VictoryShares ETFs Exceed $5 Billion AUM Milestone

December 18 2019 - 10:00AM

Business Wire

Victory Capital today announced that its VictoryShares ETF

platform has crossed the $5 billion mark in assets under

management. The firm entered the ETF business in 2015 and its

growing ETF platform includes a suite of strategies that use a

rules-based approach to seek to outperform traditional market

cap-weighted indexing strategies.

“The methodologies behind our innovative strategic beta ETFs

have resonated with investors who understand the inherent

deficiencies of traditional cap-weighted indexes,” said Mannik

Dhillon, President of VictoryShares and Solutions. “Our success is

rooted in bringing clients solutions that seek to deliver on our

mission to combine active insights with passive solutions that are

low cost and tax efficient.” *

Having amassed $5 billion in assets in five years, VictoryShares

is among the fastest-growing ETF issuers in the United States.**

“The ETF industry has seen rapid growth and we’re appreciative of

both the opportunity to contribute to that evolution and the trust

our clients have placed in us,” Dhillon said.

In addition to its risk-weighted strategies, VictoryShares

leverages the active insights of Victory Capital’s Investment

Franchises to offer innovative dividend growth and minimum

volatility strategies, as well as active fixed income ETFs. Visit

http://victoryshares.com for more information.

*Trading costs and other fees may

apply.

**Source: Morningstar. Calculated AUM

growth rate from October 2014-October 2019.

About Victory Capital

Victory Capital is a global investment management firm operating

a next-generation, integrated multi-boutique business model with

$149.5 billion in assets under management as of November 30,

2019.

Victory Capital provides specialized investment strategies to

institutions, intermediaries, retirement platforms and individual

investors, including USAA members through its direct member

channel. Through its Investment Franchises and Solutions Platform,

Victory Capital offers a diverse array of independent investment

approaches and innovative investment vehicles designed to drive

better investor outcomes. This includes actively managed mutual

funds and separately managed accounts, rules-based and active ETFs,

multi-asset class strategies, custom solutions and a 529 College

Savings Plan.

For more information, please visit www.vcm.com or follow us on

Twitter and LinkedIn.

VictoryShares AUM will differ from consolidated Victory Capital

AUM reporting which excludes assets managed for other proprietary

product (e.g. funds of funds) in order to adjust for double

counting.

Strategic beta refers to rules-based investment strategies that

do not use traditional market capitalization weights. Rather, a

strategic beta ETF uses alternative weighting schemes based on

measures such as volatility or dividends.

Victory Capital means Victory Capital Management Inc., the

investment manager of the Victory Capital mutual funds, USAA Mutual

Funds, VictoryShares ETFs, and VictoryShares USAA ETFs. Victory

Capital mutual funds and USAA Mutual Funds are distributed by

Victory Capital Advisers, Inc. (VCA). VictoryShares ETFs and

VictoryShares USAA ETFs are distributed by Foreside Fund Services,

LLC (Foreside). VCA and Foreside are members of FINRA and SIPC.

Victory Capital Management Inc. (VCM) is the investment adviser to

the Victory Capital mutual funds, USAA Mutual Funds, VictoryShares

ETFs and VictoryShares USAA ETFs. VCA and VCM are not affiliated

with Foreside. USAA is not affiliated with Foreside, VCM, or VCA.

USAA and the USAA logos are registered trademarks and the USAA

Mutual Funds and USAA Investments logos are trademarks of United

Services Automobile Association and are being used by Victory

Capital and its affiliates under license.

Consider the Fund’s investment objectives, risks, charges and

expenses and other information about the VictoryShares ETFs and

VictoryShares USAA ETFs, available in each ETF’s prospectus or, if

available, summary prospectus, carefully before investing. To

obtain a copy, please visit www.victorysharesliterature.com or call

800.991.8191. Read it carefully before investing.

Investments involve risk including possible loss of principal.

ETFs have the same risks as the underlying securities traded on the

exchange throughout the day. Redemptions are limited and often

commissions are charged on each trade, and ETFs may trade at a

premium or discount to their net asset value. ETFs focused on high

dividend strategies may not be successful. Dividend paying stocks

may fall out of favor relative to the overall market. ETFs may

invest in securities included in, or representative of securities

included in, the index, regardless of their investment merits.

The ETFs are not actively managed and do not, therefore, seek

returns in excess of their respective Index. However, the UITB and

USTB ETFs are actively managed and judgments about a particular

security, markets or investment strategy may prove to be incorrect

and may cause the ETFs to incur losses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191218005436/en/

Investors: Matthew Dennis, CFA Chief of Staff &

Director, Investor Relations 216-898-2412 mdennis@vcm.com

Media: Tricia Ross 310-622-8226 tross@finprofiles.com

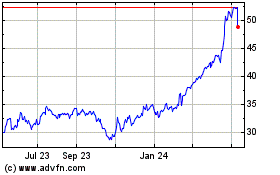

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Jun 2024 to Jul 2024

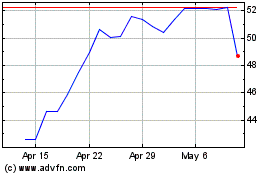

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Jul 2023 to Jul 2024