UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

SCHEDULE 13E-3

(Rule 13e-100)

RULE 13E-3 TRANSACTION STATEMENT UNDER SECTION 13(e)

OF THE SECURITIES EXCHANGE ACT OF 1934

VITRU LIMITED

(Name of the Issuer)

VITRU BRASIL EMPREENDIMENTOS, PARTICIPAÇÕES

E COMÉRCIO S.A.

VITRU LIMITED

(Names of Person(s) Filing Statement)

Common Shares, par value U.S.$0.00005

(Title of Class of Securities)

KYG9440D1034

(ISIN of Class of Securities)

G9440D103

(CUSIP Number of Class of Securities)

| |

Vitru Brasil Empreendimentos, Participações

e Comércio S.A.

Rodovia José Carlos Daux, 5500,

Torre Jurerê A, 2nd floor, Saco Grande,

Florianópolis, State of Santa

Catarina,

Brazil

88032-005

+55 (47) 3281-9500

Attention: Carlos Henrique

Boquimpani de Freitas

|

|

| |

Vitru Limited

Rodovia José Carlos Daux, 5500,

Torre Jurerê A, 2nd floor, Saco Grande,

Florianópolis, State of Santa

Catarina,

Brazil

88032-005

+55 (47) 3281-9500

Attention: Carlos Henrique Boquimpani

de Freitas

|

|

(Name, address, and telephone numbers of person authorized to receive notices and communications on behalf of filing persons)

|

|

| |

Copies to: |

|

| |

Manuel

Garciadiaz

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, New York 10017

Telephone: (212) 450-4000

|

|

This statement is filed in connection with (check the appropriate box):

☐

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the

Securities Exchange Act of 1934.

☒

The filing of a registration statement under the Securities Act of 1933.

☐

A tender offer.

☐

None of the above.

Check the following box if the soliciting materials or information

statement referred to in checking box (a) are preliminary copies: ☐

Check the following box if the filing is a final amendment reporting

the results of the transaction: ☐

Filing Fee Exhibit filed herewith.

Neither

the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of this

transaction, passed upon the merits or fairness of this transaction, or passed upon the adequacy or accuracy of the disclosure in this

Schedule 13E-3. Any representation to the contrary is a criminal offense.

INTRODUCTION

This Amendment No. 1 to the Transaction Statement

on Schedule 13E-3 (“Amendment No. 1”) is being filed with the SEC pursuant to Section 13(e) of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”) to amend and supplement the Transaction Statement on Schedule 13E-3 originally

filed on September 13, 2023 (together with any subsequent amendments and supplements thereto, the “Schedule 13E-3” or the

“Statement”), by Vitru Brasil Empreendimentos, Participações e Comércio S.A., a corporation (sociedade

anônima) incorporated under the laws of Brazil (“Vitru Brazil”) and Vitru Limited, an exempted company incorporated

in the Cayman Islands (“Vitru Cayman”). The Statement is being filed with respect to the common

shares, par value U.S.$0.0005 (the “Vitru Cayman Shares”) of Vitru Cayman, which are traded

on the Nasdaq Global Select Market.

This Statement relates to a merger proposal described in the prospectus forming part of the Registration Statement on Form F-4 filed with

the U.S. Securities and Exchange Commission (the “SEC”) by Vitru Brazil (File No. 333-274353), originally filed on September

6, 2023, together with Amendment No.1 filed on November 15, 2023 (as amended or supplemented from time to time, the “Prospectus”),

pursuant to which, if implemented, Vitru Cayman will be merged with and into Vitru Brazil (the “Merger”) and all of its shareholders

will receive Vitru Brazil Shares in exchange for the Vitru Cayman Shares that they hold, provided however, that each holder of Vitru Cayman

Shares will receive, in lieu of Vitru Brazil Shares, Vitru Brazil Shares represented by American Depositary Shares (“Vitru Brazil

ADSs”) to the extent that they do not make a valid Election to receive Vitru Cayman Shares.

Pursuant to General Instruction F to Schedule

13E-3, the information contained in the Prospectus is incorporated by reference herein and, except as described below, the responses to

each item in this Statement are qualified in their entirety by the information contained in the Prospectus. As of the date hereof, the

Prospectus is in preliminary form and is subject to completion or amendment. The information contained in the annual report of Vitru Cayman

on Form 20-F for the fiscal year ended December 31, 2022 filed on April 28, 2023, or the “Vitru Cayman 2022 Form 20-F,” is

also incorporated by reference herein.

The cross-references identified herein are being

supplied pursuant to General Instruction G to Schedule 13E-3 and indicate the location in the Prospectus or other document of the information

required to be included in response to the respective items of this Statement.

Any information contained in the documents incorporated

herein by reference shall be deemed modified or superseded for purposes of this Statement to the extent that any information contained

herein modifies or supersedes such information. All information contained in, or incorporated by reference into, this Statement concerning

each Filing Person has been supplied by such Filing Person. The information concerning Vitru Brazil or Vitru Cayman, as applicable, contained

in, or incorporated by reference into, this Statement has been furnished by Vitru Brazil or Vitru Cayman, as applicable, or has been taken

from, or based upon, publicly available documents and records on file with the SEC and other public sources.

All capitalized

terms used in this Statement without definition have the meanings ascribed to them in the Prospectus.

| ITEM 1. | SUMMARY TERM SHEET. |

The information set forth in the Prospectus under

the headings “Summary” and “Questions and Answers About The Merger and the Vitru Cayman Special Meeting” is incorporated

herein by reference.

| ITEM 2. | SUBJECT COMPANY INFORMATION. |

(a) Name

and Address

The name of the subject company to which this

Statement relates is Vitru Limited, an exempted company incorporated in the Cayman Islands. The principal executive office of Vitru Cayman

is located at Rodovia José Carlos Daux, 5500, Torre Jurerê A, 2nd floor, Saco Grande, Florianópolis, in the State

of Santa Catarina, 88032-005, Brazil. The telephone number of Vitru Cayman’s principal executive offices is +55 (47) 3281-9500.

(b) Securities

The class of equity securities

to which this Statement relates is the Vitru Cayman Shares, which are traded on the Nasdaq Global Select Market under the ticker symbol

“VTRU.”

The information set forth in the Prospectus under

the heading “Major Shareholders and Related Party Transactions―Vitru Cayman” is incorporated herein by reference.

(c) Trading

Market and Price

The information set forth in the Prospectus under

the heading “Price Range of Securities” is incorporated herein by reference.

(d) Dividends

The information set forth in the Vitru Cayman

20-F under the heading “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Dividends

and Dividend Policy” and in the Prospectus under the headings “Selected Unaudited Per Share Data,” “Comparative

Historical Per Share Data” and “The Merger—Dividend Information” is incorporated herein by reference.

(e) Prior

Public Offerings

The information set forth in the Vitru Cayman

20-F under the headings “Item 4. Information on the Company—A. History and Development

of the Company—Our History” and “Item 14. Material Modifications To The Rights of Security Holders and Use of

Proceeds—E. Use of Proceeds” is incorporated herein by reference.

(f) Prior

Share Purchases

The information set forth in the Prospectus under

the heading “Major Shareholders and Related Party Transactions―Securities Transactions” is incorporated herein by reference.

| ITEM 3. | IDENTITY AND BACKGROUND OF FILING PERSONS. |

(a) Name

and Address

The name of the first filing person to which this

Statement relates is Vitru Brasil Empreendimentos, Participações e Comércio S.A., a corporation (sociedade anônima)

incorporated under the laws of Brazil. The principal executive offices of Vitru Brazil are located at Rodovia José Carlos Daux,

5500, Torre Jurerê A, 2nd floor, Saco Grande, Florianópolis, in the State of Santa Catarina, 88032-005, Brazil. The telephone

number of Vitru Brazil’s principal executive offices is +55 (47) 3281-9500. The filing person, Vitru Brazil, is a wholly-owned subsidiary

of the subject company, Vitru Cayman.

The second filing person is Vitru Cayman, the

subject company. See “Item 2. Subject Company Information—(a) Name and Address” in this Statement for the name, address

and telephone number of Vitru Cayman.

(b)-(c) Business and Background of Entities;

Business and Background of Natural Persons

The information set forth in the Prospectus under

the headings “Information About the Companies,” “Information About Vitru Brazil,” “Information About Vitru

Cayman,” “Management and Compensation of Vitru Brazil—Overview of Vitru Brazil’s Management—Board of Directors,”

“Management and Compensation of Vitru Brazil—Overview of Vitru Brazil’s Management—Executive Officers” and

“Management and Compensation of Vitru Cayman” is incorporated herein by reference.

| ITEM 4. | TERMS OF THE TRANSACTION. |

(a) Material

Terms

(1) Tender

Offers.

Not applicable.

(2) Mergers

or similar transactions.

The information set forth in the Prospectus under

the headings “Special Factors—2. Purpose of and Reasons for the Merger; Plans for the Company after the Merger,” “The

Merger—Overview,” “The Merger—Merger Consideration,” “The Merger—Elections as to Form of Consideration,”

“The Merger—Recommendation of the Vitru Cayman Board of Directors; Vitru Cayman’s Reasons for the Merger,” “The

Merger—Vitru Cayman’s Reasons for the Merger,” “The Merger—Vitru Brazil’s Reasons for the Merger,”

“The Merger—Benefits and Detriments of the Proposed Transaction to Unaffiliated Shareholders,” “The Merger—Accounting

Treatment of the Merger,” “The Merger—Certain Information on the Ownership and Management of Vitru Brazil and Vitru

Cayman Following the Merger—Ownership of Vitru Cayman and Vitru Brazil Following the Merger,” “The Vitru Cayman Special

Meeting—Required Vote,” “Description of Vitru Brazil Shares and Vitru Brazil By-Laws—Principal Differences between

Brazilian and U.S. Corporate Governance Practices,” “Comparison of The Rights of Holders of Vitru Brazil Shares and Vitru

Cayman Shares,” “Description of Vitru Brazil ADSs and Vitru Brazil Deposit Agreement” and “Material Tax Considerations—Material

U.S. Federal Income Tax Considerations” is incorporated herein by reference.

(c) Different

Terms

Not applicable.

(d) Appraisal Rights

The information set forth in the Prospectus under

the headings “Special Factors—6. Appraisal Rights; Rule 13e-3” and “The Merger—Dissenters’ Rights

of Appraisal for Vitru Cayman Shareholders” is incorporated herein by reference.

(e) Provisions

for Unaffiliated Security Holders

Vitru Cayman has not made any provision in connection

with the transaction to grant unaffiliated security holders access to its corporate files or to obtain counsel or appraisal services at

its expense.

(f) Eligibility

for Listing or Trading

The information set forth in the Prospectus under

the headings “The Merger—Listing of Vitru Brazil Shares” and “The Merger—Listing of Vitru Brazil ADSs”

is incorporated herein by reference.

| ITEM 5. | PAST CONTACTS, TRANSACTIONS, NEGOTIATIONS AND AGREEMENTS. |

(a) Transactions

The information set forth in the Prospectus under

the headings “Special Factors—7. Related Party Transactions,” “Special Factors—8. Interests of Certain Persons

in the Merger” and “Major Shareholders and Related Party Transactions—Additional Information” is incorporated

herein by reference.

The information set forth in the Vitru Cayman

2022 Form 20-F under the headings “Item 4. Information on the Company—A. History and

Development of the Company—UniCesumar Business Combination,” “Item 4. Information on the Company—C. Organizational

Structure,” “Item 6. Directors, Senior Management and Employees—B. Compensation—Long-Term Incentive Plan”

and “Item 7. Major Shareholders and Related Party Transactions—B. Related Party Transactions” is incorporated

herein by reference.

(b)-(c) Significant Corporate Events; Negotiations

or Contacts

The information set forth in the Prospectus under

the headings “Special Factors—1. Background,” “The Merger—Overview,” “The Merger—Background

to the Merger,” “The Merger—Past Contracts, Mergers, Negotiations and Agreements,” “The Merger Documents—The

Merger Protocol,” “The Merger Documents—The Plan of Merger,” “Information About the Companies,” “Information

About Vitru Brazil,” “Information About Vitru Cayman,” “Management and Compensation of Vitru Brazil—Overview

of Vitru Brazil’s Management—Board of Directors,” “Management and Compensation of Vitru Brazil—Overview

of Vitru Brazil’s Management—Executive Officers,” “Management and Compensation of Vitru Cayman” and “Major

Shareholders and Related Party Transactions—Additional Information” is incorporated herein by reference.

The information set forth in the Vitru Cayman

2022 Form 20-F under the heading “Item 4. Information on the Company—A. History and

Development of the Company—Our History” is incorporated herein by reference.

(e) Agreements

Involving the Subject Company’s Securities

The information set forth in the Prospectus under

the heading “The Merger—Treatment of Equity and Equity-Based Awards,” “Management and Compensation of Vitru

Brazil—Compensation,” “Management and Compensation of Vitru Cayman,” “Interests of Certain Persons in the

Merger—Interests of Vitru Brazil’s and Vitru Cayman’s Directors and Executive Officers in the Merger” and “Major

Shareholders and Related Party Transactions—Vitru Cayman” is incorporated herein by reference.

The information set forth in the Vitru Cayman

2022 Form 20-F under the heading “Item 6. Directors, Senior Management and Employees—B.

Compensation—Long-Term Incentive Plan” is incorporated herein by reference.

| ITEM 6. | PURPOSE OF THE TRANSACTION AND PLANS OR PROPOSALS. |

(b) Use

of Securities Acquired

The information set forth in the Prospectus under

the headings “Special Factors—2. Purpose of and Reasons for the Merger; Plans for the Company after the Merger—Plans

for Vitru Brazil after the Merger,” “The Merger—Overview,” “The Merger—Delisting and Deregistration

of Vitru Cayman Shares,” “Questions and Answers About the Merger and the Vitru Cayman Special Meeting—Questions and

Answers About the Merger—Q: What is the proposed merger, why are Vitru Brazil and Vitru Cayman proposing it and what will happen

to Vitru Cayman as a result of the merger?” and “Questions and Answers About the Merger and the Vitru Cayman Special Meeting—Questions

and Answers About the Merger—Q: Is this the first step in a going-private transaction?” is incorporated herein by reference.

(c)(1)-(8) Plans

The information set forth in the Prospectus under

the headings “Special Factors—2. Purpose of and Reasons for the Merger; Plans for the Company after the Merger,”

“The Merger—Overview,” “The Merger—Financial Implications of the Merger,” “The Merger—Certain

Information on the Ownership and Management of Vitru Brazil and Vitru Cayman Following the Merger—Ownership of Vitru Cayman and

Vitru Brazil Following the Merger,” “The Merger—Certain Information on the Ownership and Management of Vitru Brazil

and Vitru Cayman Following the Merger—Management of Vitru Brazil Following the Merger,” “The Merger—Accounting

Treatment of the Merger,” “The Merger—Listing of Vitru Brazil Shares,” “The Merger—Listing of Vitru

Brazil ADSs,” “The Merger—Delisting and Deregistration of Vitru Cayman Shares,” “The Merger—Dividend

Information,” “Description of Vitru Brazil Shares and Vitru Brazil By-Laws,” “Questions and Answers About the

Merger and the Vitru Cayman Special Meeting—Questions and Answers About the Merger—Q: What is the proposed merger, why are

Vitru Brazil and Vitru Cayman proposing it and what will happen to Vitru Cayman as a result of the merger?” and “Questions

and Answers About the Merger and the Vitru Cayman Special Meeting—Questions and Answers About the Merger—Q: Is this the first

step in a going-private transaction?” is incorporated herein by reference.

| ITEM 7. | PURPOSES, ALTERNATIVES, REASONS AND EFFECTS. |

(a) Purposes

The information set forth in the Prospectus under

the headings “Special Factors—2. Purpose of and Reasons for the Merger; Plans for the Company after the Merger,” “The

Merger—Overview,” “The Merger—Recommendation of the Vitru Cayman Board of Directors; Vitru Cayman’s Reasons

for the Merger,” “The Merger—Vitru Cayman’s Reasons for the Merger,” “The Merger—Vitru Brazil’s

Reasons for the Merger,” “The Merger—Benefits and Detriments of the Proposed Transaction to Unaffiliated Shareholders,”

“Questions and Answers About the Merger and the Vitru Cayman Special Meeting—Questions and Answers About the Merger—Q:

What is the proposed merger, why are Vitru Brazil and Vitru Cayman proposing it and what will happen to Vitru Cayman as a result of the

merger?” and “Questions and Answers About the Merger and the Vitru Cayman Special Meeting—Questions and Answers About

the Merger—Q: Is this the first step in a going-private transaction?” is incorporated herein by reference.

(b) Alternatives

The information set forth in the Prospectus under

the headings “Special Factors—1. Background,” “The Merger—Overview,” “The Merger—Background

to the Merger,” “The Merger—Recommendation of the Vitru Cayman Board of Directors; Vitru Cayman’s Reasons for

the Merger,” “The Merger—Vitru Cayman’s Reasons for the Merger,” “The Merger—Vitru Brazil’s

Reasons for the Merger” and “The Merger—Benefits and Detriments of the Proposed Transaction to Unaffiliated Shareholders”

is incorporated herein by reference.

(c) Reasons

The information set forth in the Prospectus under

the headings “Special Factors—2. Purpose of and Reasons for the Merger; Plans for the Company after the Merger—Reasons

for the Merger,” “The Merger—Overview,” “The Merger—Recommendation of the Vitru Cayman Board of Directors;

Vitru Cayman’s Reasons for the Merger,” “The Merger—Vitru Cayman’s Reasons for the Merger,” “The

Merger—Vitru Brazil’s Reasons for the Merger,” “The Merger—Benefits and Detriments of the Proposed Transaction

to Unaffiliated Shareholders” and “Questions and Answers About the Merger and the Vitru Cayman Special Meeting—Questions

and Answers About the Merger—Q: What is the proposed merger, why are Vitru Brazil and Vitru Cayman proposing it and what will happen

to Vitru Cayman as a result of the merger?” is incorporated herein by reference.

(d) Effects

The information set forth in the Prospectus under

the headings “Special Factors—2. Purpose of and Reasons for the Merger; Plans for the Company after the Merger,”

“Special Factors—5. Effects of the Merger,” “The Merger—Overview,” “The Merger—Financial

Implications of the Merger,” “The Merger—Certain Information on the Ownership and Management of Vitru Brazil and Vitru

Cayman Following the Merger—Ownership of Vitru Cayman and Vitru Brazil Following the Merger,” “The Merger—Certain

Information on the Ownership and Management of Vitru Brazil and Vitru Cayman Following the Merger—Management of Vitru Brazil Following

the Merger,” “The Merger—Accounting Treatment of the Merger,” “The Merger—Listing of Vitru Brazil

Shares,” “The Merger—Listing of Vitru Brazil ADSs,” “The Merger—Delisting and Deregistration of Vitru

Cayman Shares,” “Description of Vitru Brazil Shares and Vitru Brazil By-Laws,” “Description of Vitru Brazil Shares

and Vitru Brazil By-Laws—Principal Differences between Brazilian and U.S. Corporate Governance Practices,” “Description

of Vitru Brazil ADSs and Vitru Brazil Deposit Agreement,” “Material Tax Considerations—Material U.S. Federal Income

Tax Considerations” “Questions and Answers About the Merger and the Vitru Cayman Special Meeting—Questions and Answers

About the Merger—Q: What is the proposed merger, why are Vitru Brazil and Vitru Cayman proposing it and what will happen to Vitru

Cayman as a result of the merger?” and “Questions and Answers About the Merger and the Vitru Cayman Special Meeting—Questions

and Answers About the Merger—Q: Is this the first step in a going-private transaction?” is incorporated herein by reference.

| ITEM 8. | FAIRNESS OF THE TRANSACTION. |

(a) Fairness

The information set forth in the Prospectus under

the headings “Special Factors—3. The Current Status of the Position of Vitru Cayman’s Board of Directors,” “Special

Factors—4. Position of Vitru Brazil Regarding Fairness of the Merger,” “The Merger—Recommendation of the Vitru

Cayman Board of Directors; Vitru Cayman’s Reasons for the Merger,” “The Merger—Vitru Cayman’s Reasons for

the Merger,” “The Merger—Vitru Brazil’s Reasons for the Merger,” “The Merger—Benefits and Detriments

of the Proposed Transaction to Unaffiliated Shareholders” and “The Vitru Cayman Special Meeting—Recommendation

of the Vitru Cayman Board of Directors” is incorporated herein by reference.

(b) Factors

Considered in Determining Fairness

The information set forth in the Prospectus under

the headings “Special Factors—3. The Current Status of the Position of Vitru Cayman’s Board of Directors,”

“Special Factors—4. Position of Vitru Brazil Regarding Fairness of the Merger,” “The Merger—Recommendation

of the Vitru Cayman Board of Directors; Vitru Cayman’s Reasons for the Merger,” “The Merger—Vitru Cayman’s

Reasons for the Merger,” “The Merger—Vitru Brazil’s Reasons for the Merger,” “The Merger—Benefits

and Detriments of the Proposed Transaction to Unaffiliated Shareholders” is incorporated herein by reference.

(c) Approval

of Security Holders

The information set forth in the Prospectus under

the headings “The Vitru Cayman Special Meeting—Required Vote” is incorporated herein by reference.

(d) Unaffiliated

Representative

The information set forth in the Prospectus under

the heading “The Merger—Unaffiliated Representative” is incorporated herein by reference.

(e) Approval

of Directors

The information set forth in the Prospectus under

the headings “Special Factors—2. Purpose of and Reasons for the Merger; Plans for the Company after the Merger,” “Special

Factors—3. The Current Status of the Position of Vitru Cayman’s Board of Directors,” “Special Factors—4.

Position of Vitru Brazil Regarding Fairness of the Merger,” “Summary—Reasons for the Proposed Transaction,” “The

Merger—Recommendation of the Vitru Cayman Board of Directors; Vitru Cayman’s Reasons for the Merger,” “The Merger—Vitru

Cayman’s Reasons for the Merger,” “The Merger—Vitru Brazil’s Reasons for the Merger,” “The Merger—Benefits

and Detriments of the Proposed Transaction to Unaffiliated Shareholders” is incorporated herein by reference.

(f) Other

Offers

Not applicable.

| ITEM 9. | REPORTS, OPINIONS, APPRAISALS AND NEGOTIATIONS. |

(a)-(b) Report, Opinion or Appraisal; Preparer

and Summary of the Report, Opinion or Appraisal

The information set forth in the Prospectus under

the headings “The Merger—Appraisal Report by Apsis Consultoria e Avaliações Ltda.” and “The Merger—Expenses”

is incorporated herein by reference.

(c) Availability

of Documents

The reports, opinions or appraisals referenced

in this Item 9 will be made available for inspection and copying at Vitru Brazil’s principal executive office located at Rodovia

José Carlos Daux, 5500, Torre Jurerê A, 2nd floor, Saco Grande, Florianópolis, during regular business hours, by any

interested shareholder of Vitru Cayman or a representative of such interested shareholder who has been so designated in writing by such

interested shareholder and at the expense of the requesting shareholder.

| ITEM 10. | SOURCE AND AMOUNTS OF FUNDS OR OTHER CONSIDERATION. |

(a)-(b) Source of Funds; Conditions

The information set forth in the Prospectus under the headings “The Merger—Overview,” “The Merger—Elections

as to Form of Consideration,” “The Merger—Obtaining an Investment Registration in Brazil and Opening a Securities Trading

Account in Brazil,” “Description of Vitru Brazil Shares and Vitru Brazil By-Laws,” “Description of Vitru Brazil

ADSs and Vitru Brazil Deposit Agreement,” “Summary—Conditions Precedent That Must Be Satisfied or Waived for the Merger

to Occur,” “Questions and Answers About the Merger and the Vitru Cayman Special Meeting—Questions and Answers About

the Merger—Q: What will Vitru Cayman shareholders receive from the Merger?” “Questions and Answers About the Merger

and the Vitru Cayman Special Meeting—Questions and Answers About the Merger—Q: How and when do I make my Election?”

“Questions and Answers About the Merger and the Vitru Cayman Special Meeting—Questions and Answers About the Merger—Q:

What do I do if I want to revoke my Election?” “Questions and Answers About the Merger and the Vitru Cayman Special Meeting—Questions

and Answers About the Merger—Q: What happens if I do not make a valid Election?” “Questions and Answers About the Merger

and the Vitru Cayman Special Meeting—Questions and Answers About the Merger—Q: How will I receive the Vitru Brazil Shares

or Vitru Brazil ADSs to which I am entitled?” and “Comparison of the Rights of Holders of Vitru Brazil Shares and Vitru Cayman

Shares” is incorporated herein by reference.

(c) Expenses

The information set forth in the Prospectus under

the heading “The Merger—Expenses” is incorporated herein by reference.

(d) Borrowed

Funds

Not applicable.

| ITEM 11. | INTEREST IN SECURITIES OF THE SUBJECT COMPANY. |

(a) Securities

Ownership

The information set forth in the Prospectus under

the headings “Major Shareholders and Related Party Transactions—Vitru Cayman,” “Major Shareholders and Related

Party Transactions—Vitru Brazil” and “Major Shareholders and Related Party Transactions—Additional Information” is

incorporated herein by reference.

The information set forth in the Vitru Cayman

2022 Form 20-F under the heading “Item 7. Major Shareholders and Related Party Transactions—A. Major Shareholders” is

incorporated herein by reference.

(b) Securities

Transactions

The information set forth in the Prospectus under

the heading “Major Shareholders and Related Party Transactions—Vitru Cayman—Securities Transactions” is incorporated

herein by reference.

| ITEM 12. | THE SOLICITATION OR RECOMMENDATION. |

(d) Intent

to Tender or Vote in a Going Private Transaction

The information set forth in the Prospectus under

the headings “The Vitru Cayman Special Meeting—Voting by Vitru Cayman’s Directors and Executive Officers,” “The

Vitru Cayman Special Meeting—Voting by Vitru Brazil’s Directors and Executive Officers” and “The Vitru Cayman

Special Meeting—Votes of Certain Shareholders” is incorporated herein by reference.

(e) Recommendations

of Others

The information set forth in the Prospectus under

the headings “Special Factors—2. Purpose of and Reasons for the Merger; Plans for the Company after the Merger,” “Special

Factors—3. The Current Status of the Position of Vitru Cayman’s Board of Directors,” “Special Factors—4.

Position of Vitru Brazil Regarding Fairness of the

Merger,” “The Merger—Recommendation of the Vitru

Cayman Board of Directors; Vitru Cayman’s Reasons for the Merger,” “The Merger—Vitru Cayman’s Reasons for

the Merger,” “The Merger—Vitru Brazil’s Reasons for the Merger” and “The Merger—Benefits and

Detriments of the Proposed Transaction to Unaffiliated Shareholders” is incorporated herein by reference.

| ITEM 13. | FINANCIAL STATEMENTS. |

(a) Financial

Information

The consolidated financial statements of Vitru

Cayman as of December 31, 2022 and 2021 and for the years ended December 31, 2022, 2021 and 2020 are incorporated herein by reference

to “Item 18. Financial Statements” of the Vitru Cayman 2022 Form 20-F. The unaudited interim consolidated financial statements

as of September 30, 2023 and for the nine-month periods ended September 30, 2023 and 2022 and the related notes thereto contained in Exhibit

99.2 to the current report on Form 6-K furnished by Vitru Cayman to the SEC on November 14, 2023 are incorporated by reference herein.

The information set forth in the Prospectus under

the headings “Selected Unaudited Per Share Data,” “Information about Vitru Cayman” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations of Vitru Cayman” is incorporated herein by reference.

(b) Pro

Forma Information

Not applicable.

| ITEM 14. | PERSONS/ASSETS RETAINED, EMPLOYED, COMPENSATED OR USED. |

(a)-(b) Solicitations or Recommendations; Employees

and Corporate Assets

The information set forth in the Prospectus under

the headings “The Merger—Recommendation of the Vitru Cayman Board of Directors; Vitru Cayman’s Reasons for the Merger,”

“The Merger—Vitru Cayman’s Reasons for the Merger,” “The Merger—Vitru Brazil’s Reasons for the

Merger,” “The Merger—Benefits and Detriments of the Proposed Transaction to Unaffiliated Shareholders” and “The

Merger—Expenses” is incorporated herein by reference.

| ITEM 15. | ADDITIONAL INFORMATION. |

(c) Other

Material Information

Not applicable.

* To

be filed by amendment. All other exhibits are submitted herewith.

SIGNATURES

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| Dated November 15, 2023 |

VITRU BRASIL EMPREENDIMENTOS,

PARTICIPAÇÕES E COMÉRCIO S.A. |

| |

|

| |

|

| |

By: |

/s/ Pedro Jorge Guterres Quintans Graça |

| |

|

Name: |

Pedro Jorge Guterres Quintans Graça |

| |

|

Title: |

Co-Chief Executive Officer |

| |

By: |

/s/ William Victor Kendrick de Matos Silva |

| |

|

Name: |

William Victor Kendrick de Matos Silva |

| |

|

Title: |

Co-Chief Executive Officer |

| |

By: |

/s/ Carlos Henrique Boquimpani de Freitas |

| |

|

Name: |

Carlos Henrique Boquimpani de Freitas |

| |

|

Title: |

Chief Financial & Investor Relations Officer |

| |

By: |

/s/ Pedro Jorge Guterres Quintans Graça |

| |

|

Name: |

Pedro Jorge Guterres Quintans Graça |

| |

|

Title: |

Co-Chief Executive Officer |

| |

By: |

/s/ William Victor Kendrick de Matos Silva |

| |

|

Name: |

William Victor Kendrick de Matos Silva |

| |

|

Title: |

Co-Chief Executive Officer |

| |

By: |

/s/ Carlos Henrique Boquimpani de Freitas |

| |

|

Name: |

Carlos Henrique Boquimpani de Freitas |

| |

|

Title: |

Chief Financial & Investor Relations Officer |

EXHIBIT INDEX

|

Exhibit

No. |

Description |

| (a)(4) |

Prospectus (incorporated by reference to Vitru Brasil Empreendimentos, Participações e Comércio S.A.’s Registration Statement on Form F-4/A (File No. 333-274353) filed November 15, 2023). |

| (a)(5)(i) |

English Translation of the Form of Merger and Justification Protocol.* |

| (a)(5)(ii) |

Form of Plan of Merger.* |

| (a)(5)(iii) |

English Translation of the Current By-Laws of Vitru Brazil.* |

| (a)(5)(iv) |

Form of Deposit Agreement.* |

| (a)(5)(v) |

Form of Proxy Card.* |

| (a)(5)(vi) |

Form of Broker Card.* |

| (a)(5)(vii) |

Form of Notice.* |

| (a)(5)(viii) |

Form of Election Form.* |

| (a)(5)(ix) |

Press Release by Vitru Limited Regarding the Announcement of the Proposed Group Restructuring and Migration of Listing (incorporated by reference to Exhibit 99.1 to Vitru Limited’s Current Report on Form 6-K (File No. 001-39519) furnished September 5, 2023). |

| (a)(5)(x) |

Material Fact by Vitru Brasil Empreendimentos, Participações e Comércio S.A. Regarding the Announcement of the Proposed Group Restructuring and Migration of Listing (incorporated by reference to Item 1 to Vitru Brasil Empreendimentos, Participações e Comércio S.A.’s Rule 425 filing on September 5, 2023). |

| (b) |

Not applicable. |

| (c) |

Appraisal Report prepared by Apsis Consultoria e Avaliações Ltda., dated November 14, 2023 (incorporated by reference to Annex A to Vitru Brasil Empreendimentos, Participações e Comércio S.A.’s Registration Statement on Form F-4/A (File No. 333-274353) filed November 15, 2023). |

| (d) |

Not applicable. |

| (f) |

Not applicable. |

| (g) |

Not applicable. |

| 107 |

Filing Fee Exhibit. |

* To

be filed by amendment. All other exhibits are submitted herewith.

Exhibit 107

Calculation of Filing Fee Tables

Schedule 13E-3

(Form Type)

Vitru Limited

(Name of the Issuer)

Vitru Brasil Empreendimentos, Participações

e Comércio S.A.

Vitru Limited

(Name of Person(s) Filing Statement)

Table 1: Transaction Valuation

| |

Transaction Valuation(1) |

Fee Rate |

Amount of Filing Fee(2) |

| Fees to Be Paid |

U.S.$88,504,567.25 |

0.0001476 |

U.S.$13,063.27 |

| Fees Previously Paid |

|

|

U.S.$14,461.96 |

| Total Transaction Valuation |

U.S.$88,504,567.25 |

|

|

| Total Fees Due for Filing |

|

|

U.S.$13,063.27 |

| Total Fees Previously Paid |

|

|

U.S.$14,461.96 |

| Total Fee Offsets |

|

|

N/A |

| Net Fee Due |

|

|

U.S.$0.00 |

Table 2: Fee Offset Claims and Sources

| |

Registrant or Filer Name |

Form or Filing Type |

File Number |

Initial Filing Date |

Filing Date |

Fee Offset Claimed |

Fee Paid with Fee Offset Source |

| Fee Offset Claims |

|

Form F-4 |

333-274353 |

September 6, 2023 |

|

U.S.$14,461.96 |

|

| Fees Offset Sources |

Vitru Brasil Empreendimentos, Participações e Comércio S.A. |

Form F-4 |

333-274353 |

|

September 6, 2023 |

|

U.S.$14,461.96(3) |

| (1) | Calculated solely for the purpose of determining the filing fee in accordance

with Rule 0-11(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Represents the maximum number

of Vitru Limited’s common shares estimated to be issuable upon completion of the transaction described in the Registration Statement

on Form F-4 filed on September 6, 2023 by Vitru Brasil Empreendimentos, Participações e Comércio S.A. in connection

with the transaction reported hereby but does not include any common shares of Vitru Brasil Empreendimentos, Participações

e Comércio S.A. to be issued to certain existing shareholders of Vitru Limited that are not U.S. persons that are being offered

pursuant to the exemption provided by Regulation S under the Securities Act or other applicable exemptions and is based upon the product

of (a)(x) 8,232,983 common shares of Vitru Limited times (y) one, which is the assumed exchange ratio for the purposes of the initial

filing of the Registration Statement on Form F-4 filed on September 6, 2023 by Vitru Brasil Empreendimentos, Participações

e Comércio S.A., times (b) U.S.$10.75 (the average of the high and low prices of shares of Vitru Limited as reported on the

Nasdaq Global Select Market on November 13, 2023).

|

| (2) | The amount of the filing

fee, calculated in accordance with Exchange Act Rule 0-11(b)(1) and the Securities and Exchange Commission Fee Rate Advisory #1 for Fiscal

Year 2023, was calculated by multiplying the Transaction Valuation by 0.0001476.

|

| (3) | Vitru Brasil Empreendimentos,

Participações e Comércio S.A. previously paid U.S.$14,461.96 upon the filing of its Registration Statement on Form

F-4 on September 6, 2023 in connection with the transaction reported hereby.

|

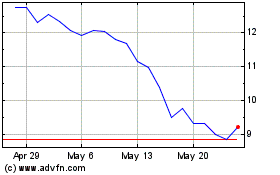

Vitru (NASDAQ:VTRU)

Historical Stock Chart

From Apr 2024 to May 2024

Vitru (NASDAQ:VTRU)

Historical Stock Chart

From May 2023 to May 2024