Synlogic Adopts Limited Duration Stockholders Rights Plan

February 20 2024 - 12:15PM

Synlogic, Inc. (Nasdaq: SYBX), a biopharmaceutical company

advancing novel therapeutics to transform the care of serious

diseases, today announced that its Board of Directors (the “Board”)

has approved the adoption of a limited duration shareholder rights

plan (the "Rights Plan") and authorized a dividend distribution of

one right ("Right") for each outstanding share of common stock. The

dividend distribution will be made on March 1, 2024, payable to

stockholders of record on that date, and is not taxable to

stockholders. The Rights Plan is effective immediately and has a

one-year duration, expiring on February 20, 2025.

The Company also announced that the Board has

engaged Ladenburg Thalmann & Co. Inc. as its financial advisor

to assist the Company in a review and evaluation of strategic

options, in consultation with its financial and legal advisors,

with the intent to unlock and maximize shareholder value.

The Board adopted the Rights Plan following an

unsolicited accumulation of Synlogic shares by a certain investor.

A Rights Plan will enable the Board and Synlogic’s management team

to protect stockholders while fulfilling its fiduciary

responsibilities to review and evaluate strategic alternatives

intended to maximize long-term value for all Synlogic stockholders.

This will include consideration of various options and proposals,

as warranted.

The Rights Plan is similar to other plans

adopted by publicly held companies in comparable circumstances and

is intended to enable all stockholders to realize the long-term

value of their investment in Synlogic. The Rights Plan will reduce

the likelihood that any entity, person, or group gains control of

Synlogic through open market accumulation without paying all

stockholders an appropriate control premium or without providing

the Board sufficient time to make informed judgments and take

actions that are in the best interests of stockholders. The Rights

Plan does not prevent the Board from engaging with parties or

accepting proposals if the Board believes that it is in the best

interests of the company and its stockholders.

Under the Rights Plan, the rights will become

exercisable only if an entity, person, or group acquires beneficial

ownership of 15% or more of Synlogic’s outstanding common stock in

a transaction not approved by the Board (or 20% in the case of

passive institutional stockholders). In the event that the rights

become exercisable due to the triggering ownership threshold being

crossed, each right will entitle its holder (other than the person,

entity, or group triggering the Rights Plan, whose rights will

become void and will not be exercisable) to purchase one

one-thousandth of a share of a new series of junior participating

preferred stock at an exercise price of $12.00. If a person or

group acquires 15% or more of Synlogic’s outstanding common stock

(or 20% or more in the case of passive institutional stockholders),

each right will entitle its holder (other than such person or

members of such group) to purchase for $12.00, a number of

Synlogic’s common shares having a market value of twice such price.

In addition, at any time after a person or group acquires 15% or

more of Synlogic’s outstanding common stock (or 20% or more in the

case of passive institutional stockholders), the Board may exchange

one share of Synlogic’s common stock for each outstanding right

(other than rights owned by such person or group, which would have

become void). Any shareholders with beneficial ownership of

Synlogic’s outstanding common stock above the applicable threshold

as of the time of this announcement are grandfathered at their

current ownership levels but are not permitted to increase their

ownership without triggering the Rights Plan.

Prior to the acquisition by a person or group of

beneficial ownership of 15% or more of Synlogic’s common stock (or

20% or more in the case of passive institutional investors), the

rights are redeemable for $0.001 per right at the option of the

Board.

Further details about the Rights Plan will be

contained in a Form 8-K to be filed by the Company with the U.S.

Securities and Exchange Commission.

About Synlogic

Synlogic is a biopharmaceutical company

advancing novel therapeutics to transform the care of serious

diseases in need of new treatment options. Synlogic designs,

develops and manufactures these drug candidates, which are produced

by applying precision genetic engineering to well-characterized

probiotics.

Forward Looking

Statements

This press release contains "forward-looking

statements" that involve substantial risks and uncertainties for

purposes of the safe harbor provided by the Private Securities

Litigation Reform Act of 1995. All statements, other than

statements of historical facts, included in this press release

regarding strategy, future operations, clinical development plans,

future financial position, future revenue, projected expenses,

prospects, plans and objectives of management are forward-looking

statements. In addition, when or if used in this press release, the

words "may," "could," "should," "anticipate," "believe," "look

forward," "estimate," "expect," “focused on,” "intend," "on track,

" "plan," "predict" and similar expressions and their variants, as

they relate to Synlogic, may identify forward-looking

statements. Actual results could differ materially from those

contained in any forward-looking statements as a result of various

factors, including: the Company may not execute its planned

exploration and evaluation of strategic alternatives; the

availability of suitable third parties with which to conduct

contemplated strategic transactions; the risk that the Company's

reduction in force efforts may not generate their intended benefits

to the extent or as quickly as anticipated; and the risk that the

Company's reduction in force efforts may negatively impact the

Company's business operations and reputation as well as those risks

identified under the heading "Risk Factors"

in Synlogic's filings with the U.S. Securities and

Exchange Commission. The forward-looking statements contained in

this press release reflect Synlogic's current views with

respect to future events. Synlogic anticipates that

subsequent events and developments will cause its views to change.

However, while Synlogic may elect to update these

forward-looking statements in the

future, Synlogic specifically disclaims any obligation to

do so. These forward-looking statements should not be relied upon

as representing Synlogic's view as of any date subsequent

to the date hereof.

Contact: info@synlogictx.com

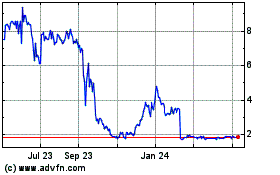

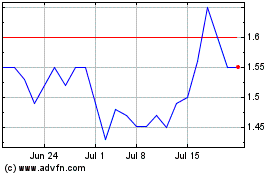

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Synlogic (NASDAQ:SYBX)

Historical Stock Chart

From Nov 2023 to Nov 2024