Sutro Biopharma, Inc. (Sutro or the Company) (NASDAQ: STRO), a

clinical-stage oncology company pioneering site-specific and

novel-format antibody drug conjugates (ADCs), today reported its

financial results for the second quarter of 2024, its recent

business highlights, and a preview of select anticipated

milestones.

“We continue to make meaningful progress with the development of

luvelta across multiple indications, including enrollment of a

patient expansion cohort in combination with bevacizumab, nearing

initiation of our second registration-enabling trial, REFRaME-P1,

for pediatric patients with a rare form of acute myeloid leukemia

(AML) and approaching site activation of a Phase 2 trial in

non-small cell lung cancer (NSCLC),” said Bill Newell, Sutro’s

Chief Executive Officer. “We plan to share supplemental data from

our Phase 1b trial of luvelta in combination with bevacizumab at

the ESMO meeting in September.”

Mr. Newell added, “We are off to strong start in our new

partnership with Ipsen for STRO-003 and continue to advance our

preclinical pipeline of next-generation ADCs, including our

tissue-factor targeting exatecan ADC, STRO-004. In parallel, we are

exploring new partnership opportunities to maximize the potential

of our platform and pipeline, led by our new Chief Business

Development Officer Barbara Leyman. Additionally, we are delighted

to welcome Sukhi Jagpal to our Board, as he brings a wealth of

invaluable financial and strategic expertise.”

Recent Business

Highlights and

Select Anticipated

Milestones

Luveltamab Tazevibulin (luvelta), FRα-Targeting ADC

Franchise:

- Sutro will present updated data from

the Phase 1b study of luvelta in combination with bevacizumab for

patients with ovarian cancer in a poster presentation at the

European Society for Medical Oncology (ESMO) Congress 2024 to be

held September 13-17 in Barcelona, Spain.

- Title: Luveltamab tazevibulin, an

antifolate receptor alpha (FRα) antibody-drug conjugate (ADC), in

combination with bevacizumab (bev) in patients with recurrent

high-grade epithelial ovarian cancer (EOC): STRO-002-GM2 phase 1

study

- Date: Saturday, September 14, 2024

- Part 2 (randomized portion) of the

Phase 3 trial, REFRαME-O1, for treatment of platinum-resistant

ovarian cancer (PROC), is underway.

- REFRαME-P1, a registration-enabling

trial for pediatric patients with CBFA2T3::GLIS2 (CBF/GLIS; RAM

phenotype) AML, is expected to be initiated in the second half of

2024.

- A Phase 2 expansion study in

combination with bevacizumab is ongoing, with data expected in the

first half of 2025.

- A Phase 2 trial for the treatment of

NSCLC is expected to initiate in the second half of 2024, with

initial data expected in the first half of 2025.

Additional Pipeline Development and Collaboration

Updates:

- In April 2024, Sutro announced a global

licensing agreement for STRO-003, a ROR1-targeting ADC, with

Ipsen.

- Sutro plans to submit an IND for

STRO-004 in 2025.

- Sutro continues to seek to maximize the

value of its proprietary cell-free platform by working with

partners on programs in multiple disease spaces and geographies and

has generated from collaborators an aggregate of approximately $970

million in payments through June 30, 2024, including equity

investments.

Corporate Updates:

- In August, Sutro strengthened its Board

of Directors with the appointment of Sukhi Jagpal, MBA, CPA, CBV.

Mr. Jagpal brings 20 years of experience in the life sciences

industry, with expertise in financial management, communication,

and organizational effectiveness, including financial analysis,

mergers and acquisitions, and cost optimization.

- In July, Sutro appointed Barbara

Leyman, Ph.D., as Chief Business Development Officer, with a focus

on building value and executing the Company’s business development

strategy, in addition to serving on Sutro’s senior management

team.

Upcoming Events: Sutro will participate in

two upcoming investor conferences. Webcasts of the presentations

will be accessible through the News & Events page of the

Investor Relations section of the Company’s website at

www.sutrobio.com. Archived replays will be available for at least

30 days after the events.

- Wedbush PacGrow Healthcare Conference

in New York, August 13-14, 2024

- Wells Fargo Healthcare Conference in

Boston, September 4-6, 2024

Second Quarter 2024 Financial

Highlights

Cash, Cash Equivalents and Marketable Securities and Vaxcyte

Common StockAs of June 30, 2024, Sutro had $426.0 million, composed

of cash, cash equivalents and marketable securities of $375.6

million and approximately 0.7 million shares of Vaxcyte common

stock with a fair value of $50.4 million.

Unrealized Gain from Increase in Value of Vaxcyte Common

StockThe non-operating, unrealized gain of $4.8 million for the

quarter ended June 30, 2024 was due to the increase since March 31,

2024 in the estimated fair value of Sutro’s holdings of Vaxcyte

common stock. Vaxcyte common stock held by Sutro will be remeasured

at fair value based on the closing price of Vaxcyte’s common stock

on the last trading day of each reporting period, with any

non-operating, unrealized gains and losses recorded in Sutro’s

statements of operations.

RevenueRevenue was $25.7 million for the quarter ended June 30,

2024, as compared to $10.4 million for the same period in 2023,

with the 2024 amount related principally to the Astellas

collaboration and the Vaxcyte agreement. Future collaboration and

license revenue under existing agreements, and from any additional

collaboration and license partners, will fluctuate as a result of

the amount and timing of revenue recognition of upfront,

milestones, and other agreement payments.

Operating ExpensesTotal operating expenses for the quarter ended

June 30, 2024 were $74.4 million, as compared to $56.6 million for

the same period in 2023. The 2024 quarter includes non-cash

expenses for stock-based compensation of $6.2 million and

depreciation and amortization of $1.8 million, as compared to $6.7

million and $1.7 million, respectively, in the comparable 2023

period. Total operating expenses for the quarter ended June 30,

2024 were comprised of research and development expenses of $62.0

million and general and administrative expenses of $12.4

million.

About Sutro Biopharma Sutro Biopharma,

Inc., is a clinical-stage company relentlessly focused on the

discovery and development of precisely designed cancer

therapeutics, to transform what science can do for patients.

Sutro’s fit-for-purpose technology, including cell-free XpressCF®,

provides the opportunity for broader patient benefit and an

improved patient experience. Sutro has multiple clinical stage

candidates, including luveltamab tazevibulin, or luvelta, a

registrational-stage folate receptor alpha (FolRα)-targeting ADC in

clinical studies. A robust pipeline, coupled with high-value

collaborations and industry partnerships, validates Sutro’s

continuous product innovation. Sutro is headquartered in South San

Francisco. For more information, follow Sutro on social

media @Sutrobio, or visit www.sutrobio.com.

Forward-Looking Statements This press release

contains forward-looking statements within the meaning of the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995, including, but not limited to, anticipated preclinical and

clinical development activities, including enrollment and site

activation; timing of announcements of clinical results, trial

initiation, and regulatory filings; outcome of regulatory

decisions; potential benefits of luvelta and the Company’s other

product candidates and platform; timing of payments under our

collaboration agreements; potential expansion into other

indications and combinations, including the timing and development

activities related to such expansion; potential market

opportunities for luvelta and the Company’s other product

candidates; and the Company’s expected cash runway. All statements

other than statements of historical fact are statements that could

be deemed forward-looking statements. Although the Company believes

that the expectations reflected in such forward-looking statements

are reasonable, the Company cannot guarantee future events,

results, actions, levels of activity, performance or achievements,

and the timing and results of biotechnology development and

potential regulatory approval is inherently uncertain.

Forward-looking statements are subject to risks and uncertainties

that may cause the Company’s actual activities or results to differ

significantly from those expressed in any forward-looking

statement, including risks and uncertainties related to the

Company’s ability to advance its product candidates, the receipt

and timing of potential regulatory designations, approvals and

commercialization of product candidates and the Company’s ability

to successfully leverage Fast Track designation, the market size

for the Company’s product candidates to be smaller than

anticipated, clinical trial sites, supply chain and manufacturing

facilities, the Company’s ability to maintain and recognize the

benefits of certain designations received by product candidates,

the timing and results of preclinical and clinical trials, the

Company’s ability to fund development activities and achieve

development goals, the Company’s ability to protect intellectual

property, the value of the Company’s holdings of Vaxcyte common

stock, and the Company’s commercial collaborations with third

parties and other risks and uncertainties described under the

heading “Risk Factors” in documents the Company files from time to

time with the Securities and Exchange Commission. These

forward-looking statements speak only as of the date of this press

release, and the Company undertakes no obligation to revise or

update any forward-looking statements to reflect events or

circumstances after the date hereof.

|

Sutro Biopharma, Inc.Selected Statements

of Operations Financial

Data(Unaudited)(In thousands,

except share and per share amounts) |

|

|

Three Months Ended |

Six Months Ended |

|

|

|

June 30, |

June 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Revenues |

$ |

25,706 |

|

|

$ |

10,412 |

|

|

$ |

38,714 |

|

|

$ |

23,086 |

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

62,020 |

|

|

|

41,592 |

|

|

|

118,898 |

|

|

|

80,991 |

|

|

General and administrative |

|

12,371 |

|

|

|

14,999 |

|

|

|

25,092 |

|

|

|

30,511 |

|

| Total operating expenses |

|

74,391 |

|

|

|

56,591 |

|

|

|

143,990 |

|

|

|

111,502 |

|

| Loss from operations |

|

(48,685 |

) |

|

|

(46,179 |

) |

|

|

(105,276 |

) |

|

|

(88,416 |

) |

| Interest income |

|

4,911 |

|

|

|

2,842 |

|

|

|

9,007 |

|

|

|

5,402 |

|

| Unrealized gain on equity

securities |

|

4,808 |

|

|

|

8,321 |

|

|

|

8,487 |

|

|

|

1,329 |

|

| Non-cash interest expense

related to the sale of future royalties |

|

(7,286 |

) |

|

|

(442 |

) |

|

|

(14,470 |

) |

|

|

(442 |

) |

| Interest and other income

(expense), net |

|

(1,758 |

) |

|

|

(2,915 |

) |

|

|

(3,971 |

) |

|

|

(5,901 |

) |

| Loss before provision for

income taxes |

|

(48,010 |

) |

|

|

(38,373 |

) |

|

|

(106,223 |

) |

|

|

(88,028 |

) |

| Provision for income

taxes |

|

8 |

|

|

|

151 |

|

|

|

8 |

|

|

|

546 |

|

| Net loss |

$ |

(48,018 |

) |

|

$ |

(38,524 |

) |

|

$ |

(106,231 |

) |

|

$ |

(88,574 |

) |

| Net loss per share, basic and

diluted |

$ |

(0.59 |

) |

|

$ |

(0.64 |

) |

|

$ |

(1.49 |

) |

|

$ |

(1.49 |

) |

| Weighted-average shares used

in computing basic and diluted loss per share |

|

81,224,628 |

|

|

|

60,339,475 |

|

|

|

71,341,211 |

|

|

|

59,535,918 |

|

|

Sutro Biopharma, Inc.Selected Balance

Sheets Financial

Data(Unaudited)(In

thousands) |

|

|

June 30,

2024(1) |

|

|

December 31,

2023(2) |

|

|

Assets |

|

|

|

|

|

|

|

|

Cash, cash equivalents and marketable securities |

$ |

375,568 |

|

|

$ |

333,681 |

|

|

Investment in equity securities |

|

50,424 |

|

|

|

41,937 |

|

|

Accounts receivable |

|

6,950 |

|

|

|

36,078 |

|

|

Property and equipment, net |

|

19,414 |

|

|

|

21,940 |

|

|

Operating lease right-of-use assets |

|

20,333 |

|

|

|

22,815 |

|

|

Other assets |

|

16,354 |

|

|

|

14,285 |

|

| Total

Assets |

$ |

489,043 |

|

|

$ |

470,736 |

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other liabilities |

$ |

50,782 |

|

|

$ |

64,293 |

|

|

Deferred revenue |

|

95,654 |

|

|

|

74,045 |

|

|

Operating lease liability |

|

26,526 |

|

|

|

29,574 |

|

| Debt |

|

- |

|

|

|

4,061 |

|

| Deferred royalty obligation

related to the sale of future royalties |

|

163,905 |

|

|

|

149,114 |

|

| Total liabilities |

|

336,867 |

|

|

|

321,087 |

|

| Total stockholders’

equity |

|

152,176 |

|

|

|

149,649 |

|

| Total Liabilities and

Stockholders’ Equity |

$ |

489,043 |

|

|

$ |

470,736 |

|

|

(1) |

|

The condensed balance sheet as of June 30, 2024 was derived from

the unaudited financial statements included in the Company's

Quarterly Report on Form 10-Q for the quarter ended June 30, 2024,

filed with the Securities and Exchange Commission on August 13,

2024. |

|

(2) |

|

The condensed balance sheet as of December 31, 2023 was derived

from the unaudited financial statements included in the Company's

Annual Report on Form 10-K for the year ended December 31,

2023, filed with the Securities and Exchange Commission on March

25, 2024. |

|

|

|

|

Contact

Emily White

Sutro Biopharma

(650) 823-7681

ewhite@sutrobio.com

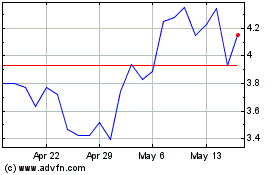

Sutro Biopharma (NASDAQ:STRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sutro Biopharma (NASDAQ:STRO)

Historical Stock Chart

From Nov 2023 to Nov 2024