0001620280

false

0001620280

2023-08-15

2023-08-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 15, 2023

Uniti Group Inc.

(Exact name of registrant as specified

in its charter)

| Maryland |

|

001-36708 |

|

46-5230630 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

2101 Riverfront Drive, Suite A

Little Rock, Arkansas |

|

72202 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number,

including area code: (501) 850-0820

Not Applicable

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

UNIT |

The NASDAQ Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation

FD Disclosure.

Uniti Group Inc. (the “Company”)

is furnishing this Current Report on Form 8-K to provide certain financial information of Windstream Holdings II, LLC, successor in interest

to Windstream Holdings, Inc., and its consolidated subsidiaries (collectively, “Windstream”) regarding the period ended June

30, 2023. The financial information was provided to the Company by Windstream; the Company did not assist in the preparation or review

of this financial information and makes no representation as to its accuracy.

The information contained

in this Item 7.01, including the exhibit attached hereto, is being “furnished” and shall not be deemed “filed”

for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to

the liabilities of Section 18 of the Exchange Act. The information in this Item 7.01 shall not be incorporated by reference into any registration

statement or other document pursuant to the Securities Act of 1933, as amended, or into any filing or other document pursuant to the Exchange

Act, except as otherwise expressly stated in any such filing.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| By: | /s/

Daniel L. Heard |

| Name: | Daniel L. Heard |

| Title: | Executive Vice President – General Counsel and Secretary |

Date: August 15, 2023

Exhibit 99.1

Windstream Holdings II, LLC ("Windstream",

"we", "us", "our", or "the Company") has presented in this Investor Supplement unaudited adjusted

results, which excludes depreciation and amortization, straight-line expense under the master leases with Uniti Group, Inc. ("Uniti"),

equity-based compensation expense, and certain other costs. We have also presented certain measures of our operating performance, on

an adjusted basis, that reflects the impact of the cash payment due under the master leases with Uniti. In addition, we have presented

on a pro forma adjusted basis Adjusted EBITDA as if Uniti's fourth quarter 2021 prepayment of all quarterly amounts due in 2022 were

made as scheduled.

During the first quarter of 2023, we completed

a number of activities to maximize our strategic optionality by further separating our business units, which included legal entity changes,

financial reporting modifications and alignment of our network infrastructure to our business unit operations. To better reflect the

individual business unit financial performance, we established various intercompany billing agreements related to network sharing arrangements

between our business units and created a new OfficeSuite business unit. These intercompany transactions have no impact on our consolidated

results of operations as the intercompany revenues and expenses are eliminated in consolidation. To further align our business unit operations,

we made additional changes to our previous segment structure, which included (1) shifting revenues and expenses related to certain time-division-multiplexing

(“TDM”) voice and data services from Wholesale to Enterprise, (2) shifting revenues and expenses related to certain fiber-to-the-tower

services from Wholesale to Kinetic and (3) reassigning certain costs and expenses. During the second quarter of 2023, we finalized the

intercompany billing arrangements between the Kinetic and Wholesale business units and also adjusted certain expense assignments. Prior

period segment information previously reported in the March 31, 2023 investor supplement has been revised to reflect these changes. A

reconciliation of previously reported to revised segment information is included within this Investor Supplement.

As a result of the 2023 changes discussed above,

our business operations are organized into four segments: Kinetic, Enterprise, Wholesale and OfficeSuite. The Kinetic business unit primarily

serves customers in markets in which we are the incumbent local exchange carrier (“ILEC”) and provides services over network

facilities operated by us. The Enterprise and Wholesale business units primarily serve customers in markets in which we are a competitive

local exchange carrier (“CLEC”) and provide services over network facilities primarily leased from other carriers. The OfficeSuite

business unit charges Kinetic, Enterprise and certain external reseller customers licensing fees for the usage of the OfficeSuite UC

© product.

We use Adjusted EBITDA, Adjusted EBITDAR, Adjusted

Free Cash Flow and Adjusted Capital Expenditures as key measures of the operational performance of our business. Our management, including

the chief operating decision-maker, consistently uses these measures for internal reporting and the evaluation of business objectives,

opportunities and performance, and the determination of management compensation. Management believes that Adjusted Free Cash Flow provides

investors with useful information about the ability of our core operations to generate cash flow. Because capital spending is necessary

to maintain our operational capabilities, we believe that capital expenditures represents a recurring and necessary use of cash. As such,

we believe investors should consider our capital spending and payments due under our master leases with Uniti when evaluating the amount

of cash provided by our operating activities.

WINDSTREAM HOLDINGS II, LLC

UNAUDITED ADJUSTED RESULTS OF OPERATIONS (NON-GAAP)

QUARTERLY SUPPLEMENTAL INFORMATION

for the quarterly periods in the years 2023 and 2022

(In millions)

| | |

2023 | | |

2022 | |

| | |

Total | | |

2nd

Qtr. | | |

1st Qtr. | | |

Total | | |

4th Qtr. | | |

3rd

Qtr. | | |

2nd Qtr. | | |

1st Qtr. | |

| ADJUSTED

RESULTS OF OPERATIONS: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues

and sales: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Service

revenues | |

$ | 1,999.4 | | |

$ | 980.0 | | |

$ | 1,019.4 | | |

$ | 4,183.8 | | |

$ | 1,042.9 | | |

$ | 1,047.3 | | |

$ | 1,034.1 | | |

$ | 1,059.5 | |

| Product

and fiber sales | |

| 18.8 | | |

| 10.9 | | |

| 7.9 | | |

| 45.1 | | |

| 10.3 | | |

| 12.6 | | |

| 10.8 | | |

| 11.4 | |

| Total

revenues and sales | |

| 2,018.2 | | |

| 990.9 | | |

| 1,027.3 | | |

| 4,228.9 | | |

| 1,053.2 | | |

| 1,059.9 | | |

| 1,044.9 | | |

| 1,070.9 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Costs

and expenses: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cost

of services | |

| 927.9 | | |

| 457.0 | | |

| 470.9 | | |

| 2,017.3 | | |

| 476.2 | | |

| 516.6 | | |

| 498.1 | | |

| 526.4 | |

| Cost

of sales | |

| 25.2 | | |

| 13.1 | | |

| 12.1 | | |

| 55.0 | | |

| 11.8 | | |

| 15.4 | | |

| 13.5 | | |

| 14.3 | |

| Selling,

general and administrative | |

| 325.6 | | |

| 161.1 | | |

| 164.5 | | |

| 672.3 | | |

| 165.3 | | |

| 169.4 | | |

| 169.4 | | |

| 168.2 | |

| Costs

and expenses | |

| 1,278.7 | | |

| 631.2 | | |

| 647.5 | | |

| 2,744.6 | | |

| 653.3 | | |

| 701.4 | | |

| 681.0 | | |

| 708.9 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted

EBITDAR (A) | |

| 739.5 | | |

| 359.7 | | |

| 379.8 | | |

| 1,484.3 | | |

| 399.9 | | |

| 358.5 | | |

| 363.9 | | |

| 362.0 | |

| Cash

payment under master leases with Uniti | |

| (335.5 | ) | |

| (168.0 | ) | |

| (167.5 | ) | |

| (668.9 | ) | |

| (167.5 | ) | |

| (167.5 | ) | |

| (167.2 | ) | |

| (166.7 | ) |

| Cash

received from Uniti per settlement agreement (B) | |

| 49.0 | | |

| 24.5 | | |

| 24.5 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Adjusted

EBITDA (C) | |

$ | 453.0 | | |

$ | 216.2 | | |

$ | 236.8 | | |

$ | 815.4 | | |

$ | 232.4 | | |

$ | 191.0 | | |

$ | 196.7 | | |

$ | 195.3 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pro

forma Adjusted EBITDA (D) | |

$ | 453.0 | | |

$ | 216.2 | | |

$ | 236.8 | | |

$ | 908.3 | | |

$ | 255.6 | | |

$ | 214.2 | | |

$ | 219.9 | | |

$ | 218.6 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Margins

(E): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted

EBITDAR margin | |

| 36.6 | % | |

| 36.3 | % | |

| 37.0 | % | |

| 35.1 | % | |

| 38.0 | % | |

| 33.8 | % | |

| 34.8 | % | |

| 33.8 | % |

| Adjusted

EBITDA margin | |

| 22.4 | % | |

| 21.8 | % | |

| 23.1 | % | |

| 19.3 | % | |

| 22.1 | % | |

| 18.0 | % | |

| 18.8 | % | |

| 18.2 | % |

| Pro

forma Adjusted EBITDA margin | |

| 22.4 | % | |

| 21.8 | % | |

| 23.1 | % | |

| 21.5 | % | |

| 24.3 | % | |

| 20.2 | % | |

| 21.0 | % | |

| 20.4 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted

Capital Expenditures | |

$ | 549.0 | | |

$ | 245.9 | | |

$ | 303.1 | | |

$ | 1,067.2 | | |

$ | 274.0 | | |

$ | 296.4 | | |

$ | 286.6 | | |

$ | 210.2 | |

| Adjusted

Free Cash Flow (F) | |

$ | (65.7 | ) | |

$ | 16.5 | | |

$ | (82.2 | ) | |

$ | (212.9 | ) | |

$ | 13.6 | | |

$ | (116.6 | ) | |

$ | (72.2 | ) | |

$ | (37.7 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| As

of | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| 6/30/2023 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Debt Leverage

Ratio: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Long-term

debt, including current maturities (G) | |

$ | 2,365.3 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Add:

Capital lease obligations | |

| 31.2 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Less:

Cash and cash equivalents | |

| (29.3 | ) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

debt | (1) |

$ | 2,367.2 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| Twelve | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| Months

Ended | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| 6/30/2023 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Pro

forma Adjusted EBITDA | (2) |

$ | 922.8 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net

leverage ratio (H) - computed as (1)/(2) | |

| 2.56 | x | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Available

liquidity as of June 30, 2023: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash

and cash equivalents | |

$ | 29.3 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Available

capacity under credit facility (I) | |

| 395.7 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Available

liquidity | |

$ | 425.0 | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| (A) | Adjusted EBITDAR is earnings before interest

expense, income taxes and depreciation and amortization and is calculated as operating income

(loss) excluding depreciation and amortization, straight-line expense under the master leases

with Uniti, equity-based compensation expense, and certain other costs. |

| (B) | In the fourth quarter of 2021, Uniti

prepaid all of the quarterly amounts payable to Windstream in 2022. |

| (C) | Adjusted EBITDA is Adjusted EBITDAR after

the cash payment due under the master leases with Uniti excluding additional rent paid for

growth capital expenditures funded by Uniti and increased for cash received from Uniti per

the settlement agreement. |

| (D) | Pro forma Adjusted EBITDA is Adjusted

EBITDA as if Uniti's fourth quarter 2021 prepayment of all quarterly amounts due in 2022

were made as scheduled. |

| (E) | Margins are calculated by dividing the

respective profitability measures by total revenues and sales. |

| (F) | Adjusted Free Cash

Flow is Adjusted EBITDA less adjusted capital expenditures, additional rent paid for growth

capital expenditures funded by Uniti and cash paid for interest on long-term debt obligations

plus funding received from Uniti for growth capital expenditures and adjusted for cash (paid)

refunded for income taxes, net. |

| (G) | Long-term debt, including current maturities

excluding unamortized debt discount. |

| (H) | The net leverage ratio is computed by

dividing net debt by Pro forma Adjusted EBITDA. |

| (I) | Available capacity under credit facility

excludes outstanding letters of credit of $104.3 million of which $78.4 million was issued

to Universal Service Administrative Company as a condition for Windstream receiving Rural

Digital Opportunity Fund ("RDOF") funding. |

See page

7 for computations of Adjusted EBITDAR, Adjusted EBITDA, Pro Forma Adjusted EBITDA, Adjusted Free Cash Flow and Adjusted Capital Expenditures.

WINDSTREAM HOLDINGS II, LLC

QUARTERLY SUPPLEMENTAL INFORMATION - REVENUE SUPPLEMENT

for the quarterly periods in the years 2023 and 2022

(In millions)

| | |

2023 | | |

2022 | |

| | |

Total | | |

2nd Qtr. | | |

1st Qtr. | | |

Total | | |

4th

Qtr. | | |

3rd

Qtr. | | |

2nd Qtr. | | |

1st Qtr. | |

| Service revenues: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Kinetic: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| High-speed

Internet bundles | |

$ | 603.5 | | |

$ | 303.9 | | |

$ | 299.6 | | |

$ | 1,160.2 | | |

$ | 290.0 | | |

$ | 291.4 | | |

$ | 289.0 | | |

$ | 289.8 | |

| Voice

and other | |

| 36.0 | | |

| 17.6 | | |

| 18.4 | | |

| 76.6 | | |

| 18.0 | | |

| 18.9 | | |

| 18.5 | | |

| 21.2 | |

| Consumer | |

| 639.5 | | |

| 321.5 | | |

| 318.0 | | |

| 1,236.8 | | |

| 308.0 | | |

| 310.3 | | |

| 307.5 | | |

| 311.0 | |

| Small business | |

| 144.9 | | |

| 72.0 | | |

| 72.9 | | |

| 299.1 | | |

| 73.9 | | |

| 75.1 | | |

| 74.4 | | |

| 75.7 | |

| Large business | |

| 56.5 | | |

| 26.6 | | |

| 29.9 | | |

| 122.9 | | |

| 30.1 | | |

| 30.9 | | |

| 30.1 | | |

| 31.8 | |

| Wholesale | |

| 154.6 | | |

| 78.1 | | |

| 76.5 | | |

| 291.0 | | |

| 75.1 | | |

| 73.6 | | |

| 74.1 | | |

| 68.2 | |

| Switched

access | |

| 6.7 | | |

| 3.4 | | |

| 3.3 | | |

| 18.3 | | |

| 3.9 | | |

| 4.3 | | |

| 4.8 | | |

| 5.3 | |

| RDOF funding | |

| 26.1 | | |

| 13.0 | | |

| 13.1 | | |

| 51.8 | | |

| 13.0 | | |

| 13.1 | | |

| 13.3 | | |

| 12.4 | |

| State USF | |

| 32.0 | | |

| 16.0 | | |

| 16.0 | | |

| 100.2 | | |

| 70.5 | | |

| 13.4 | | |

| 7.7 | | |

| 8.6 | |

| End user

surcharges | |

| 34.4 | | |

| 15.9 | | |

| 18.5 | | |

| 69.2 | | |

| 18.1 | | |

| 19.3 | | |

| 15.3 | | |

| 16.5 | |

| Intersegment

revenues (A) | |

| 7.4 | | |

| 3.6 | | |

| 3.8 | | |

| 17.1 | | |

| 4.2 | | |

| 4.2 | | |

| 4.3 | | |

| 4.4 | |

| Kinetic | |

| 1,102.1 | | |

| 550.1 | | |

| 552.0 | | |

| 2,206.4 | | |

| 596.8 | | |

| 544.2 | | |

| 531.5 | | |

| 533.9 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Enterprise: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Strategic

(B) | |

| 237.4 | | |

| 120.5 | | |

| 116.9 | | |

| 429.4 | | |

| 111.2 | | |

| 109.4 | | |

| 105.4 | | |

| 103.4 | |

| Advanced

IP (C) | |

| 255.5 | | |

| 124.1 | | |

| 131.4 | | |

| 548.6 | | |

| 130.0 | | |

| 137.4 | | |

| 136.2 | | |

| 145.0 | |

| Total | |

| 492.9 | | |

| 244.6 | | |

| 248.3 | | |

| 978.0 | | |

| 241.2 | | |

| 246.8 | | |

| 241.6 | | |

| 248.4 | |

| TDM/Other

(D) | |

| 211.3 | | |

| 92.0 | | |

| 119.3 | | |

| 648.0 | | |

| 119.2 | | |

| 163.1 | | |

| 173.7 | | |

| 192.0 | |

| End user

surcharges | |

| 31.0 | | |

| 14.3 | | |

| 16.7 | | |

| 73.8 | | |

| 14.9 | | |

| 19.0 | | |

| 18.0 | | |

| 21.9 | |

| Intersegment

revenues (E) | |

| 0.3 | | |

| 0.2 | | |

| 0.1 | | |

| 0.7 | | |

| 0.1 | | |

| 0.2 | | |

| 0.2 | | |

| 0.2 | |

| Enterprise | |

| 735.5 | | |

| 351.1 | | |

| 384.4 | | |

| 1,700.5 | | |

| 375.4 | | |

| 429.1 | | |

| 433.5 | | |

| 462.5 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Wholesale: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fiber and

colocation services | |

| 168.8 | | |

| 82.3 | | |

| 86.5 | | |

| 293.6 | | |

| 74.7 | | |

| 78.1 | | |

| 73.4 | | |

| 67.4 | |

| Intersegment

revenues (F) | |

| 48.0 | | |

| 23.6 | | |

| 24.4 | | |

| 99.3 | | |

| 24.9 | | |

| 24.8 | | |

| 24.7 | | |

| 24.9 | |

| Wholesale | |

| 216.8 | | |

| 105.9 | | |

| 110.9 | | |

| 392.9 | | |

| 99.6 | | |

| 102.9 | | |

| 98.1 | | |

| 92.3 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| OfficeSuite: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| License

fees | |

| 0.7 | | |

| 0.3 | | |

| 0.4 | | |

| 1.1 | | |

| 0.3 | | |

| 0.3 | | |

| 0.2 | | |

| 0.3 | |

| Intersegment

revenues (G) | |

| 10.5 | | |

| 5.4 | | |

| 5.1 | | |

| 19.0 | | |

| 5.0 | | |

| 4.8 | | |

| 4.7 | | |

| 4.5 | |

| OfficeSuite | |

| 11.2 | | |

| 5.7 | | |

| 5.5 | | |

| 20.1 | | |

| 5.3 | | |

| 5.1 | | |

| 4.9 | | |

| 4.8 | |

| Total

service revenues | |

| 2,065.6 | | |

| 1,012.8 | | |

| 1,052.8 | | |

| 4,319.9 | | |

| 1,077.1 | | |

| 1,081.3 | | |

| 1,068.0 | | |

| 1,093.5 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Product and

fiber sales: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Kinetic

product sales | |

| 16.1 | | |

| 8.6 | | |

| 7.5 | | |

| 39.1 | | |

| 8.2 | | |

| 12.0 | | |

| 8.6 | | |

| 10.3 | |

| Enterprise

product sales | |

| 0.7 | | |

| 0.3 | | |

| 0.4 | | |

| 4.3 | | |

| 0.4 | | |

| 0.6 | | |

| 2.2 | | |

| 1.1 | |

| Wholesale

fiber sales | |

| 2.0 | | |

| 2.0 | | |

| - | | |

| 1.7 | | |

| 1.7 | | |

| - | | |

| - | | |

| - | |

| Total

product and fiber sales | |

| 18.8 | | |

| 10.9 | | |

| 7.9 | | |

| 45.1 | | |

| 10.3 | | |

| 12.6 | | |

| 10.8 | | |

| 11.4 | |

| Total

segment revenues and sales | |

$ | 2,084.4 | | |

$ | 1,023.7 | | |

$ | 1,060.7 | | |

$ | 4,365.0 | | |

$ | 1,087.4 | | |

$ | 1,093.9 | | |

$ | 1,078.8 | | |

$ | 1,104.9 | |

| (A) | Consists of charges to Enterprise for network transport services and

last mile access to Enterprise locations within the Kinetic footprint. |

| (B) | Strategic revenues consist of recurring Secure Access Service Edge ("SASE"),

Unified Communications as a Service ("UCaaS"), OfficeSuite UC©, and associated network access products

and services. SASE includes both Software Defined Wide Area Network (“SD-WAN”) and Security Service Edge (“SSE”). |

| (C) | Advanced IP revenues consist of recurring dynamic Internet protocol, dedicated Internet access,

multi-protocol label switching services, integrated voice and data, long distance and managed services. |

| (D) | TDM revenues consist of time-division multiplexing ("TDM") voice and data services.

Other revenues include usage-based long-distance revenues and resale revenues as well as all non-recurring revenues. |

| (E) | Consists of charges to Kinetic for the resale of TDM voice and data services provisioned

by Enterprise switching equipment. |

| (F) | Consists of charges to Kinetic and Enterprise for transport services including network and

customer specific usage. |

| (G) | OfficeSuite UC© charges Kinetic and Enterprise licensing fees for the usage

of the OfficeSuite UC© product. |

WINDSTREAM

HOLDINGS II, LLC

QUARTERLY

SUPPLEMENTAL INFORMATION - BUSINESS SEGMENTS

for

the quarterly periods in the years 2023 and 2022

(In

millions)

| | |

2023 | | |

2022 | |

| | |

Total | | |

2nd Qtr. | | |

1st Qtr. | | |

Total | | |

4th

Qtr. | | |

3rd Qtr. | | |

2nd

Qtr. | | |

1st Qtr. | |

| Kinetic | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues and sales: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Service

revenues | |

$ | 1,102.1 | | |

$ | 550.1 | | |

$ | 552.0 | | |

$ | 2,206.4 | | |

$ | 596.8 | | |

$ | 544.2 | | |

$ | 531.5 | | |

$ | 533.9 | |

| Product

sales | |

| 16.1 | | |

| 8.6 | | |

| 7.5 | | |

| 39.1 | | |

| 8.2 | | |

| 12.0 | | |

| 8.6 | | |

| 10.3 | |

| Total

revenues and sales | |

| 1,118.2 | | |

| 558.7 | | |

| 559.5 | | |

| 2,245.5 | | |

| 605.0 | | |

| 556.2 | | |

| 540.1 | | |

| 544.2 | |

| Costs and expenses | |

| 538.8 | | |

| 270.4 | | |

| 268.4 | | |

| 1,102.0 | | |

| 268.2 | | |

| 291.0 | | |

| 269.3 | | |

| 273.5 | |

| Intersegment costs and expenses (A) | |

| 30.9 | | |

| 15.4 | | |

| 15.5 | | |

| 61.4 | | |

| 15.5 | | |

| 15.4 | | |

| 15.2 | | |

| 15.3 | |

| Total

costs and expenses | |

| 569.7 | | |

| 285.8 | | |

| 283.9 | | |

| 1,163.4 | | |

| 283.7 | | |

| 306.4 | | |

| 284.5 | | |

| 288.8 | |

| Kinetic contribution margin | |

$ | 548.5 | | |

$ | 272.9 | | |

$ | 275.6 | | |

$ | 1,082.1 | | |

$ | 321.3 | | |

$ | 249.8 | | |

$ | 255.6 | | |

$ | 255.4 | |

| Kinetic contribution margin % | |

| 49.1 | % | |

| 48.8 | % | |

| 49.3 | % | |

| 48.2 | % | |

| 53.1 | % | |

| 44.9 | % | |

| 47.3 | % | |

| 46.9 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Enterprise | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenues and sales: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service revenues | |

$ | 735.5 | | |

$ | 351.1 | | |

$ | 384.4 | | |

$ | 1,700.5 | | |

$ | 375.4 | | |

$ | 429.1 | | |

$ | 433.5 | | |

$ | 462.5 | |

| Product

sales | |

| 0.7 | | |

| 0.3 | | |

| 0.4 | | |

| 4.3 | | |

| 0.4 | | |

| 0.6 | | |

| 2.2 | | |

| 1.1 | |

| Total

revenues and sales | |

| 736.2 | | |

| 351.4 | | |

| 384.8 | | |

| 1,704.8 | | |

| 375.8 | | |

| 429.7 | | |

| 435.7 | | |

| 463.6 | |

| Costs and expenses | |

| 545.1 | | |

| 262.4 | | |

| 282.7 | | |

| 1,249.2 | | |

| 286.8 | | |

| 312.6 | | |

| 313.0 | | |

| 336.8 | |

| Intersegment costs and expenses (A) | |

| 64.3 | | |

| 31.9 | | |

| 32.4 | | |

| 131.9 | | |

| 33.0 | | |

| 32.9 | | |

| 33.0 | | |

| 33.0 | |

| Total

costs and expenses | |

| 609.4 | | |

| 294.3 | | |

| 315.1 | | |

| 1,381.1 | | |

| 319.8 | | |

| 345.5 | | |

| 346.0 | | |

| 369.8 | |

| Enterprise contribution margin | |

$ | 126.8 | | |

$ | 57.1 | | |

$ | 69.7 | | |

$ | 323.7 | | |

$ | 56.0 | | |

$ | 84.2 | | |

$ | 89.7 | | |

$ | 93.8 | |

| Enterprise contribution margin % | |

| 17.2 | % | |

| 16.2 | % | |

| 18.1 | % | |

| 19.0 | % | |

| 14.9 | % | |

| 19.6 | % | |

| 20.6 | % | |

| 20.2 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Wholesale | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenues and sales: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service revenues | |

$ | 216.8 | | |

$ | 105.9 | | |

$ | 110.9 | | |

$ | 392.9 | | |

$ | 99.6 | | |

$ | 102.9 | | |

$ | 98.1 | | |

$ | 92.3 | |

| Fiber

sales | |

| 2.0 | | |

| 2.0 | | |

| - | | |

| 1.7 | | |

| 1.7 | | |

| - | | |

| - | | |

| - | |

| Total

revenues and sales | |

| 218.8 | | |

| 107.9 | | |

| 110.9 | | |

| 394.6 | | |

| 101.3 | | |

| 102.9 | | |

| 98.1 | | |

| 92.3 | |

| Costs and expenses | |

| 152.4 | | |

| 77.3 | | |

| 75.1 | | |

| 298.2 | | |

| 73.9 | | |

| 75.4 | | |

| 73.5 | | |

| 75.4 | |

| Intersegment costs and expenses (A) | |

| (29.5 | ) | |

| (14.7 | ) | |

| (14.8 | ) | |

| (58.4 | ) | |

| (14.6 | ) | |

| (14.6 | ) | |

| (14.6 | ) | |

| (14.6 | ) |

| Total

costs and expenses | |

| 122.9 | | |

| 62.6 | | |

| 60.3 | | |

| 239.8 | | |

| 59.3 | | |

| 60.8 | | |

| 58.9 | | |

| 60.8 | |

| Wholesale contribution margin | |

$ | 95.9 | | |

$ | 45.3 | | |

$ | 50.6 | | |

$ | 154.8 | | |

$ | 42.0 | | |

$ | 42.1 | | |

$ | 39.2 | | |

$ | 31.5 | |

| Wholesale contribution margin % | |

| 43.8 | % | |

| 42.0 | % | |

| 45.6 | % | |

| 39.2 | % | |

| 41.5 | % | |

| 40.9 | % | |

| 40.0 | % | |

| 34.1 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| OfficeSuite | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenues and sales: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service

revenues | |

$ | 11.2 | | |

$ | 5.7 | | |

$ | 5.5 | | |

$ | 20.1 | | |

$ | 5.3 | | |

$ | 5.1 | | |

$ | 4.9 | | |

$ | 4.8 | |

| Total

revenues and sales | |

| 11.2 | | |

| 5.7 | | |

| 5.5 | | |

| 20.1 | | |

| 5.3 | | |

| 5.1 | | |

| 4.9 | | |

| 4.8 | |

| Costs and expenses | |

| 1.8 | | |

| 0.9 | | |

| 0.9 | | |

| 4.4 | | |

| 1.1 | | |

| 1.1 | | |

| 1.0 | | |

| 1.2 | |

| Intersegment costs and expenses (A) | |

| 0.5 | | |

| 0.2 | | |

| 0.3 | | |

| 1.2 | | |

| 0.3 | | |

| 0.3 | | |

| 0.3 | | |

| 0.3 | |

| Total

costs and expenses | |

| 2.3 | | |

| 1.1 | | |

| 1.2 | | |

| 5.6 | | |

| 1.4 | | |

| 1.4 | | |

| 1.3 | | |

| 1.5 | |

| OfficeSuite contribution margin | |

$ | 8.9 | | |

$ | 4.6 | | |

$ | 4.3 | | |

$ | 14.5 | | |

$ | 3.9 | | |

$ | 3.7 | | |

$ | 3.6 | | |

$ | 3.3 | |

| OfficeSuite contribution margin % | |

| 79.5 | % | |

| 80.7 | % | |

| 77.7 | % | |

| 72.1 | % | |

| 72.6 | % | |

| 73.5 | % | |

| 73.5 | % | |

| 68.8 | % |

| (A) | Intercompany costs and expenses include the effects

of the intercompany billing agreements. In addition, charges for usage of network and colocation facilities

owned or operated by Wholesale are reported as contra-expense on Wholesale with corresponding increases

in the other business segments’ costs and expenses. |

WINDSTREAM

HOLDINGS II, LLC

QUARTERLY

SUPPLEMENTAL INFORMATION - BUSINESS SEGMENTS

for

the quarterly periods in the years 2023 and 2022

(In

millions)

| | |

2023 | | |

2022 | |

| | |

Total | | |

2nd Qtr. | | |

1st Qtr. | | |

Total | | |

4th

Qtr. | | |

3rd Qtr. | | |

2nd

Qtr. | | |

1st Qtr. | |

| Total segment

revenues and expenses | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenues and sales: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Service

revenues | |

$ | 2,065.6 | | |

$ | 1,012.8 | | |

$ | 1,052.8 | | |

$ | 4,319.9 | | |

$ | 1,077.1 | | |

$ | 1,081.3 | | |

$ | 1,068.0 | | |

$ | 1,093.5 | |

| Product

and fiber sales | |

| 18.8 | | |

| 10.9 | | |

| 7.9 | | |

| 45.1 | | |

| 10.3 | | |

| 12.6 | | |

| 10.8 | | |

| 11.4 | |

| Total segment

revenues and sales | |

| 2,084.4 | | |

| 1,023.7 | | |

| 1,060.7 | | |

| 4,365.0 | | |

| 1,087.4 | | |

| 1,093.9 | | |

| 1,078.8 | | |

| 1,104.9 | |

| Total segment costs and expenses | |

| 1,304.3 | | |

| 643.8 | | |

| 660.5 | | |

| 2,789.9 | | |

| 664.2 | | |

| 714.1 | | |

| 690.7 | | |

| 720.9 | |

| Segment contribution margin | |

| 780.1 | | |

| 379.9 | | |

| 400.2 | | |

| 1,575.1 | | |

| 423.2 | | |

| 379.8 | | |

| 388.1 | | |

| 384.0 | |

| Segment contribution margin % | |

| 37.4 | % | |

| 37.1 | % | |

| 37.7 | % | |

| 36.1 | % | |

| 38.9 | % | |

| 34.7 | % | |

| 36.0 | % | |

| 34.8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Intersegment eliminations | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service revenues | |

$ | (66.2 | ) | |

$ | (32.8 | ) | |

$ | (33.4 | ) | |

$ | (136.1 | ) | |

$ | (34.2 | ) | |

$ | (34.0 | ) | |

$ | (33.9 | ) | |

$ | (34.0 | ) |

| Cost

and expenses | |

| (66.2 | ) | |

| (32.8 | ) | |

| (33.4 | ) | |

| (136.1 | ) | |

| (34.2 | ) | |

| (34.0 | ) | |

| (33.9 | ) | |

| (34.0 | ) |

| Contribution

margin | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Consolidated revenues and

sales | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service revenues | |

$ | 1,999.4 | | |

$ | 980.0 | | |

$ | 1,019.4 | | |

$ | 4,183.8 | | |

$ | 1,042.9 | | |

$ | 1,047.3 | | |

$ | 1,034.1 | | |

$ | 1,059.5 | |

| Product

and fiber sales | |

| 18.8 | | |

| 10.9 | | |

| 7.9 | | |

| 45.1 | | |

| 10.3 | | |

| 12.6 | | |

| 10.8 | | |

| 11.4 | |

| Consolidated

revenues and sales | |

$ | 2,018.2 | | |

$ | 990.9 | | |

$ | 1,027.3 | | |

$ | 4,228.9 | | |

$ | 1,053.2 | | |

$ | 1,059.9 | | |

$ | 1,044.9 | | |

$ | 1,070.9 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Consolidated costs and expenses | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Segment costs

and expenses | |

$ | 1,238.1 | | |

$ | 611.0 | | |

$ | 627.1 | | |

$ | 2,653.8 | | |

$ | 630.0 | | |

$ | 680.1 | | |

$ | 656.8 | | |

$ | 686.9 | |

| Shared

expenses (B) | |

| 40.6 | | |

| 20.2 | | |

| 20.4 | | |

| 90.8 | | |

| 23.3 | | |

| 21.3 | | |

| 24.2 | | |

| 22.0 | |

| Consolidated

costs and expenses | |

$ | 1,278.7 | | |

$ | 631.2 | | |

$ | 647.5 | | |

$ | 2,744.6 | | |

$ | 653.3 | | |

$ | 701.4 | | |

$ | 681.0 | | |

$ | 708.9 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Consolidated | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDAR | |

$ | 739.5 | | |

$ | 359.7 | | |

$ | 379.8 | | |

$ | 1,484.3 | | |

$ | 399.9 | | |

$ | 358.5 | | |

$ | 363.9 | | |

$ | 362.0 | |

| Adjusted EBITDAR

margin | |

| 36.6 | % | |

| 36.3 | % | |

| 37.0 | % | |

| 35.1 | % | |

| 38.0 | % | |

| 33.8 | % | |

| 34.8 | % | |

| 33.8 | % |

| (B) | Shared expenses

are not allocated to the segments and primarily consist of accounting and finance, information

technology, legal, and corporate program management activities that are centrally managed

and are not monitored by management at a segment level. |

WINDSTREAM HOLDINGS II, LLC

QUARTERLY SUPPLEMENTAL INFORMATION - OPERATING STATISTICS

for the quarterly periods in the years 2023 and 2022

(Units in thousands, Dollars in millions, except per unit amounts)

| | |

2023 | | |

2022 | |

| | |

Total | | |

2nd Qtr. | | |

1st Qtr. | | |

Total | | |

4th

Qtr. | | |

3rd Qtr. | | |

2nd

Qtr. | | |

1st Qtr. | |

| Kinetic

Operating Metrics: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Next

Gen high-speed Internet customers | |

| 340.3 | | |

| 340.3 | | |

| 315.9 | | |

| 287.2 | | |

| 287.2 | | |

| 263.6 | | |

| 230.7 | | |

| 194.5 | |

| Net

customer additions | |

| 53.1 | | |

| 24.4 | | |

| 28.7 | | |

| 124.0 | | |

| 23.6 | | |

| 32.9 | | |

| 36.2 | | |

| 31.3 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| DSL high-speed

Internet customers | |

| 814.7 | | |

| 814.7 | | |

| 846.8 | | |

| 878.5 | | |

| 878.5 | | |

| 909.9 | | |

| 946.4 | | |

| 980.1 | |

| Net

customer losses | |

| (63.8 | ) | |

| (32.1 | ) | |

| (31.7 | ) | |

| (121.7 | ) | |

| (31.4 | ) | |

| (36.5 | ) | |

| (33.7 | ) | |

| (20.1 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total high-speed

Internet customers | |

| 1,155.0 | | |

| 1,155.0 | | |

| 1,162.7 | | |

| 1,165.7 | | |

| 1,165.7 | | |

| 1,173.5 | | |

| 1,177.1 | | |

| 1,174.6 | |

| Net

customer (losses) additions | |

| (10.7 | ) | |

| (7.7 | ) | |

| (3.0 | ) | |

| 2.3 | | |

| (7.8 | ) | |

| (3.6 | ) | |

| 2.5 | | |

| 11.2 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average revenue per high-speed

Internet customer per month | |

$ | 86.68 | | |

$ | 87.41 | | |

$ | 85.78 | | |

$ | 82.57 | | |

$ | 82.65 | | |

$ | 82.65 | | |

$ | 81.93 | | |

$ | 82.63 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Next Gen premises

passed - Consumer | |

| 1,336 | | |

| 1,336 | | |

| 1,294 | | |

| 1,237 | | |

| 1,237 | | |

| 1,174 | | |

| 1,111 | | |

| 1,012 | |

| Next Gen premises

passed - Business | |

| 174 | | |

| 174 | | |

| 173 | | |

| 170 | | |

| 170 | | |

| 170 | | |

| 169 | | |

| 162 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service Revenues Used in

Average Revenue Per Month | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Computations

Above (per page 3): | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| High-speed

Internet bundle revenues | |

$ | 603.5 | | |

$ | 303.9 | | |

$ | 299.6 | | |

$ | 1,160.2 | | |

$ | 290.0 | | |

$ | 291.4 | | |

$ | 289.0 | | |

$ | 289.8 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Enterprise: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Strategic

sales as a percentage of total Enterprise sales (A) | |

| 68.8 | % | |

| 69.5 | % | |

| 68.0 | % | |

| 65.7 | % | |

| 64.1 | % | |

| 67.9 | % | |

| 66.1 | % | |

| 64.4 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Capital Expenditures: | |

$ | 554.1 | | |

$ | 248.9 | | |

$ | 305.2 | | |

$ | 1,080.8 | | |

$ | 275.8 | | |

$ | 299.5 | | |

$ | 290.6 | | |

$ | 214.9 | |

| Incremental

construction equipment capital expenditures (B) | |

| (1.4 | ) | |

| (0.6 | ) | |

| (0.8 | ) | |

| (13.6 | ) | |

| (1.8 | ) | |

| (3.1 | ) | |

| (4.0 | ) | |

| (4.7 | ) |

| Reimbursement

for cost to remove equipment (C) | |

| (3.7 | ) | |

| (2.4 | ) | |

| (1.3 | ) | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Adjusted

Capital Expenditures | |

$ | 549.0 | | |

$ | 245.9 | | |

$ | 303.1 | | |

$ | 1,067.2 | | |

$ | 274.0 | | |

$ | 296.4 | | |

$ | 286.6 | | |

$ | 210.2 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted Capital Expenditures

by Segment: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Kinetic | |

$ | 361.3 | | |

$ | 159.1 | | |

$ | 202.2 | | |

$ | 719.8 | | |

$ | 175.3 | | |

$ | 200.9 | | |

$ | 201.8 | | |

$ | 141.8 | |

| Enterprise | |

| 83.5 | | |

| 36.5 | | |

| 47.0 | | |

| 159.7 | | |

| 38.3 | | |

| 43.8 | | |

| 41.0 | | |

| 36.6 | |

| Wholesale | |

| 98.9 | | |

| 47.9 | | |

| 51.0 | | |

| 174.3 | | |

| 56.6 | | |

| 48.4 | | |

| 40.1 | | |

| 29.2 | |

| OfficeSuite | |

| 5.3 | | |

| 2.4 | | |

| 2.9 | | |

| 13.4 | | |

| 3.8 | | |

| 3.3 | | |

| 3.7 | | |

| 2.6 | |

| Adjusted

Capital Expenditures | |

$ | 549.0 | | |

$ | 245.9 | | |

$ | 303.1 | | |

$ | 1,067.2 | | |

$ | 274.0 | | |

$ | 296.4 | | |

$ | 286.6 | | |

$ | 210.2 | |

| (A) | Enterprise strategic sales consist of SASE, UCaaS, OfficeSuite UC©

and associated network access products and services. |

| (B) | Consists of non-recurring capital expenditures for construction equipment to support the

Company's internal engineering and fiber construction organization. |

| (C) | Reimbursement from the Federal Communications Commission ("FCC")

for the cost to remove from our network certain equipment purchased from a Chinese manufacturer that we were required to

remove by FCC order. Windstream completed the removal of this equipment in the first quarter of 2023 and we expect to receive

total reimbursements of approximately $10 million from the FCC in 2023. |

WINDSTREAM HOLDINGS II, LLC

QUARTERLY SUPPLEMENTAL INFORMATION - NON-GAAP RECONCILIATIONS

for the quarterly periods in the years 2023 and 2022

(In millions)

| | |

2023 | | |

2022 | |

| | |

Total | | |

2nd Qtr. | | |

1st Qtr. | | |

Total | | |

4th

Qtr. | | |

3rd Qtr. | | |

2nd

Qtr. | | |

1st Qtr. | |

| ADJUSTED FREE CASH FLOW: | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Operating

(loss) income | |

$ | (10.2 | ) | |

$ | (12.1 | ) | |

$ | 1.9 | | |

$ | (72.4 | ) | |

$ | 20.8 | | |

$ | (46.0 | ) | |

$ | (38.7 | ) | |

$ | (8.5 | ) |

| Depreciation

and amortization | |

| 395.2 | | |

| 199.5 | | |

| 195.7 | | |

| 801.4 | | |

| 189.8 | | |

| 211.0 | | |

| 202.7 | | |

| 197.9 | |

| EBITDA | |

| 385.0 | | |

| 187.4 | | |

| 197.6 | | |

| 729.0 | | |

| 210.6 | | |

| 165.0 | | |

| 164.0 | | |

| 189.4 | |

| Adjustments: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Straight-line

expense under master leases with Uniti | |

| 335.9 | | |

| 168.7 | | |

| 167.2 | | |

| 657.4 | | |

| 166.0 | | |

| 164.7 | | |

| 163.7 | | |

| 163.0 | |

| Cash payment

under master leases with Uniti | |

| (335.5 | ) | |

| (168.0 | ) | |

| (167.5 | ) | |

| (668.9 | ) | |

| (167.5 | ) | |

| (167.5 | ) | |

| (167.2 | ) | |

| (166.7 | ) |

| Cash received

from Uniti per settlement agreement | |

| 49.0 | | |

| 24.5 | | |

| 24.5 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Net (gain)

loss on asset retirements and dispositions | |

| (5.6 | ) | |

| (5.2 | ) | |

| (0.4 | ) | |

| 51.1 | | |

| 6.4 | | |

| 17.1 | | |

| 25.4 | | |

| 2.2 | |

| Other costs

(A) | |

| 21.0 | | |

| 7.2 | | |

| 13.8 | | |

| 38.8 | | |

| 14.1 | | |

| 9.6 | | |

| 9.3 | | |

| 5.8 | |

| Equity-based

compensation | |

| 3.2 | | |

| 1.6 | | |

| 1.6 | | |

| 8.0 | | |

| 2.8 | | |

| 2.1 | | |

| 1.5 | | |

| 1.6 | |

| Adjusted EBITDA | |

| 453.0 | | |

| 216.2 | | |

| 236.8 | | |

| 815.4 | | |

| 232.4 | | |

| 191.0 | | |

| 196.7 | | |

| 195.3 | |

| Adjusted Capital

Expenditures | |

| (549.0 | ) | |

| (245.9 | ) | |

| (303.1 | ) | |

| (1,067.2 | ) | |

| (274.0 | ) | |

| (296.4 | ) | |

| (286.6 | ) | |

| (210.2 | ) |

| Additional

rent paid for growth capital expenditures funded by Uniti | |

| (13.7 | ) | |

| (7.3 | ) | |

| (6.4 | ) | |

| (13.9 | ) | |

| (5.2 | ) | |

| (3.9 | ) | |

| (2.9 | ) | |

| (1.9 | ) |

| Cash paid

for interest on long-term debt obligations | |

| (105.0 | ) | |

| (28.2 | ) | |

| (76.8 | ) | |

| (173.4 | ) | |

| (17.8 | ) | |

| (71.5 | ) | |

| (15.2 | ) | |

| (68.9 | ) |

| Uniti funding

of growth capital expenditures | |

| 158.7 | | |

| 91.2 | | |

| 67.5 | | |

| 237.9 | | |

| 79.8 | | |

| 66.5 | | |

| 43.4 | | |

| 48.2 | |

| Cash

(paid) refunded for income taxes, net | |

| (9.7 | ) | |

| (9.5 | ) | |

| (0.2 | ) | |

| (11.7 | ) | |

| (1.6 | ) | |

| (2.3 | ) | |

| (7.6 | ) | |

| (0.2 | ) |

| Adjusted

Free Cash Flow | |

$ | (65.7 | ) | |

$ | 16.5 | | |

$ | (82.2 | ) | |

$ | (212.9 | ) | |

$ | 13.6 | | |

$ | (116.6 | ) | |

$ | (72.2 | ) | |

$ | (37.7 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| COMPUTATION OF ADJUSTED EBITDA: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operating (loss)

income | |

$ | (10.2 | ) | |

$ | (12.1 | ) | |

$ | 1.9 | | |

$ | (72.4 | ) | |

$ | 20.8 | | |

$ | (46.0 | ) | |

$ | (38.7 | ) | |

$ | (8.5 | ) |

| Depreciation

and amortization expense | |

| 395.2 | | |

| 199.5 | | |

| 195.7 | | |

| 801.4 | | |

| 189.8 | | |

| 211.0 | | |

| 202.7 | | |

| 197.9 | |

| Straight-line

expense under master leases with Uniti | |

| 335.9 | | |

| 168.7 | | |

| 167.2 | | |

| 657.4 | | |

| 166.0 | | |

| 164.7 | | |

| 163.7 | | |

| 163.0 | |

| Net (gain)

loss on asset retirements and dispositions | |

| (5.6 | ) | |

| (5.2 | ) | |

| (0.4 | ) | |

| 51.1 | | |

| 6.4 | | |

| 17.1 | | |

| 25.4 | | |

| 2.2 | |

| Other costs

(A) | |

| 21.0 | | |

| 7.2 | | |

| 13.8 | | |

| 38.8 | | |

| 14.1 | | |

| 9.6 | | |

| 9.3 | | |

| 5.8 | |

| Equity-based

compensation | |

| 3.2 | | |

| 1.6 | | |

| 1.6 | | |

| 8.0 | | |

| 2.8 | | |

| 2.1 | | |

| 1.5 | | |

| 1.6 | |

| Adjusted EBITDAR | |

| 739.5 | | |

| 359.7 | | |

| 379.8 | | |

| 1,484.3 | | |

| 399.9 | | |

| 358.5 | | |

| 363.9 | | |

| 362.0 | |

| Cash payment

under master leases with Uniti | |

| (335.5 | ) | |

| (168.0 | ) | |

| (167.5 | ) | |

| (668.9 | ) | |

| (167.5 | ) | |

| (167.5 | ) | |

| (167.2 | ) | |

| (166.7 | ) |

| Cash

received from Uniti per settlement agreement | |

| 49.0 | | |

| 24.5 | | |

| 24.5 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Adjusted

EBITDA | |

$ | 453.0 | | |

$ | 216.2 | | |

$ | 236.8 | | |

$ | 815.4 | | |

$ | 232.4 | | |

$ | 191.0 | | |

$ | 196.7 | | |

$ | 195.3 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| COMPUTATION OF PRO FORMA ADJUSTED

EBITDA: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA

(per above) | |

$ | 453.0 | | |

$ | 216.2 | | |

$ | 236.8 | | |

$ | 815.4 | | |

$ | 232.4 | | |

$ | 191.0 | | |

$ | 196.7 | | |

$ | 195.3 | |

| Prepayment

from Uniti received in fourth quarter of 2021 | |

| - | | |

| - | | |

| - | | |

| 92.9 | | |

| 23.2 | | |

| 23.2 | | |

| 23.2 | | |

| 23.3 | |

| Pro

forma Adjusted EBITDA (B) | |

$ | 453.0 | | |

$ | 216.2 | | |

$ | 236.8 | | |

$ | 908.3 | | |

$ | 255.6 | | |

$ | 214.2 | | |

$ | 219.9 | | |

$ | 218.6 | |

| (A) Other

costs for the periods presented consist of the following: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | |

2023 | | |

2022 | |

| | |

Total | | |

2nd Qtr. | | |

1st Qtr. | | |

Total | | |

4th

Qtr. | | |

3rd Qtr. | | |

2nd

Qtr. | | |

1st Qtr. | |

| Cost

initiatives (1) | |

$ | 7.3 | | |

$ | 3.4 | | |

$ | 3.9 | | |

$ | 10.6 | | |

$ | 4.5 | | |

$ | 3.8 | | |

$ | 2.2 | | |

$ | 0.1 | |

| Severance and benefit costs | |

| 13.7 | | |

| 3.8 | | |

| 9.9 | | |

| 17.6 | | |

| 9.6 | | |

| 3.2 | | |

| 2.9 | | |

| 1.9 | |

| Start-up costs (2) | |

| - | | |

| - | | |

| - | | |

| 10.6 | | |

| - | | |

| 2.6 | | |

| 4.2 | | |

| 3.8 | |

| Other costs | |

$ | 21.0 | | |

$ | 7.2 | | |

$ | 13.8 | | |

$ | 38.8 | | |

$ | 14.1 | | |

$ | 9.6 | | |

$ | 9.3 | | |

$ | 5.8 | |

| (1) | Cost initiatives include lease termination

costs, professional and consulting fees, and other miscellaneous expenses incurred in completing

certain cost optimization projects. |

| (2) | Start-up costs primarily consisted of

incremental wages, recruitment and training costs incurred in expanding the Company’s

workforce to support its internal engineering and fiber construction organization. |

| (B) | Pro forma Adjusted EBITDA is Adjusted

EBITDA as if Uniti's fourth quarter 2021 prepayment of all quarterly amounts due in 2022

were made as scheduled. |

WINDSTREAM

HOLDINGS II, LLC

RECONCILIATION

OF PREVIOUSLY REPORTED TO REVISED SEGMENT INFORMATION

for

the quarter ended March 31, 2023 and the year ended December 31, 2022

(In

millions)

| | |

Quarter Ended March 31, 2023 | |

| | |

| | |

| | |

| | |

| | |

| | |

Total | |

| | |

Kinetic | | |

Enterprise | | |

Wholesale | | |

OfficeSuite | | |

Eliminations | | |

Consolidated | |

| Revenues and sales: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total revenues and sales, as previously reported | |

$ | 563.2 | | |

$ | 384.8 | | |

$ | 112.3 | | |

$ | 5.5 | | |

$ | (38.5 | ) | |

$ | 1,027.3 | |

| Intersegment activity revisions (A) | |

| (3.7 | ) | |

| - | | |

| (1.4 | ) | |

| - | | |

| 5.1 | | |

| - | |

| Total revenues and sales, as revised | |

$ | 559.5 | | |

$ | 384.8 | | |

$ | 110.9 | | |

$ | 5.5 | | |

$ | (33.4 | ) | |

$ | 1,027.3 | |

| | |

| | |

| | |

| | |

| | |

Shared | | |

Total | |

| | |

Kinetic | | |

Enterprise | | |

Wholesale | | |

OfficeSuite | | |

Expenses | | |

Consolidated | |

| Contribution margin: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Contribution margin, as previously reported | |

$ | 278.7 | | |

$ | 69.7 | | |

$ | 48.3 | | |

$ | 4.3 | | |

$ | (21.2 | ) | |

$ | 379.8 | |

| Intersegment activity revisions (A) | |

| (2.3 | ) | |

| - | | |

| 2.3 | | |

| - | | |

| - | | |

| - | |

| Expense realignments (B) | |

| (0.8 | ) | |

| - | | |

| - | | |

| - | | |

| 0.8 | | |

| - | |

| Contribution margin, as revised | |

$ | 275.6 | | |

$ | 69.7 | | |

$ | 50.6 | | |

$ | 4.3 | | |

$ | (20.4 | ) | |

$ | 379.8 | |

| | |

Year Ended December 31, 2022 | |

| | |

| | |

| | |

| | |

| | |

| | |

Total | |

| | |

Kinetic | | |

Enterprise | | |

Wholesale | | |

OfficeSuite | | |

Eliminations | | |

Consolidated | |

| Revenues and sales: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total revenues and sales, as previously reported | |

$ | 2,260.3 | | |

$ | 1,704.8 | | |

$ | 400.4 | | |

$ | 20.1 | | |

$ | (156.7 | ) | |

$ | 4,228.9 | |

| Intersegment activity revisions (A) | |

| (14.8 | ) | |

| - | | |

| (5.8 | ) | |

| - | | |

| 20.6 | | |

| - | |

| Total revenues and sales, as revised | |

$ | 2,245.5 | | |

$ | 1,704.8 | | |

$ | 394.6 | | |

$ | 20.1 | | |

$ | (136.1 | ) | |

$ | 4,228.9 | |

| | |

| | |

| | |

| | |

| | |

Shared | | |

Total | |

| | |

Kinetic | | |

Enterprise | | |

Wholesale | | |

OfficeSuite | | |

Expenses | | |

Consolidated | |

| Contribution margin: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Contribution margin, as previously reported | |

$ | 1,092.6 | | |

$ | 323.7 | | |

$ | 145.8 | | |

$ | 14.5 | | |

$ | (92.3 | ) | |

$ | 1,484.3 | |

| Intersegment activity revisions (A) | |

| (9.0 | ) | |

| - | | |

| 9.0 | | |

| - | | |

| - | | |

| - | |

| Expense realignments (B) | |

| (1.5 | ) | |

| - | | |

| - | | |

| - | | |

| 1.5 | | |

| - | |

| Contribution margin, as revised | |

$ | 1,082.1 | | |

$ | 323.7 | | |

$ | 154.8 | | |

$ | 14.5 | | |

$ | (90.8 | ) | |

$ | 1,484.3 | |

| (A) | Reflects updates to intercompany billing

agreements between Kinetic and Wholesale completed in the second quarter of 2023. |

| (B) | Reflects updates to cost and expense

assignments completed in the second quarter of 2023. |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

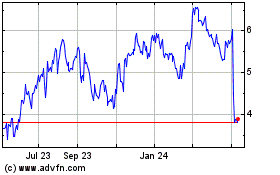

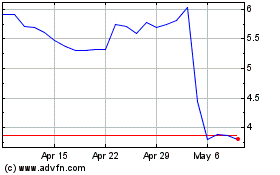

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Jul 2023 to Jul 2024