00018275062023FYFalse0.1100018275062023-01-012023-12-3100018275062023-06-30iso4217:USD00018275062024-03-15xbrli:shares00018275062023-12-3100018275062022-12-31iso4217:USDxbrli:shares0001827506us-gaap:NonvotingCommonStockMember2023-12-3100018275062022-01-012022-12-310001827506trml:SeriesAPreferredUnitMember2021-12-310001827506us-gaap:SeriesAPreferredStockMember2021-12-310001827506us-gaap:CapitalUnitsMember2021-12-310001827506us-gaap:CommonStockMember2021-12-310001827506us-gaap:AdditionalPaidInCapitalMember2021-12-310001827506us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001827506us-gaap:RetainedEarningsMember2021-12-3100018275062021-12-310001827506us-gaap:CapitalUnitsMember2022-01-012022-12-310001827506us-gaap:CommonStockMember2022-01-012022-12-310001827506trml:SeriesAPreferredUnitMember2022-01-012022-12-310001827506us-gaap:SeriesAPreferredStockMember2022-01-012022-12-310001827506us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001827506us-gaap:RetainedEarningsMember2022-01-012022-12-310001827506trml:SeriesAPreferredUnitMember2022-12-310001827506us-gaap:SeriesAPreferredStockMember2022-12-310001827506us-gaap:CapitalUnitsMember2022-12-310001827506us-gaap:CommonStockMember2022-12-310001827506us-gaap:AdditionalPaidInCapitalMember2022-12-310001827506us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001827506us-gaap:RetainedEarningsMember2022-12-310001827506us-gaap:SeriesAPreferredStockMember2023-01-012023-12-310001827506us-gaap:CommonStockMember2023-01-012023-12-310001827506us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001827506us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001827506us-gaap:RetainedEarningsMember2023-01-012023-12-310001827506trml:SeriesAPreferredUnitMember2023-12-310001827506us-gaap:SeriesAPreferredStockMember2023-12-310001827506us-gaap:CapitalUnitsMember2023-12-310001827506us-gaap:CommonStockMember2023-12-310001827506us-gaap:AdditionalPaidInCapitalMember2023-12-310001827506us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001827506us-gaap:RetainedEarningsMember2023-12-310001827506us-gaap:CommonStockMember2023-10-192023-10-1900018275062023-10-19xbrli:pure0001827506us-gaap:PrivatePlacementMember2023-10-192023-10-190001827506trml:January2024OfferingMemberus-gaap:SubsequentEventMember2024-01-012024-01-3100018275062023-10-192023-10-19trml:segment0001827506us-gaap:ResearchAndDevelopmentExpenseMember2023-10-192023-10-190001827506us-gaap:GeneralAndAdministrativeExpenseMember2023-10-192023-10-190001827506trml:PfizerLicenseAgreementMember2022-05-032022-05-030001827506trml:SeriesAPreferredUnitMembertrml:PfizerLicenseAgreementMember2022-05-030001827506trml:PfizerLicenseAgreementMemberus-gaap:SeriesAPreferredStockMember2022-05-030001827506trml:PfizerLicenseAgreementMemberus-gaap:SeriesAPreferredStockMembertrml:PfizerInc.Member2022-05-030001827506trml:SeriesAPreferredUnitMembertrml:PfizerLicenseAgreementMember2022-05-032022-05-030001827506trml:PfizerLicenseAgreementMember2022-01-012022-12-310001827506trml:PfizerLicenseAgreementMembertrml:DevelopmentAndRegulatoryMilestonesMember2022-05-030001827506trml:PfizerLicenseAgreementMembertrml:SalesMilestonesMember2022-05-030001827506trml:PfizerLicenseAgreementMember2022-05-030001827506trml:PfizerLicenseAgreementMemberus-gaap:SeriesAPreferredStockMember2023-05-022023-05-020001827506us-gaap:MoneyMarketFundsMember2023-12-310001827506us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2023-12-310001827506us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2023-12-310001827506us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2023-12-310001827506us-gaap:CommercialPaperMember2023-12-310001827506us-gaap:CommercialPaperMemberus-gaap:FairValueInputsLevel1Member2023-12-310001827506us-gaap:FairValueInputsLevel2Memberus-gaap:CommercialPaperMember2023-12-310001827506us-gaap:FairValueInputsLevel3Memberus-gaap:CommercialPaperMember2023-12-310001827506us-gaap:USGovernmentDebtSecuritiesMember2023-12-310001827506us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-12-310001827506us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMember2023-12-310001827506us-gaap:FairValueInputsLevel3Memberus-gaap:USGovernmentDebtSecuritiesMember2023-12-310001827506us-gaap:CorporateDebtSecuritiesMember2023-12-310001827506us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Member2023-12-310001827506us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001827506us-gaap:FairValueInputsLevel3Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310001827506us-gaap:FairValueInputsLevel1Member2023-12-310001827506us-gaap:FairValueInputsLevel2Member2023-12-310001827506us-gaap:FairValueInputsLevel3Member2023-12-310001827506us-gaap:CashAndCashEquivalentsMemberus-gaap:MoneyMarketFundsMember2023-12-310001827506us-gaap:CommercialPaperMemberus-gaap:ShortTermInvestmentsMember2023-12-310001827506us-gaap:USGovernmentDebtSecuritiesMemberus-gaap:ShortTermInvestmentsMember2023-12-310001827506us-gaap:ShortTermInvestmentsMemberus-gaap:CorporateDebtSecuritiesMember2023-12-310001827506us-gaap:LeaseholdsAndLeaseholdImprovementsMember2023-12-310001827506us-gaap:LeaseholdsAndLeaseholdImprovementsMember2022-12-310001827506us-gaap:OfficeEquipmentMember2022-12-310001827506us-gaap:OfficeEquipmentMember2023-12-310001827506trml:SeriesAPreferredUnitMembertrml:InitialSeriesASecuritiesPurchaseAgreementMember2022-04-182022-04-180001827506trml:SeriesAPreferredUnitMembertrml:InitialSeriesASecuritiesPurchaseAgreementMember2022-04-180001827506trml:SeriesAPreferredUnitMember2022-04-180001827506us-gaap:SeriesAPreferredStockMember2022-09-020001827506us-gaap:SeriesAPreferredStockMembertrml:SeriesAExtensionMember2023-05-022023-05-020001827506us-gaap:SeriesAPreferredStockMembertrml:SeriesAExtensionMember2023-05-020001827506us-gaap:SeriesAPreferredStockMember2023-04-012023-06-3000018275062022-05-0300018275062022-09-02trml:vote0001827506us-gaap:ConvertiblePreferredStockMember2023-12-310001827506us-gaap:ConvertiblePreferredStockMember2022-12-310001827506us-gaap:EmployeeStockOptionMembertrml:A2022EquityIncentivePlanMember2023-12-310001827506us-gaap:EmployeeStockOptionMembertrml:A2022EquityIncentivePlanMember2022-12-310001827506trml:A2023EquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2023-12-310001827506trml:A2023EquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2022-12-310001827506us-gaap:RestrictedStockUnitsRSUMember2023-12-310001827506us-gaap:RestrictedStockUnitsRSUMember2022-12-310001827506trml:EarlyExercisableStockOptionsMember2023-12-310001827506trml:EarlyExercisableStockOptionsMember2022-12-310001827506trml:A2022EquityIncentivePlanMember2023-12-310001827506trml:A2022EquityIncentivePlanMember2022-12-310001827506trml:A2023EquityIncentivePlanMember2023-12-310001827506trml:A2023EquityIncentivePlanMember2022-12-310001827506trml:A2023ESPPMember2023-12-310001827506trml:A2023ESPPMember2022-12-310001827506trml:A2023EquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2023-10-172023-10-170001827506trml:A2023EquityIncentivePlanMember2023-10-170001827506trml:A2023EquityIncentivePlanMember2023-10-172023-10-170001827506us-gaap:EmployeeStockMembertrml:A2023ESPPMember2023-10-170001827506us-gaap:EmployeeStockMembertrml:A2023ESPPMember2023-10-172023-10-170001827506us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001827506us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001827506us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001827506us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-12-310001827506us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001827506us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001827506srt:MinimumMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001827506srt:MaximumMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001827506srt:MinimumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001827506srt:MaximumMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001827506trml:EarlyExercisableStockOptionsMember2023-01-012023-12-310001827506trml:EarlyExercisableStockOptionsMember2022-01-012022-12-310001827506us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001827506us-gaap:DomesticCountryMember2023-12-310001827506us-gaap:StateAndLocalJurisdictionMember2023-12-3100018275062023-07-252023-10-03trml:lettertrml:lawsuit0001827506us-gaap:SubsequentEventMember2024-02-132024-02-130001827506us-gaap:InvestorMembertrml:KVPCapitalLPPromissoryNoteMember2021-10-010001827506us-gaap:InvestorMembertrml:KVPCapitalLPPromissoryNoteMember2022-04-040001827506us-gaap:InvestorMembertrml:KVPCapitalLPPromissoryNoteMember2022-01-012022-12-310001827506srt:AffiliatedEntityMember2023-05-012023-05-310001827506srt:AffiliatedEntityMember2023-05-312023-05-3100018275062023-05-312023-05-3100018275062023-06-012023-06-010001827506us-gaap:ConvertiblePreferredStockMember2023-01-012023-12-310001827506us-gaap:ConvertiblePreferredStockMember2022-01-012022-12-310001827506us-gaap:EmployeeStockOptionMembertrml:A2022EquityIncentivePlanMember2023-01-012023-12-310001827506us-gaap:EmployeeStockOptionMembertrml:A2022EquityIncentivePlanMember2022-01-012022-12-310001827506trml:A2023EquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2023-01-012023-12-310001827506trml:A2023EquityIncentivePlanMemberus-gaap:EmployeeStockOptionMember2022-01-012022-12-310001827506us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001827506us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001827506trml:EarlyExercisableStockOptionsMember2023-01-012023-12-310001827506trml:EarlyExercisableStockOptionsMember2022-01-012022-12-310001827506trml:UnderwritingAgreementMemberus-gaap:SubsequentEventMember2024-01-252024-01-250001827506trml:UnderwritingAgreementMemberus-gaap:SubsequentEventMember2024-01-250001827506us-gaap:OverAllotmentOptionMemberus-gaap:SubsequentEventMember2024-01-250001827506us-gaap:OverAllotmentOptionMemberus-gaap:SubsequentEventMember2024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________

FORM 10-K

_____________________________

(Mark One)

| | | | | |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO |

Commission File Number: 001-40384

__________________________________________________________

Tourmaline Bio, Inc.

(Exact name of Registrant as specified in its Charter)

___________________________________________________________

| | | | | |

| Delaware | 83-2377352 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

27 West 24th Street, Suite 702 New York, NY | 10010 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (646) 481-9832

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | TRML | | The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the Registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | o | | Accelerated filer | | o |

| | | | | | |

| Non-accelerated filer | | x | | Smaller reporting company | | x |

| | | | | | |

| | | | Emerging growth company | | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2023 (the last business day of the Registrant’s second fiscal quarter), the Registrant’s aggregate market value of its voting common equity held by non-affiliates was approximately $89.9 million based on the closing sale price of $3.04 per share as reported on The Nasdaq Global Market on that date. As of March 15, 2024, there were 25,646,509 shares of the Registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive proxy statement (the “2024 Proxy Statement”) for its 2024 Annual Meeting of Stockholders, which the Registrant intends to file pursuant to Regulation 14A with the Securities and Exchange Commission not later than 120 days after the Registrant’s fiscal year ended December 31, 2023, are incorporated by reference into Part III of this Annual Report on Form 10-K.

Table of Contents

EXPLANATORY NOTE

On October 19, 2023, the Delaware corporation formerly known as “Talaris Therapeutics, Inc.” completed its previously announced merger transaction in accordance with the terms and conditions of the Agreement and Plan of Merger, dated as of June 22, 2023 (the “Merger Agreement”), by and among Talaris Therapeutics, Inc. (“Talaris”), Tourmaline Bio, Inc. (“Legacy Tourmaline”) and Terrain Merger Sub, Inc., a direct wholly owned subsidiary of Talaris (“Merger Sub”), pursuant to which Merger Sub merged with and into Legacy Tourmaline, with Legacy Tourmaline surviving as a direct wholly owned subsidiary of Talaris and the surviving corporation of the merger (the “Merger”). Additionally, as a result of the Merger, (i) Legacy Tourmaline changed its name from “Tourmaline Bio, Inc.” to “Tourmaline Sub, Inc.”, and (ii) Talaris changed its name from “Talaris Therapeutics, Inc.” to “Tourmaline Bio, Inc.”

On October 19, 2023, in connection with the transactions contemplated by the Merger Agreement, Talaris filed a Certificate of Amendment to the Third Amended and Restated Certificate of Incorporation effecting a 1-for-10 reverse stock split of Talaris’ common stock (the “Reverse Stock Split”). As a result of the Reverse Stock Split, the number of issued and outstanding shares of Talaris’ common stock immediately prior to the Reverse Stock Split was reduced such that every 10 shares of Talaris’ common stock held by a stockholder immediately prior to the Reverse Stock Split were combined and reclassified into one share of common stock after the Reverse Stock Split.

In this Report, unless the context indicates otherwise, the terms “Company,” “we,” “us,” and “our” refer to Tourmaline Bio, Inc. (formerly known as Talaris Therapeutics, Inc.) and its consolidated subsidiaries. Unless otherwise noted, all references to share of common stock and per share amounts in this Annual Report on Form 10-K have been retroactively adjusted to reflect the conversion of shares in the Merger based on an exchange ratio of 0.7977.

This Report contains references to trademarks belonging to other entities, which are the property of their respective holders. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

All statements other than statements of historical fact included in this Report, including, without limitation, statements under “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” regarding our financial position, business strategy and the plans and objectives of management for future operations, are forward-looking statements. When used in this Report, words and phrases such as “designed to,” “intended to,” “may,” “might,” “can,” “will,” “to be,” “could,” “would,” “should,” “expect,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “project,” “potential,” “likely,” “continue” and “ongoing,” or the negative of such terms or other similar expressions, as they relate to us or our management, identify forward-looking statements.

Any statements in this Report, or incorporated herein, about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. Within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), these forward-looking statements include statements regarding:

•the success, cost and timing of our development activities, non-clinical studies and clinical trials;

•the timing and outcome of our current and future clinical trials, and the reporting of data from those trials;

•the therapeutic potential of TOUR006 and future product candidates;

•the ability to obtain funding for our operations, including funding necessary to develop and commercialize our current and future product candidates, subject to regulatory approvals;

•our ability to extend our operating capital;

•the potential of our technologies and our ability to execute on our corporate strategy;

•our ability to contract with third-party suppliers and manufacturers and their ability to perform adequately;

•our reliance on third parties to manufacture and conduct preclinical studies and clinical trials of our current and future product candidates;

•the success of competing therapies that are or may become available;

•our ability to obtain regulatory approval for our product candidates and any related restrictions, limitations and/or warnings in the label of any approved product candidate;

•existing regulations and regulatory developments in the United States and other jurisdictions;

•the strength and breadth of our patent portfolio;

•our ability to obtain and adequately protect intellectual property rights for our product candidates;

•potential claims relating to our intellectual property;

•our financial performance;

•our ability to develop and maintain our corporate infrastructure, including our ability to design and maintain an effective system of internal controls;

•our ability to remediate the existing material weaknesses in our internal control over financial reporting;

•our ability to attract and retain key scientific, medical, commercial and management personnel;

•our ability to continue to satisfy the listing requirements of The Nasdaq Stock Market and have our stock continue to trade thereon; and

•the effects of macroeconomic and geopolitical conditions and unforeseeable events, such as the war in Ukraine and hostilities in the Middle East, potential bank failures and the COVID-19 pandemic.

These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to revise any forward-looking statements to reflect events or developments occurring after the date of this Report, even if new information becomes available in the future.

PART I

Item 1. Business.

Overview

We are a late-stage clinical biotechnology company focused on developing transformative medicines that dramatically improve the lives of patients with life-altering immune and inflammatory diseases. In doing so, we seek to identify and develop medicines that have the potential to establish new standards-of-care in areas of high unmet medical need.

Our initial product candidate is TOUR006, a fully human monoclonal antibody that selectively binds to interleukin-6 (“IL-6”), a key proinflammatory cytokine involved in the pathogenesis of many autoimmune and inflammatory disorders. The anti-IL-6 and anti-IL-6 receptor (“IL-6R”) antibody class (“IL-6 class”) has over two decades of clinical and commercial experience treating over a million patients with a variety of autoimmune and inflammatory diseases. To date, four anti-IL-6 or anti-IL-6R antibodies have been approved in the United States (“U.S.”). These four anti-IL-6 or anti-IL-6R antibodies together generated more than $3.5 billion in global sales in 2023.

TOUR006 is a long-acting anti-IL-6 antibody which we believe has best-in-class properties including a high binding affinity to IL-6, long half-life, and low observed immunogenicity. These characteristics may allow TOUR006 to achieve substantial IL-6 pathway suppression with relatively low amounts of drug exposure, potentially enabling delivery in a convenient, low volume, infrequently administered, subcutaneous injection.

We are pursuing two strategic paths for TOUR006, the first of which we refer to as “FcRn+”. Neonatal Fc receptor (“FcRn”) inhibitors have emerged as a novel therapeutic class to treat autoantibody-driven diseases. However, FcRn inhibitors have significant limitations including suboptimal efficacy, lack of durable efficacy, high burden dosing profile, and an unknown long-term safety profile. We believe TOUR006 has the potential to be a superior therapy for a wide range of autoantibody-driven diseases, compared to FcRn inhibitors. We have identified thyroid eye disease (“TED”) as our beachhead indication for our FcRn+ strategy. TED is an autoimmune disease characterized by autoantibody-mediated activation of the tissues surrounding the eye, causing inflammation and disfigurement which can be sight-threatening in severe cases. We have identified a substantial body of published clinical observations characterizing the beneficial off-label use of currently marketed IL-6 pathway inhibitors, namely Actemra® (tocilizumab), an anti-IL-6R monoclonal antibody, in reducing inflammation, eye-bulging, and levels of autoantibodies in patients with TED. However, no formal, industry-sponsored development effort studying the IL-6 class for the treatment of TED has been completed to date.

We are currently evaluating TOUR006 in a pivotal Phase 2b trial in first-line TED, which we refer to as the spiriTED trial. We initiated the spiriTED trial in September 2023 and expect to report topline data in the first half of 2025. Further, we expect to commence a pivotal Phase 3 trial of TOUR006 in first-line TED in 2024, with topline data expected to be reported in 2026.

Our second strategic path is cardiovascular inflammation. We believe TOUR006 has the potential to transform the care of high-risk cardiovascular patients by targeting key inflammatory pathways driving cardiovascular disease. Atherosclerotic cardiovascular disease (“ASCVD”) is a leading cause of death globally. Preventing major adverse cardiovascular events (“MACE”), such as death, nonfatal myocardial infarction or nonfatal stroke, has the potential to significantly reduce global cardiovascular disease burden. IL-6 has been identified as a promising drug target for addressing the risk of MACE in ASCVD, and multiple external Phase 3 cardiovascular outcome trials investigating IL-6 blockade are ongoing. We believe that TOUR006 potentially offers a meaningfully enhanced product profile to these competitor programs with a potential for subcutaneous dosing once every three months. As previously announced in January 2024, we have reached alignment with the U.S. Food and Drug Administration (“FDA”) on the ASCVD clinical development program, including a Phase 2 trial evaluating the reduction of C-reactive protein (“CRP”), a validated biomarker for inflammation, with quarterly and monthly dosing of TOUR006 in patients with elevated cardiovascular risk. In March 2024, the FDA cleared our Investigational New Drug application (“IND”) related to our ASCVD clinical development program. The Phase 2 trial is targeted to commence in the first half of 2024, and we expect to report topline data in the first half of 2025. Pending successful initiation and completion, positive results from the Phase 2 trial are expected to position us to be ready in 2025 to commence a pivotal Phase 3 trial for TOUR006 in cardiovascular disease.

Our Pipeline

The following figure summarizes our current development programs:

Note: Hatched bars represent trials that have not yet commenced. The timing of regulatory submissions and clinical trial milestones are subject to change and additional discussion with the FDA. *Clinical development plan for additional indications subject to change upon indication selection and discussion with the FDA

As can be seen in the chart above, we plan to identify additional indication opportunities for TOUR006. In addition, we continue to evaluate new in-licensing and acquisition opportunities for assets that we believe have standard-of-care changing potential for patients with immune, inflammatory and other diseases.

Our Strategy

We seek to identify and develop transformative medicines that have the potential to establish new standards-of-care in areas of high unmet medical need. We plan to apply a human data-focused approach to indication selection, identifying diseases where IL-6 pathway inhibitors have been used successfully in practice despite limited formal industry development and where we believe TOUR006 can potentially bring significant improvements over existing standards-of-care. We also plan to leverage insights from clinical trials of competitor IL-6 pathway inhibitor programs with a goal of rapidly bringing TOUR006 into indications that have already been externally de-risked. We believe this focus on leveraging existing human data could allow us identify indications with high potential for clinical and commercial success and can maximize the value of TOUR006.

The key elements of our strategy include:

•In our FcRn+ strategy, advance TOUR006 through clinical development in patients with TED as our beachhead indication in autoantibody-driven diseases. Our initial product candidate, TOUR006, has the potential for a differentiated product profile for the treatment of TED based on the literature supporting IL-6 pathway inhibition in active TED, a favorable long-term safety profile of the IL-6 class observed to date, and the potentially low administrative burden offered by infrequent, subcutaneous dosing. In September 2023, we initiated our pivotal Phase 2b spiriTED trial to assess the safety and efficacy of TOUR006 for the treatment of TED, and we expect to report topline results from this trial in the first half of 2025. Further, we expect to commence a pivotal Phase 3 trial for TOUR006 in TED in 2024. Topline data from this planned Phase 3 trial are expected in 2026.

•In our cardiovascular inflammation strategy, advance TOUR006 through clinical development in patients with ASCVD. We believe that TOUR006 has the potential to provide a differentiated product profile for the treatment of inflammatory risk in ASCVD with the potential for subcutaneous dosing once every three months. We plan to initiate a Phase 2 clinical trial to assess the safety, pharmacokinetics (“PK”), and pharmacodynamics (“PD”) of TOUR006 for the treatment of ASCVD in the first half of 2024, with topline data expected in the first half of 2025.

•Maximize the potential of TOUR006 in additional indications where IL-6 inhibition has shown compelling evidence of clinical benefit. We believe that TOUR006 has broad application beyond TED and ASCVD. We aim to identify and develop in additional indications where IL-6 inhibition has shown evidence of clinical benefit, but has not entered industry-led clinical development, as well as indications where we could bring TOUR006 forward, capitalizing on external de-risking events.

•Explore business development opportunities to selectively expand our product portfolio. We continue to evaluate new in-licensing and acquisition opportunities for assets that we believe have standard-of-care changing potential for patients with immune, inflammatory and other diseases. We also plan to strategically evaluate potential collaborations with external parties to maximize the potential of TOUR006.

Scientific Background

Overview of Autoimmune Disorders

The immune system plays a critical role in nearly every aspect of human health. In addition to providing protection against external pathogens such as viruses, bacteria, and fungi, the immune system is involved in the surveillance and elimination of internal threats such as pre-malignant and malignant lesions. Beyond providing protection, the immune system regulates key regenerative and homeostatic processes in healthy individuals on an ongoing basis.

In patients with autoimmune diseases, the immune system inappropriately recognizes and attacks normal healthy tissues, resulting in inflammation, organ damage, debilitating symptoms and, in severe cases, death. To date over 80 autoimmune diseases have been documented, each with a wide range of clinical manifestations, pathophysiology, and severities. It is estimated that approximately 320 million people globally and approximately 24 million people in the U.S. are affected by an autoimmune disease.

The standard-of-care for immune-related disorders has been immunomodulatory and anti-inflammatory agents that are intended to prevent and control immune system overactivity. Recently, improved research and development efforts have resulted in targeted therapies that have shown greater efficacy while reducing treatment-limiting side effects, including those associated with broad immunosuppression. However, despite these advances, many patients with autoimmune diseases continue to be underserved. Existing targeted therapies may not fully address underlying disease biology or may have meaningful side effects.

IL-6: Mechanism of Action and Overview

IL-6 is a pleiotropic cytokine which plays a key role in driving inflammation and cellular and humoral immune responses. In typical immunity, IL-6 is produced by various immune cells, including monocytes, macrophages, T cells, and B cells as well as fibroblasts and other non-immune cells, in response to cellular stresses and proinflammatory signals. Increased levels of IL-6 induce the acute phase inflammatory response, activating the innate immune system and providing a nonspecific response to infections and pathogens. IL-6 also plays a key role in activating the adaptive immune system by inducing proliferation and differentiation of B and T cells and release of additional inflammatory signals. IL-6 is a critical stimulation factor for B-cell and plasma cell survival, promoting antibody production. In addition, IL-6 serves as a key differentiating factor for T-cells, specifically promoting the development of Th17 cells and T follicular helper (“Tfh”) cells. Tfh cells also serve to promote B cell proliferation and antibody production.

Binding of IL-6 to IL-6R leads to recruitment of gp130, resulting in the downstream activation of a JAK/STAT-mediated signaling pathway which, depending on cell type, results in survival, proliferation, differentiation, and/or release of additional inflammatory signals. IL-6 is the exclusive binding partner of IL-6R and inhibition of either the ligand or the receptor blocks this signaling pathway. Clinical studies of IL-6 and IL-6R inhibitors have similarly produced observed reductions in C-reactive protein (“CRP”), an acute phase protein commonly used as a biomarker for IL-6 pathway activation and inflammation.

IL-6 mediates many autoimmune pathways including production of autoantibodies and proliferation of autoreactive T-cells; TOUR006 inhibits IL-6 from driving these pathways

Given the multiple roles of IL-6 in inflammation and immune cell activation, inhibiting IL-6 has emerged as an important therapeutic strategy for managing a wide range of immune disorders, including diseases caused by autoantibodies. Based on a review of the scientific literature and publicly reported clinical evidence, we believe that IL-6 may contribute to the disease pathobiology of over 30 diseases which may affect over 25 million patients in the U.S., including, but not limited to, those listed in the following figure:

*Incidence Number

Currently, there are four FDA approved therapies targeting the IL-6/IL-6R pathway: ACTEMRA® (tocilizumab), KEVZARA® (sarilumab), ENSPRYNG® (satralizumab-mwge), and SYLVANT® (siltuximab). Collectively, these therapies have been approved for nine indications: rheumatoid arthritis (“RA”), giant cell arteritis, juvenile idiopathic

arthritis, polymyalgia rheumatica, cytokine release syndrome, multicentric Castleman’s disease, neuromyelitis optica spectrum disorder (“NMOSD”), systemic sclerosis associated interstitial lung disease, and COVID-19. Collectively, these four anti-IL-6 or anti-IL-6R antibodies generated more than $3.5 billion in global sales in 2022.

| | | | | | | | |

| Approved IL-6 pathway inhibitors: | | Approved for the treatment of: |

| ACTEMRA® (tocilizumab) | | RA, giant cell arteritis, systemic sclerosis-associated interstitial lung disease, polyarticular juvenile idiopathic arthritis, systemic juvenile idiopathic arthritis, cytokine release syndrome, COVID-19 |

| KEVZARA® (sarilumab) | | RA, polymyalgia rheumatica |

| ENSPRYNG® (satralizumab) | | NMOSD |

| SYLVANT® (siltuximab) | | multicentric Castleman’s disease |

Our Product Candidate: TOUR006

We licensed TOUR006, previously known as PF-04236921, from Pfizer Inc. (“Pfizer”) in May 2022. TOUR006 was originally developed from a hybridoma cell line using the Medarex UltiMAb transgenic mouse platform. The UltiMAb platform produces fully human monoclonal antibodies. The IgG1 isotype of the original clone was switched by Pfizer to IgG2 to reduce Fc receptor binding, thereby creating TOUR006.

To date, TOUR006 has been tested by Pfizer in 448 participants across six clinical trials, including over 400 autoimmune patients with RA, systemic lupus erythematosus (“SLE”), or Crohn’s disease (“CD”). Across these studies, TOUR006 was generally well-tolerated, consistent with other therapies in the IL-6 class and had low rates of anti- drug antibodies (“ADAs”) in the 448 participants tested. We seek to leverage this large existing clinical dataset for TOUR006, along with the extensive clinical experience with the IL-6 class, in our development programs. We believe this existing clinical dataset for TOUR006 serves as a basis for which the FDA will allow us to move directly into additional Phase 2 and/or pivotal trials in future selected development indications. To date, the FDA has cleared our Investigational New Drug application (“IND”) to support the initiation of the ongoing pivotal Phase 2b spiriTED study, and we have reached alignment with the FDA on a Phase 2 study in patients with elevated cardiovascular risk.

Potential Benefits of TOUR006

We believe TOUR006 presents a potentially best-in-class product profile for a wide range of indications where IL-6 biology is implicated. The potential benefits of TOUR006 may include:

•Deep and sustained suppression of the IL-6 pathway. In preclinical studies, TOUR006 has exhibited high affinity for IL-6 (kD in the picomolar range) and, in clinical studies, has exhibited a naturally occurring terminal half-life of 47 to 58 days. TOUR006 has demonstrated meaningful suppression of IL-6 signaling at doses as low as 10mg as measured by CRP. CRP is an acute phase protein and a key downstream marker of IL-6 pathway signaling.

•Low-volume, subcutaneous delivery. TOUR006 is expected to be subcutaneously administered with a 1mL or lower volume, making it a potentially more convenient therapy for patients and physicians compared to agents that require intravenous infusion or high-volume subcutaneous injection or infusion.

•Infrequent dosing. We expect TOUR006 will be dosed once every eight weeks or possibly every three months, depending on the indication, which is supported by prior studies conducted by Pfizer as well as our pharmacokinetic-pharmacodynamic modeling.

•Low immunogenicity. To date, low potential for immunogenicity has been observed for TOUR006, with only two patients demonstrating evidence of treatment-emergent ADAs out of the 448 participants dosed to date.

AE: Autoimmune Encephalitis; ASCVD: Atherosclerotic Cardiovascular Disease; COVID-19: Coronavirus Disease 2019; CRS: Cytokine Release Syndrome; GCA: Giant Cell Arteritis; MCD: Multicentric Castleman’s Disease; MG: Myasthenia Gravis; MOGAD: Myelin Oligodendrocyte Glycoprotein Antibody-Associated Disease; NMOSD: Neuromyelitis Optica Spectrum Disorder; PJIA: Polyarticular Juvenile Idiopathic Arthritis; PMR: Polymyalgia Rheumatica; RA: Rheumatoid Arthritis; SJIA: Systemic Juvenile Idiopathic Arthritis; SSc-ILD: Systemic Sclerosis-Associated Interstitial Lung Disease; 1 As reported in the label or FDA review documents of the approved products; no head-to-head studies have been conducted against the approved products shown here, which have each been evaluated in indications other than those we are pursuing

Our FcRn+ Strategy: IL-6 Inhibition for the Treatment of Autoantibody-Driven Disorders

Autoantibody driven disorders are a type of autoimmune disease in which antibodies erroneously recognize and bind to normal cell-surface or circulating antigens. The binding of autoantibodies to their respective targets can result in inflammation, receptor activation, and further immune system attack. In some diseases, autoantibodies directed against cell surface receptors may have agonistic or antagonistic activity and aberrantly modulate signaling pathways. Approximately 2.5% of the world’s population live with a disease where autoantibodies are believed to play a role. These disorders impact multiple organs and systems and include TED, Graves’ disease, NMOSD, MG, and chronic inflammatory demyelinating polyneuropathy, among many others.

Therapeutic strategies that reduce autoantibody levels have been observed to produce clinical benefit in multiple indications. For example, FcRn inhibition has emerged as a novel therapeutic modality to treat patients with autoantibody driven disorders. Treatment with FcRn inhibitors results in non-disease specific depletion of circulating antibodies and has been observed to reduce autoantibody levels in patients with autoantibody driven disorders by approximately 60-70%.

Despite these advances, we believe that FcRn inhibitors may have the following limitations:

•Limited efficacy potential due to narrow mechanism of action. The efficacy of FcRn inhibitors is limited to their ability to reduce antibody levels, without direct effects on non-antibody mediated components of disease or ongoing active inflammation.

•Limited durability of effect. FcRn inhibitors do not inhibit upstream disease processes such as antibody production. As a result, their observed clinical benefit may not persist after stopping treatment. In clinical trials with FcRn inhibitors, autoantibody levels have generally been observed to increase back to baseline shortly after stopping treatment, leading to symptom worsening.

•High drug administration burden. Because FcRn is abundantly expressed, FcRn inhibition requires high doses and frequent administration to achieve the desired target dose maintenance. VYVGART® (efgartigimod), the first FDA-

approved FcRn inhibitor, is dosed in cycles of four weekly intravenous infusions. Long-term follow-up data from efgartigimod’s ADAPT study in MG patients indicates patients received a median of 5 cycles in a year, with 45% of patients receiving 6 or more cycles. Recently approved subcutaneous FcRn inhibitors continue to require high administration burden. VYVGART HYTRULO® (efgartigimod and hyaluronidase) requires four weekly subcutaneous infusions of 1008mg of drug in 5.6 mL of drug volume. RYSTIGGO® (rozanolixizumab-noli) requires six weekly subcutaneous infusions of up to 840mg of drug in 6 mL.

•Uncertain long-term safety profile. The first FcRn inhibitor was approved in 2021 and there is therefore limited long-term experience with this drug class. FcRn inhibition results in non-specific lowering of IgG antibody levels by 60-80%, which may impair humoral immunity and potentially increase susceptibility to infection. Treatment with certain FcRn inhibitors has resulted in significant decreases in albumin, a key blood protein, which have been associated with increases in cholesterol levels, which may further impact their long-term safety profile.

Given the importance of IL-6 signaling for antibody production and plasma cell biology, we believe that IL-6 inhibition has the potential to treat autoantibody-driven disorders upstream of FcRn inhibition, although no head-to-head trial has been conducted to date. Particularly, in the four autoantibody indications where there is currently clinical evidence for both FcRn and IL-6 inhibitors— TED, MG, RA, and NMOSD— IL-6 inhibition has shown potential to outperform FcRn inhibition. Experimental models have shown that adding IL-6 to cell cultures derived from affected patients can stimulate autoantibody production. Furthermore, off-label use of IL-6 inhibitors has been observed to reduce autoantibody levels and offer clinical benefits in autoantibody-driven disorders including TED, MG, anti-neutrophil cytoplasmic antibody-associated vasculitis, and NMOSD.

In 2020, satralizumab, an anti-IL-6R monoclonal antibody, was approved for the treatment of NMOSD, a disease characterized by autoantibodies formed against aquaporin-4 (“AQP4”). This was the first approval and regulatory validation for an IL-6 targeted approach for the treatment of autoantibody-driven diseases. Subsequently, F. Hoffmann-La Roche AG (“Roche”), the developer of satralizumab, has initiated Phase 3 studies in additional autoantibody driven disorders including MG, autoimmune encephalitis, myelin oligodendrocyte glycoprotein antibody-associated disease and TED.

We believe the role of IL-6 targeted therapies has not yet been fully explored in autoantibody-mediated disorders and that there remains significant opportunity to address a variety of autoantibody-driven diseases. IL-6 inhibition has activity on other components of the immune response including the actions of pathogenic T-cells, B-cells, and macrophages. Given the pleiotropic activity of IL-6, we believe IL-6 inhibition may lead to a comprehensive suppression of disease pathophysiology, not limited to autoantibody lowering alone. We believe this approach may translate into clinical efficacy that could exceed what has been observed with treatment modalities that only lower autoantibodies.

Thyroid Eye Disease (TED) Overview

In pursuit of our FcRn+ strategy, we have identified TED as our beachhead indication. TED, also known as Graves’ ophthalmopathy or thyroid-associated orbitopathy, is a debilitating autoimmune disorder that affects the eyes and surrounding tissues of patients. In the U.S., the annual incidence of TED is estimated to be approximately 16 per 100,000 females and 3 per 100,000 males, or approximately 30,000 new cases a year. TED occurs in two phases – the initial active phase, characterized by high inflammation which lasts between 6-36 months, and the subsequent inactive phase that is characterized by lower inflammation. TED can cause significant discomfort and can be sight-threatening if left untreated. Initial symptoms of TED may include dryness and irritation of the eyes, sensitivity to light, excessive tearing, diplopia and pain. As TED progresses, patients may develop retraction of their upper eyelids, swelling and redness around the eyes, and bulging of the eyes, also called proptosis. In severe cases, TED can be sight-threatening as a result of swelling and inflammation that can lead to compression of the optic nerve.

The underlying cause of TED is the production of stimulatory autoantibodies against thyroid-stimulating hormone receptor (“TSHR”), which activate TSHR-expressing fibroblasts and adipocytes around the eye, leading to aberrant cellular proliferation and production of cytokines that promote inflammation and tissue remodeling.

Levels of anti-TSHR antibody, specifically thyroid stimulating immunoglobulin (“TSI”), have been shown to be associated with the clinical features of TED and can influence its prognosis.

Recent studies have shown that the insulin-like growth factor 1 receptor (“IGF-1R”) and TSHR form a receptor complex, with IGF-1R augmenting the signaling of TSHR. While the exact nature of the interaction between IGF-1R and TSHR is

still being investigated, experimental evidence suggests that the effects of TSHR stimulating antibodies might only be partially blocked by an IGF-1R antagonist.

Autoantibodies that stimulate the TSHR have also been implicated in the disease pathology of Graves’ disease, an autoimmune disorder that affects the thyroid gland. Graves’ disease and TED are closely linked, and up to 95% of TED patients may have a history of Graves’ hyperthyroidism at TED diagnosis. Some patients may also develop hyperthyroidism following presentation of TED symptoms.

Role of IL-6 in TED

IL-6 is believed to play a critical role in TED, including in autoantibody production, T cell-mediated inflammation, and orbital fibroblast activity. IL-6 and soluble IL-6R levels are elevated in patients with TED and correlate with disease activity. In a study of patients with Graves’ disease, those who developed TED had significantly higher IL-6 levels than those who did not. In addition, elevated levels of biomarkers of IL-6 mediated signaling, such as CRP, red blood cell distribution width, and neutrophil-to-lymphocyte ratio have been observed in patients with TED. Each of these markers represents distinct, downstream biological pathways modulated by IL-6, such as acute phase inflammation, iron metabolism, and immune cell regulation.

Current Treatment Paradigm for TED

Steroids, either oral or intravenous, are routinely used for the treatment of TED. While steroids may be an effective first-line treatment for some TED patients, as many as 50% of patients may not receive an adequate response and long-term use of steroids is associated with significant safety risks including weight gain, bone thinning, neuropsychiatric effects, hyperglycemia, and hypertension. For patients with moderate-to-severe TED that are unresponsive to steroids, orbital radiation and, in severe cases, surgical interventions such as decompression surgery or strabismus surgery may be required.

In 2020, the FDA approved the first targeted therapy for the treatment of TED: TEPEZZA® (teprotumumab), a monoclonal antibody that targets IGF-1R. In two randomized, double-masked, placebo-controlled trials, eight intravenous infusions of teprotumumab infused every three weeks led to proptosis response rates, defined as a ≥2 mm decrease in proptosis from baseline, in 71% and 83% of patients respectively, compared to 20% and 10% with placebo, respectively, at week 24. Based on our third-party and internal market research, the majority of TEPEZZA use appears to be reserved to later lines of treatment, primarily by oculoplastic surgeons, while front-line treatment providers, namely general ophthalmologists, have had limited uptake of TEPEZZA to date.

Limitations of Current IGF-1R Treatment

While IGF-1R treatments for TED may be promising and have demonstrated meaningful proptosis response rates for patients, we believe there remains a significant unmet need in light of the limitations of IGF-1R related treatments, including:

•High patient and physician burden. Teprotumumab’s dosing regimen requires visits to an IV infusion center once every three weeks for a total of eight visits. Generalist ophthalmologists, who typically are the front-line treatment providers of TED, do not usually have direct access to an IV infusion center, and patients with significant diplopia or visual impairment may have difficulty traveling to centers.

•Significant side effects. Teprotumumab is associated with significant, debilitating side effects including nausea, muscle spasms, hyperglycemia, and hearing impairment, the latter of which has at times been reported as possibly permanent.

•Incomplete durability of proptosis benefit. Long-term follow-up of patients studied in teprotumumab’s Phase 3 clinical trial showed that approximately 40% of patients did not sustain their proptosis response 48 weeks after their last infusion.

•Incomplete treatment response rates. Clinical trials of teprotumumab observed lower response rates on other clinically important aspects of TED besides proptosis, such as improvements in diplopia or inflammatory disease activity as measured by Clinical Activity Score (“CAS”).

Hearing Disturbances Associated with IGF-1R Inhibition

IGF-1 pathway signaling is required for development and function of cell types in the inner ear, and thus is critical for the ability to hear. Loss-of-function genetic mutations in the IGF-1 pathway have been associated with sensorineural hearing loss and deafness.

Evidence of hearing impairment has been observed in clinical trials with IGF-1R inhibitors. Across the Phase 2 and Phase 3 clinical trials of teprotumumab (TEPEZZA), 10% of TEPEZZA-treated patients reported hearing-related adverse events. Other IGF-1R inhibitors have also reported hearing-related adverse events.

A recently published meta-analysis reported that hearing-related disturbances occurred in 15% of patients treated with TEPEZZA, of which 45% were reported as persistent. Another publication reports that hearing disturbances began to emerge after a mean of 3.6 infusions of TEPEZZA (out of the standard eight infusions per treatment course). Furthermore, as of December 2023, 552 cases of hearing and ear-related adverse events related to TEPEZZA treatment have been captured in the FDA’s Adverse Event Reporting System (FAERS) database. These events have included reports of permanent deafness.

As of January 2024, over 80 lawsuits have been filed by patients who allege suffering hearing loss due to treatment with TEPEZZA related to a failure by Horizon Therapeutics plc, now Amgen, which manufactures, promotes, and sells TEPEZZA, to adequately inform patients of the risk of hearing loss associated with the product. In July 2023, the FDA required Horizon Therapeutics plc to update TEPEZZA’s label to include a warning that states, “TEPEZZA may cause severe hearing impairment including hearing loss, which in some cases may be permanent. Assess patients’ hearing before, during, and after treatment with TEPEZZA and consider the benefit-risk of treatment with patients.”

Clinical Experience in TED with IL-6 Inhibition

There is a large and growing body of literature documenting successful clinical experiences with IL-6 pathway inhibition, namely the use of tocilizumab, an anti-IL-6R antibody, as an off-label treatment for TED. In over 40 investigator-led studies and retrospective analyses, spanning a total of over 340 patients with TED, IL-6 pathway inhibition was reported to offer meaningful improvement in proptosis, CAS, and/or diplopia. Substantial reductions in TSI levels have also been noted. Treatment was observed to be generally well-tolerated, with no major safety signals reported. In addition to this host of published literature, the European Group on Graves’ orbitopathy (“EUGOGO”) recommends tocilizumab for treatment of moderate-to-severe, steroid-resistant TED.

Together, this evidence highlights the consistent and beneficial use of IL-6 pathway blockade in the treatment of TED by leading physicians. Notably, many of the published treatment experiences were in patients with glucocorticoid-resistant TED, who were treated later in their disease course after a prolonged period of inflammation. We believe that first-line intervention earlier in the inflammatory phase may be an optimal approach to maximize the potential treatment benefit of blocking the IL-6 pathway.

A summary of published literature reporting on the off-label use of IL-6 pathway inhibition in TED is provided in the table below. This published literature listed below may not be indicative of future clinical results for TOUR006.

Published literature reporting on the off-label use of IL-6 pathway inhibitors supports the potential of IL-6 blockade to offer meaningful effects upon proptosis and CAS. Proptosis response rate is generally defined in the data outlined here as a ≥2 mm proptosis improvement in the worse eye at baseline without any worsening in the other eye. CAS response rate is generally defined in the data outlined here as a CAS of 0 or 1. Studies referenced in this table represent investigator-led studies and were not designed with the intent of generating evidence for an approval of tocilizumab or sarilumab in TED. The majority of these studies were not designed with power to detect statistical significance. NR: not reported. TCZ: tocilizumab. SAR: sarilumab

TOUR006 for the Treatment of TED

We seek to establish TOUR006 as a new standard-of-care for the first-line treatment of TED. We believe TOUR006 has the potential to offer attributes of an ideal first-line therapy for TED, including:

•Broad, deep, and durable effects. Based on the strong evidence implicating IL-6’s central role in TED, we believe TOUR006 offers the potential for meaningful and durable benefit across multiple efficacy outcome measures relevant to TED, such as proptosis, CAS, and diplopia.

•A generally well-tolerated product without a risk of hearing loss. Based on the extensive safety experience with IL-6 pathway inhibitors as a class and the available safety data to date for TOUR006, we believe that TOUR006, at the dosing regimens being evaluated, has the potential to be generally well-tolerated in TED without a risk of hearing loss.

•An anti-inflammatory mechanism, well-suited for use early in disease. Given the natural pathology of TED, TOUR006’s anti-inflammatory mechanism may be best suited for early use in the active inflammatory phase of disease, which has a time-limited window before tissue injury and fibrosis occur.

•A patient-centric experience. We plan to dose TOUR006 as a subcutaneous, low-volume (≤1 mL) injection once every eight weeks, which we believe will provide substantial improvements to ease of access and ease of use over the current standard of care.

We estimate that 15,000 to 20,000 patients out of the incident population in the U.S. have moderate to severe, active, inflammatory TED that may be appropriate candidates for treatment with an advanced therapy such as TOUR006.

TOUR006 Clinical Program in TED

We have initiated our first pivotal trial in TED, which we refer to as the spiriTED trial. This trial is a randomized, double-masked, placebo-controlled, dose-ranging Phase 2b study in adult patients with active, moderate-to-severe TED. We are enrolling approximately 81 patients with baseline proptosis at least 3 mm greater than the normal range for race and sex, baseline CAS score of 4 or greater on the 7-point scale, and TED symptom onset of approximately one year or less prior to entering the study. Patients must also have TSI positivity. The study protocol specifies additional inclusion and exclusion criteria.

In the Primary Efficacy Period (24-week duration), patients receive TOUR006 (20mg or 50mg) or placebo, administered subcutaneously every eight weeks at Day 1, Week 8, and Week 16. The primary endpoint of the study is the proptosis response rate at Week 20, defined as the percentage of patients who achieve at least a 2 mm reduction in proptosis from baseline in the study eye without worsening in the fellow eye and without need for rescue therapy or intervention. Additional endpoints include other efficacy outcomes (such as CAS and diplopia), safety, PK, PD, and ADA testing.

In the Extension Period, patients not experiencing a proptosis response (and not having received any rescue therapy or intervention) after completing the 24-week Primary Efficacy Period will receive 50mg of TOUR006 in an open-label fashion every eight weeks for three administrations. All patients (regardless of whether they receive TOUR006) will be followed through week 72.

We expect to report topline results for spiriTED’s Primary Efficacy Period in the first half of 2025.

Further, in January 2024, we announced our plans to accelerate initiation of our pivotal Phase 3 trial for TOUR006 in TED in 2024. The Phase 3 trial is expected to evaluate first-line use of TOUR006 in patients with TED. Subject to FDA and other regulatory feedback, this trial is planned to be a randomized, double-masked, placebo-controlled trial evaluating TOUR006 administration on an eight-week dosing schedule. The primary endpoint is expected to be proptosis response at week 20 following three subcutaneous (SC) administrations. Other efficacy endpoints are anticipated to include additional measures such as CAS, diplopia and quality of life (“QoL”). Topline data from this Phase 3 study are expected in 2026.

TOUR006 Phase 2b spiriTED trial design in TED. *Any patient who receives rescue therapy/intervention in Period A will not receive TOUR006 in Period B and will instead undergo follow-up only.

Our Cardiovascular Inflammation Strategy

Cardiovascular disease (“CVD”) is a group of disorders that affect the heart and blood vessels and includes coronary artery disease, heart failure, and stroke. CVD is a leading cause of morbidity and mortality, with an estimated 20 million cardiovascular-related deaths worldwide in 2021. CVD-related deaths continue to increase each year despite the wide availability of targeted treatment options, indicating that current therapies are not adequately addressing all risk factors as the global population continues to grow and age.

Atherosclerotic Cardiovascular Disease (ASCVD)

Atherosclerosis, or the accumulation of fatty and fibrous material along the artery walls, is a significant contributing factor to approximately 80% of all cardiovascular deaths. Atherosclerotic plaques can acutely rupture, leading to blood clot formation in the artery and impairment of blood supply to vital organs, such as the heart or brain. Clinically, plaque ruptures manifest as fatal or nonfatal MACE such as myocardial infarction, or heart attack, and stroke.

A variety of risk factors are associated with the development of ASCVD including:

•Demographic factors such as family histories of ASCVD, race, and sex.

•Lifestyle factors including smoking, unhealthy diet, or lack of activity and exercise.

•Comorbidities including diabetes, obesity, chronic kidney disease, hypertension, and chronic inflammatory diseases.

•Biomarkers such as elevated cholesterol, CRP, and triglyceride levels.

Current Treatment Paradigm for ASCVD

ASCVD treatment focuses on mitigating risk factors and includes lifestyle modifications, such as diet and exercise, and pharmacological interventions such as lipid lowering agents, antihypertensive agents, antiplatelet agents, and anticoagulants. In some cases, invasive procedures such as angioplasty or bypass surgery may be required for patients with more advanced disease. Most pharmacological interventions for ASCVD are once-daily, oral therapies, such as statins, a mainstay lipid-lowering therapy. Despite the wide availability of such agents, the overall disease burden remains high

globally. Even in patients optimally managed with lifestyle modifications and pharmacologic therapies, a sizable subset of individuals with ASCVD continue to suffer from a high risk of MACE, indicating additional risk factors, such as inflammation, remain inadequately addressed. Additionally, adherence to these oral therapies is low as patients do not immediately experience the benefit of treatment. We believe a therapy with a longer dosing interval may be better suited for the treatment of ASCVD as it may better align with regular physician check-ins and improve patient adherence. Thus, we believe there is a significant unmet need for additional therapies with longer dosing intervals that target risk factors for ASCVD not currently addressed by current therapies, particularly inflammation.

Role of IL-6-driven Inflammation in ASCVD

The critical role of inflammation in ASCVD pathogenesis has been studied for over two decades. Pro-inflammatory monocytes home to atherosclerotic lesions and engulf lipoproteins and become foam cells that accumulate in plaques. Oxidized phospholipids and lipoproteins serve as inflammatory markers which can recruit and activate T-cell and humoral responses, further driving inflammation and atherosclerosis. Elevated CRP is a known risk factor for ASCVD and is included in multiple guidelines for risk assessment for ASCVD. Chronic inflammatory conditions such as psoriasis, RA, and lupus are also risk factors. Across multiple cardiovascular outcomes studies, reduction of inflammation has been associated with improved outcomes and has been shown to be a more powerful predictor for therapeutic benefit than other biomarkers, such as cholesterol levels. Further, across a number of external cardiovascular outcomes trials, indirect inhibitors of IL-6-driven inflammation demonstrated statistically significant MACE reductions while outcomes trials of non-IL-6-related anti-inflammatory mechanisms did not produce statistically significant MACE reductions, highlighting the importance of IL-6 inhibition in targeting inflammation in CVD. These trials did not directly test an anti-IL-6 mechanism.

A targeted anti-inflammatory approach to treat CV disease was most recently supported by the third-party CANTOS study of canakinumab, a monoclonal antibody targeting IL-1ß, a key cytokine that can upregulate IL-6 levels. In three months, 150mg canakinumab achieved approximately 59% reduction in CRP, without any discernable effect on other key risk factors such as low-density lipoprotein cholesterol; thus, the CANTOS study was the first significant investigation of a targeted anti-inflammatory approach for the treatment of ASCVD. In the large cardiovascular outcomes trial, 150mg canakinumab given once every three months provided a statistically significant 15% relative benefit compared to placebo in the secondary prevention of MACE in patients who had a previous myocardial infarction or stroke, confirming the therapeutic potential of a targeted, anti-inflammatory approach in CVD. Notably, the relative benefit versus placebo was 25% for the subgroup of patients who, following one treatment of canakinumab, had CRP levels less than or equal to 2.0 mg/L, or within the normal range. This benefit was increased to 35% versus placebo for the subgroup of patients whose on-treatment IL-6 levels were in the lowest tertile following one dose of canakinumab. Notably, these trends in therapeutic benefit were also seen on reductions in cardiovascular death.

Results from CANTOS study of canakinumab in ASCVD. Reduction in MACE shown as 1-Hazard Ratio. MACE: major adverse cardiovascular events including CV death, myocardial infarction (MI), stroke. Overall CANTOS analysis presents data for 150mg dose group; values for CANTOS subanalyses combine all doses (50, 150, 300 mg). Ridker et al., NEJM (2017). Ridker et al., Lancet (2018). Adjusted for age, gender, smoking, hypertension, diabetes, BMI, baseline hsCRP, baseline LDL-C. Ridker et al., Eur Heart J (2018). Adjusted for age, gender, smoking, hypertension, diabetes, BMI, baseline IL-6, baseline LDL-C. Ridker et al., JACC (2018).

As demonstrated in the CANTOS study, IL-6 is a key inflammatory cytokine in the pathology of ASCVD. Prior to CANTOS, the role of IL-6 in ASCVD had been characterized by over two decades of research. Patient IL-6 levels are a powerful predictor of future CV events, with one study showing that patients in the highest quartile of IL-6 levels were over twice as likely to have a CV event as patients in the lowest quartile. Additional genome and phenome-wide association studies have linked genes and phenotypes associated with higher IL-6 levels with greater cardiovascular risk. Nonclinical research has also implicated IL-6 in plaque erosion and rupture. CV system endothelial cells express IL-6 in response to inflammation, stress, and/or injury. Additionally, IL-6 has demonstrated the ability to upregulate cell adhesion molecules and plays a role in vascular permeability.

Following the results of the CANTOS study, the potential of an IL-6 targeted approach for ASCVD was further supported by the third-party Phase 2b RESCUE study of ziltivekimab, an anti-IL-6 monoclonal antibody, which showed up to 92% CRP reductions for the 30 mg group at 12 weeks following monthly doses in an ASCVD patient cohort co-presenting with renal disease. By comparison, canakinumab only achieved as high as 68% reduction in CRP.

CRP reductions after treatment with canakinumab and ziltivekimab. 1. Ridker et al., NEJM (2017). 2. Ridker et al., Lancet (2021)

Multiple external Phase 3 cardiovascular outcome trials investigating IL-6 blockade are ongoing, and a positive readout from any of these trials could substantially validate the therapeutic hypothesis for IL-6 blockade in ASCVD. Novo Nordisk is currently testing ziltivekimab in four concurrent Phase 3 trials which we believe are de-risking opportunities for our own clinical development plan. For example, the ZEUS trial is testing ziltivekimab once every month in a 6,200 patient cardiovascular outcomes trial in ASCVD patients with chronic kidney disease. Topline data are expected in 2025.

TOUR006 for the Treatment of ASCVD

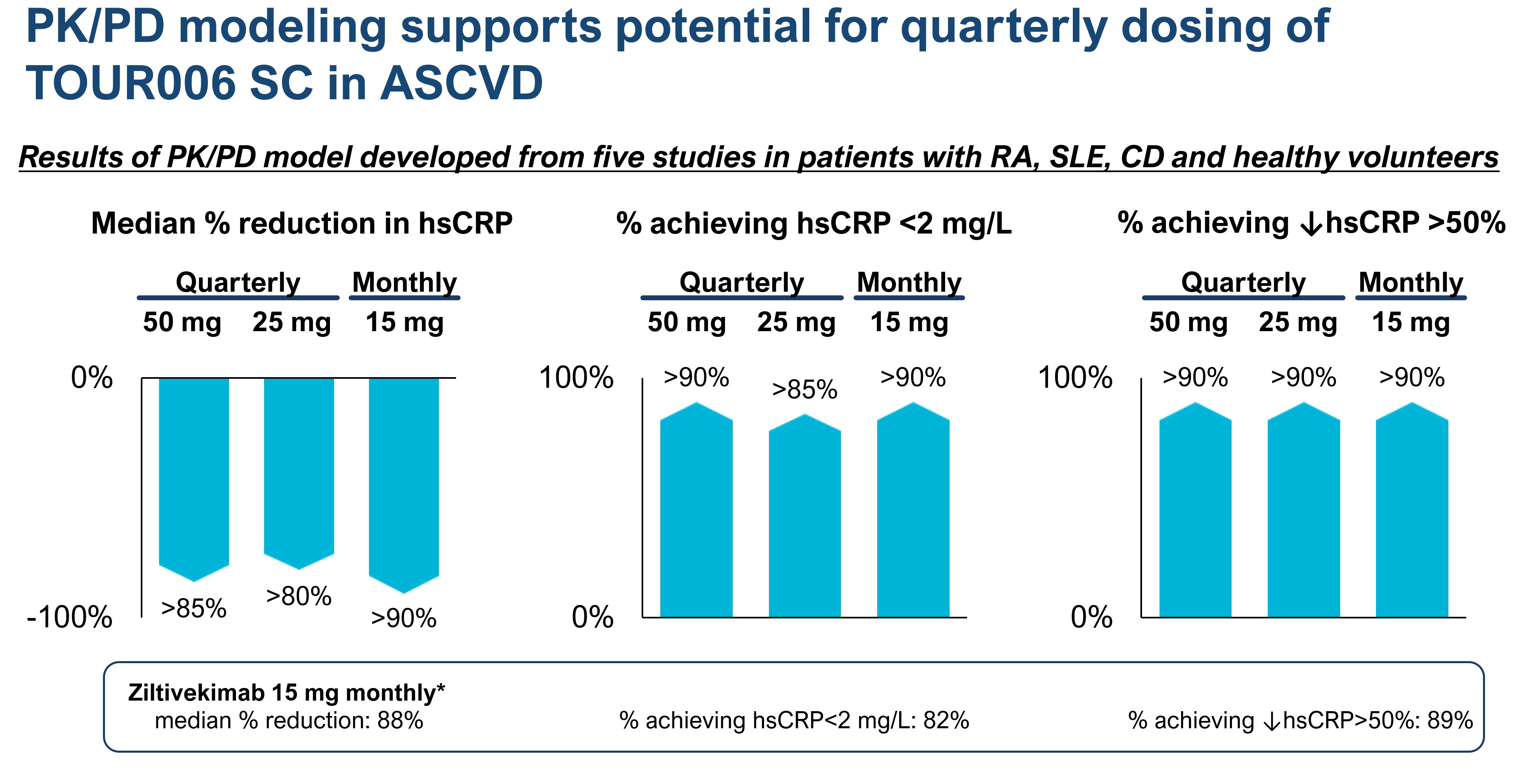

We believe TOUR006 may offer a more convenient dosing profile for IL-6 inhibitors in the treatment of ASCVD. Competitor anti-IL-6 agents under development involve either intravenous administration or a subcutaneous administration once a month. In contrast, the targeted dosing regimen for TOUR006 is subcutaneous administration once every three months supported by its PK/PD modeling as shown in the figure below. Prior Phase 1 and Phase 2 trials of TOUR006 observed consistently lower levels of CRP approximately three months following the last dose. A quarterly dosing regimen for TOUR006 would offer the potential to meaningfully improve patient convenience as well as optimize patient adherence to therapy due to the decreased drug administration burden.

ASCVD: atherosclerotic cardiovascular disease, RA: rheumatoid arthritis, SLE: systemic lupus erythematosus, CD: Crohn’s disease. The PK and PK/PD models for TOUR006 were developed based on the data from 5 clinical studies (two phase 1 studies in healthy volunteers, one phase 1 study in RA, one phase 2 study in SLE, and one phase 2 study in CD). A two-compartment model with first-order absorption and linear elimination and a mechanism-based indirect response model (in a relationship on CRP) adequately described the PK and PK/PD relationships, respectively. Simulations were performed assuming an RA-like population with baseline CRP >2 mg/L to 10 mg/L. Results at Day 90 are shown. *Ridker et al., Lancet (2021). Results after 12 weeks of treatment are shown. Certain data in this slide are based on a cross-trial comparison and are not based on head-to-head clinical trials. Cross-trial comparisons are inherently limited and may suggest misleading similarities or differences in outcomes. Results of head-to-head comparisons may differ significantly from those set forth herein.

TOUR006 Clinical Program in ASCVD

As previously announced in January 2024, we have reached alignment with the FDA on our ASCVD clinical development program for TOUR006, including a Phase 2 trial evaluating CRP reduction, a validated biomarker for inflammation, with quarterly and monthly dosing of TOUR006 in patients with elevated cardiovascular risk. In March 2024, the FDA cleared our IND related to our ASCVD clinical development program. The Phase 2 trial is targeted to commence in the first half of 2024, and we expect to report topline data in the first half of 2025. Pending successful initiation and completion, positive results from the Phase 2 trial are expected to position us to be ready in 2025 to commence a pivotal Phase 3 trial for TOUR006 in cardiovascular disease.

Proposed trial design for TOUR006 Phase 2 trial in ASCVD. *Trial design to be finalized ahead of study start.

Previous Clinical Experience with TOUR006

Prior to our in-licensing of TOUR006 in May 2022, Pfizer had treated 448 study participants with TOUR006 across six clinical trials including Phase 2 studies in SLE and CD.

The following table summarizes the previous studies conducted by Pfizer:

| | | | | | | | | | | | | | |

| Study Description | | Subjects

Who

Received

TOUR006 | | Doses Tested |

| | | | |

| Single Ascending Dose PK Study in Healthy Participants | | 36 | | 7, 22, 44, 112, 284, 500, 700 mg IV, single dose |

| | | | |

| Multiple Ascending Dose PK Study in Participants with Rheumatoid Arthritis Receiving Methotrexate | | 31 | | 1, 10, 30, 100, 250 mg IV Q4W |

| | | | |

| Single Dose PK Study of TOUR006 Administered Subcutaneously to Healthy Participants | | 10 | | 200mg SC, single dose |

| | | | |

| Phase 2 Dose-ranging Study in Participants with Moderate to Severe CD who are Anti-TNF Inadequate Responders | | 178 | | 10, 50, 200 mg SC Q4W |

| | | | |

| Phase 2 Open-label Extension Study in Participants with Moderate to Severe CD | | 191 | | 50, 100 mg SC Q8W |

| | | | |

Phase 2 Dose-ranging Study in Participants with Active Generalized Systemic Lupus Erythematosus | | 138 | | 10, 50, 200 mg SC Q8W |

Phase 1 trial in healthy volunteers

Study design:

TOUR006 was studied by Pfizer in a first-in-human Phase 1, randomized, placebo-controlled, double-masked, single ascending dose study in healthy volunteers. A total of 48 participants were enrolled; 12 received placebo and 36 received seven different fixed intravenous doses of TOUR006: 7, 22, 44, 112, 284, 500, and 700mg. Participants were followed until their serum levels of TOUR006 were below the lower limit of quantitation (“LLOQ”) and all treatment-related adverse events had resolved. The study was not powered for statistical significance.

PK/PD:

TOUR006’s exposure PK increased in a dose-proportional manner across the dose range tested. Mean terminal elimination half-life was similar across dose groups, ranging from 47-58 days. A dose-dependent reduction in high-sensitivity HS-CRP (“hs-CRP”) was observed. hs-CRP is an indicator of inflammation and a downstream signal of IL-6 pathway activation. Maximal hs-CRP reductions relative to baseline were observed on Day 7 or Day 14 post dose across the various dose groups. Given the low baseline levels of Free IL-6 hs-CRP in this healthy population, the full PD effect of TOUR006 was not able to be observed compared to later studies in patients with inflammatory diseases.

Safety Data:

TOUR006 in doses up to 500 mg appeared to be generally well-tolerated in this study with no dose limiting adverse effects, clinically significant laboratory abnormalities, or clinically relevant vital sign or ECG changes. During the study, three serious adverse events (“SAEs”) were reported by two participants. An SAE of spontaneous abortion that was considered potentially treatment-related by the sponsor was reported in the sexual partner of a participant in the 284 mg TOUR006 arm. One participant in the 700 mg TOUR006 arm reported 2 SAEs (tonsillitis and acute pancreatitis), both of which were considered treatment-related. At least 67% of subjects in each TOUR006 group experienced at least one AE compared to 58% in the placebo group. Headache and fatigue were the most frequently reported AEs (all causalities and treatment-related). The most frequently reported treatment-related AEs by Medical Dictionary for Regulatory Activities (MedDRA) version 13.1 system organ class were infections and infestations and gastrointestinal disorders, reported by 8 and 11 subjects in the TOUR006 groups and 1 and 0 subjects in the placebo group, respectively.

Phase 1 trial in RA patients

Trial design:

TOUR006 was studied by Pfizer in a Phase 1 randomized, placebo-controlled, double-masked, escalating dose study investigating multiple ascending doses of intravenous TOUR006 in RA patients receiving methotrexate. A total of 40 participants were treated 9 received placebo and 31 received 3 monthly IV doses of TOUR006 at a set dosing level: 1, 10, 30, 100, or 250 mg. Participants were followed until their serum levels of TOUR006 were below the LLOQ and all treatment-related AEs had resolved. The study was not powered for statistical significance.

PK/PD:

TOUR006 exposure increased approximately in proportion with dose. Accumulation of TOUR006 exposure, in terms of increases in Cmax after each 4-week dosing interval, was nearly constant from dose to dose and consistent with time-linear PK. Mean terminal elimination half-lives were 36-49 days across TOUR006 treatment groups. Greater serum CRP concentration reductions from baseline were observed in TOUR006 treatment groups compared with placebo from Day 7 to Day 84 and reductions appeared to be dose-related. Mean percent reductions from baseline were >80% (and up to 96%) in the higher TOUR006 dose groups. A single 10 mg intravenous dose of TOUR006 led to rapid and substantial decrease in CRP as shown in the figure below. Maximal reductions in CRP concentrations relative to baseline were generally observed by day 7 or day 14 across the various treatment groups. The time required for CRP levels to return to baseline appeared to increase as dose increased.

Median serum concentration of CRP over time, with intravenous doses of study drug administered on day 1, 28, and 56 to RA subjects

Safety Data:

All doses of TOUR006 tested in the study appeared to be generally well-tolerated. During the study, three participants reported five treatment-emergent SAEs: two participants in the 30 mg TOUR006 arm and one in the 100 mg TOUR006 arm. The observed SAEs were plantar fasciitis, plantar abscess, pneumonia, chest pain (all in the 30 mg arm) and road traffic accident (100 mg arm). Proportions of subjects with treatment-emergent and treatment-related AEs were similar between placebo and TOUR006 treatment groups (100.0% vs 80.6%, and 44.4% vs 51.6%, respectively). A slightly greater proportion of TOUR006-treated subjects experienced upper respiratory tract infection, increases in alanine transaminase (“ALT”) and aspartate transaminase (“AST”), and leukopenia treatment-emergent adverse effects (“TEAEs”), compared with placebo-treated subjects (25.8% vs 11.1%, 12.9% vs 0%, 12.9% vs 0%, and 9.7% vs 0%, respectively). No subjects with increased ALT or AST TEAEs met study criteria for abnormal laboratory values (i.e., >3 × upper limit of normal). Of the 4 subjects with TEAEs related to either hypercholesterolemia or dyslipidemia during the study, all responded well to the addition of lipid-lowering treatment with a reduction in serum lipid levels.

Phase 1 trial in healthy volunteers for single subcutaneous dose

Trial design:

Pfizer investigated TOUR006 in a Phase 1, single center, open-label study to investigate the safety, tolerability, and PK of a single dose level of subcutaneously administered TOUR006 in 10 healthy adult participants (all male). A dose of 200 mg SC was chosen for this study (2 concurrent 100 mg doses). The study was not powered for statistical significance.

Safety Data:

There were no SAEs, deaths, dose reductions, or discontinuations due to AEs during the study. A single 200 mg total dose of TOUR006 administered SC appeared to be well-tolerated in this study.

PK:

The PK profile of TOUR006 was characterized by a prolonged absorption rate followed by a mono-exponential decline in plasma concentrations. Comparison of exposure at similar doses following IV and SC administrations indicates that SC bioavailability is relatively high. The estimated dose-normalized AUCinf following the SC dose of 262 mg.h/mL/mg was similar to the average AUCinf of 249 mg.h/mL/mg following IV administration in healthy participants across a range of doses from 7 to 700 mg in the phase 1 single ascending dose trial of IV TOUR006. The mean terminal elimination half-life was approximately 52 days.

Phase 2 trial in SLE patients

Trial design: