UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities

Exchange Act of 1934

(Amendment No. )*

Ucommune International

Ltd

(Name of Issuer)

Class A Ordinary

Shares, par value US$0.024 per share

(Title of Class of

Securities)

G9449A134

(CUSIP Number)

Daqing Mao

Floor B1, Tower D

No. 2 Guang Hua Road

Chaoyang District, Beijing

People’s Republic

of China, 100026

Phone: +86 138 1124 7023

(Name, Address and Telephone

Number of Person

Authorized to Receive Notices and Communications)

March 6, 2024

(Date of Event Which Requires

Filing of This Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| * | The remainder of this cover page shall be filled out

for a reporting person’s initial filing on this form with respect to the sub*The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the sject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

| CUSIP No. G9449A134 |

|

Page 2 of 10 Pages |

| 1. |

NAMES OF REPORTING PERSONS

Daqing Mao |

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐ (b) ☐ |

|

| 3. |

SEC

USE ONLY

|

|

| 4. |

SOURCE

OF FUNDS (see instructions)

PF, OO |

|

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

|

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Singapore |

|

NUMBER

OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH |

7. |

SOLE

VOTING POWER

124,033 Class A Ordinary Shares(1) |

| 8. |

SHARED

VOTING POWER

5,980 Class A Ordinary Shares(1) |

| 9. |

SOLE

DISPOSITIVE POWER

124,033 Class A Ordinary Shares(1) |

| 10. |

SHARED

DISPOSITIVE POWER

5,980 Class A Ordinary Shares(1) |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

130,013 Class A Ordinary Shares(1) |

|

| 12. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

|

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

17.2% (representing 91.3% of the total outstanding

voting power) |

|

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

|

| (1) | Represents (i) 5,626 Class

A Class A ordinary shares at par value of US$0.024 per share (each a “Class A Ordinary

Share”) and 97,500 Class A Ordinary Shares issuable upon conversion of Class B

ordinary shares at par value of US$0.024 per share (each a “Class B Ordinary Share”),

directly held by Maodq Limited, a limited liability company incorporated in the British Virgin

Islands wholly owned by Dr. Daqing Mao, (ii) 15,907 Class A Ordinary Shares issuable upon

conversion of Class B Ordinary Shares held by Fair Vision Group Limited, a British Virgin

Islands company wholly owned by Planet MDQ Limited, which is in turn wholly owned by Dr.

Daqing Mao, (iii) 5,000 Class A Ordinary Shares directly held by Dr. Daqing Mao, and (iv)

5,980 Class A Ordinary Shares issuable upon conversion of Class B Ordinary Shares held by

Astro Angel Limited, a British Virgin Islands company wholly owned by Baixh Limited and ultimately

controlled by Ms. Angela Bai, the spouse of Dr. Daqing Mao. |

| CUSIP No. G9449A134 |

|

Page 3 of 10 Pages |

| 1. |

NAMES OF REPORTING PERSONS

Maodq Limited |

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐ (b) ☐ |

|

| 3. |

SEC

USE ONLY

|

|

| 4. |

SOURCE

OF FUNDS (see instructions)

WC, OO |

|

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

|

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

British Virgin Islands |

|

NUMBER

OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH |

7. |

SOLE

VOTING POWER

103,126 Class A Ordinary Shares(1) |

| 8. |

SHARED

VOTING POWER

0 |

| 9. |

SOLE

DISPOSITIVE POWER

103,126 Class A Ordinary Shares(1) |

| 10. |

SHARED

DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

103,126 Class A Ordinary Shares(1) |

|

| 12. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

|

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

14.1% |

|

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

CO |

|

| (1) | Represents 5,626 Class A

Ordinary Shares and 97,500 Class A Ordinary Shares issuable upon conversion of Class B Ordinary

Shares, directly held by Maodq Limited, a limited liability company incorporated in the British

Virgin Islands wholly owned by Dr. Daqing Mao. |

| CUSIP No. G9449A134 |

|

Page 4 of 10 Pages |

| 1. |

NAMES OF REPORTING PERSONS

FAIR VISION GROUP LIMITED |

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐ (b) ☐ |

|

| 3. |

SEC

USE ONLY

|

|

| 4. |

SOURCE

OF FUNDS (see instructions)

WC, OO |

|

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

|

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

British Virgin Islands |

|

NUMBER

OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH |

7. |

SOLE

VOTING POWER

15,907 Class A Ordinary Shares(1) |

| 8. |

SHARED

VOTING POWER

0 |

| 9. |

SOLE

DISPOSITIVE POWER

15,907 Class A Ordinary Shares(1) |

| 10. |

SHARED

DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

15,907 Class A Ordinary Shares(1) |

|

| 12. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

|

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

2.4% |

|

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

CO |

|

| (1) | Represents 15,907 Class

A Ordinary Shares issuable upon conversion of Class B Ordinary Shares held by Fair Vision

Group Limited, a British Virgin Islands company wholly owned by Planet MDQ Limited, which

is in turn wholly owned by Dr. Daqing Mao. |

| CUSIP No. G9449A134 |

|

Page 5 of 10 Pages |

| 1. |

NAMES OF REPORTING PERSONS

Astro Angel Limited |

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐ (b) ☐ |

|

| 3. |

SEC

USE ONLY

|

|

| 4. |

SOURCE

OF FUNDS (see instructions)

WC, OO |

|

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

|

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

British Virgin Islands |

|

NUMBER

OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH |

7. |

SOLE

VOTING POWER

0 |

| 8. |

SHARED

VOTING POWER

5,980 Class A Ordinary Shares(1) |

| 9. |

SOLE

DISPOSITIVE POWER

0 |

| 10. |

SHARED

DISPOSITIVE POWER

5,980 Class A Ordinary Shares(1) |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,980 Class A Ordinary Shares(1) |

|

| 12. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

|

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.9% |

|

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

CO |

|

| (1) | Represents 5,980 Class A

Ordinary Shares issuable upon conversion of Class B Ordinary Shares held by Astro Angel Limited,

a British Virgin Islands company wholly owned by Baixh Limited and ultimately controlled

by Ms. Angela Bai, the spouse of Dr. Daqing Mao. |

| CUSIP No. G9449A134 |

|

Page 6 of 10 Pages |

| 1. |

NAMES OF REPORTING PERSONS

Angela Bai |

|

| 2. |

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) ☐ (b) ☐ |

|

| 3. |

SEC

USE ONLY

|

|

| 4. |

SOURCE

OF FUNDS (see instructions)

PF, OO |

|

| 5. |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

☐ |

|

| 6. |

CITIZENSHIP

OR PLACE OF ORGANIZATION

Canadian |

|

NUMBER

OF

SHARES

BENEFICIALLY OWNED

BY EACH REPORTING

PERSON

WITH |

7. |

SOLE

VOTING POWER

0 |

| 8. |

SHARED

VOTING POWER

5,980 Class A Ordinary Shares(1) |

| 9. |

SOLE

DISPOSITIVE POWER

0 |

| 10. |

SHARED

DISPOSITIVE POWER

5,980 Class A Ordinary Shares(1) |

| 11. |

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,980 Class A Ordinary Shares (9) |

|

| 12. |

CHECK

IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (see instructions)

☐ |

|

| 13. |

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

0.9%(1) |

|

| 14. |

TYPE

OF REPORTING PERSON (see instructions)

IN |

|

| (1) | Represents 5,980 Class A

Ordinary Shares issuable upon conversion of Class B Ordinary Shares held by Astro Angel Limited,

a British Virgin Islands company wholly owned by Baixh Limited and ultimately controlled

by Ms. Angela Bai, the spouse of Dr. Daqing Mao. |

| CUSIP No. G9449A134 |

|

Page 7 of 10 Pages |

Item 1. Security and Issuer.

This statement on Schedule 13D (this “Statement”)

relates to Class A Ordinary Shares of Ucommune International Ltd, a Cayman Islands company (the “Issuer”). The

Reporting Persons (as defined below) previously reported their beneficial ownership of Class A Ordinary Shares of the Issuer on

Schedule 13G filed with the Securities and Exchange Commission (the “SEC”) on February 8, 2021, as amended by amendments

thereto.

The Issuer’s Class A Ordinary Shares

are listed on the Nasdaq Capital Market under the symbol “UK.”

The principal executive offices of the Issuer

are at Floor B1, Tower D, No.2 Guang Hua Road, Chaoyang District, Beijing, People’s Republic of China, 100026.

Item 2. Identity and Background.

Dr. Daqing Mao, Maodq Limited, Fair Vision Group

Limited, Astro Angel Limited and Ms. Angela Bai are collectively referred to herein as “Reporting Persons,” and each,

a “Reporting Person.” This Statement is being filed jointly by the Reporting Persons pursuant to Rule 13d-1(k) promulgated

by the SEC under Section 13 of the Act. The agreement among the Reporting Persons relating to the joint filing is attached hereto as

Exhibit 99.1. Information with respect to each of the Reporting Persons is given solely by such Reporting Person, and no Reporting Person

assumes responsibility for the accuracy or completeness of the information concerning the other Reporting Persons, except as otherwise

provided in Rule 13d-1(k).

Dr. Daqing Mao is the chairman of the board of

directors of the Issuer. He is a citizen of Singapore. The business address of Dr. Daqing Mao is Floor B1, Tower D, No.2 Guang Hua Road,

Chaoyang District, Beijing, People’s Republic of China, 100026.

Maodq Limited is a limited liability company incorporated

in the British Virgin Islands wholly owned by Dr. Daqing Mao. Maodq Limited solely engages in investment holdings. The registered address

of Maodq Limited is Commerce House, Wickhams Cay 1, P.O. Box 3140, Road Town, Tortola, British Virgin Islands.

Fair Vision Group Limited is a British Virgin

Islands company wholly owned by Planet MDQ Limited, which is in turn wholly owned by Dr. Daqing Mao. Fair Vision Group Limited solely

engages in investment holdings. The registered address of Fair Vision Group Limited is Vistra Corporate Services Centre, Wickhams Cay

II, Road Town, Tortola, VG1110, British Virgin Islands.

Astro Angel Limited is a British Virgin Islands

company wholly owned by Baixh Limited and ultimately controlled by Ms. Angela Bai, the spouse of Dr. Daqing Mao. Astro Angel Limited

solely engages in investment holdings. The registered address of Astro Angel Limited is Vistra Corporate Services Centre, Wickhams Cay

II, Road Town, Tortola, VG1110, British Virgin Islands.

Ms. Angela Bai is the director of Astro Angel

Limited and the spouse of Dr. Daqing Mao. She is a citizen of Canada. The business address of Ms. Angela Bai is Floor B1, Tower D, No.2

Guang Hua Road, Chaoyang District, Beijing, People’s Republic of China, 100026.

(d)-(e) During the last five years, none

of the Reporting Persons has been (i) convicted in a criminal proceeding or (ii) a party to a civil proceeding of a judicial

or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final

order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding

any violation with respect to such laws.

Item 3. Source or Amount of Funds or Other Consideration.

The information set forth in Item 4 of this Statement

is incorporated by reference.

| CUSIP No. G9449A134 |

|

Page 8 of 10 Pages |

Item 4. Purpose of Transaction.

On March 6, 2024, the Issuer entered into a share

subscription agreement (the “Share Subscription Agreement”) with Maodq Limited, pursuant to which Maodq Limited subscribed

for 80,000 newly issued Class B Ordinary Shares of the Issuer at a per share subscription price of US$3.00, for an aggregate cash

consideration of US$240,000, to incentivize Dr. Daqing Mao to provide continued services and contribution to the Issuer. The description

of the Share Subscription Agreement is qualified in its entirety by reference to the full text of the Share Subscription Agreement, a

copy of which is filed herewith as Exhibit 99.2 and incorporated herein by reference. The purchase was funded by existing capital

held by the Reporting Persons.

Except as set forth in this Statement, none of

the Reporting Persons has any present plans or proposals that relate to or would result in any transaction, change or event specified

in paragraphs (a) through (j) of Item 4 of Schedule 13D. The Reporting Persons reserve the right to, at any time and from time

to time, review or reconsider their position and/or change their purpose and/or, either separately or together with other persons, formulate

plans or proposals with respect to those items in the future depending upon then existing factors.

Item 5. Interest in Securities of the Issuer.

(a)-(b) The responses of each Reporting Person

to Rows (7) through (13), including the footnotes thereto, of the cover pages of this Statement are hereby incorporated by

reference in this Item 5. The information set forth in Item 2 above is hereby incorporated by reference.

The percentage of the class of securities identified

pursuant to Item 1 beneficially owned by the Reporting Persons is based on 635,111 Class A Ordinary Shares of the Issuer (excluding 1,000,000

Class A Ordinary Shares held by the Issuer itself reserved for future issuance under its 2020 share incentive plan) outstanding as of

March 6, 2024. Holders of Class A Ordinary Shares and Class B Ordinary Shares are entitled to the same rights, except for voting

and conversion rights. Each Class A Ordinary Share is entitled to one vote, and each Class B Ordinary Share is entitled to

55 votes. Each Class B Ordinary Share is convertible into one Class A Ordinary Share at any time by the holder thereof. Class A Ordinary

Shares are not convertible into Class B Ordinary Shares under any circumstances.

Ordinary shares beneficially owned by Dr. Daqing

Mao represent approximately 91.3% of the aggregate voting power of the total issued and outstanding ordinary shares of the Issuer, based

on 635,111 outstanding Class A Ordinary Shares and 119,387 Class B Ordinary Shares outstanding as of the March 6, 2024.

(c) Except as disclosed in this Statement,

none the Reporting Persons has effected any transaction in the ordinary shares of the Issuer during the past 60 days.

(d) Except as disclosed in this Statement,

to the best knowledge of the Reporting Persons, no person other than the Reporting Persons has the right to receive or the power to direct

the receipt of dividends from, or the proceeds from the sale of, the ordinary shares of the Issuer beneficially owned by the Reporting

Persons.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

The information set forth in Item 3 and Item 4

of this Statement is incorporated by reference.

To the best knowledge of the Reporting Persons,

except as provided herein, there are no other contracts, arrangements, understandings or relationships (legal or otherwise) among the

Reporting Persons and between any of the Reporting Persons and any other person with respect to any securities of the Issuer, transfer

or voting of any of the securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits,

division of profits or loss, or the giving or withholding of proxies, or a pledge or otherwise subject to a contingency, the occurrence

of which would give another person voting power over the securities of the Issuer.

| CUSIP No. G9449A134 |

|

Page 9 of 10 Pages |

Item 7. Material to Be Filed as Exhibits.

| CUSIP No. G9449A134 |

|

Page 10 of 10 Pages |

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: March 7, 2024

| |

DAQING MAO |

| |

|

| |

/s/ Daqing Mao |

| |

MAODQ LIMITED |

| |

|

|

| |

By: |

/s/ Daqing Mao |

| |

Name: |

Daqing Mao |

| |

Title: |

Director |

| |

|

|

| |

FAIR VISION GROUP LIMITED |

| |

|

|

| |

By: |

/s/ Daqing Mao |

| |

Name: |

Daqing Mao |

| |

Title: |

Director |

| |

|

|

| |

ASTRO ANGEL LIMITED |

| |

|

|

| |

By: |

/s/ Angela Bai |

| |

Name: |

Angela Bai |

| |

Title: |

Director |

| |

|

|

| |

ANGELA BAI |

| |

|

|

| |

/s/ Angela Bai |

[Signature Page to Schedule 13D]

Exhibit 99.1

JOINT FILING AGREEMENT

In accordance with Rule 13d-1(k) promulgated under

the Securities Exchange Act of 1934, as amended, the undersigned hereby agree to the joint filing with all other Reporting Persons (as

such term is defined in the Schedule 13D referred to below) on behalf of each of them of a statement on Schedule 13D (including amendments

thereto) with respect to the Class A ordinary shares, par value $0.024 per share, of Ucommune International Ltd, a Cayman Islands company,

and that this Agreement may be included as an Exhibit to such joint filing.

The undersigned acknowledge that each shall be

responsible for the timely filing of such statement on Schedule 13D and any amendments thereto, and for the completeness and accuracy

of the information concerning him, her or it contained herein and therein, but shall not be responsible for the completeness and accuracy

of the information concerning the other persons making the filing, unless such person knows or has reason to believe that such information

is inaccurate.

This Agreement may be executed in any number of

counterparts, all of which taken together shall constitute one and the same instrument.

[Signature page follows]

SIGNATURE

IN WITNESS WHEREOF, the undersigned hereby execute

this Agreement as of March 7, 2024.

| |

DAQING MAO |

| |

|

| |

/s/ Daqing Mao |

| |

|

|

| |

MAODQ LIMITED |

| |

|

|

| |

By: |

/s/ Daqing Mao |

| |

Name: |

Daqing Mao |

| |

Title: |

Director |

| |

|

|

| |

FAIR VISION GROUP LIMITED |

| |

|

|

| |

By: |

/s/ Daqing Mao |

| |

Name: |

Daqing Mao |

| |

Title: |

Director |

| |

|

|

| |

ASTRO ANGEL LIMITED |

| |

|

|

| |

By: |

/s/ Angela Bai |

| |

Name: |

Angela Bai |

| |

Title: |

Director |

| |

|

|

| |

ANGELA BAI |

| |

|

|

| |

/s/ Angela Bai |

[Signature Page to 13D Joint Filing Agreement]

Exhibit 99.2

SHARE SUBSCRIPTION AGREEMENT

This Share Subscription Agreement

(this “Agreement”) is made as of March 6, 2024 by and between Ucommune International Ltd, an exempted company

incorporated with limited liability in the Cayman Islands (the “Company”) and Maodq Limited (the “Subscriber”),

a company incorporated with limited liability in the British Virgin Islands, which is wholly owned by Dr. Daqing Mao, the founder and

chairman of the board of directors of the Company.

The Subscriber and the Company

are each referred to herein as a “Party,” and collectively as the “Parties.”

W I T N E S S E T H:

WHEREAS, Dr. Daqing Mao has

contributed significantly to the Company’s overall development, as well as its recent strategic upgrade and organizational structure

optimization, with his experiences, resources and industry insights.

WHEREAS, to incentivize Dr.

Daqing Mao and to encourage his continued services and contribution, the Parties desire to set forth the terms and conditions under which

the Company shall issue and the Subscriber shall subscribe for Class B ordinary shares of par value US$0.024 per share with the rights,

restrictions, preferences and privileges ascribed to them in the Company’s second amended and restated memorandum and articles of

association currently in effect (the “Class B Ordinary Shares”), in reliance on an exemption from registration

under the U.S. Securities Act of 1933, as amended (the “Securities Act”), on the terms set forth herein.

NOW, THEREFORE, in consideration

of the foregoing recitals and the mutual promises hereinafter set forth, the Parties hereto agree as follows:

Article

1

Subscription

OF CLASS B ORDINARY SHARES

1.1 Subscription

and Issuance of Class B Ordinary Shares. Pursuant to the terms and subject to the conditions of this Agreement, the Subscriber agrees

to subscribe for, and the Company agrees to issue to the Subscriber, 80,000 Class B Ordinary Shares (the “Subscribed Shares”).

The subscription price for each Class B Ordinary Share shall be US$3.00 per share, which is determined with reference to the average closing

price of the Class A ordinary shares of par value US$0.024 per share for the 10 trading days from January 18, 2024 to January 31, 2024

preceding the Agreement, and the aggregate subscription price for all Subscribed Shares shall be US$240,000.00 (the “Subscription

Amount”).

1.2 Closing.

(a) The closing of the

subscription of the Subscribed Shares contemplated hereby (the “Closing”) shall take place remotely as promptly

as practicable following the execution of this Agreement. The date on which the closing actually takes place is referred to in this Agreement

as the “Closing Date.”

(b) At the Closing, the

Subscriber, or its designee, shall (i) pay the Company the Subscription Amount by wire transfer in immediately available funds to the

bank account which shall be designated by the Company in writing to the Subscriber prior to the Closing and (ii) deliver to the Company

documentation evidencing such payment; and the Company shall (i) update the register of members of the Company (the “Register

of Members”) reflecting the issuance of the corresponding number of Subscribed Shares on the Closing Date, and (ii) if requested

by the Subscriber, deliver a duly executed share certificate in original form, registered in the name of the Subscriber, together with

a certified true copy of the Register of Members of the Company, evidencing the Subscribed Shares being issued to and registered in the

name of the Subscriber.

1.3 Legends.

The Register of Members and the share certificate representing the Subscribed Shares shall be endorsed with the following legends:

“THIS SECURITY HAS NOT BEEN REGISTERED

UNDER THE SECURITIES ACT OF 1933 (AS AMENDED, THE “ACT”) OR UNDER THE SECURITIES LAWS OF ANY STATE. THIS SECURITY MAY NOT

BE TRANSFERRED, SOLD OR OFFERED FOR SALE: (A) IN THE ABSENCE OF (1) AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT, OR (2) AN EXEMPTION

OR QUALIFICATION UNDER APPLICABLE SECURITIES LAWS. ANY ATTEMPT TO TRANSFER OR SELL THIS SECURITY IN VIOLATION OF THESE RESTRICTIONS SHALL

BE VOID.”

Article

2

REPRESENTATIONS

AND WARRANTIES

2.1 Representations

and Warranties of the Subscriber. The Subscriber hereby represents and warrants to the Company, as of the date hereof and the Closing

Date, as follows:

(a) Authority.

The Subscriber has full power and authority to enter into, execute and deliver this Agreement and each agreement, certificate, document

and instrument to be executed and delivered by the Subscriber pursuant to this Agreement and to perform its obligations hereunder and

thereunder.

(b) Valid

Agreement. This Agreement has been duly executed and delivered by the Subscriber and constitutes the legal, valid and binding obligation

of the Subscriber, enforceable against it in accordance with its terms, except (i) as limited by applicable bankruptcy, insolvency, reorganization,

moratorium, and other laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by laws

relating to the availability of specific performance, injunctive relief, or other equitable remedies.

(c) Noncontravention.

Neither the execution and the delivery of this Agreement, nor the consummation of the transactions contemplated hereby, will (i) violate

any constitution, statute, regulation, rule, injunction, judgment, order, decree, ruling, charge, or other restriction of any government,

governmental entity or court to which the Subscriber is subject, or (ii) conflict with, result in a breach of, constitute a default under,

result in the acceleration of or creation of an encumbrance under, or create in any party the right to accelerate, terminate, modify,

or cancel, any agreement, contract, lease, license, instrument, or other arrangement to which the Subscriber is a party or by which the

Subscriber is bound or to which any of the Subscriber’s assets are subject. There is no action, suit or proceeding, pending or threatened

against the Subscriber that questions the validity of this Agreement or the right of the Subscriber to enter into this Agreement or to

consummate the transactions contemplated hereby.

(d) Consents

and Approvals. Neither the execution and delivery by the Subscriber of this Agreement, nor the consummation by the Subscriber of any

of the transactions contemplated hereby or thereby, nor the performance by the Subscriber of this Agreement in accordance with its terms

requires the consent, approval, order or authorization of, or registration with, or the giving of notice to, any governmental or public

body or authority or any third party, except such as have been or will have been obtained, made or given on or prior to the Closing Date.

(e) Sophisticated

Investor. The Subscriber is a sophisticated investor with knowledge and experience in financial and business matters such that the

Subscriber is capable of evaluating the merits and risks of its subscription of the Subscribed Shares. The Subscriber is able to bear

the economic risks of the subscription and can afford a complete loss of such subscription. The Subscriber acknowledges and affirms that,

with the assistance of its advisors, it has conducted and completed its own investigation, analysis and evaluation related to the subscription

of the Subscribed Shares.

(f) Not

U.S. Person. The Subscriber is not a “U.S. person” as defined in Rule 902 of Regulation S.

(g) Restricted

Securities. The Subscriber acknowledges that the Subscribed Shares are “restricted securities” that have not been registered

under the Securities Act or any applicable state securities law. The Subscriber further acknowledges that, absent an effective registration

under the Securities Act, the Subscribed Shares may only be offered, sold or otherwise transferred (i) to the Company, or (ii) pursuant

to an exemption from registration under the Securities Act.

2.2 Representations

and Warranties of the Company. The Company hereby represents and warrants to the Subscriber, as of the date hereof and the Closing

Date, as follows:

(a) Due

Formation. The Company is a company duly incorporated as an exempted company with limited liability, validly existing and in good

standing under the laws of the Cayman Islands. The Company has all requisite power and authority to carry on its business as it is currently

being conducted.

(b) Authority.

The Company has full power and authority to enter into, execute and deliver this Agreement and each agreement, certificate, document and

instrument to be executed and delivered by the Company pursuant to this Agreement and to perform its obligations hereunder and thereunder.

The execution and delivery by the Company of this Agreement and the performance by the Company of its obligations has been duly authorized

by all requisite actions on its part.

(c) Valid

Agreement. This Agreement has been duly executed and delivered by the Company and constitutes the legal, valid and binding obligations

of the Company, enforceable against it in accordance with its terms, except (i) as limited by applicable bankruptcy, insolvency, reorganization,

moratorium, and other laws of general application affecting enforcement of creditors’ rights generally, and (ii) as limited by laws

relating to the availability of specific performance, injunctive relief, or other equitable remedies.

(d) Due

Issuance of the Subscribed Shares. The Subscribed Shares have been duly authorized and, when issued and allotted to and paid for by

the Subscriber pursuant to this Agreement, will be validly issued, fully paid and non-assessable and free and clear of any pledge, mortgage,

security interest, encumbrance, lien, charge, assessment, title defect, right of first refusal, right of pre-emption, third party right

or interest, claim or restriction of any kind or nature, except for restrictions arising under the Securities Act or created by virtue

of this Agreement, and upon delivery and entry into the Register of Members of the Company will transfer to the Subscriber good and valid

title to the Subscribed Shares.

(e) Noncontravention.

Neither the execution and the delivery of this Agreement, nor the consummation of the transactions contemplated hereby and thereby, will

(i) violate any provision of the organizational documents of the Company or violate any constitution, statute, regulation, rule, injunction,

judgment, order, decree, ruling, charge, or other restriction of any government, governmental entity or court to which the Company is

subject, or (ii) conflict with, result in a breach of, constitute a default under, result in the acceleration of or creation of an encumbrance

under, or create in any party the right to accelerate, terminate, modify, or cancel, any agreement, contract, lease, license, instrument,

or other arrangement to which the Company is a party or by which the Company is bound or to which any of the Company’s assets is

subject. There is no action, suit or proceeding, pending or threatened against the Company that questions the validity of this Agreement

or the right of the Company to enter into this Agreement or to consummate the transactions contemplated hereby.

(f) Consents

and Approvals. Neither the execution and delivery by the Company of this Agreement, nor the consummation by the Company of any of

the transactions contemplated hereby and thereby, nor the performance by the Company of this Agreement in accordance with its terms requires

the consent, approval, order or authorization of, or registration with, or the giving notice to, any governmental or public body or authority

or any third party, except (i) such as have been or will have been obtained, made or given on or prior to the Closing Date, and (ii) the

filing with the China Securities Regulatory Commission in connection with the subscription hereunder.

Article

3

MISCELLANEOUS

3.1 Governing

Law; Arbitration. This Agreement shall be governed and interpreted in accordance with the laws of the Cayman Islands. Any dispute

arising out of or relating to this Agreement, including any question regarding its existence, validity or termination shall be referred

to and finally resolved by arbitration at the Hong Kong International Arbitration Centre in accordance with the Hong Kong International

Arbitration Centre Administered Arbitration Rules then in force. There shall be three arbitrators. Each Party has the right to appoint

one arbitrator and the third arbitrator shall be appointed by the Hong Kong International Arbitration Centre. The language to be used

in the arbitration proceedings shall be English. Each of the Parties irrevocably waives any immunity to jurisdiction to which it may be

entitled or become entitled (including without limitation sovereign immunity, immunity to pre-award attachment, post-award attachment

or otherwise) in any arbitration proceedings and/or enforcement proceedings against it arising out of or based on this Agreement or the

transactions contemplated hereby.

3.2 Amendment.

This Agreement shall not be amended, changed or modified, except by another agreement in writing executed by the Parties hereto.

3.3 Binding

Effect. This Agreement shall inure to the benefit of, and be binding upon, each of the Company and the Subscriber and their respective

heirs, successors and permitted assigns and legal representatives.

3.4 Assignment.

Neither this Agreement nor any of the rights, duties or obligations hereunder may be assigned by the Company or the Subscriber without

the express written consent of the other Party, except that the Subscriber may assign all or any part of his rights and obligations hereunder

to any affiliate controlled by the Subscriber without the consent of the Company, provided that no such assignment shall relieve the Subscriber

of its obligations hereunder if such assignee does not perform such obligations. Any purported assignment in violation of the foregoing

sentence shall be null and void.

3.5 Entire

Agreement. This Agreement constitutes the entire understanding and agreement between the Parties with respect to the matters covered

hereby, and all prior agreements and understandings, oral or in writing, if any, between the Parties with respect to the matters covered

hereby are merged and superseded by this Agreement.

3.6 Severability.

If any provisions of this Agreement shall be adjudicated to be illegal, invalid or unenforceable in any action or proceeding whether in

its entirety or in any portion, then such provision shall be deemed amended, if possible, or deleted, as the case may be, from the Agreement

in order to render the remainder of the Agreement and any provision thereof both valid and enforceable, and all other provisions hereof

shall be given effect separately therefrom and shall not be affected thereby.

3.7 Execution

in Counterparts. For the convenience of the Parties and to facilitate execution, this Agreement may be executed in one or more counterparts,

each of which shall be deemed to be an original, but all of which together shall constitute but one and the same instrument.

[Signature Page Follows]

IN WITNESS WHEREOF, the Parties

have caused this Agreement to be executed as of the day and year first above written.

| |

COMPANY: |

| |

|

| |

UCOMMUNE INTERNATIONAL LTD |

| |

|

| |

By: |

/s/ Zirui Wang |

| |

Name: |

Zirui Wang |

| |

Title: |

Chief Executive Officer and Chief Risk Officer |

[Signature Page to Share Subscription Agreement]

IN WITNESS WHEREOF, the Parties

have caused this Agreement to be executed as of the day and year first above written.

| |

SUBSCRIBER: |

| |

|

| |

MAODQ LIMITED |

| |

|

| |

By: |

/s/ Daqing Mao |

| |

Name: |

Daqing Mao |

| |

Title: |

Authorized Signatory |

[Signature Page to Share Subscription Agreement]

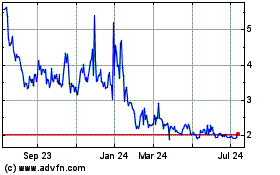

Ucommune (NASDAQ:UK)

Historical Stock Chart

From Dec 2024 to Jan 2025

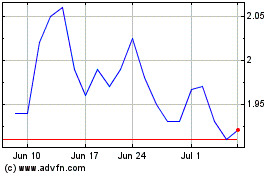

Ucommune (NASDAQ:UK)

Historical Stock Chart

From Jan 2024 to Jan 2025