false000170652400017065242024-06-192024-06-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 19, 2024

URBAN-GRO, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39933 | | 46-5158469 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

1751 Panorama Point, Unit G Lafayette, Colorado | | 80026 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (720) 390-3880

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common stock, par value $0.001 per share | | UGRO | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As described under Item 5.07 of this report, on June 19, 2024, at the Annual Meeting of Stockholders (“Annual Meeting”) of urban-gro, Inc. (“Company”), the Company's stockholders approved a second amendment (the “Plan Amendment”) to the Company's 2021 Omnibus Stock Incentive Plan (the “2021 Plan”). The 2021 Plan, as amended by the Plan Amendment, is referred to herein as the “Amended Plan.” The Amended Plan increased the number of shares of common stock the Company authorized for issuance under the 2021 Plan by 1,200,000 shares.

A summary of the Amended Plan is included in Proposal 2 of the Company's Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on April 25, 2024 (the “Proxy Statement”), which summary is incorporated in its entirety herein by reference. The summary of the Amended Plan contained herein and in the Proxy Statement does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Amended Plan, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. Item 5.07 Submission of Matters to a Vote of Security Holders.

The Company held its Annual Meeting on June 19, 2024. At the close of business on April 22, 2024, the record date for the Annual Meeting (the “Record Date”), there were 12,318,761 shares of common stock, par value $0.001 per share, of the Company issued and outstanding, each share being entitled to one vote and to be voted together as one class vote at the Annual Meeting. At the Annual Meeting, there were present in person or by proxy 6,368,597 shares of the Company’s common stock, representing stockholders entitled to cast approximately 51.70% of the total outstanding eligible votes and constituting a quorum.

Five proposals were submitted in the Proxy Statement, one proposal was withdrawn, and the remaining four proposals were considered and voted upon at the Annual Meeting, all of which were described in the Proxy Statement filed with the Securities and Exchange Commission on April 25, 2024. Because Proposal Number 3 was withdrawn, there were no non-discretionary matters voted on at the Annual Meeting and, as such, the Company did not record any broker non-votes. Below are the voting results of the four proposals that were considered at the Annual Meeting:

Proposal 1. Election of Directors

At the Annual Meeting, the Company’s stockholders elected all of the incumbent directors that stood for reelection. Each director was elected by a plurality vote. The directors elected and the final vote tabulation for each director were as follows:

| | | | | | | | | | | | | | | | | | | | |

| Director | | For | | Withhold | |

| Bradley J. Nattrass | | 6,034,316 | | | 334,281 | | |

| James R. Lowe | | 6,011,531 | | | 357,066 | | |

| Lewis O. Wilks | | 5,654,835 | | | 713,762 | | |

| Anita Britt | | 5,578,505 | | | 790,092 | | |

| David Hsu | | 5,217,966 | | | 1,150,631 | | |

| Sonia Lo | | 5,217,679 | | | 1,150,918 | | |

| | | | | | |

Proposal 2. Amendment to the 2021 Omnibus Stock Incentive Plan

The Company’s stockholders approved an amendment to the Company's Omnibus 2021 Stock Incentive Plan. The proposal passed by the affirmative vote of a majority of votes cast. The final vote tabulation for that proposal was as follows:

| | | | | |

| For | 5,755,205 | |

| Against | 553,284 | |

| Abstain | 60,108 | |

Proposal 3. Appointment of Independent Registered Public Accounting Firm

As further described in the Company’s proxy supplement filed on May 7, 2024, the third proposal listed in the Proxy Statement was withdrawn by the Company. Proposal 4. Compensation of Named Executive Officers

The Company’s stockholders approved, on a non-binding advisory basis, the compensation of the named executive officers as set forth in the Proxy Statement. The proposal passed by the affirmative vote of a majority of votes cast. The final vote tabulation for that proposal was as follows:

| | | | | |

| For | 3,964,817 | |

| Against | 594,037 | |

| Abstain | 1,809,743 | |

Proposal 5. Frequency of Future Advisory Votes on the Compensation of Named Executive Officers

The Company’s stockholders approved, on a non-binding advisory basis, the frequency of future advisory votes on the compensation of named executive officers for a one year frequency. The proposal passed by the affirmative vote of a majority of votes cast. The final vote tabulation for that proposal was as follows:

| | | | | |

For “ONE YEAR” | 4,161,588 | |

For “TWO YEARS” | 220,648 | |

For “THREE YEARS” | 143,399 | |

| Abstain | 1,842,962 | |

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits.

| | | | | | | | |

| Exhibit Number | | Exhibit Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| URBAN-GRO, INC. |

| | |

Date: June 20, 2024 | By: | /s/ Bradley Nattrass |

| | Bradley Nattrass |

| | Chairperson of the Board of Directors and Chief Executive Officer |

Exhibit 10.1

AMENDMENT NO. 2 TO

URBAN-GRO, INC.

2021 OMNIBUS STOCK INCENTIVE PLAN

WHEREAS, urban-gro, Inc. (the “Corporation”) maintains the urban-gro, Inc. 2021 Omnibus Stock Incentive Plan (the “Plan,” capitalized terms not defined in this Amendment shall have the meaning as defined in the Plan), which was previously adopted by the Board of Directors of the Corporation (the “Board”) on February 23, 2021, and approved by the stockholders of the Corporation effective May 27, 2021;

WHEREAS, pursuant to Section 3(a) of the Plan, a total of 2,300,000 shares of common stock of the Corporation (the “Shares”) have been approved for issuance under the Plan;

WHEREAS, pursuant to Section 16(a) of the Plan, the Board may not increase the total number of shares that may be issued under the Plan without the approval of the stockholders;

WHEREAS, the Board has determined that it is in the best interests of the Corporation to amend the Plan, subject to stockholder approval, to increase the aggregate number of Shares available for issuance under the Plan by 1,200,000 shares (this “Amendment”); and

WHEREAS, this Amendment will become effective upon approval by the Corporation’s stockholders at the 2024 Annual Meeting of Stockholders and if, for any reason, the Corporation’s stockholders fail to approve this Amendment, the existing Plan shall continue in full force and effect.

NOW, THEREFORE, the following amendments and modifications are hereby made a part of the Plan:

1.Section 3(a) of the Plan is hereby deleted in its entirety and replaced as follows:

“(a) Subject to adjustment as described in Section 13 below, the maximum aggregate number of Shares which may be issued pursuant to all Awards (including Incentive Stock Options) is 3,500,000 Shares. The Shares may be authorized, but unissued, or reacquired Common Stock.”

This Amendment to the Plan shall become effective upon the date it is approved by the Company’s stockholders in accordance with Applicable Laws.

Except as set forth above, all other provisions of the Plan shall remain unchanged.

v3.24.1.1.u2

Cover

|

Jun. 19, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 19, 2024

|

| Entity Registrant Name |

URBAN-GRO, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39933

|

| Entity Tax Identification Number |

46-5158469

|

| Entity Address, Address Line One |

1751 Panorama Point

|

| Entity Address, Address Line Two |

Unit G

|

| Entity Address, City or Town |

Lafayette

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80026

|

| City Area Code |

(720)

|

| Local Phone Number |

390-3880

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

UGRO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001706524

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

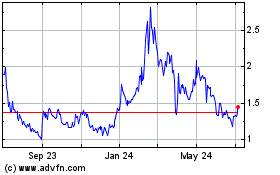

Urban Gro (NASDAQ:UGRO)

Historical Stock Chart

From Dec 2024 to Jan 2025

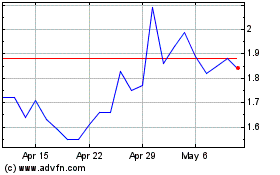

Urban Gro (NASDAQ:UGRO)

Historical Stock Chart

From Jan 2024 to Jan 2025