifically involving

overdraft fees and insufficient funds fees. This agreement-in-principle reflects our business decision to avoid the costs, uncertainties

and distractions of further litigation. Excluding the legal settlement accrual of $510,000, non-interest expense increased $588,000,

or 1.0%, from $57.8 million for the twelve months ended December 31, 2023 to $58.4 million for the twelve months ended December

31, 2024.

During

the same period, salaries and related benefits increased $472,000, or 1.5%, software expenses increased $208,000, or 9.0%, data

processing expense increased $320,000, or 10.1%, debit card processing and ATM network costs increased $298,000, or 13.9%, occupancy

expense increased $146,000, or 3.0%, due to higher repair and maintenance costs, real estate taxes, and depreciation expense.

FDIC insurance expense increased $139,000, or 10.5%. These increases were partially offset by a decrease in professional fees

of $571,000, or 20.9%, which is comprised of legal fees, audit and other professional fees. During the three months ended December

31, 2023, professional fees included legal fees related to the settlement of the purported class action lawsuits. Advertising

expense decreased $226,000, or 15.1%, and other non-interest expense, excluding the $510,000 legal settlement accrual, decreased

$199,000, or 3.5%.

For

the twelve months ended December 31, 2024, the efficiency ratio was 80.4%, compared to 74.0% for the twelve months ended December

31, 2023. For the twelve months ended December 31, 2024, the adjusted efficiency ratio, a non-GAAP financial measure, was 81.8%,

compared to 74.3% for the twelve months ended December 31, 2023. See pages 20-22 for the related efficiency ratio calculations

and a reconciliation of GAAP to non-GAAP financial measures.

Income

Tax Provision

For

the twelve months ended December 31, 2024, income tax expense was $3.3 million, with an effective tax rate of 22.0%, compared

to $4.5 million, with an effective tax rate of 23.1%, for twelve months ended December 31, 2023. The decrease in income tax expense

for the twelve months ended December 31, 2024 compared to the twelve months December 31, 2023 was due to lower income before taxes

in 2024.

Balance

Sheet

At

December 31, 2024, total assets were $2.7 billion, an increase of $88.5 million, or 3.5%, from December 31, 2023. The increase

in total assets was primarily due to an increase in total loans of $42.9 million, or 2.1%, an increase in cash and cash equivalents

of $37.6 million, or 130.4%, and an increase in investment securities of $5.5 million, or 1.5%.

Investments

At

December 31, 2024, the investment securities portfolio totaled $366.1 million, or 13.8% of total assets, compared to $360.7 million,

or 14.1% of total assets, at December 31, 2023. At December 31, 2024, the Company’s available-for-sale securities portfolio,

recorded at fair market value, increased $23.6 million, or 17.2%, from $137.1 million at December 31, 2023 to $160.7 million.

The held-to-maturity securities portfolio, recorded at amortized cost, decreased $18.4 million, or 8.2%, from $223.4 million at

December 31, 2023 to $205.0 million at December 31, 2024.

At

December 31, 2024, the Company reported unrealized losses on the available-for-sale securities portfolio of $31.2 million, or

16.2% of the amortized cost basis of the available-for-sale securities portfolio, compared to unrealized losses of $29.2 million,

or 17.5% of the amortized cost basis of the available-for-sale securities at December 31, 2023. At December 31, 2024, the Company

reported unrealized losses on the held-to-maturity securities portfolio of $39.4 million, or 19.2% of the amortized cost basis

of the held-to-maturity securities portfolio, compared to $35.7 million, or 16.0% of the amortized cost basis of the held-to-maturity

securities portfolio at December 31, 2023.

The

securities in which the Company may invest are limited by regulation. Federally chartered savings banks have authority to invest

in various types of assets, including U.S. Treasury obligations, securities of various government-sponsored enterprises, mortgage-backed

securities, certain certificates of deposit of insured financial institutions, repurchase agreements, overnight and short-term

loans to other banks, corporate debt instruments and marketable equity securities. The securities, with the exception of $4.6

million in corporate bonds, are issued by the United States government or government-sponsored enterprises and are therefore either

explicitly or implicitly guaranteed as to the timely payment of contractual principal and interest. These positions are deemed

to have no credit impairment, therefore, the disclosed unrealized losses with the securities portfolio relate primarily to changes

in prevailing interest rates. In all cases, price improvement in future periods will be realized as the issuances approach maturity.

Management

regularly reviews the portfolio for securities in an unrealized loss position. At December 31, 2024 and December 31, 2023, the

Company did not record any credit impairment charges on its securities portfolio and attributed the unrealized losses primarily

due to fluctuations in general interest rates or changes in expected prepayments and not due to credit quality. The primary objective

of the Company’s investment portfolio is to provide liquidity and to secure municipal deposit accounts while preserving

the safety of principal. The available-for-sale and held-to-maturity portfolios are both eligible for pledging to the Federal

Home Loan Bank (“FHLB”) as collateral for borrowings. The portfolios are comprised of high-credit quality investments

and both portfolios generated cash flows monthly from interest, principal amortization and payoffs, which support’s the

Bank's objective to provide liquidity.

Total

Loans

Total

loans increased $42.9 million, or 2.1%, from December 31, 2023, to $2.1 billion at December 31, 2024. The increase in total loans

was due to an increase in residential real estate loans, including home equity loans, of $53.5 million, or 7.4%, partially offset

by a decrease in commercial real estate loans of $4.0 million, or 0.4%, a decrease in commercial and industrial loans of $5.7

million, or 2.7% and a decrease in consumer loans of $1.1 million, or 19.8%. During the twelve months ended December 31, 2024,

the Company sold $20.1 million in fixed rate residential loans to the secondary market with servicing retained.

The

following table presents the summary of the loan portfolio by the major classification of the loan at the periods indicated:

| | |

December 31, 2024 | | |

December 31, 2023 | |

| | |

(Dollars in thousands) | |

| Commercial real estate loans: | |

| | | |

| | |

| Non-owner occupied | |

$ | 880,828 | | |

$ | 881,643 | |

| Owner-occupied | |

| 194,904 | | |

| 198,108 | |

| Total commercial real estate loans | |

| 1,075,732 | | |

| 1,079,751 | |

| | |

| | | |

| | |

| Residential real estate loans: | |

| | | |

| | |

| Residential | |

| 653,802 | | |

| 612,315 | |

| Home equity | |

| 121,857 | | |

| 109,839 | |

| Total residential real estate loans | |

| 775,659 | | |

| 722,154 | |

| | |

| | | |

| | |

| Commercial and industrial loans | |

| 211,656 | | |

| 217,447 | |

| | |

| | | |

| | |

| Consumer loans | |

| 4,391 | | |

| 5,472 | |

| Total gross loans | |

| 2,067,438 | | |

| 2,024,824 | |

| Unamortized premiums and net deferred loans fees and costs | |

| 2,751 | | |

| 2,493 | |

| Total loans | |

$ | 2,070,189 | | |

$ | 2,027,317 | |

Credit

Quality

Management

continues to closely monitor the loan portfolio for any signs of deterioration in borrowers’ financial condition and also

in light of speculation that commercial real estate values may deteriorate as the market continues to adjust to higher vacancies

and interest rates. We continue to proactively take steps to mitigate risk in our loan portfolio.

Total

delinquency was $5.0 million, or 0.24% of total loans, at December 31, 2024, compared to $6.0 million, or 0.30% of total loans

at December 31, 2023. At December 31, 2024, nonperforming loans totaled $5.4 million, or 0.26% of total loans, compared to $6.4

million, or 0.32% of total loans, at December 31, 2023. At December 31, 2024 and December 31, 2023, there were no loans 90 or

more days past due and still accruing interest. Total nonperforming assets totaled $5.4 million, or 0.20% of total assets, at

December 31, 2024, compared to $6.4 million, or 0.25% of total assets, at December 31, 2023. At December 31, 2024 and December

31, 2023, the Company did not have any other real estate owned. At December 31, 2024, the allowance for credit losses was $19.5

million, or 0.94% of total loans and 362.9% of nonperforming loans, compared to $20.3 million, or 1.00% of total loans and 315.6%

of nonperforming loans, at December 31, 2023. Total classified loans, defined as special mention and substandard loans, decreased

$1.1 million, or 2.8%, from $39.5 million, or 1.9% of total loans, at December 31, 2023 to $38.4 million, or 1.9% of total loans,

at December 31, 2024. Our commercial real estate portfolio is comprised of diversified property types and primarily within our

geographic footprint. At December 31, 2024, the commercial real estate portfolio totaled $1.1 billion, and represented 52.0% of

total loans. Of the $1.1 billion, $880.8 million, or 81.9%, was categorized as non-owner occupied commercial real estate and represented

325.2% of the Bank’s total risk-based capital. More details on the diversification of the loan portfolio are available in

the supplementary earnings presentation.

Deposits

Total

deposits increased $118.9 million, or 5.6%, from $2.1 billion at December 31, 2023 to $2.3 billion at December 31, 2024. Core

deposits, which the Company defines as all deposits except time deposits, increased $26.7 million, or 1.7%, from $1.5 billion,

or 71.5% of total deposits, at December 31, 2023, to $1.6 billion, or 68.9% of total deposits, at December 31, 2024. Non-interest-bearing

deposits decreased $14.0 million, or 2.4%, to $565.6 million, and represent 25.0% of total deposits, money market accounts increased

$27.1 million, or 4.3%, to $661.5 million, savings accounts decreased $5.8 million, or 3.1%, to $181.6 million and interest-bearing

checking accounts increased $19.3 million, or 14.7%, to $150.3 million.

Time

deposits increased $92.2 million, or 15.1%, from $611.4 million at December 31, 2023 to $703.6 million at December 31, 2024. Brokered

time deposits, which are included in time deposits, totaled $1.7 million at December 31, 2024 and at December 31, 2023. The Company

has experienced growth and movement in both money market accounts and time deposits as a result of relationship pricing, the current

interest rate environment, and customer behaviors, as opposed to time deposit specials or interest rate adjustments. We continue

our disciplined and focused approach to core relationship management and customer outreach to meet funding requirements and liquidity

needs, with an emphasis on retaining a long-term customer relationship base by competing for and retaining deposits in our local

market. At December 31, 2024, the Bank’s uninsured deposits represented 28.4% of total deposits, compared to 26.8% at December

31, 2023.

The

table below is a summary of our deposit balances for the periods noted:

| | |

December 31, 2024 | | |

September 30, 2024 | | |

December 31, 2023 | |

| | |

(Dollars in thousands) | |

| Core Deposits: | |

| | | |

| | | |

| | |

| Demand accounts | |

$ | 565,620 | | |

$ | 568,685 | | |

$ | 579,595 | |

| Interest-bearing accounts | |

| 150,348 | | |

| 140,332 | | |

| 131,031 | |

| Savings accounts | |

| 181,618 | | |

| 179,214 | | |

| 187,405 | |

| Money market accounts | |

| 661,478 | | |

| 635,824 | | |

| 634,361 | |

| Total Core Deposits | |

$ | 1,559,064 | | |

$ | 1,524,055 | | |

$ | 1,532,392 | |

| Time Deposits: | |

| 703,583 | | |

| 700,151 | | |

| 611,352 | |

| Total Deposits: | |

$ | 2,262,647 | | |

$ | 2,224,206 | | |

$ | 2,143,744 | |

FHLB

and Subordinated Debt

At

December 31, 2024, total borrowings decreased $33.4 million, or 21.3%, from $156.5 million at December 31, 2023 to $123.1 million.

At December 31, 2024, short-term borrowings decreased $10.7 million, or 66.5%, to $5.4 million, compared to $16.1 million at December

31, 2023. Long-term borrowings decreased $22.6 million, or 18.8%, from $120.6 million at December 31, 2023 to $98.0 million at

December 31, 2024. At December 31, 2024 and December 31, 2023, borrowings also consisted of $19.8 million and $19.7 million, respectively,

in fixed-to-floating rate subordinated notes.

The

Company utilized the Bank Term Funding Program (“BTFP”), which was created in March 2023 to enhance banking system

liquidity by allowing institutions to pledge certain securities at par value and borrow at a rate of ten basis points over the

one-year overnight index swap rate. The BTFP was available to federally insured depository institutions in the U.S., with advances

having a term of up to one year with no prepayment penalties. The BTFP ceased extending new advances in March 2024. At December

31, 2023, the Company’s outstanding balance under the BTFP was $90.0 million. There was no outstanding balance under the

BTFP at December 31, 2024.

As

of December 31, 2024, the Company had $461.6 million of additional borrowing capacity at the Federal Home Loan Bank, $382.9

million of additional borrowing capacity under the Federal Reserve Bank Discount Window and $25.0 million of other unsecured

lines of credit with correspondent banks.

Capital

At

December 31, 2024, shareholders’ equity was $235.9 million, or 8.9% of total assets, compared to $237.4 million, or 9.3%

of total assets, at December 31, 2023. The change was primarily attributable to an increase in accumulated other comprehensive

loss of $1.5 million, cash dividends paid of $5.9 million, repurchase of shares at a cost of $7.8 million, partially offset by

net income of $11.7 million. At December 31, 2024, total shares outstanding were 20,875,713. The Company’s regulatory capital

ratios continue to be strong and in excess of regulatory minimum requirements to be considered well-capitalized as defined by

regulators and internal Company targets.

| | |

December 31, 2024 | | |

December 31, 2023 | |

| | |

Company | | |

Bank | | |

Company | | |

Bank | |

| Total Capital (to Risk Weighted Assets) | |

| 14.38 | % | |

| 13.65 | % | |

| 14.67 | % | |

| 13.94 | % |

| Tier 1 Capital (to Risk Weighted Assets) | |

| 12.37 | % | |

| 12.64 | % | |

| 12.59 | % | |

| 12.88 | % |

| Common Equity Tier 1 Capital (to Risk Weighted Assets) | |

| 12.37 | % | |

| 12.64 | % | |

| 12.59 | % | |

| 12.88 | % |

| Tier 1 Leverage Ratio (to Adjusted Average Assets) | |

| 9.14 | % | |

| 9.34 | % | |

| 9.40 | % | |

| 9.62 | % |

Dividends

Although

the Company has historically paid quarterly dividends on its common stock and currently intends to continue to pay such dividends,

the Company’s ability to pay such dividends depends on a number of factors, including restrictions under federal laws and

regulations on the Company’s ability to pay dividends, and as a result, there can be no assurance that dividends will continue

to be paid in the future.

About

Western New England Bancorp, Inc.

Western

New England Bancorp, Inc. is a Massachusetts-chartered stock holding company and the parent company of Westfield Bank, CSB Colts,

Inc., Elm Street Securities Corporation, WFD Securities, Inc. and WB Real Estate Holdings, LLC. Western New England Bancorp, Inc.

and its subsidiaries are headquartered in Westfield, Massachusetts and operate 25 banking offices throughout western Massachusetts

and northern Connecticut. To learn more, visit our website at www.westfieldbank.com.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, with respect to the Company’s financial

condition, liquidity, results of operations, future performance, and business. Forward-looking statements may be identified by

the use of such words as “believe,” “expect,” “anticipate,” “should,” “planned,”

“estimated,” and “potential.” Examples of forward-looking statements include, but are not limited

to, estimates with respect to our financial condition, results of operations and business that are subject to various factors

which could cause actual results to differ materially from these estimates. These factors include, but are not limited to:

| ● | unpredictable

changes in general economic or political conditions, financial markets, fiscal, monetary and regulatory policies, including actual

or potential stress in the banking industry; |

| ● | the

duration and scope of potential pandemics, including the emergence of new variants and the response thereto; |

| ● | unstable

political and economic conditions which could materially impact credit quality trends and the ability to generate loans and gather

deposits; |

| ● | inflation

and governmental responses to inflation, including recent sustained increases and potential future increases in interest rates

that reduce margins; |

| ● | the

effect on our operations of governmental legislation and regulation, including changes in accounting regulation or standards,

the nature and timing of the adoption and effectiveness of new requirements under the Dodd-Frank Wall Street Reform and Consumer

Protection Act of 2010, Basel guidelines, capital requirements and other applicable laws and regulations; |

| ● | significant

changes in accounting, tax or regulatory practices or requirements; |

| ● | new

legal obligations or liabilities or unfavorable resolutions of litigation; |

| ● | disruptive

technologies in payment systems and other services traditionally provided by banks; |

| ● | the

highly competitive industry and market area in which we operate; |

| ● | operational

risks or risk management failures by us or critical third parties, including without limitation with respect to data processing,

information systems, cybersecurity, technological changes, vendor issues, business interruption, and fraud risks; |

| ● | failure

or circumvention of our internal controls or procedures; |

| ● | changes

in the securities markets which affect investment management revenues; |

| ● | increases

in Federal Deposit Insurance Corporation deposit insurance premiums and assessments; |

| ● | the

soundness of other financial services institutions which may adversely affect our credit risk; |

| ● | certain

of our intangible assets may become impaired in the future; |

| ● | new

lines of business or new products and services, which may subject us to additional risks; |

| ● | changes

in key management personnel which may adversely impact our operations; |

| ● | severe

weather, natural disasters, acts of war or terrorism and other external events which could significantly impact our business;

and |

| ● | other

risk factors detailed from time to time in our SEC filings. |

Although

we believe that the expectations reflected in such forward-looking statements are reasonable, actual results may differ materially

from the results discussed in these forward-looking statements. You are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. We do not undertake any obligation to republish revised forward-looking statements

to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except to the extent

required by law.

WESTERN NEW ENGLAND BANCORP, INC. AND

SUBSIDIARIES

Consolidated Statements of Net Income

and Other Data

(Dollars in thousands, except per share

data)

(Unaudited)

| | |

Three Months Ended | | |

Twelve Months Ended | |

| | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2024 | | |

2024 | | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| INTEREST AND DIVIDEND INCOME: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans | |

$ | 25,183 | | |

$ | 25,134 | | |

$ | 24,340 | | |

$ | 24,241 | | |

$ | 23,939 | | |

$ | 98,898 | | |

$ | 91,169 | |

| Securities | |

| 2,273 | | |

| 2,121 | | |

| 2,141 | | |

| 2,114 | | |

| 2,094 | | |

| 8,649 | | |

| 8,370 | |

| Other investments | |

| 214 | | |

| 189 | | |

| 148 | | |

| 136 | | |

| 140 | | |

| 687 | | |

| 558 | |

| Short-term investments | |

| 916 | | |

| 396 | | |

| 173 | | |

| 113 | | |

| 597 | | |

| 1,598 | | |

| 1,021 | |

| Total interest and dividend income | |

| 28,586 | | |

| 27,840 | | |

| 26,802 | | |

| 26,604 | | |

| 26,770 | | |

| 109,832 | | |

| 101,118 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| INTEREST EXPENSE: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| 11,443 | | |

| 11,165 | | |

| 10,335 | | |

| 9,293 | | |

| 8,773 | | |

| 42,236 | | |

| 26,649 | |

| Short-term borrowings | |

| 60 | | |

| 71 | | |

| 186 | | |

| 283 | | |

| 123 | | |

| 600 | | |

| 1,589 | |

| Long-term debt | |

| 1,557 | | |

| 1,622 | | |

| 1,557 | | |

| 1,428 | | |

| 1,444 | | |

| 6,164 | | |

| 3,957 | |

| Subordinated debt | |

| 253 | | |

| 254 | | |

| 254 | | |

| 254 | | |

| 254 | | |

| 1,015 | | |

| 1,014 | |

| Total interest expense | |

| 13,313 | | |

| 13,112 | | |

| 12,332 | | |

| 11,258 | | |

| 10,594 | | |

| 50,015 | | |

| 33,209 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest and dividend income | |

| 15,273 | | |

| 14,728 | | |

| 14,470 | | |

| 15,346 | | |

| 16,176 | | |

| 59,817 | | |

| 67,909 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (REVERSAL OF) PROVISION FOR CREDIT LOSSES | |

| (762 | ) | |

| 941 | | |

| (294 | ) | |

| (550 | ) | |

| 486 | | |

| (665 | ) | |

| 872 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net interest and dividend income after (reversal of) provision for credit losses | |

| 16,035 | | |

| 13,787 | | |

| 14,764 | | |

| 15,896 | | |

| 15,690 | | |

| 60,482 | | |

| 67,037 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NON-INTEREST INCOME: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service charges and fees on deposits | |

| 2,301 | | |

| 2,341 | | |

| 2,341 | | |

| 2,219 | | |

| 2,283 | | |

| 9,202 | | |

| 8,856 | |

| Income from bank-owned life insurance | |

| 486 | | |

| 470 | | |

| 502 | | |

| 453 | | |

| 432 | | |

| 1,911 | | |

| 1,820 | |

| Unrealized (loss) gain on marketable equity securities | |

| (9 | ) | |

| 10 | | |

| 4 | | |

| 8 | | |

| (1 | ) | |

| 13 | | |

| (1 | ) |

| (Loss) gain on sale of mortgages | |

| (11 | ) | |

| 246 | | |

| — | | |

| — | | |

| — | | |

| 235 | | |

| — | |

| Gain on non-marketable equity investments | |

| 300 | | |

| — | | |

| 987 | | |

| — | | |

| — | | |

| 1,287 | | |

| 590 | |

| Loss on disposal of premises and equipment | |

| — | | |

| — | | |

| — | | |

| (6 | ) | |

| — | | |

| (6 | ) | |

| (3 | ) |

| Loss on defined benefit plan termination | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| (1,143 | ) |

| Gain on bank-owned life insurance death benefit | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| 778 | |

| Other income | |

| 187 | | |

| 74 | | |

| — | | |

| — | | |

| — | | |

| 261 | | |

| — | |

| Total non-interest income | |

| 3,254 | | |

| 3,141 | | |

| 3,834 | | |

| 2,674 | | |

| 2,714 | | |

| 12,903 | | |

| 10,897 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| NON-INTEREST EXPENSE: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Salaries and employees benefits | |

| 8,429 | | |

| 8,112 | | |

| 7,901 | | |

| 8,244 | | |

| 7,739 | | |

| 32,686 | | |

| 32,214 | |

| Occupancy | |

| 1,256 | | |

| 1,217 | | |

| 1,218 | | |

| 1,363 | | |

| 1,198 | | |

| 5,054 | | |

| 4,908 | |

| Furniture and equipment | |

| 505 | | |

| 483 | | |

| 483 | | |

| 484 | | |

| 494 | | |

| 1,955 | | |

| 1,954 | |

| Data processing | |

| 900 | | |

| 869 | | |

| 846 | | |

| 862 | | |

| 788 | | |

| 3,477 | | |

| 3,157 | |

| Software | |

| 642 | | |

| 612 | | |

| 566 | | |

| 699 | | |

| 598 | | |

| 2,519 | | |

| 2,311 | |

| Debit/ATM card processing expense | |

| 593 | | |

| 649 | | |

| 643 | | |

| 552 | | |

| 559 | | |

| 2,437 | | |

| 2,139 | |

| Professional fees | |

| 471 | | |

| 540 | | |

| 581 | | |

| 569 | | |

| 674 | | |

| 2,161 | | |

| 2,732 | |

| FDIC insurance | |

| 389 | | |

| 338 | | |

| 323 | | |

| 410 | | |

| 338 | | |

| 1,460 | | |

| 1,321 | |

| Advertising | |

| 310 | | |

| 271 | | |

| 339 | | |

| 349 | | |

| 377 | | |

| 1,269 | | |

| 1,495 | |

| Other | |

| 1,431 | | |

| 1,315 | | |

| 1,414 | | |

| 1,250 | | |

| 2,020 | | |

| 5,410 | | |

| 6,119 | |

| Total non-interest expense | |

| 14,926 | | |

| 14,406 | | |

| 14,314 | | |

| 14,782 | | |

| 14,785 | | |

| 58,428 | | |

| 58,350 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| INCOME BEFORE INCOME TAXES | |

| 4,363 | | |

| 2,522 | | |

| 4,284 | | |

| 3,788 | | |

| 3,619 | | |

| 14,957 | | |

| 19,584 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| INCOME TAX PROVISION | |

| 1,075 | | |

| 618 | | |

| 771 | | |

| 827 | | |

| 1,108 | | |

| 3,291 | | |

| 4,516 | |

| NET INCOME | |

$ | 3,288 | | |

$ | 1,904 | | |

$ | 3,513 | | |

$ | 2,961 | | |

$ | 2,511 | | |

$ | 11,666 | | |

$ | 15,068 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic earnings per share | |

$ | 0.16 | | |

$ | 0.09 | | |

$ | 0.17 | | |

$ | 0.14 | | |

$ | 0.12 | | |

$ | 0.56 | | |

$ | 0.70 | |

| Weighted average shares outstanding | |

| 20,561,749 | | |

| 20,804,162 | | |

| 21,056,173 | | |

| 21,180,968 | | |

| 21,253,452 | | |

| 20,899,573 | | |

| 21,535,888 | |

| Diluted earnings per share | |

$ | 0.16 | | |

$ | 0.09 | | |

$ | 0.17 | | |

$ | 0.14 | | |

$ | 0.12 | | |

$ | 0.56 | | |

$ | 0.70 | |

| Weighted average diluted shares outstanding | |

| 20,701,276 | | |

| 20,933,833 | | |

| 21,163,762 | | |

| 21,271,323 | | |

| 21,400,664 | | |

| 21,016,358 | | |

| 21,610,329 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Return on average assets (1) | |

| 0.49 | % | |

| 0.29 | % | |

| 0.55 | % | |

| 0.47 | % | |

| 0.39 | % | |

| 0.45 | % | |

| 0.59 | % |

| Return on average equity (1) | |

| 5.48 | % | |

| 3.19 | % | |

| 6.03 | % | |

| 5.04 | % | |

| 4.31 | % | |

| 4.93 | % | |

| 6.47 | % |

| Efficiency ratio | |

| 80.56 | % | |

| 80.62 | % | |

| 78.20 | % | |

| 82.03 | % | |

| 78.27 | % | |

| 80.35 | % | |

| 74.04 | % |

| Adjusted efficiency ratio (2) | |

| 81.85 | % | |

| 80.67 | % | |

| 82.68 | % | |

| 82.04 | % | |

| 78.26 | % | |

| 81.80 | % | |

| 74.25 | % |

| Net interest margin | |

| 2.41 | % | |

| 2.40 | % | |

| 2.42 | % | |

| 2.57 | % | |

| 2.64 | % | |

| 2.45 | % | |

| 2.82 | % |

| Net interest margin, on a fully tax-equivalent basis | |

| 2.43 | % | |

| 2.42 | % | |

| 2.44 | % | |

| 2.59 | % | |

| 2.66 | % | |

| 2.47 | % | |

| 2.84 | % |

| (2) | The adjusted efficiency ratio (non-GAAP) represents the

ratio of operating expenses divided by the sum of net interest and dividend income and non-interest income, excluding realized

and unrealized gains and losses on securities, gain on non-marketable equity investments, loss on disposal of premises and equipment,

loss on defined benefit plan termination and gain on bank-owned life insurance death benefit. |

WESTERN NEW ENGLAND BANCORP, INC. AND

SUBSIDIARIES

Consolidated Balance Sheets

(Dollars in thousands)

(Unaudited)

| | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2024 | | |

2024 | | |

2024 | | |

2023 | |

| Cash and cash equivalents | |

$ | 66,450 | | |

$ | 72,802 | | |

$ | 53,458 | | |

$ | 22,613 | | |

$ | 28,840 | |

| Securities available-for-sale, at fair value | |

| 160,704 | | |

| 155,889 | | |

| 135,089 | | |

| 138,362 | | |

| 137,115 | |

| Securities held to maturity, at amortized cost | |

| 205,036 | | |

| 213,266 | | |

| 217,632 | | |

| 221,242 | | |

| 223,370 | |

| Marketable equity securities, at fair value | |

| 397 | | |

| 252 | | |

| 233 | | |

| 222 | | |

| 196 | |

| Federal Home Loan Bank of Boston and other restricted stock - at cost | |

| 5,818 | | |

| 7,143 | | |

| 7,143 | | |

| 3,105 | | |

| 3,707 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans | |

| 2,070,189 | | |

| 2,049,002 | | |

| 2,026,226 | | |

| 2,025,566 | | |

| 2,027,317 | |

| Allowance for credit losses | |

| (19,529 | ) | |

| (19,955 | ) | |

| (19,444 | ) | |

| (19,884 | ) | |

| (20,267 | ) |

| Net loans | |

| 2,050,660 | | |

| 2,029,047 | | |

| 2,006,782 | | |

| 2,005,682 | | |

| 2,007,050 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Bank-owned life insurance | |

| 77,056 | | |

| 76,570 | | |

| 76,100 | | |

| 75,598 | | |

| 75,145 | |

| Goodwill | |

| 12,487 | | |

| 12,487 | | |

| 12,487 | | |

| 12,487 | | |

| 12,487 | |

| Core deposit intangible | |

| 1,438 | | |

| 1,531 | | |

| 1,625 | | |

| 1,719 | | |

| 1,813 | |