false000160206500016020652023-10-122023-10-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 12, 2023

___________

VIPER ENERGY PARTNERS LP

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | | | | |

DE | 001-36505 | 46-5001985 | |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) | |

| 500 West Texas Ave. | | | | |

| Suite 100 | | | | |

| Midland, | TX | | | 79701 | |

(Address of principal

executive offices) | | | (Zip code) | |

(432) 221-7400

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Units | VNOM | The Nasdaq Stock Market LLC |

| | (NASDAQ Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

Pricing of Senior Notes

On October 12, 2023, Viper Energy Partners LP (the “Partnership”) issued a press release announcing that it priced an offering of $400.0 million aggregate principal amount of its 7.375% Senior Notes due 2031 (the “Notes”) to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and to certain non-U.S. persons in accordance with Regulation S under the Securities Act (the “Notes Offering”). The Notes will be issued at par. The Partnership intends to loan the proceeds from the Notes Offering to Viper Energy Partners LLC (the “Operating Company”) to pay a portion of the cash consideration for the pending acquisition of the right, title and interest in, and to certain mineral interests, overriding royalty interests, royalty interests and non-participating royalty interests in oil, gas, and other hydrocarbons of Royalty Asset Holdings, LP, Royalty Asset Holdings II, LP, and Saxum Asset Holdings, LP in the Permian Basin, primarily in the Midland and Delaware basins, and other major basins (assuming closing occurs). The Notes Offering is expected to close on October 19, 2023. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The Notes have not been registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from such registration requirements. The Partnership is under no obligation, and has no intention, to register the Notes under the Securities Act or any state securities laws in the future. This report is neither an offer to sell nor a solicitation of an offer to buy any of these securities and shall not constitute an offer, solicitation or sale in any jurisdiction in which such offer, solicitation or sale is unlawful.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | | | | |

| Number | | Description |

| 99.1* | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | VIPER ENERGY PARTNERS LP |

| | | | |

| | | By: | Viper Energy Partners GP LLC,

its general partner |

| Date: | October 12, 2023 | | | |

| | | | |

| | | By: | /s/ Teresa L. Dick |

| | | Name: | Teresa L. Dick |

| | | Title: | Chief Financial Officer, Executive Vice President and Assistant Secretary |

Exhibit 99.1

VIPER ENERGY PARTNERS LP, A SUBSIDIARY OF DIAMONDBACK ENERGY, INC., PRICES $400 MILLION OFFERING OF 7.375% SENIOR NOTES

MIDLAND, Texas, October 12, 2023 (GLOBE NEWSWIRE) -- Viper Energy Partners LP (NASDAQ:VNOM) (“Viper”), a subsidiary of Diamondback Energy, Inc. (NASDAQ:FANG) (“Diamondback”), announced today that it has priced at par an offering of $400 million aggregate principal amount of its 7.375% Senior Notes due 2031 (the “Notes”). The Notes are being sold to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and to certain non-U.S. persons outside the United States in accordance with Regulation S under the Securities Act (the “Notes Offering”). The Notes will be issued under a new indenture and will rank equally with Viper’s other senior indebtedness. The Notes Offering is expected to close on October 19, 2023, subject to customary closing conditions. Net proceeds to Viper from the Notes Offering will be approximately $394.4 million. Viper intends to loan the proceeds from the Notes Offering to Viper Energy Partners, LLC (“OpCo”) to pay a portion of the cash consideration for the pending acquisition of the right, title and interest in, and to certain mineral interests, overriding royalty interests, royalty interests and non-participating royalty interests in oil, gas and other hydrocarbons of Royalty Asset Holdings, LP, Royalty Asset Holdings II, LP, and Saxum Asset Holdings, LP in the Permian Basin, primarily in the Midland and Delaware basins, and other major basins (assuming closing occurs).

The Notes will be senior unsecured obligations of Viper, initially will be guaranteed on a senior unsecured basis by OpCo, Viper’s sole subsidiary, and will pay interest semi-annually. Neither Viper’s parent Diamondback nor Viper’s general partner will guarantee the Notes. In the future, each of Viper’s restricted subsidiaries that either (1) guarantees any of its or a guarantor’s other indebtedness or (2) is a domestic restricted subsidiary and is an obligor with respect to any indebtedness under any credit facility will be required to guarantee the Notes.

The Notes have not been registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent registration or an applicable exemption from such registration requirements. Viper is under no obligation, and has no intention, to register the Notes under the Securities Act or any state securities laws in the future.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Viper Energy Partners LP

Viper is a limited partnership formed by Diamondback to own, acquire and exploit oil and natural gas properties in North America, with a focus on owning and acquiring mineral and royalty interests in oil-weighted basins, primarily the Permian Basin. For more information, please visit www.viperenergy.com.

Investor Contacts:

Adam Lawlis

+1 432.221.7467

alawlis@diamondbackenergy.com

Austen Gilfillian

+1 432.221.7420

agilfillian@viperenergy.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

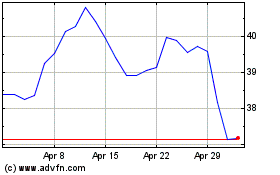

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From Apr 2024 to May 2024

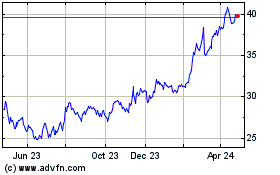

Viper Energy (NASDAQ:VNOM)

Historical Stock Chart

From May 2023 to May 2024