Form 8-K - Current report

December 04 2024 - 4:30PM

Edgar (US Regulatory)

SYNOPSYS INC false 0000883241 0000883241 2024-12-04 2024-12-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): December 4, 2024

SYNOPSYS, INC.

(Exact name of registrant as specified in charter)

|

|

|

|

|

| Delaware |

|

000-19807 |

|

56-1546236 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

675 Almanor Ave.

Sunnyvale, California 94085

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: (650) 584-5000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock (par value of $0.01 per share) |

|

SNPS |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On December 4, 2024, Synopsys, Inc. (“Synopsys”, “we”, “our”, or “us”) issued a press release announcing the financial results of its fourth fiscal quarter and fiscal year ended October 31, 2024. A copy of the press release is furnished and attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto and incorporated by reference herein, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any registration statement or other document filed with the Securities and Exchange Commission by Synopsys whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

SYNOPSYS, INC. |

|

|

|

|

| Dated: December 4, 2024 |

|

|

|

By: |

|

/s/ John F. Runkel, Jr. |

|

|

|

|

|

|

John F. Runkel, Jr. |

|

|

|

|

|

|

General Counsel and Corporate Secretary |

EXHIBIT 99.1

PRESS RELEASE

INVESTOR CONTACT:

Trey Campbell

Synopsys, Inc.

650-584-4289

Synopsys-ir@synopsys.com

EDITORIAL CONTACT:

Cara Walker

Synopsys, Inc.

650-584-5000

corp-pr@synopsys.com

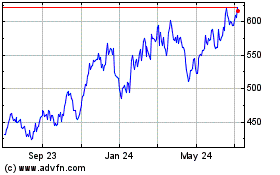

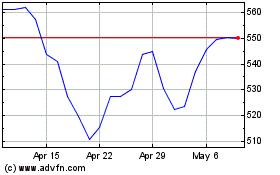

Synopsys Posts Financial Results for Fourth Quarter and Fiscal Year 2024

Results Summary1

| |

• |

|

Record quarterly revenue of $1.636 billion, up approximately 11% year over year (YoY), exceeding the mid-point of guidance. |

| |

• |

|

Quarterly GAAP earnings per diluted share (EPS) of $1.79; non-GAAP EPS of

$3.40, up approximately 13% YoY, exceeding guidance. |

| |

• |

|

Achieved record full-year 2024 revenue of $6.127 billion, up approximately 15% YoY, while improving non-GAAP operating margin and delivering approximately 25% non-GAAP EPS growth. |

| |

• |

|

Expecting to deliver double digit revenue growth in 2025 while preparing for Ansys acquisition close,

which remains on-track for the first half of 2025. |

SUNNYVALE, Calif. – Dec. 4,

2024 – Synopsys, Inc. (Nasdaq: SNPS) today reported results for its fourth quarter and fiscal year 2024. Revenue for the fourth quarter of fiscal year 2024 was $1.636 billion, compared to $1.467 billion for the

fourth quarter of fiscal year 2023. Revenue for fiscal year 2024 was $6.127 billion, an increase of approximately 15% from $5.318 billion in fiscal year 2023.

| 1 |

On September 30, 2024, Synopsys completed the sale of its Software Integrity business. Synopsys’

Software Integrity business has been presented as a discontinued operation in the consolidated financial statements for all periods presented herein and all financial results and targets are presented herein on a continuing operations basis unless

otherwise noted. |

1

“The fourth quarter was a strong finish to a transformational year for Synopsys. We achieved record

financial results while doubling down on our strategy with the sale of our Software Integrity business and the pending acquisition of Ansys,” said Sassine Ghazi, president and CEO of Synopsys. “Looking ahead, the AI-driven reinvention of compute is accelerating the pace, scale and complexity of technology R&D, which expands our opportunity to solve engineering challenges from silicon to systems.”

“Continued strong execution drove excellent Q4 results, which exceeded the midpoint of our guidance targets and capped a year of 15% revenue growth for

the company,” said Shelagh Glaser, CFO of Synopsys. “The combination of our execution focus, operating discipline, and the critical nature of our industry-leading technology positions us well for the future. In 2025, we expect to deliver

double-digit revenue growth grounded in pragmatism given continued macro uncertainties and the impact of our fiscal year calendar change.”

Synopsys’ previously announced acquisition of Ansys is expected to close in the first half of 2025, subject to the receipt of required regulatory

approvals and other customary closing conditions. This week marked the expiration of the Hart-Scott-Rodino (HSR) Act waiting period, and Synopsys is working cooperatively with Federal Trade Commission (FTC) staff to conclude the investigation and

the staff’s review of Synopsys’ proposed remedies.

Continuing Operations

On September 30, 2024, Synopsys completed the sale of its Software Integrity business. Unless otherwise noted, Synopsys’ Software Integrity business

has been presented as a discontinued operation in the Synopsys’ consolidated financial statements for all periods presented herein and all financial results and targets are presented herein on a continuing operations basis.

GAAP Results

On a U.S. generally accepted accounting

principles (GAAP) basis, net income for the fourth quarter of fiscal year 2024 was $279.3 million, or $1.79 per diluted share, compared to $346.1 million, or $2.23 per diluted share, for the fourth quarter of fiscal year 2023. GAAP net

income for fiscal year 2024 was $1.442 billion, or $9.25 per diluted share, compared to $1.227 billion, or $7.91 per diluted share, for fiscal year 2023.

2

Non-GAAP Results

On a non-GAAP basis, net income for the fourth quarter of fiscal year 2024 was $529.9 million, or $3.40 per

diluted share, compared to non-GAAP net income of $464.1 million, or $3.00 per diluted share, for the fourth quarter of fiscal year 2023. Non-GAAP net income for

fiscal year 2024 was $2.058 billion, or $13.20 per diluted share, compared to non-GAAP net income of $1.636 billion, or $10.54 per diluted share, for fiscal year 2023.

For a reconciliation of net income, earnings per diluted share and other measures on a GAAP and non-GAAP basis, see

“GAAP to Non-GAAP Reconciliation” in the accompanying tables below.

Business Segments

Synopsys reports revenue and operating income in two segments: (1) Design Automation, which includes our advanced silicon design, verification products

and services, system integration products and services, digital, custom and field programmable gate array IC design software, verification software and hardware products, manufacturing software products and other and (2) Design IP, which

includes our interface, foundation, security, and embedded processor IP, IP subsystems, and IP implementation services.

Financial Targets

Synopsys also provided its consolidated financial targets for the first quarter and full fiscal year 2025. These targets reflect a change in Synopsys’

fiscal year from a 52/53-week period ending on the Saturday nearest to October 31 of each year to October 31 of each year. As a result of this change, there will be ten fewer days in the first half

of fiscal year 2025 and two extra days in the second half of fiscal year 2025, which results in eight fewer days in the aggregate in Synopsys’ fiscal year 2025 as compared to its fiscal year 2024. These targets also assume no further changes to

export control restrictions or the current U.S. government “Entity List” restrictions. These targets constitute forward-looking statements and are based on current expectations. For a discussion of factors that could cause actual results

to differ materially from these targets, see “Forward-Looking Statements” below.

3

First Quarter and Full Fiscal Year 2025 Financial Targets (1)

(in millions except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Range for Three Months Ending |

|

|

Range for Fiscal Year Ending |

|

| |

|

January 31, 2025 |

|

|

October 31, 2025 |

|

| |

|

Low |

|

|

High |

|

|

Low |

|

|

High |

|

| Revenue |

|

$ |

1,435 |

|

|

$ |

1,465 |

|

|

$ |

6,745 |

|

|

$ |

6,805 |

|

| GAAP Expenses |

|

$ |

1,142 |

|

|

$ |

1,162 |

|

|

$ |

4,926 |

|

|

$ |

4,983 |

|

| Non-GAAP Expenses |

|

$ |

945 |

|

|

$ |

955 |

|

|

$ |

4,045 |

|

|

$ |

4,085 |

|

| Non-GAAP Interest and Other Income (Expense), net |

|

$ |

20 |

|

|

$ |

22 |

|

|

$ |

94 |

|

|

$ |

98 |

|

| Non-GAAP Tax Rate |

|

|

16 |

% |

|

|

16 |

% |

|

|

16 |

% |

|

|

16 |

% |

| Outstanding Shares (fully diluted) |

|

|

156 |

|

|

|

158 |

|

|

|

157 |

|

|

|

159 |

|

| GAAP EPS |

|

$ |

1.81 |

|

|

$ |

1.95 |

|

|

$ |

10.42 |

|

|

$ |

10.63 |

|

| Non-GAAP EPS |

|

$ |

2.77 |

|

|

$ |

2.82 |

|

|

$ |

14.88 |

|

|

$ |

14.96 |

|

| Operating Cash Flow |

|

|

|

|

|

|

|

|

|

|

~ $1,800 |

|

| Free Cash Flow(2) |

|

|

|

|

|

|

|

|

|

|

~ $1,600 |

|

| Capital Expenditures |

|

|

|

|

|

|

|

|

|

|

~ $170 |

|

| (1) |

Synopsys’ first quarter of fiscal year 2025 will end on January 31, 2025 and its fiscal year 2025

will end on October 31, 2025. |

| (2) |

Free cash flow is calculated as cash provided from operating activities less capital expenditures.

|

For a reconciliation of Synopsys’ first quarter and fiscal year 2025 targets, including expenses, earnings per diluted share and

other measures on a GAAP and non-GAAP basis and a discussion of the financial targets that we are not able to reconcile without unreasonable efforts, see “GAAP to

Non-GAAP Reconciliation” in the accompanying tables below.

Earnings Call Open to Investors

Synopsys will hold a conference call for financial analysts and investors today at 2:00 p.m. Pacific Time. A live webcast of the call will be available on

Synopsys’ corporate website at www.investor.synopsys.com. Synopsys uses its website as a tool to disclose important information about Synopsys and comply with its disclosure obligations under Regulation Fair Disclosure. A webcast replay

will also be available on the corporate website from approximately 5:30 p.m. Pacific Time today through the time Synopsys announces its results for the first quarter of fiscal year 2025 in February 2025.

Effectiveness of Information

The targets included in

this press release, the statements made during the earnings conference call, the information contained in the financial supplement and the corporate overview presentation, each of which are available on Synopsys’ corporate website at

www.synopsys.com (collectively, the “Earnings Materials”), represent Synopsys’ expectations and beliefs as of December 4, 2024. Although these Earnings Materials will remain available on Synopsys’

website through the date of the earnings call for the first quarter of fiscal year 2025, their continued availability through such date does not mean that Synopsys is reaffirming or confirming their continued validity. Synopsys undertakes no duty

and does not intend to update any forward-looking statement, whether as a result of new information or future events, or otherwise update, the targets given in this press release unless required by law.

4

Availability of Final Financial Statements

Synopsys will include final financial statements for the fiscal year 2024 in its annual report on Form 10-K to be filed

on or before January 2, 2025.

About Synopsys

Catalyzing the era of pervasive intelligence, Synopsys, Inc. (Nasdaq: SNPS) delivers trusted and comprehensive silicon to systems design solutions, from

electronic design automation to silicon IP and system verification and validation. We partner closely with semiconductor and systems customers across a wide range of industries to maximize their R&D capability and productivity, powering

innovation today that ignites the ingenuity of tomorrow. Learn more at www.synopsys.com.

Reconciliation of Fourth Quarter and Fiscal Year 2024

Results

The following tables reconcile the specific items excluded from GAAP in the calculation of non-GAAP

net income, earnings per diluted share, and tax rate for the periods indicated below.

GAAP to

Non-GAAP Reconciliation of Fourth Quarter and Fiscal Year 2024 Results(1)

(unaudited and in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

October 31, |

|

|

October 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| GAAP net income from continuing operations attributed to Synopsys |

|

$ |

279,281 |

|

|

$ |

346,051 |

|

|

$ |

1,441,710 |

|

|

$ |

1,227,045 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of acquired intangible assets |

|

|

54,258 |

|

|

|

14,886 |

|

|

|

104,220 |

|

|

|

50,477 |

|

| Stock-based compensation |

|

|

165,116 |

|

|

|

128,286 |

|

|

|

656,632 |

|

|

|

511,730 |

|

| Acquisition/divestiture related items |

|

|

62,428 |

|

|

|

4,016 |

|

|

|

172,638 |

|

|

|

13,831 |

|

| Restructuring charges |

|

|

— |

|

|

|

(1,348 |

) |

|

|

— |

|

|

|

53,091 |

|

| Gain on sale of strategic investments |

|

|

— |

|

|

|

— |

|

|

|

(55,077 |

) |

|

|

— |

|

| Tax settlement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(23,752 |

) |

| Tax adjustments |

|

|

(31,158 |

) |

|

|

(27,753 |

) |

|

|

(262,322 |

) |

|

|

(196,471 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income from continuing operations attributed

to Synopsys |

|

$ |

529,925 |

|

|

$ |

464,138 |

|

|

$ |

2,057,801 |

|

|

$ |

1,635,951 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

October 31, |

|

|

October 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| GAAP net income from continuing operations per diluted share attributed to Synopsys |

|

$ |

1.79 |

|

|

$ |

2.23 |

|

|

$ |

9.25 |

|

|

$ |

7.91 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Amortization of acquired intangible assets |

|

|

0.35 |

|

|

|

0.10 |

|

|

|

0.67 |

|

|

|

0.33 |

|

| Stock-based compensation |

|

|

1.06 |

|

|

|

0.83 |

|

|

|

4.21 |

|

|

|

3.30 |

|

| Acquisition/divestiture related items |

|

|

0.40 |

|

|

|

0.03 |

|

|

|

1.11 |

|

|

|

0.09 |

|

| Restructuring charges |

|

|

— |

|

|

|

(0.01 |

) |

|

|

— |

|

|

|

0.34 |

|

| Gain on sale of strategic investments |

|

|

— |

|

|

|

— |

|

|

|

(0.35 |

) |

|

|

— |

|

| Tax settlement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.15 |

) |

| Tax adjustments |

|

|

(0.20 |

) |

|

|

(0.18 |

) |

|

|

(1.69 |

) |

|

|

(1.28 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income from continuing operations per diluted

share attributed to Synopsys |

|

$ |

3.40 |

|

|

$ |

3.00 |

|

|

$ |

13.20 |

|

|

$ |

10.54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in computing net income per diluted share amounts: |

|

|

155,991 |

|

|

|

154,845 |

|

|

|

155,944 |

|

|

|

155,195 |

|

| (1) |

Synopsys’ fourth quarter of fiscal year 2024 and 2023 ended on November 2, 2024 and October 28,

2023, respectively. For presentation purposes, we refer to the closest calendar month end. Fiscal year 2024 was a 53-week year, which included an extra week in the first quarter. |

GAAP to Non-GAAP Tax Rate Reconciliation (1)(2)

(unaudited)

|

|

|

|

|

| |

|

Twelve Months Ended |

|

| |

|

October 31, 2024 |

|

| GAAP effective tax rate |

|

|

6.6 |

% |

| Stock-based compensation |

|

|

2.9 |

% |

| Income tax adjustments (3) |

|

|

5.5 |

% |

|

|

|

|

|

| Non-GAAP effective tax rate |

|

|

15.0 |

% |

|

|

|

|

|

| (1) |

Synopsys’ fiscal year 2024 ended on November 2, 2024. For presentation purposes, we refer to the

closest calendar month end. Fiscal year 2024 was a 53-week year, which included an extra week in the first quarter. |

| (2) |

Presented on a continuing operations basis. |

| (3) |

The adjustments are primarily related to the differences in the tax rate effect of certain deductions, such as

the deduction for foreign-derived intangible income and credits. |

6

GAAP to Non-GAAP Reconciliation of 2025 Targets

The following tables reconcile the specific items excluded from GAAP in the calculation of non-GAAP targets for the

periods indicated below.

GAAP to Non-GAAP Reconciliation of First Quarter Fiscal Year 2025

Targets

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

| |

|

Range for Three Months Ending |

|

| |

|

January 31, 2025 |

|

| |

|

Low |

|

|

High |

|

| Target GAAP expenses |

|

$ |

1,142,000 |

|

|

$ |

1,162,000 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

| Amortization of acquired intangible assets |

|

|

(12,000 |

) |

|

|

(15,000 |

) |

| Stock-based compensation |

|

|

(185,000 |

) |

|

|

(192,000 |

) |

|

|

|

|

|

|

|

|

|

| Target non-GAAP expenses |

|

$ |

945,000 |

|

|

$ |

955,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Range for Three Months Ending |

|

| |

|

January 31, 2025 |

|

| |

|

Low |

|

|

High |

|

| Target GAAP earnings per diluted share attributed to Synopsys |

|

$ |

1.81 |

|

|

$ |

1.95 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

| Amortization of acquired intangible assets |

|

|

0.10 |

|

|

|

0.08 |

|

| Stock-based compensation |

|

|

1.22 |

|

|

|

1.18 |

|

| Acquisition/divestiture related items

(1) |

|

|

0.08 |

|

|

|

0.06 |

|

| Tax adjustments |

|

|

(0.44 |

) |

|

|

(0.45 |

) |

|

|

|

|

|

|

|

|

|

| Target non-GAAP earnings per diluted share attributed to

Synopsys |

|

$ |

2.77 |

|

|

$ |

2.82 |

|

|

|

|

|

|

|

|

|

|

| Shares used in non-GAAP calculation (midpoint of target

range) |

|

|

157,000 |

|

|

|

157,000 |

|

7

GAAP to Non-GAAP Reconciliation of Full Fiscal

Year 2025 Targets

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

| |

|

Range for Fiscal Year Ending |

|

| |

|

October 31, 2025 |

|

| |

|

Low |

|

|

High |

|

| Target GAAP expenses |

|

$ |

4,926,000 |

|

|

$ |

4,983,000 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

| Amortization of acquired intangible assets |

|

|

(46,000 |

) |

|

|

(51,000 |

) |

| Stock-based compensation |

|

|

(835,000 |

) |

|

|

(847,000 |

) |

|

|

|

|

|

|

|

|

|

| Target non-GAAP expenses |

|

$ |

4,045,000 |

|

|

$ |

4,085,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Range for Fiscal Year Ending |

|

| |

|

October 31, 2025 |

|

| |

|

Low |

|

|

High |

|

| Target GAAP earnings per diluted share attributed to Synopsys |

|

$ |

10.42 |

|

|

$ |

10.63 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

| Amortization of acquired intangible assets |

|

|

0.32 |

|

|

|

0.29 |

|

| Stock-based compensation |

|

|

5.36 |

|

|

|

5.28 |

|

| Acquisition/divestiture related items

(1) |

|

|

0.29 |

|

|

|

0.26 |

|

| Tax adjustments |

|

|

(1.51 |

) |

|

|

(1.50 |

) |

|

|

|

|

|

|

|

|

|

| Target non-GAAP earnings per diluted share attributed to

Synopsys |

|

$ |

14.88 |

|

|

$ |

14.96 |

|

|

|

|

|

|

|

|

|

|

| Shares used in non-GAAP calculation (midpoint of target

range) |

|

|

158,000 |

|

|

|

158,000 |

|

| (1) |

Adjustments reflect certain contractually obligated financing fees and related amortization expenses, and do

not fully reflect all potential adjustments for future periods for the reasons set forth in “GAAP to Non-GAAP Reconciliation” below. |

Forward-Looking Statements

This press release and the

investor conference call contain forward-looking statements, including, but not limited to, statements regarding short-term and long-term financial targets, expectations and objectives including, among others, our long-term financial objectives,

which include the anticipated effects of our pending acquisition of ANSYS, Inc. (the Ansys Merger); business and market outlook, opportunities, strategies and technological trends, such as artificial intelligence; planned acquisitions and their

expected impact, including the Ansys Merger; the potential impact of the uncertain macroeconomic and geopolitical environment on our financial results; the expected impact of U.S. and foreign government trade restrictions and regulatory changes,

including export control restrictions and tariffs on our financial results; customer license renewals and the expected realization and timing of our contracted but unsatisfied or partially unsatisfied performance obligations (backlog); planned

dispositions and their expected

8

impact; customer demand and market expansion for our products and our customers’ products; our ability to successfully compete in the markets we serve; our planned product releases and

capabilities; industry growth rates; software trends; planned stock repurchases; our expected tax rate; and the impact and result of pending legal, regulatory, administrative and tax proceedings. These statements involve risks, uncertainties and

other factors that could cause our actual results, time frames or achievements to differ materially from those expressed or implied in such forward-looking statements. Such risks, uncertainties and factors include, but are not limited to:

macroeconomic conditions and geopolitical uncertainty in the global economy; uncertainty in the growth of the semiconductor and electronics industries; the highly competitive industry we operate in; actions by the U.S. or foreign governments, such

as the imposition of additional export restrictions or tariffs; consolidation among our customers and our dependence on a relatively small number of large customers; risks and compliance obligations relating to the global nature of our operations;

failure to complete the Ansys Merger on the terms described in our filings with the SEC, if at all; failure to obtain required governmental approvals related to the Ansys Merger or the imposition of conditions to such governmental approvals that may

have an adverse effect on us; failure to realize the benefits expected from the Ansys Merger; and more. Additional information on potential risks, uncertainties and other factors that could affect Synopsys’ results is included in filings we

make with the SEC from time to time, including in the sections entitled “Risk Factors” in our latest Annual Report on Form 10-K and in our latest Quarterly Report on Form 10-Q. The financial information contained in this press release should be read in conjunction with the consolidated financial statements and notes thereto included in Synopsys’ most recent reports on Forms 10-K and 10-Q, each as may be amended from time to time. Synopsys’ financial results for its fourth quarter and fiscal year 2024 are not necessarily indicative of

Synopsys’ operating results for any future periods. The information provided herein is as of December 4, 2024. Synopsys undertakes no duty to, and does not intend to, update any forward-looking statement, whether as a result of new

information, future events or otherwise, unless required by law.

9

SYNOPSYS, INC.

Unaudited Consolidated Statements of Income (1)

(in thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

October 31, |

|

|

October 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Time-based products |

|

$ |

834,375 |

|

|

$ |

780,725 |

|

|

$ |

3,224,299 |

|

|

$ |

3,016,256 |

|

| Upfront products |

|

|

520,939 |

|

|

|

441,494 |

|

|

|

1,802,222 |

|

|

|

1,400,125 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total products revenue |

|

|

1,355,314 |

|

|

|

1,222,219 |

|

|

|

5,026,521 |

|

|

|

4,416,381 |

|

| Maintenance and service |

|

|

280,672 |

|

|

|

245,164 |

|

|

|

1,100,915 |

|

|

|

901,633 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

|

|

1,635,986 |

|

|

|

1,467,383 |

|

|

|

6,127,436 |

|

|

|

5,318,014 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Products |

|

|

216,485 |

|

|

|

197,540 |

|

|

|

770,238 |

|

|

|

697,686 |

|

| Maintenance and service |

|

|

91,707 |

|

|

|

76,043 |

|

|

|

367,055 |

|

|

|

287,876 |

|

| Amortization of acquired intangible assets |

|

|

66,831 |

|

|

|

12,598 |

|

|

|

107,996 |

|

|

|

45,281 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of revenue |

|

|

375,023 |

|

|

|

286,181 |

|

|

|

1,245,289 |

|

|

|

1,030,843 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

1,260,963 |

|

|

|

1,181,202 |

|

|

|

4,882,147 |

|

|

|

4,287,171 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

554,818 |

|

|

|

465,815 |

|

|

|

2,082,360 |

|

|

|

1,849,935 |

|

| Sales and marketing |

|

|

219,225 |

|

|

|

186,953 |

|

|

|

859,342 |

|

|

|

724,934 |

|

| General and administrative |

|

|

172,032 |

|

|

|

102,271 |

|

|

|

568,496 |

|

|

|

376,677 |

|

| Amortization of acquired intangible assets |

|

|

4,086 |

|

|

|

3,346 |

|

|

|

16,238 |

|

|

|

9,295 |

|

| Restructuring charges |

|

|

— |

|

|

|

(1,348 |

) |

|

|

— |

|

|

|

53,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

950,161 |

|

|

|

757,037 |

|

|

|

3,526,436 |

|

|

|

3,013,932 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

310,802 |

|

|

|

424,165 |

|

|

|

1,355,711 |

|

|

|

1,273,239 |

|

| Interest and other income (expense), net |

|

|

12,077 |

|

|

|

(20,400 |

) |

|

|

158,147 |

|

|

|

32,231 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

322,879 |

|

|

|

403,765 |

|

|

|

1,513,858 |

|

|

|

1,305,470 |

|

| Provision (benefit) for income taxes |

|

|

62,084 |

|

|

|

60,409 |

|

|

|

99,718 |

|

|

|

90,188 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income from continuing operations |

|

|

260,795 |

|

|

|

343,356 |

|

|

|

1,414,140 |

|

|

|

1,215,282 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from discontinued operations, net of income taxes |

|

|

834,825 |

|

|

|

3,139 |

|

|

|

821,670 |

|

|

|

2,843 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

1,095,620 |

|

|

|

346,495 |

|

|

|

2,235,810 |

|

|

|

1,218,125 |

|

| Less: Net income (loss) attributed to non-controlling

interest and redeemable non-controlling interest |

|

|

(18,486 |

) |

|

|

(2,695 |

) |

|

|

(27,570 |

) |

|

|

(11,763 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributed to Synopsys |

|

$ |

1,114,106 |

|

|

$ |

349,190 |

|

|

$ |

2,263,380 |

|

|

$ |

1,229,888 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributed to Synopsys |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

279,281 |

|

|

$ |

346,051 |

|

|

$ |

1,441,710 |

|

|

$ |

1,227,045 |

|

| Discontinued operations |

|

|

834,825 |

|

|

|

3,139 |

|

|

|

821,670 |

|

|

|

2,843 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

1,114,106 |

|

|

$ |

349,190 |

|

|

$ |

2,263,380 |

|

|

$ |

1,229,888 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share attributed to Synopsys - basic: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

1.81 |

|

|

$ |

2.28 |

|

|

$ |

9.41 |

|

|

$ |

8.06 |

|

| Discontinued operations |

|

|

5.43 |

|

|

|

0.02 |

|

|

|

5.37 |

|

|

|

0.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income per share |

|

$ |

7.24 |

|

|

$ |

2.30 |

|

|

$ |

14.78 |

|

|

$ |

8.08 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share attributed to Synopsys - diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Continuing operations |

|

$ |

1.79 |

|

|

$ |

2.23 |

|

|

$ |

9.25 |

|

|

$ |

7.91 |

|

| Discontinued operations |

|

|

5.35 |

|

|

|

0.03 |

|

|

|

5.26 |

|

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income per share |

|

$ |

7.14 |

|

|

$ |

2.26 |

|

|

$ |

14.51 |

|

|

$ |

7.92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in computing per share amounts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

153,916 |

|

|

|

151,972 |

|

|

|

153,138 |

|

|

|

152,146 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

155,991 |

|

|

|

154,845 |

|

|

|

155,944 |

|

|

|

155,195 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Synopsys’ fourth quarter of fiscal year 2024 and 2023 ended on November 2, 2024 and October 28,

2023, respectively. For presentation purposes, we refer to the closest calendar month end. Fiscal year 2024 was a 53-week year, which included an extra week in the first quarter. |

10

SYNOPSYS, INC.

Unaudited Consolidated Balance Sheets (1)

(in thousands, except par value amounts)

|

|

|

|

|

|

|

|

|

| |

|

October 31, 2024 |

|

|

October 31, 2023 |

|

| ASSETS: |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

3,896,532 |

|

|

$ |

1,433,966 |

|

| Short-term investments |

|

|

153,869 |

|

|

|

151,639 |

|

|

|

|

|

|

|

|

|

|

| Total cash, cash equivalents and short-term investments |

|

|

4,050,401 |

|

|

|

1,585,605 |

|

| Accounts receivable, net |

|

|

934,470 |

|

|

|

856,660 |

|

| Inventories |

|

|

361,849 |

|

|

|

325,590 |

|

| Prepaid and other current assets |

|

|

1,122,946 |

|

|

|

548,115 |

|

| Current assets of discontinued operations |

|

|

— |

|

|

|

114,654 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

6,469,666 |

|

|

|

3,430,624 |

|

| Property and equipment, net |

|

|

563,006 |

|

|

|

549,837 |

|

| Operating lease

right-of-use assets, net |

|

|

565,917 |

|

|

|

559,923 |

|

| Goodwill |

|

|

3,448,850 |

|

|

|

3,346,065 |

|

| Intangible assets, net |

|

|

195,164 |

|

|

|

239,577 |

|

| Deferred income taxes |

|

|

1,247,258 |

|

|

|

853,526 |

|

| Other long-term assets |

|

|

583,700 |

|

|

|

444,820 |

|

| Long-term assets of discontinued operations |

|

|

— |

|

|

|

908,759 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

13,073,561 |

|

|

$ |

10,333,131 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES, REDEEMABLE NON-CONTROLLING INTEREST AND

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities |

|

$ |

1,163,592 |

|

|

$ |

1,059,914 |

|

| Operating lease liabilities |

|

|

94,791 |

|

|

|

79,832 |

|

| Deferred revenue |

|

|

1,391,737 |

|

|

|

1,559,461 |

|

| Current liabilities of discontinued operations |

|

|

— |

|

|

|

286,244 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

2,650,120 |

|

|

|

2,985,451 |

|

| Long-term operating lease liabilities |

|

|

574,065 |

|

|

|

579,686 |

|

| Long-term deferred revenue |

|

|

340,831 |

|

|

|

150,827 |

|

| Long-term debt |

|

|

15,601 |

|

|

|

18,078 |

|

| Other long-term liabilities |

|

|

469,738 |

|

|

|

381,531 |

|

| Long-term liabilities of discontinued operations |

|

|

— |

|

|

|

33,257 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

4,050,355 |

|

|

|

4,148,830 |

|

|

|

|

|

|

|

|

|

|

| Redeemable non-controlling interest |

|

|

30,000 |

|

|

|

31,043 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Preferred stock, $0.01 par value: 2,000 shares authorized; none outstanding |

|

|

— |

|

|

|

— |

|

| Common stock, $0.01 par value: 400,000 shares authorized; 154,112 and 152,053 shares outstanding,

respectively |

|

|

1,541 |

|

|

|

1,521 |

|

| Capital in excess of par value |

|

|

1,211,206 |

|

|

|

1,276,152 |

|

| Retained earnings |

|

|

8,984,105 |

|

|

|

6,741,699 |

|

| Treasury stock, at cost: 3,148 and 5,207 shares, respectively |

|

|

(1,025,770 |

) |

|

|

(1,675,650 |

) |

| Accumulated other comprehensive income (loss) |

|

|

(180,380 |

) |

|

|

(196,414 |

) |

|

|

|

|

|

|

|

|

|

| Total Synopsys stockholders’ equity |

|

|

8,990,702 |

|

|

|

6,147,308 |

|

| Non-controlling interest |

|

|

2,504 |

|

|

|

5,950 |

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

8,993,206 |

|

|

|

6,153,258 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities, redeemable non-controlling interest and

stockholders’ equity |

|

$ |

13,073,561 |

|

|

$ |

10,333,131 |

|

|

|

|

|

|

|

|

|

|

| (1) |

Synopsys’ fiscal year 2024 and 2023 ended on November 2, 2024 and October 28, 2023,

respectively. For presentation purposes, we refer to the closest calendar month end. Fiscal year 2024 was a 53-week year, which included an extra week in the first quarter. |

11

SYNOPSYS, INC.

Unaudited Consolidated Statements of Cash Flows (1)

(in thousands)

|

|

|

|

|

|

|

|

|

| |

|

Twelve Months Ended |

|

| |

|

2024 |

|

|

2023 |

|

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

2,235,810 |

|

|

$ |

1,218,125 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Amortization and depreciation |

|

|

295,065 |

|

|

|

247,120 |

|

| Reduction of operating lease

right-of-use assets |

|

|

97,273 |

|

|

|

97,705 |

|

| Amortization of capitalized costs to obtain revenue contracts |

|

|

73,587 |

|

|

|

82,190 |

|

| Stock-based compensation |

|

|

692,316 |

|

|

|

563,292 |

|

| Allowance for credit losses |

|

|

19,724 |

|

|

|

19,932 |

|

| Gain on sale of strategic investments |

|

|

(55,077 |

) |

|

|

— |

|

| Gain on divestitures, net of transaction costs |

|

|

(868,830 |

) |

|

|

— |

|

| Amortization of bridge financing costs |

|

|

33,677 |

|

|

|

— |

|

| Deferred income taxes |

|

|

(407,649 |

) |

|

|

(211,045 |

) |

| Other |

|

|

(1,295 |

) |

|

|

13,295 |

|

| Net changes in operating assets and liabilities, net of effects from acquisitions and

dispositions: |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(103,460 |

) |

|

|

(178,432 |

) |

| Inventories |

|

|

(51,449 |

) |

|

|

(123,752 |

) |

| Prepaid and other current assets |

|

|

(410,432 |

) |

|

|

(106,396 |

) |

| Other long-term assets |

|

|

(168,255 |

) |

|

|

(100,618 |

) |

| Accounts payable and accrued liabilities |

|

|

187,564 |

|

|

|

170,496 |

|

| Operating lease liabilities |

|

|

(96,966 |

) |

|

|

(73,281 |

) |

| Income taxes |

|

|

(73,215 |

) |

|

|

198,078 |

|

| Deferred revenue |

|

|

8,641 |

|

|

|

(113,435 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

1,407,029 |

|

|

|

1,703,274 |

|

| CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Proceeds from maturities and sales of short-term investments |

|

|

138,961 |

|

|

|

130,435 |

|

| Purchases of short-term investments |

|

|

(136,821 |

) |

|

|

(131,079 |

) |

| Proceeds from sales of strategic investments |

|

|

55,696 |

|

|

|

8,492 |

|

| Purchases of strategic investments |

|

|

(1,293 |

) |

|

|

(435 |

) |

| Purchases of property and equipment, net |

|

|

(123,161 |

) |

|

|

(189,618 |

) |

| Acquisitions, net of cash acquired |

|

|

(156,947 |

) |

|

|

(297,692 |

) |

| Proceeds from business divestiture, net of cash divested |

|

|

1,446,578 |

|

|

|

— |

|

| Capitalization of software development costs |

|

|

— |

|

|

|

(2,204 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) investing activities |

|

|

1,223,013 |

|

|

|

(482,101 |

) |

| CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

| Repayment of debt |

|

|

(2,607 |

) |

|

|

(2,603 |

) |

| Payment of bridge financing and term loan costs |

|

|

(72,265 |

) |

|

|

— |

|

| Issuances of common stock |

|

|

232,212 |

|

|

|

252,986 |

|

| Payments for taxes related to net share settlement of equity awards |

|

|

(337,541 |

) |

|

|

(241,408 |

) |

| Purchase of equity forward contract |

|

|

— |

|

|

|

(45,000 |

) |

| Purchases of treasury stock |

|

|

— |

|

|

|

(1,160,724 |

) |

| Other |

|

|

(1,096 |

) |

|

|

(122 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

|

(181,297 |

) |

|

|

(1,196,871 |

) |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

8,797 |

|

|

|

(2,979 |

) |

|

|

|

|

|

|

|

|

|

| Net change in cash, cash equivalents and restricted cash |

|

|

2,457,542 |

|

|

|

21,323 |

|

| Cash, cash equivalents and restricted cash, beginning of year, including cash from discontinued

operations |

|

|

1,441,187 |

|

|

|

1,419,864 |

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and restricted cash, end of period, including cash from discontinued

operations |

|

|

3,898,729 |

|

|

|

1,441,187 |

|

| Less: Cash, cash equivalents and restricted cash from discontinued operations |

|

|

— |

|

|

|

4,947 |

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and restricted cash from continuing operations |

|

$ |

3,898,729 |

|

|

$ |

1,436,240 |

|

|

|

|

|

|

|

|

|

|

| (1) |

Synopsys’ fiscal year 2024 and 2023 ended on November 2, 2024 and October 28, 2023,

respectively. For presentation purposes, we refer to the closest calendar month end. Fiscal year 2024 was a 53-week year, which included an extra week in the first quarter. |

12

Synopsys provides segment information, namely revenue, adjusted segment operating income and adjusted

segment operating margin, in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 280, Segment Reporting. Synopsys’ chief operating decision maker (“CODM”) is our Chief Executive

Officer. In evaluating our business segments, the CODM considers the income and expenses that the CODM believes are directly related to those segments. The CODM does not allocate certain operating expenses managed at a consolidated level to our

business segments and, as a result, the reported operating income and operating margin do not include these unallocated expenses as shown in the table below. These unallocated expenses are presented in the table below to provide a reconciliation of

the total adjusted operating income from segments to our consolidated operating income from continuing operations:

SYNOPSYS, INC.

Business Segment Reporting (1)(2)(5)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

October 31, 2024 |

|

|

Three Months Ended

October 31, 2023 |

|

|

Twelve Months Ended

October 31, 2024 |

|

|

Twelve Months Ended

October 31, 2023 |

|

| Revenue by segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - Design Automation |

|

$ |

1,118.2 |

|

|

$ |

953.7 |

|

|

$ |

4,221.1 |

|

|

$ |

3,775.3 |

|

| % of Total |

|

|

68.3 |

% |

|

|

65.0 |

% |

|

|

68.9 |

% |

|

|

71.0 |

% |

| - Design IP |

|

$ |

517.8 |

|

|

$ |

513.7 |

|

|

$ |

1,906.3 |

|

|

$ |

1,542.7 |

|

| % of Total |

|

|

31.7 |

% |

|

|

35.0 |

% |

|

|

31.1 |

% |

|

|

29.0 |

% |

| Adjusted operating income by segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - Design Automation |

|

$ |

413.3 |

|

|

$ |

311.1 |

|

|

$ |

1,631.9 |

|

|

$ |

1,413.9 |

|

| - Design IP |

|

$ |

189.9 |

|

|

$ |

236.4 |

|

|

$ |

730.2 |

|

|

$ |

514.1 |

|

| Adjusted operating margin by segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| - Design Automation |

|

|

37.0 |

% |

|

|

32.6 |

% |

|

|

38.7 |

% |

|

|

37.5 |

% |

| - Design IP |

|

|

36.7 |

% |

|

|

46.0 |

% |

|

|

38.3 |

% |

|

|

33.3 |

% |

13

Total Adjusted Segment Operating Income Reconciliation (1)(2)(5)

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

October 31, 2024 |

|

|

Three Months Ended

October 31, 2023 |

|

|

Twelve Months Ended

October 31, 2024 |

|

|

Twelve Months Ended

October 31, 2023 |

|

| GAAP total operating income – as reported |

|

$ |

310.8 |

|

|

$ |

424.2 |

|

|

$ |

1,355.7 |

|

|

$ |

1,273.2 |

|

| Other expenses managed at consolidated level |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| -Amortization of acquired intangible assets

(3) |

|

|

70.9 |

|

|

|

15.9 |

|

|

|

124.2 |

|

|

|

54.6 |

|

| -Stock-based compensation (3) |

|

|

165.4 |

|

|

|

128.6 |

|

|

|

657.9 |

|

|

|

513.1 |

|

| -Non-qualified deferred compensation plan |

|

|

9.2 |

|

|

|

(23.9 |

) |

|

|

85.4 |

|

|

|

20.2 |

|

| -Acquisition/divestiture related items

(4) |

|

|

47.0 |

|

|

|

4.0 |

|

|

|

138.7 |

|

|

|

13.8 |

|

| -Restructuring charges |

|

|

— |

|

|

|

(1.3 |

) |

|

|

— |

|

|

|

53.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total adjusted segment operating income |

|

$ |

603.2 |

|

|

$ |

547.5 |

|

|

$ |

2,362.1 |

|

|

$ |

1,928.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Synopsys manages the business on a long-term, annual basis, and considers quarterly fluctuations of revenue and

profitability as normal elements of our business. Amounts may not foot due to rounding. |

| (2) |

Synopsys’ fourth quarter of fiscal year 2024 and 2023 ended on November 2, 2024 and October 28,

2023, respectively. For presentation purposes, we refer to the closest calendar month end. Fiscal year 2024 was a 53-week year, which included an extra week in the first quarter. |

| (3) |

The adjustment includes non-GAAP expenses attributable to non-controlling interest and redeemable non-controlling interest. |

| (4) |

The adjustment excludes the amortization of bridge financing costs entered into in connection with the pending

acquisition of Ansys, that was recorded in interest and other income (expense), net, in our unaudited condensed consolidated statements of income. |

| (5) |

Presented on a continuing operations basis. |

GAAP to Non-GAAP Reconciliation

Synopsys continues to provide all information required in accordance with GAAP but acknowledges evaluating its ongoing operating results may not be as useful

if an investor is limited to reviewing only GAAP financial measures. Accordingly, Synopsys presents non-GAAP financial measures in reporting its financial results to provide investors with an additional tool

to evaluate Synopsys’ operating results in a manner that focuses on what Synopsys believes to be its core business operations and what Synopsys uses to evaluate its business operations and for internal budgeting and resource allocation

purposes. This press release includes non-GAAP earnings per diluted share, non-GAAP net income and non-GAAP tax rate for the

periods presented. It also includes future estimates for non-GAAP expenses, non-GAAP interest and other income (expense),

non-GAAP tax rate, non-GAAP earnings per diluted share and free cash flow. These non-GAAP financial measures may be different

from non-GAAP financial measures used by other companies.

14

When possible, Synopsys provides a reconciliation of non-GAAP

financial measures to their most closely applicable GAAP financial measures. Synopsys is unable to provide a full reconciliation of certain first quarter and full fiscal year 2025 non-GAAP financial targets to

the corresponding GAAP financial measures on a forward-looking basis because Synopsys believes that it would not be possible for it to have the required information necessary to quantitatively reconcile such measures with sufficient precision

without unreasonable efforts due to, among other things, the potential variability and limited predictability of the excluded adjustment items necessary for a full reconciliation such as certain acquisition/divestiture related items, restructuring

charges, tax deduction variability, changes in the fair value of non-qualified deferred compensation plan, and gains (losses) on the sale of strategic investments. For the same reasons, Synopsys is unable to

address the probable significance of the unavailable information.

Synopsys’ management does not itself, nor does it suggest that investors should,

consider such non-GAAP financial measures in isolation from, as superior to, or as a substitute for, financial information prepared in accordance with GAAP. These

non-GAAP financial measures are meant to supplement, and be viewed in conjunction with, the corresponding GAAP financial measures. Synopsys’ management believes presentation of non-GAAP financial measures, when shown in conjunction with the corresponding GAAP financial measures, provides useful information to investors allowing them to view financial and business trends relating to our

financial condition and results of operations through the eyes of management. Synopsys’ management evaluates and makes decisions about our business operations using both GAAP financial measures and

non-GAAP financial measures to help facilitate internal comparisons to Synopsys’ historical operating results and forecasted targets, planning and forecasting in subsequent periods and comparisons to

competitors’ operating results.

The following are descriptions of the adjustments made to reconcile non-GAAP

financial measures (other than free cash flow, which is defined in the footnote to the Financial Targets table above) to the most directly comparable GAAP financial measures:

(i) Amortization of acquired intangible assets. We incur expenses from amortization of acquired intangible assets, which may include impairment charges

from write-downs of acquired intangible assets. Acquired intangible assets include, among other things, core/developed technology, customer relationships, contract rights, trademarks and trade names, and other intangibles related to acquisitions. We

amortize the intangible assets over their estimated useful lives. We do not enter into acquisitions on a predictable cycle. The amount of an acquisition’s purchase price allocated to intangible assets and their estimated useful lives can vary

significantly and are unique to each acquisition. From time to time, we incur impairment charges

15

due to write-downs of acquired intangible assets. We believe that the presentation of non-GAAP financial measures that adjust for the amortization of

intangible assets, including impairment charges, provides investors and others with a consistent basis for comparison across accounting periods. We also exclude this item because such expenses are non-cash in

nature and we believe the non-GAAP financial measures excluding this item provide meaningful supplemental information regarding our core operational performance and liquidity, and ability to invest in research

and development and fund future acquisitions and capital expenditures.

(ii) Stock-based compensation. Stock-based compensation expenses consist

primarily of expenses related to restricted stock units, stock options, employee stock purchase rights and other stock awards, including such expenses associated with acquisitions. We exclude stock-based compensation expense from our non-GAAP financial measures primarily because it is not an expense that typically requires or will require cash settlement by us. Further, the expense for the fair value of the stock-based instruments we utilize may

bear little resemblance to the actual value realized upon the vesting or future exercise of the related stock-based awards and, therefore, is not used by management to assess the core profitability of our business operations.

(iii) Acquisition/divestiture related items. In connection with certain of our business combinations and/or divestitures, we incur significant expenses

that we would not have otherwise incurred as part of our business operations. These expenses include, among other things, compensation expenses, professional fees and other direct expenses, concurrent restructuring activities and divestiture

activities, including employee severance and other exit costs, bridge financing costs, costs related to integration activities, changes to the fair value of contingent consideration related to the acquired company, and amortization of the fair value

difference of below-market value assets arising from arrangements entered into or acquired in conjunction with an acquisition. We also recognize the gains and losses from the mark-up of equity or cost method

investments to fair value upon obtaining control through acquisition. We exclude these items because they are related to acquisitions and have no direct correlation to the core operation of our business. Further, because we do not acquire businesses

on a predictable cycle and the terms of each transaction can vary significantly and are unique to each transaction, we believe it is useful to exclude such expenses when looking for a consistent basis for comparison across accounting periods.

16

(iv) Restructuring charges. We initiate restructuring activities to align our costs to our operating

plans and business strategies based on then-current economic conditions, and such activities have a specific and defined term. Restructuring costs generally include severance and other termination benefits related to voluntary retirement programs,

involuntary headcount reductions and facilities closures. Such restructuring costs include elimination of operational redundancy, permanent reductions in workforce and facilities closures and, therefore, are not considered by us to be a part of the

core operation of our business and are not used by management when assessing the core profitability and performance of our business operations.

(v)

Gains (losses) on the sale of strategic investments. We exclude gains and losses on the sale of equity investments in privately held companies because we do not believe they are reflective of our core business and operating results.

(vi) Deferred compensation. We exclude changes in the fair value of our non-qualified deferred

compensation plan because we do not use these to assess the core profitability of our business operations.

(vii) Income tax effect of non-GAAP pre-tax adjustments. Excluding the income tax effect of non-GAAP pre-tax

adjustments from the provision for income taxes assists investors in understanding the tax provision associated with those adjustments and the effect on net income. We utilize an annual non-GAAP tax rate in

calculating non-GAAP financial measures to provide better consistency across interim reporting periods by eliminating the effects of certain non-recurring and other

period-specific items, which can vary in size and frequency and do not necessarily reflect our normal operations, and to more closely align our tax rate with our expected geographic earnings mix. This annual

non-GAAP tax rate is based on an evaluation of our historical and projected mix of U.S. and international profit before tax, taking into account the impact of non-GAAP

adjustments, U.S. tax law changes, as well as other factors such as our current tax structure, existing tax positions and expected recurring tax incentives. Based on these considerations, we have elected to adopt a

non-GAAP tax rate of 16% for fiscal year 2025.

17

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |