false000178332800017833282024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Date of Report (Date of earliest event reported) |

March 6, 2024 |

|

TSCAN THERAPEUTICS, INC. (Exact name of registrant as specified in its charter) |

|

|

|

|

|

Delaware |

001-40603 |

82-5282075 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

830 Winter Street |

|

Waltham, Massachusetts |

|

02451 |

(Address of principal executive offices) |

|

(Zip Code) |

|

|

Registrant’s telephone number, including area code |

857 399-9500 |

|

Not Applicable (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Voting Common Stock, par value $0.0001 per share |

|

TCRX |

|

The Nasdaq Global Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 6, 2023, TScan Therapeutics, Inc. issued a press release announcing its financial results for the fourth quarter and fiscal year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Current Report on Form 8-K and Exhibit 99.1 attached hereto is intended to be furnished and shall neither be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit relating to Item 2.02 shall be deemed to be furnished, and not filed:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

TScan Therapeutics, Inc. |

|

|

|

|

Date: |

March 6, 2024 |

By: |

/s/ Gavin MacBeath |

|

|

|

Gavin MacBeath

Chief Executive Officer |

TScan Therapeutics Reports Fourth Quarter and Full Year 2023 Financial Results and Provides Business Update

Presented updated data from ongoing Phase 1 study of TSC-100 and TSC-101 for the treatment of heme malignancies at the Tandem Meetings of ASTCT and CIBMTR; 8/8 (100%) patients in treatment arms are relapse-free and show complete donor chimerism

Announced the clearance of two additional INDs for Solid Tumor Program: TSC-201-B0702 targeting MAGE-C2 on HLA-B*07:02 and TSC-204-A0101 targeting MAGE-A1 on HLA-A*01:01

Solid tumor clinical trial actively enrolling, with initial data for singleplex and multiplex cohorts anticipated in 2024

Expands leadership team with key appointments and promotions

Cash, cash equivalents, and marketable securities continues to fund operations into 2026

WALTHAM, Mass., Mar. 6, 2024 -- TScan Therapeutics, Inc. (Nasdaq: TCRX), a clinical-stage biopharmaceutical company focused on the development of T cell receptor (TCR)-engineered T cell therapies (TCR-T) for the treatment of patients with cancer, today reported financial results for the three months and full year ended December 31, 2023, and provided a business update.

“The advancements we made across our pipeline in 2023 have set the stage for a momentous year ahead as we continue to treat and follow patients in the heme malignancies study and commence patient dosing in the solid tumor program. We continue to make meaningful progress with our Phase 1 heme malignancies study, with updated data on eight treatment-arm patients and six control-arm patients presented at the Tandem Meetings of ASTCT and CIBMTR,” said Gavin MacBeath, Ph.D., Chief Executive Officer. “We are encouraged to see that none of the patients in the treatment arms has relapsed following treatment with TSC-100 or TSC-101, including one high-risk TP53-mutated MDS patient who has now reached one year of follow-up. The one-year mark is a meaningful milestone for patients as the likelihood of relapse is now much lower, leading to an improved quality of life. We look forward to completing Phase 1 enrollment and reporting clinical and translational data in 2024 with two-year relapse-free survival data in 2025.”

“We are on-track to treat the first patient in our Phase 1 solid tumor program this month, which will bring us one step closer to delivering customized, enhanced, multiplexed TCR-T therapies to patients with a variety of solid tumors,” said Debora Barton, M.D., Chief Medical Officer. “Solid tumors are notoriously heterogenous, with tumors frequently expressing more than one target antigen. We believe the only way to eradicate solid tumors is through a multi-targeted approach. To make this a reality, we continue to prioritize expanding the ImmunoBank with additional TCRs to increase patient eligibility for multiplexed therapy. With recent FDA clearance of our INDs for TSC-201-B0702 and TSC-204-A0101, we now have six TCR-Ts cleared for clinical development. We look forward to continuing to advance the solid tumor program and sharing data on patients from singleplex and multiplex cohorts in 2024.”

Recent Corporate Highlights

•In February 2024, the Company presented updated Phase 1 clinical results on lead TCR-T candidates TSC-100 and TSC-101 at the Tandem Meetings: Transplantation & Cellular Therapy Meetings of the American Society for Transplantation and Cellular Therapy (ASTCT®) and the Center for International Blood and Marrow Transplant Research (CIBMTR®).

oData showed that all eight (100%) treatment-arm patients were free from relapse, including four patients with follow-up beyond ten months. Notably, one high-risk TP53-mutated MDS patient has now reached the one-year mark following treatment with TSC-101. Additionally, no patient-derived hematopoietic cells were detected in any of the eight treatment-arm patients, indicating complete elimination of target cells. One AML patient with detectable disease post-transplant converted to, and continues to show, no detectable disease following treatment with TSC-101, with the most recent measurement at day 180. Patients have now been enrolled up to the third and final dose level in both treatment arms with no dose limiting toxicities thus far, suggesting that the third dose level will likely become the recommended Phase 2 dose.

oOf the six patients enrolled in the control arm (transplant alone), two control-arm patients relapsed at day 161 and day 180, and one of them succumbed to the relapse on day 265 post-transplant. A third control-arm patient required clinical intervention on day 133 because of concerns of impending relapse, and only two of the control-arm patients achieved and maintained complete donor chimerism following transplantation.

oThe Company hosted a virtual KOL event following the Tandem Meetings to discuss these data. A replay of the event can be found here.

•The Company recently received U.S. Food and Drug Administration (FDA) clearance of its investigational new drug (IND) applications for two additional TCR-Ts in their Solid Tumor Program:

oTSC-201-B0702, a TCR-T targeting melanoma-associated antigen C2 (MAGE-C2) on HLA -B*07:02

oTSC-204-A0101, a TCR-T targeting melanoma-associated antigen 1 (MAGE-A1) on HLA-A*01:01

With the clearance of these IND applications, TScan now has six enhanced TCR-Ts cleared for clinical development. The Company remains on-track to dose the first patient in its Phase 1 solid tumor program in the first quarter of 2024 and anticipates sharing initial data on patients from both the singleplex and multiplex cohorts in 2024.

•The Company will present two “Trials in Progress” poster presentations at the upcoming American Association for Cancer Research (AACR) Annual Meeting 2024. Details for the posters include:

Title: Trial in progress: A phase 1 trial of TSC-100 and TSC-101, engineered T cell therapies that target minor histocompatibility antigens to eliminate residual disease after hematopoietic cell transplantation

Session Title: Phase I Clinical Trials in Progress 2

Session Date and Time: Monday April 8, 2024; 1:30 - 5:00 PM PDT

Location: Poster Section 50

Poster Board Number: 2

Abstract Presentation Number: CT151

Title: Trial in progress: A phase 1, first in human clinical trial for T-Plex, a multiplexed, enhanced T cell receptor-engineered T cell therapy (TCR-T) for solid tumors

Session Title: Phase I Clinical Trials in Progress 2

Session Date and Time: Monday April 8, 2024; 1:30 - 5:00 PM PDT

Location: Poster Section 50

Poster Board Number: 21

Abstract Presentation Number: CT170

•The Company continues to expand its leadership team with key appointments and promotions:

oAppointed Jason A. Amello as Chief Financial Officer

oAppointed Justin McCue, Ph.D., as Chief Technology Officer

oPromoted Zoran Zdraveski, J.D., Ph.D., to Chief Legal and Strategy Officer

oAppointed R. Keith Woods to its Board of Directors

oPromoted Cagan Gurer, Ph.D., to Senior Vice President, Discovery

oPromoted Jim Murray to Senior Vice President, Head of Development Operations

oAppointed Dawn Pinchasik, M.D., M.S., as Vice President, Clinical Development

•In November 2023, the Company was named a Top Place to Work by The Boston Globe for the second consecutive year.

Upcoming Anticipated Milestones

Heme Malignancies Program: TScan’s two lead TCR-T cell therapy candidates, TSC-100 and TSC-101, are designed to treat residual disease and prevent relapse in patients with acute myeloid leukemia (AML), acute lymphocytic leukemia (ALL), or myelodysplastic syndromes (MDS) undergoing hematopoietic cell transplantation (HCT) (NCT05473910).

•Plans to open expansion cohorts at the recommended Phase 2 dose level to further characterize safety and evaluate translational and efficacy endpoints in the third quarter of 2024.

•Plans to complete Phase 1 enrollment and report one-year clinical and translational data on initial patients in 2024.

•Expects to initiate registration trial and report two-year relapse data in 2025.

Solid Tumor Program: TScan continues to expand the ImmunoBank, a collection of therapeutic TCRs that target different cancer-associated antigens presented on diverse HLA types. TScan’s strategy is to treat patients with multiple TCR-Ts to overcome tumor heterogeneity and prevent resistance that may arise from either target or HLA loss (screening protocol: NCT05812027) (treatment protocol: NCT05973487).

•Initiated Phase 1 solid tumor clinical study and expects to dose the first patient in the first quarter of 2024.

•Expects to share initial data on patients from both singleplex and multiplex cohorts in 2024.

•Plans to continue to expand the ImmunoBank with additional IND filings throughout 2024.

•Long-term duration of response data for multiplexed therapy anticipated in 2025.

Financial Results

Revenue: Revenue for the fourth quarter of 2023, was $7.2 million, compared to $3.1 million for the fourth quarter of 2022, and $21.0 million for the full-year 2023, compared to $13.5 million for the full-year 2022. The increase in both periods is primarily due to timing of research activities related to the collaboration agreement with Amgen which commenced in May 2023 compared to the collaboration and license agreement with Novartis which ended in March 2023.

R&D Expenses: Research and development expenses for the fourth quarter of 2023 were $22.4 million, compared to $15.6 million for the fourth quarter of 2022, and $88.2 million for the full-year 2023, compared to $59.8 million for the full-year 2022. The period over period increases were primarily driven by increased costs associated with clinical trial start-up fees and patient enrollment, increased personnel costs, and expansion of facilities.

G&A Expenses: General and administrative expenses for the fourth quarter of 2023, were $6.2 million, compared to $6.1 million for the fourth quarter of 2022, and $26.4 million for the full-year 2023, compared to $20.4 million for the full-year 2022. The full-year increase of $6.0 million was primarily driven by increased legal and professional fees and expansion of facilities.

Net Loss: Net loss was $19.6 million for the fourth quarter of 2023, compared to $18.7 million for the fourth quarter of 2022, and included net interest income of $1.7 million and $0, respectively. Net loss for the full-year 2023 was $89.2 million, compared to $66.2 million for the full-year 2022, and included net interest income of $4.2 million and $0.4 million, respectively.

Cash Position: Cash, cash equivalents, and marketable securities as of December 31, 2023 were $192.0 million, excluding $5.0 million of restricted cash. The Company believes that its existing cash resources will be sufficient to fund its current operating plan into 2026.

Share Count: As of December 31, 2023, the Company had issued and outstanding shares of 47,829,529, which consists of 43,552,941 shares of voting common stock and 4,276,588 shares of non-voting common stock, and outstanding pre-funded warrants to purchase 47,010,526 shares of voting common stock at an exercise price of $0.0001 per share.

About TScan Therapeutics, Inc.

TScan is a clinical-stage biopharmaceutical company focused on the development of T cell receptor (TCR)-engineered T cell therapies (TCR-T) for the treatment of patients with cancer. The Company’s lead TCR-T therapy candidates, TSC-100 and TSC-101, are in development for the treatment of patients with hematologic malignancies to prevent relapse following allogeneic hematopoietic cell transplantation. The Company is also developing TCR-T therapy candidates for the treatment of various solid tumors. The Company has developed and continues to expand its ImmunoBank, the Company’s repository of therapeutic TCRs that recognize diverse targets and are associated with multiple HLA types, to provide customized multiplexed TCR-T therapies for patients with a variety of cancers.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, express or implied statements regarding the Company’s plans, progress, and timing relating to the Company’s hematologic malignancies program, including potential indicators of treatment success, completion of enrollment and opening of expansion cohorts, and the presentation of data; the Company’s plans, progress, and timing relating to the Company’s solid tumor programs, including treatment of patients and the presentation of data; the Company’s current and future research and development plans or expectations; the structure, timing and success of the Company’s planned preclinical development, submission of INDs, and clinical trials; the potential benefits of any of the Company’s proprietary platforms, multiplexing, or current or future product candidates in treating patients; the Company’s ability to fund its operating expenses and capital expenditure requirements with its existing cash and cash equivalents; and the Company’s goals and strategy, focus, and anticipated financial performance. TScan intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. In some cases, you can identify forward-looking statements by terms such as, but not limited to, “may,” “might,” “will,” “objective,” “intend,” “should,” “could,” “can,” “would,” “expect,” “believe,” “anticipate,” “project,” “target,” “design,” “estimate,” “predict,” “potential,” “plan,” “on track,” or similar expressions or the negative of those terms. Such forward-looking statements are based upon current expectations that involve risks, changes in circumstances, assumptions, and uncertainties. The express or implied forward-looking statements included in this release are only predictions and are subject to a number of risks, uncertainties and assumptions, including, without limitation: the beneficial characteristics, safety, efficacy, therapeutic effects and potential advantages of TScan’s TCR-T therapy candidates; TScan’s expectations regarding its preclinical studies being predictive of clinical trial results; TScan’s recently approved INDs being indicative or predictive of bringing TScan closer to its goal of providing customized TCR-T therapies to treat patients with cancer; the timing of the launch, initiation, progress, expected results and announcements of TScan’s preclinical studies, clinical trials and its research and development programs; TScan’s timeline regarding its filing of INDs for its TCRs throughout the year; TScan’s ability to enroll patients for its clinical trials within its expected timeline; TScan’s plans relating to developing and commercializing its TCR-T therapy candidates, if approved, including sales strategy; estimates of the size of the addressable market for TScan’s TCR-T therapy candidates; TScan’s manufacturing capabilities and the scalable nature of its manufacturing process; TScan’s estimates regarding expenses, future milestone payments and revenue, capital requirements and needs for additional financing; TScan’s expectations regarding competition; TScan’s anticipated growth strategies; TScan’s ability to attract or retain key personnel; TScan’s ability to establish and maintain development partnerships and collaborations; TScan’s expectations regarding federal, state and foreign regulatory requirements; TScan’s ability to obtain and maintain intellectual property protection for its proprietary platform technology and our product candidates; the sufficiency of TScan’s existing capital resources

to fund its future operating expenses and capital expenditure requirements; and other factors that are described in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of TScan’s most recent Annual Report on Form 10-K and any other filings that TScan has made or may make with the SEC in the future. Any forward-looking statements contained in this release represent TScan’s views only as of the date hereof and should not be relied upon as representing its views as of any subsequent date. Except as required by law, TScan explicitly disclaims any obligation to update any forward-looking statements.

Contacts

Heather Savelle

TScan Therapeutics, Inc.

VP, Investor Relations

857-399-9840

hsavelle@tscan.com

Joyce Allaire

LifeSci Advisors, LLC

Managing Director

617-435-6602

jallaire@lifesciadvisors.com

|

|

|

|

|

|

|

|

|

TScan Therapeutics, Inc. |

|

Condensed Consolidated Balance Sheet Data |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

Assets |

|

|

|

|

|

|

Cash, cash equivalents, and marketable securities |

|

$ |

192,044 |

|

|

$ |

120,027 |

|

Other assets |

|

|

80,105 |

|

|

|

79,064 |

|

Total assets |

|

|

272,149 |

|

|

|

199,091 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

Total liabilities |

|

|

121,282 |

|

|

|

99,657 |

|

Total stockholders' equity |

|

|

150,867 |

|

|

|

99,434 |

|

Total liabilities and stockholders' deficit |

|

$ |

272,149 |

|

|

$ |

199,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TScan Therapeutics, Inc. |

|

Condensed Consolidated Statements of Operations |

|

(in thousands, except share and per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Twelve Months Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

Collaboration and license revenue |

|

$ |

7,211 |

|

|

$ |

3,096 |

|

|

$ |

21,049 |

|

|

$ |

13,535 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

22,407 |

|

|

|

15,604 |

|

|

|

88,153 |

|

|

|

59,819 |

|

General and administrative |

|

|

6,161 |

|

|

|

6,140 |

|

|

|

26,354 |

|

|

|

20,352 |

|

Total operating expenses |

|

|

28,568 |

|

|

|

21,744 |

|

|

|

114,507 |

|

|

|

80,171 |

|

Loss from operations |

|

|

(21,357 |

) |

|

|

(18,648 |

) |

|

|

(93,458 |

) |

|

|

(66,636 |

) |

Interest and other income, net |

|

|

2,596 |

|

|

|

900 |

|

|

|

7,999 |

|

|

|

1,591 |

|

Interest expense |

|

|

(852 |

) |

|

|

(975 |

) |

|

|

(3,759 |

) |

|

|

(1,176 |

) |

Net loss |

|

$ |

(19,613 |

) |

|

$ |

(18,723 |

) |

|

$ |

(89,218 |

) |

|

$ |

(66,221 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.21 |

) |

|

$ |

(0.78 |

) |

|

$ |

(1.36 |

) |

|

$ |

(2.75 |

) |

Weighted average common shares outstanding—basic and diluted |

|

|

94,835,735 |

|

|

|

24,077,857 |

|

|

|

65,599,858 |

|

|

|

24,048,267 |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

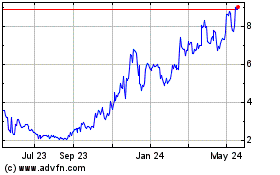

TScan Therapeutics (NASDAQ:TCRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

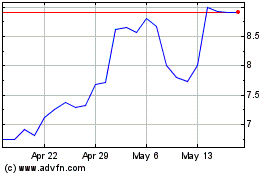

TScan Therapeutics (NASDAQ:TCRX)

Historical Stock Chart

From Dec 2023 to Dec 2024