-- Pivotal Complete Response (CR) Data from

SELECT-MDS-1 Phase 3 Trial Expected by Mid-4Q24 --

-- Additional Data from SELECT-AML-1 Phase 2

Trial Expected in September 2024--

-- Management to Host Conference Call at 8:30

AM ET Today --

Syros Pharmaceuticals (NASDAQ: SYRS), a biopharmaceutical

company committed to advancing new standards of care for the

frontline treatment of hematologic malignancies, today reported

financial results for the quarter ended June 30, 2024 and provided

a corporate update.

“Syros is well-positioned heading into key clinical data

readouts expected in the second half of 2024, including pivotal

complete response (CR) data from the Phase 3 SELECT-MDS-1 trial by

mid-fourth quarter. In addition, we will present clinical activity

and tolerability data from over 40 patients from the SELECT-AML-1

Phase 2 trial at the SOHO 2024 annual meeting in September,” said

Conley Chee, Chief Executive Officer of Syros. “We are keenly

focused on execution across our late-stage clinical development

programs and pre-commercial activities in support of our mission to

provide tamibarotene as a new frontline standard-of-care for

patients with RARA overexpression.

“Supported by compelling, consistent clinical data generated

to-date across multiple trials, we believe our differentiated and

biologically-targeted approach with tamibarotene provides a

meaningful opportunity to address the approximately 50% of

higher-risk MDS and 30% of AML patients with RARA overexpression.

There is a significant unmet need in these two closely related

diseases, with patients and physicians looking for new, convenient,

and well-tolerated options that enhance clinical outcomes while

maintaining quality of life. As we approach two critical data

readouts, we are working diligently to prepare for our first New

Drug Application (NDA) filing and launch, so that we can

effectively deliver tamibarotene to the thousands of HR-MDS

patients in need of new treatment options. We look forward to an

exciting second half of the year and remain committed in our

pursuit to provide profound benefit to patients in need,” Mr. Chee

continued.

UPCOMING MILESTONES

- Report pivotal CR data from the SELECT-MDS-1 Phase 3 trial in

newly diagnosed HR-MDS patients with RARA gene overexpression by

the middle of the fourth quarter of 2024.

- Report clinical activity and tolerability data from a

prespecified analysis of more than 40 patients from the

SELECT-AML-1 Phase 2 trial in unfit AML patients with RARA

overexpression at the 12th Annual Meeting of the Society of

Hematologic Oncology (SOHO) meeting in September 2024.

RECENT HIGHLIGHTS

- In June, Syros hosted a webinar event to discuss disease

biology and the current treatment landscape in HR-MDS, as well as

to highlight the design of the ongoing pivotal Phase 3 SELECT-MDS-1

trial and the opportunity for tamibarotene. In addition to Syros

management, the event featured presentations from medical experts

in MDS. An archived replay of the event is available on the

Investors & Media section of Syros’ website,

www.syros.com.

Second Quarter 2024 Financial Results

- Syros did not recognize revenue in the second quarter of 2024,

as compared to $2.8 million for the second quarter of 2023. The

decrease reflects last year’s termination of Syros’ collaboration

agreement with Pfizer.

- Research and development (R&D) expenses were $22.0 million

for the second quarter of 2024, as compared to $29.6 million for

the second quarter of 2023. The decrease was primarily due to the

reduction in external R&D consulting, contract manufacturing,

and a reduction in headcount and related expenses.

- General and administrative (G&A) expenses were $5.5 million

for the second quarter of 2024, as compared to $7.2 million for the

second quarter of 2023. The decrease was primarily due to a

reduction of headcount and related expenses, consulting fees, and

facilities expenses.

- For the second quarter of 2024, Syros reported a net loss of

$23.3 million, or $0.59 per share, compared to a net loss of $36.3

million, or $1.30 per share, for the same period in 2023.

Cash and Financial Guidance

Cash, cash equivalents and marketable securities as of June 30,

2024, were $79.0 million, as compared with $108.3 million as of

March 31, 2024.

Based on its current plans, Syros believes that its existing

cash, cash equivalents and marketable securities will be sufficient

to fund its anticipated operating expenses and capital expenditure

requirements into the third quarter of 2025, beyond pivotal Phase 3

data from the SELECT-MDS-1 trial and additional data from the

randomized portion of the SELECT-AML-1 trial.

Conference Call and Webcast

Syros will host a conference call today at 8:30 a.m. ET to

discuss the second quarter 2024 financial results and provide a

corporate update.

To access the live conference call, please dial (800) 549-8228

(domestic) or (289) 819-1520 (international) and refer to

conference ID 64947. A webcast of the call will also be available

on the Investors & Media section of the Syros website at

www.syros.com. An archived replay of the webcast will be available

for approximately 30 days following the presentation.

About Syros Pharmaceuticals

Syros is committed to developing new standards of care for the

frontline treatment of patients with hematologic malignancies.

Driven by the motivation to help patients with blood disorders that

have largely eluded other targeted approaches, Syros is developing

tamibarotene, an oral selective RARα agonist in frontline patients

with higher-risk myelodysplastic syndrome and acute myeloid

leukemia with RARA gene overexpression. For more information, visit

www.syros.com and follow us on X (@SyrosPharma) and LinkedIn.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of The Private Securities Litigation Reform Act of

1995, including without limitation statements regarding Syros’

clinical development plans, the progression of its clinical trials,

the timing to report clinical data, the ability to commercialize

tamibarotene and deliver benefit to patients, and the sufficiency

of Syros’ capital resources to fund its operating expenses and

capital expenditure requirements into the third quarter of 2025.

The words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “hope,” “intend,” “may,” “plan,” “potential,” “predict,”

“project,” “target,” “should,” “would,” and similar expressions are

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Actual

results or events could differ materially from the plans,

intentions and expectations disclosed in these forward-looking

statements as a result of various important factors, including

Syros’ ability to: advance the development of its programs under

the timelines it projects in current and future clinical trials;

demonstrate in any current and future clinical trials the requisite

safety, efficacy and combinability of its drug candidates; sustain

the response rates and durability of response seen to date with its

drug candidates; successfully develop a diagnostic test to identify

patients with the RARA biomarker; obtain and maintain patent

protection for its drug candidates and the freedom to operate under

third party intellectual property; obtain and maintain necessary

regulatory approvals; identify, enter into and maintain

collaboration agreements with third parties; manage competition;

manage expenses; raise the substantial additional capital needed to

achieve its business objectives; attract and retain qualified

personnel; and successfully execute on its business strategies;

risks described under the caption “Risk Factors” in Syros’ Annual

Report on Form 10-K for the year ended December 31, 2023 and

Quarterly Report on Form 10-Q for the quarter ended June 30, 2024,

each of which is on file with the Securities and Exchange

Commission; and risks described in other filings that Syros makes

with the Securities and Exchange Commission in the future.

Financial Tables

Syros Pharmaceuticals,

Inc.

Selected Condensed

Consolidated Balance Sheet Data

(in thousands)

(unaudited)

June 30, 2024

December 31, 2023

Cash, cash equivalents and marketable

securities (current and noncurrent)

$

78,964

$

139,526

Working capital1

60,400

108,299

Total assets

106,722

168,174

Total stockholders’ (deficit) equity

(6,352)

16,662

(1)

The Company defines working capital as

current assets less current liabilities. See the Company’s

condensed consolidated financial statements for further details

regarding its current assets and current liabilities.

Syros Pharmaceuticals,

Inc.

Condensed Consolidated

Statement of Operations

(in thousands, except share

and per share data)

(unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Revenue

$

—

$

2,833

$

—

$

5,787

Operating expenses:

Research and development

21,953

29,608

46,608

58,369

General and administrative

5,463

7,225

11,729

14,630

Total operating expenses

27,416

36,833

58,337

72,999

Loss from operations

(27,416

)

(34,000

)

(58,337

)

(67,212

)

Interest income

1,085

2,125

2,631

3,900

Interest expense

(1,382

)

(1,278

)

(2,689

)

(2,495

)

Change in fair value of warrant

liabilities

4,386

(3,105

)

31,360

5,760

Net loss applicable to common

stockholders

$

(23,327

)

$

(36,258

)

$

(27,035

)

$

(60,047

)

Net loss per share applicable to common

stockholders - basic and diluted

$

(0.59

)

$

(1.30

)

$

(0.69

)

$

(2.15

)

Weighted-average number of common shares

used in net loss per share applicable to common stockholders -

basic and diluted

39,269,434

27,913,448

39,123,740

27,878,030

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731944527/en/

Syros Contact Karen Hunady Director of Corporate

Communications & Investor Relations 1-857-327-7321

khunady@syros.com

Investor Relations Amanda Isacoff Precision AQ

1-212-362-1200 amanda.isacoff@precisionaq.com

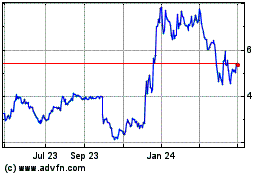

Syros Pharmaceuticals (NASDAQ:SYRS)

Historical Stock Chart

From Nov 2024 to Dec 2024

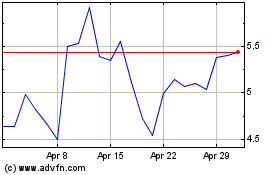

Syros Pharmaceuticals (NASDAQ:SYRS)

Historical Stock Chart

From Dec 2023 to Dec 2024