false

0000803578

0000803578

2024-03-05

2024-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 5, 2024

WAVEDANCER, INC

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-41092

|

54-1167364

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

12015 Lee Jackson Memorial Highway

Suite 210

Fairfax, VA 22030

(Address of principal executive offices, including zip code)

703-383-3000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on which registered

|

| Common Stock, par value $0.001 per share |

WAVD |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On March 5 2024, WaveDancer, Inc., (the “WaveDancer” or the "Company") and Firefly Neuroscience, Inc. (“Firefly”) issued a joint press release entitled "Firefly Neuroscience's White Paper Unveils BNATM Platform's Significant Impact on Disease Management in 2,253 U.S. Patients". This press release pertains to the prospectus and proxy statement underlying WaveDancer's Registration Statement on Form S-4 (the “Registration Statement”), regarding its previously announced merger agreement with Firefly. The Registration Statement was declared effective by the U.S. Securities and Exchange Commission on February 6, 2024 and the Company has scheduled a special meeting of shareholders for March 14, 2024, where it will seek shareholder approval for the merger among other proposals which pertain thereto. The Registration Statement and the information contained therein is subject to change and provides important information about WaveDancer, Firefly, and the proposed transactions. The definitive transaction agreements were announced on November 16, 2023.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

WAVEDANCER, INC. |

|

| |

|

|

|

|

Date: March 8, 2024

|

By:

|

/s/ Timothy G. Hannon

|

|

| |

|

Timothy G. Hannon

|

|

| |

|

Chief Financial Officer

|

|

Exhibit 99.1

Firefly Neuroscience’s White Paper Unveils BNA™ Platform’s Significant Impact on Disease Management in 2,253 U.S Patients

The white paper is titled “Brain Network Analytics (BNA) in the Psychiatric Practice: Real-Life Data Analysis”

The analysis involved a cohort of 2,253 patients receiving treatment at a prominent psychiatric and multispecialty clinic in the U.S.

FAIRFAX, Va. and TORONTO, On., March 5, 2024 (GLOBE NEWSWIRE) – Firefly Neuroscience, Inc. (“Firefly”), a pioneering AI company developing innovative neuroscientific solutions to improve outcomes for patients with mental illnesses and neurological disorders, today announced the findings presented in a 2023 white paper “Brain Network Analytics (BNA) in the Psychiatric Practice: Real-Life Data Analysis” by Charlotte Baumeister, Ph.D., with analysis by Offir Laufer, Ph.D. Firefly has entered into an agreement (as amended, the “Merger Agreement”) to merge with WaveDancer, Inc. (“WaveDancer”) (NASDAQ: WAVD), subject to the approval of the stockholders of Firefly and WaveDancer (the “Merger”).

The comprehensive analysis involved a cohort of 2,253 patients receiving treatment at a prominent psychiatric and multispecialty clinic in the United States, utilizing the Company’s Brain Network Analytics software platform (“BNA™ Platform”). This FDA-approved 510(k) tool harnesses vast data sets, including thousands of normative, age-matched electroencephalogram (“EEG”) recordings, empowering clinicians to make informed decisions in therapy and disease management.

The results suggest the transformative potential of the BNA™ Platform to significantly improve psychiatric care. By automating the analysis of EEG data, the BNA™ Platform not only streamlined clinical processes, but also enhanced the clinical journey and outcomes for patients suffering from major depressive disorder (“MDD”), generalized anxiety disorder (“GAD”), and attention deficit hyperactivity disorder (“ADHD”).

Key Research Highlights:

| |

●

|

Enhanced Treatment Compliance: Patients grappling with depression, guided by BNA™ Platform-informed therapy, exhibited a significant 15% rise in adherence to MDD treatment protocols, encompassing both antidepressant medications and transcranial magnetic stimulation.

|

| |

●

|

Decreased Medication Alteration Necessity: The study demonstrated a noteworthy reduction of over 50% in the percentage of MDD patients required to switch antidepressant medications. This emphasizes the potential of the BNA™ Platform in optimizing medication selection and dosing.

|

| |

●

|

Amplified Improvements in General Functionality: Individuals diagnosed with MDD, GAD, and ADHD experienced more than double the improvement in their overall general functioning when receiving BNA™ Platform-guided interventions. This suggests that the BNA™ Platform has the potential to enhance patients’ quality of life and daily functioning.

|

| |

●

|

Elevated Rates of Antidepressant Response: The application of the BNA™ Platform was associated with a notable 10% increase in antidepressant response rates, signaling its capacity to augment the effectiveness of conventional treatment methods.

|

| |

●

|

Reduction in Non-Responder Rates: Among MDD patients, the study observed a significant 17% decrease in the rate of treatment non-responders, indicating that the BNA™ Platform holds promise in mitigating treatment resistance and increasing positive outcomes.

|

Jon Olsen, Chief Executive Officer of Firefly, “Our BNA™ Platform, powered by cutting-edge AI, automizes EEG analysis to provide comprehensive insights into brain function. With the potential to revolutionize disease management, enhance treatment outcomes, and improve the overall well-being of patients with mental illnesses and cognitive disorders, we believe the BNA™ Platform can have a transformative impact. Backed by real-world clinical data from 2,253 patients, the societal ramifications are clear - the potential to usher in a new era of improved patient outcomes. Moreover, the BNA™ Platform can lead to substantial cost savings for healthcare systems and payors alike. We believe these findings will pave the way for widespread adoption of the BNA™ Platform into standard patient management protocols.”

About WaveDancer

WaveDancer, based in Fairfax, VA, has been servicing federal and commercial customers since 1979. WaveDancer is in the business of developing and maintaining information technology (“IT”) systems, modernizing client information systems, and performing other IT-related professional services to government and commercial organizations. https://wavedancer.com/

About Firefly

Firefly is a pioneering AI company developing innovative neuroscientific solutions that improve outcomes for patients with mental illnesses and neurological disorders. The BNA™ Platform is a scalable cloud-based platform built on the company’s extensive proprietary database of standardized, high-definition EEG recordings of the brain at rest and during activity, including behavioral data. Firefly’s BNA™ Platform leverages this database to discover useful biomarkers for clinicians and pharmaceutical companies. With a focus on developing state-of-the-art technologies that bridge the gap between neuroscience and clinical practice, Firefly is dedicated to transforming brain health by advancing diagnostic and treatment approaches. https://fireflyneuro.com/

Forward-Looking Statements

Certain statements in this press release and the information incorporated herein by reference may constitute “forward-looking statements” for purposes of the federal securities laws concerning WaveDancer, Firefly, the Merger, and other matters. These forward-looking statements include express or implied statements relating to WaveDancer’s and Firefly’s management teams’ expectations, hopes, beliefs, intentions, or strategies regarding the future. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. The words “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “should,” “will,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects. There can be no assurance that future developments affecting WaveDancer, Firefly or the Merger will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond WaveDancer’s or Firefly’s control) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, the risk that the conditions to the closing of the Merger are not satisfied, including the failure to obtain stockholder approval for the transaction; uncertainties as to the timing of the consummation of the Merger and the ability of each of WaveDancer and Firefly to consummate the Merger; risks related to WaveDancer’s continued listing on the Nasdaq Stock Market until closing of the Merger; risks related to WaveDancer’s and Firefly’s ability to correctly estimate their respective operating expenses and expenses associated with the Merger, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the Merger Agreement; the effect of the announcement or pendency of the Merger on WaveDancer’s or Firefly’s business relationships, operating results and business generally; costs related to the Merger; the outcome of any legal proceedings that may be instituted against WaveDancer, Firefly or any of their respective directors or officers related to the Merger Agreement or the Mergers contemplated thereby; the ability of WaveDancer or Firefly to protect their respective intellectual property rights; competitive responses to the Merger; unexpected costs, charges or expenses resulting from the Merger; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the Merger; legislative, regulatory, political and economic developments; and those factors described under the heading “Risk Factors” in the WaveDancer’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (“SEC”), as well as discussions of potential risks, uncertainties, and other important factors included in later filings, including any Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, and those factors included under the heading “Risk Factors” in the registration statement on Form S-4 filed by WaveDancer with the SEC, as amended. Should one or more of these risks or uncertainties materialize, or should any of WaveDancer’s assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements. It is not possible to predict or identify all such risks. Forward-looking statements included in this press release only speak as of the date they are made, and neither WaveDancer nor Firefly undertakes any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

No Offer or Solicitation

This press release is not intended to and does not constitute a proxy statement or an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the Merger or otherwise, nor shall there be any sale, issuance, or transfer of securities in any jurisdiction in contravention of applicable law. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

Important Additional Information Filed with the SEC

In connection with the Merger, WaveDancer has filed relevant materials with the SEC, including a registration statement on Form S-4, as amended, that contains a proxy statement/prospectus and consent solicitation pertaining to WaveDancer and Firefly. WAVEDANCER AND FIREFLY URGE INVESTORS AND STOCKHOLDERS TO READ THESE MATERIALS CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT WAVEDANCER, FIREFLY, THE MERGER AND RELATED MATTERS. Investors and stockholders can obtain free copies of the proxy statement/prospectus and consent solicitation and other documents filed by WaveDancer with the SEC through the website maintained by the SEC at www.sec.gov. In addition, investors and stockholders should note that WaveDancer communicates with investors and the public using its website (https://WaveDancer.com) and its investor relations website (https://ir.WaveDancer.com), where anyone can obtain free copies of the proxy statement/prospectus and consent solicitation and other documents filed by WaveDancer with the SEC. Stockholders are urged to read the proxy statement/prospectus and consent solicitation and the other relevant materials before making any voting or investment decision with respect to the Merger.

Participants in the Solicitation

WaveDancer, Firefly, and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in connection with the Merger. Information about WaveDancer’s directors and executive officers is included in WaveDancer’s most recent Annual Report on Form 10-K, including any information incorporated therein by reference, as filed with the SEC. Additional information regarding these persons, Firefly’s directors and executive officers and their respective interests in the Merger is included in the proxy statement/prospectus and consent solicitation relating to the Merger filed with the SEC. These documents can be obtained free of charge from the sources indicated above.

Contact Information

WaveDancer

Tim Hannon, CFO

Investors@WaveDancer.com

Investor Contact

KCSA Strategic Communications

Valter Pinto, Managing Director

PH: (212) 896-1254

Valter@KCSA.com

v3.24.0.1

Document And Entity Information

|

Mar. 05, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

WAVEDANCER, INC

|

| Document, Type |

8-K

|

| Document, Period End Date |

Mar. 05, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-41092

|

| Entity, Tax Identification Number |

54-1167364

|

| Entity, Address, Address Line One |

12015 Lee Jackson Memorial Highway

|

| Entity, Address, Address Line Two |

Suite 210

|

| Entity, Address, City or Town |

Fairfax

|

| Entity, Address, State or Province |

VA

|

| Entity, Address, Postal Zip Code |

22030

|

| City Area Code |

703

|

| Local Phone Number |

383-3000

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

WAVD

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000803578

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

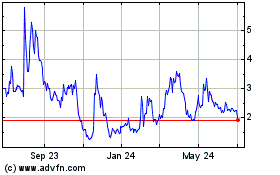

WaveDancer (NASDAQ:WAVD)

Historical Stock Chart

From Nov 2024 to Dec 2024

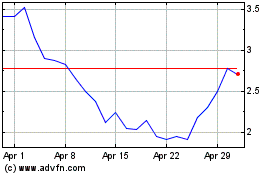

WaveDancer (NASDAQ:WAVD)

Historical Stock Chart

From Dec 2023 to Dec 2024