- Current report filing (8-K)

November 07 2011 - 4:19PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

|

|

Date of Report (Date of earliest event reported)

|

November 4, 2011

|

|

|

TF FINANCIAL CORPORATION

|

|

(Exact Name of Registrant as Specified in its Charter)

|

|

Pennsylvania

|

0-24168

|

74-2705050

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

3 Penns Trail, Newtown, Pennsylvania

|

18940

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(215) 579-4000

|

Not Applicable

|

|

(Former name or former address, if changed since last report)

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)).

|

TF FINANCIAL CORPORATION

INFORMATION TO BE INCLUDED IN THE REPORT

Section 1 – Registrant’s Business and Operations

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On November 4, 2011, TF Financial Corporation (the “Company”) entered into an Agreement (the “Agreement”) with Lawrence B. Seidman, Dennis Pollack, 2514 Multi-Strategy Fund, LP, Broad Park Investors, LLC, CBPS, LLC, LSBK06-08, LLC, Seidman and Associates, LLC, Seidman Investment Partnership, LP and Seidman Investment Partnership II, LP (such entities, together with Mr. Seidman, the “Group”; each individually, a “Group Member”). The Group Members and Mr. Pollack are stockholders of the Company who beneficially own 5.48% of the Company’s outstanding shares of common stock as of the date of the Agreement.

In the Agreement, the Company agreed to nominate one qualified person selected by the Group to the Company’s Board of Directors at the next regular meeting of the Board of Directors following the date of the Agreement. The Board of Directors expects to appoint Mr. Pollack at its Board meeting in January 2012. The Agreement will remain in effect for one year from the date of its execution, and thereafter for as long as the director chosen by the Group remains a member of the Company’s Board of Directors.

Each Group Member and Mr. Pollack have agreed, among other items, to vote, during the term of the Agreement, all shares beneficially owned (a) in favor of any proposal submitted by the Company’s management or the Board of Directors to a vote of the Company’s stockholders and (b) in accordance with the recommendations of a majority of the member of the Board of Directors of the Company on all procedural matters.

Each Group Member also agreed, among other items, that during the term of the Agreement, they will not (a) acquire additional shares of the Company’s common stock, provided that they may own, in the aggregate, up to 7.0% of the outstanding common shares during the one year following the date of the Agreement, and up to 9.9% of the outstanding common shares thereafter, (b) publicly propose or seek to effect a merger, change in control or similar transaction involving the Company, (c) make or in any way participate in the solicitation of proxies, (d) seek to advise, encourage or influence any other person with respect to the voting of the Company’s common stock, or (e) propose, encourage or otherwise solicit stockholders of the Company for the approval of stockholder proposals or the removal of any member of the Company’s Board of Directors.

The foregoing description is qualified in its entirety by reference to the full text of the Agreement, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Section 9 – Financial Statements and Exhibits

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d)

Exhibits

|

|

Exhibit No.

|

Description of Exhibit

|

|

|

10.1

|

Agreement, dated November 4, 2011, by and among TF Financial Corporation, Dennis Pollack, Lawrence B. Seidman, 2514 Multi-Strategy Fund, LP, Broad Park Investors, LLC, CBPS, LLC, LSBK06-08, LLC, Seidman and Associates, LLC, Seidman Investment Partnership, LP and Seidman Investment Partnership II, LP.

|

|

SIGNATURES

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

TF FINANCIAL CORPORATION

|

|

Date: November 4, 2011

|

|

By:

|

/s/ Kent C. Lufkin

|

|

|

|

|

Kent C. Lufkin

President and Chief Executive Officer

(Duly Authorized Representative)

|

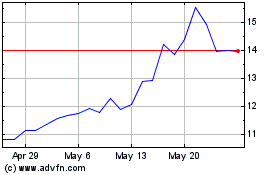

Third Harmonic Bio (NASDAQ:THRD)

Historical Stock Chart

From Oct 2024 to Nov 2024

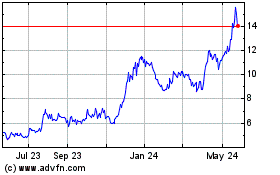

Third Harmonic Bio (NASDAQ:THRD)

Historical Stock Chart

From Nov 2023 to Nov 2024