false 0001827506 0001827506 2023-09-13 2023-09-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 13, 2023

TALARIS THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-40384 |

|

83-2377352 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 93 Worcester St. Wellesley, Massachusetts |

|

02481 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (502) 398-9250

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trade Symbol(s) |

|

Name of each exchange on which registered |

| Series A Common Stock, $0.0001 par value per share |

|

TALS |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 |

Regulation FD Disclosure |

As previously announced, on June 22, 2023, Talaris Therapeutics, Inc., a Delaware corporation (“Talaris”), Terrain Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Talaris (“Merger Sub”), and Tourmaline Bio, Inc., a Delaware corporation (“Tourmaline”), entered into an Agreement and Plan of Merger (the “Merger Agreement”), pursuant to which, among other matters, and subject to the satisfaction or waiver of the conditions set forth in the Merger Agreement, Merger Sub will merge with and into Tourmaline, with Tourmaline continuing as a wholly owned subsidiary of Talaris and the surviving corporation of the merger (the “Merger”). In connection with the Merger, on September 13, 2023, Tourmaline updated information reflected in an investor presentation, which is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. Representatives of Tourmaline will use the updated presentation in various meetings with investors from time to time.

The information in Item 7.01 of this Current Report on Form 8-K, including the information set forth in Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall Exhibit 99.1 furnished herewith be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Forward-Looking Statements

This Current Report on Form 8-K and the exhibit furnished herewith contain “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, express or implied statements regarding the structure, timing and completion of the proposed Merger; Talaris’ cash position at December 31, 2022 and for subsequent periods; the combined company’s listing on Nasdaq after closing of the proposed Merger; expectations regarding the ownership structure of the combined company; the anticipated timing of Closing; the expected executive officers and directors of the combined company; each company’s and the combined company’s expected cash position at the closing of the proposed Merger and cash runway of the combined company; the future operations of the combined company; the nature, strategy and focus of the combined company; the development and commercial potential and potential benefits of any product candidates or platform technologies of the combined company; the executive and board structure of the combined company; the location of the combined company’s corporate headquarters; anticipated preclinical and clinical drug development activities and related timelines, including the expected timing for data and other clinical results; and other statements that are not historical fact. All statements other than statements of historical fact contained in this Current Report on Form 8-K are forward-looking statements. These forward-looking statements are made as of the date they were first issued, and were based on the then-current expectations, estimates, forecasts, and projections, as well as the beliefs and assumptions of management. There can be no assurance that future developments affecting Talaris, Tourmaline or the proposed transaction will be those that have been anticipated.

Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Talaris’ control. Talaris’ actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to (i) the risk that the conditions to the closing of the proposed Merger are not satisfied, including the failure to timely obtain shareholder approval for the transaction, if at all; (ii) uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Talaris and Tourmaline to consummate the proposed Merger; (iii) risks related to Talaris’ ability to manage its operating expenses and its expenses associated with the proposed Merger pending closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental or quasi-governmental entity necessary to consummate the proposed Merger; (v) the risk that as a result of adjustments to the exchange ratio, Talaris shareholders and Tourmaline stockholders could own more or less of the combined company than is currently anticipated; (vi) risks related to the market price of Talaris’ common stock relative to the value suggested by the exchange ratio; (vii) unexpected costs, charges or expenses resulting from the transaction; (viii) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed Merger; (ix) the uncertainties associated with Tourmaline’s platform technologies, as well as risks associated with the clinical development and regulatory approval of product candidates, including potential delays in the commencement, enrollment and completion of clinical trials; (x) risks related to the inability of the combined company to obtain

sufficient additional capital to continue to advance these product candidates and its preclinical programs; (xi) uncertainties in obtaining successful clinical results for product candidates and unexpected costs that may result therefrom; (xii) risks related to the failure to realize any value from product candidates and preclinical programs being developed and anticipated to be developed in light of inherent risks and difficulties involved in successfully bringing product candidates to market; (xiii) risks associated with the possible failure to realize certain anticipated benefits of the proposed Merger, including with respect to future financial and operating results; (xiv) risks associated with Talaris’ financial close process; (xv) the risk that the pre-closing financing is not consummated; and (xvi) the risk that Talaris shareholders receive more or less of the cash dividend than is currently anticipated, among others. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described in periodic filings with the SEC, including the factors described in the section titled “Risk Factors” in Talaris’ Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC, and in other filings that Talaris makes and will make with the SEC in connection with the proposed Merger, including the Proxy Statement described below under “Additional Information and Where to Find It.” You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated in the forward-looking statements. Talaris expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based. This Current Report on Form 8-K does not purport to summarize all of the conditions, risks and other attributes of an investment in Talaris or Tourmaline.

Participants in the Solicitation

This Current Report on Form 8-K and the exhibit filed or furnished herewith relate to the proposed merger transaction involving Talaris and Tourmaline and may be deemed to be solicitation material in respect of the proposed merger transaction. In connection with the proposed merger transaction, Talaris has filed relevant materials with the SEC, including a registration statement on Form S-4 (the “Form S-4”) that contains a proxy statement (the “Proxy Statement”) and prospectus. This Current Report on Form 8-K is not a substitute for the Form S-4, the Proxy Statement or for any other document that Talaris may file with the SEC and or send to Talaris’ shareholders in connection with the proposed merger transaction. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF TALARIS ARE URGED TO READ THE FORM S-4, THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TALARIS, THE PROPOSED MERGER TRANSACTION AND RELATED MATTERS.

No Offer or Solicitation

This Current Report on Form 8-K and the exhibit furnished herewith do not constitute an offer to sell or the solicitation of an offer to buy any securities nor a solicitation of any vote or approval with respect to the proposed transaction or otherwise. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U S. Securities Act of 1933, as amended, and otherwise in accordance with applicable law.

Additional Information and Where to Find It

Investors and security holders may obtain free copies of the Form S-4, the Proxy Statement and other documents filed by Talaris with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed by Talaris with the SEC are also available free of charge on Talaris’ website at www.talaristx.com, or by contacting Talaris’ Investor Relations at investors@talaristx.com. Talaris, Tourmaline, and their respective directors and certain of their executive officers may be considered participants in the solicitation of proxies from Talaris’ shareholders with respect to the proposed merger transaction under the rules of the SEC. Information about the directors and executive officers of Talaris is set forth in its Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 31, 2023, and in subsequent documents filed with the SEC. Additional information regarding the persons who may be deemed participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, are also included in the Form S-4, the Proxy Statement and other relevant materials to be filed with the SEC when they become available. You may obtain free copies of this document as described above.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

TALARIS THERAPEUTICS, INC. |

|

|

|

|

| Date: September 13, 2023 |

|

|

|

By: |

|

/s/ Mary Kay Fenton |

|

|

|

|

|

|

May Kay Fenton |

|

|

|

|

|

|

Chief Financial Officer and Interim Chief Financial Officer |

Corporate overview September 2023

Exhibit 99.1

This communication contains

“forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, express or implied statements regarding the structure,

timing and completion of the proposed Merger; the combined company’s listing on Nasdaq after closing of the proposed Merger; expectations regarding the ownership structure of the combined company; the anticipated timing of closing; each

company’s and the combined company’s expected cash position at the closing of the proposed Merger and cash runway of the combined company; the future operations of the combined company; the nature, strategy and focus of the combined

company; the development and commercial potential and potential benefits of TOUR006; anticipated preclinical and clinical drug development activities and related timelines, including the expected timing for data and other clinical results; the

competitive landscape of the combined company; anticipated intellectual property timelines; and other statements that are not historical fact. All statements other than statements of historical fact contained in this communication are

forward-looking statements. These forward-looking statements are made as of the date they were first issued, and were based on the then-current expectations, estimates, forecasts, and projections, as well as the beliefs and assumptions of

management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Talaris’, Tourmaline’s or the combined company’s control. Actual results

could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to (i) the risk that the conditions to the closing of the proposed Merger are not satisfied, including the

failure to timely obtain shareholder approval for the transaction, if at all; (ii) uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Talaris and Tourmaline to consummate the proposed Merger; (iii)

risks related to Talaris’ ability to manage its operating expenses and its expenses associated with the proposed merger pending closing; (iv) risks related to the failure or delay in obtaining required approvals from any governmental or

quasi-governmental entity necessary to consummate the proposed Merger; (v) the risk that as a result of adjustments to the exchange ratio, Talaris shareholders and Tourmaline stockholders could own more or less of the combined company than is

currently anticipated; (vi) risks related to the market price of Talaris’ common stock relative to the value suggested by the exchange ratio; (vii) unexpected costs, charges or expenses resulting from the transaction; (viii) potential adverse

reactions or changes to business relationships resulting from the announcement or completion of the proposed Merger; (ix) the uncertainties associated with Tourmaline’s platform technologies, as well as risks associated with the clinical

development and regulatory approval of product candidates, including potential delays in the commencement, enrollment and completion of clinical trials; (x) risks related to the inability of the combined company to obtain sufficient additional

capital to continue to advance these product candidates and its preclinical programs; (xi) uncertainties in obtaining successful clinical results for product candidates and unexpected costs that may result therefrom; (xii) risks related to the

failure to realize any value from product candidates and preclinical programs being developed and anticipated to be developed in light of inherent risks and difficulties involved in successfully bringing product candidates to market; (xiii) risks

associated with the possible failure to realize certain anticipated benefits of the proposed Merger, including with respect to future financial and operating results; (xiv) risks associated with Talaris’ financial close process; (xv) the risk

that the pre-closing financing is not consummated; and (xvi) the risk that Talaris shareholders receive more or less of the cash dividend than is currently anticipated, among others. Actual results and the timing of events could differ materially

from those anticipated in such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties are more fully described in filings that Talaris makes and will make with the SEC in connection with the

proposed Merger, including the Proxy Statement described below under “Additional Information and Where to Find It.” You should not place undue reliance on these forward-looking statements, which are made only as of the date hereof or as

of the dates indicated in the forward-looking statements. Talaris, Tourmaline and the combined company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein

to reflect any change in its expectations with regard thereto or any change in events, conditions or circumstances on which any such statements are based. Tourmaline obtained the industry, market and competitive position data used throughout

this presentation from its own internal estimates and research, as well as from industry and general publications, and research, surveys and studies conducted by third parties. Internal estimates are derived from publicly available information

released by industry analysts and third-party sources, Tourmaline’s internal research and its industry experience, and are based on assumptions made by Tourmaline based on such data and its knowledge of the industry and market, which it

believes to be reasonable. In addition, while Tourmaline believes the industry, market and competitive position data included in this presentation is reliable and based on reasonable assumptions, Tourmaline has not independently verified any

third-party information, and all such data involve risks and uncertainties and are subject to change based on various factors. This presentation contains trademarks, services marks, trade names and copyrights of Tourmaline and other

companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade name or products in this presentation is not intended to, and does not imply, a relationship with Tourmaline,

or an endorsement of sponsorship by Tourmaline. Solely for convenience, the trademarks, service marks and trade names referred to in this presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in

any way, that the company will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade name. Disclaimer

Participants in the Solicitation

This communication relates to the proposed merger transaction involving Talaris and Tourmaline and may be deemed to be solicitation material in respect of the proposed merger transaction. In connection with the proposed merger transaction,

Talaris has filed relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4 (the “Form S-4”) that contains a proxy statement (the “Proxy

Statement”) and prospectus. This communication is not a substitute for the Form S-4, the Proxy Statement or for any other document that Talaris may file with the SEC and or send to Talaris’ shareholders in connection with the proposed

merger transaction. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF TALARIS ARE URGED TO READ THE FORM S-4, THE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT TALARIS, THE PROPOSED MERGER TRANSACTION AND RELATED MATTERS. Additional Information and Where to Find It Investors and security holders may obtain free copies of the Form S-4, the

Proxy Statement and other documents filed by Talaris with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed by Talaris with the SEC are also available free of charge on Talaris’ website at

www.talaristx.com, or by contacting Talaris’ Investor Relations at investors@talaristx.com. Talaris, Tourmaline, and their respective directors and certain of their executive officers may be considered participants in the solicitation of

proxies from Talaris’ shareholders with respect to the proposed merger transaction under the rules of the SEC. Information about the directors and executive officers of Talaris is set forth in its Annual Report on Form 10-K for the year ended

December 31, 2022, which was filed with the SEC on March 31, 2023, and in subsequent documents filed with the SEC. Additional information regarding the persons who may be deemed participants in the proxy solicitations and a description of their

direct and indirect interests, by security holdings or otherwise, are also included in the Form S-4, the Proxy Statement and other relevant materials to be filed with the SEC when they become available. You may obtain free copies of this document as

described above. No Offer or Solicitation This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities nor a solicitation of any vote or approval with respect to the proposed transaction

or otherwise. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U S. Securities Act of 1933, as amended, and otherwise in accordance with applicable law. Disclaimer (continued)

Our mission: developing transformative

medicines that dramatically improve the lives of patients with life-altering immune diseases Our product candidate: TOUR006, a Phase 2/pivotal-ready anti-IL-6 monoclonal antibody with potentially differentiated profile High affinity, long

half-life, low immunogenicity; delivered in ≤1mL subcutaneous injection Completed multiple Phase 1 and Phase 2 clinical trials while under development by Pfizer (448 subjects dosed) Originally developed by Pfizer Our focus: immune-mediated

diseases where IL-6 blockers have been underexplored despite compelling signals of clinical activity Our lead indication: thyroid eye disease (TED), an autoantibody disease that affects the tissue surrounding the eye TOUR006’s potential

administration profile (low volume, low frequency) and upstream mechanism of action could make it an ideal treatment option for TED Mechanism clinically validated after >300 TED patients treated with IL-6 blockers, showing autoantibody

reductions and evidence of clinical benefit IND cleared in the US and Phase 2b TED study expected to begin in Q3 2023 Our second indication: atherosclerotic cardiovascular disease (ASCVD), a leading cause of global morbidity and mortality Emerging

clinical evidence appears to validate decades-long research on IL-6 as a key cardiovascular risk factor TOUR006 could pursue a fast follower strategy, with potential for less frequent dosing than competitor IL-6 agents in ASCVD Phase 2 ASCVD

biomarker trial expected to begin in 2024 $112 million Series A financing with participation from leading biotechnology investors Company highlights

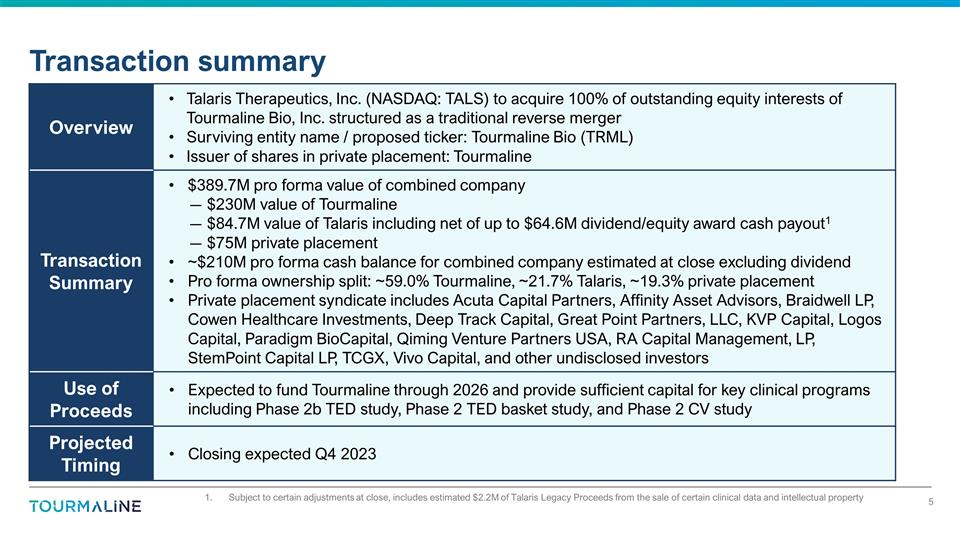

Subject to certain adjustments at

close, includes estimated $2.2M of Talaris Legacy Proceeds from the sale of certain clinical data and intellectual property Transaction summary Overview Talaris Therapeutics, Inc. (NASDAQ: TALS) to acquire 100% of outstanding equity interests of

Tourmaline Bio, Inc. structured as a traditional reverse merger Surviving entity name / proposed ticker: Tourmaline Bio (TRML) Issuer of shares in private placement: Tourmaline Transaction Summary $389.7M pro forma value of combined company $230M

value of Tourmaline $84.7M value of Talaris including net of up to $64.6M dividend/equity award cash payout1 $75M private placement ~$210M pro forma cash balance for combined company estimated at close excluding dividend Pro forma ownership split:

~59.0% Tourmaline, ~21.7% Talaris, ~19.3% private placement Private placement syndicate includes Acuta Capital Partners, Affinity Asset Advisors, Braidwell LP, Cowen Healthcare Investments, Deep Track Capital, Great Point Partners, LLC, KVP Capital,

Logos Capital, Paradigm BioCapital, Qiming Venture Partners USA, RA Capital Management, LP, StemPoint Capital LP, TCGX, Vivo Capital, and other undisclosed investors Use of Proceeds Expected to fund Tourmaline through 2026 and provide sufficient

capital for key clinical programs including Phase 2b TED study, Phase 2 TED basket study, and Phase 2 CV study Projected Timing Closing expected Q4 2023

Leadership team Sandeep Kulkarni, MD

Co-founder and Chief Executive Officer Brad Middlekauff, JD Chief Business Officer and General Counsel Ryan Iarrobino Senior Vice President, Product Development Yung Chyung, MD Chief Medical Officer Susan Dana Jones, PhD Chief Technology Officer

Kevin Johnson, PhD Chief Regulatory Officer Dora Rau Senior Vice President, Head of Quality Gerhard Hagn Senior Vice President, Head of Commercial & BD

Board of Directors Advisors Board of

directors, advisors, and investors Burt Adelman, MD Co-founder and Chairman of the Board, Verve Therapeutics and Clear Creek Bio; former EVP of R&D and Portfolio Strategy, Biogen; former Evp of R&D and CMO, Dyax Corp. Pouya N. Dayani, MD

Vitreoretinal Surgery and Ocular Inflammation Retina-Vitreous Associates Medical Group; Adjunct Clinical Professor USC Keck School of Medicine, USC Roski Eye Institute Kristine Erickson, OD Former Global Ophthalmology

Clinical Lead for sarilumab, Regeneron; former VP Clinical Research, Aerie Pharmaceuticals Jarmila Heissigerová, MD, PhD Head, Department of Ophthalmology, Charles University and General University Hospital in Prague Quan Dong Nguyen, MD

Professor, Ophthalmology (Retina and Uveitis), Pediatrics (Rheumatology), and Medicine (Immunology / Rheumatology); Director, Uveitis and Ocular Inflammation Service, Byers Eye Institute at Stanford University Marco Sales-Sanz, MD Head of Orbital

and Oculoplastic Surgery Unit, Hospital Universitario Ramón y Cajal (Madrid) and IMO Grupo Miranza (Madrid) Stuart Seiff, MD Professor, Ophthalmology, Senate Emeritus, University of California San Francisco; Medical Director and CEO, Pacific

Center for Oculofacial and Aesthetic Plastic Surgery Marius Stan, MD Consultant in Endocrinology, Associate Professor in Medicine, and Chair of the Thyroid Core Group, Mayo Clinic (Rochester) Edward J. Wladis, MD Professor and Chair of the Lions Eye

Institute, Department of Ophthalmology, Albany Medical College; Chief of Service for Ophthalmology, Albany Medical Center Hospital Investors Tim Anderson Managing Director, Cowen Healthcare Investments Caley Castelein, MD Co-founder, Tourmaline Bio

and Managing Partner, KVP Capital Cariad Chester Partner, TCG Crossover Aaron Kantoff Managing Partner, Scion Life Sciences Rebecca Luse Principal, Deep Track Capital Parvinder Thiara Chief Investment Officer, Athanor Capital Sandeep Kulkarni, MD

Co-founder and Chief Executive Officer, Tourmaline Bio

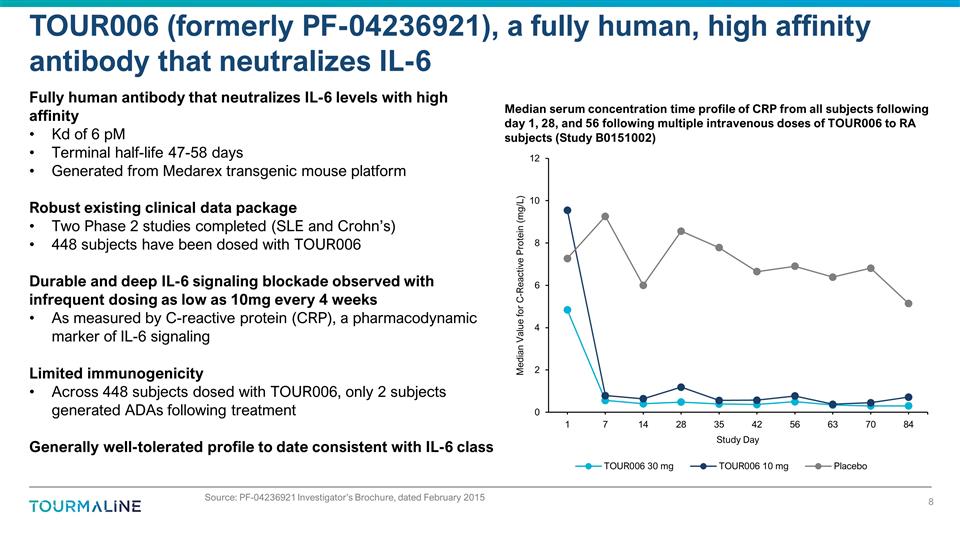

Fully human antibody that neutralizes

IL-6 levels with high affinity Kd of 6 pM Terminal half-life 47-58 days Generated from Medarex transgenic mouse platform Robust existing clinical data package Two Phase 2 studies completed (SLE and Crohn’s) 448 subjects have been dosed with

TOUR006 Durable and deep IL-6 signaling blockade observed with infrequent dosing as low as 10mg every 4 weeks As measured by C-reactive protein (CRP), a pharmacodynamic marker of IL-6 signaling Limited immunogenicity Across 448 subjects dosed

with TOUR006, only 2 subjects generated ADAs following treatment Generally well-tolerated profile to date consistent with IL-6 class TOUR006 (formerly PF-04236921), a fully human, high affinity antibody that neutralizes IL-6 Source: PF-04236921

Investigator’s Brochure, dated February 2015 Median serum concentration time profile of CRP from all subjects following day 1, 28, and 56 following multiple intravenous doses of TOUR006 to RA subjects (Study B0151002)

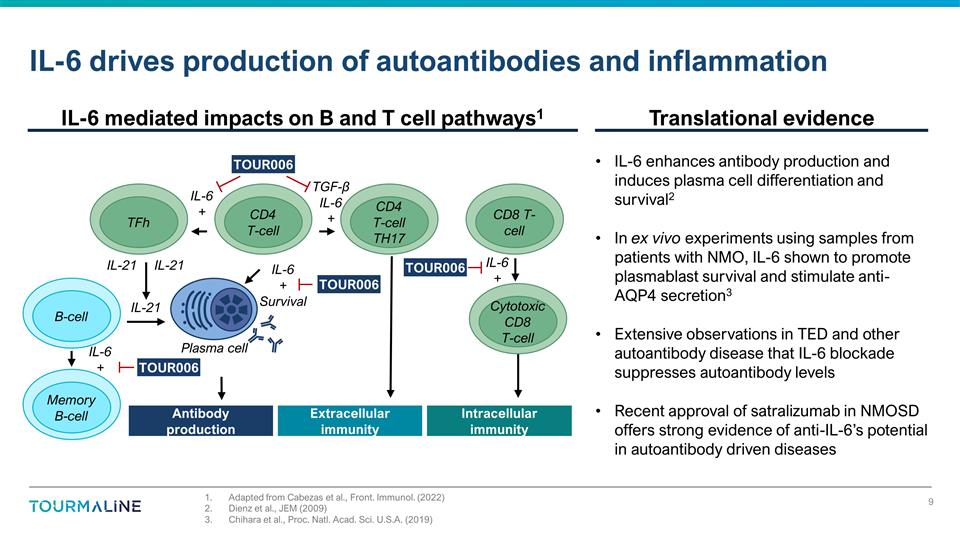

IL-6 enhances antibody production and

induces plasma cell differentiation and survival2 In ex vivo experiments using samples from patients with NMO, IL-6 shown to promote plasmablast survival and stimulate anti-AQP4 secretion3 Extensive observations in TED and other autoantibody disease

that IL-6 blockade suppresses autoantibody levels Recent approval of satralizumab in NMOSD offers strong evidence of anti-IL-6’s potential in autoantibody driven diseases Adapted from Cabezas et al., Front. Immunol. (2022) Dienz et al., JEM

(2009) Chihara et al., Proc. Natl. Acad. Sci. U.S.A. (2019) IL-6 drives production of autoantibodies and inflammation CD4 T-cell TH17 CD4 T-cell TFh Memory B-cell B-cell IL-6 + TGF-β IL-6 + IL-6 + TOUR006 TOUR006 IL-6 + IL-6 + Survival Plasma

cell CD8 T-cell Cytotoxic CD8 T-cell TOUR006 IL-21 IL-21 IL-21 Antibody production Intracellular immunity Extracellular immunity TOUR006 IL-6 mediated impacts on B and T cell pathways1 Translational evidence

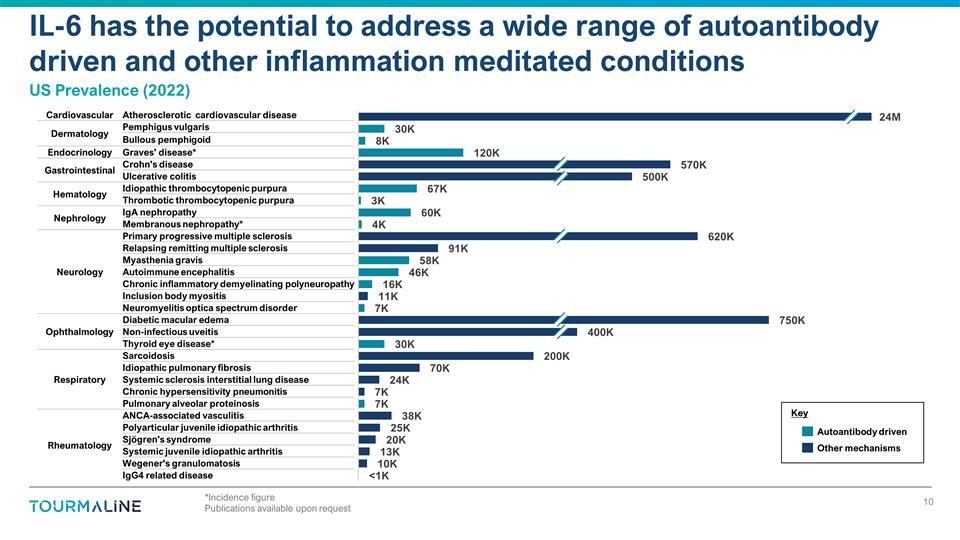

*Incidence figure Publications

available upon request IL-6 has the potential to address a wide range of autoantibody driven and other inflammation meditated conditions US Prevalence (2022) Cardiovascular Atherosclerotic cardiovascular disease Dermatology Pemphigus vulgaris

Bullous pemphigoid Endocrinology Graves' disease* Gastrointestinal Crohn's disease Ulcerative colitis Hematology Idiopathic thrombocytopenic purpura Thrombotic thrombocytopenic purpura Nephrology IgA nephropathy Membranous nephropathy* Neurology

Primary progressive multiple sclerosis Relapsing remitting multiple sclerosis Myasthenia gravis Autoimmune encephalitis Chronic inflammatory demyelinating polyneuropathy Inclusion body myositis Neuromyelitis optica spectrum disorder Ophthalmology

Diabetic macular edema Non-infectious uveitis Thyroid eye disease* Respiratory Sarcoidosis Idiopathic pulmonary fibrosis Systemic sclerosis interstitial lung disease Chronic hypersensitivity pneumonitis Pulmonary alveolar proteinosis Rheumatology

ANCA-associated vasculitis Polyarticular juvenile idiopathic arthritis Sjögren's syndrome Systemic juvenile idiopathic arthritis Wegener's granulomatosis IgG4 related disease Key Autoantibody driven Other mechanisms

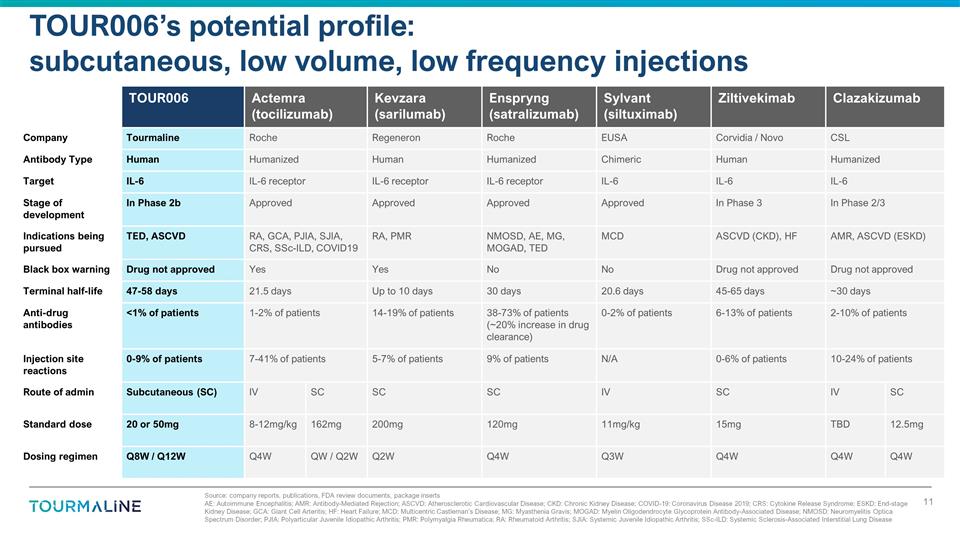

TOUR006’s potential profile:

subcutaneous, low volume, low frequency injections TOUR006 Actemra (tocilizumab) Kevzara (sarilumab) Enspryng (satralizumab) Sylvant (siltuximab) Ziltivekimab Clazakizumab Company Tourmaline Roche Regeneron Roche EUSA Corvidia / Novo CSL Antibody

Type Human Humanized Human Humanized Chimeric Human Humanized Target IL-6 IL-6 receptor IL-6 receptor IL-6 receptor IL-6 IL-6 IL-6 Stage of development In Phase 2b Approved Approved Approved Approved In Phase 3 In Phase 2/3 Indications being pursued

TED, ASCVD RA, GCA, PJIA, SJIA, CRS, SSc-ILD, COVID19 RA, PMR NMOSD, AE, MG, MOGAD, TED MCD ASCVD (CKD), HF AMR, ASCVD (ESKD) Black box warning Drug not approved Yes Yes No No Drug not approved Drug not approved Terminal half-life 47-58 days 21.5

days Up to 10 days 30 days 20.6 days 45-65 days ~30 days Anti-drug antibodies <1% of patients 1-2% of patients 14-19% of patients 38-73% of patients (~20% increase in drug clearance) 0-2% of patients 6-13% of patients 2-10% of patients Injection

site reactions 0-9% of patients 7-41% of patients 5-7% of patients 9% of patients N/A 0-6% of patients 10-24% of patients Route of admin Subcutaneous (SC) IV SC SC SC IV SC IV SC Standard dose 20 or 50mg 8-12mg/kg 162mg 200mg 120mg 11mg/kg 15mg TBD

12.5mg Dosing regimen Q8W / Q12W Q4W QW / Q2W Q2W Q4W Q3W Q4W Q4W Q4W Source: company reports, publications, FDA review documents, package inserts AE: Autoimmune Encephalitis; AMR: Antibody-Mediated Rejection; ASCVD: Atherosclerotic Cardiovascular

Disease; CKD: Chronic Kidney Disease; COVID-19: Coronavirus Disease 2019; CRS: Cytokine Release Syndrome; ESKD: End-stage Kidney Disease; GCA: Giant Cell Arteritis; HF: Heart Failure; MCD: Multicentric Castleman’s Disease; MG: Myasthenia

Gravis; MOGAD: Myelin Oligodendrocyte Glycoprotein Antibody-Associated Disease; NMOSD: Neuromyelitis Optica Spectrum Disorder; PJIA: Polyarticular Juvenile Idiopathic Arthritis; PMR: Polymyalgia Rheumatica; RA: Rheumatoid Arthritis; SJIA: Systemic

Juvenile Idiopathic Arthritis; SSc-ILD: Systemic Sclerosis-Associated Interstitial Lung Disease

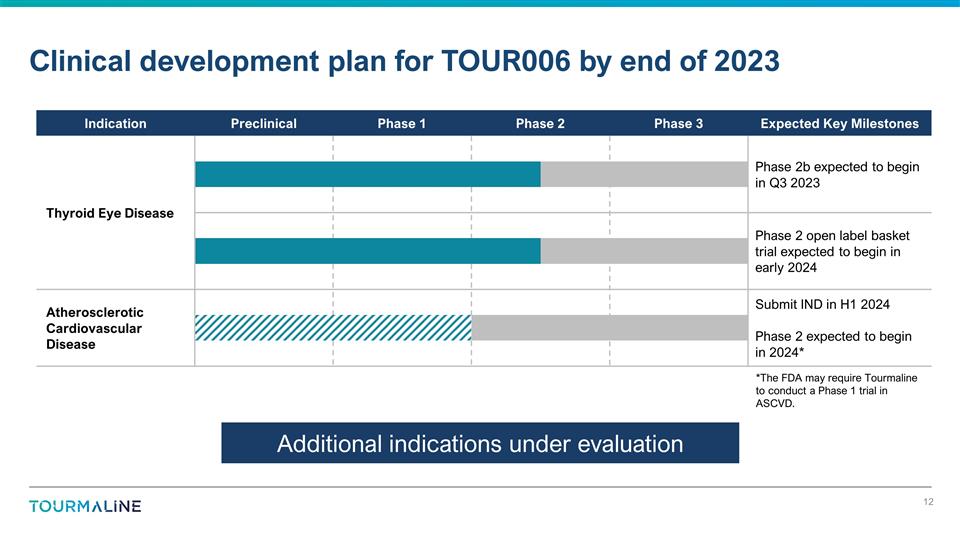

Indication Preclinical Phase 1

Phase 2 Phase 3 Expected Key Milestones Thyroid Eye Disease Phase 2b expected to begin in Q3 2023 Phase 2 open label basket trial expected to begin in early 2024 Atherosclerotic Cardiovascular Disease Submit IND in H1 2024 Phase 2 expected to begin

in 2024* Clinical development plan for TOUR006 by end of 2023 Additional indications under evaluation *The FDA may require Tourmaline to conduct a Phase 1 trial in ASCVD.

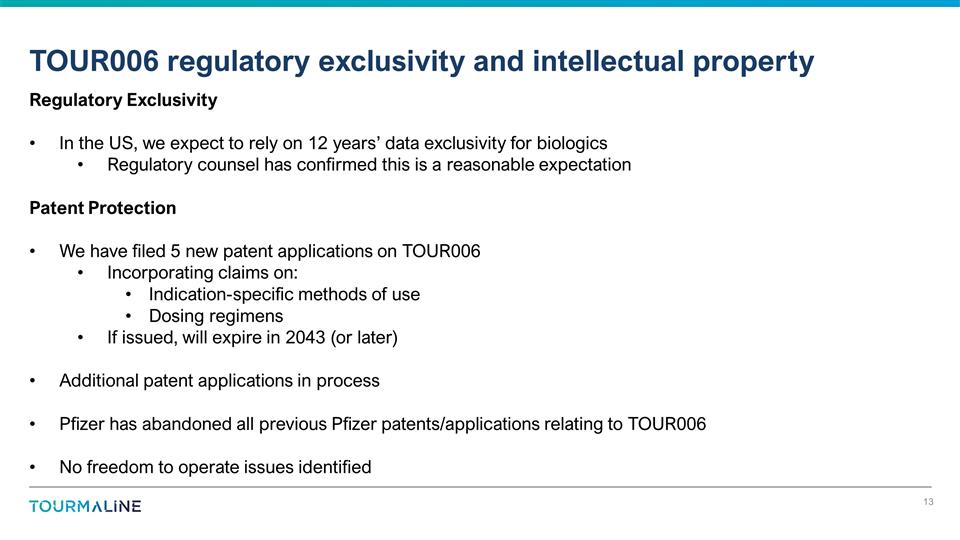

Regulatory Exclusivity In the US,

we expect to rely on 12 years’ data exclusivity for biologics Regulatory counsel has confirmed this is a reasonable expectation Patent Protection We have filed 5 new patent applications on TOUR006 Incorporating claims on: Indication-specific

methods of use Dosing regimens If issued, will expire in 2043 (or later) Additional patent applications in process Pfizer has abandoned all previous Pfizer patents/applications relating to TOUR006 No freedom to operate issues identified TOUR006

regulatory exclusivity and intellectual property

Thyroid eye disease

Autoimmune disease associated with

proliferation and inflammation of the cell types surrounding the eye Symptoms include proptosis, double-vision, and disfigurement Involvement of optic nerve can be sight-threatening and requires emergent surgery Approximately 30,000 new cases per

year (of all severities), of which we estimate 15,000-20,000 are moderate-to-severe1 Pathophysiology driven by autoantibodies that bind to the TSH receptor, which is expressed on cell types surrounding the eye Same autoantibody can also cause

Graves’ hyperthyroidism (GH); up to 95% of TED patients also have GH2 IL-6 is elevated in patients with TED and experimental evidence suggests a role in disease pathogenesis3 Bartalena et al., Front. Endocrinol. (2020); Lazarus, Best Pract.

Res. Clin. Endocrinol. Metab. (2021) Sabini et al., Eur. Thyroid J. (2018) Hiromatsu et al., J. Clin. Endocrinol. Metab. (2000); Slowik et al., Endocr. Res. (2012); Jyonouchi et al., Thyroid (2001); Hwang et al., Invest Ophthalmol Vis Sci (2009)

Thyroid eye disease (also called Graves’ ophthalmopathy and Graves’ orbitopathy) Source: Getty Images

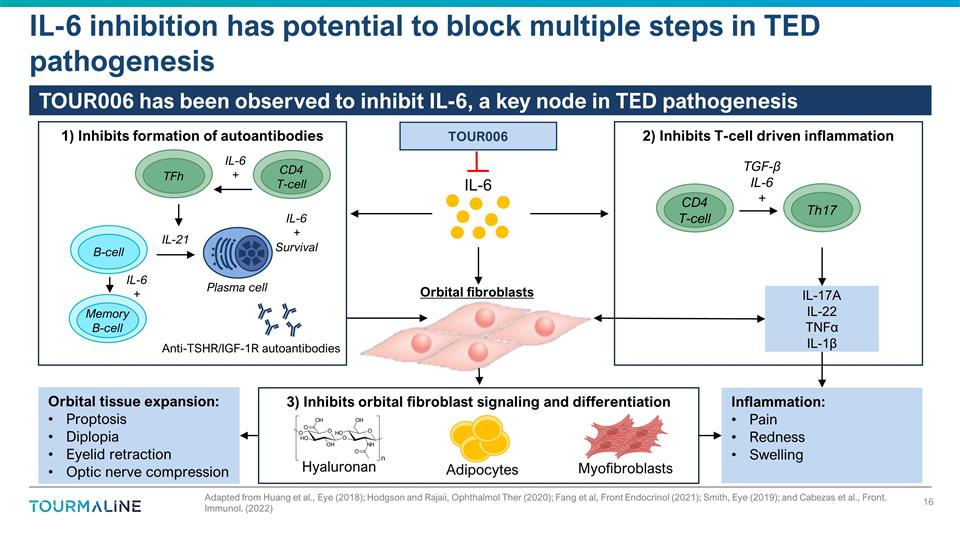

Adapted from Huang et al., Eye

(2018); Hodgson and Rajaii, Ophthalmol Ther (2020); Fang et al, Front Endocrinol (2021); Smith, Eye (2019); and Cabezas et al., Front. Immunol. (2022) IL-6 inhibition has potential to block multiple steps in TED pathogenesis TOUR006 has been

observed to inhibit IL-6, a key node in TED pathogenesis Adipocytes Myofibroblasts Hyaluronan 3) Inhibits orbital fibroblast signaling and differentiation Inflammation: Pain Redness Swelling Orbital tissue expansion: Proptosis Diplopia Eyelid

retraction Optic nerve compression Anti-TSHR/IGF-1R autoantibodies IL-6 TOUR006 Orbital fibroblasts 2) Inhibits T-cell driven inflammation 1) Inhibits formation of autoantibodies CD4 T-cell TFh Memory B-cell B-cell IL-6 + IL-6 + IL-6 + Survival

Plasma cell IL-21 Th17 CD4 T-cell TGF-β IL-6 + IL-17A IL-22 TNFα IL-1β

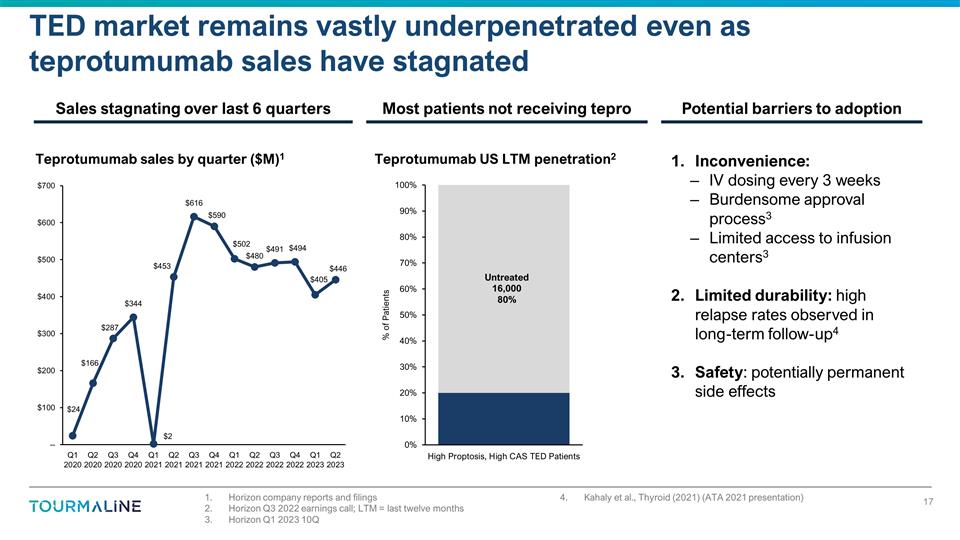

Horizon company reports and filings

Horizon Q3 2022 earnings call; LTM = last twelve months Horizon Q1 2023 10Q Kahaly et al., Thyroid (2021) (ATA 2021 presentation) TED market remains vastly underpenetrated even as teprotumumab sales have stagnated Untreated 16,000 80% Inconvenience:

IV dosing every 3 weeks Burdensome approval process3 Limited access to infusion centers3 Limited durability: high relapse rates observed in long-term follow-up4 Safety: potentially permanent side effects Teprotumumab sales by quarter ($M)1

Teprotumumab US LTM penetration2 Sales stagnating over last 6 quarters Most patients not receiving tepro Potential barriers to adoption

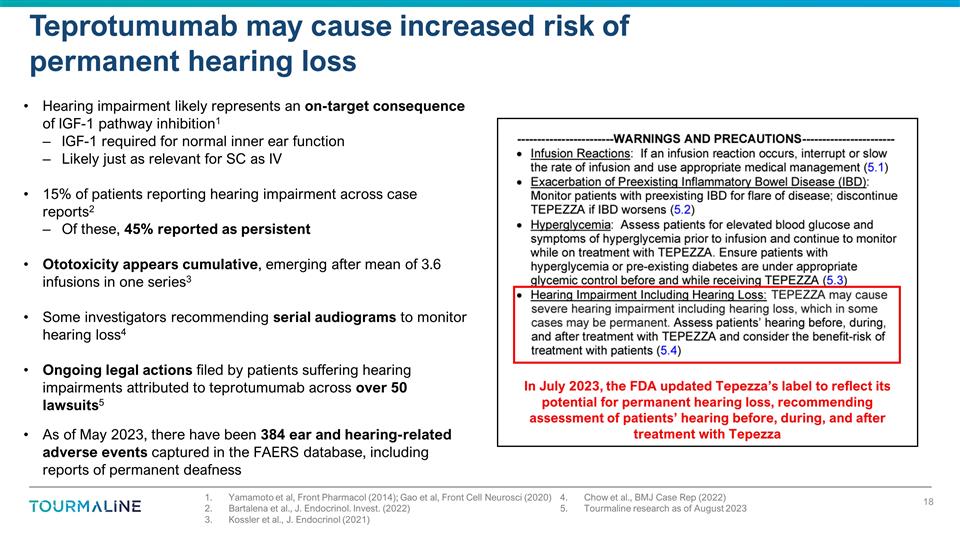

Yamamoto et al, Front Pharmacol

(2014); Gao et al, Front Cell Neurosci (2020) Bartalena et al., J. Endocrinol. Invest. (2022) Kossler et al., J. Endocrinol (2021) Chow et al., BMJ Case Rep (2022) Tourmaline research as of August 2023 Teprotumumab may cause increased risk of

permanent hearing loss Hearing impairment likely represents an on-target consequence of IGF-1 pathway inhibition1 IGF-1 required for normal inner ear function Likely just as relevant for SC as IV 15% of patients reporting hearing impairment across

case reports2 Of these, 45% reported as persistent Ototoxicity appears cumulative, emerging after mean of 3.6 infusions in one series3 Some investigators recommending serial audiograms to monitor hearing loss4 Ongoing legal actions filed by patients

suffering hearing impairments attributed to teprotumumab across over 50 lawsuits5 As of May 2023, there have been 384 ear and hearing-related adverse events captured in the FAERS database, including reports of permanent deafness In July 2023, the

FDA updated Tepezza’s label to reflect its potential for permanent hearing loss, recommending assessment of patients’ hearing before, during, and after treatment with Tepezza

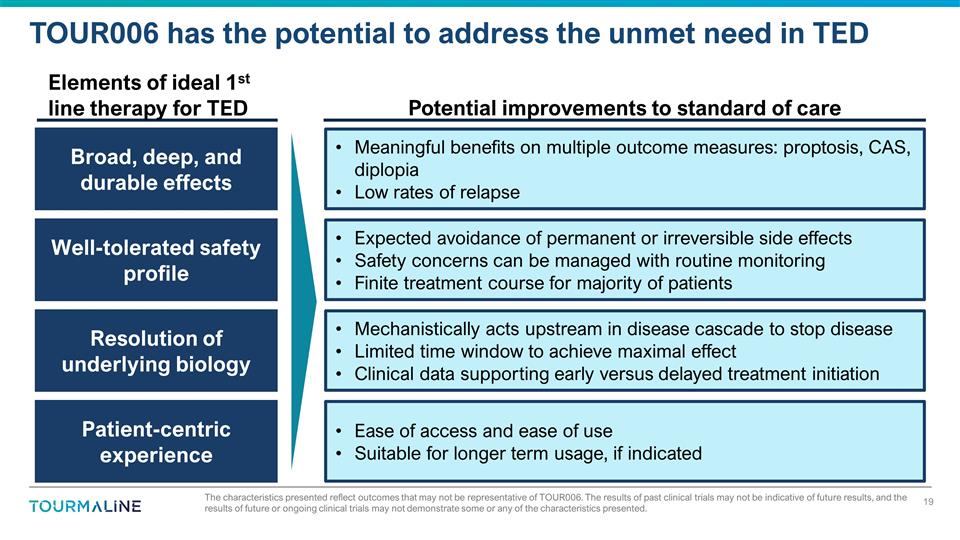

TOUR006 has the potential to

address the unmet need in TED Broad, deep, and durable effects Meaningful benefits on multiple outcome measures: proptosis, CAS, diplopia Low rates of relapse Well-tolerated safety profile Expected avoidance of permanent or irreversible side effects

Safety concerns can be managed with routine monitoring Finite treatment course for majority of patients Resolution of underlying biology Mechanistically acts upstream in disease cascade to stop disease Limited time window to achieve maximal effect

Clinical data supporting early versus delayed treatment initiation Patient-centric experience Ease of access and ease of use Suitable for longer term usage, if indicated Elements of ideal 1st line therapy for TED Potential improvements to standard

of care The characteristics presented reflect outcomes that may not be representative of TOUR006. The results of past clinical trials may not be indicative of future results, and the results of future or ongoing clinical trials may not demonstrate

some or any of the characteristics presented.

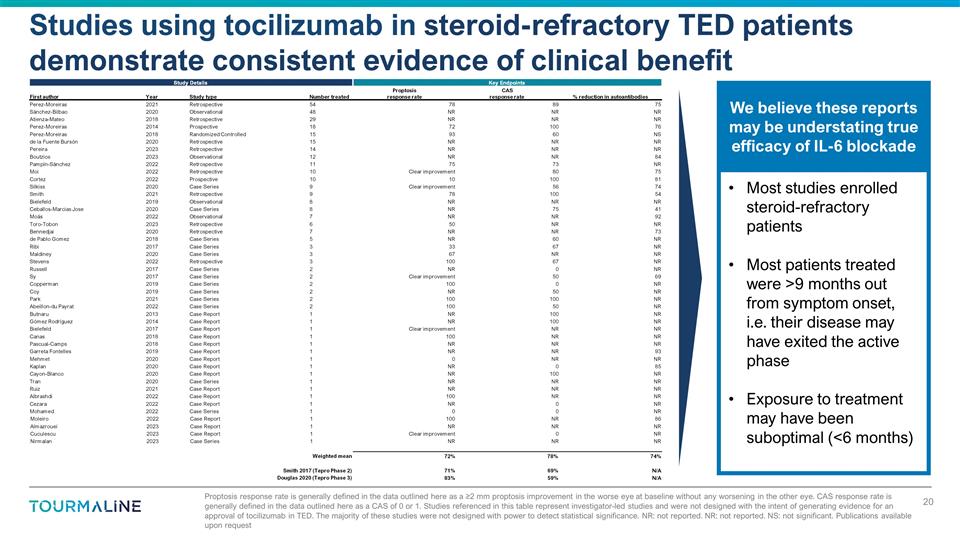

Study Details Key

Endpoints First author Year Study type Number treated Proptosis response rate CAS response rate % reduction in autoantibodies Perez-Moreiras 2021 Retrospective 54 78 89 75 Sánchez-Bilbao 2020 Observational 48 NR NR NR

Atienza-Mateo 2018 Retrospective 29 NR NR NR Perez-Moreiras 2014 Prospective 18 72 100 76 Perez-Moreiras 2018 Randomized Controlled 15 93 60 NS de la Fuente Bursón 2020 Retrospective 15 NR NR NR Pereira 2023 Retrospective 14 NR NR NR

Boutzios 2023 Observational 12 NR NR 84 Pampín-Sánchez 2022 Retrospective 11 75 73 NR Moi 2022 Retrospective 10 Clear improvement 80 75 Cortez 2022 Prospective 10 10 100 81 Silkiss 2020 Case Series 9 Clear improvement 56 74 Smith

2021 Retrospective 9 78 100 54 Bielefeld 2019 Observational 8 NR NR NR Ceballos-Marcias Jose 2020 Case Series 8 NR 75 41 Moás 2022 Observational 7 NR NR 92 Toro-Tobon 2023 Retrospective 6 50 NR NR Bennedjai 2020 Retrospective 7 NR NR 73

de Pablo Gomez 2018 Case Series 5 NR 60 NR Ribi 2017 Case Series 3 33 67 NR Maldiney 2020 Case Series 3 67 NR NR Stevens 2022 Retrospective 3 100 67 NR Russell 2017 Case Series 2 NR 0 NR Sy 2017 Case Series 2 Clear improvement 50

69 Copperman 2019 Case Series 2 100 0 NR Coy 2019 Case Series 2 NR 50 NR Park 2021 Case Series 2 100 100 NR Abeillon-du Payrat 2022 Case Series 2 100 50 NR Butnaru 2013 Case Report 1 NR 100 NR Gómez Rodríguez 2014 Case Report 1

NR 100 NR Bielefeld 2017 Case Report 1 Clear improvement NR NR Canas 2018 Case Report 1 100 NR NR Pascual-Camps 2018 Case Report 1 NR NR NR Garreta Fontelles 2019 Case Report 1 NR NR 93 Mehmet 2020 Case Report 1 0 NR NR Kaplan 2020 Case Report 1 NR

0 85 Cayon-Blanco 2020 Case Report 1 NR 100 NR Tran 2020 Case Series 1 NR NR NR Ruiz 2021 Case Report 1 NR NR NR Albrashdi 2022 Case Report 1 100 NR NR Cezara 2022 Case Report 1 NR 0 NR Mohamed 2022 Case Series 1 0 0 NR Moleiro 2022 Case Report 1

100 NR 86 Almazrouei 2023 Case Report 1 NR NR NR Cuculescu 2023 Case Report 1 Clear improvement 0 NR Nirmalan 2023 Case Series 1 NR NR NR Weighted mean 72% 78% 74% Smith 2017 (Tepro Phase 2) 71% 69% N/A Douglas 2020 (Tepro Phase 3) 83% 59% N/A

Studies using tocilizumab in steroid-refractory TED patients demonstrate consistent evidence of clinical benefit Most studies enrolled steroid-refractory patients Most patients treated were >9 months out from symptom onset, i.e. their disease may

have exited the active phase Exposure to treatment may have been suboptimal (<6 months) We believe these reports may be understating true efficacy of IL-6 blockade Proptosis response rate is generally defined in the data outlined here as a

≥2 mm proptosis improvement in the worse eye at baseline without any worsening in the other eye. CAS response rate is generally defined in the data outlined here as a CAS of 0 or 1. Studies referenced in this table represent investigator-led

studies and were not designed with the intent of generating evidence for an approval of tocilizumab in TED. The majority of these studies were not designed with power to detect statistical significance. NR: not reported. NR: not reported. NS: not

significant. Publications available upon request

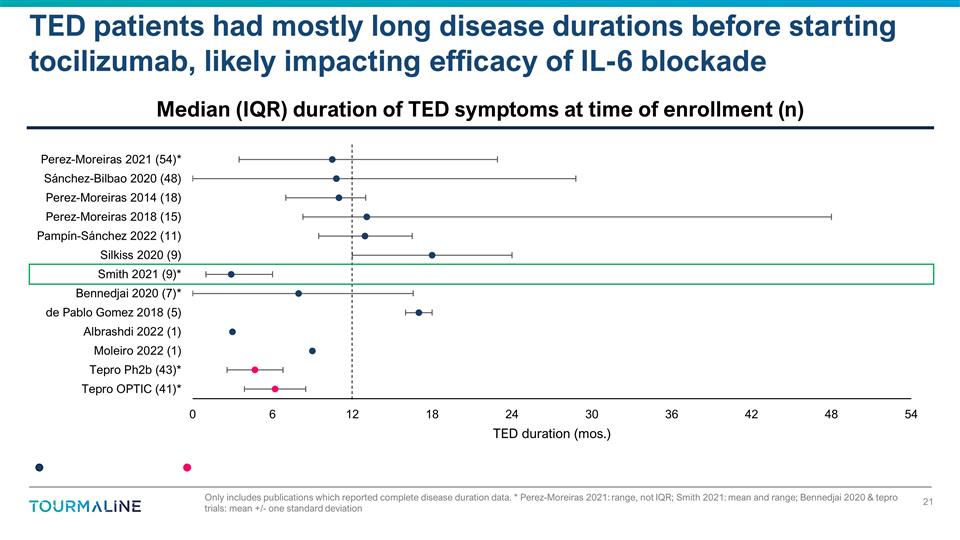

Only includes publications which

reported complete disease duration data. * Perez-Moreiras 2021: range, not IQR; Smith 2021: mean and range; Bennedjai 2020 & tepro trials: mean +/- one standard deviation TED patients had mostly long disease durations before starting

tocilizumab, likely impacting efficacy of IL-6 blockade Median (IQR) duration of TED symptoms at time of enrollment (n)

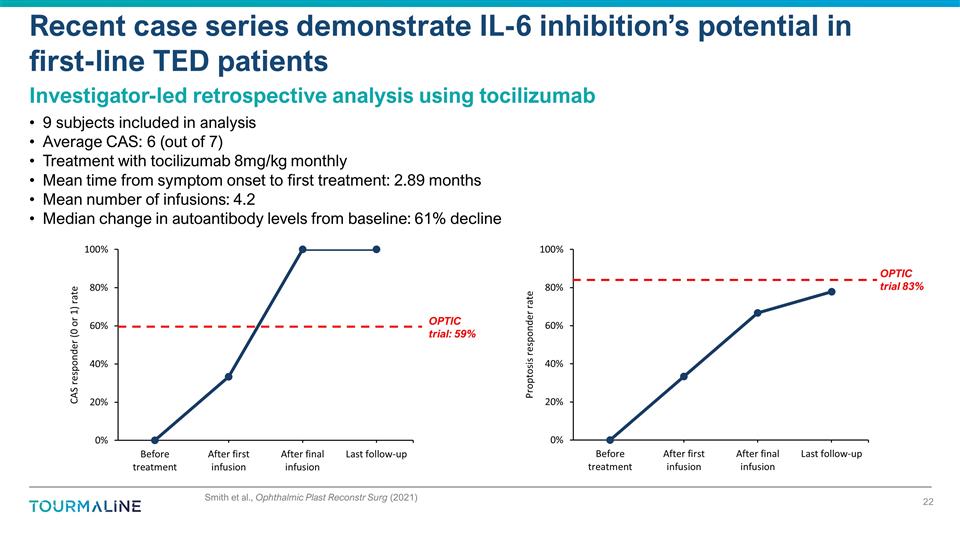

Smith et al., Ophthalmic

Plast Reconstr Surg (2021) Recent case series demonstrate IL-6 inhibition’s potential in first-line TED patients Investigator-led retrospective analysis using tocilizumab 9 subjects included in analysis Average CAS: 6 (out of 7) Treatment with

tocilizumab 8mg/kg monthly Mean time from symptom onset to first treatment: 2.89 months Mean number of infusions: 4.2 Median change in autoantibody levels from baseline: 61% decline OPTIC trial 83% OPTIC trial: 59%

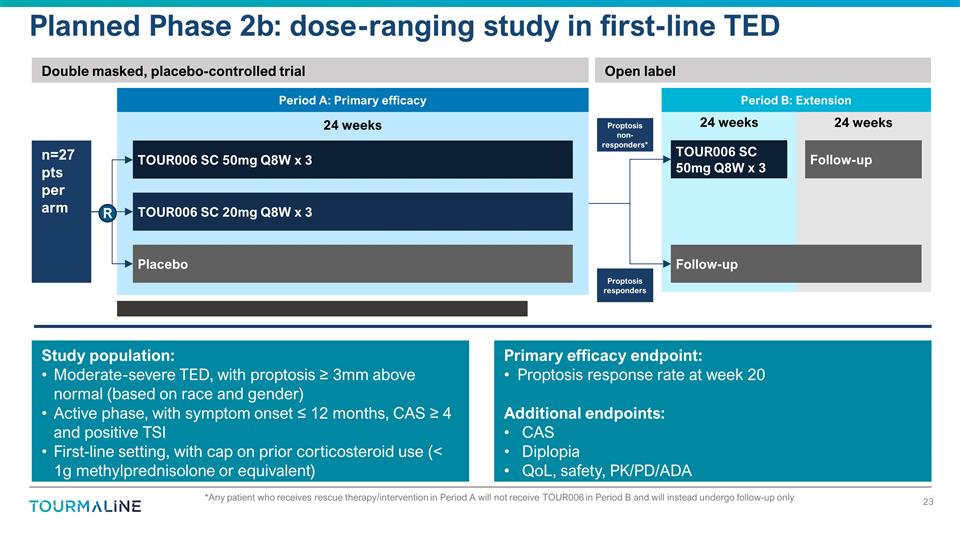

24 weeks 24 weeks 24 weeks Planned

Phase 2b: dose-ranging study in first-line TED n=27 pts per arm TOUR006 SC 50mg Q8W x 3 TOUR006 SC 20mg Q8W x 3 Period A: Primary efficacy Study population: Moderate-severe TED, with proptosis ≥ 3mm above normal (based on race and gender)

Active phase, with symptom onset ≤ 12 months, CAS ≥ 4 and positive TSI First-line setting, with cap on prior corticosteroid use (< 1g methylprednisolone or equivalent) Primary efficacy endpoint: Proptosis response rate at week 20

Additional endpoints: CAS Diplopia QoL, safety, PK/PD/ADA Double masked, placebo-controlled trial Placebo R *Any patient who receives rescue therapy/intervention in Period A will not receive TOUR006 in Period B and will instead undergo follow-up

only TOUR006 SC 50mg Q8W x 3 Follow-up Period B: Extension Proptosis non-responders* Proptosis responders Open label Follow-up

Evaluate through TED basket trial

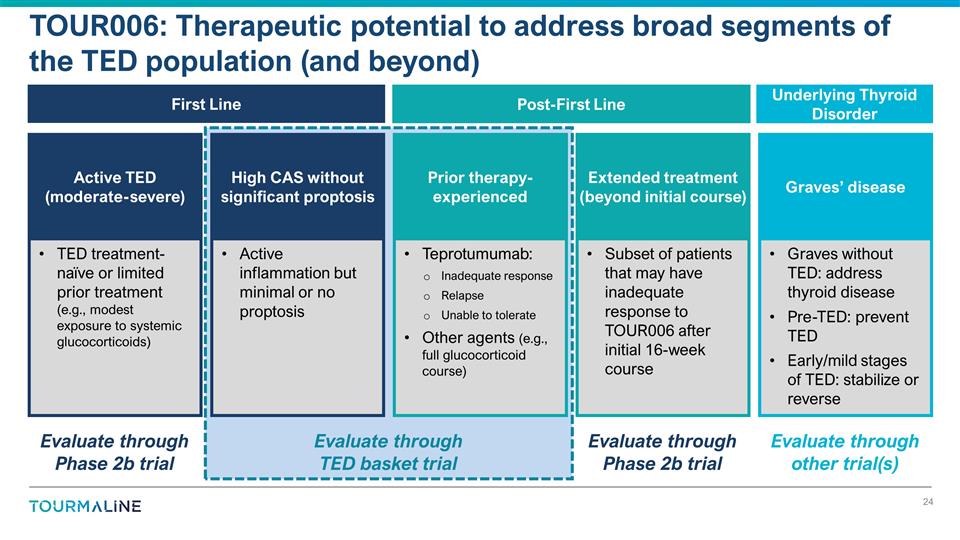

TOUR006: Therapeutic potential to address broad segments of the TED population (and beyond) Active TED (moderate-severe) High CAS without significant proptosis Prior therapy-experienced Extended treatment (beyond initial course) Graves’

disease TED treatment-naïve or limited prior treatment (e.g., modest exposure to systemic glucocorticoids) Active inflammation but minimal or no proptosis Teprotumumab: Inadequate response Relapse Unable to tolerate Other agents (e.g., full

glucocorticoid course) Subset of patients that may have inadequate response to TOUR006 after initial 16-week course Graves without TED: address thyroid disease Pre-TED: prevent TED Early/mild stages of TED: stabilize or reverse First Line Post-First

Line Underlying Thyroid Disorder Evaluate through Phase 2b trial Evaluate through Phase 2b trial Evaluate through other trial(s)

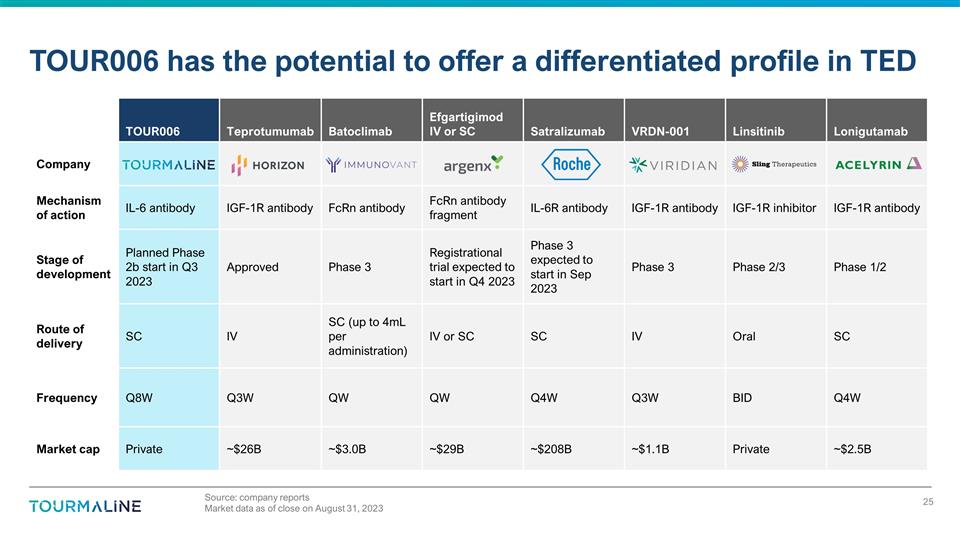

TOUR006 has the potential to offer

a differentiated profile in TED TOUR006 Teprotumumab Batoclimab Efgartigimod IV or SC Satralizumab VRDN-001 Linsitinib Lonigutamab Company Mechanism of action IL-6 antibody IGF-1R antibody FcRn antibody FcRn antibody fragment IL-6R antibody IGF-1R

antibody IGF-1R inhibitor IGF-1R antibody Stage of development Planned Phase 2b start in Q3 2023 Approved Phase 3 Registrational trial expected to start in Q4 2023 Phase 3 expected to start in Sep 2023 Phase 3 Phase 2/3 Phase 1/2 Route of delivery

SC IV SC (up to 4mL per administration) IV or SC SC IV Oral SC Frequency Q8W Q3W QW QW Q4W Q3W BID Q4W Market cap Private ~$26B ~$3.0B ~$29B ~$208B ~$1.1B Private ~$2.5B Source: company reports Market data as of close on August 31, 2023

Atherosclerotic Cardiovascular

Disease (ASCVD)

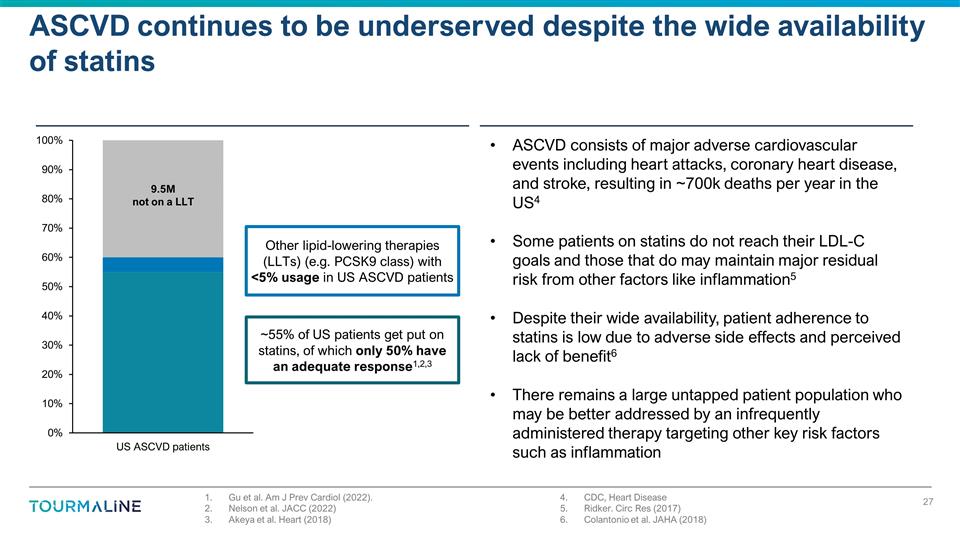

ASCVD continues to be underserved

despite the wide availability of statins ~55% of US patients get put on statins, of which only 50% have an adequate response1,2,3 9.5M not on a LLT Gu et al. Am J Prev Cardiol (2022). Nelson et al. JACC (2022) Akeya et al. Heart (2018) CDC, Heart

Disease Ridker. Circ Res (2017) Colantonio et al. JAHA (2018) Other lipid-lowering therapies (LLTs) (e.g. PCSK9 class) with <5% usage in US ASCVD patients ASCVD consists of major adverse cardiovascular events including heart attacks, coronary

heart disease, and stroke, resulting in ~700k deaths per year in the US4 Some patients on statins do not reach their LDL-C goals and those that do may maintain major residual risk from other factors like inflammation5 Despite their wide

availability, patient adherence to statins is low due to adverse side effects and perceived lack of benefit6 There remains a large untapped patient population who may be better addressed by an infrequently administered therapy targeting other key

risk factors such as inflammation

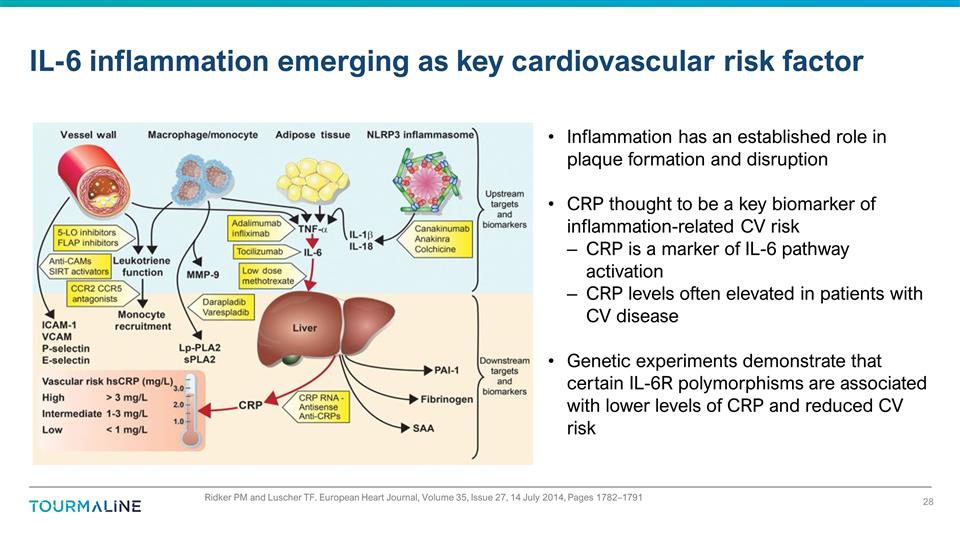

Inflammation has an established

role in plaque formation and disruption CRP thought to be a key biomarker of inflammation-related CV risk CRP is a marker of IL-6 pathway activation CRP levels often elevated in patients with CV disease Genetic experiments demonstrate that certain

IL-6R polymorphisms are associated with lower levels of CRP and reduced CV risk Ridker PM and Luscher TF. European Heart Journal, Volume 35, Issue 27, 14 July 2014, Pages 1782–1791 IL-6 inflammation emerging as key cardiovascular risk factor

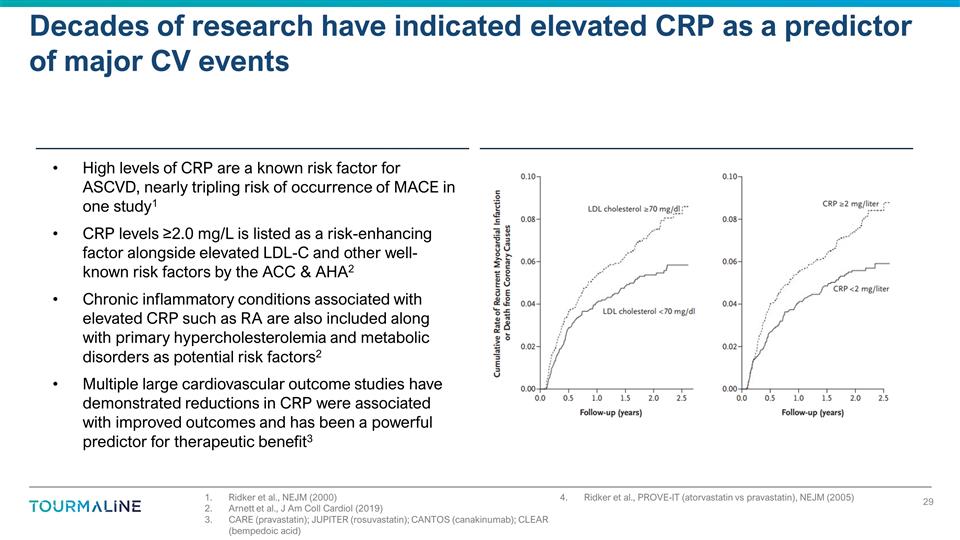

Ridker et al., NEJM (2000) Arnett

et al., J Am Coll Cardiol (2019) CARE (pravastatin); JUPITER (rosuvastatin); CANTOS (canakinumab); CLEAR (bempedoic acid) Ridker et al., PROVE-IT (atorvastatin vs pravastatin), NEJM (2005) Decades of research have indicated elevated CRP as a

predictor of major CV events High levels of CRP are a known risk factor for ASCVD, nearly tripling risk of occurrence of MACE in one study1 CRP levels ≥2.0 mg/L is listed as a risk-enhancing factor alongside elevated LDL-C and other well-known

risk factors by the ACC & AHA2 Chronic inflammatory conditions associated with elevated CRP such as RA are also included along with primary hypercholesterolemia and metabolic disorders as potential risk factors2 Multiple large cardiovascular

outcome studies have demonstrated reductions in CRP were associated with improved outcomes and has been a powerful predictor for therapeutic benefit3

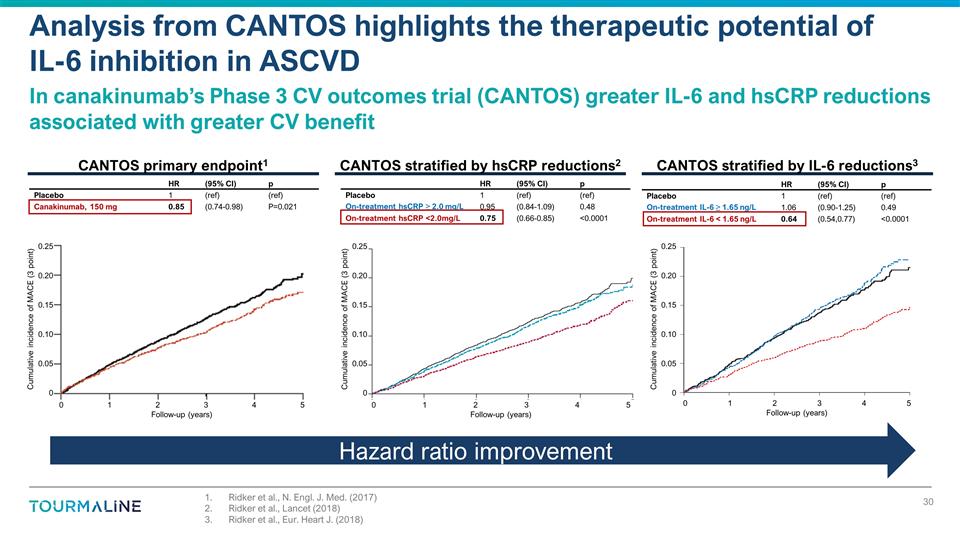

Ridker et al., N. Engl. J. Med.

(2017) Ridker et al., Lancet (2018) Ridker et al., Eur. Heart J. (2018) Analysis from CANTOS highlights the therapeutic potential of IL-6 inhibition in ASCVD In canakinumab’s Phase 3 CV outcomes trial (CANTOS) greater IL-6 and hsCRP reductions

associated with greater CV benefit CANTOS primary endpoint1 CANTOS stratified by hsCRP reductions2 CANTOS stratified by IL-6 reductions3 HR (95% CI) p Placebo 1 (ref) (ref) On-treatment IL-6 ≥ 1.65 ng/L 1.06 (0.90-1.25) 0.49 On-treatment IL-6

< 1.65 ng/L 0.64 (0.54,0.77) <0.0001 HR (95% CI) p Placebo 1 (ref) (ref) On-treatment hsCRP ≥ 2.0 mg/L 0.95 (0.84-1.09) 0.48 On-treatment hsCRP <2.0mg/L 0.75 (0.66-0.85) <0.0001 HR (95% CI) p Placebo 1 (ref) (ref) Canakinumab, 150

mg 0.85 (0.74-0.98) P=0.021 Hazard ratio improvement Cumulative incidence of MACE (3 point) 0.25 0.20 0.15 0.10 0.05 0 0 1 2 3 4 5 Follow-up (years) 0 1 2 3 4 5 Follow-up (years) Cumulative incidence of MACE (3 point) 0.25 0.20 0.15 0.10 0.05 0

Cumulative incidence of MACE (3 point) 0.25 0.20 0.15 0.10 0.05 0 0 1 2 3 4 5 Follow-up (years)

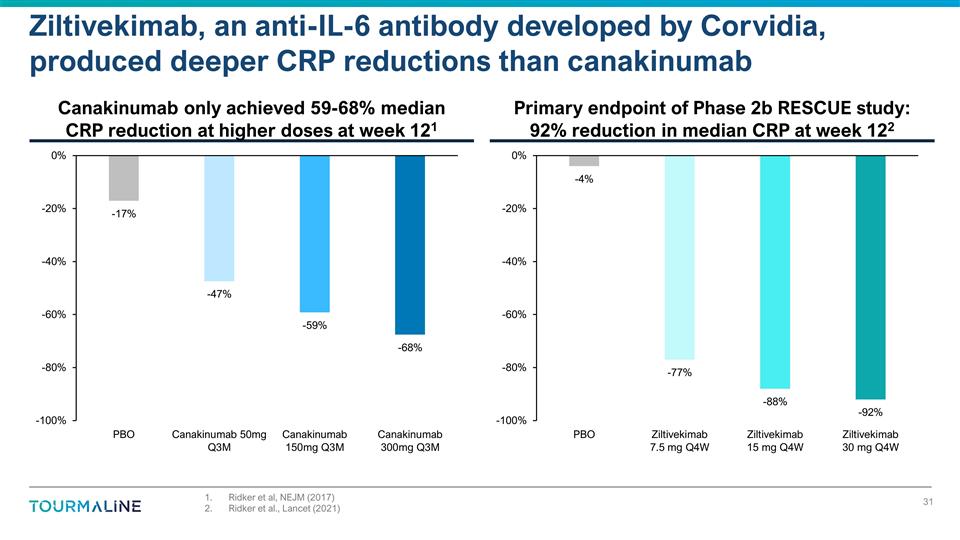

Ridker et al, NEJM (2017) Ridker et

al., Lancet (2021) Primary endpoint of Phase 2b RESCUE study: 92% reduction in median CRP at week 122 Canakinumab only achieved 59-68% median CRP reduction at higher doses at week 121 Ziltivekimab, an anti-IL-6 antibody developed by Corvidia,

produced deeper CRP reductions than canakinumab

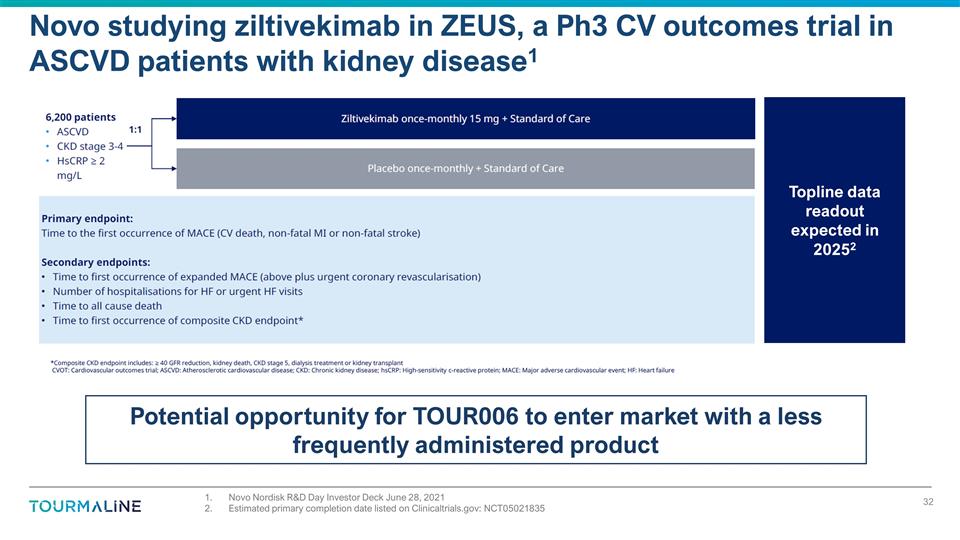

Novo studying ziltivekimab in ZEUS,

a Ph3 CV outcomes trial in ASCVD patients with kidney disease1 Topline data readout expected in 20252 Novo Nordisk R&D Day Investor Deck June 28, 2021 Estimated primary completion date listed on Clinicaltrials.gov: NCT05021835 Potential

opportunity for TOUR006 to enter market with a less frequently administered product

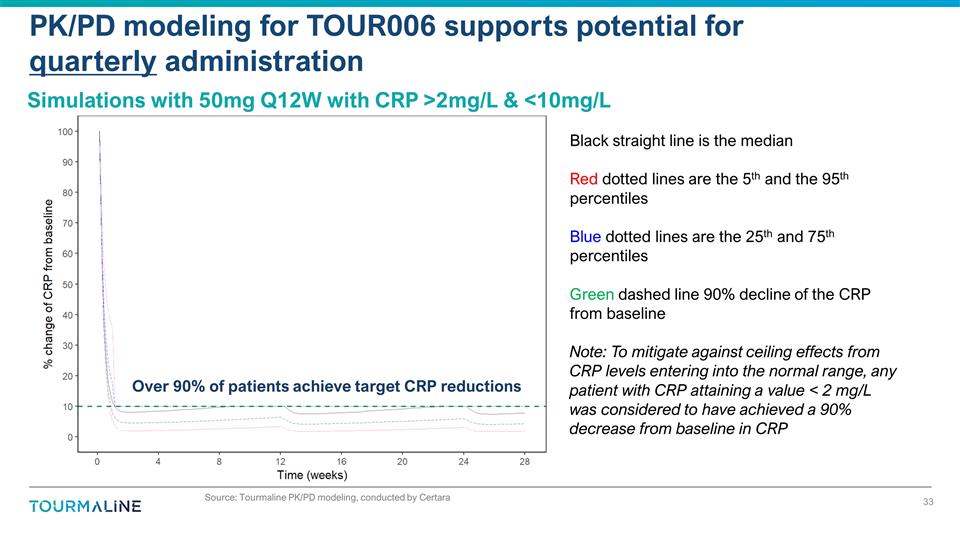

PK/PD modeling for TOUR006 supports

potential for quarterly administration Source: Tourmaline PK/PD modeling, conducted by Certara Black straight line is the median Red dotted lines are the 5th and the 95th percentiles Blue dotted lines are the 25th and 75th percentiles Green dashed

line 90% decline of the CRP from baseline Note: To mitigate against ceiling effects from CRP levels entering into the normal range, any patient with CRP attaining a value < 2 mg/L was considered to have achieved a 90% decrease from baseline in

CRP Simulations with 50mg Q12W with CRP >2mg/L & <10mg/L Over 90% of patients achieve target CRP reductions

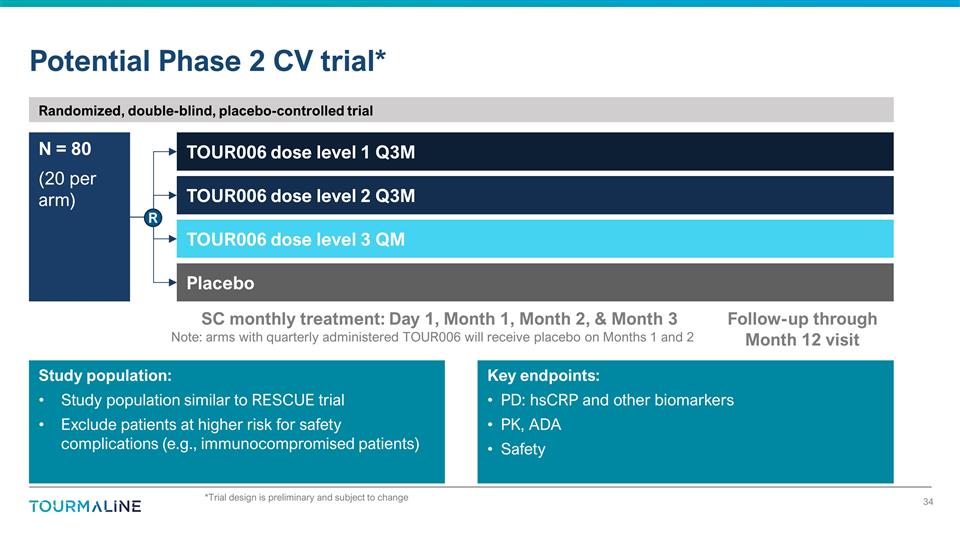

N = 80 (20 per arm) *Trial design

is preliminary and subject to change Potential Phase 2 CV trial* TOUR006 dose level 1 Q3M TOUR006 dose level 2 Q3M TOUR006 dose level 3 QM SC monthly treatment: Day 1, Month 1, Month 2, & Month 3 Note: arms with quarterly administered TOUR006

will receive placebo on Months 1 and 2 Follow-up through Month 12 visit Study population: Study population similar to RESCUE trial Exclude patients at higher risk for safety complications (e.g., immunocompromised patients) Key endpoints: PD: hsCRP

and other biomarkers PK, ADA Safety Randomized, double-blind, placebo-controlled trial R Placebo

Next Steps

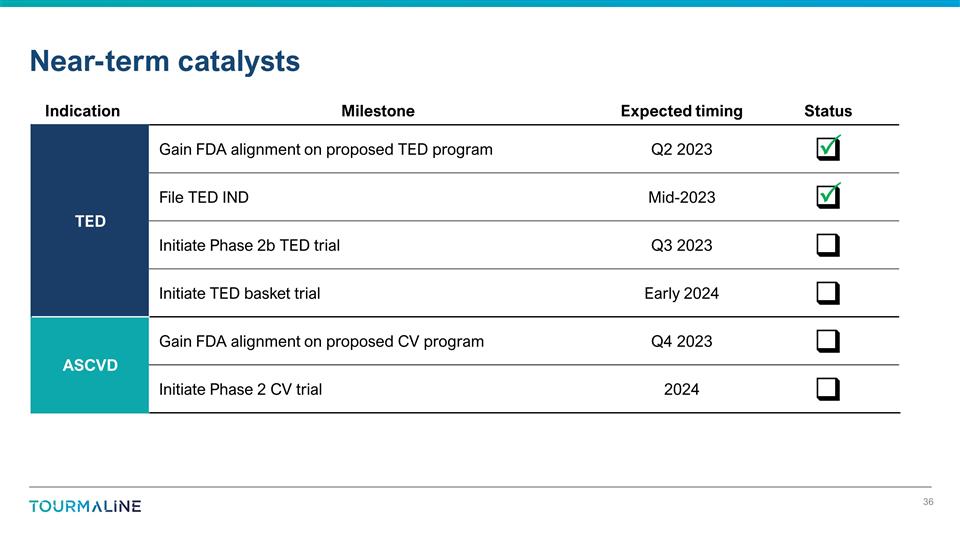

Near-term catalysts Indication

Milestone Expected timing Status TED Gain FDA alignment on proposed TED program Q2 2023 q File TED IND Mid-2023 q Initiate Phase 2b TED trial Q3 2023 q Initiate TED basket trial Early 2024 q ASCVD Gain FDA alignment on proposed CV program Q4 2023 q

Initiate Phase 2 CV trial 2024 q P P

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Talaris Therapeutics (NASDAQ:TALS)

Historical Stock Chart

From Apr 2024 to May 2024

Talaris Therapeutics (NASDAQ:TALS)

Historical Stock Chart

From May 2023 to May 2024